8de06026e1af4173333c69955fc9e6cf.ppt

- Количество слайдов: 26

From “Walled Gardens” into the “Telecom Chaos” Key trends in Contemporary Communication Systems Jens Zander Director, Wireless@KTH Royal Institute of Technology, Stockholm 1

From “Walled Gardens” into the “Telecom Chaos” Key trends in Contemporary Communication Systems Jens Zander Director, Wireless@KTH Royal Institute of Technology, Stockholm 1

Outline – Technology track • Key trends and challenges (JZ) • Key area: Infrastructure (Jan Markendahl) – Mobile Broadband the ”Revenue Gap” (”teaser” today) • Key area: Services & user behavior (Zary Segall) – What would Google do ? • Meeting 2: Networks & Services (Gerald Maguire) • Meeting 3: Personal logistics & Terminals (Mark Smith) • Meeting 4: Infrastructure deployment (Jan Markendahl)

Outline – Technology track • Key trends and challenges (JZ) • Key area: Infrastructure (Jan Markendahl) – Mobile Broadband the ”Revenue Gap” (”teaser” today) • Key area: Services & user behavior (Zary Segall) – What would Google do ? • Meeting 2: Networks & Services (Gerald Maguire) • Meeting 3: Personal logistics & Terminals (Mark Smith) • Meeting 4: Infrastructure deployment (Jan Markendahl)

Part I: Key challenges & trends 3

Part I: Key challenges & trends 3

Trend 1: Much more for (even) less 4

Trend 1: Much more for (even) less 4

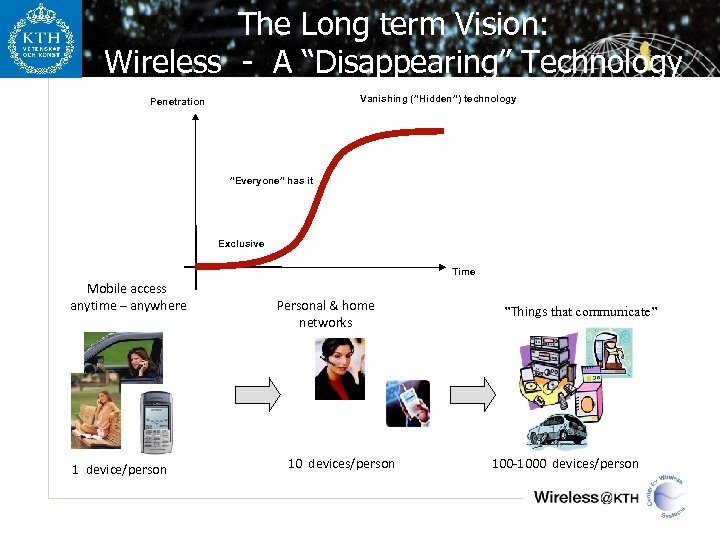

The Long term Vision: Wireless - A “Disappearing” Technology Vanishing (”Hidden”) technology Penetration ”Everyone” has it Exclusive Time Mobile access anytime – anywhere 1 device/person Personal & home networks 10 devices/person ”Things that communicate” 100 -1000 devices/person

The Long term Vision: Wireless - A “Disappearing” Technology Vanishing (”Hidden”) technology Penetration ”Everyone” has it Exclusive Time Mobile access anytime – anywhere 1 device/person Personal & home networks 10 devices/person ”Things that communicate” 100 -1000 devices/person

Trend 1: (Much) More for less First fixed IP access – then mobile access Vision 2000 • Mobile Web-browsing – the multimedia service platform • Interactive information services • Streaming audio/video • Rich exponentially growing content • Adapted to small terminals + Location & context aware services + Same price as mobile telephony TODAYs reality: • Same price as home-ADSL • Mobile telephony prices dropping • Take-off was delayed – but happening now 6

Trend 1: (Much) More for less First fixed IP access – then mobile access Vision 2000 • Mobile Web-browsing – the multimedia service platform • Interactive information services • Streaming audio/video • Rich exponentially growing content • Adapted to small terminals + Location & context aware services + Same price as mobile telephony TODAYs reality: • Same price as home-ADSL • Mobile telephony prices dropping • Take-off was delayed – but happening now 6

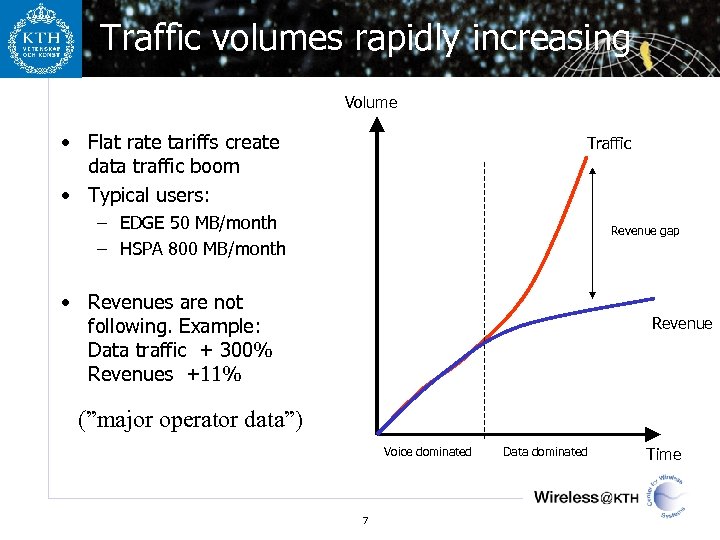

Traffic volumes rapidly increasing Volume • Flat rate tariffs create data traffic boom • Typical users: Traffic – EDGE 50 MB/month – HSPA 800 MB/month Revenue gap • Revenues are not following. Example: Data traffic + 300% Revenues +11% Revenue (”major operator data”) Voice dominated 7 Data dominated Time

Traffic volumes rapidly increasing Volume • Flat rate tariffs create data traffic boom • Typical users: Traffic – EDGE 50 MB/month – HSPA 800 MB/month Revenue gap • Revenues are not following. Example: Data traffic + 300% Revenues +11% Revenue (”major operator data”) Voice dominated 7 Data dominated Time

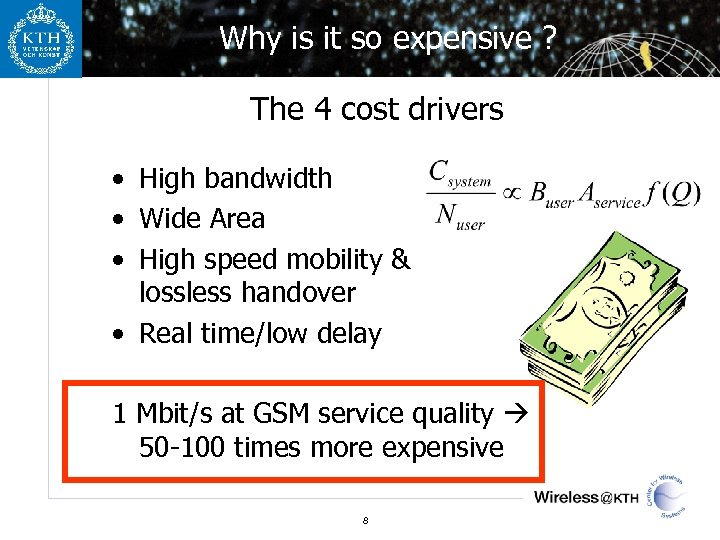

Why is it so expensive ? The 4 cost drivers • High bandwidth • Wide Area • High speed mobility & lossless handover • Real time/low delay 1 Mbit/s at GSM service quality 50 -100 times more expensive 8

Why is it so expensive ? The 4 cost drivers • High bandwidth • Wide Area • High speed mobility & lossless handover • Real time/low delay 1 Mbit/s at GSM service quality 50 -100 times more expensive 8

The street light analogy Why are parts of Sweden dark at night ? – Technical limitations ? – User demand ? – Economical limitations ? 9

The street light analogy Why are parts of Sweden dark at night ? – Technical limitations ? – User demand ? – Economical limitations ? 9

Trend 2: Bits are just bits and can be produced anywhere – now also in the mobile domain! Services provided by anyone - except the network operator ? 14

Trend 2: Bits are just bits and can be produced anywhere – now also in the mobile domain! Services provided by anyone - except the network operator ? 14

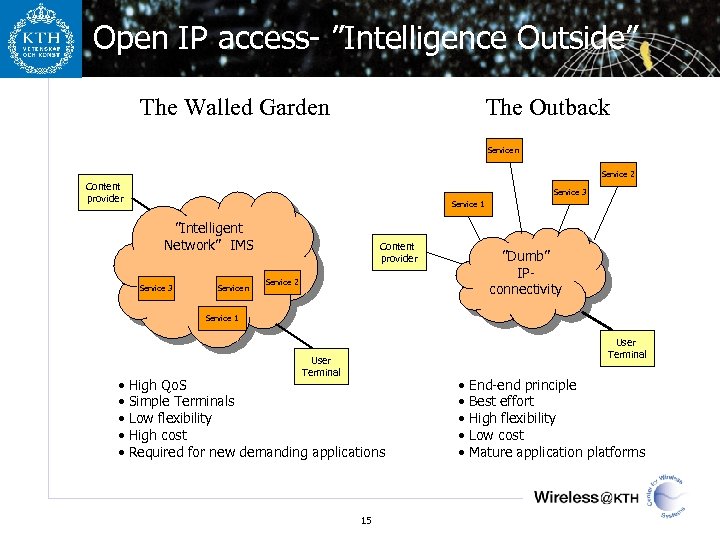

Open IP access- ”Intelligence Outside” The Walled Garden The Outback Service n Service 2 Content provider Service 3 Service 1 ”Intelligent Network” IMS Service 3 Service n Content provider ”Dumb” IPconnectivity Service 2 Service 1 • • • User Terminal High Qo. S Simple Terminals Low flexibility High cost Required for new demanding applications 15 • • • End-end principle Best effort High flexibility Low cost Mature application platforms

Open IP access- ”Intelligence Outside” The Walled Garden The Outback Service n Service 2 Content provider Service 3 Service 1 ”Intelligent Network” IMS Service 3 Service n Content provider ”Dumb” IPconnectivity Service 2 Service 1 • • • User Terminal High Qo. S Simple Terminals Low flexibility High cost Required for new demanding applications 15 • • • End-end principle Best effort High flexibility Low cost Mature application platforms

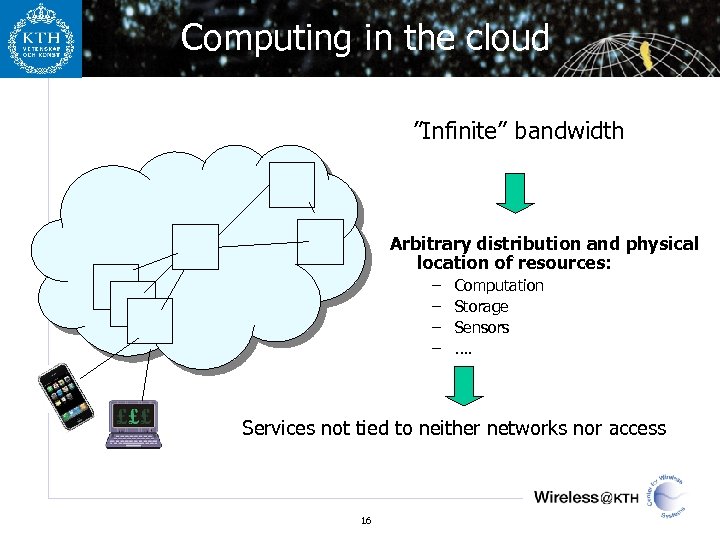

Computing in the cloud ”Infinite” bandwidth Arbitrary distribution and physical location of resources: – – Computation Storage Sensors …. Services not tied to neither networks nor access 16

Computing in the cloud ”Infinite” bandwidth Arbitrary distribution and physical location of resources: – – Computation Storage Sensors …. Services not tied to neither networks nor access 16

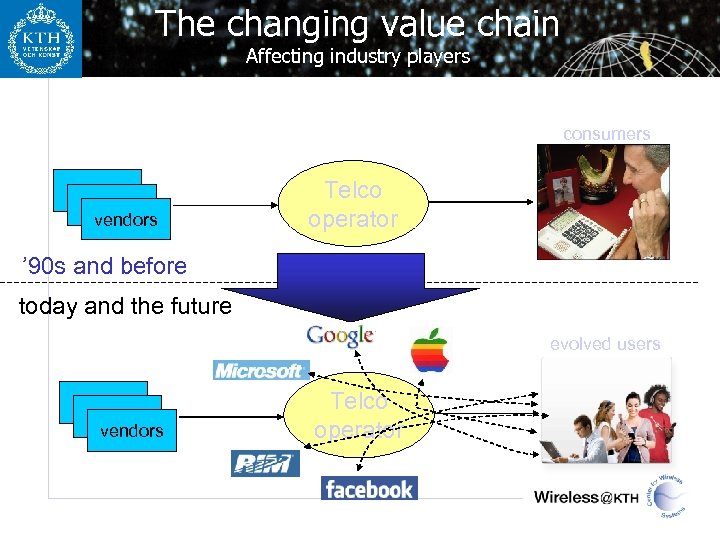

The changing value chain Affecting industry players consumers vendors Telco operator ’ 90 s and before today and the future evolved users vendors Telco operator

The changing value chain Affecting industry players consumers vendors Telco operator ’ 90 s and before today and the future evolved users vendors Telco operator

Mobile services. . ”over the top” • Sufficient mobile bandwidth: • Services ”over the top” (IP) • No need for networked services • New Actors: – Apple (Appstore) – Google (Android Market) • New Service paradigm – Try & Buy • Death of SMS, Voice. . ? (Google Talk ? )

Mobile services. . ”over the top” • Sufficient mobile bandwidth: • Services ”over the top” (IP) • No need for networked services • New Actors: – Apple (Appstore) – Google (Android Market) • New Service paradigm – Try & Buy • Death of SMS, Voice. . ? (Google Talk ? )

Some consequences: Mobile TV • Mobile TV – – – Operator provided service Streaming Real-time Existing TV-content is dead ! ISDN • Personal Multi Media – Individual personalized content – Non-real time – on demand – Time-shifting is ”out there” and lives but without access operator intervention! 19 WAP Mobile TV

Some consequences: Mobile TV • Mobile TV – – – Operator provided service Streaming Real-time Existing TV-content is dead ! ISDN • Personal Multi Media – Individual personalized content – Non-real time – on demand – Time-shifting is ”out there” and lives but without access operator intervention! 19 WAP Mobile TV

Questions for discussions • Where is TS going in mobile ? – High quality bit-pipe provider? – Content aggregator – (e. g. Mobile entertainment) ? – Generic IP based Services – Business solutions …. 20

Questions for discussions • Where is TS going in mobile ? – High quality bit-pipe provider? – Content aggregator – (e. g. Mobile entertainment) ? – Generic IP based Services – Business solutions …. 20

Part II: Challenges and potential Showstoppers ahead ….

Part II: Challenges and potential Showstoppers ahead ….

The Challenges & potential ”Showstoppers” • • Spectrum ”Shannon” Energy Cost Complexity – Reliability Legal issues Health Hazards ? New business models ?

The Challenges & potential ”Showstoppers” • • Spectrum ”Shannon” Energy Cost Complexity – Reliability Legal issues Health Hazards ? New business models ?

Do we need more spectrum for wireless access services ? • Basically no: Higher data rate – short range communication • But: More spectrum – cheaper systems – less energy Low power Spectrum Efficiency Low Infrastructure Cost

Do we need more spectrum for wireless access services ? • Basically no: Higher data rate – short range communication • But: More spectrum – cheaper systems – less energy Low power Spectrum Efficiency Low Infrastructure Cost

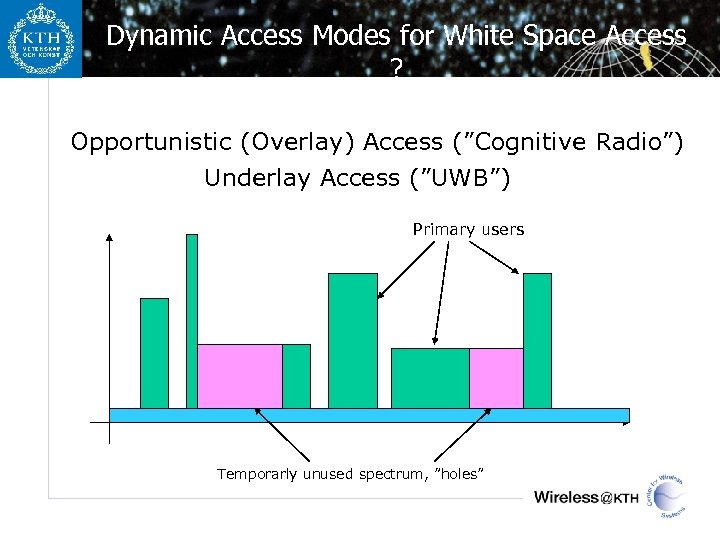

Dynamic Access Modes for White Space Access ? Opportunistic (Overlay) Access (”Cognitive Radio”) Underlay Access (”UWB”) Primary users Temporarly unused spectrum, ”holes”

Dynamic Access Modes for White Space Access ? Opportunistic (Overlay) Access (”Cognitive Radio”) Underlay Access (”UWB”) Primary users Temporarly unused spectrum, ”holes”

Business implications ? • From ”exclusive ownership” – to commodity • Lower price of spectrum due to – Increased supply of spectrum – Increased interference from secondary users • Easier access to spectrum - more competition • More difficult to guarantee service ? • New spectrum business models ?

Business implications ? • From ”exclusive ownership” – to commodity • Lower price of spectrum due to – Increased supply of spectrum – Increased interference from secondary users • Easier access to spectrum - more competition • More difficult to guarantee service ? • New spectrum business models ?

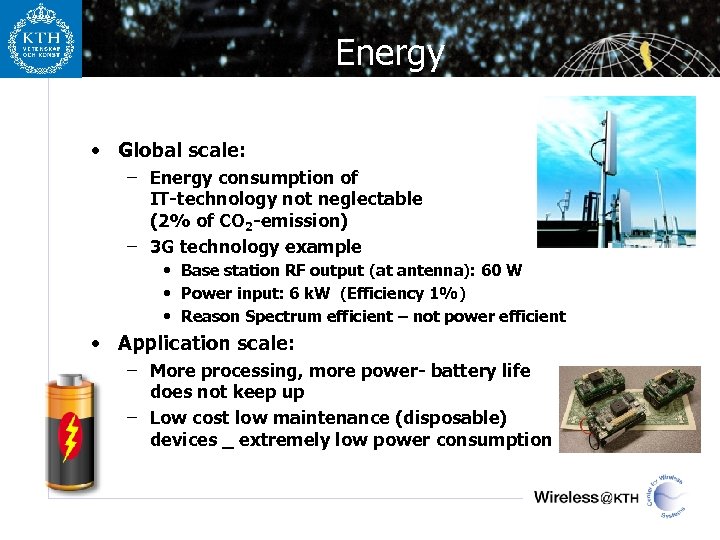

Energy • Global scale: – Energy consumption of IT-technology not neglectable (2% of CO 2 -emission) – 3 G technology example • Base station RF output (at antenna): 60 W • Power input: 6 k. W (Efficiency 1%) • Reason Spectrum efficient – not power efficient • Application scale: – More processing, more power- battery life does not keep up – Low cost low maintenance (disposable) devices _ extremely low power consumption

Energy • Global scale: – Energy consumption of IT-technology not neglectable (2% of CO 2 -emission) – 3 G technology example • Base station RF output (at antenna): 60 W • Power input: 6 k. W (Efficiency 1%) • Reason Spectrum efficient – not power efficient • Application scale: – More processing, more power- battery life does not keep up – Low cost low maintenance (disposable) devices _ extremely low power consumption

Storage • Mobile Storage rapidly increasing – 100 KB 1 TB. . and more • Cost down – HD < 10 c / GB – Flash < 1$/GB • Always connected and everything stored centrally OR Everything in the devices ? • New storage based internet paradigm ?

Storage • Mobile Storage rapidly increasing – 100 KB 1 TB. . and more • Cost down – HD < 10 c / GB – Flash < 1$/GB • Always connected and everything stored centrally OR Everything in the devices ? • New storage based internet paradigm ?

The Vision Complexity & Reliability Yesterday 0. 1 -1. 0 billion of users Complex networks Complex expensive devices • Complex to use • Does not scale Tomorrow 10 -100 billion of users and devices Even more complex networks Complex but in-expensive devices • Simple to use and deploy • Extremely reliable • Affordable for everyone

The Vision Complexity & Reliability Yesterday 0. 1 -1. 0 billion of users Complex networks Complex expensive devices • Complex to use • Does not scale Tomorrow 10 -100 billion of users and devices Even more complex networks Complex but in-expensive devices • Simple to use and deploy • Extremely reliable • Affordable for everyone

Some conclusions • Key Opportunities: – Moore’s law keeps going: more memory, more processing in less space – Plug-and-play / Zero configuration systems • Key challenges: – Energy – both global and battery life – Spectrum – plenty availblable but difficult to access – Complexity – Reliability

Some conclusions • Key Opportunities: – Moore’s law keeps going: more memory, more processing in less space – Plug-and-play / Zero configuration systems • Key challenges: – Energy – both global and battery life – Spectrum – plenty availblable but difficult to access – Complexity – Reliability

www. wireless. kth. se 30

www. wireless. kth. se 30