999b21832fd7237c651dd98a953d68bf.ppt

- Количество слайдов: 21

Full Service Fleet Leasing: The Business Model and the Accounting Standards Aernout van der Mersch, Managing Director ING Car Lease Belgium Chairman Renta Vincent Rupied, International Director Corporate Relations, Arval Chairman Automotive Steering Group Brussels, 05/11/2007

Introduction : Why a specific issue on Full Service Fleet Leasing? • Definition of fleet contract hire – Full Service Operating lease – Specialisation on one type of asset, not on a technique of financing • Relevance: – Volumes & Market share on automotive assets within Leaseurope 2

Relevance within Leaseurope Commercial Vehicles Total: 3, 6 Mio veh. Personal cars Total: 12, 3 Mio veh. 3

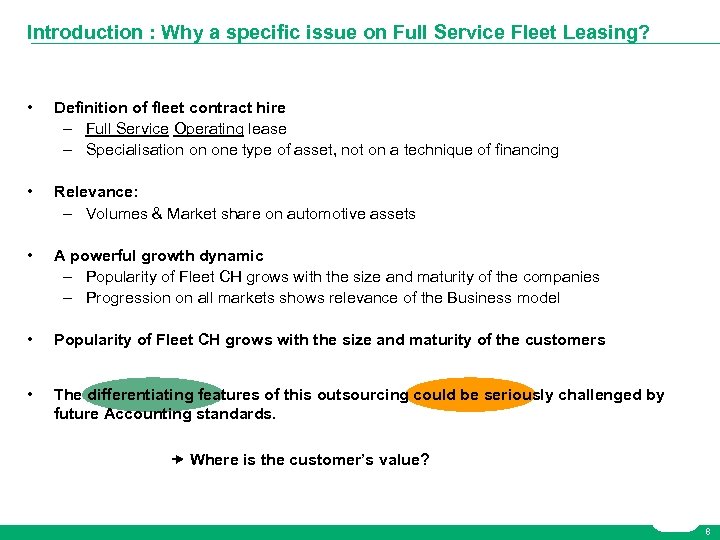

Introduction : Why a specific issue on Full Service Fleet Leasing? • Definition of fleet contract hire – Full Service Operating lease – Specialisation on one type of asset, not on a technique of financing • Relevance: – Volumes & Market share on automotive assets within Leaseurope • A powerful growth dynamic – Popularity of Fleet CH grows with the size and maturity of the companies – Progression on all markets shows relevance of the Business model 4

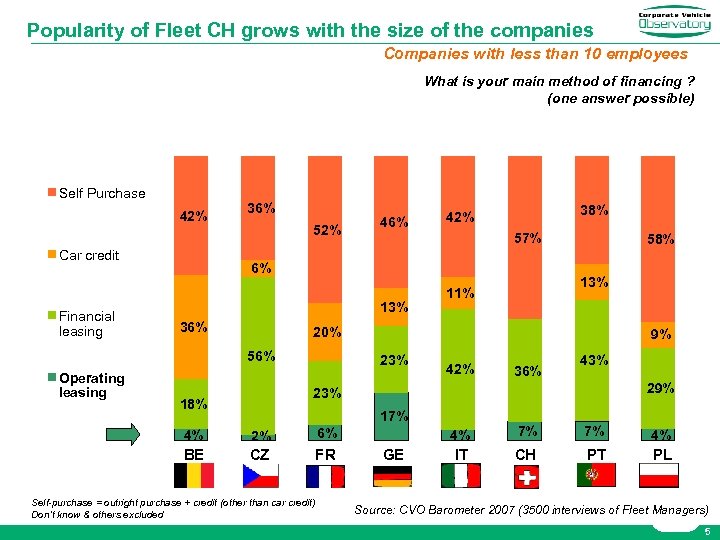

Popularity of Fleet CH grows with the size of the companies Companies with less than 10 employees What is your main method of financing ? (one answer possible) Self Purchase 42% Car credit Financial leasing 36% 52% 38% 42% 57% 6% 13% 36% 58% 13% 11% 20% 56% Operating leasing 46% 9% 23% 42% 36% 43% 29% 23% 18% 17% 4% 2% BE CZ FR 4% 6% Self-purchase = outright purchase + credit (other than car credit) Don’t know & others excluded GE 7% 7% 4% IT CH PT PL Source: CVO Barometer 2007 (3500 interviews of Fleet Managers) 5

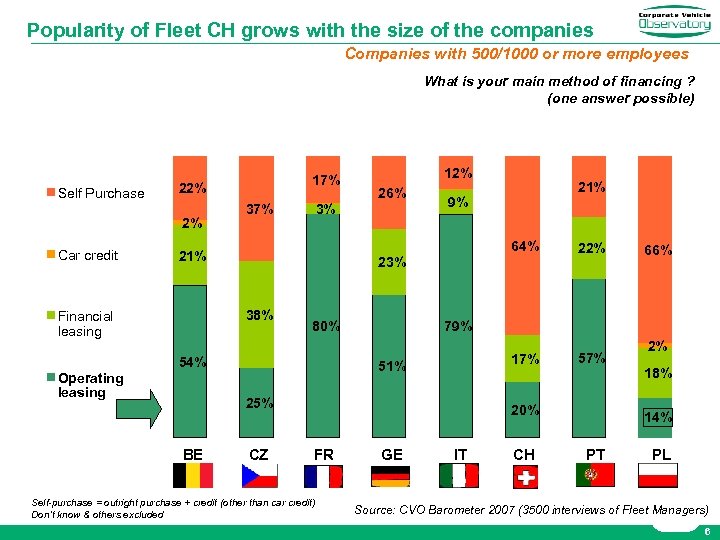

Popularity of Fleet CH grows with the size of the companies Companies with 500/1000 or more employees What is your main method of financing ? (one answer possible) Self Purchase 22% 2% Car credit 17% 37% 9% 22% 17% 57% 23% 80% 54% 51% CZ 20% FR Self-purchase = outright purchase + credit (other than car credit) Don’t know & others excluded 66% 79% 25% BE 21% 64% 38% Operating leasing 26% 3% 21% Financial leasing 12% GE IT CH 2% 18% 14% PT PL Source: CVO Barometer 2007 (3500 interviews of Fleet Managers) 6

Progression on all markets L’argus de l’automobile 01/2007 (F) 7

Introduction : Why a specific issue on Full Service Fleet Leasing? • Definition of fleet contract hire – Full Service Operating lease – Specialisation on one type of asset, not on a technique of financing • Relevance: – Volumes & Market share on automotive assets • A powerful growth dynamic – Popularity of Fleet CH grows with the size and maturity of the companies – Progression on all markets shows relevance of the Business model • Popularity of Fleet CH grows with the size and maturity of the customers • The differentiating features of this outsourcing could be seriously challenged by future Accounting standards. Where is the customer’s value? 8

1. A business model based on a full operational outsourcing … far from financial engineering 9

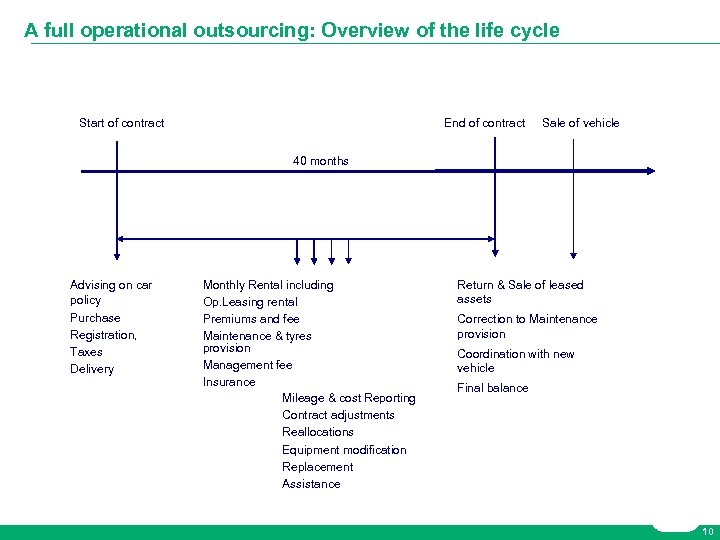

A full operational outsourcing: Overview of the life cycle Start of contract End of contract Sale of vehicle 40 months Advising on car policy Purchase Registration, Taxes Delivery Monthly Rental including Op. Leasing rental Premiums and fee Maintenance & tyres provision Management fee Insurance Mileage & cost Reporting Contract adjustments Reallocations Equipment modification Replacement Assistance Return & Sale of leased assets Correction to Maintenance provision Coordination with new vehicle Final balance 10

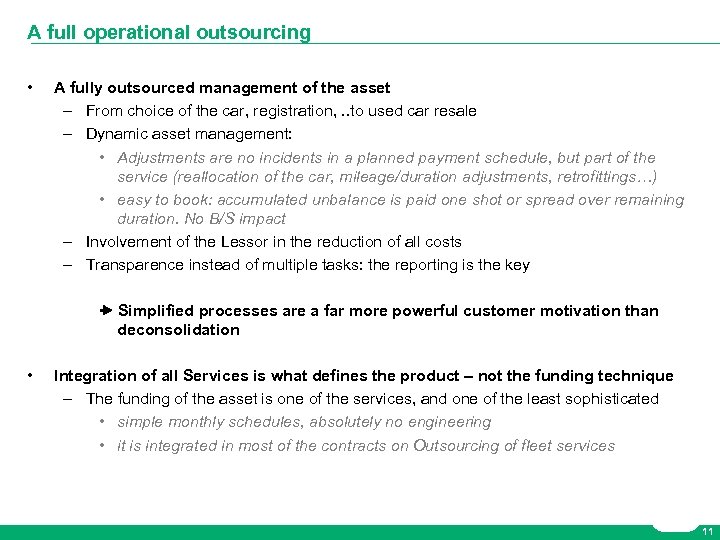

A full operational outsourcing • A fully outsourced management of the asset – From choice of the car, registration, . . to used car resale – Dynamic asset management: • Adjustments are no incidents in a planned payment schedule, but part of the service (reallocation of the car, mileage/duration adjustments, retrofittings…) • easy to book: accumulated unbalance is paid one shot or spread over remaining duration. No B/S impact – Involvement of the Lessor in the reduction of all costs – Transparence instead of multiple tasks: the reporting is the key Simplified processes are a far more powerful customer motivation than deconsolidation • Integration of all Services is what defines the product – not the funding technique – The funding of the asset is one of the services, and one of the least sophisticated • simple monthly schedules, absolutely no engineering • it is integrated in most of the contracts on Outsourcing of fleet services 11

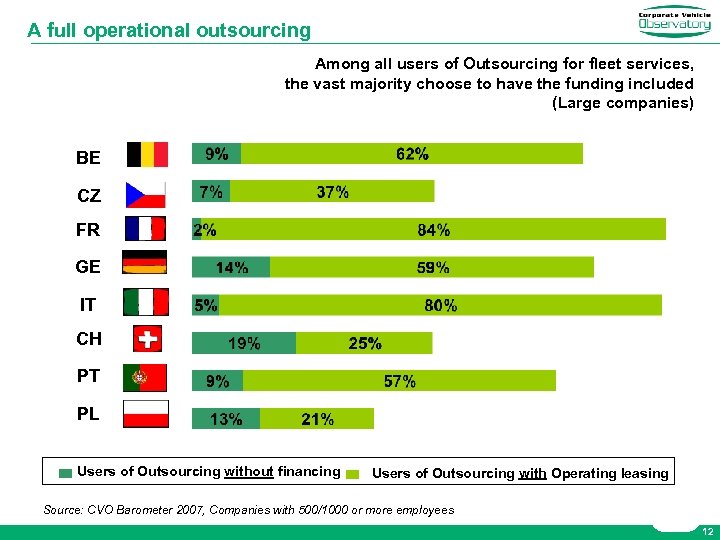

A full operational outsourcing Among all users of Outsourcing for fleet services, the vast majority choose to have the funding included (Large companies) BE CZ FR GE IT CH PT PL Users of Outsourcing without financing Users of Outsourcing with Operating leasing Source: CVO Barometer 2007, Companies with 500/1000 or more employees 12

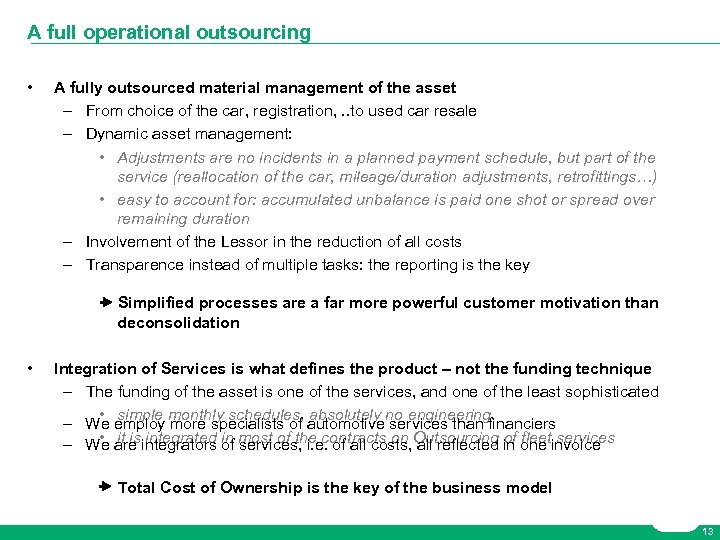

A full operational outsourcing • A fully outsourced material management of the asset – From choice of the car, registration, . . to used car resale – Dynamic asset management: • Adjustments are no incidents in a planned payment schedule, but part of the service (reallocation of the car, mileage/duration adjustments, retrofittings…) • easy to account for: accumulated unbalance is paid one shot or spread over remaining duration – Involvement of the Lessor in the reduction of all costs – Transparence instead of multiple tasks: the reporting is the key Simplified processes are a far more powerful customer motivation than deconsolidation • Integration of Services is what defines the product – not the funding technique – The funding of the asset is one of the services, and one of the least sophisticated • simple monthly schedules, absolutely no engineering – We employ more specialists of automotive services than financiers • it is integrated of services, i. e. of all costs, all reflected of fleet services – We are integrators in most of the contracts on Outsourcing in one invoice Total Cost of Ownership is the key of the business model 13

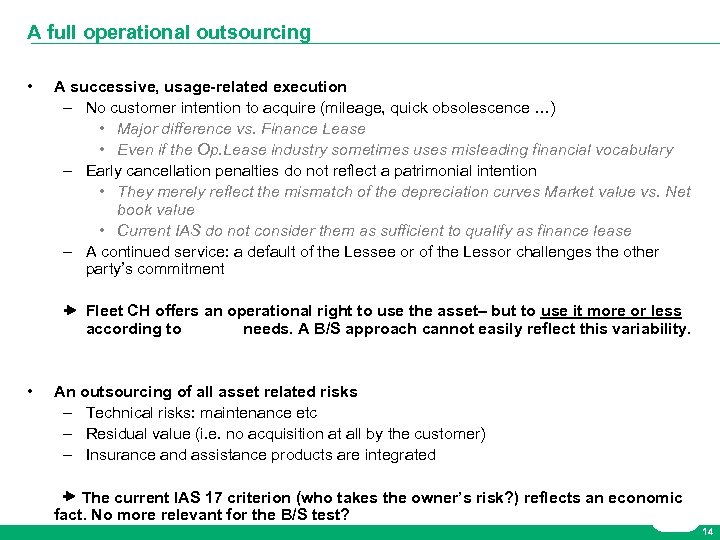

A full operational outsourcing • A successive, usage-related execution – No customer intention to acquire (mileage, quick obsolescence …) • Major difference vs. Finance Lease • Even if the Op. Lease industry sometimes uses misleading financial vocabulary – Early cancellation penalties do not reflect a patrimonial intention • They merely reflect the mismatch of the depreciation curves Market value vs. Net book value • Current IAS do not consider them as sufficient to qualify as finance lease – A continued service: a default of the Lessee or of the Lessor challenges the other party’s commitment Fleet CH offers an operational right to use the asset– but to use it more or less according to needs. A B/S approach cannot easily reflect this variability. • An outsourcing of all asset related risks – Technical risks: maintenance etc – Residual value (i. e. no acquisition at all by the customer) – Insurance and assistance products are integrated The current IAS 17 criterion (who takes the owner’s risk? ) reflects an economic fact. No more relevant for the B/S test? 14

Conclusion 1: a business model essentially different from finance engineering and strongly recognised as such by the economic actors 15

2. What would change in the fleet business with the Lease Accounting Project? “No increase in the implicit funding rate” … however a real loss for the customer and for our industry: 16

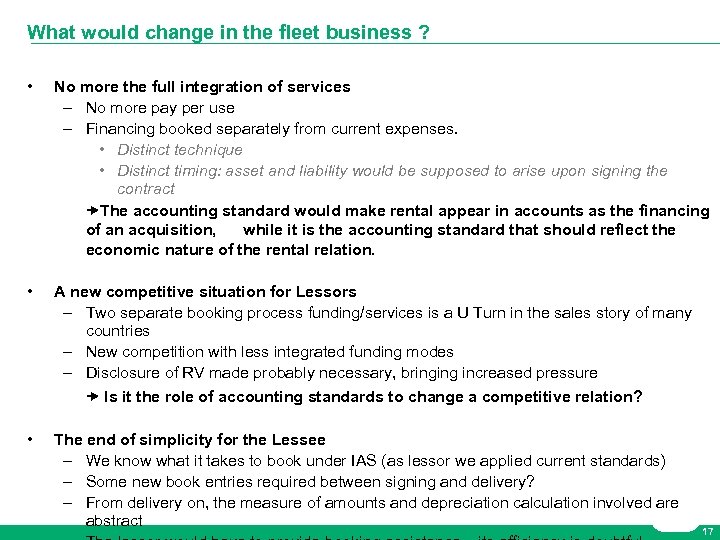

What would change in the fleet business ? • No more the full integration of services – No more pay per use – Financing booked separately from current expenses. • Distinct technique • Distinct timing: asset and liability would be supposed to arise upon signing the contract The accounting standard would make rental appear in accounts as the financing of an acquisition, while it is the accounting standard that should reflect the economic nature of the rental relation. • A new competitive situation for Lessors – Two separate booking process funding/services is a U Turn in the sales story of many countries – New competition with less integrated funding modes – Disclosure of RV made probably necessary, bringing increased pressure Is it the role of accounting standards to change a competitive relation? • The end of simplicity for the Lessee – We know what it takes to book under IAS (as lessor we applied current standards) – Some new book entries required between signing and delivery? – From delivery on, the measure of amounts and depreciation calculation involved are abstract 17

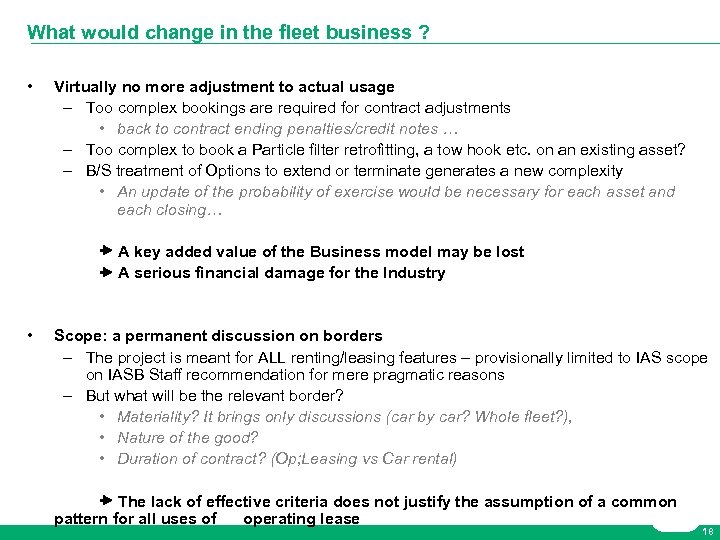

What would change in the fleet business ? • Virtually no more adjustment to actual usage – Too complex bookings are required for contract adjustments • back to contract ending penalties/credit notes … – Too complex to book a Particle filter retrofitting, a tow hook etc. on an existing asset? – B/S treatment of Options to extend or terminate generates a new complexity • An update of the probability of exercise would be necessary for each asset and each closing… A key added value of the Business model may be lost A serious financial damage for the Industry • Scope: a permanent discussion on borders – The project is meant for ALL renting/leasing features – provisionally limited to IAS scope on IASB Staff recommendation for mere pragmatic reasons – But what will be the relevant border? • Materiality? It brings only discussions (car by car? Whole fleet? ), • Nature of the good? • Duration of contract? (Op; Leasing vs Car rental) The lack of effective criteria does not justify the assumption of a common pattern for all uses of operating lease 18

What would change in the fleet business ? • An improved transparency? At what cost? – The industry shares this legitimate objective – But is the B/S the right instrument to reflect the provision of operating resources? • The process of depreciation, impairment etc has a cost • Other less heavy means are available and widely used (off B/S entries, statements in appendix etc) 19

Conclusion 2: Probably, a serious threat for our industry (for its mere existence or for its competitiveness, opinions may vary). Certainly, a loss for the customers, who massively adopted this outsourcing not for window dressing motivations but for reasons related to rational process and costs. 20

ØGeneral Conclusions : Such a “fundamental reconsideration of how to account for all contracts providing a right of use” i. e. of most essential accounting concepts should be justified by an overwhelmingly positive balance of pro and cons. For fleet Lessees and Lessors, it is not. The methodological assimilation, in the first approach, of all industries using Operating Lease, based on simplified examples, is not sustainable. Essential aspects of a business model recognised for its contribution to cost reduction are at stake. 21

999b21832fd7237c651dd98a953d68bf.ppt