755869111650e7c2ae58a12c93445def.ppt

- Количество слайдов: 96

Functional Workshop Groningen, 7 October 2010 Version: 1. 0

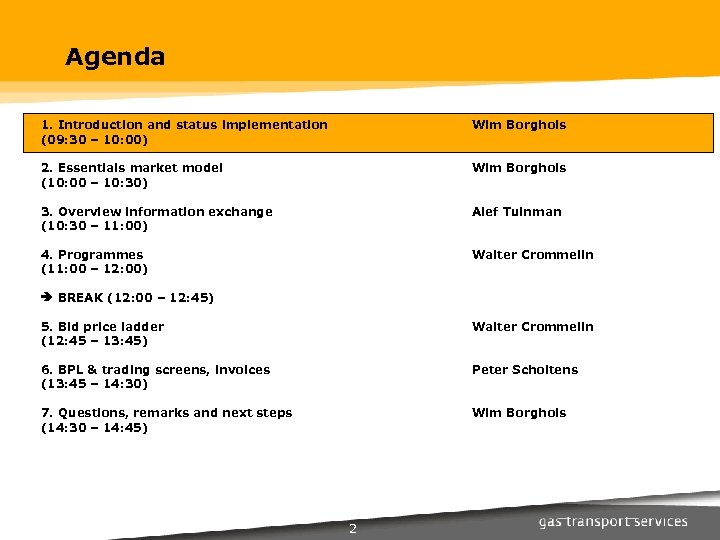

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 2

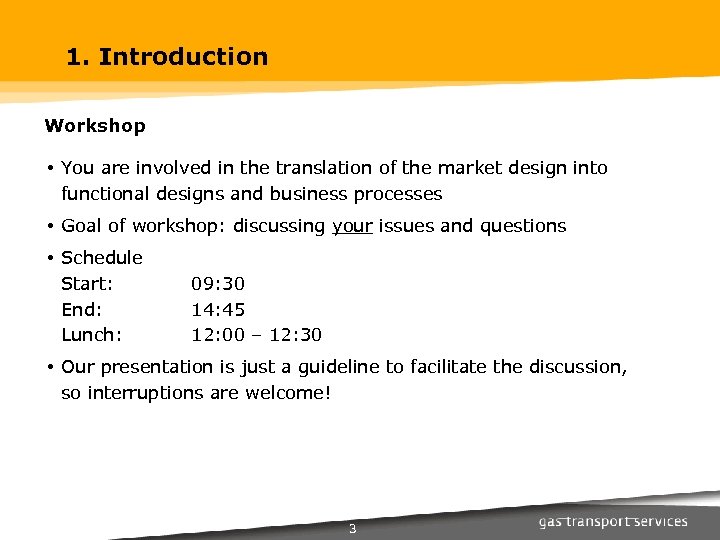

1. Introduction Workshop • You are involved in the translation of the market design into functional designs and business processes • Goal of workshop: discussing your issues and questions • Schedule Start: End: Lunch: 09: 30 14: 45 12: 00 – 12: 30 • Our presentation is just a guideline to facilitate the discussion, so interruptions are welcome! 3

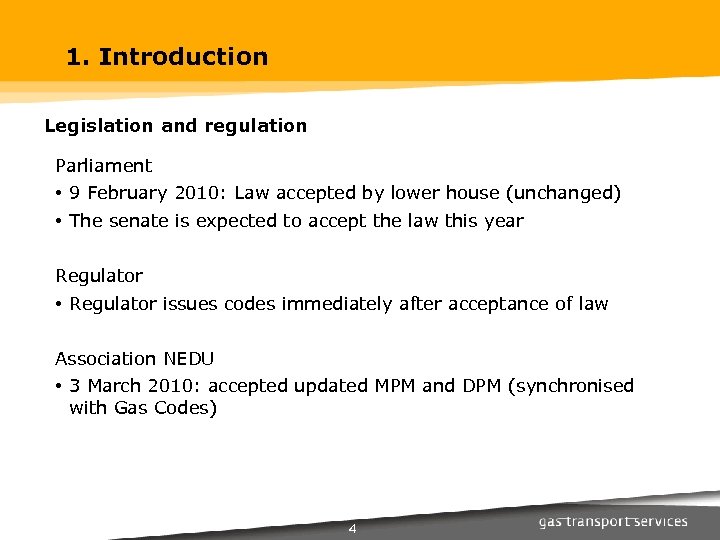

1. Introduction Legislation and regulation Parliament • 9 February 2010: Law accepted by lower house (unchanged) • The senate is expected to accept the law this year Regulator • Regulator issues codes immediately after acceptance of law Association NEDU • 3 March 2010: accepted updated MPM and DPM (synchronised with Gas Codes) 4

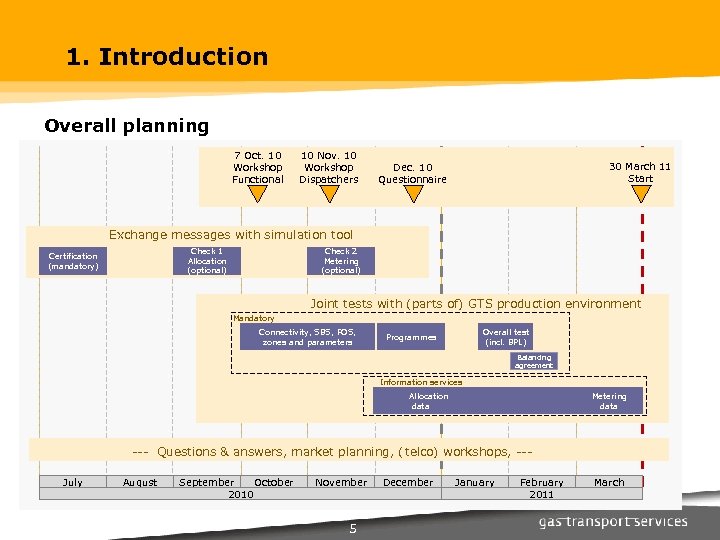

1. Introduction Overall planning 7 Oct. 10 Workshop Functional 10 Nov. 10 Workshop Dispatchers 30 March 11 Start Dec. 10 Questionnaire Exchange messages with simulation tool Check 1 Allocation (optional) Certification (mandatory) Check 2 Metering (optional) Joint tests with (parts of) GTS production environment Mandatory Connectivity, SBS, POS, zones and parameters Overall test (incl. BPL) Programmes Balancing agreement Information services Allocation data Metering data --- Questions & answers, market planning, (telco) workshops, --July August September October 2010 November 5 December January February 2011 March

1. Introduction Status implementation Certification • Over 80% of current market parties are certified by EDSN and cover almost 100% percent of market volume • Certification is mandatory for PVs Means for Bid price ladder • At his moment 8 market parties plan to participate in the bid price ladder Follow up • Few shippers show no progress at all – addressed by GTS 6

1. Introduction Joint tests The following phases start with a Getting started document: - Phase I October and November 2010 – SBS and POS - Phase II December 2010 – Programmes and allocation data - Phase III January and February 2011 – Market test with programmes, BPL and balancing agreement - Phase IV March 2011 – Metering data - Phase live 7

1. Introduction New market parties • All market parties have a account manager (AM) • Read the To. Do on the GTS market transition website and discuss with account managers how obtain necessary knowledge • Apply for EDSN certification • Discuss with AM participation joint tests 8

1. Introduction Next steps • 10 November 2010 workshop Dispatchers • November 2010 publishing getting started phase II joint tests • December 2010 Questionnaires • January 2011 Focus on procedure bid price ladder means 9

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 10

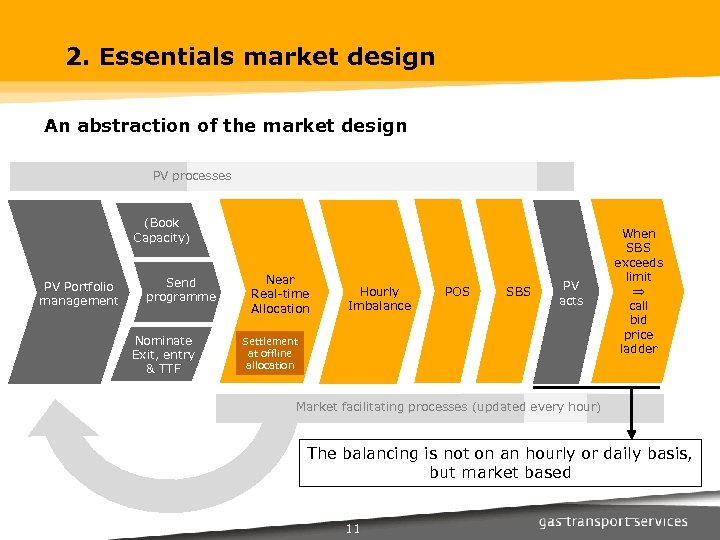

2. Essentials market design An abstraction of the market design PV processes (Book Capacity) PV Portfolio management Send programme Nominate Exit, entry & TTF Near Real-time Allocation Hourly Imbalance POS SBS PV acts Settlement at offline allocation When SBS exceeds limit call bid price ladder Market facilitating processes (updated every hour) The balancing is not on an hourly or daily basis, but market based 11

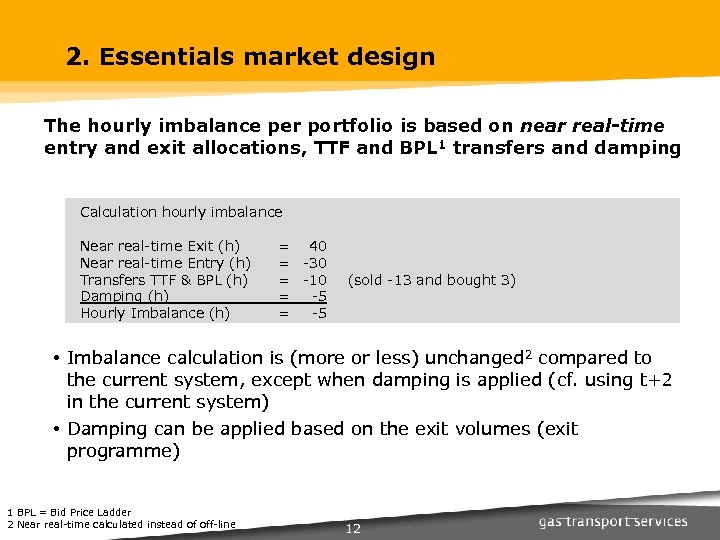

2. Essentials market design The hourly imbalance per portfolio is based on near real-time entry and exit allocations, TTF and BPL 1 transfers and damping Calculation hourly imbalance Near real-time Exit (h) Near real-time Entry (h) Transfers TTF & BPL (h) Damping (h) Hourly Imbalance (h) = 40 = -30 = -10 = -5 (sold -13 and bought 3) • Imbalance calculation is (more or less) unchanged 2 compared to the current system, except when damping is applied (cf. using t+2 in the current system) • Damping can be applied based on the exit volumes (exit programme) 1 BPL = Bid Price Ladder 2 Near real-time calculated instead of off-line 12

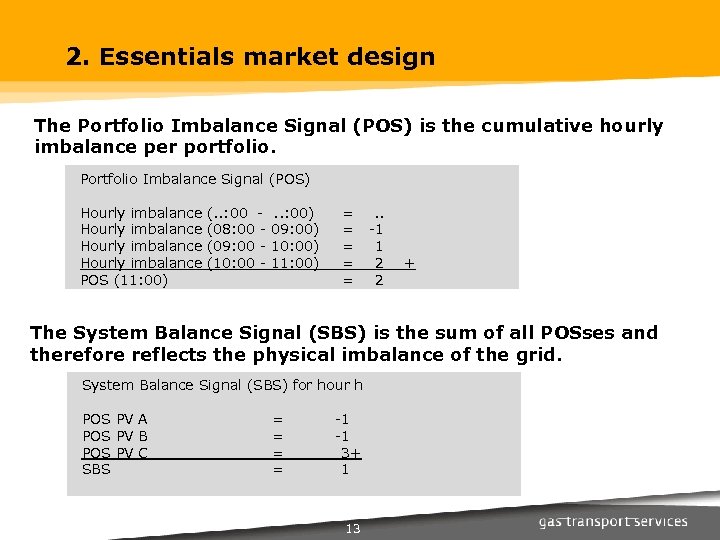

2. Essentials market design The Portfolio Imbalance Signal (POS) is the cumulative hourly imbalance per portfolio. Portfolio Imbalance Signal (POS) Hourly imbalance POS (11: 00) (. . : 00 (08: 00 (09: 00 (10: 00 - . . : 00) 09: 00) 10: 00) 11: 00) = = = . . -1 1 2 2 + The System Balance Signal (SBS) is the sum of all POSses and therefore reflects the physical imbalance of the grid. System Balance Signal (SBS) for hour h POS PV A POS PV B POS PV C SBS = = -1 -1 3+ 1 13

2. Essentials market design When the imbalance is exceeding a pre-set system limit the imbalance will be solved by calling the bid price ladder • No bandwidth or tolerance per portfolio but for the system as a whole • The bid price ladder contains bids of PV’s for solving the imbalance of the system • Calling the bid price ladder implies that GTS buys or sells gas (on the bid price ladder) in order to restore the system balance Call bid price ladder SBS 0 14

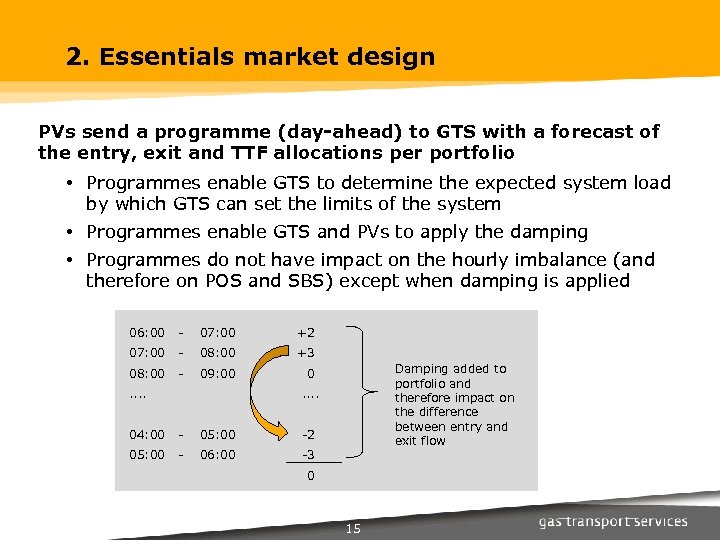

2. Essentials market design PVs send a programme (day-ahead) to GTS with a forecast of the entry, exit and TTF allocations per portfolio • Programmes enable GTS to determine the expected system load by which GTS can set the limits of the system • Programmes enable GTS and PVs to apply the damping • Programmes do not have impact on the hourly imbalance (and therefore on POS and SBS) except when damping is applied 06: 00 - 07: 00 +2 07: 00 - 08: 00 +3 08: 00 - 09: 00 0 . . Damping added to portfolio and therefore impact on the difference between entry and exit flow . . 04: 00 - 05: 00 -2 05: 00 - 06: 00 -3 0 15

2. Essentials market design The difference between near real-time allocations and offline allocations will be settled. • The offline allocations are near real-time allocations with corrections applies if necessary • The corrections will be settled by GTS and have no impact on the POS of PVs Unchanged • Nominations are still required at entry and exit points wherever GTS needs nominations for technical transport reasons or for the purpose of calculation of the assignment of interruptible capacity or points where they are needed to determine allocations • Entry and exit capacity will still be booked both firm and interruptible 16

2. Essentials market design Your experiences? • Questions • Issues • . . . 17

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 18

Topics 1. Context and overview 2. Information exchange in more detail 3. Planning 4. Documentation 19

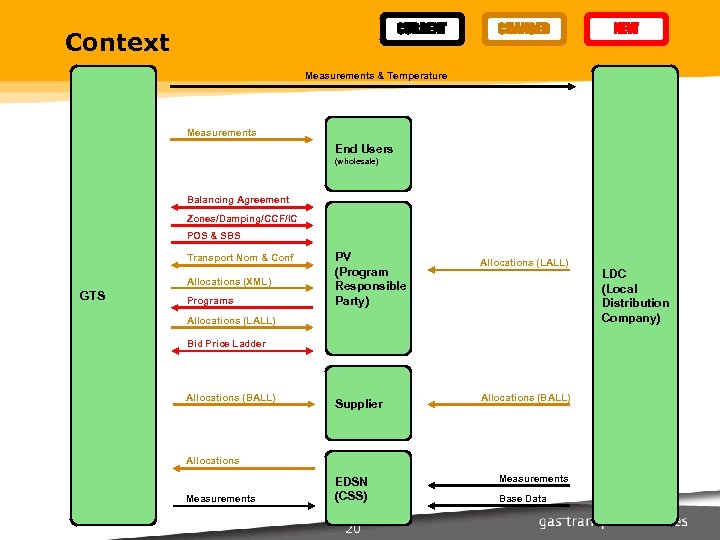

CURRENT Context CHANGED NEW Measurements & Temperature Measurements End Users (wholesale) Balancing Agreement Zones/Damping/CCF/IC POS & SBS Transport Nom & Conf Allocations (XML) GTS Programs PV (Program Responsible Party) Allocations (LALL) Bid Price Ladder Allocations (BALL) Supplier Allocations (BALL) Allocations Measurements EDSN (CSS) 20 Measurements Base Data LDC (Local Distribution Company)

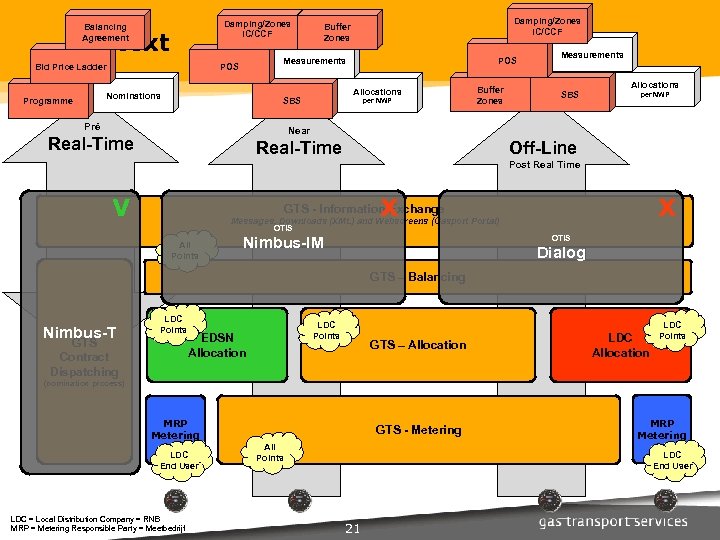

Damping/Zones IC/CCF Balancing Agreement Context Bid Price Ladder POS Measurements POS Nominations Programme Damping/Zones IC/CCF Buffer Zones Allocations SBS Pré per NWP Buffer Zones Measurements SBS Allocations per NWP Near Real-Time Off-Line Post Real Time V X X GTS - Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) OTIS All Points OTIS Nimbus-IM Dialog GTS – Balancing Nimbus-T LDC Points GTS Contract Dispatching LDC Points EDSN Allocation GTS – Allocation LDC Points (nomination process) MRP Metering LDC End User LDC = Local Distribution Company = RNB MRP = Metering Responsible Party = Meetbedrijf GTS - Metering All Points MRP Metering LDC End User 21

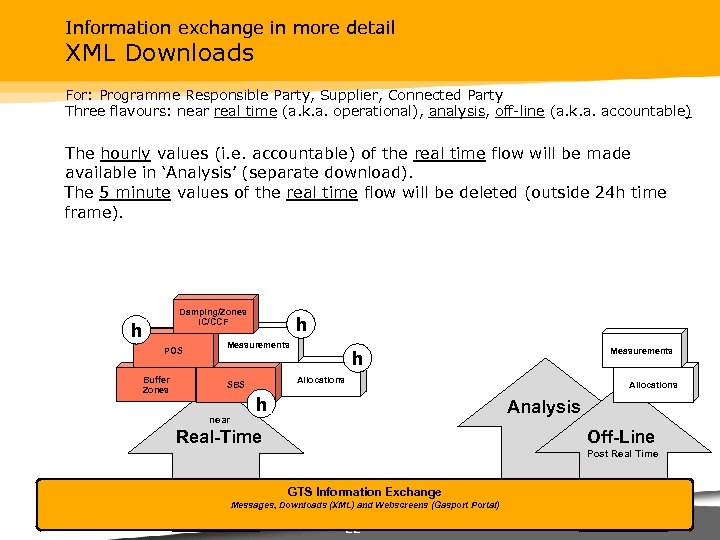

Information exchange in more detail XML Downloads For: Programme Responsible Party, Supplier, Connected Party Three flavours: near real time (a. k. a. operational), analysis, off-line (a. k. a. accountable) The hourly values (i. e. accountable) of the real time flow will be made available in ‘Analysis’ (separate download). The 5 minute values of the real time flow will be deleted (outside 24 h time frame). Damping/Zones IC/CCF h POS Buffer Zones h Measurements h Allocations SBS Allocations h Analysis near Off-Line Real-Time Post Real Time GTS Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) 22

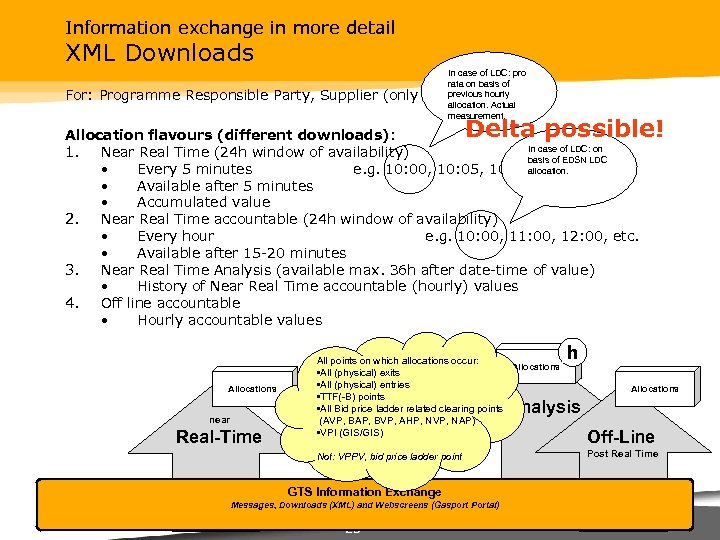

Information exchange in more detail XML Downloads For: Programme Responsible Party, Supplier (only In case of LDC: pro rata on basis of previous hourly off-line) allocation. Actual measurement. Delta possible! Allocation flavours (different downloads): In case of LDC: on 1. Near Real Time (24 h window of availability) basis of EDSN LDC • Every 5 minutes e. g. 10: 00, 10: 05, 10: 10, etc. allocation. • Available after 5 minutes • Accumulated value 2. Near Real Time accountable (24 h window of availability) • Every hour e. g. 10: 00, 11: 00, 12: 00, etc. • Available after 15 -20 minutes 3. Near Real Time Analysis (available max. 36 h after date-time of value) • History of Near Real Time accountable (hourly) values 4. Off line accountable • Hourly accountable values Allocations All points on which allocations occur: Allocations • All (physical) exits • All (physical) entries • TTF(-B) points • All Bid price ladder related clearing points (AVP, BAP, BVP, AHP, NVP, NAP) • VPI (GIS/GIS) h Allocations Analysis near Real-Time Not: VPPV, bid price ladder point GTS Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) 23 Off-Line Post Real Time

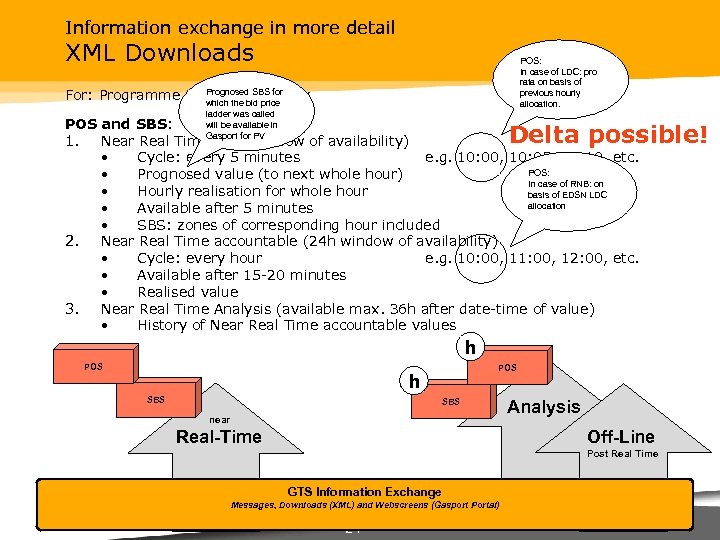

Information exchange in more detail XML Downloads POS: In case of LDC: pro rata on basis of previous hourly allocation. Prognosed SBS for For: Programme Responsible Party which the bid price ladder was called will be available in POS and SBS: Gasport for PV 1. Near Real Time (24 h window of availability) • Cycle: every 5 minutes e. g. 10: 00, 10: 05, 10: 10, etc. POS: • Prognosed value (to next whole hour) In case of RNB: on • Hourly realisation for whole hour basis of EDSN LDC allocation • Available after 5 minutes • SBS: zones of corresponding hour included 2. Near Real Time accountable (24 h window of availability) • Cycle: every hour e. g. 10: 00, 11: 00, 12: 00, etc. • Available after 15 -20 minutes • Realised value 3. Near Real Time Analysis (available max. 36 h after date-time of value) • History of Near Real Time accountable values Delta possible! h POS h SBS near Analysis Off-Line Real-Time Post Real Time GTS Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) 24

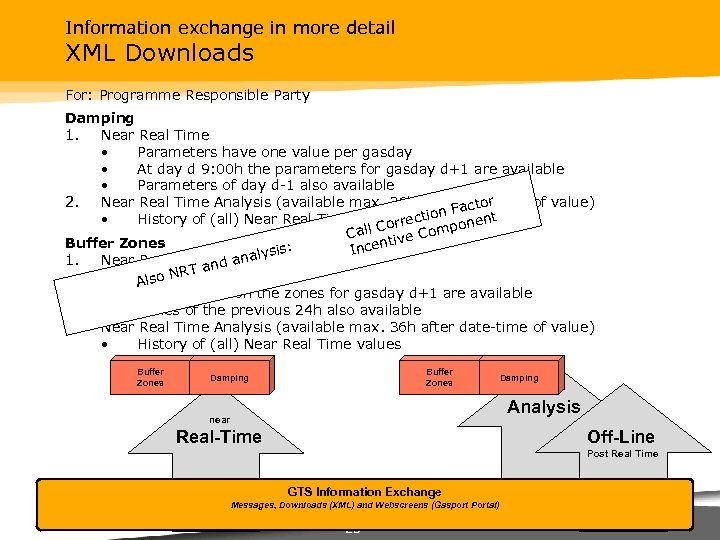

Information exchange in more detail XML Downloads For: Programme Responsible Party Damping 1. Near Real Time • Parameters have one value per gasday • At day d 9: 00 h the parameters for gasday d+1 are available • Parameters of day d-1 also available 2. Near Real Time Analysis (available max. 36 h after. Fdate-time of value) ctor on a ent • History of (all) Near Real Time valuesrecti or on Call C ive Comp t Buffer Zones Incen lysis: 1. Near Real Time nd ana Ta • Hourly values o NR Als • At day d 23: 00 h the zones for gasday d+1 are available • Zones of the previous 24 h also available 2. Near Real Time Analysis (available max. 36 h after date-time of value) • History of (all) Near Real Time values Buffer Zones Damping Analysis near Off-Line Real-Time Post Real Time GTS Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) 25

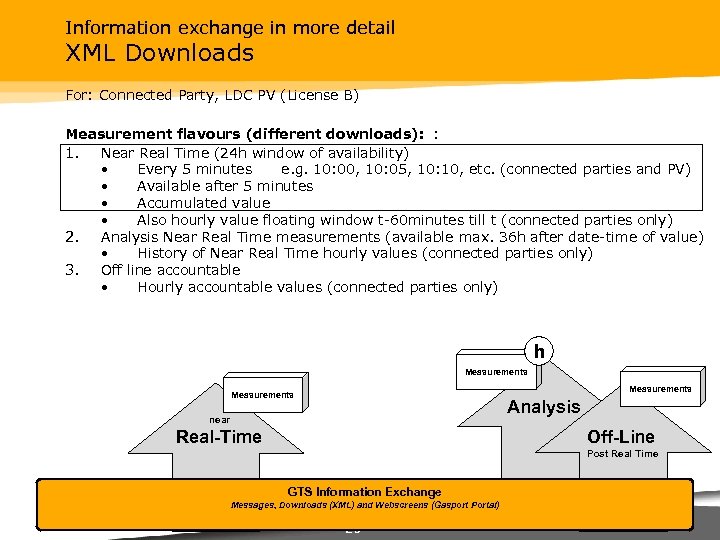

Information exchange in more detail XML Downloads For: Connected Party, LDC PV (License B) Measurement flavours (different downloads): : 1. Near Real Time (24 h window of availability) • Every 5 minutes e. g. 10: 00, 10: 05, 10: 10, etc. (connected parties and PV) • Available after 5 minutes • Accumulated value • Also hourly value floating window t-60 minutes till t (connected parties only) 2. Analysis Near Real Time measurements (available max. 36 h after date-time of value) • History of Near Real Time hourly values (connected parties only) 3. Off line accountable • Hourly accountable values (connected parties only) h Measurements Analysis near Off-Line Real-Time Post Real Time GTS Information Exchange Messages, Downloads (XML) and Webscreens (Gasport Portal) 26

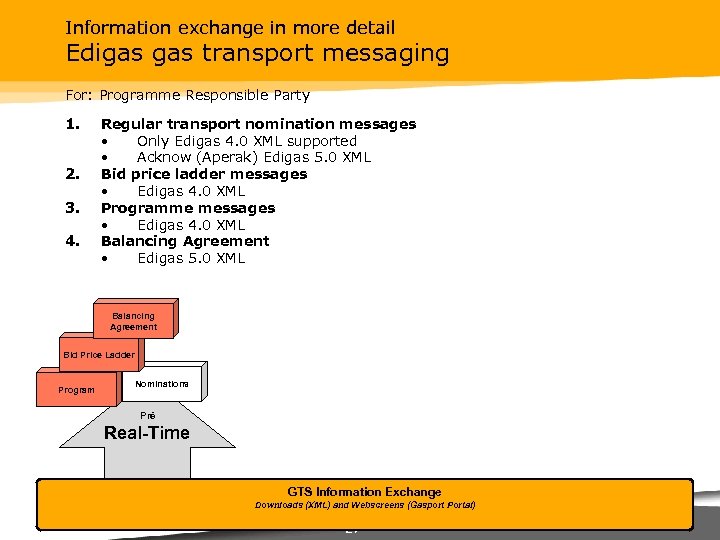

Information exchange in more detail Edigas transport messaging For: Programme Responsible Party 1. 2. 3. 4. Regular transport nomination messages • Only Edigas 4. 0 XML supported • Acknow (Aperak) Edigas 5. 0 XML Bid price ladder messages • Edigas 4. 0 XML Programme messages • Edigas 4. 0 XML Balancing Agreement • Edigas 5. 0 XML Balancing Agreement Bid Price Ladder Program Nominations Pré Real-Time GTS Information Exchange Downloads (XML) and Webscreens (Gasport Portal) 27

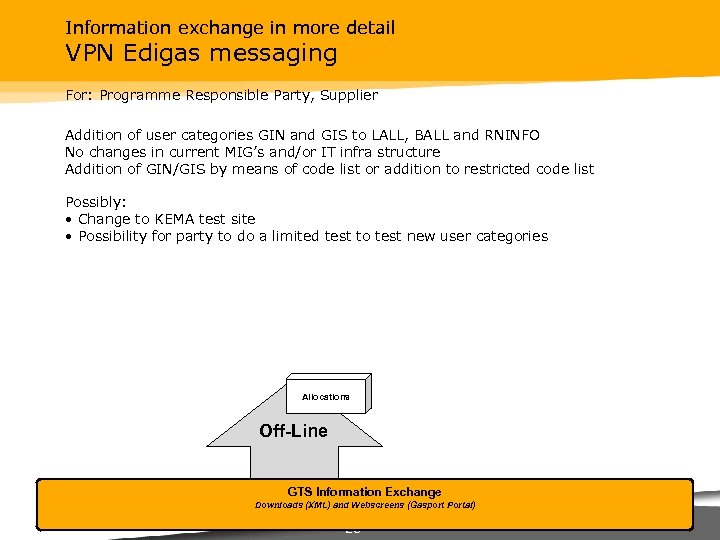

Information exchange in more detail VPN Edigas messaging For: Programme Responsible Party, Supplier Addition of user categories GIN and GIS to LALL, BALL and RNINFO No changes in current MIG’s and/or IT infra structure Addition of GIN/GIS by means of code list or addition to restricted code list Possibly: • Change to KEMA test site • Possibility for party to do a limited test to test new user categories Allocations Off-Line GTS Information Exchange Downloads (XML) and Webscreens (Gasport Portal) 28

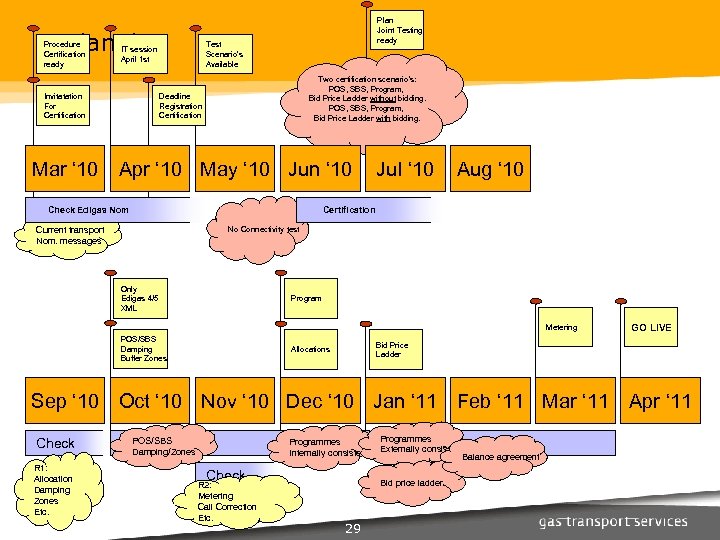

Planning Procedure Certification ready Mar ‘ 10 Test Scenario’s Available IT session April 1 st Invitatation For Certification Plan Joint Testing ready Two certification scenario’s: POS, SBS, Program, Bid Price Ladder without bidding. POS, SBS, Program, Bid Price Ladder with bidding. Deadline Registration Certification Apr ‘ 10 May ‘ 10 Jun ‘ 10 Check Edigas Nom. Jul ‘ 10 Aug ‘ 10 Certification No Connectivity test Current transport Nom. messages Only Edigas 4/5 XML Program Metering POS/SBS Damping Buffer Zones Bid Price Ladder Allocations Sep ‘ 10 Oct ‘ 10 Nov ‘ 10 Dec ‘ 10 Jan ‘ 11 Feb ‘ 11 Mar ‘ 11 Check R 1: Allocation Damping Zones Etc. Programmes Joint testing Internally consistent Externally consistent Balance agreement POS/SBS Damping/Zones Check R 2: Metering Call Correction Etc. GO LIVE Bid price ladder 29 Apr ‘ 11

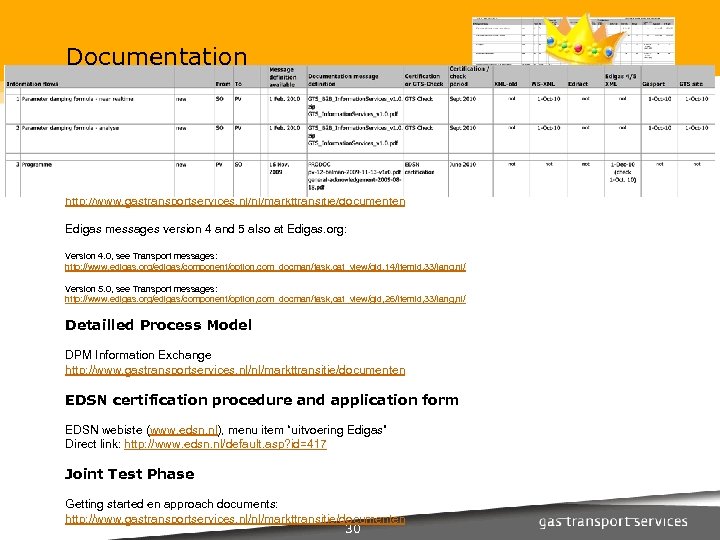

Documentation Planning, milestones, deliverables, etc The King of All Sheets: Overview for information exchange messages http: //www. gastransportservices. nl/nl/markttransitie/documenten Message specs XML (POS, SBS, allocations, etc) and new Edigas messages: http: //www. gastransportservices. nl/nl/markttransitie/documenten Edigas messages version 4 and 5 also at Edigas. org: Version 4. 0, see Transport messages: http: //www. edigas. org/edigas/component/option, com_docman/task, cat_view/gid, 14/Itemid, 33/lang, nl/ Version 5. 0, see Transport messages: http: //www. edigas. org/edigas/component/option, com_docman/task, cat_view/gid, 26/Itemid, 33/lang, nl/ Detailled Process Model DPM Information Exchange http: //www. gastransportservices. nl/nl/markttransitie/documenten EDSN certification procedure and application form EDSN webiste (www. edsn. nl), menu item “uitvoering Edigas” Direct link: http: //www. edsn. nl/default. asp? id=417 Joint Test Phase Getting started en approach documents: http: //www. gastransportservices. nl/nl/markttransitie/documenten 30

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 31

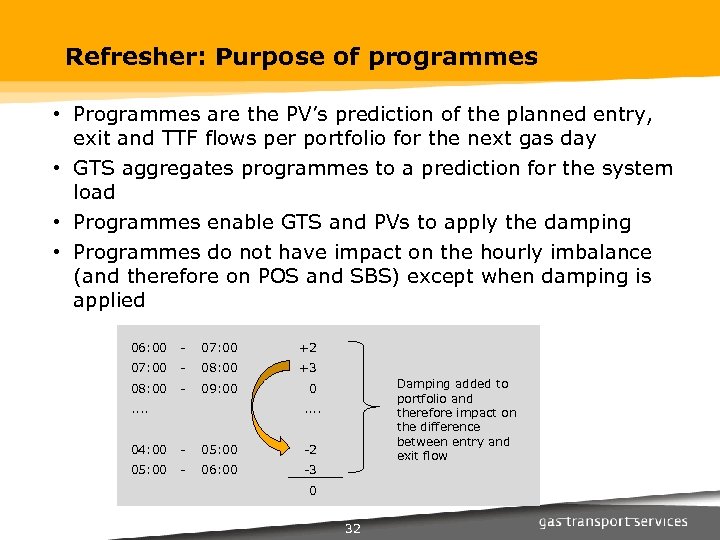

Refresher: Purpose of programmes • Programmes are the PV’s prediction of the planned entry, exit and TTF flows per portfolio for the next gas day • GTS aggregates programmes to a prediction for the system load • Programmes enable GTS and PVs to apply the damping • Programmes do not have impact on the hourly imbalance (and therefore on POS and SBS) except when damping is applied 06: 00 - 07: 00 +2 07: 00 - 08: 00 +3 08: 00 - 09: 00 0 . . Damping added to portfolio and therefore impact on the difference between entry and exit flow . . 04: 00 - 05: 00 -2 05: 00 - 06: 00 -3 0 32

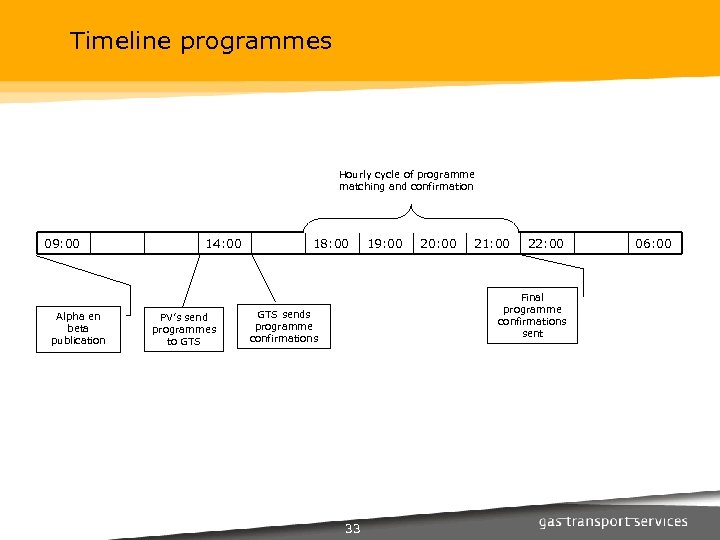

Timeline programmes Hourly cycle of programme matching and confirmation 09: 00 Alpha en beta publication 14: 00 PV’s send programmes to GTS 18: 00 19: 00 20: 00 21: 00 22: 00 Final programme confirmations sent GTS sends programme confirmations 33 06: 00

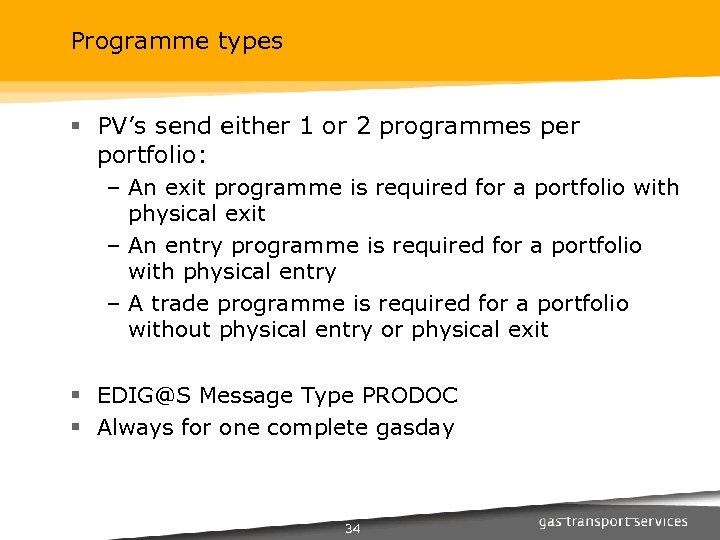

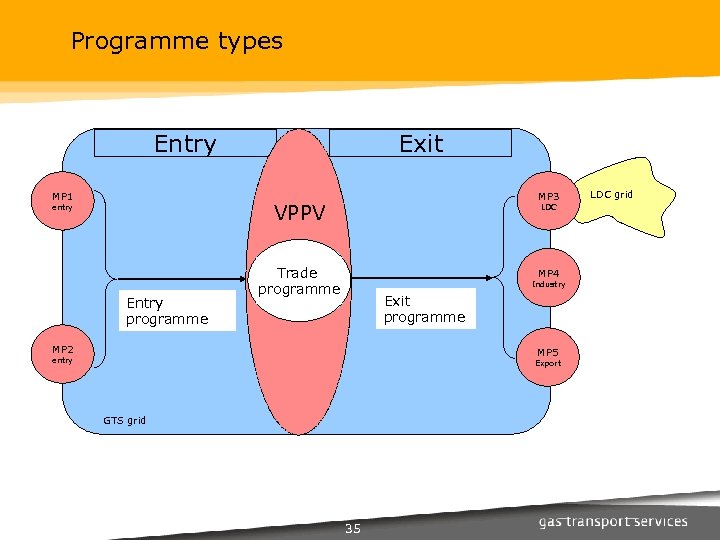

Programme types § PV’s send either 1 or 2 programmes per portfolio: – An exit programme is required for a portfolio with physical exit – An entry programme is required for a portfolio with physical entry – A trade programme is required for a portfolio without physical entry or physical exit § EDIG@S Message Type PRODOC § Always for one complete gasday 34

Programme types Exit Entry MP 1 MP 3 VPPV entry Entry programme LDC Trade programme MP 4 Industry Exit programme MP 2 MP 5 entry Export GTS grid 35 LDC grid

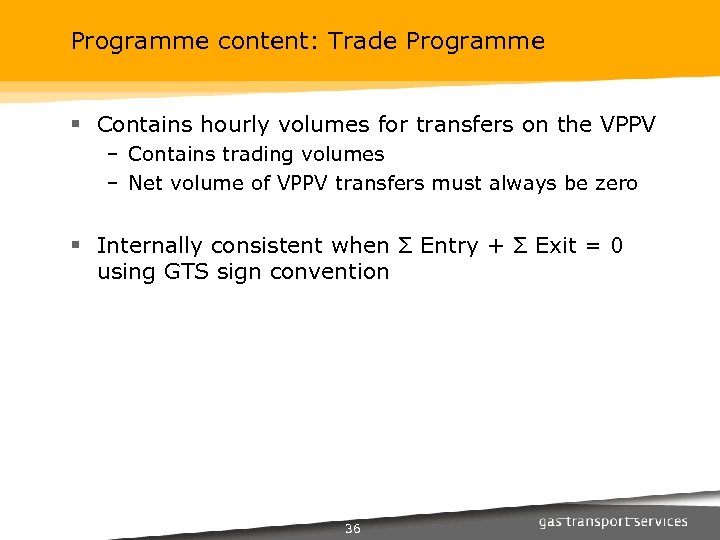

Programme content: Trade Programme § Contains hourly volumes for transfers on the VPPV – Contains trading volumes – Net volume of VPPV transfers must always be zero § Internally consistent when Σ Entry + Σ Exit = 0 using GTS sign convention 36

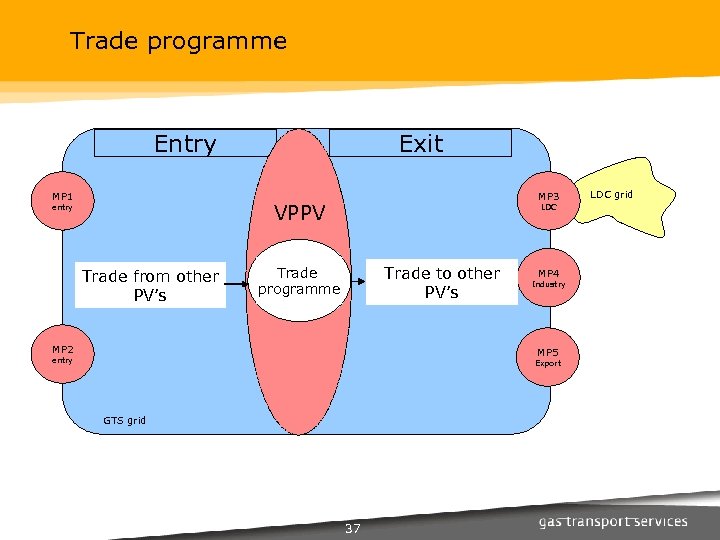

Trade programme Exit Entry MP 1 MP 3 VPPV entry Trade from other PV’s LDC Trade to other PV’s Trade programme MP 2 MP 4 Industry MP 5 entry Export GTS grid 37 LDC grid

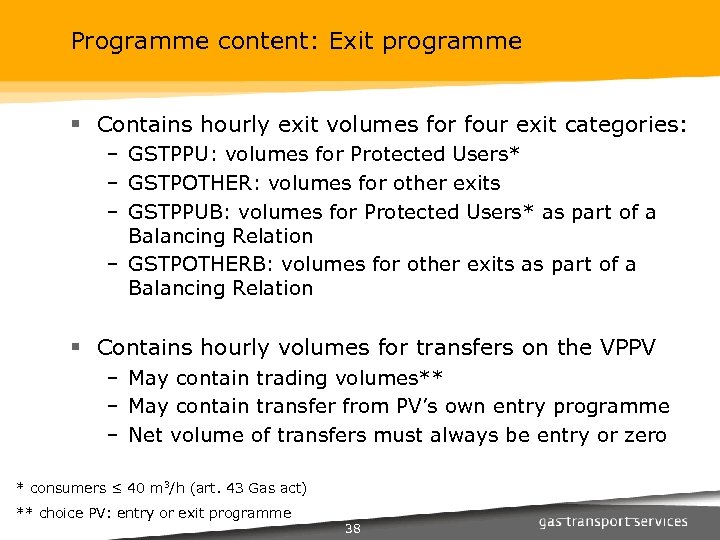

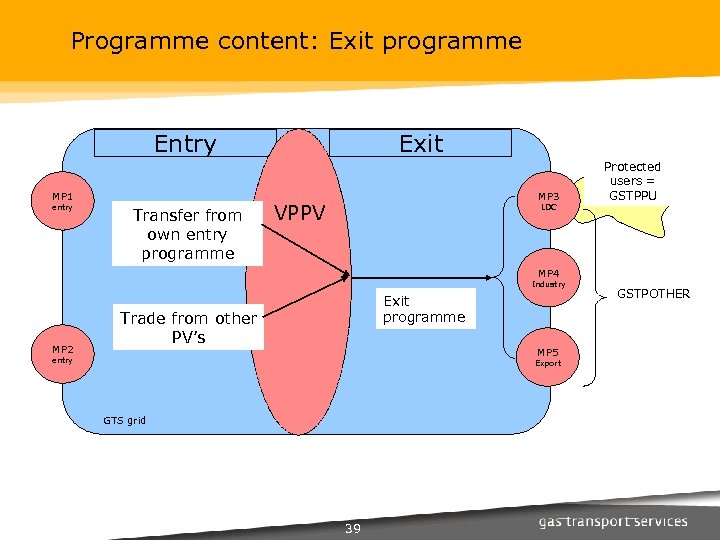

Programme content: Exit programme § Contains hourly exit volumes for four exit categories: – GSTPPU: volumes for Protected Users* – GSTPOTHER: volumes for other exits – GSTPPUB: volumes for Protected Users* as part of a Balancing Relation – GSTPOTHERB: volumes for other exits as part of a Balancing Relation § Contains hourly volumes for transfers on the VPPV – May contain trading volumes** – May contain transfer from PV’s own entry programme – Net volume of transfers must always be entry or zero * consumers ≤ 40 m 3/h (art. 43 Gas act) ** choice PV: entry or exit programme 38

Programme content: Exit programme Exit Entry MP 1 entry Transfer from own entry programme MP 3 VPPV LDC Protected users = LDCGSTPPU grid MP 4 Industry MP 2 Exit programme Trade from other PV’s MP 5 entry Export GTS grid 39 GSTPOTHER

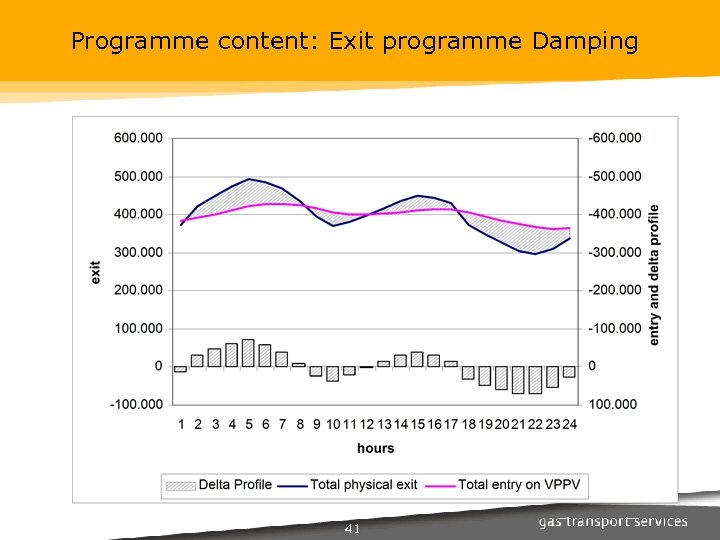

Programme content: Exit programme § Damping is obligatory if the Exit Programme is for a portfolio that includes Protected Users. § Damping calculated with damping formula and alpha and beta parameters § Internally consistent when Σ Entry + Σ Exit + Damping = 0 using GTS sign convention § Damping is implicit in PRODOC message as the difference between sum of exits and net entry on VPPV; the values are not included in the message. 40

Programme content: Exit programme Damping 41

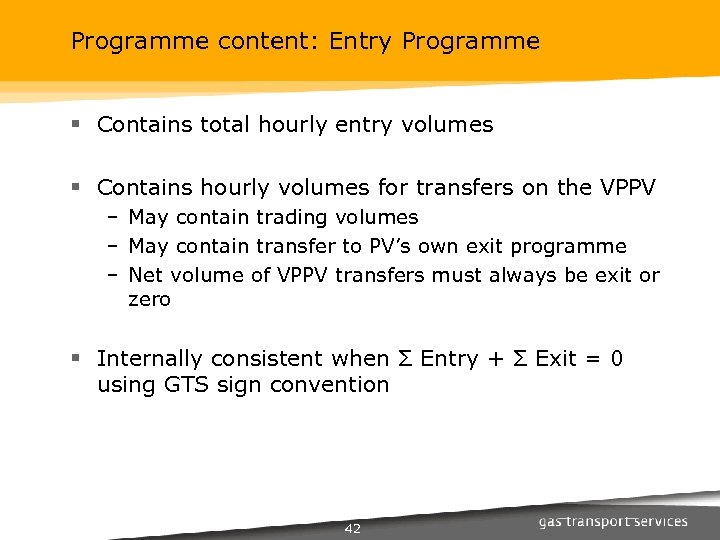

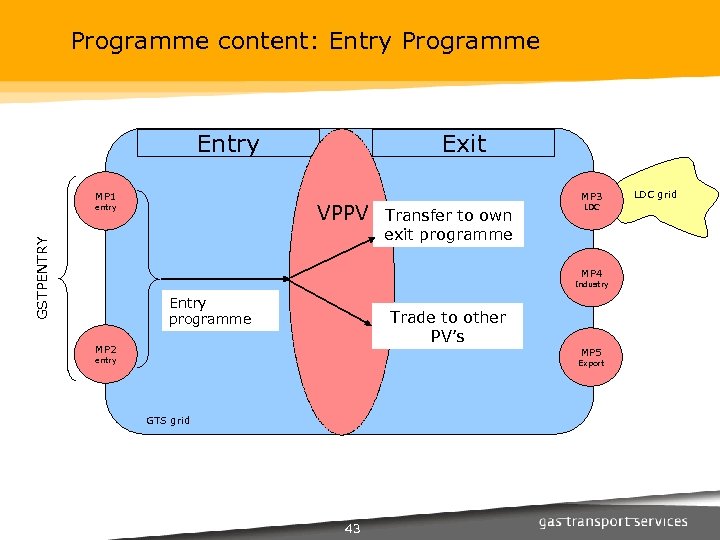

Programme content: Entry Programme § Contains total hourly entry volumes § Contains hourly volumes for transfers on the VPPV – May contain trading volumes – May contain transfer to PV’s own exit programme – Net volume of VPPV transfers must always be exit or zero § Internally consistent when Σ Entry + Σ Exit = 0 using GTS sign convention 42

Programme content: Entry Programme Exit Entry MP 1 VPPV GSTPENTRY entry MP 3 Transfer to own exit programme LDC MP 4 Industry Entry programme Trade to other PV’s MP 2 MP 5 entry Export GTS grid 43 LDC grid

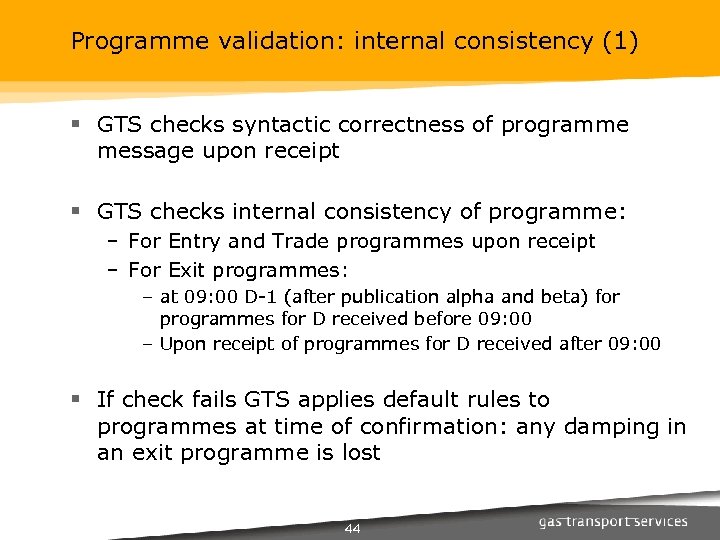

Programme validation: internal consistency (1) § GTS checks syntactic correctness of programme message upon receipt § GTS checks internal consistency of programme: – For Entry and Trade programmes upon receipt – For Exit programmes: – at 09: 00 D-1 (after publication alpha and beta) for programmes for D received before 09: 00 – Upon receipt of programmes for D received after 09: 00 § If check fails GTS applies default rules to programmes at time of confirmation: any damping in an exit programme is lost 44

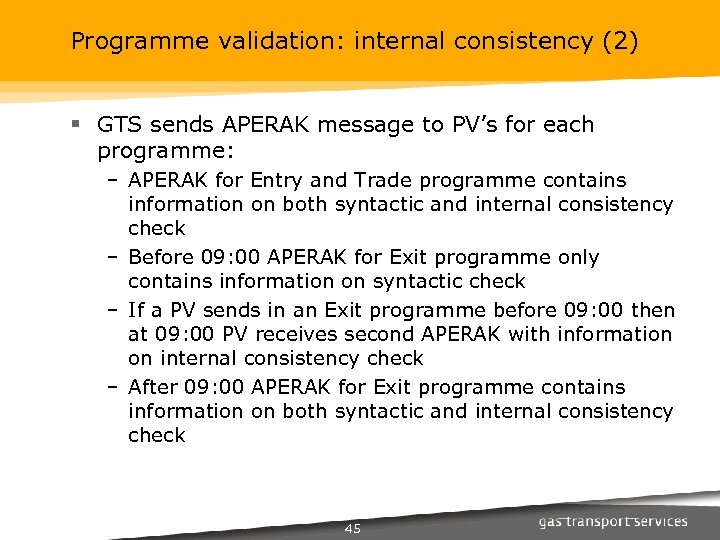

Programme validation: internal consistency (2) § GTS sends APERAK message to PV’s for each programme: – APERAK for Entry and Trade programme contains information on both syntactic and internal consistency check – Before 09: 00 APERAK for Exit programme only contains information on syntactic check – If a PV sends in an Exit programme before 09: 00 then at 09: 00 PV receives second APERAK with information on internal consistency check – After 09: 00 APERAK for Exit programme contains information on both syntactic and internal consistency check 45

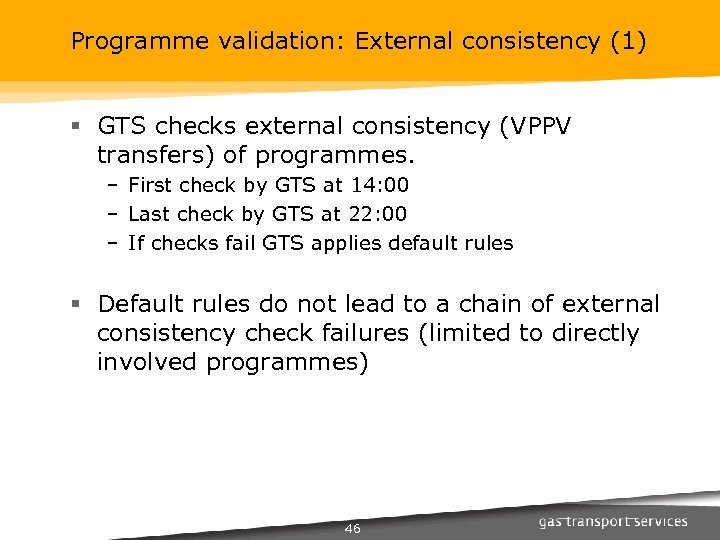

Programme validation: External consistency (1) § GTS checks external consistency (VPPV transfers) of programmes. – First check by GTS at 14: 00 – Last check by GTS at 22: 00 – If checks fail GTS applies default rules § Default rules do not lead to a chain of external consistency check failures (limited to directly involved programmes) 46

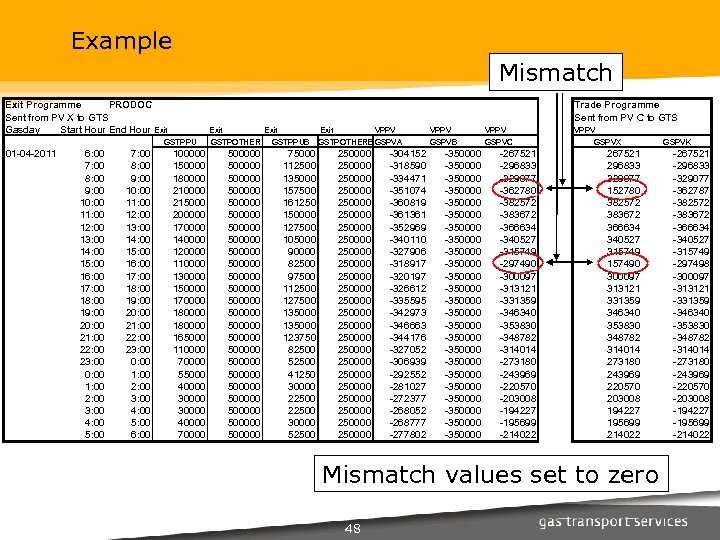

Programme validation: External consistency (2) For each transfer between programmes on the VPPV GTS matches the following: § The submitted counterportfolio § The submitted volume § The specified time period § The direction of the transfer Transfers which mismatch are set to zero. Transfers submitted by a clearing house (e. g. APX) are assumed to be correct and override transfers submitted by PV’s 47

Example Mismatch Exit Programme PRODOC Sent from PV X to GTS Gasday Start Hour End Hour Exit Trade Programme Sent from PV C to GTS Exit GSTPPU 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 100000 150000 180000 215000 200000 170000 140000 120000 110000 130000 150000 170000 180000 165000 110000 70000 55000 40000 30000 40000 70000 Exit GSTPOTHER 500000 500000 500000 500000 500000 500000 Exit GSTPPUB 75000 112500 135000 157500 161250 150000 127500 105000 90000 82500 97500 112500 127500 135000 123750 82500 52500 41250 30000 22500 30000 52500 VPPV GSTPOTHERB GSPVA 250000 250000 250000 250000 250000 250000 -304152 -318590 -334471 -351074 -360819 -361361 -352969 -340110 -327906 -318917 -320197 -326612 -335595 -342973 -346663 -344176 -327052 -306939 -292552 -281027 -272377 -268052 -268777 -277802 VPPV GSPVB GSPVC -350000 -350000 -350000 -350000 -350000 -350000 -267521 -296833 -329077 0 -362787 -382572 -383672 -366634 -340527 -315749 0 -297498 -300097 -313121 -331359 -346340 -353830 -348782 -314014 -273180 -243969 -220570 -203008 -194227 -195699 -214022 VPPV GSPVX 267521 296833 329077 0 152787 382572 383672 366634 340527 315749 0 157498 300097 313121 331359 346340 353830 348782 314014 273180 243969 220570 203008 194227 195699 214022 Mismatch values set to zero 48 GSPVK -267521 -296833 -329077 -362787 -382572 -383672 -366634 -340527 -315749 -297498 -300097 -313121 -331359 -346340 -353830 -348782 -314014 -273180 -243969 -220570 -203008 -194227 -195699 -214022

Programme confirmation (1) § After each check GTS communicates the result to the PV’s: – EDIG@S Message Type PROCON – Message Statuses allow PV’s to identify and correct errors – New confirmations are sent if statuses change § The PROCON message includes additional dummy counterportfolios that confirm total flows and damping 49

Programme confirmation (2) § Dummy counterportfolios for the exit programme: – GSTPEXIT: total hourly physical exit – GSTPVPPVEN: net hourly virtual entry – GSTPD: damping § Dummy counterportfolios for the entry programme: – GSTPVPPVEX: net hourly virtual exit – GSTPD: damping § Dummy counterportfolios for the trade programme: – GSTPVPPVEN: total hourly virtual entry – GSTPVPPVEX: total hourly virtual exit – GSTPD: damping 50

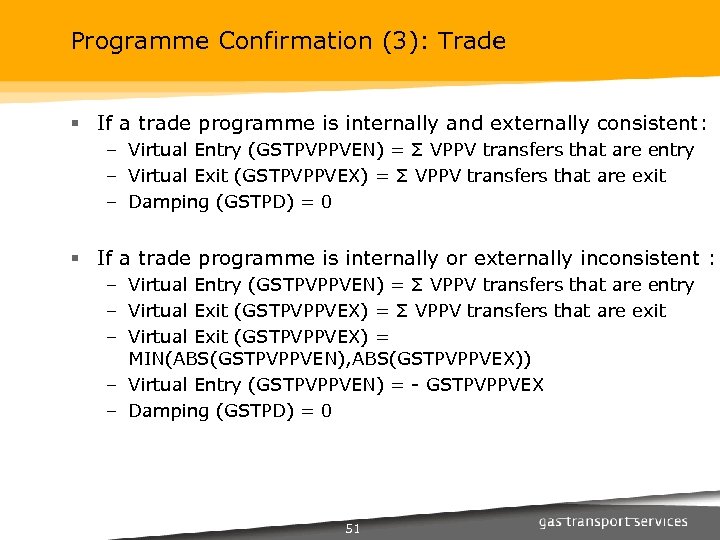

Programme Confirmation (3): Trade § If a trade programme is internally and externally consistent: – Virtual Entry (GSTPVPPVEN) = Σ VPPV transfers that are entry – Virtual Exit (GSTPVPPVEX) = Σ VPPV transfers that are exit – Damping (GSTPD) = 0 § If a trade programme is internally or externally inconsistent : – Virtual Entry (GSTPVPPVEN) = Σ VPPV transfers that are entry – Virtual Exit (GSTPVPPVEX) = Σ VPPV transfers that are exit – Virtual Exit (GSTPVPPVEX) = MIN(ABS(GSTPVPPVEN), ABS(GSTPVPPVEX)) – Virtual Entry (GSTPVPPVEN) = - GSTPVPPVEX – Damping (GSTPD) = 0 51

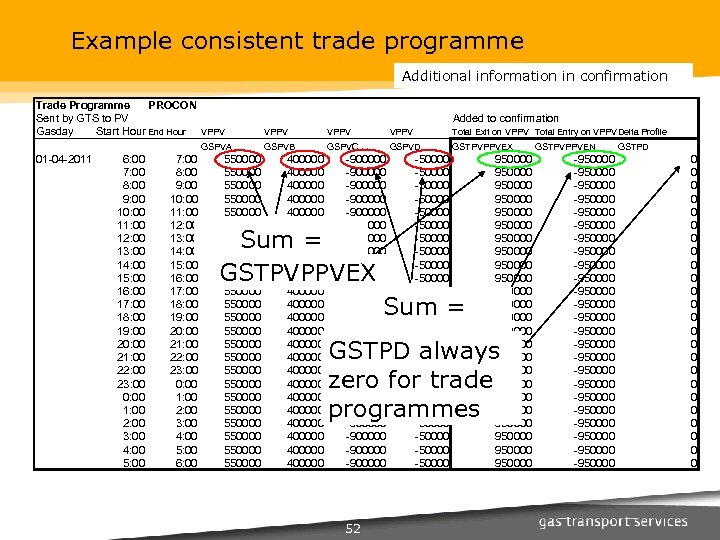

Example consistent trade programme Additional information in confirmation Trade Programme PROCON Sent by GTS to PV Gasday Start Hour End Hour VPPV GSPVA 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 550000 550000 550000 550000 550000 550000 Added to confirmation VPPV Total Exit on VPPV Total Entry on VPPVDelta Profile GSPVB GSPVC GSPVD GSTPVPPVEX 400000 400000 400000 400000 400000 400000 -900000 -900000 -900000 -900000 -900000 -900000 Sum = GSTPVPPVEX -50000 -50000 -50000 -50000 -50000 -50000 950000 950000 950000 950000 950000 950000 Sum = GSTPVPPVEN GSTPD always zero for trade programmes 52 GSTPVPPVEN -950000 -950000 -950000 -950000 -950000 -950000 GSTPD 0 0 0 0 0 0

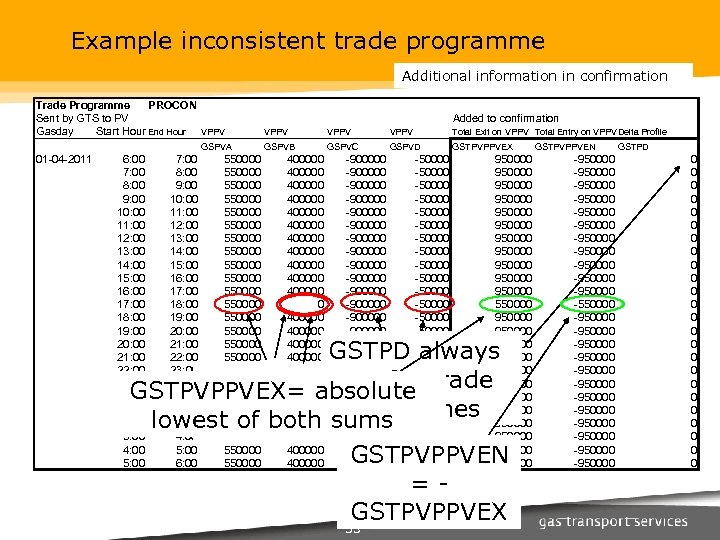

Example inconsistent trade programme Additional information in confirmation Trade Programme PROCON Sent by GTS to PV Gasday Start Hour End Hour VPPV GSPVA 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 550000 550000 550000 550000 550000 550000 Added to confirmation VPPV Total Exit on VPPV Total Entry on VPPVDelta Profile GSPVB GSPVC GSPVD GSTPVPPVEX 400000 400000 400000 0 400000 400000 400000 -900000 -900000 -900000 -900000 -900000 -900000 -50000 -50000 -50000 -50000 -50000 -50000 950000 950000 950000 550000 950000 950000 950000 GSTPD always Sum absolute Sum = GSTPVPPVEX== zero for trade programmes lowest. Mismatch of both -950000 550000 sums GSTPVPPVEN =GSTPVPPVEX 53 GSTPVPPVEN -950000 -950000 -950000 -550000 -950000 -950000 -950000 GSTPD 0 0 0 0 0 0

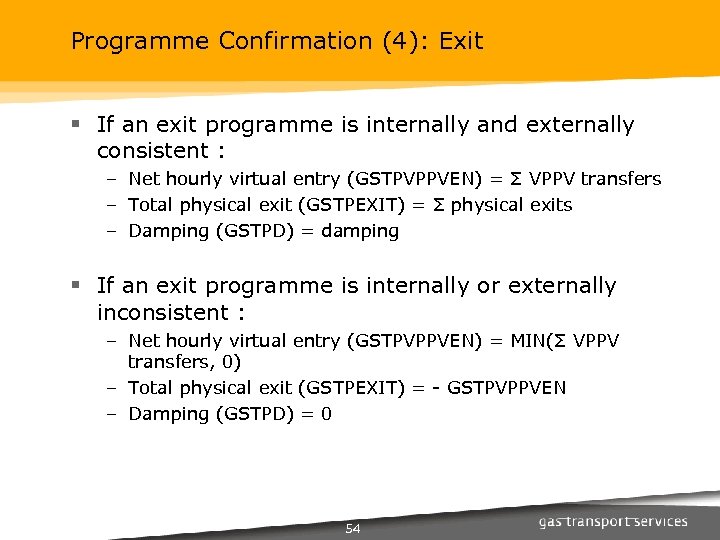

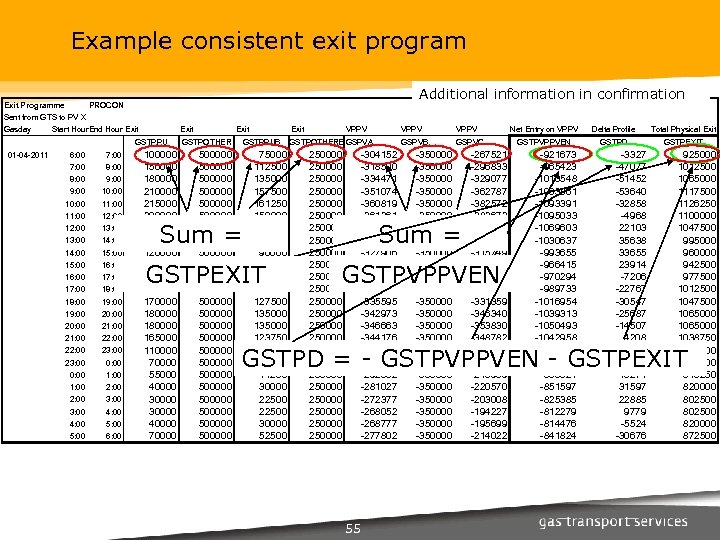

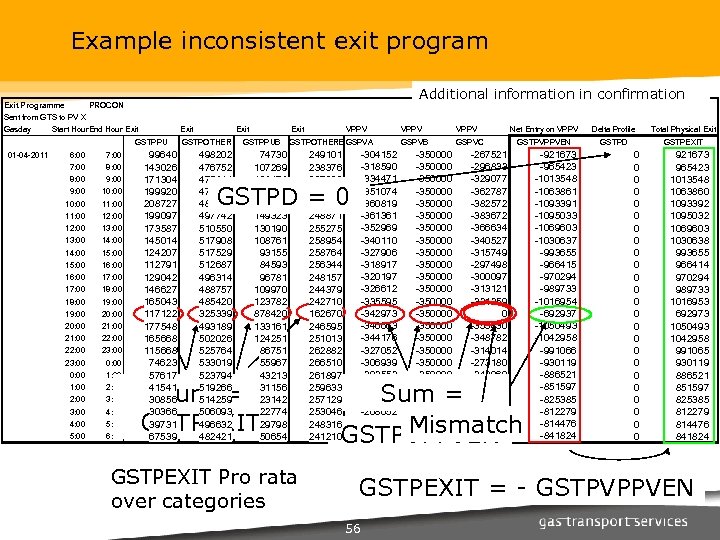

Programme Confirmation (4): Exit § If an exit programme is internally and externally consistent : – Net hourly virtual entry (GSTPVPPVEN) = Σ VPPV transfers – Total physical exit (GSTPEXIT) = Σ physical exits – Damping (GSTPD) = damping § If an exit programme is internally or externally inconsistent : – Net hourly virtual entry (GSTPVPPVEN) = MIN(Σ VPPV transfers, 0) – Total physical exit (GSTPEXIT) = - GSTPVPPVEN – Damping (GSTPD) = 0 54

Example consistent exit program Exit Programme Additional information in confirmation PROCON Sent from GTS to PV X Gasday Start Hour. End Hour Exit GSTPPU 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 100000 150000 180000 215000 200000 170000 140000 120000 110000 130000 150000 170000 180000 165000 110000 70000 55000 40000 30000 40000 70000 Exit GSTPOTHER 500000 500000 500000 500000 500000 500000 Exit GSTPPUB Sum = 75000 112500 135000 157500 161250 150000 127500 105000 90000 82500 97500 112500 127500 135000 123750 82500 52500 41250 30000 22500 30000 52500 GSTPEXIT VPPV 250000 250000 250000 250000 250000 250000 -304152 -318590 -334471 -351074 -360819 -361361 -352969 -340110 -327906 -318917 -320197 -326612 -335595 -342973 -346663 -344176 -327052 -306939 -292552 -281027 -272377 -268052 -268777 -277802 VPPV Net Entry on VPPV Delta Profile Total Physical Exit GSPVB GSTPOTHERB GSPVA GSPVC GSTPVPPVEN GSTPD GSTPEXIT -350000 -350000 -350000 -350000 -350000 -350000 Sum = -267521 -296833 -329077 -362787 -382572 -383672 -366634 -340527 -315749 -297498 -300097 -313121 -331359 -346340 -353830 -348782 -314014 -273180 -243969 -220570 -203008 -194227 -195699 -214022 GSTPVPPVEN -921673 -965423 -1013548 -1063861 -1093391 -1095033 -1069603 -1030637 -993655 -966415 -970294 -989733 -1016954 -1039313 -1050493 -1042958 -991066 -930119 -886521 -851597 -825385 -812279 -814476 -841824 -3327 -47077 -51452 -53640 -32858 -4968 22103 35638 33655 23914 -7206 -22767 -30547 -25687 -14507 4208 48565 57619 40271 31597 22885 9779 -5524 -30676 925000 1012500 1065000 1117500 1126250 1100000 1047500 995000 960000 942500 977500 1012500 1047500 1065000 1038750 942500 872500 846250 820000 802500 820000 872500 GSTPD = - GSTPVPPVEN - GSTPEXIT 55

Example inconsistent exit program Exit Programme Additional information in confirmation PROCON Sent from GTS to PV X Gasday Start Hour. End Hour Exit GSTPPU 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 100000 99640 150000 143026 180000 171304 210000 199920 215000 208727 200000 199097 170000 173587 140000 145014 120000 124207 110000 112791 130000 129042 150000 146627 170000 165043 180000 117122 180000 177548 165000 165668 110000 115668 70000 74623 55000 57617 40000 41541 30000 30856 30000 30366 40000 39731 70000 67539 Exit GSTPOTHER 500000 498202 500000 476752 500000 475844 500000 476000 500000 485412 500000 497742 500000 510550 500000 517908 500000 517529 500000 512687 500000 496314 500000 488757 500000 485420 500000 325339 500000 493189 500000 502026 500000 525764 500000 533019 500000 523794 500000 519266 500000 514259 500000 506093 500000 496632 500000 482421 Exit GSTPPUB VPPV GSTPOTHERB GSPVA 75000 74730 112500 107269 135000 128478 157500 149940 161250 156545 150000 149323 127500 130190 105000 108761 90000 93155 82500 84593 97500 96781 112500 109970 127500 123782 135000 87842 135000 133161 123750 124251 82500 86751 52500 55967 41250 43213 30000 31156 22500 23142 22500 22774 30000 29798 52500 50654 250000 249101 250000 238376 250000 237922 250000 238000 250000 242706 250000 248871 250000 255275 250000 258954 250000 258764 250000 256344 250000 248157 250000 244379 250000 242710 250000 162670 250000 246595 250000 251013 250000 262882 250000 266510 250000 261897 250000 259633 250000 257129 250000 253046 250000 248316 250000 241210 -304152 -318590 -334471 -351074 -360819 -361361 -352969 -340110 -327906 -318917 -320197 -326612 -335595 -342973 -346663 -344176 -327052 -306939 -292552 -281027 -272377 -268052 -268777 -277802 GSTPD = 0 Sum = GSTPEXIT Pro rata over categories VPPV Net Entry on VPPV Delta Profile Total Physical Exit GSPVB GSPVC GSTPVPPVEN GSTPD GSTPEXIT -350000 -350000 -350000 -350000 -350000 -350000 -267521 -296833 -329077 -362787 -382572 -383672 -366634 -340527 -315749 -297498 -300097 -313121 -331359 0 -353830 -348782 -314014 -273180 -243969 -220570 -203008 -194227 -195699 -214022 Sum = Mismatch GSTPVPPVEN -921673 -965423 -1013548 -1063861 -1093391 -1095033 -1069603 -1030637 -993655 -966415 -970294 -989733 -1016954 -692937 -1050493 -1042958 -991066 -930119 -886521 -851597 -825385 -812279 -814476 -841824 0 0 0 0 0 0 921673 965423 1013548 1063860 1093392 1095032 1069603 1030638 993655 966414 970294 989733 1016953 692973 1050493 1042958 991065 930119 886521 851597 825385 812279 814476 841824 GSTPEXIT = - GSTPVPPVEN 56

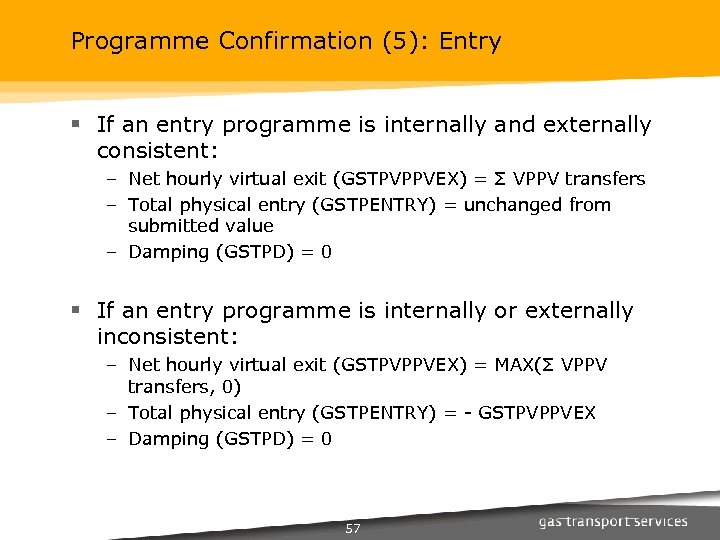

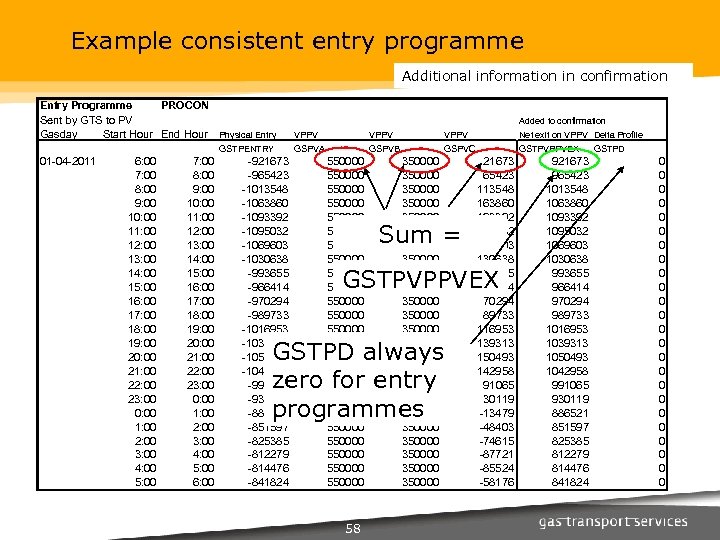

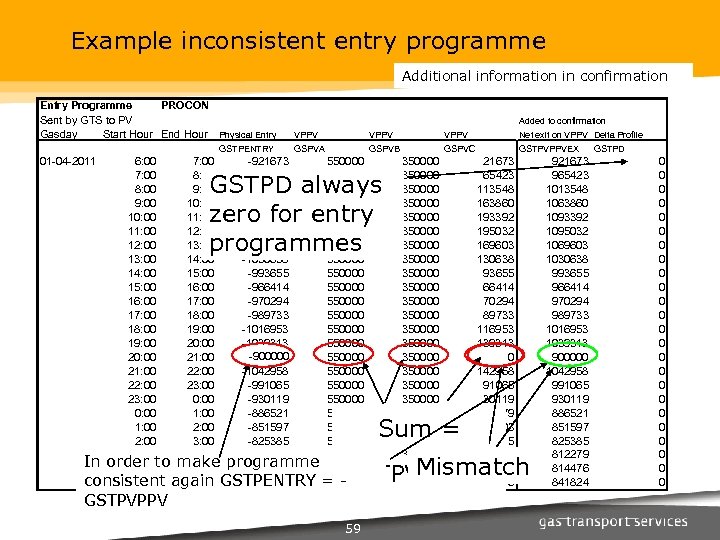

Programme Confirmation (5): Entry § If an entry programme is internally and externally consistent: – Net hourly virtual exit (GSTPVPPVEX) = Σ VPPV transfers – Total physical entry (GSTPENTRY) = unchanged from submitted value – Damping (GSTPD) = 0 § If an entry programme is internally or externally inconsistent: – Net hourly virtual exit (GSTPVPPVEX) = MAX(Σ VPPV transfers, 0) – Total physical entry (GSTPENTRY) = - GSTPVPPVEX – Damping (GSTPD) = 0 57

Example consistent entry programme Additional information in confirmation Entry Programme PROCON Sent by GTS to PV Gasday Start Hour End Hour Physical Entry GSTPENTRY 01 -04 -2011 6: 00 7: 00 8: 00 9: 00 10: 00 11: 00 12: 00 13: 00 14: 00 15: 00 16: 00 17: 00 18: 00 19: 00 20: 00 21: 00 22: 00 23: 00 0: 00 1: 00 2: 00 3: 00 4: 00 5: 00 6: 00 -921673 -965423 -1013548 -1063860 -1093392 -1095032 -1069603 -1030638 -993655 -966414 -970294 -989733 -1016953 -1039313 -1050493 -1042958 -991065 -930119 -886521 -851597 -825385 -812279 -814476 -841824 Added to confirmation VPPV Net exit on VPPV Delta Profile GSPVA GSPVB GSPVC GSTPVPPVEX 550000 550000 550000 550000 550000 550000 350000 350000 350000 350000 350000 350000 Sum = 21673 65423 113548 163860 193392 195032 169603 130638 93655 66414 70294 89733 116953 139313 150493 142958 91065 30119 -13479 -48403 -74615 -87721 -85524 -58176 GSTPVPPVEX GSTPD always zero for entry programmes 58 921673 965423 1013548 1063860 1093392 1095032 1069603 1030638 993655 966414 970294 989733 1016953 1039313 1050493 1042958 991065 930119 886521 851597 825385 812279 814476 841824 GSTPD 0 0 0 0 0 0

Example inconsistent entry programme Additional information in confirmation Entry Programme PROCON Sent by GTS to PV Gasday Start Hour End Hour Physical Entry GSTPENTRY Added to confirmation VPPV Net exit on VPPV Delta Profile GSPVA GSPVB GSPVC GSTPVPPVEX 01 -04 -2011 6: 00 7: 00 -921673 550000 7: 00 8: 00 -965423 550000 8: 00 9: 00 -1013548 550000 9: 00 10: 00 -1063860 550000 10: 00 11: 00 -1093392 550000 11: 00 12: 00 -1095032 550000 12: 00 13: 00 -1069603 550000 13: 00 14: 00 -1030638 550000 14: 00 15: 00 -993655 550000 15: 00 16: 00 -966414 550000 16: 00 17: 00 -970294 550000 17: 00 18: 00 -989733 550000 18: 00 19: 00 -1016953 550000 19: 00 20: 00 -1039313 550000 -900000 20: 00 21: 00 -1050493 550000 21: 00 22: 00 -1042958 550000 22: 00 23: 00 -991065 550000 23: 00 0: 00 -930119 550000 0: 00 1: 00 -886521 550000 1: 00 2: 00 -851597 550000 2: 00 3: 00 -825385 550000 3: 00 4: 00 -812279 550000 In order to make programme 550000 4: 00 5: 00 -814476 5: 00 6: 00 -841824 550000 consistent again GSTPENTRY = - GSTPD always zero for entry programmes 350000 350000 350000 350000 350000 350000 Sum = 21673 65423 113548 163860 193392 195032 169603 130638 93655 66414 70294 89733 116953 139313 0 142958 91065 30119 -13479 -48403 -74615 -87721 -85524 -58176 Mismatch GSTPVPPVEX GSTPVPPV 59 921673 965423 1013548 1063860 1093392 1095032 1069603 1030638 993655 966414 970294 989733 1016953 1039313 900000 1042958 991065 930119 886521 851597 825385 812279 814476 841824 GSTPD 0 0 0 0 0 0

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 60

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 61

Agenda § Timeline § Process § Messages 62

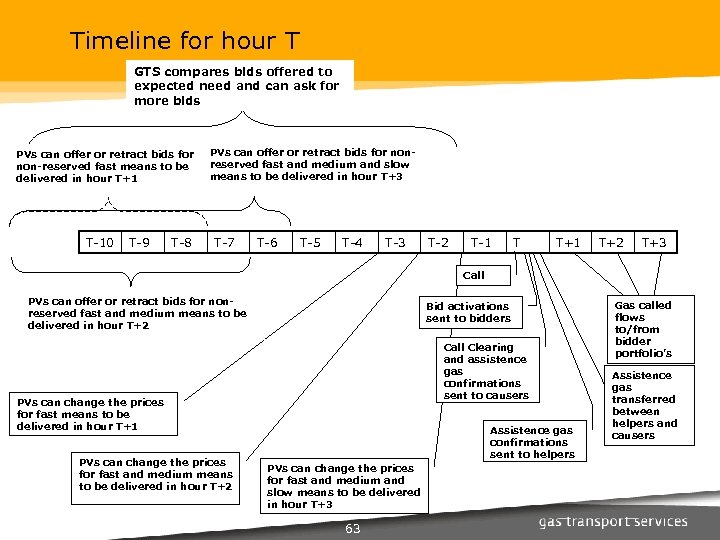

Timeline for hour T GTS compares bids offered to expected need and can ask for more bids PVs can offer or retract bids for non-reserved fast means to be delivered in hour T+1 T-10 T-9 T-8 PVs can offer or retract bids for nonreserved fast and medium and slow means to be delivered in hour T+3 T-7 T-6 T-5 T-4 T-3 T-2 T-1 T T+1 T+2 T+3 Call PVs can offer or retract bids for nonreserved fast and medium means to be delivered in hour T+2 Bid activations sent to bidders Call Clearing and assistence gas confirmations sent to causers PVs can change the prices for fast means to be delivered in hour T+1 PVs can change the prices for fast and medium means to be delivered in hour T+2 Assistence gas confirmations sent to helpers PVs can change the prices for fast and medium and slow means to be delivered in hour T+3 63 Gas called flows to/from bidder portfolio’s Assistence gas transferred between helpers and causers

Process § When will the bid price ladder be called? § How will the volume to be called be determined? § How will the bidders be informed what is called from them? § How will the called volume be divided over the causers? § How will the assistance gas be divided? 64

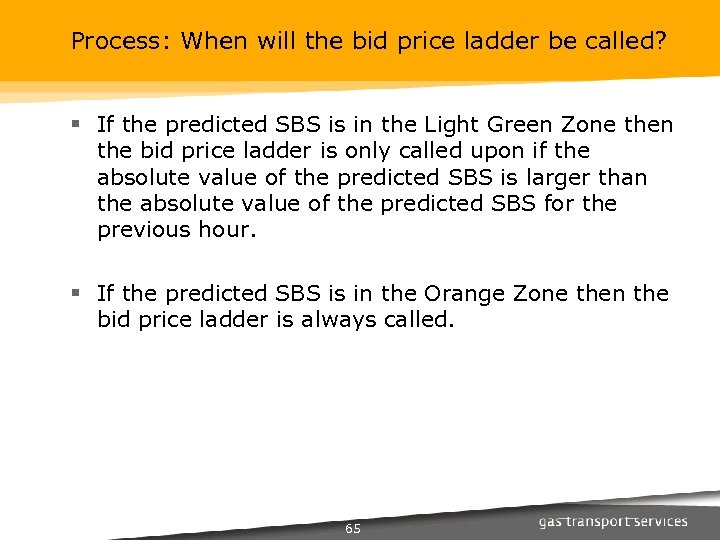

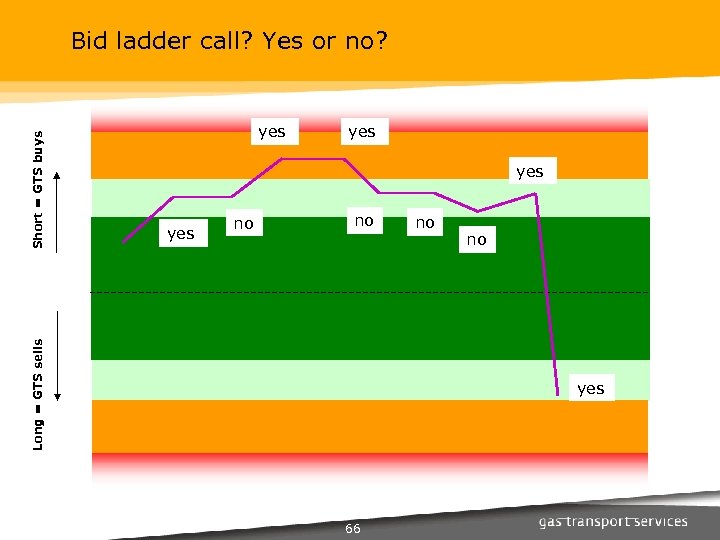

Process: When will the bid price ladder be called? § If the predicted SBS is in the Light Green Zone then the bid price ladder is only called upon if the absolute value of the predicted SBS is larger than the absolute value of the predicted SBS for the previous hour. § If the predicted SBS is in the Orange Zone then the bid price ladder is always called. 65

yes yes no no Long = GTS sells Short = GTS buys Bid ladder call? Yes or no? no no yes 66

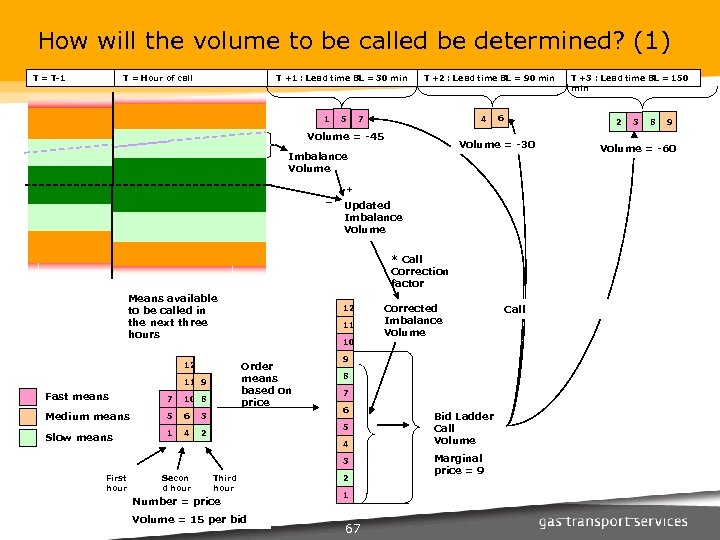

How will the volume to be called be determined? (1) T = T-1 T = Hour of call T +1 : Lead time BL = 30 min 1 5 T +2 : Lead time BL = 90 min 4 7 Volume = -45 6 2 Volume = -30 Imbalance Volume + _ Updated Imbalance Volume * Call Correction factor Means available to be called in the next three hours 12 7 10 8 Medium means 5 6 Slow means 1 4 11 10 Order means based on price 11 9 Fast means 12 3 9 8 7 6 5 2 4 3 First hour Secon d hour Third hour Number = price Volume = 15 per bid Corrected Imbalance Volume 2 1 67 Bid Ladder Call Volume Marginal price = 9 T +3 : Lead time BL = 150 min Call 3 8 9 Volume = -60

How will the volume to be called be determined? (2) § Call Correction Factor (CCF): A percentage GTS can adjust in order to prevent bid ladder calls leading to system instability. – There are two CCF’s: one for the Light Green Zone and one for the Orange Zone – Value can be changed daily – Published at 09: 00 along with other parameters – Expected start value CCF is 100% § Incentive component (IC): an extra price on top of the marginal price. – GTS will adjust the incentive component based on how often and for how much volume the SBS enters the Orange and Red Zones – Incentive to market parties to improve their balancing – Expected start value is zero EUR/MWh 68

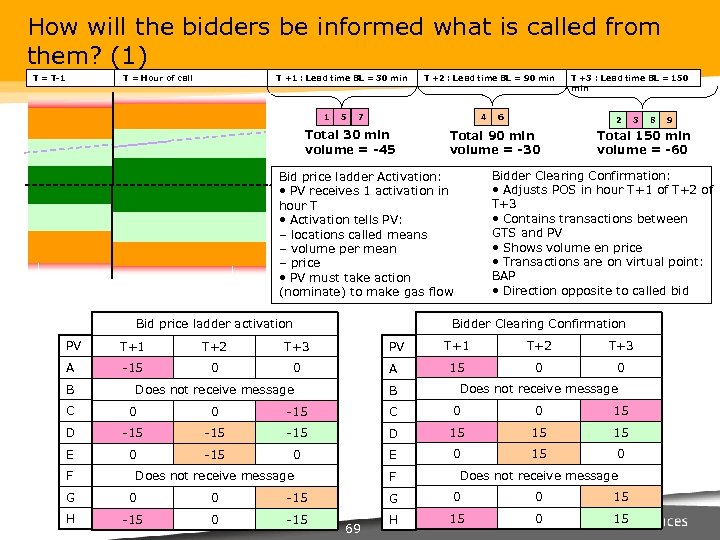

How will the bidders be informed what is called from them? (1) T = T-1 T = Hour of call T +1 : Lead time BL = 30 min 1 5 T +2 : Lead time BL = 90 min 4 7 Total 30 min volume = -45 PV T+1 T+2 -15 0 0 B PV A Does not receive message B T+1 T+2 T+3 15 0 0 Does not receive message 0 -15 C 0 0 15 D -15 -15 D 15 15 15 E 0 -15 0 E 0 15 0 G 0 0 -15 Does not receive message G -15 H F 69 9 Bidder Clearing Confirmation: • Adjusts POS in hour T+1 of T+2 of T+3 • Contains transactions between GTS and PV • Shows volume en price • Transactions are on virtual point: BAP • Direction opposite to called bid 0 Does not receive message 8 Total 150 min volume = -60 C F 3 Bidder Clearing Confirmation T+3 A 2 Total 90 min volume = -30 Bid price ladder Activation: • PV receives 1 activation in hour T • Activation tells PV: – locations called means – volume per mean – price • PV must take action (nominate) to make gas flow Bid price ladder activation 6 T +3 : Lead time BL = 150 min 0 0 15 H 15 0 15

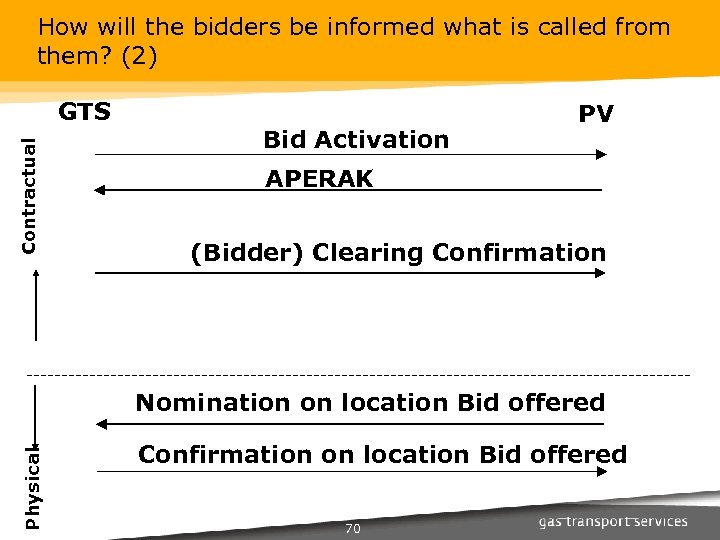

How will the bidders be informed what is called from them? (2) Contractual GTS Bid Activation PV APERAK (Bidder) Clearing Confirmation Physical Nomination on location Bid offered Confirmation on location Bid offered 70

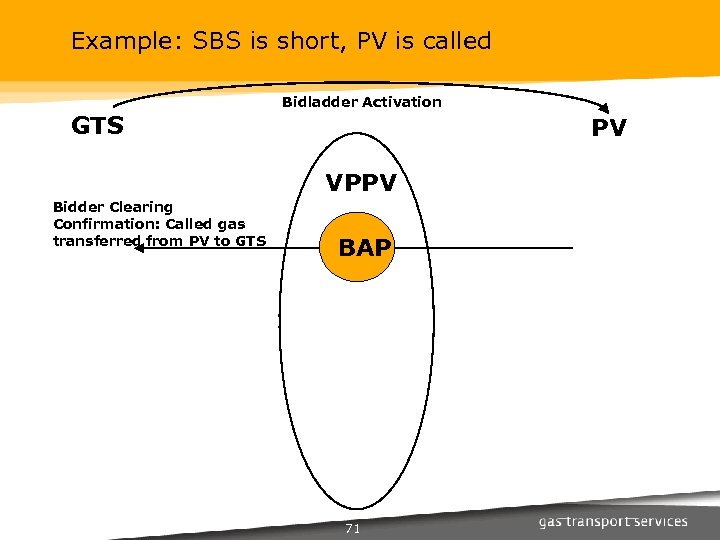

Example: SBS is short, PV is called GTS Bidladder Activation PV VPPV Bidder Clearing Confirmation: Called gas transferred from PV to GTS BAP 71

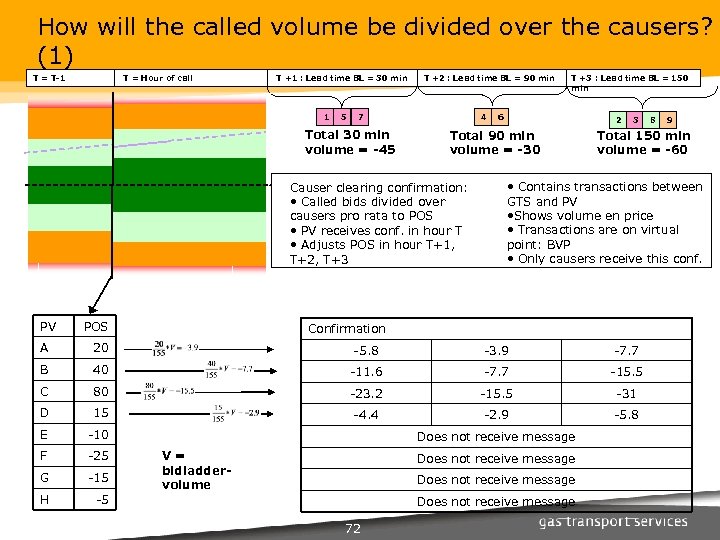

How will the called volume be divided over the causers? (1) T = T-1 T = Hour of call T +1 : Lead time BL = 30 min 1 5 T +2 : Lead time BL = 90 min 4 7 Total 30 min volume = -45 POS 6 2 Total 90 min volume = -30 Causer clearing confirmation: • Called bids divided over causers pro rata to POS • PV receives conf. in hour T • Adjusts POS in hour T+1, T+2, T+3 PV T +3 : Lead time BL = 150 min 3 • Contains transactions between GTS and PV • Shows volume en price • Transactions are on virtual point: BVP • Only causers receive this conf. A 20 -5. 8 -3. 9 -7. 7 B 40 -11. 6 -7. 7 -15. 5 C 80 -23. 2 -15. 5 -31 D 15 -4. 4 -2. 9 -5. 8 E -10 F -25 G -15 H -5 Does not receive message 72 9 Total 150 min volume = -60 Confirmation V= bidladdervolume 8

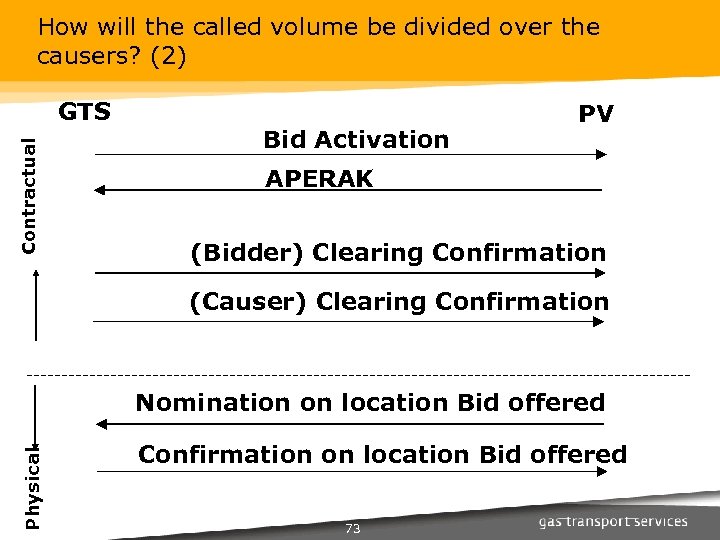

How will the called volume be divided over the causers? (2) Contractual GTS Bid Activation PV APERAK (Bidder) Clearing Confirmation (Causer) Clearing Confirmation Physical Nomination on location Bid offered Confirmation on location Bid offered 73

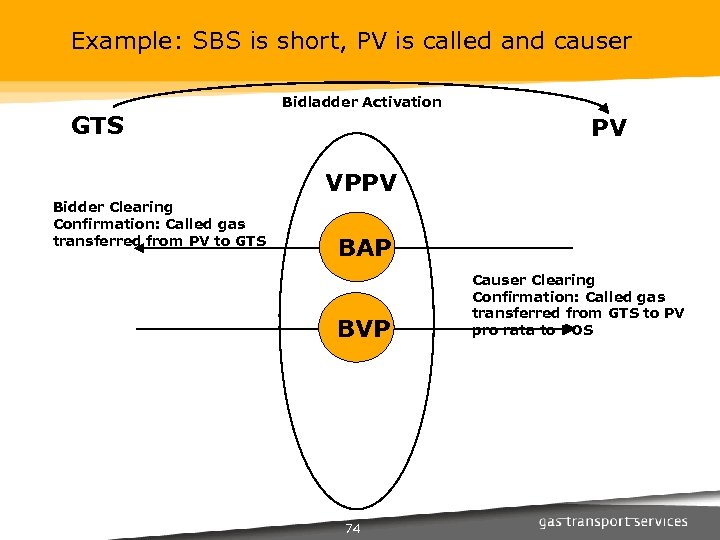

Example: SBS is short, PV is called and causer GTS Bidladder Activation PV VPPV Bidder Clearing Confirmation: Called gas transferred from PV to GTS BAP BVP 74 Causer Clearing Confirmation: Called gas transferred from GTS to PV pro rata to POS

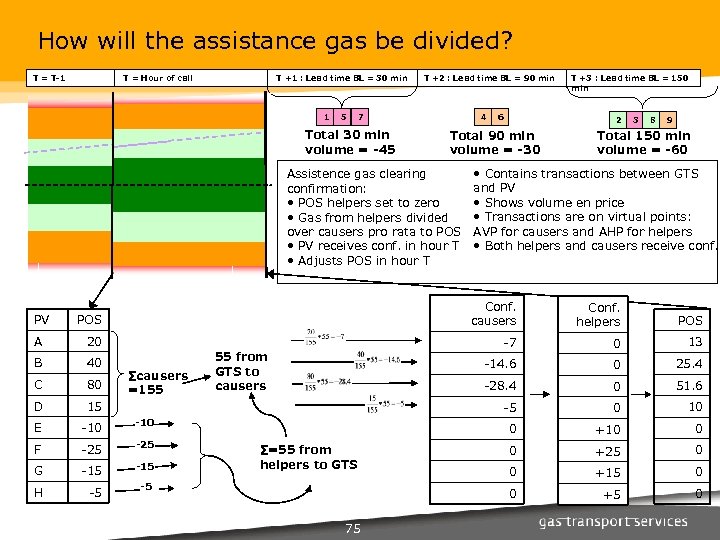

How will the assistance gas be divided? T = T-1 T = Hour of call T +1 : Lead time BL = 30 min 1 5 T +2 : Lead time BL = 90 min 4 7 Total 30 min volume = -45 6 2 Total 90 min volume = -30 Assistence gas clearing confirmation: • POS helpers set to zero • Gas from helpers divided over causers pro rata to POS • PV receives conf. in hour T • Adjusts POS in hour T T +3 : Lead time BL = 150 min 3 8 9 Total 150 min volume = -60 • Contains transactions between GTS and PV • Shows volume en price • Transactions are on virtual points: AVP for causers and AHP for helpers • Both helpers and causers receive conf. POS Conf. causers Conf. helpers POS A 20 -7 0 13 B 40 -14. 6 0 25. 4 C 80 -28. 4 0 51. 6 D 15 -5 0 10 E -10 0 +10 0 F -25 0 +25 0 G -15 0 +15 0 -5 -5 0 +5 0 PV H ∑causers =155 55 from GTS to causers ∑=55 from helpers to GTS 75

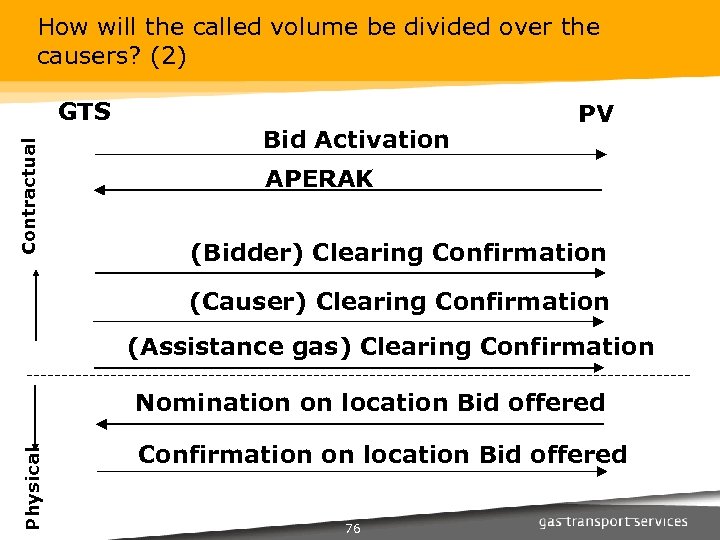

How will the called volume be divided over the causers? (2) Contractual GTS Bid Activation PV APERAK (Bidder) Clearing Confirmation (Causer) Clearing Confirmation (Assistance gas) Clearing Confirmation Physical Nomination on location Bid offered Confirmation on location Bid offered 76

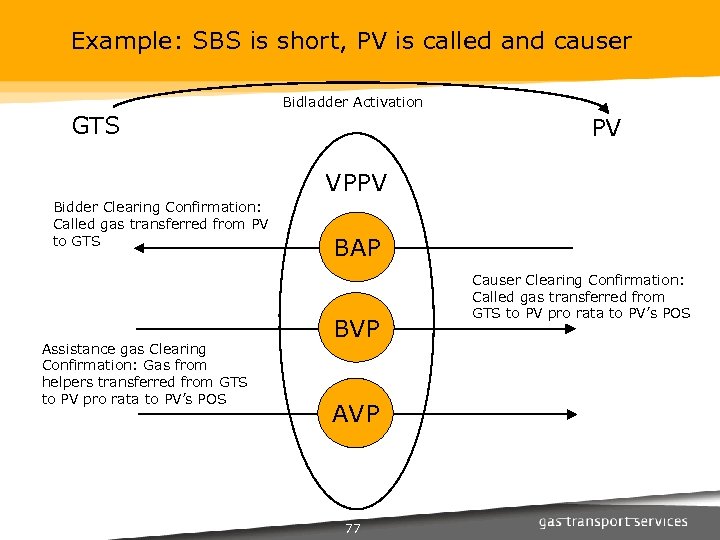

Example: SBS is short, PV is called and causer GTS Bidladder Activation PV VPPV Bidder Clearing Confirmation: Called gas transferred from PV to GTS Assistance gas Clearing Confirmation: Gas from helpers transferred from GTS to PV pro rata to PV’s POS BAP BVP AVP 77 Causer Clearing Confirmation: Called gas transferred from GTS to PV pro rata to PV’s POS

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 78

Topics § Outline of the changes ahead § Overview of foreseen functionality within Gasport § Sneak preview of Gasport § Questions 79

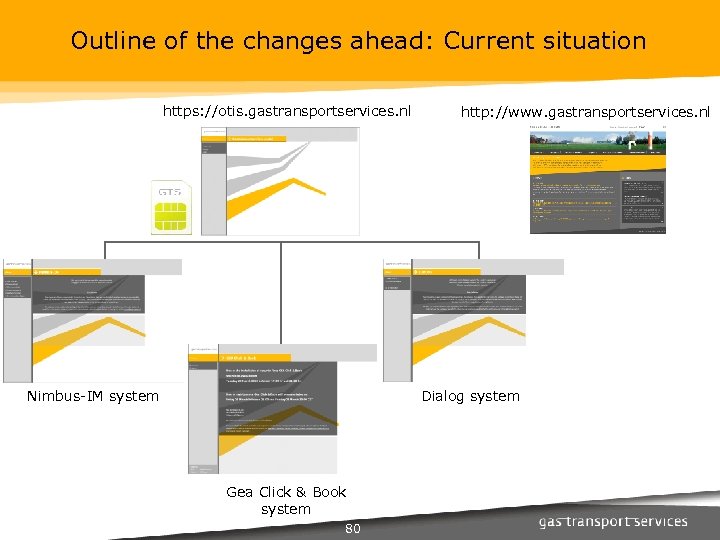

Outline of the changes ahead: Current situation https: //otis. gastransportservices. nl Nimbus-IM system http: //www. gastransportservices. nl Dialog system Gea Click & Book system 80

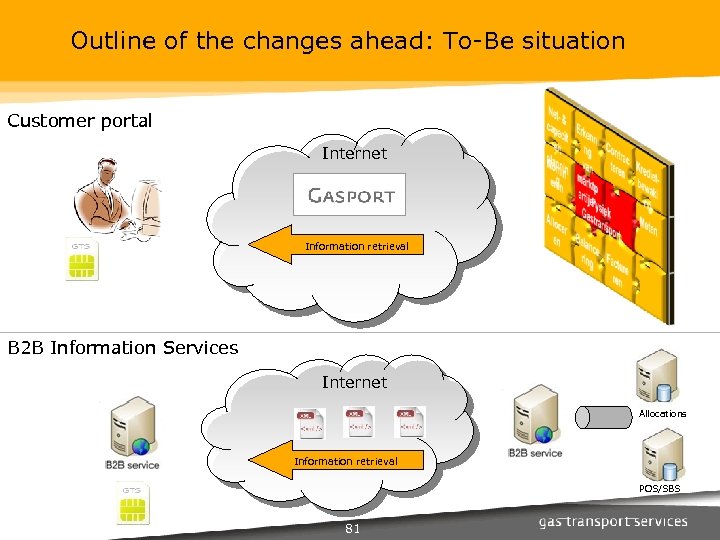

Outline of the changes ahead: To-Be situation Customer portal Internet Information retrieval B 2 B Information Services Internet Allocations Information retrieval POS/SBS 81

Outline of the changes ahead: To-Be situation Differences Gasport v. s. B 2 B information services –B 2 B is a download service which can used for real-time integration of GTS data within customer specific processes (applications). Exchange of XML messages between IT-systems –B 2 B downloads operates with fixed units for example everything is in CET en KWh. –B 2 B Information services POS & SBS services are part of the PV acknowledgment requirements –Gasport is a end-user solution providing predefined information by means of user friendly web pages. –Gasport works with customer adjustable units for example CET or LET, and KWh, MJ, m 3(35, 17) –Only in Gasport market parties can view the Bid Price ladder 82

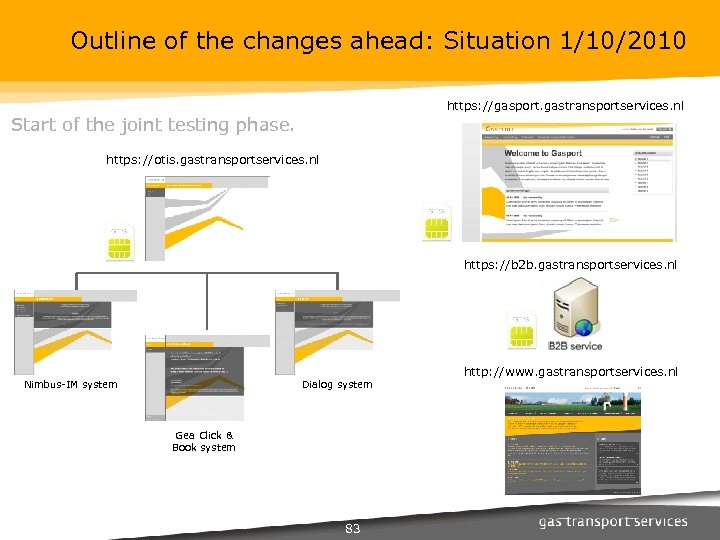

Outline of the changes ahead: Situation 1/10/2010 https: //gasport. gastransportservices. nl Start of the joint testing phase. https: //otis. gastransportservices. nl https: //b 2 b. gastransportservices. nl Nimbus-IM system Dialog system Gea Click & Book system 83 http: //www. gastransportservices. nl

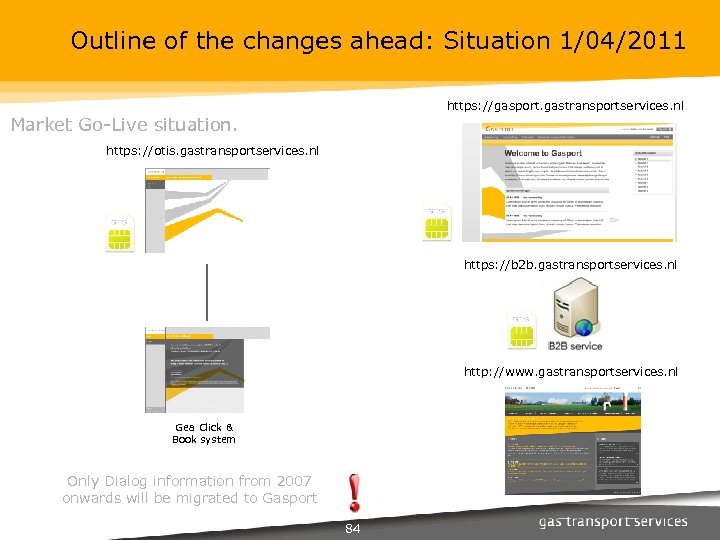

Outline of the changes ahead: Situation 1/04/2011 https: //gasport. gastransportservices. nl Market Go-Live situation. https: //otis. gastransportservices. nl https: //b 2 b. gastransportservices. nl http: //www. gastransportservices. nl Gea Click & Book system Only Dialog information from 2007 onwards will be migrated to Gasport 84

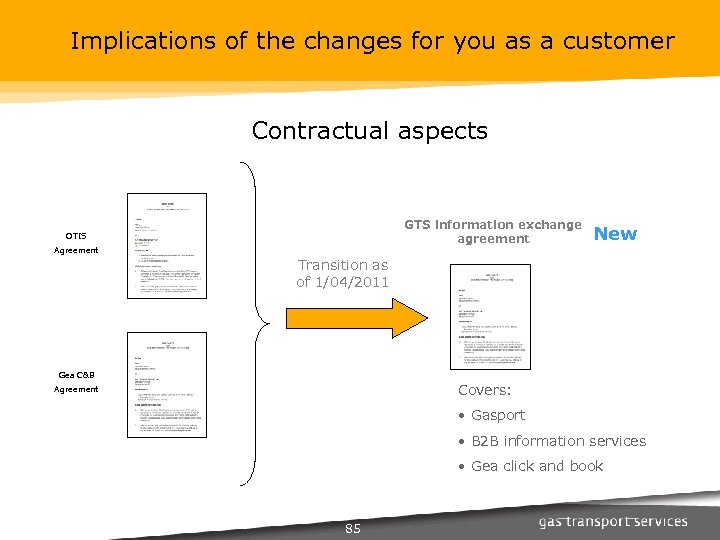

Implications of the changes for you as a customer Contractual aspects GTS information exchange agreement OTIS Agreement New Transition as of 1/04/2011 Gea C&B Covers: Agreement • Gasport • B 2 B information services • Gea click and book 85

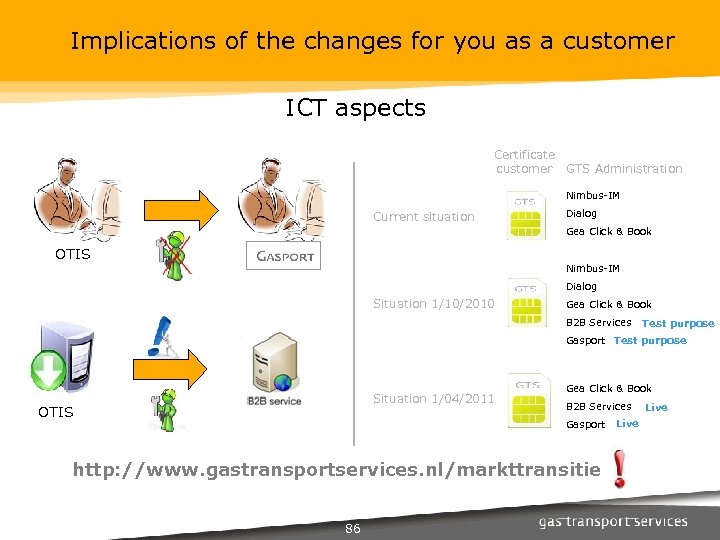

Implications of the changes for you as a customer ICT aspects Certificate customer GTS Administration Nimbus-IM Current situation Dialog Gea Click & Book OTIS Nimbus-IM Dialog Situation 1/10/2010 Gea Click & Book B 2 B Services Test purpose Gasport Test purpose Situation 1/04/2011 OTIS Gea Click & Book B 2 B Services Gasport http: //www. gastransportservices. nl/markttransitie 86 Live

Topics § Outline of the changes ahead § Overview of foreseen functionality within Gasport § Sneak preview of Gasport § Questions 87

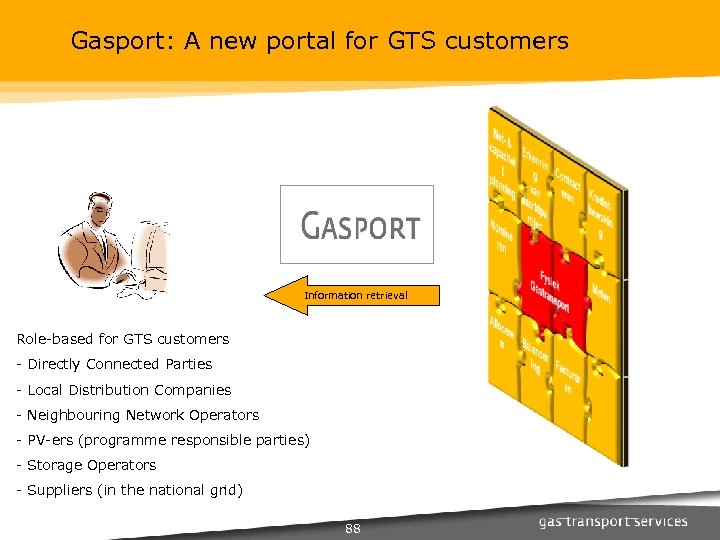

Gasport: A new portal for GTS customers Information retrieval Role-based for GTS customers - Directly Connected Parties - Local Distribution Companies - Neighbouring Network Operators - PV-ers (programme responsible parties) - Storage Operators - Suppliers (in the national grid) 88

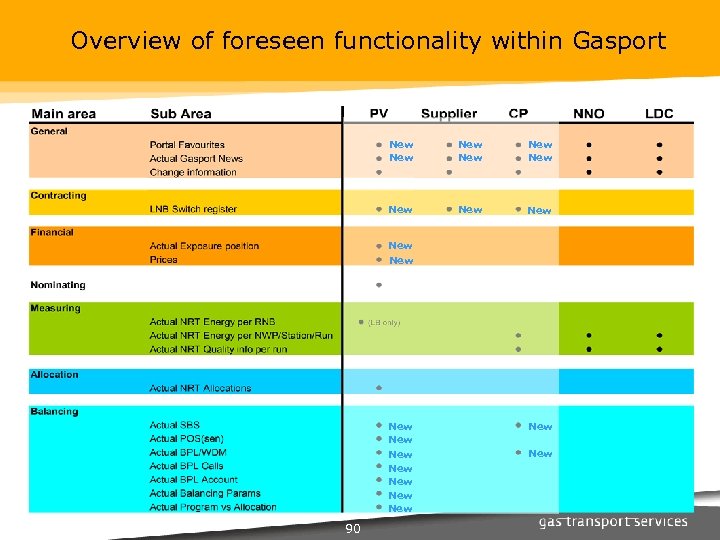

Gasport: A new portal for GTS customers Role-based information retrieval Customer Information roles Role based for GTS customers - PV-ers PV Dispatching CP Dispatching Information retrieval NNO Dispatching Invoice verification Data analysis Dispatching • POS/SBS • NRT Metering • Bid Price Ladder • NRT Metering - Direct Connected Parties Detailed information role - Neighboring Network Operators (example) - Local Distribution Companies - Suppliers • NRT Allocation 89

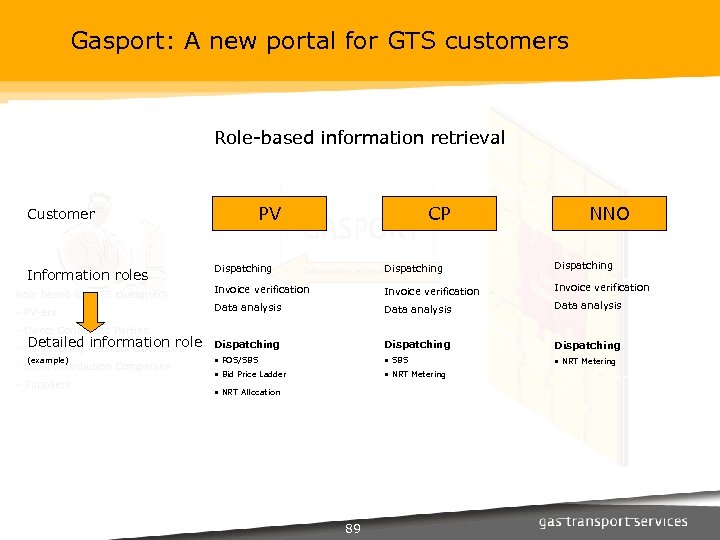

Overview of foreseen functionality within Gasport New New New New New 90 New

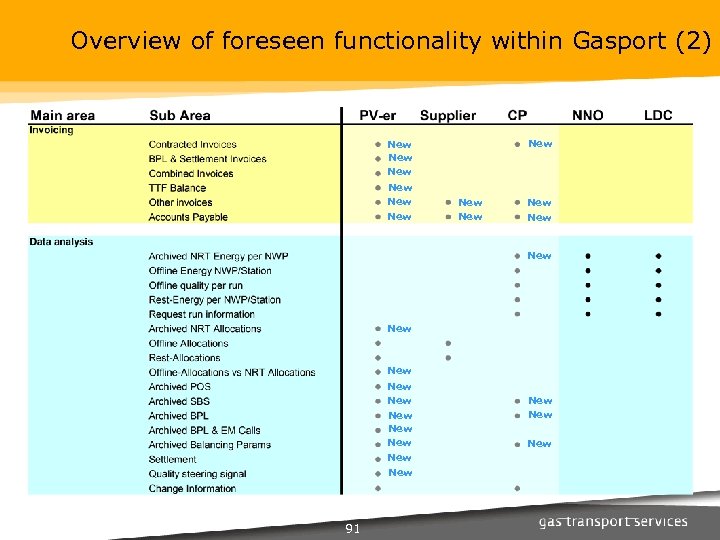

Overview of foreseen functionality within Gasport (2) New New New New New New 91 New New

Topics § Outline of the changes ahead § Overview of foreseen functionality within Gasport § Sneak preview of Gasport § Questions 92

Sneak preview of Gasport: Showcase § Showcase is not role-based, full functionality is shown § The data shown is fictitious, not based on real data § All shown screens are still work in progress 93

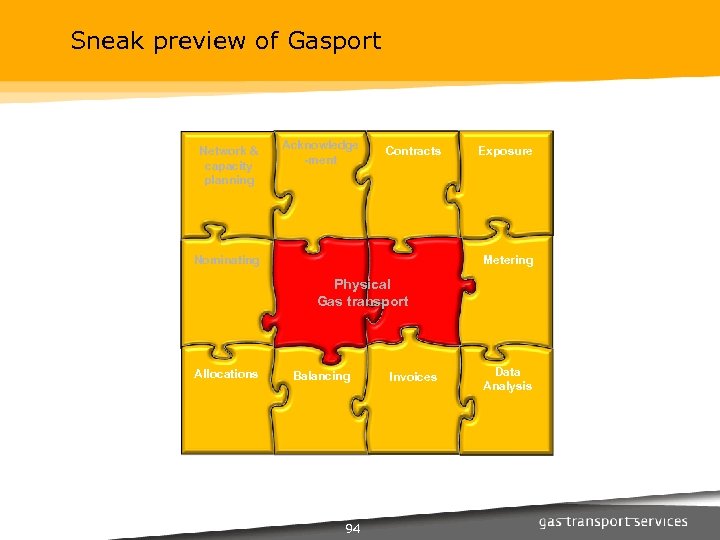

Sneak preview of Gasport Network & capacity planning Acknowledge -ment Contracts Nominating Exposure Metering Physical Gas transport Allocations Balancing 94 Invoices Data Analysis

Questions 95

Agenda 1. Introduction and status implementation (09: 30 – 10: 00) Wim Borghols 2. Essentials market model (10: 00 – 10: 30) Wim Borghols 3. Overview information exchange (10: 30 – 11: 00) Alef Tuinman 4. Programmes (11: 00 – 12: 00) Walter Crommelin BREAK (12: 00 – 12: 45) 5. Bid price ladder (12: 45 – 13: 45) Walter Crommelin 6. BPL & trading screens, invoices (13: 45 – 14: 30) Peter Scholtens 7. Questions, remarks and next steps (14: 30 – 14: 45) Wim Borghols 96

755869111650e7c2ae58a12c93445def.ppt