c2ac10bacbecf49945257389efba6d87.ppt

- Количество слайдов: 47

Fundamentals of the Chilean Economy Central Bank of Chile October 2002

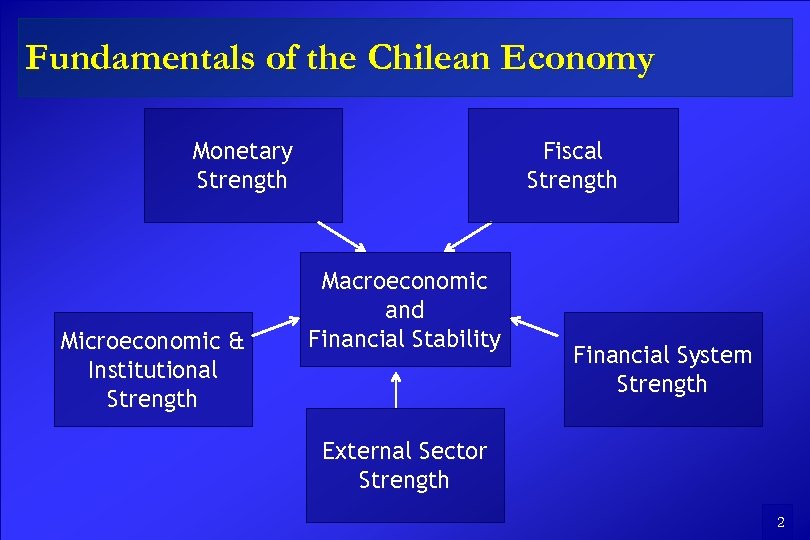

Fundamentals of the Chilean Economy Monetary Strength Microeconomic & Institutional Strength Fiscal Strength Macroeconomic and Financial Stability Financial System Strength External Sector Strength 2

Monetary Strength

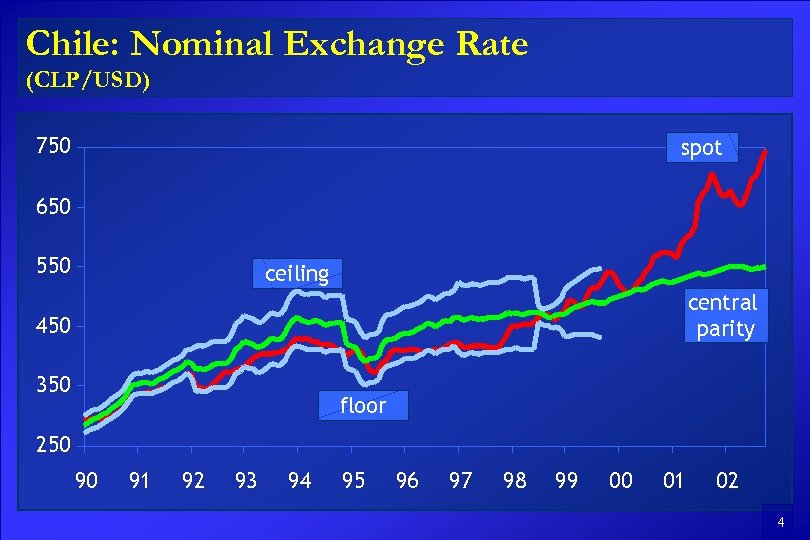

Chile: Nominal Exchange Rate (CLP/USD) 750 spot 650 550 ceiling central parity 450 350 floor 250 90 91 92 93 94 95 96 97 98 99 00 01 02 4

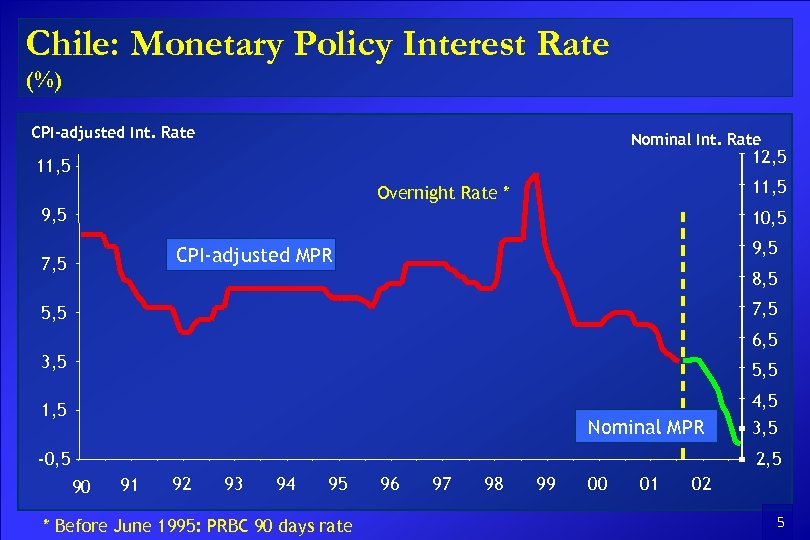

Chile: Monetary Policy Interest Rate (%) CPI-adjusted Int. Rate Nominal Int. Rate 12, 5 11, 5 Overnight Rate * 9, 5 10, 5 9, 5 CPI-adjusted MPR 7, 5 8, 5 7, 5 5, 5 6, 5 3, 5 5, 5 4, 5 1, 5 Nominal MPR -0, 5 3, 5 2, 5 90 91 92 93 94 95 * Before June 1995: PRBC 90 days rate 96 97 98 99 00 01 02 5

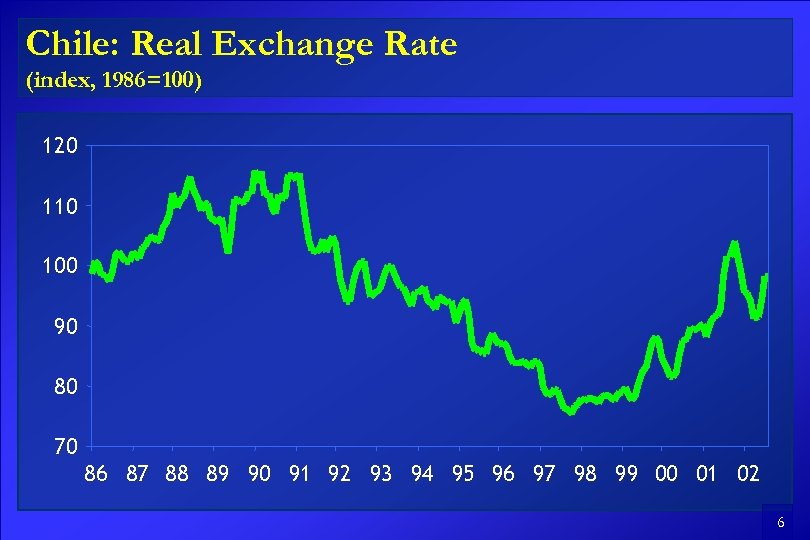

Chile: Real Exchange Rate (index, 1986=100) 120 110 100 90 80 70 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 6

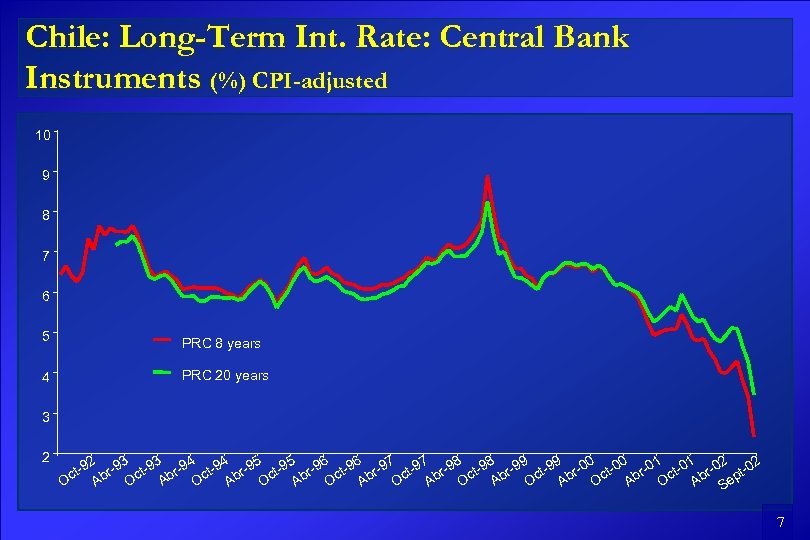

Chile: Long-Term Int. Rate: Central Bank Instruments (%) CPI-adjusted 10 9 8 7 6 5 PRC 8 years 4 PRC 20 years 3 2 4 9 5 7 8 3 6 0 1 2 3 5 6 2 4 7 8 9 0 1 2 t-9 br-9 ct-9 br-9 ct-9 br-0 ct-0 br-0 pt-0 A A O O A A Oc A O O O A O A Se 7

Fiscal Strength

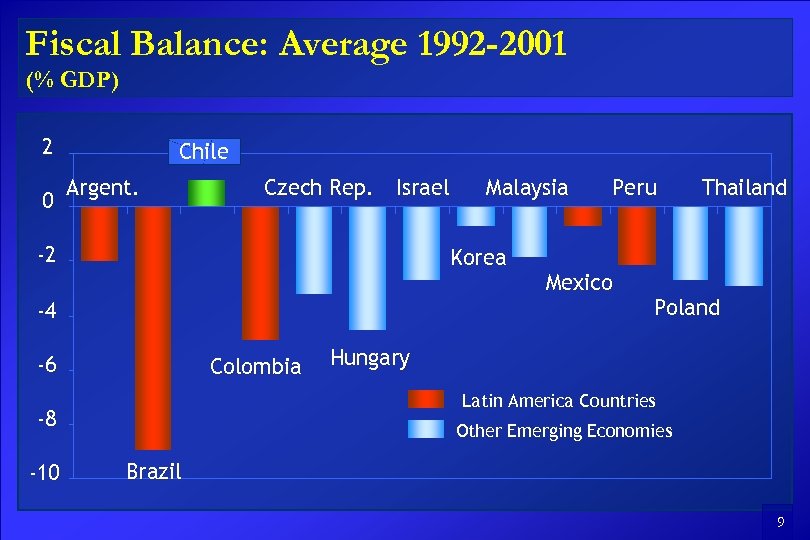

Fiscal Balance: Average 1992 -2001 (% GDP) 2 0 Chile A r g ent. C z e c h Re p. I s r a e l -2 K o r ea -4 -6 C o l o mb i a P er u M e x i co T h a il a n d P o l and Hu n g a r y Latin America Countries -8 -10 M a l a ys ia Other Emerging Economies B r a z il 9

Public Debt 2001 (% GDP; Source: Moody´s and Ministry of Finance) 120 100 Latin American Countries Other Emerging Economies 80 60 40 20 Chile 0 Argent. Colombia Peru Brazil Mexico Czech Rep. Israel S. Korea Thailand Poland Hungary Malaysia 10

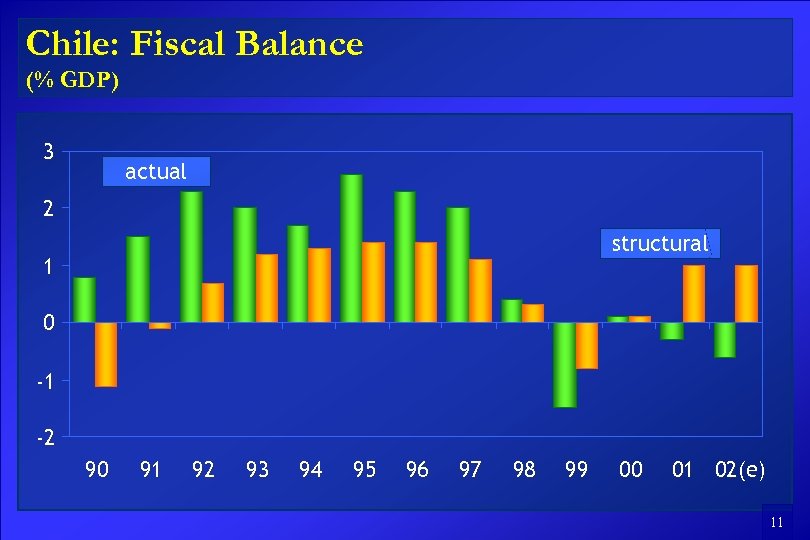

Chile: Fiscal Balance (% GDP) 3 actual 2 structural 1 0 -1 -2 90 91 92 93 94 95 96 97 98 99 00 01 02(e) 11

Financial System Strength

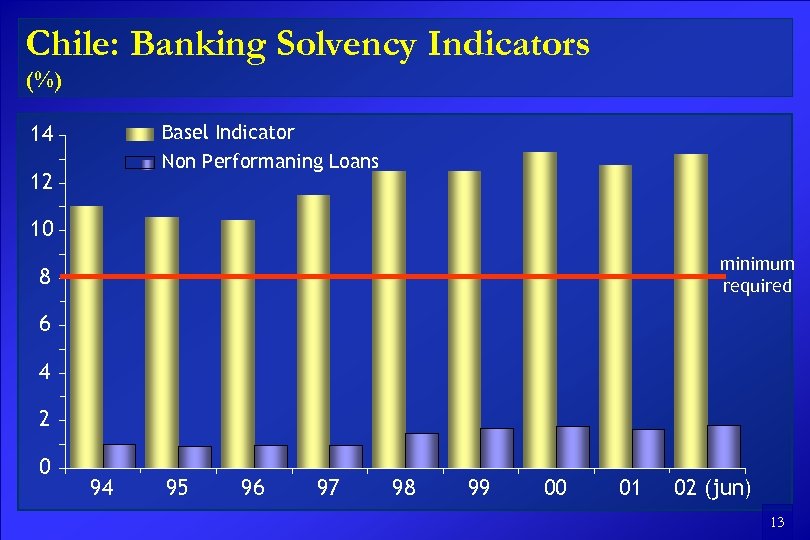

Chile: Banking Solvency Indicators (%) Basel Indicator Non Performaning Loans 14 12 10 minimum required 8 6 4 2 0 94 95 96 97 98 99 00 01 02 (jun) 13

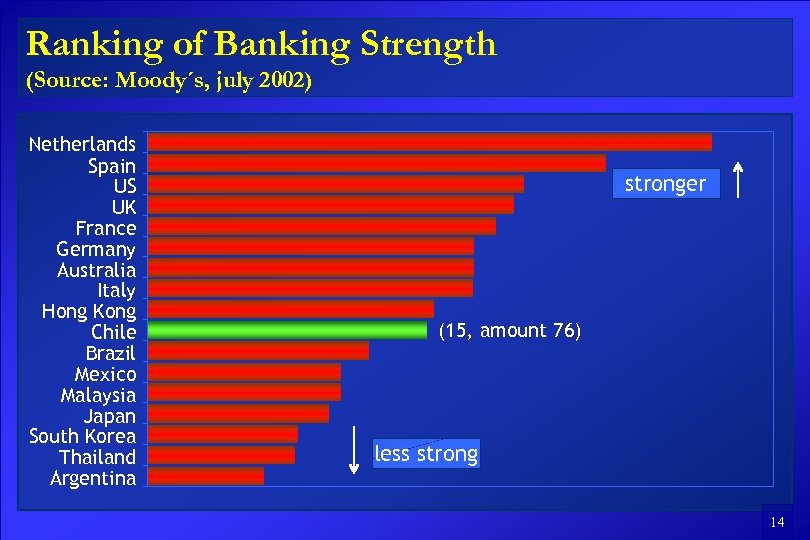

Ranking of Banking Strength (Source: Moody´s, july 2002) Netherlands Spain US UK France Germany Australia Italy Hong Kong Chile Brazil Mexico Malaysia Japan South Korea Thailand Argentina stronger (15, amount 76) less strong 14

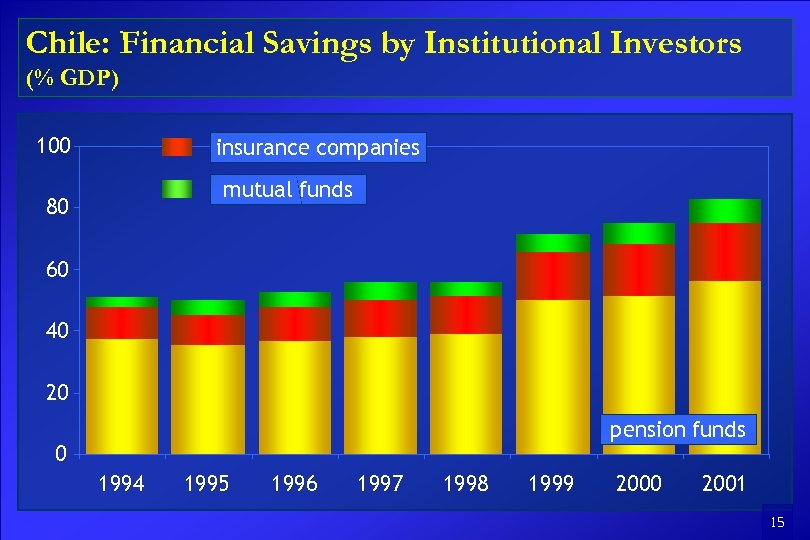

Chile: Financial Savings by Institutional Investors (% GDP) 100 insurance companies mutual funds 80 60 40 20 pension funds 0 1994 1995 1996 1997 1998 1999 2000 2001 15

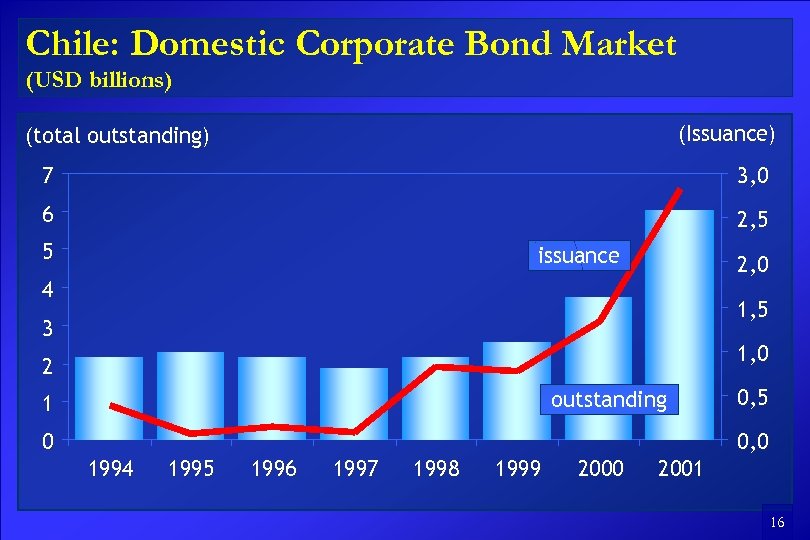

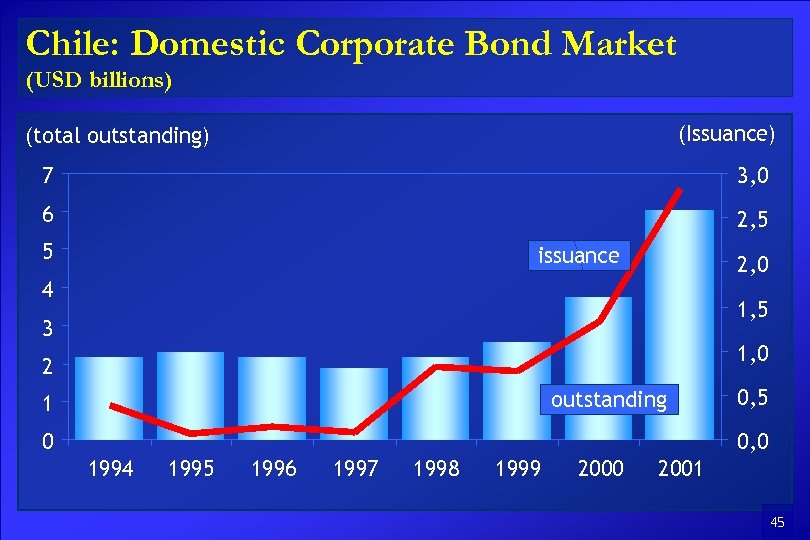

Chile: Domestic Corporate Bond Market (USD billions) (Issuance) (total outstanding) 7 3, 0 6 2, 5 5 issuance 2, 0 4 1, 5 3 1, 0 2 outstanding 1 0 0, 5 0, 0 1994 1995 1996 1997 1998 1999 2000 2001 16

External Sector Strength

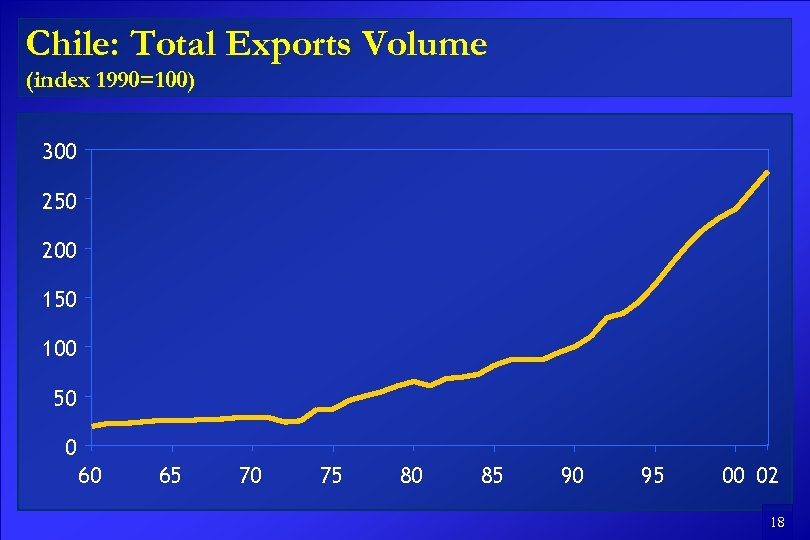

Chile: Total Exports Volume (index 1990=100) 300 250 200 150 100 50 0 60 65 70 75 80 85 90 95 00 02 18

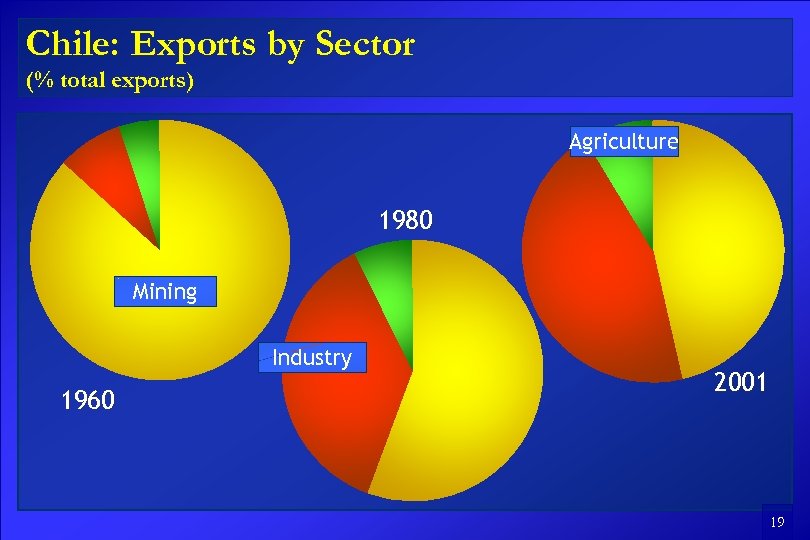

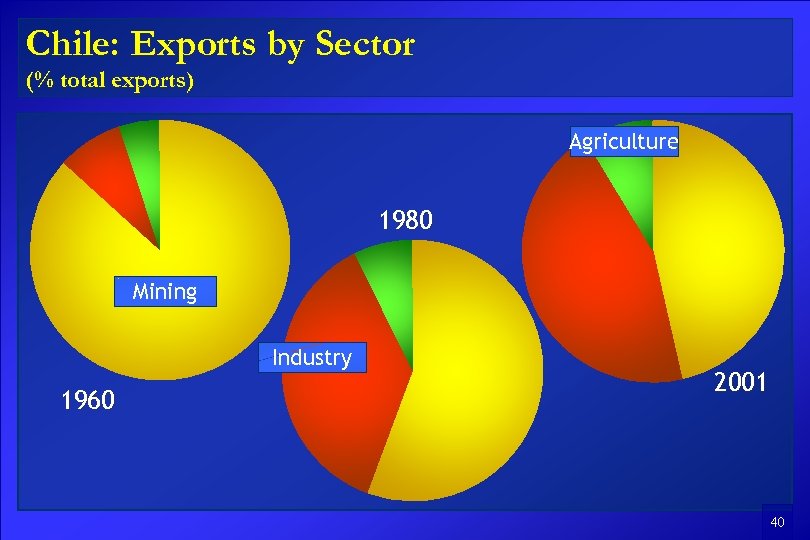

Chile: Exports by Sector (% total exports) Agriculture 1980 Mining Industry 1960 2001 19

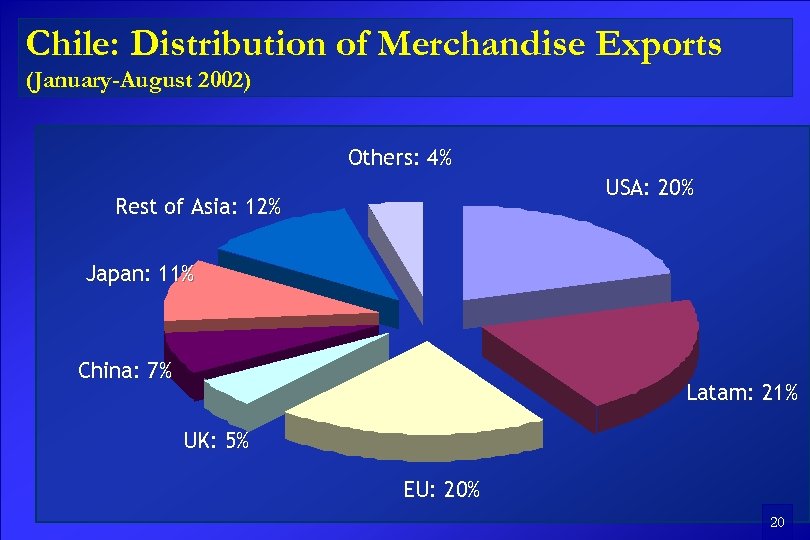

Chile: Distribution of Merchandise Exports (January-August 2002) Others: 4% USA: 20% Rest of Asia: 12% Japan: 11% China: 7% Latam: 21% UK: 5% EU: 20% 20

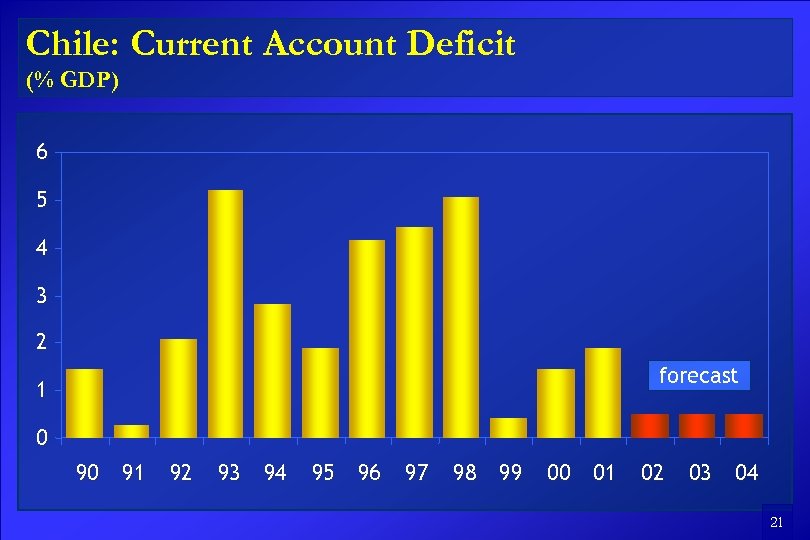

Chile: Current Account Deficit (% GDP) 6 5 4 3 2 forecast 1 0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 21

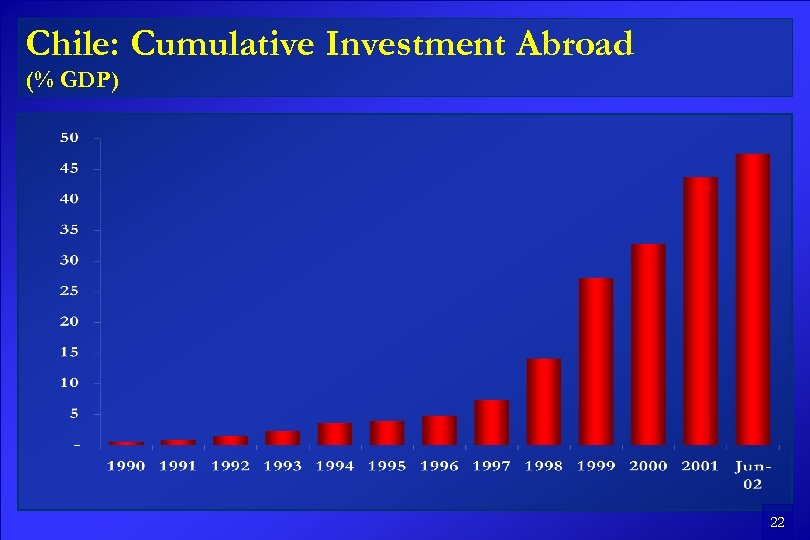

Chile: Cumulative Investment Abroad (% GDP) 22

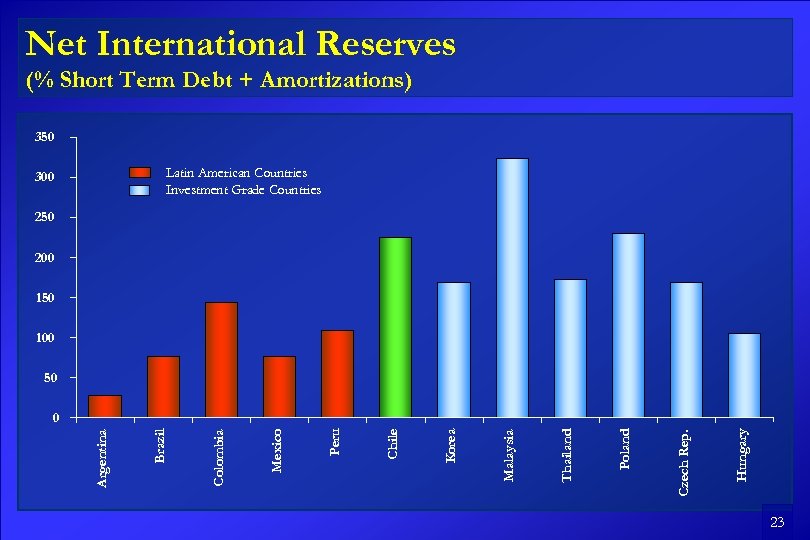

Net International Reserves (% Short Term Debt + Amortizations) 350 Latin American Countries Investment Grade Countries 300 250 200 150 100 50 Hungary Czech Rep. Poland Thailand Malaysia Korea Chile Peru Mexico Colombia Brazil Argentina 0 23

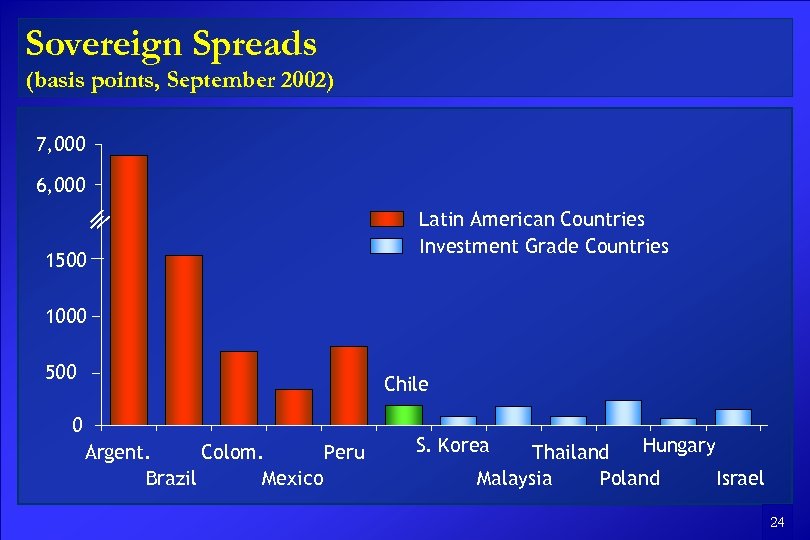

Sovereign Spreads (basis points, September 2002) 7, 000 6, 000 1500 Latin American Countries Investment Grade Countries 1000 500 Chile 0 Peru Argent. Colom. Brazil Mexico S. Korea Hungary Thailand Malaysia Israel Poland 24

Microeconomic & Institutional Strength

Competitiviness Ranking 2002 (Source: International Institute for Management Development) USA Hong Kong Australia Germany U. Kingdom Chile France Spain Malaysia S. Korea Czech Rep. Japan Italy Thailand Brazil Mexico Argentina + compet. (19, amount 49) - compet. 26

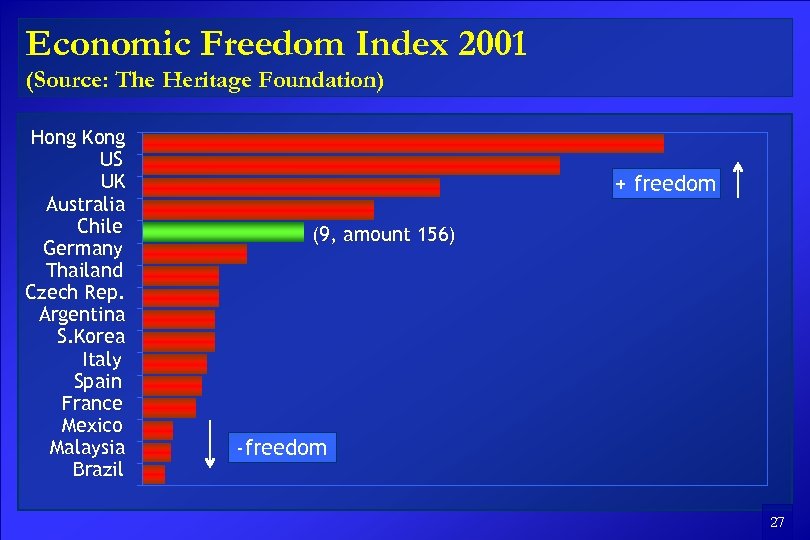

Economic Freedom Index 2001 (Source: The Heritage Foundation) Hong Kong US UK Australia Chile Germany Thailand Czech Rep. Argentina S. Korea Italy Spain France Mexico Malaysia Brazil + freedom (9, amount 156) -freedom 27

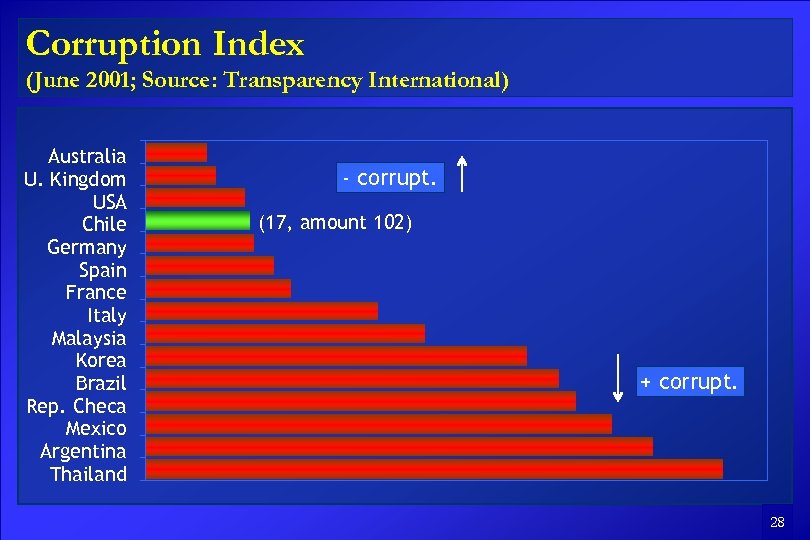

Corruption Index (June 2001; Source: Transparency International) Australia U. Kingdom USA Chile Germany Spain France Italy Malaysia Korea Brazil Rep. Checa Mexico Argentina Thailand - corrupt. (17, amount 102) + corrupt. 28

Macroeconomic Stability

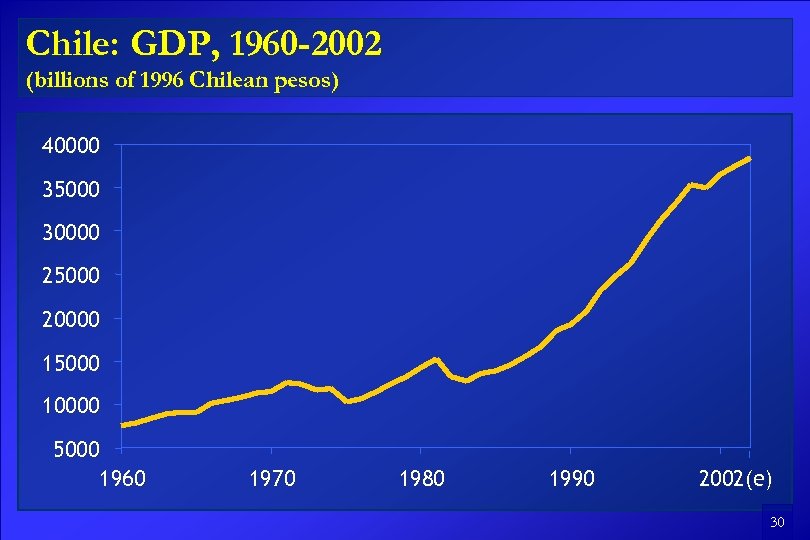

Chile: GDP, 1960 -2002 (billions of 1996 Chilean pesos) 40000 35000 30000 25000 20000 15000 10000 5000 1960 1970 1980 1990 2002(e) 30

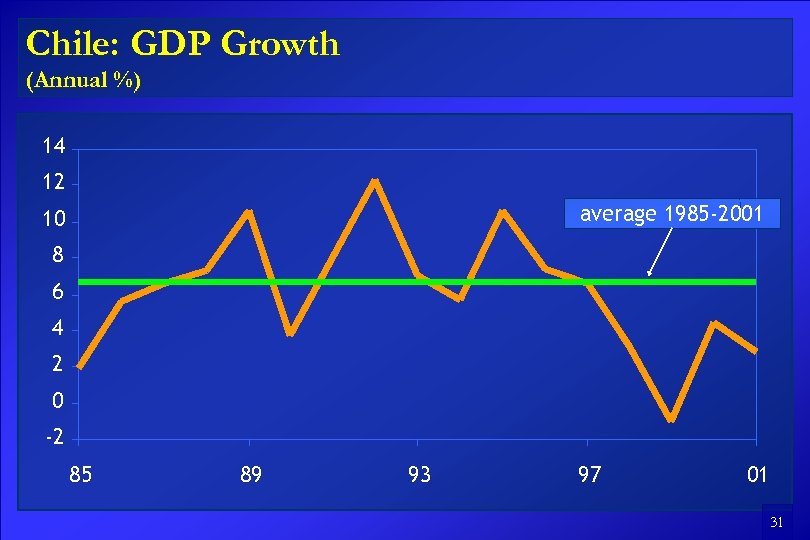

Chile: GDP Growth (Annual %) 14 12 average 1985 -2001 10 8 6 4 2 0 -2 85 89 93 97 01 31

Chile: Inflation and Targets (annual %) 35 30 25 20 15 10 5 0 90 91 92 93 94 95 96 97 98 99 00 01 02 32

Recent Structural Reforms

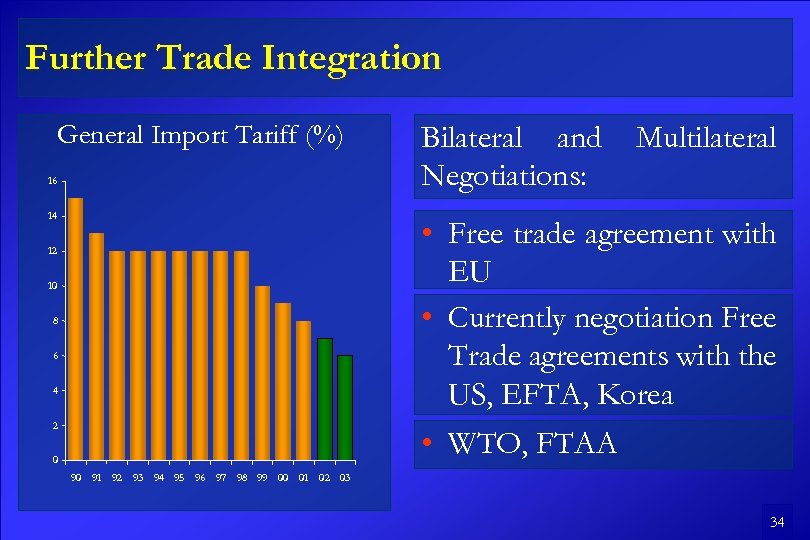

Further Trade Integration General Import Tariff (%) 16 14 Bilateral and Negotiations: Multilateral • Free trade agreement with EU • Currently negotiation Free Trade agreements with the US, EFTA, Korea 12 10 8 6 4 2 • WTO, FTAA 0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 34

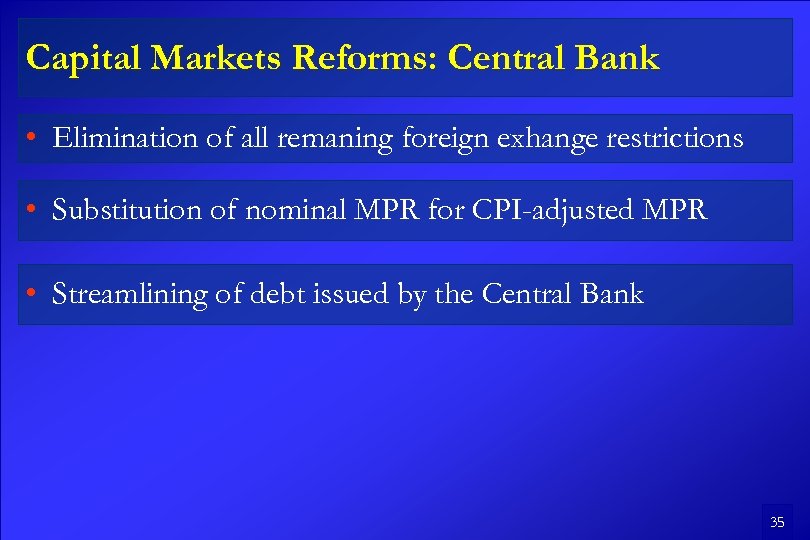

Capital Markets Reforms: Central Bank • Elimination of all remaning foreign exhange restrictions • Substitution of nominal MPR for CPI-adjusted MPR • Streamlining of debt issued by the Central Bank 35

Capital Markets Reforms: legal changes • New corporate governance and tender offer regulation • Elimination of capital gains tax on liquid stocks and reduction of withholding tax on interest from 35 to 4% on local bonds foreign investors • Increased flexibility for allocation of personal savings 36

How to Reduce Growth Volatility?

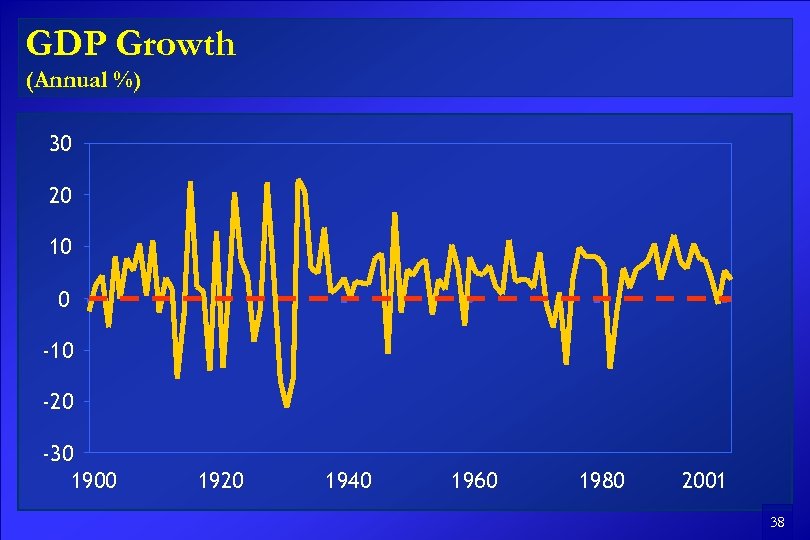

GDP Growth (Annual %) 30 20 10 0 -10 -20 -30 1900 1920 1940 1960 1980 2001 38

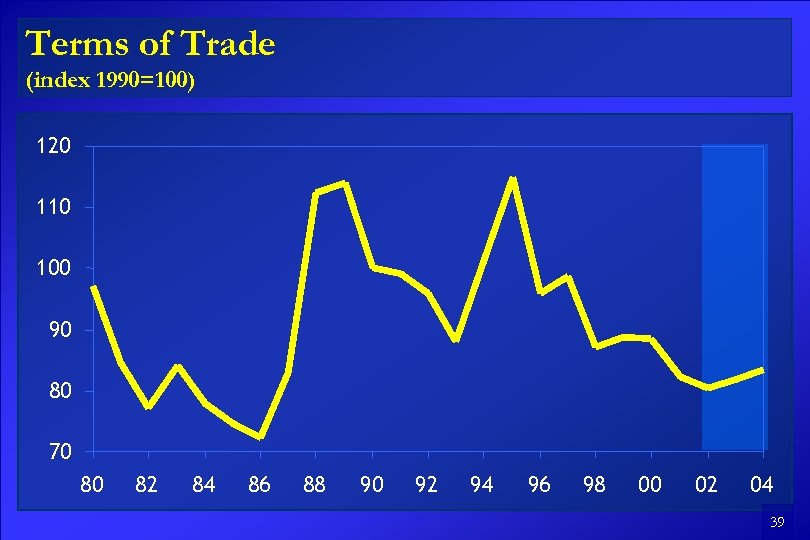

Terms of Trade (index 1990=100) 120 110 100 90 80 70 80 82 84 86 88 90 92 94 96 98 00 02 04 39

Chile: Exports by Sector (% total exports) Agriculture 1980 Mining Industry 1960 2001 40

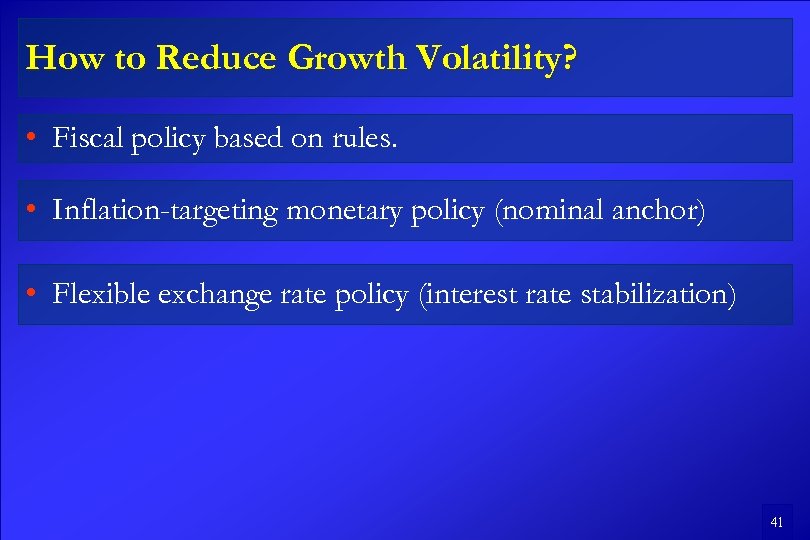

How to Reduce Growth Volatility? • Fiscal policy based on rules. • Inflation-targeting monetary policy (nominal anchor) • Flexible exchange rate policy (interest rate stabilization) 41

Inflation and Targets (annual %) 35 30 25 20 15 10 5 0 90 91 92 93 94 95 96 97 98 99 00 01 02 42

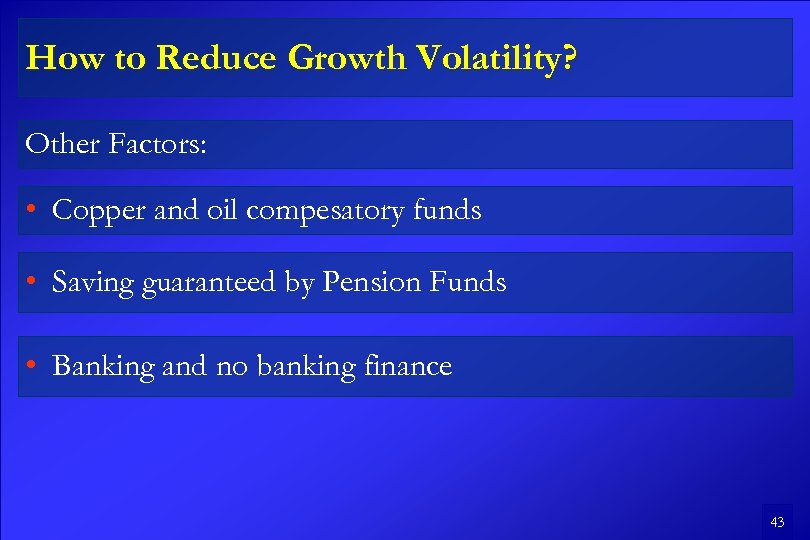

How to Reduce Growth Volatility? Other Factors: • Copper and oil compesatory funds • Saving guaranteed by Pension Funds • Banking and no banking finance 43

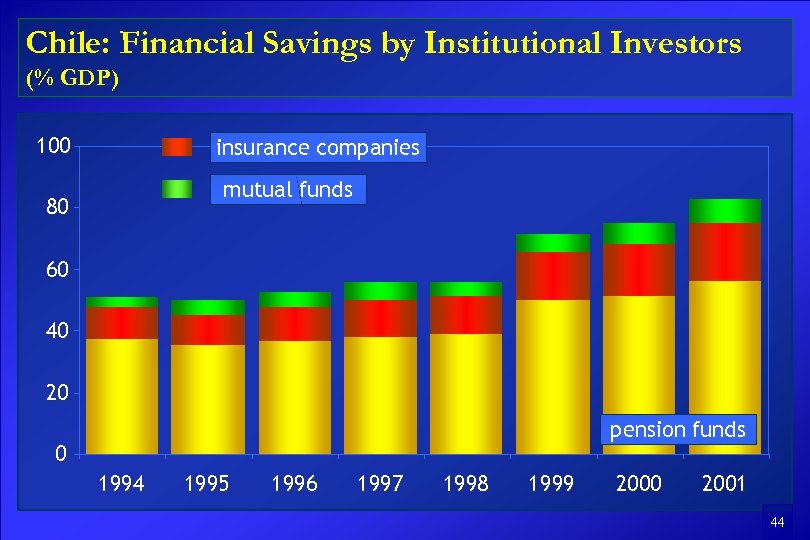

Chile: Financial Savings by Institutional Investors (% GDP) 100 insurance companies mutual funds 80 60 40 20 pension funds 0 1994 1995 1996 1997 1998 1999 2000 2001 44

Chile: Domestic Corporate Bond Market (USD billions) (Issuance) (total outstanding) 7 3, 0 6 2, 5 5 issuance 2, 0 4 1, 5 3 1, 0 2 outstanding 1 0 0, 5 0, 0 1994 1995 1996 1997 1998 1999 2000 2001 45

Fundamentals of the Chilean Economy Monetary Strength Microeconomic & Institutional Strength Fiscal Strength Macroeconomic and Financial Stability Financial System Strength External Sector Strength 46

Fundamentals of the Chilean Economy Central Bank of Chile October 2002

c2ac10bacbecf49945257389efba6d87.ppt