b42d1d57e07503aad254da9f311ca380.ppt

- Количество слайдов: 16

FSAP Actuarial Valuation of General Insurance Claims Provisions Instituto de Seguros de Portugal 01/02/2006

FSAP Actuarial Valuation of General Insurance Claims Provisions Instituto de Seguros de Portugal 01/02/2006

Claims Provisions Summary 1. Underlying principles 2. Information reported by insurance undertakings 3. Supervisory process 3. 1. Ratio Analysis 3. 2. Statistical Approaches 4. Responsible actuaries practice

Claims Provisions Summary 1. Underlying principles 2. Information reported by insurance undertakings 3. Supervisory process 3. 1. Ratio Analysis 3. 2. Statistical Approaches 4. Responsible actuaries practice

Claims Provisions 1. Underlying principles • Adequate claims provisions are essential for the financial soundness of general insurance companies • Claims provisions should correspond to a reasonably conservative estimate of the amount of future payments arising from claims incurred before the valuation date: ØClaims Reported to the insurance company ØClaims Incurred but Not Reported (IBNR) ØClaims Management Costs • Statistical methods are commonly used for the estimation of claims provisions

Claims Provisions 1. Underlying principles • Adequate claims provisions are essential for the financial soundness of general insurance companies • Claims provisions should correspond to a reasonably conservative estimate of the amount of future payments arising from claims incurred before the valuation date: ØClaims Reported to the insurance company ØClaims Incurred but Not Reported (IBNR) ØClaims Management Costs • Statistical methods are commonly used for the estimation of claims provisions

Claims Provisions 2. Information reported by insurance undertakings • ISP supervisory analysis is based on: § Responsible Actuary’s report § Auditor’s appraisal § Run-off triangles (claims paid, claims provision, number of claims) for main LOB’s: Ø Motor (also by coverage) ü Property claims ü Liability claims Ø Workers’ compensation ü Temporary incapacity ü Long-term assistance Ø Health ü Individual insurance ü Group insurance § Other relevant statistical data (e. g. premiums, number of policies, Claims settlement expenses, etc. ) • Data quality is crucial

Claims Provisions 2. Information reported by insurance undertakings • ISP supervisory analysis is based on: § Responsible Actuary’s report § Auditor’s appraisal § Run-off triangles (claims paid, claims provision, number of claims) for main LOB’s: Ø Motor (also by coverage) ü Property claims ü Liability claims Ø Workers’ compensation ü Temporary incapacity ü Long-term assistance Ø Health ü Individual insurance ü Group insurance § Other relevant statistical data (e. g. premiums, number of policies, Claims settlement expenses, etc. ) • Data quality is crucial

Claims Provisions 3. ISP Supervisory Process • ISP pays particular attention to the responsible actuary’s critical analysis of the claims provision estimates • Several ratios are computed analysed • ISP runs various statistical methods (deterministic and stochastic) to estimate the expected value and variability of the claims provision • A detailed technical and practical manual is available to ISP supervision staff as a guidance for the analysis of claims provisioning (off-site and on-site analysis)

Claims Provisions 3. ISP Supervisory Process • ISP pays particular attention to the responsible actuary’s critical analysis of the claims provision estimates • Several ratios are computed analysed • ISP runs various statistical methods (deterministic and stochastic) to estimate the expected value and variability of the claims provision • A detailed technical and practical manual is available to ISP supervision staff as a guidance for the analysis of claims provisioning (off-site and on-site analysis)

Claims Provisions 3. 1. Ratio Analysis • Ratios and indicators considered on ISP analysis of claims provisions: § Growth on Premiums § Average Premium § Loss Ratio § Average Cost of New Claims § Average Claims Provision § Claims Frequency § Development of Claims Payments § “Speed” of Process closure § Re-openings § Claims Expenses § Provisioning, including IBNR § Readjustments • Ratios are calculated individually and compared on a static and evolutionary perspective with peer group and market benchmarks

Claims Provisions 3. 1. Ratio Analysis • Ratios and indicators considered on ISP analysis of claims provisions: § Growth on Premiums § Average Premium § Loss Ratio § Average Cost of New Claims § Average Claims Provision § Claims Frequency § Development of Claims Payments § “Speed” of Process closure § Re-openings § Claims Expenses § Provisioning, including IBNR § Readjustments • Ratios are calculated individually and compared on a static and evolutionary perspective with peer group and market benchmarks

Claims Provisions 3. 2. Statistical Approaches • The statistical methods’ objective is to project the expected future claims experience, using assumptions based on past data analysis complemented with expert opinion • The analysis should consist of: § Analysis of results (particularly the estimation error), taking into account theoretical assumptions underlying each model § Analysis of relevant graphs and hypothesis tests to assess each models’ fitness

Claims Provisions 3. 2. Statistical Approaches • The statistical methods’ objective is to project the expected future claims experience, using assumptions based on past data analysis complemented with expert opinion • The analysis should consist of: § Analysis of results (particularly the estimation error), taking into account theoretical assumptions underlying each model § Analysis of relevant graphs and hypothesis tests to assess each models’ fitness

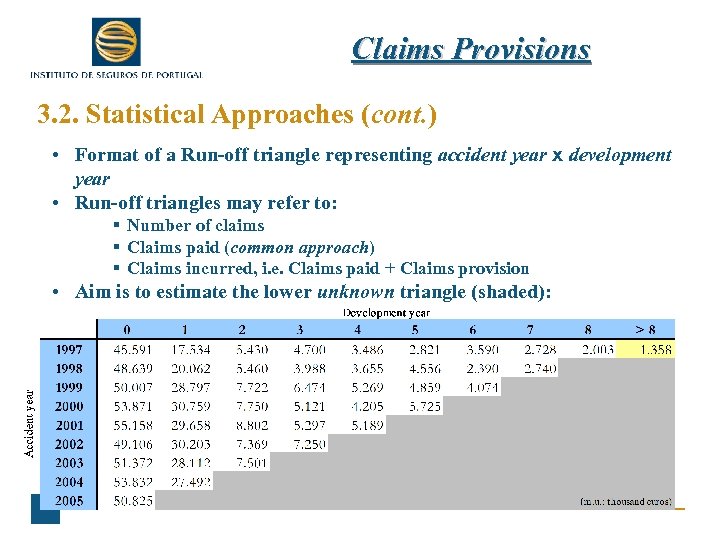

Claims Provisions 3. 2. Statistical Approaches (cont. ) • Format of a Run-off triangle representing accident year x development year • Run-off triangles may refer to: § Number of claims § Claims paid (common approach) § Claims incurred, i. e. Claims paid + Claims provision • Aim is to estimate the lower unknown triangle (shaded):

Claims Provisions 3. 2. Statistical Approaches (cont. ) • Format of a Run-off triangle representing accident year x development year • Run-off triangles may refer to: § Number of claims § Claims paid (common approach) § Claims incurred, i. e. Claims paid + Claims provision • Aim is to estimate the lower unknown triangle (shaded):

Claims Provisions 3. 2. Statistical Approaches (cont. ) • Deterministic methods § Projection of past claims experience assuming fixed development factors § Provides point estimates of the expected future claims amounts § Various actuarial techniques are available • Stochastic models § Random nature of variables is considered § Generally speaking, the future claims amounts are assumed to follow a specified probability distribution § Allows for the measurement of the estimates variability, essential for the construction of confidence intervals for the estimates § Various actuarial models are available

Claims Provisions 3. 2. Statistical Approaches (cont. ) • Deterministic methods § Projection of past claims experience assuming fixed development factors § Provides point estimates of the expected future claims amounts § Various actuarial techniques are available • Stochastic models § Random nature of variables is considered § Generally speaking, the future claims amounts are assumed to follow a specified probability distribution § Allows for the measurement of the estimates variability, essential for the construction of confidence intervals for the estimates § Various actuarial models are available

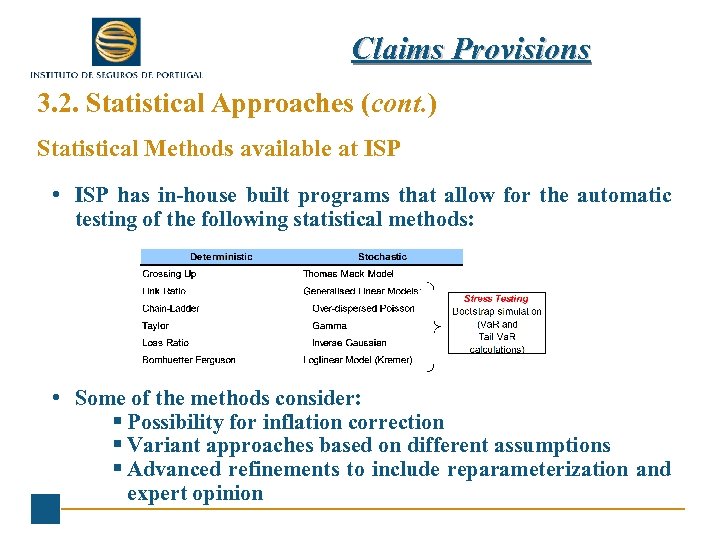

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Methods available at ISP • ISP has in-house built programs that allow for the automatic testing of the following statistical methods: • Some of the methods consider: § Possibility for inflation correction § Variant approaches based on different assumptions § Advanced refinements to include reparameterization and expert opinion

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Methods available at ISP • ISP has in-house built programs that allow for the automatic testing of the following statistical methods: • Some of the methods consider: § Possibility for inflation correction § Variant approaches based on different assumptions § Advanced refinements to include reparameterization and expert opinion

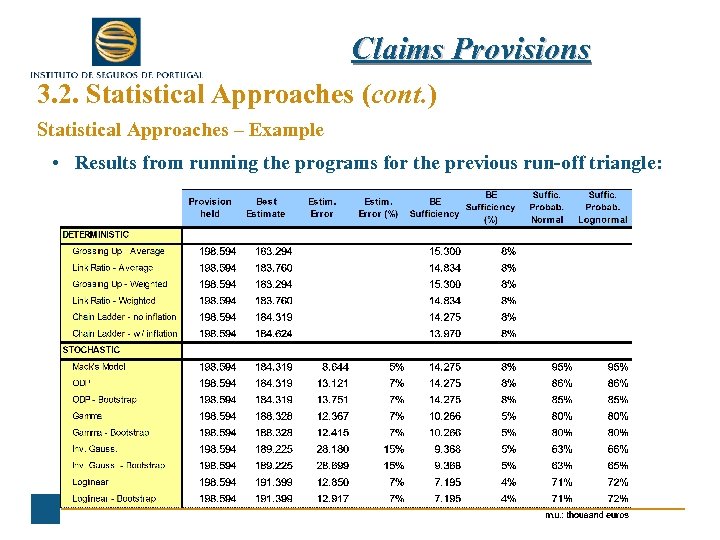

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example • Results from running the programs for the previous run-off triangle:

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example • Results from running the programs for the previous run-off triangle:

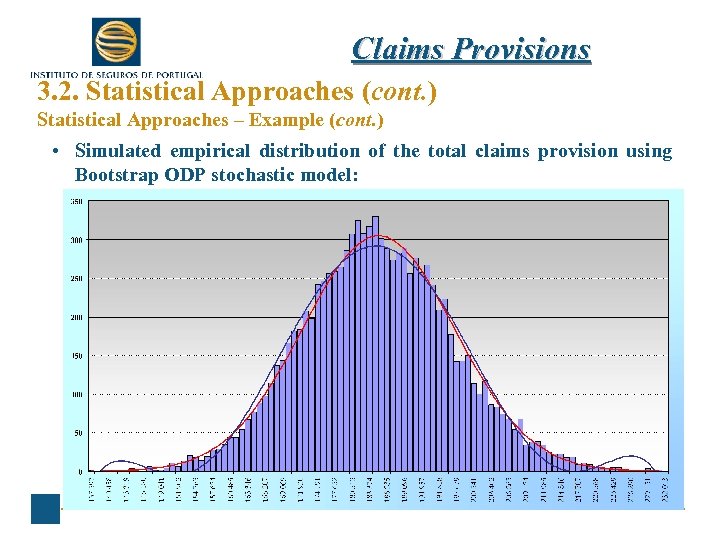

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. ) • Simulated empirical distribution of the total claims provision using Bootstrap ODP stochastic model:

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. ) • Simulated empirical distribution of the total claims provision using Bootstrap ODP stochastic model:

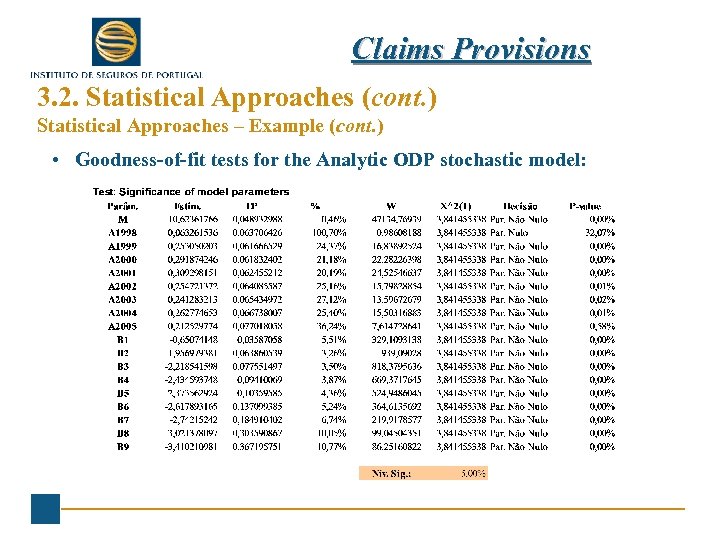

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. ) • Goodness-of-fit tests for the Analytic ODP stochastic model:

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. ) • Goodness-of-fit tests for the Analytic ODP stochastic model:

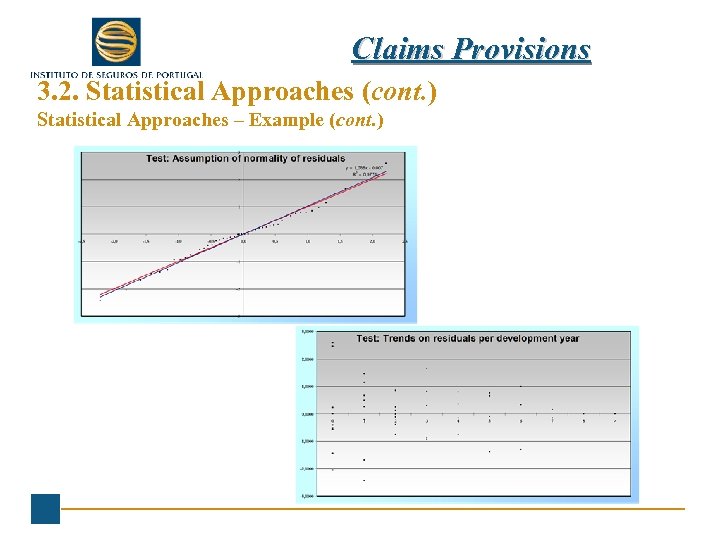

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. )

Claims Provisions 3. 2. Statistical Approaches (cont. ) Statistical Approaches – Example (cont. )

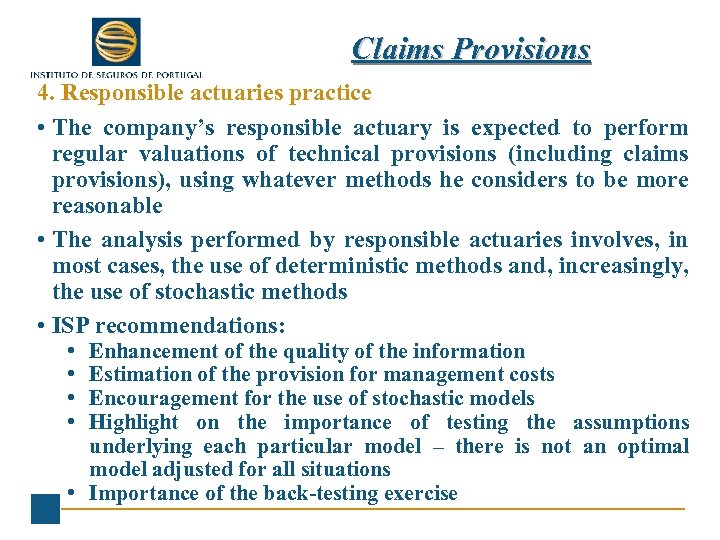

Claims Provisions 4. Responsible actuaries practice • The company’s responsible actuary is expected to perform regular valuations of technical provisions (including claims provisions), using whatever methods he considers to be more reasonable • The analysis performed by responsible actuaries involves, in most cases, the use of deterministic methods and, increasingly, the use of stochastic methods • ISP recommendations: • • Enhancement of the quality of the information Estimation of the provision for management costs Encouragement for the use of stochastic models Highlight on the importance of testing the assumptions underlying each particular model – there is not an optimal model adjusted for all situations • Importance of the back-testing exercise

Claims Provisions 4. Responsible actuaries practice • The company’s responsible actuary is expected to perform regular valuations of technical provisions (including claims provisions), using whatever methods he considers to be more reasonable • The analysis performed by responsible actuaries involves, in most cases, the use of deterministic methods and, increasingly, the use of stochastic methods • ISP recommendations: • • Enhancement of the quality of the information Estimation of the provision for management costs Encouragement for the use of stochastic models Highlight on the importance of testing the assumptions underlying each particular model – there is not an optimal model adjusted for all situations • Importance of the back-testing exercise

Claims Provisions Risk oriented approach The supervisory process of claims provisions analysis provides one important input for the global risk oriented framework

Claims Provisions Risk oriented approach The supervisory process of claims provisions analysis provides one important input for the global risk oriented framework