b8828d743a34d999f99051bbc1fc0024.ppt

- Количество слайдов: 18

From Technology Transfer to Local Manufacturing: China’s Emergence in the Global Wind Power Industry Photo: Wind farm construction in Inner Mongolia, April 2004. Dr. Joanna Lewis Senior International Fellow Pew Center on Global Climate Change Presented at the Woodrow Wilson Center’s China Environment Forum October 2, 2006

From Technology Transfer to Local Manufacturing: China’s Emergence in the Global Wind Power Industry Photo: Wind farm construction in Inner Mongolia, April 2004. Dr. Joanna Lewis Senior International Fellow Pew Center on Global Climate Change Presented at the Woodrow Wilson Center’s China Environment Forum October 2, 2006

2 Research motivations • How can energy and emissions pathways be changed in the developing world through the transfer, development and dissemination of advanced energy technologies? • Examined in the context of: – China’s significance in global energy system – Recent political and policy support for renewables – Potential to develop technology for export, drive down costs, promote wider dissemination

2 Research motivations • How can energy and emissions pathways be changed in the developing world through the transfer, development and dissemination of advanced energy technologies? • Examined in the context of: – China’s significance in global energy system – Recent political and policy support for renewables – Potential to develop technology for export, drive down costs, promote wider dissemination

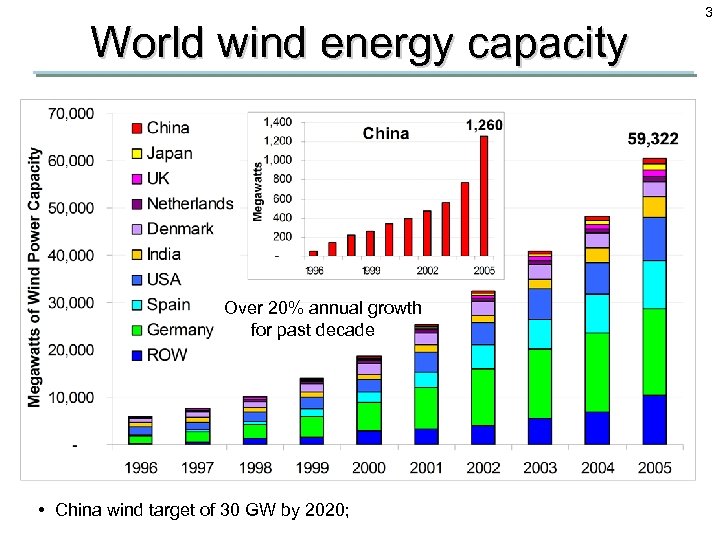

World wind energy capacity Over 20% annual growth for past decade • China wind target of 30 GW by 2020; 3

World wind energy capacity Over 20% annual growth for past decade • China wind target of 30 GW by 2020; 3

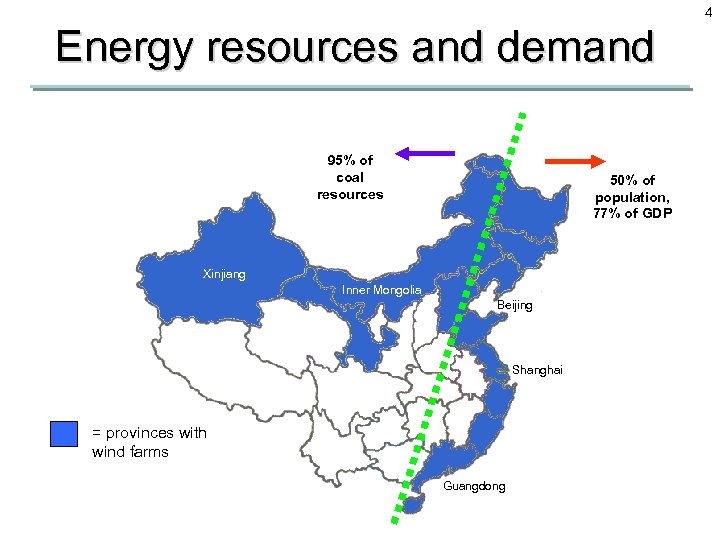

4 Energy resources and demand 95% of coal resources 50% of population, 77% of GDP Xinjiang Inner Mongolia Beijing Shanghai = provinces with wind farms Guangdong

4 Energy resources and demand 95% of coal resources 50% of population, 77% of GDP Xinjiang Inner Mongolia Beijing Shanghai = provinces with wind farms Guangdong

5 Research questions 1. What companies, both foreign and domestic, are involved in the Chinese wind turbine industry, and how do their models of wind technology development compare? 2. What policies are being used by the government to support wind power, and how are they influencing the technology development models of China-based wind turbine manufacturers? 3. How do these models shape wind technology innovation and deployment in China, and what do they mean for domestic technical capacity? For domestic installations?

5 Research questions 1. What companies, both foreign and domestic, are involved in the Chinese wind turbine industry, and how do their models of wind technology development compare? 2. What policies are being used by the government to support wind power, and how are they influencing the technology development models of China-based wind turbine manufacturers? 3. How do these models shape wind technology innovation and deployment in China, and what do they mean for domestic technical capacity? For domestic installations?

6 Wind turbine manufacturer case studies • NEG Micon/Vestas - Denmark • Nordex - Germany • GE Wind - USA • Goldwind - China

6 Wind turbine manufacturer case studies • NEG Micon/Vestas - Denmark • Nordex - Germany • GE Wind - USA • Goldwind - China

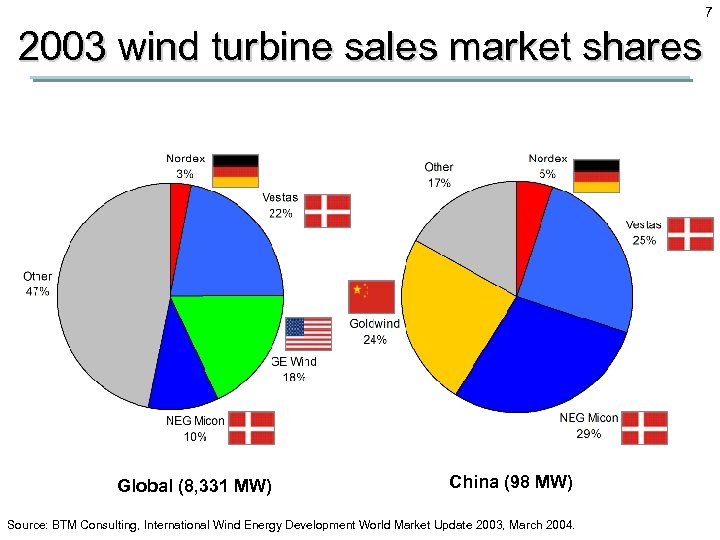

7 2003 wind turbine sales market shares Global (8, 331 MW) China (98 MW) Source: BTM Consulting, International Wind Energy Development World Market Update 2003, March 2004.

7 2003 wind turbine sales market shares Global (8, 331 MW) China (98 MW) Source: BTM Consulting, International Wind Energy Development World Market Update 2003, March 2004.

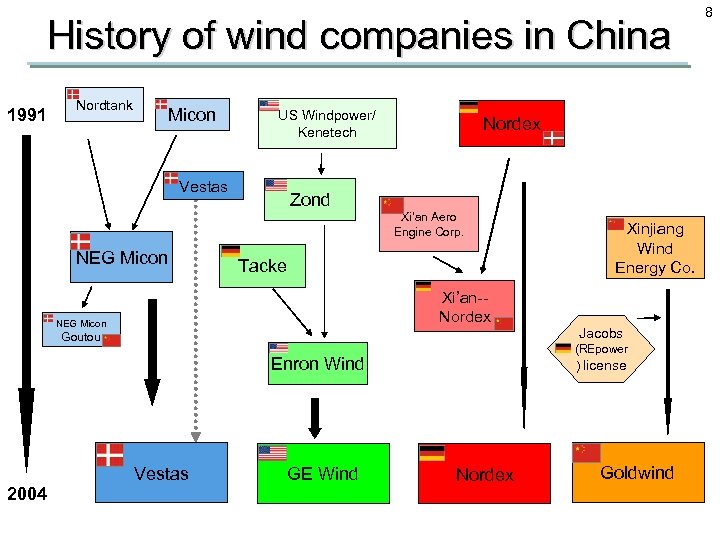

History of wind companies in China 1991 Nordtank Micon US Windpower/ Kenetech Vestas Nordex Zond Xi’an Aero Engine Corp. NEG Micon Tacke Xi’an-Nordex NEG Micon Jacobs Goutou (REpower ) license Enron Wind Vestas 2004 Xinjiang Wind Energy Co. GE Wind Nordex Goldwind 8

History of wind companies in China 1991 Nordtank Micon US Windpower/ Kenetech Vestas Nordex Zond Xi’an Aero Engine Corp. NEG Micon Tacke Xi’an-Nordex NEG Micon Jacobs Goutou (REpower ) license Enron Wind Vestas 2004 Xinjiang Wind Energy Co. GE Wind Nordex Goldwind 8

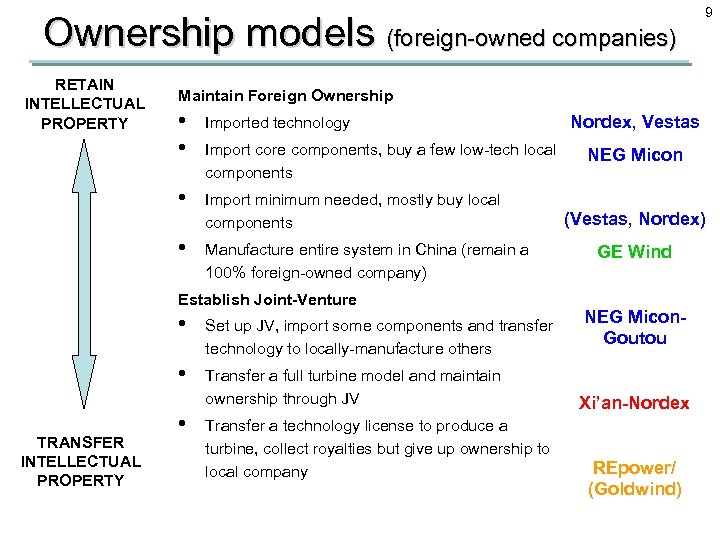

Ownership models (foreign-owned companies) RETAIN INTELLECTUAL PROPERTY Maintain Foreign Ownership • • Imported technology • Import minimum needed, mostly buy local components • Manufacture entire system in China (remain a 100% foreign-owned company) Import core components, buy a few low-tech local components Establish Joint-Venture • Set up JV, import some components and transfer technology to locally-manufacture others • TRANSFER INTELLECTUAL PROPERTY 9 Transfer a full turbine model and maintain ownership through JV • Transfer a technology license to produce a turbine, collect royalties but give up ownership to local company Nordex, Vestas NEG Micon (Vestas, Nordex) GE Wind NEG Micon. Goutou Xi’an-Nordex REpower/ (Goldwind)

Ownership models (foreign-owned companies) RETAIN INTELLECTUAL PROPERTY Maintain Foreign Ownership • • Imported technology • Import minimum needed, mostly buy local components • Manufacture entire system in China (remain a 100% foreign-owned company) Import core components, buy a few low-tech local components Establish Joint-Venture • Set up JV, import some components and transfer technology to locally-manufacture others • TRANSFER INTELLECTUAL PROPERTY 9 Transfer a full turbine model and maintain ownership through JV • Transfer a technology license to produce a turbine, collect royalties but give up ownership to local company Nordex, Vestas NEG Micon (Vestas, Nordex) GE Wind NEG Micon. Goutou Xi’an-Nordex REpower/ (Goldwind)

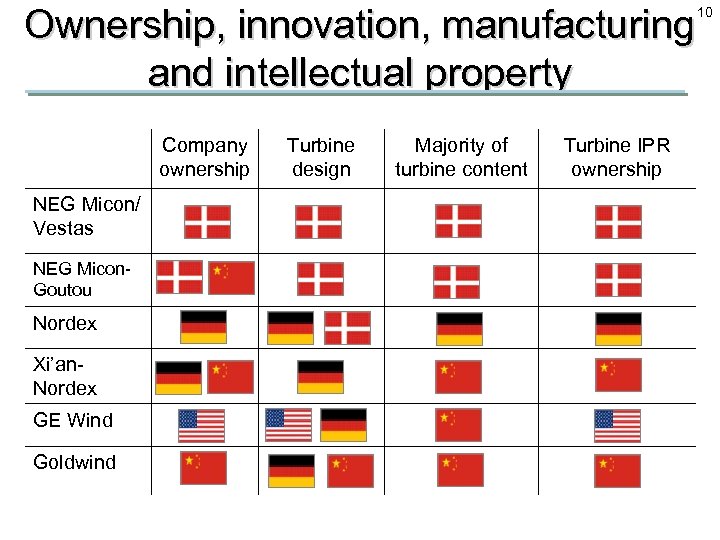

Ownership, innovation, manufacturing and intellectual property Company ownership NEG Micon/ Vestas NEG Micon. Goutou Nordex Xi’an. Nordex GE Wind Goldwind Turbine design Majority of turbine content Turbine IPR ownership 10

Ownership, innovation, manufacturing and intellectual property Company ownership NEG Micon/ Vestas NEG Micon. Goutou Nordex Xi’an. Nordex GE Wind Goldwind Turbine design Majority of turbine content Turbine IPR ownership 10

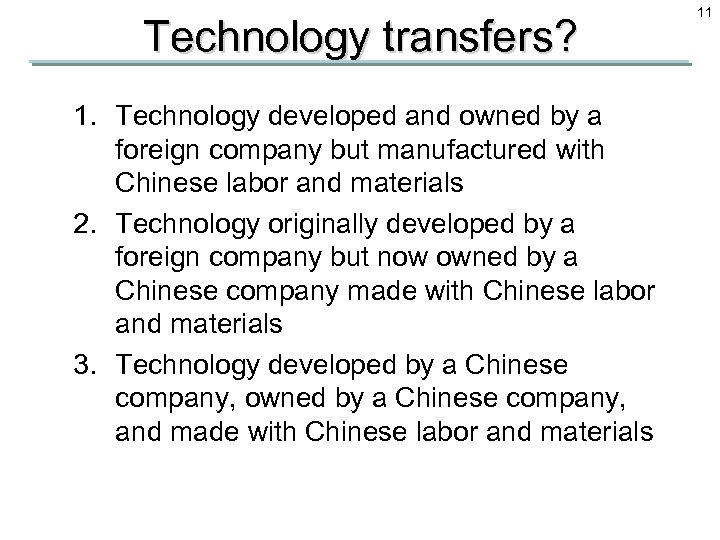

Technology transfers? 1. Technology developed and owned by a foreign company but manufactured with Chinese labor and materials 2. Technology originally developed by a foreign company but now owned by a Chinese company made with Chinese labor and materials 3. Technology developed by a Chinese company, owned by a Chinese company, and made with Chinese labor and materials 11

Technology transfers? 1. Technology developed and owned by a foreign company but manufactured with Chinese labor and materials 2. Technology originally developed by a foreign company but now owned by a Chinese company made with Chinese labor and materials 3. Technology developed by a Chinese company, owned by a Chinese company, and made with Chinese labor and materials 11

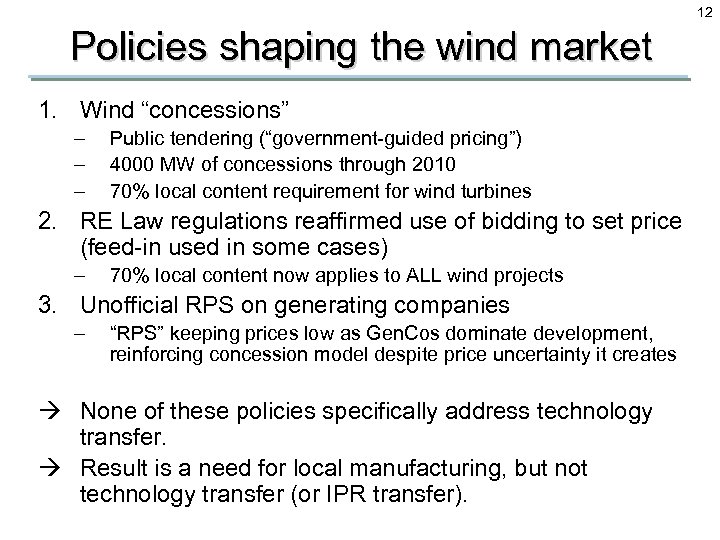

12 Policies shaping the wind market 1. Wind “concessions” – – – Public tendering (“government-guided pricing”) 4000 MW of concessions through 2010 70% local content requirement for wind turbines 2. RE Law regulations reaffirmed use of bidding to set price (feed-in used in some cases) – 70% local content now applies to ALL wind projects 3. Unofficial RPS on generating companies – “RPS” keeping prices low as Gen. Cos dominate development, reinforcing concession model despite price uncertainty it creates à None of these policies specifically address technology transfer. à Result is a need for local manufacturing, but not technology transfer (or IPR transfer).

12 Policies shaping the wind market 1. Wind “concessions” – – – Public tendering (“government-guided pricing”) 4000 MW of concessions through 2010 70% local content requirement for wind turbines 2. RE Law regulations reaffirmed use of bidding to set price (feed-in used in some cases) – 70% local content now applies to ALL wind projects 3. Unofficial RPS on generating companies – “RPS” keeping prices low as Gen. Cos dominate development, reinforcing concession model despite price uncertainty it creates à None of these policies specifically address technology transfer. à Result is a need for local manufacturing, but not technology transfer (or IPR transfer).

13 Current situation • Chinese manufacturers lead in cost reductions, but lag in advanced design – Up to 30% cheaper – Relying on 600, 750 k. W turbines • Government looking for new means of policy support aimed at Chinese-owned companies – Stuck on local content requirements – Discussing local IP requirements • Risk of WTO challenges increases with a move in this direction – Threatens operations of foreign-owned companies

13 Current situation • Chinese manufacturers lead in cost reductions, but lag in advanced design – Up to 30% cheaper – Relying on 600, 750 k. W turbines • Government looking for new means of policy support aimed at Chinese-owned companies – Stuck on local content requirements – Discussing local IP requirements • Risk of WTO challenges increases with a move in this direction – Threatens operations of foreign-owned companies

14 Recommendations • Instead of mandating local content/IP, focus on finding policies to support demonstration, testing & certification of local technology • Need for Chinese companies to further develop channels for informal knowledge transfer and learning – Including overseas R&D centers [Suzlon model] • Purchasing IP has proven successful in this industry; scope can be expanded – Many new entrants to Chinese market using licenses, joint ventures [Gamesa, Goldwind model]

14 Recommendations • Instead of mandating local content/IP, focus on finding policies to support demonstration, testing & certification of local technology • Need for Chinese companies to further develop channels for informal knowledge transfer and learning – Including overseas R&D centers [Suzlon model] • Purchasing IP has proven successful in this industry; scope can be expanded – Many new entrants to Chinese market using licenses, joint ventures [Gamesa, Goldwind model]

15

15

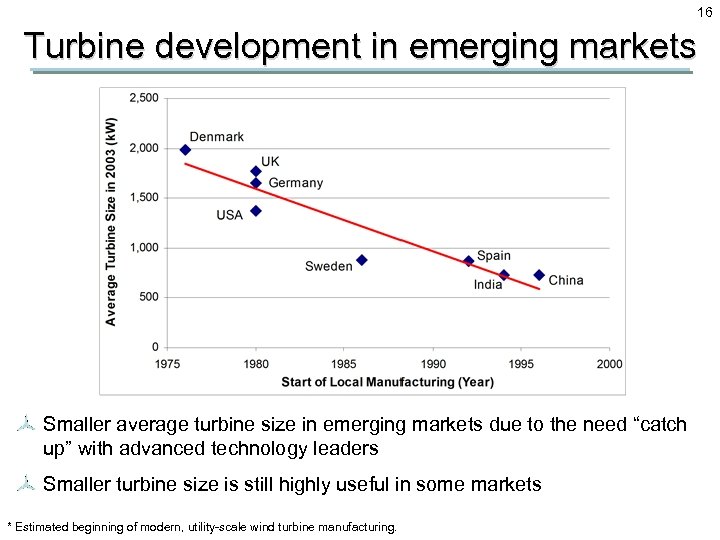

16 Turbine development in emerging markets Smaller average turbine size in emerging markets due to the need “catch up” with advanced technology leaders Smaller turbine size is still highly useful in some markets * Estimated beginning of modern, utility-scale wind turbine manufacturing.

16 Turbine development in emerging markets Smaller average turbine size in emerging markets due to the need “catch up” with advanced technology leaders Smaller turbine size is still highly useful in some markets * Estimated beginning of modern, utility-scale wind turbine manufacturing.

Current and potential wind utilization in China • Estimated 1, 000 megawatts (MW) of total exploitable wind resources (250, 000 MW on land + 750, 000 MW offshore) – 440, 000 MW of electric generation capacity in China (2004) – 1 large coal plant = 1, 000 MW • Current installed wind capacity (770 MW) contributes to less than 1% of national electricity generation • Chinese government plans 20, 000 MW of wind power by 2020 – EWEA/Greenpeace study says 170, 000 MW feasible in China by 2020 Source: NREL, EWEA, China National Bureau of Statistics. Current wind capacity estimated from interviews. 17

Current and potential wind utilization in China • Estimated 1, 000 megawatts (MW) of total exploitable wind resources (250, 000 MW on land + 750, 000 MW offshore) – 440, 000 MW of electric generation capacity in China (2004) – 1 large coal plant = 1, 000 MW • Current installed wind capacity (770 MW) contributes to less than 1% of national electricity generation • Chinese government plans 20, 000 MW of wind power by 2020 – EWEA/Greenpeace study says 170, 000 MW feasible in China by 2020 Source: NREL, EWEA, China National Bureau of Statistics. Current wind capacity estimated from interviews. 17

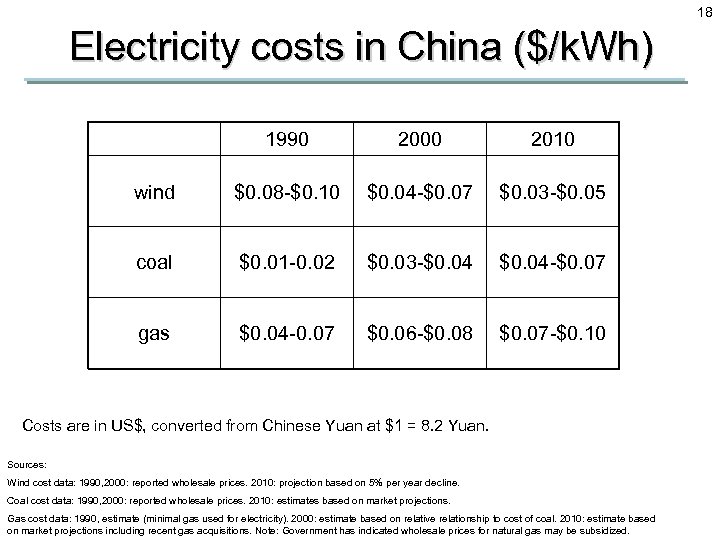

18 Electricity costs in China ($/k. Wh) 1990 2000 2010 wind $0. 08 -$0. 10 $0. 04 -$0. 07 $0. 03 -$0. 05 coal $0. 01 -0. 02 $0. 03 -$0. 04 -$0. 07 gas $0. 04 -0. 07 $0. 06 -$0. 08 $0. 07 -$0. 10 Costs are in US$, converted from Chinese Yuan at $1 = 8. 2 Yuan. Sources: Wind cost data: 1990, 2000: reported wholesale prices. 2010: projection based on 5% per year decline. Coal cost data: 1990, 2000: reported wholesale prices. 2010: estimates based on market projections. Gas cost data: 1990, estimate (minimal gas used for electricity). 2000: estimate based on relative relationship to cost of coal. 2010: estimate based on market projections including recent gas acquisitions. Note: Government has indicated wholesale prices for natural gas may be subsidized.

18 Electricity costs in China ($/k. Wh) 1990 2000 2010 wind $0. 08 -$0. 10 $0. 04 -$0. 07 $0. 03 -$0. 05 coal $0. 01 -0. 02 $0. 03 -$0. 04 -$0. 07 gas $0. 04 -0. 07 $0. 06 -$0. 08 $0. 07 -$0. 10 Costs are in US$, converted from Chinese Yuan at $1 = 8. 2 Yuan. Sources: Wind cost data: 1990, 2000: reported wholesale prices. 2010: projection based on 5% per year decline. Coal cost data: 1990, 2000: reported wholesale prices. 2010: estimates based on market projections. Gas cost data: 1990, estimate (minimal gas used for electricity). 2000: estimate based on relative relationship to cost of coal. 2010: estimate based on market projections including recent gas acquisitions. Note: Government has indicated wholesale prices for natural gas may be subsidized.