df21bed1e7adbde03a8e52ad4f5b21ee.ppt

- Количество слайдов: 34

FTA Practice Chih-Peng Huang Director General Bureau of Foreign Trade, MOEA 10 May 2007

Agenda 1. 2. 3. 4. 5. 6. 7. Introduction Recent development of RTA/FTAs RTAs/FTAs in the context of the WTO APEC’s responses to the RTAs/FTAs Content of an RTA/FTA Taiwan’s response to the RTAs/FTAs Conclusion

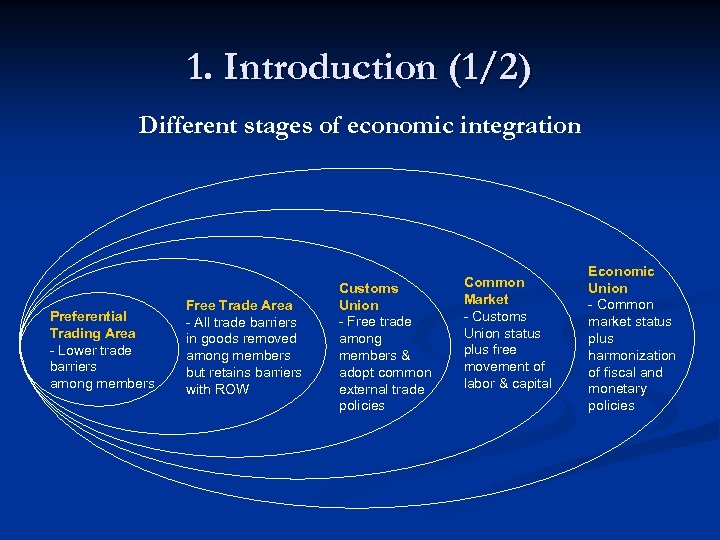

1. Introduction (1/2) Different stages of economic integration Preferential Trading Area - Lower trade barriers among members Free Trade Area - All trade barriers in goods removed among members but retains barriers with ROW Customs Union - Free trade among members & adopt common external trade policies Common Market - Customs Union status plus free movement of labor & capital Economic Union - Common market status plus harmonization of fiscal and monetary policies

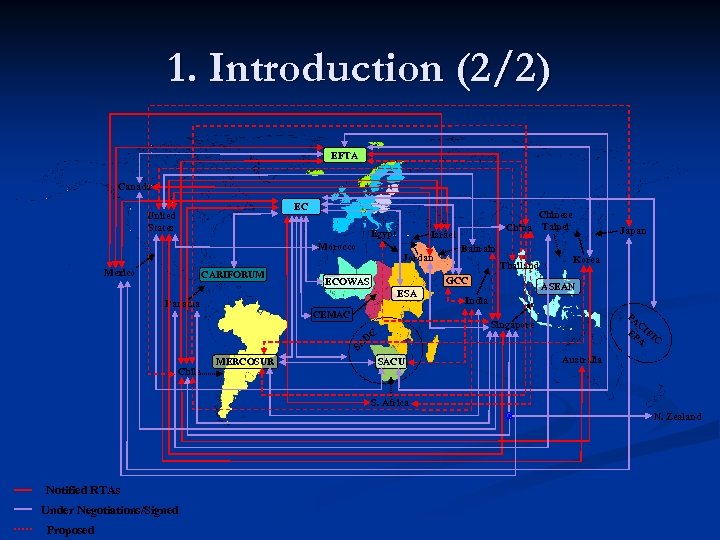

1. Introduction (2/2) EFTA Canada EC United States Egypt Israel Morocco Jordan Mexico CARIFORUM CEMAC Chinese Taipei Bahrain Thailand GCC ECOWAS ESA Panama China Japan Korea ASEAN India PA C EP IFI A C Singapore DC SA Chile MERCOSUR SACU Australia S. Africa N. Zealand Notified RTAs Under Negotiations/Signed Proposed

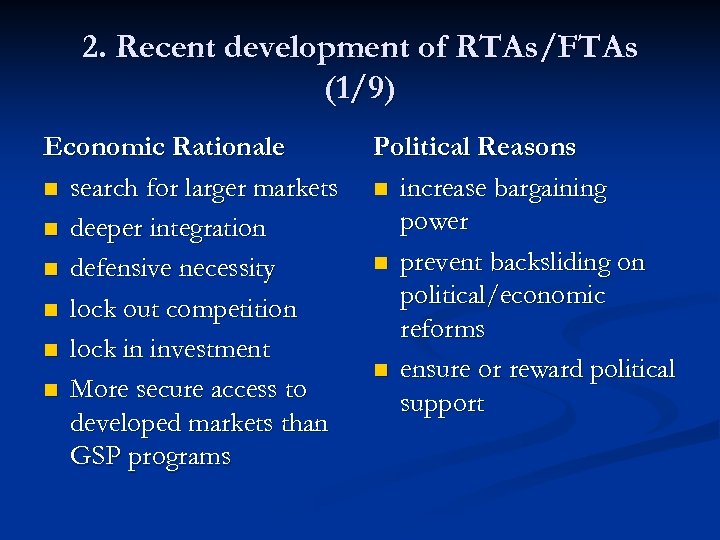

2. Recent development of RTAs/FTAs (1/9) Economic Rationale n search for larger markets n deeper integration n defensive necessity n lock out competition n lock in investment n More secure access to developed markets than GSP programs Political Reasons n increase bargaining power n prevent backsliding on political/economic reforms n ensure or reward political support

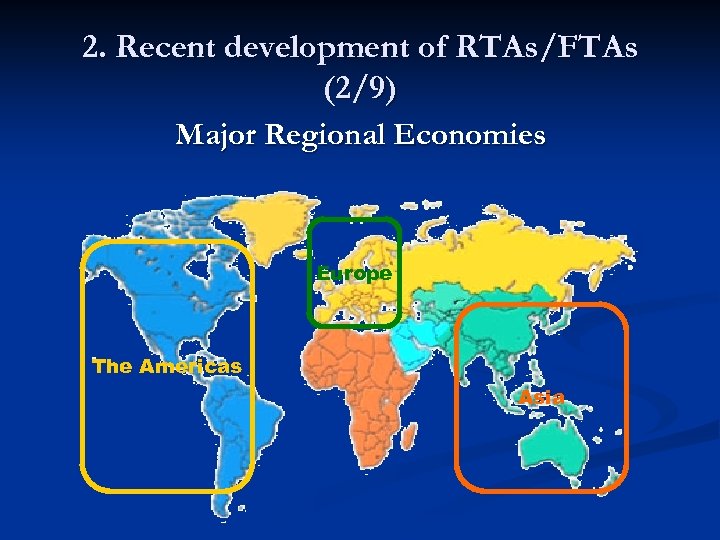

2. Recent development of RTAs/FTAs (2/9) Major Regional Economies Europe The Americas Asia

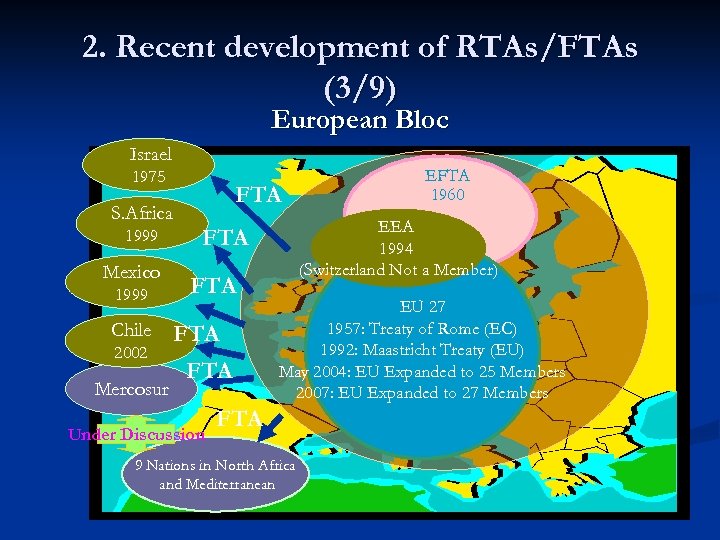

2. Recent development of RTAs/FTAs (3/9) European Bloc Israel 1975 S. Africa 1999 Mexico 1999 Chile 2002 Mercosur FTA EEA 1994 (Switzerland Not a Member) FTA FTA Under Discussion EFTA 1960 EU 27 1957: Treaty of Rome (EC) 1992: Maastricht Treaty (EU) May 2004: EU Expanded to 25 Members 2007: EU Expanded to 27 Members FTA 9 Nations in North Africa and Mediterranean

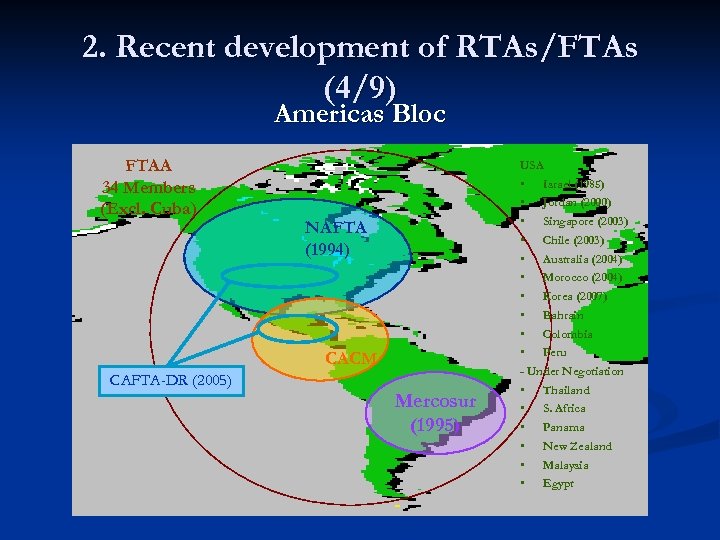

2. Recent development of RTAs/FTAs (4/9) Americas Bloc FTAA 34 Members (Excl. Cuba) USA NAFTA (1994) CACM CAFTA-DR (2005) Mercosur (1995) • Israel (1985) • Jordan (2000) • Singapore (2003) • Chile (2003) • Australia (2004) • Morocco (2004) • Korea (2007) • Bahrain • Colombia • Peru - Under Negotiation • Thailand • S. Africa • Panama • New Zealand • Malaysia • Egypt

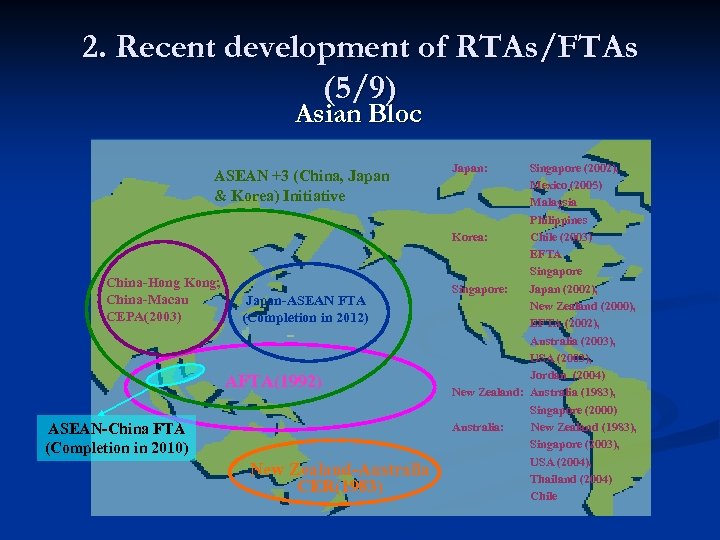

2. Recent development of RTAs/FTAs (5/9) Asian Bloc ASEAN +3 (China, Japan & Korea) Initiative China-Hong Kong; China-Macau CEPA(2003) Japan-ASEAN FTA (Completion in 2012) AFTA(1992) ASEAN-China FTA (Completion in 2010) New Zealand-Australia CER(1983) Japan: Singapore (2002), Mexico (2005) Malaysia Philippines Korea: Chile (2003) EFTA Singapore: Japan (2002), New Zealand (2000), EFTA (2002), Australia (2003), USA (2003), Jordan (2004) New Zealand: Australia (1983), Singapore (2000) Australia: New Zealand (1983), Singapore (2003), USA (2004), Thailand (2004) Chile

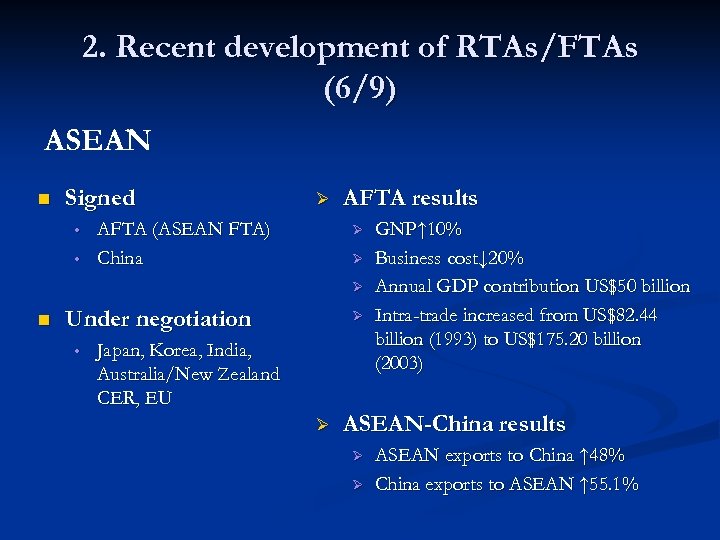

2. Recent development of RTAs/FTAs (6/9) ASEAN n Signed • • Ø AFTA (ASEAN FTA) China AFTA results Ø Ø Ø n Under negotiation • Ø Japan, Korea, India, Australia/New Zealand CER, EU Ø GNP↑ 10% Business cost↓ 20% Annual GDP contribution US$50 billion Intra-trade increased from US$82. 44 billion (1993) to US$175. 20 billion (2003) ASEAN-China results Ø Ø ASEAN exports to China ↑ 48% China exports to ASEAN ↑ 55. 1%

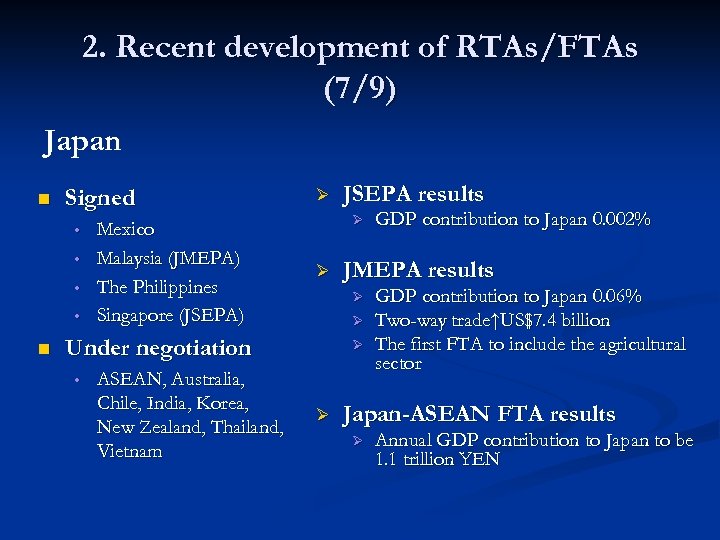

2. Recent development of RTAs/FTAs (7/9) Japan n Signed • • n Mexico Malaysia (JMEPA) The Philippines Singapore (JSEPA) Ø Ø Ø ASEAN, Australia, Chile, India, Korea, New Zealand, Thailand, Vietnam Ø Ø Ø GDP contribution to Japan 0. 002% JMEPA results Ø Under negotiation • JSEPA results GDP contribution to Japan 0. 06% Two-way trade↑US$7. 4 billion The first FTA to include the agricultural sector Japan-ASEAN FTA results Ø Annual GDP contribution to Japan to be 1. 1 trillion YEN

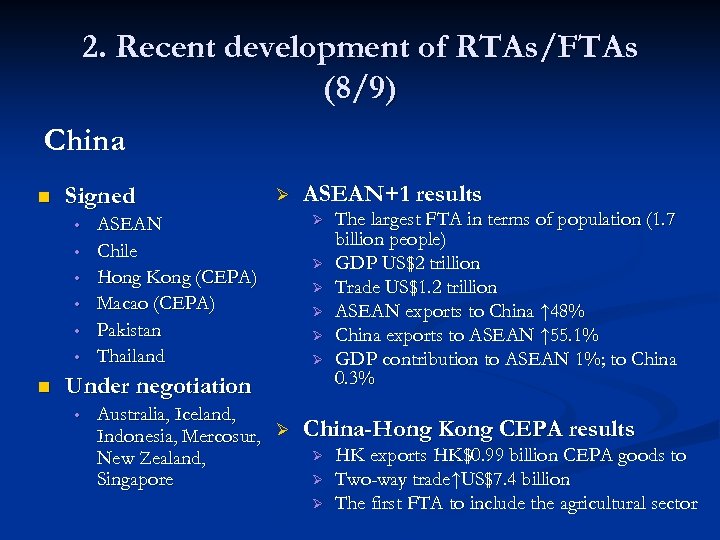

2. Recent development of RTAs/FTAs (8/9) China n Signed • • • n Ø ASEAN Chile Hong Kong (CEPA) Macao (CEPA) Pakistan Thailand ASEAN+1 results Ø Ø Ø Under negotiation • Australia, Iceland, Indonesia, Mercosur, Ø New Zealand, Singapore The largest FTA in terms of population (1. 7 billion people) GDP US$2 trillion Trade US$1. 2 trillion ASEAN exports to China ↑ 48% China exports to ASEAN ↑ 55. 1% GDP contribution to ASEAN 1%; to China 0. 3% China-Hong Kong CEPA results Ø Ø Ø HK exports HK$0. 99 billion CEPA goods to Two-way trade↑US$7. 4 billion The first FTA to include the agricultural sector

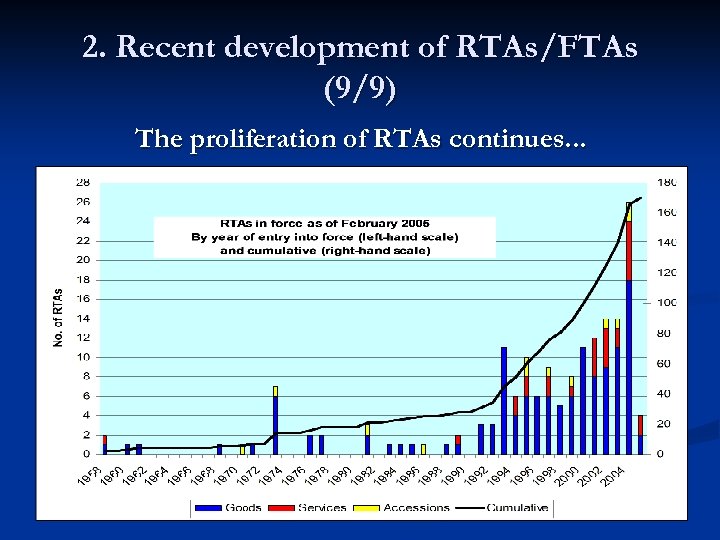

2. Recent development of RTAs/FTAs (9/9) The proliferation of RTAs continues. . .

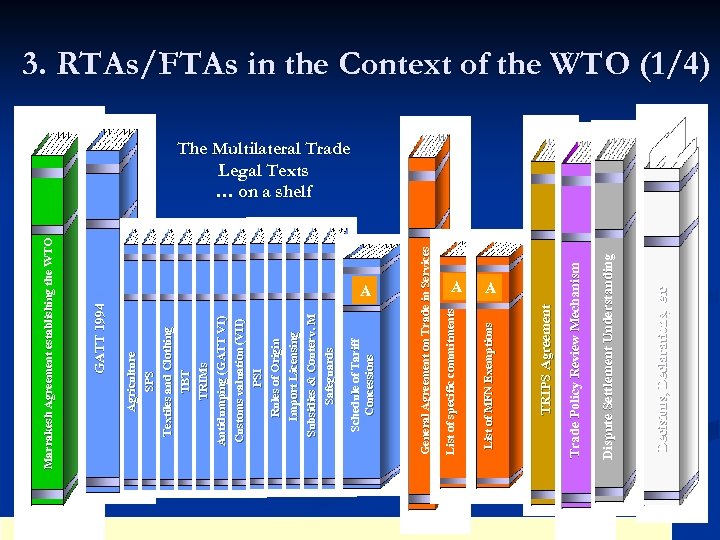

A A Decisions, Declarations, etc Dispute Settlement Understanding Trade Policy Review Mechanism TRIPS Agreement A List of MFN Exemptions List of specific commitments General Agreement on Trade in Services Schedule of Tariff Concessions Rules of Origin Import Licensing Couterv. Subsidies & Couterv. M Safeguards Antidumping (GATT VI) Customs valuation (VII) PSI TBT TRIMs Agriculture SPS Textiles and Clothing GATT 1994 Marrakesh Agreement establishing the WTO 3. RTAs/FTAs in the Context of the WTO (1/4) The Multilateral Trade Legal Texts … on a shelf

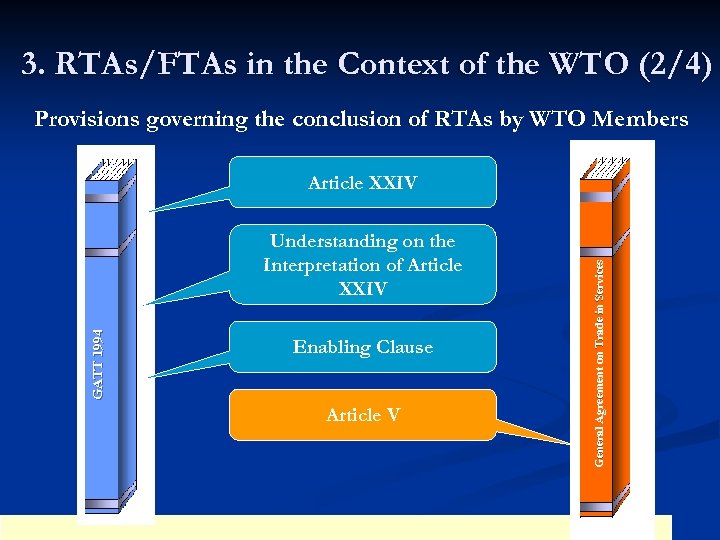

3. RTAs/FTAs in the Context of the WTO (2/4) Provisions governing the conclusion of RTAs by WTO Members GATT 1994 Understanding on the Interpretation of Article XXIV Enabling Clause Article V General Agreement on Trade in Services Article XXIV

3. RTAs/FTAs in the Context of the WTO (3/4) Ministerial Declaration (14 Nov 2001) Doha RTAs mandate 4. We stress our commitment to the WTO as a unique forum for global trade rule-making and liberalization, while also recognizing that regional trade agreements can play an important role in promoting the liberalization and expansion of trade, and in fostering development. 29. We also agree to negotiations seeking to clarify and improve disciplines and procedures under the existing WTO provisions applying to regional trade agreements. The negotiations shall take into account the developmental aspects of regional trade agreements.

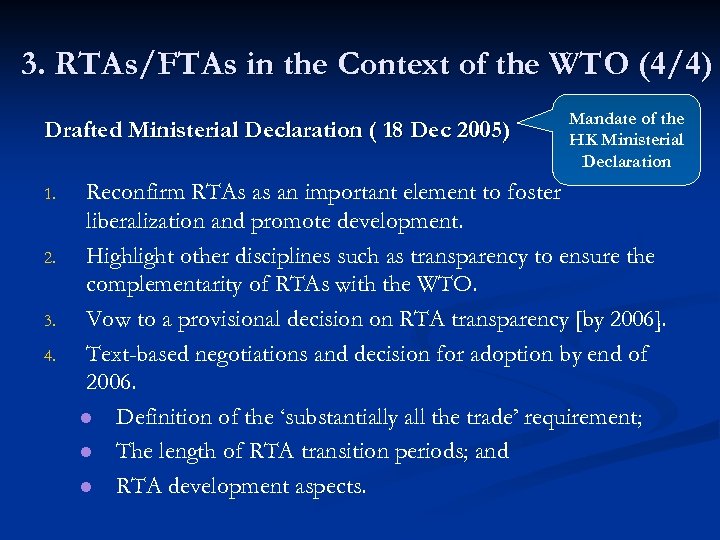

3. RTAs/FTAs in the Context of the WTO (4/4) Drafted Ministerial Declaration ( 18 Dec 2005) 1. 2. 3. 4. Mandate of the HK Ministerial Declaration Reconfirm RTAs as an important element to foster liberalization and promote development. Highlight other disciplines such as transparency to ensure the complementarity of RTAs with the WTO. Vow to a provisional decision on RTA transparency [by 2006]. Text-based negotiations and decision for adoption by end of 2006. l Definition of the ‘substantially all the trade’ requirement; l The length of RTA transition periods; and l RTA development aspects.

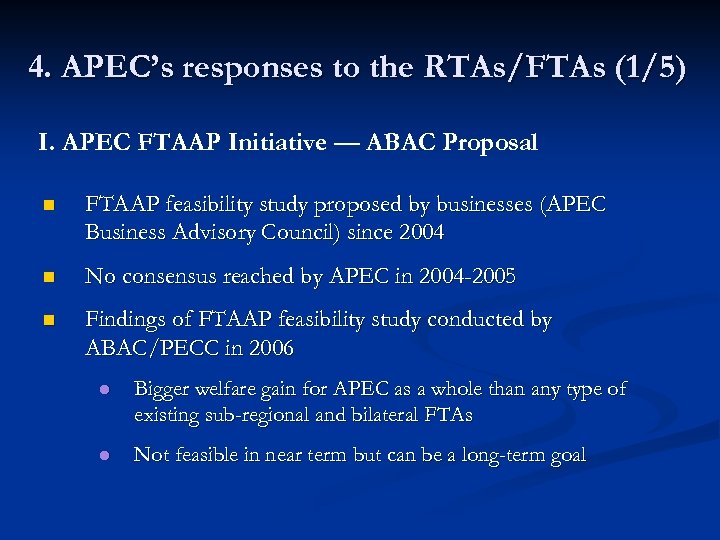

4. APEC’s responses to the RTAs/FTAs (1/5) I. APEC FTAAP Initiative — ABAC Proposal n FTAAP feasibility study proposed by businesses (APEC Business Advisory Council) since 2004 n No consensus reached by APEC in 2004 -2005 n Findings of FTAAP feasibility study conducted by ABAC/PECC in 2006 l Bigger welfare gain for APEC as a whole than any type of existing sub-regional and bilateral FTAs l Not feasible in near term but can be a long-term goal

4. APEC’s responses to the RTAs/FTAs (2/5) I. APEC FTAAP Initiative — Taiwan’s Perspective n Reasons for Taiwan’s supporting FTAAP l Negative impacts of RTA/FTA proliferation • • l n SMEs placed at competitive disadvantage Discriminatory treatment for nonmembers Economic integration is a right way forward for APEC due to close trade ties, complementarity and high degree of mutual dependency among APEC member economies. The difficulties in initial stage of process are well understood and expected.

4. APEC’s responses to the RTAs/FTAs (3/5) I. APEC FTAAP Initiative — 2006 APEC Economic Leaders’ Meeting Declaration (FTAAP part) (1/2) n n n Noted that our business communities have highlighted the implications of the growing number of diverse FTAs in the Asia-Pacific and that other regional arrangements are emerging. Reiterated our commitment to greater economic integration in the Asia-Pacific region and pledged to strengthen our efforts towards this end. Shared the APEC Business Advisory Council’s (ABAC) views that while there are practical difficulties in negotiating a Free Trade Area of the Asia-Pacific at this time, it would nonetheless be timely for APEC to seriously consider more effective avenues towards trade and investment liberalization in the Asia-Pacific region.

4. APEC’s responses to the RTAs/FTAs (4/5) I. APEC FTAAP Initiative — 2006 APEC Economic Leaders’ Meeting Declaration (FTAAP part) (2/2) n While affirming our commitments to the Bogor Goals and the successful conclusion of the WTO/DDA negotiations, we instructed Officials to undertake further studies on ways and means to promote regional economic integration, including a Free Trade Area of the Asia-Pacific as a long-term prospect, and report to the 2007 APEC Economic Leaders’ Meeting in Australia.

4. APEC’s responses to the RTAs/FTAs (5/5) II. APEC Model Measures for FTA n APEC’s chapter-specific model measures l l Reason: Difference in provisions, especially rules of origin of various FTAs incurs extra cost for businesses and government agencies. Objective: • • l serve as reference in negotiating FTAs (non-binding and voluntary in nature) increase coherence and convergence of various FTAs of member economies Timeline: complete all 14 chapters of model measures by the end of 2008 (Six RTAs/FTAs chapters are completed in 2006).

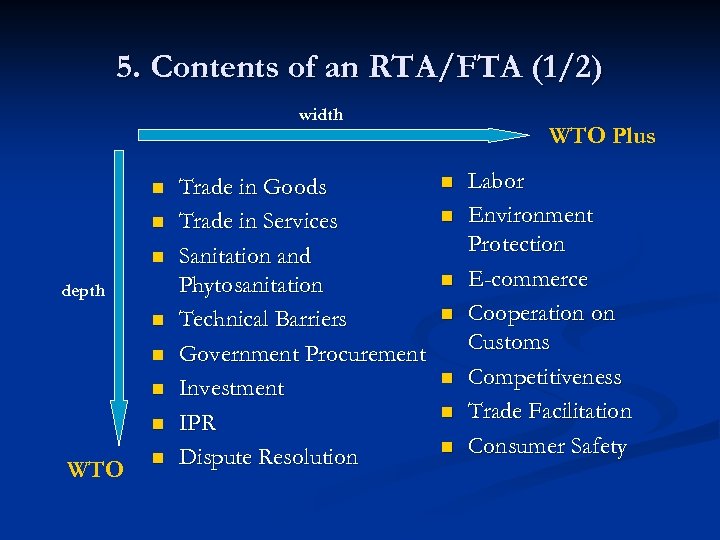

5. Contents of an RTA/FTA (1/2) width n n n depth n n WTO n Trade in Goods Trade in Services Sanitation and Phytosanitation Technical Barriers Government Procurement Investment IPR Dispute Resolution WTO Plus n n n n Labor Environment Protection E-commerce Cooperation on Customs Competitiveness Trade Facilitation Consumer Safety

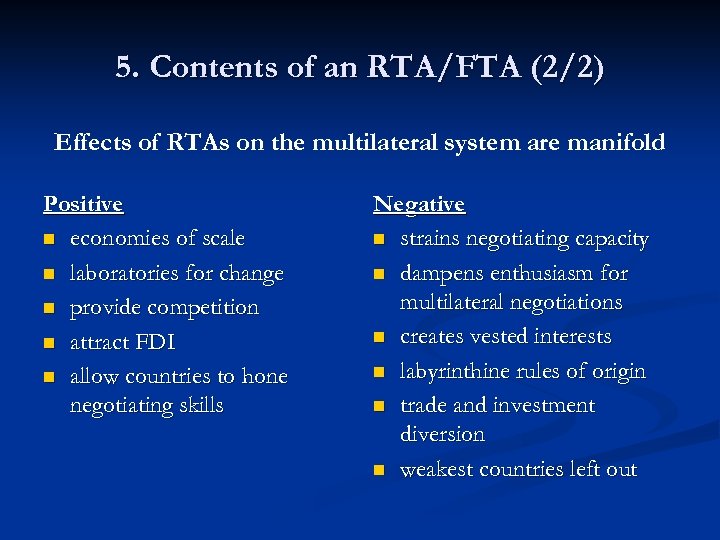

5. Contents of an RTA/FTA (2/2) Effects of RTAs on the multilateral system are manifold Positive n economies of scale n laboratories for change n provide competition n attract FDI n allow countries to hone negotiating skills Negative n strains negotiating capacity n dampens enthusiasm for multilateral negotiations n creates vested interests n labyrinthine rules of origin n trade and investment diversion n weakest countries left out

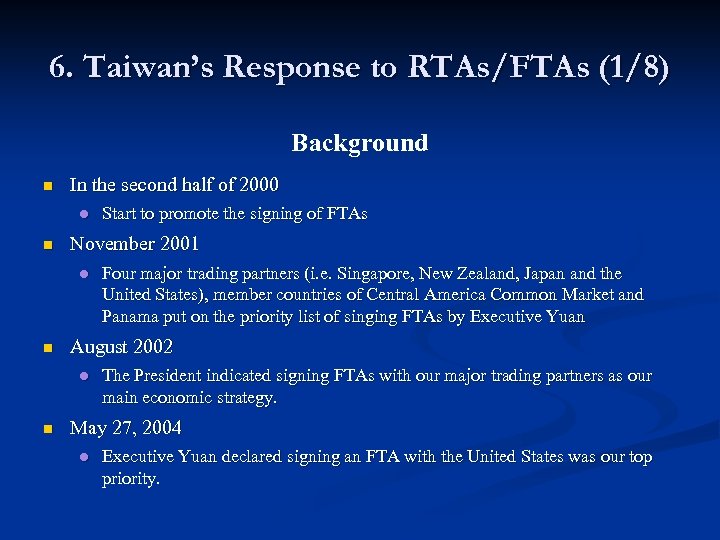

6. Taiwan’s Response to RTAs/FTAs (1/8) Background n In the second half of 2000 l n November 2001 l n Four major trading partners (i. e. Singapore, New Zealand, Japan and the United States), member countries of Central America Common Market and Panama put on the priority list of singing FTAs by Executive Yuan August 2002 l n Start to promote the signing of FTAs The President indicated signing FTAs with our major trading partners as our main economic strategy. May 27, 2004 l Executive Yuan declared signing an FTA with the United States was our top priority.

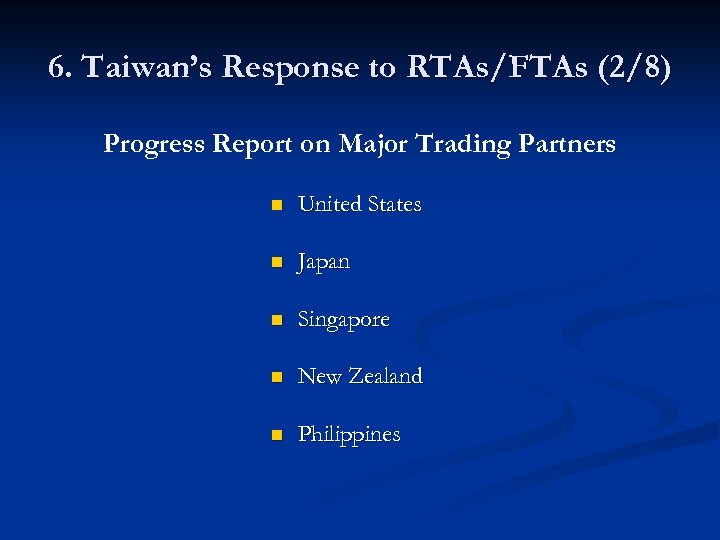

6. Taiwan’s Response to RTAs/FTAs (2/8) Progress Report on Major Trading Partners n United States n Japan n Singapore n New Zealand n Philippines

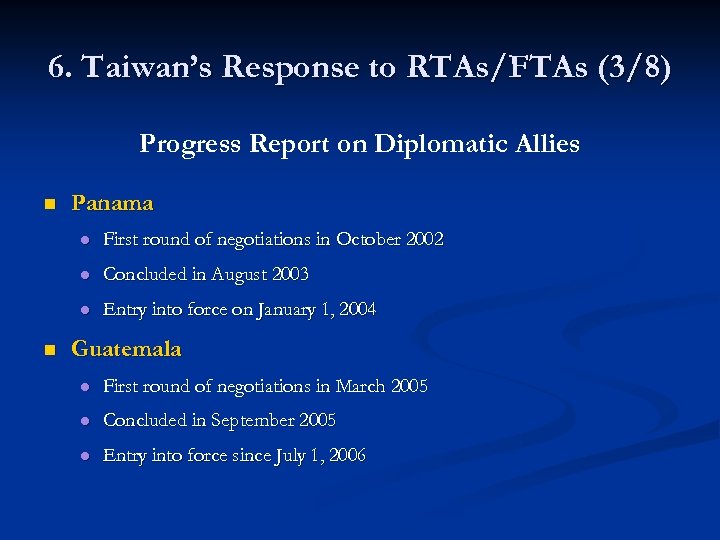

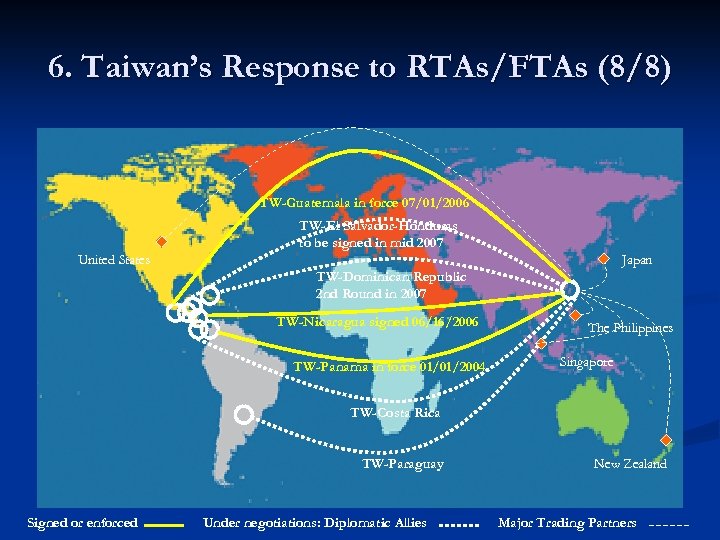

6. Taiwan’s Response to RTAs/FTAs (3/8) Progress Report on Diplomatic Allies n Panama l l Concluded in August 2003 l n First round of negotiations in October 2002 Entry into force on January 1, 2004 Guatemala l First round of negotiations in March 2005 l Concluded in September 2005 l Entry into force since July 1, 2006

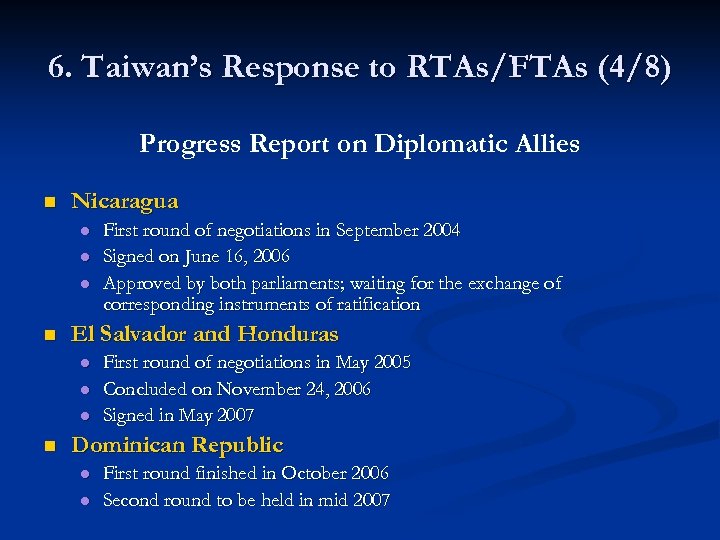

6. Taiwan’s Response to RTAs/FTAs (4/8) Progress Report on Diplomatic Allies n Nicaragua l l l n El Salvador and Honduras l l l n First round of negotiations in September 2004 Signed on June 16, 2006 Approved by both parliaments; waiting for the exchange of corresponding instruments of ratification First round of negotiations in May 2005 Concluded on November 24, 2006 Signed in May 2007 Dominican Republic l l First round finished in October 2006 Second round to be held in mid 2007

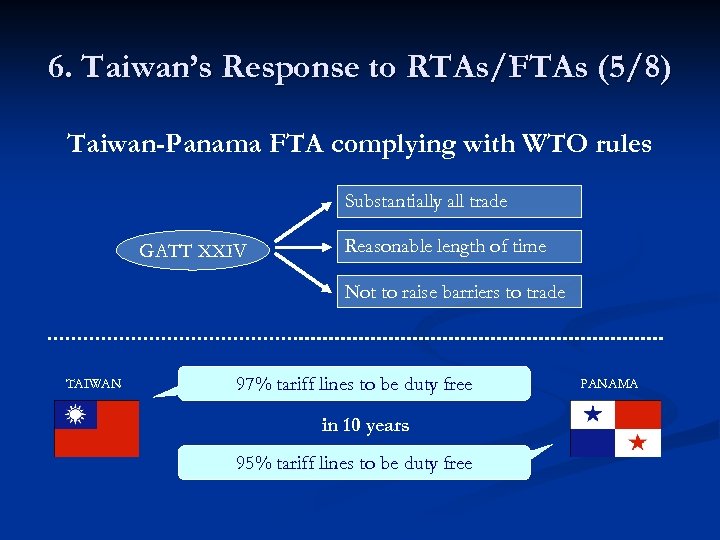

6. Taiwan’s Response to RTAs/FTAs (5/8) Taiwan-Panama FTA complying with WTO rules Substantially all trade GATT XXIV Reasonable length of time Not to raise barriers to trade TAIWAN 97% tariff lines to be duty free in 10 years 95% tariff lines to be duty free PANAMA

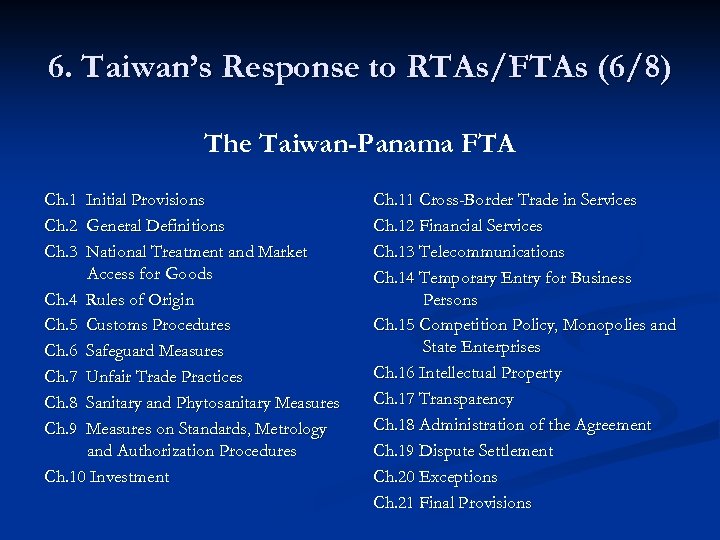

6. Taiwan’s Response to RTAs/FTAs (6/8) The Taiwan-Panama FTA Ch. 1 Initial Provisions Ch. 2 General Definitions Ch. 3 National Treatment and Market Access for Goods Ch. 4 Rules of Origin Ch. 5 Customs Procedures Ch. 6 Safeguard Measures Ch. 7 Unfair Trade Practices Ch. 8 Sanitary and Phytosanitary Measures Ch. 9 Measures on Standards, Metrology and Authorization Procedures Ch. 10 Investment Ch. 11 Cross-Border Trade in Services Ch. 12 Financial Services Ch. 13 Telecommunications Ch. 14 Temporary Entry for Business Persons Ch. 15 Competition Policy, Monopolies and State Enterprises Ch. 16 Intellectual Property Ch. 17 Transparency Ch. 18 Administration of the Agreement Ch. 19 Dispute Settlement Ch. 20 Exceptions Ch. 21 Final Provisions

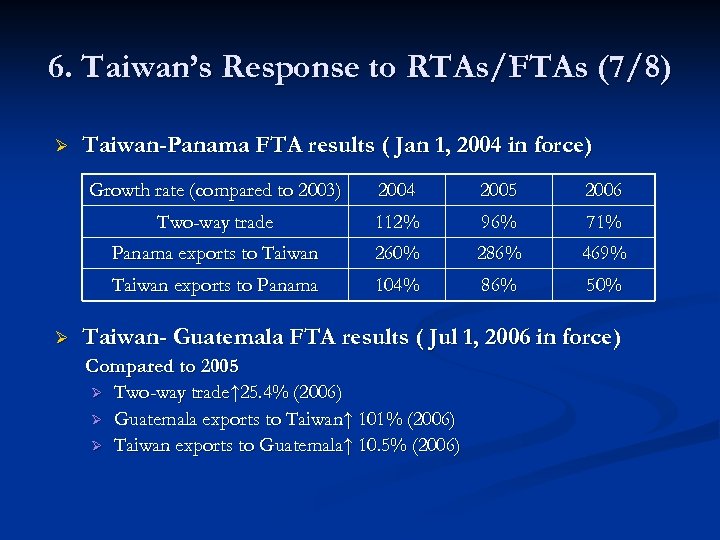

6. Taiwan’s Response to RTAs/FTAs (7/8) Ø Taiwan-Panama FTA results ( Jan 1, 2004 in force) Growth rate (compared to 2003) 2005 2006 Two-way trade 112% 96% 71% Panama exports to Taiwan 260% 286% 469% Taiwan exports to Panama Ø 2004 104% 86% 50% Taiwan- Guatemala FTA results ( Jul 1, 2006 in force) Compared to 2005 Ø Two-way trade↑ 25. 4% (2006) Ø Guatemala exports to Taiwan↑ 101% (2006) Ø Taiwan exports to Guatemala↑ 10. 5% (2006)

6. Taiwan’s Response to RTAs/FTAs (8/8) TW-Guatemala in force 07/01/2006 TW-El Salvador-Honduras to be signed in mid 2007 United States Japan TW-Dominican Republic 2 nd Round in 2007 TW-Nicaragua signed 06/16/2006 TW-Panama in force 01/01/2004 The Philippines Singapore TW-Costa Rica TW-Paraguay Signed or enforced Under negotiations: Diplomatic Allies New Zealand Major Trading Partners

7. Conclusion n Regional integration is an inevitable trend; the alternative is marginalization n Support the multinational trading system n Active pursuit of FTAs with our major trading partners and diplomatic allies n FTA is not a miracle cure: increased competitiveness is a must n Develop the knowledge-based economy to secure Taiwan’s role in the global supply chain n Improve the investment environment to entice countries to enter into FTAs

df21bed1e7adbde03a8e52ad4f5b21ee.ppt