eba769d648fcb920d1672218bcad9759.ppt

- Количество слайдов: 20

From financial options to real options 4. Financing real options Prof. André Farber Solvay Business School ESCP March 10, 2000 Financing real options 1

From financial options to real options 4. Financing real options Prof. André Farber Solvay Business School ESCP March 10, 2000 Financing real options 1

Financing new ventures: • For new ventures, financing needs are greater than initial capital available. • Outside financing required? How? – Debt ? principal source of outside financing for companies. – Equity ? – Convertible bonds (or bonds with warrants)? • An example: • Current value of company : 80, no debt, 100 shares • Financing needed: 70 Financing real options 2

Financing new ventures: • For new ventures, financing needs are greater than initial capital available. • Outside financing required? How? – Debt ? principal source of outside financing for companies. – Equity ? – Convertible bonds (or bonds with warrants)? • An example: • Current value of company : 80, no debt, 100 shares • Financing needed: 70 Financing real options 2

Debt • Suppose it borrows by issuing a 2 -year zero-coupon with a face value of 80. • If, at maturity, V*< 80: financial trouble…. • Ultimate solution: bankruptcy, stockholders loose everything • Now, let’s look at the value of equity in 2 years: V*<80 V*>80 Value of equity 0 V* - 80 • This is like a call option: stocks of a levered company are similar to a call option on the company with a striking price equal to the face value of the debt. Financing real options 3

Debt • Suppose it borrows by issuing a 2 -year zero-coupon with a face value of 80. • If, at maturity, V*< 80: financial trouble…. • Ultimate solution: bankruptcy, stockholders loose everything • Now, let’s look at the value of equity in 2 years: V*<80 V*>80 Value of equity 0 V* - 80 • This is like a call option: stocks of a levered company are similar to a call option on the company with a striking price equal to the face value of the debt. Financing real options 3

Pricing the equity and the debt • • Let’s use Black Schole to value the equity and the debt In our example: Maturity = 2, K = 100 Here: V = 150, r = 5%, Volatility = 40% Using BS: C = 80 this is the market value of equity today • So : Equity = 80 • Debt = 150 - 80 = 70 (thanks to Modigliani Miller) • Borrowing rate = 7. 13% Financing real options 4

Pricing the equity and the debt • • Let’s use Black Schole to value the equity and the debt In our example: Maturity = 2, K = 100 Here: V = 150, r = 5%, Volatility = 40% Using BS: C = 80 this is the market value of equity today • So : Equity = 80 • Debt = 150 - 80 = 70 (thanks to Modigliani Miller) • Borrowing rate = 7. 13% Financing real options 4

More on debt value • Value of company = Value of equity + Value of debt • Now, remember put-call parity : S = C + PV(K) - P • Let’s map market value debt and equity onto option values Value of company S Stock price Value of equity C Call option Value of debt PV(K) - P PV(Strike) - Put option • Why this put option? – Limited liability acts as an insurance for the stockholders – The amount that they borrow is the difference between • the value of a risk-free bond (72. 4 in our example) • the value of a put option (2. 4) Financing real options 5

More on debt value • Value of company = Value of equity + Value of debt • Now, remember put-call parity : S = C + PV(K) - P • Let’s map market value debt and equity onto option values Value of company S Stock price Value of equity C Call option Value of debt PV(K) - P PV(Strike) - Put option • Why this put option? – Limited liability acts as an insurance for the stockholders – The amount that they borrow is the difference between • the value of a risk-free bond (72. 4 in our example) • the value of a put option (2. 4) Financing real options 5

Agency problems related to debt • We are now in a position to better understand conflicts of interests between stockholders and bonds holders: – incentive to take large risks – incentive toward underinvestment – milking the property – increasing debt Financing real options 6

Agency problems related to debt • We are now in a position to better understand conflicts of interests between stockholders and bonds holders: – incentive to take large risks – incentive toward underinvestment – milking the property – increasing debt Financing real options 6

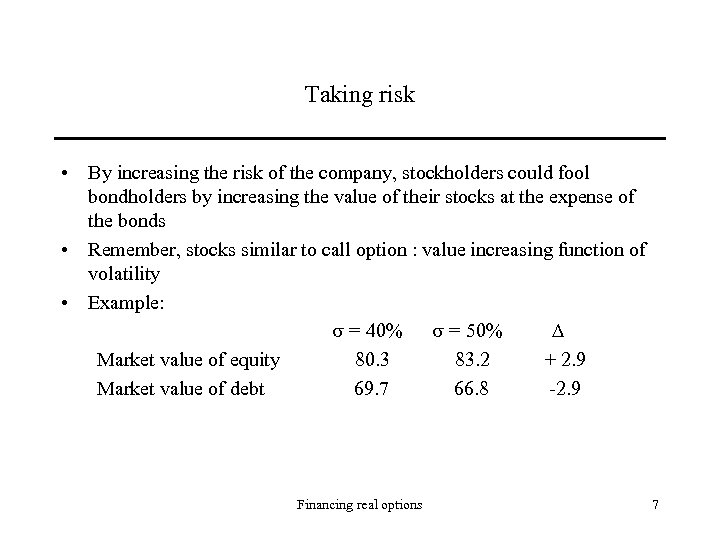

Taking risk • By increasing the risk of the company, stockholders could fool bondholders by increasing the value of their stocks at the expense of the bonds • Remember, stocks similar to call option : value increasing function of volatility • Example: = 40% = 50% Market value of equity 80. 3 83. 2 + 2. 9 Market value of debt 69. 7 66. 8 -2. 9 Financing real options 7

Taking risk • By increasing the risk of the company, stockholders could fool bondholders by increasing the value of their stocks at the expense of the bonds • Remember, stocks similar to call option : value increasing function of volatility • Example: = 40% = 50% Market value of equity 80. 3 83. 2 + 2. 9 Market value of debt 69. 7 66. 8 -2. 9 Financing real options 7

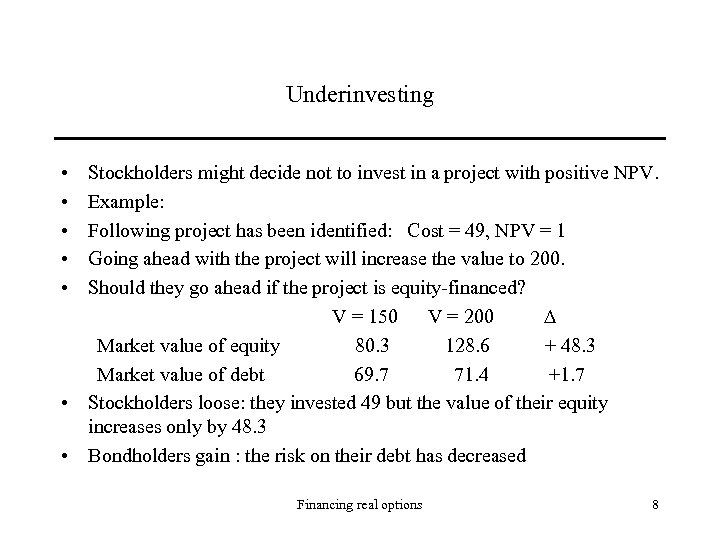

Underinvesting • • • Stockholders might decide not to invest in a project with positive NPV. Example: Following project has been identified: Cost = 49, NPV = 1 Going ahead with the project will increase the value to 200. Should they go ahead if the project is equity-financed? V = 150 V = 200 Market value of equity 80. 3 128. 6 + 48. 3 Market value of debt 69. 7 71. 4 +1. 7 • Stockholders loose: they invested 49 but the value of their equity increases only by 48. 3 • Bondholders gain : the risk on their debt has decreased Financing real options 8

Underinvesting • • • Stockholders might decide not to invest in a project with positive NPV. Example: Following project has been identified: Cost = 49, NPV = 1 Going ahead with the project will increase the value to 200. Should they go ahead if the project is equity-financed? V = 150 V = 200 Market value of equity 80. 3 128. 6 + 48. 3 Market value of debt 69. 7 71. 4 +1. 7 • Stockholders loose: they invested 49 but the value of their equity increases only by 48. 3 • Bondholders gain : the risk on their debt has decreased Financing real options 8

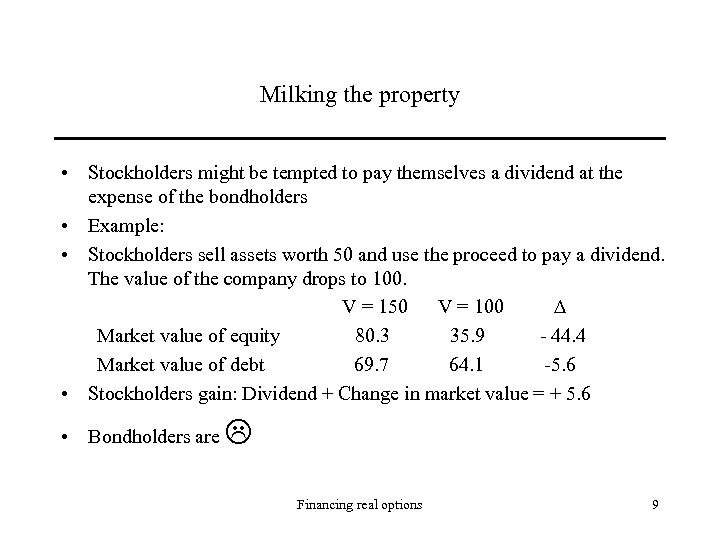

Milking the property • Stockholders might be tempted to pay themselves a dividend at the expense of the bondholders • Example: • Stockholders sell assets worth 50 and use the proceed to pay a dividend. The value of the company drops to 100. V = 150 V = 100 Market value of equity 80. 3 35. 9 - 44. 4 Market value of debt 69. 7 64. 1 -5. 6 • Stockholders gain: Dividend + Change in market value = + 5. 6 • Bondholders are Financing real options 9

Milking the property • Stockholders might be tempted to pay themselves a dividend at the expense of the bondholders • Example: • Stockholders sell assets worth 50 and use the proceed to pay a dividend. The value of the company drops to 100. V = 150 V = 100 Market value of equity 80. 3 35. 9 - 44. 4 Market value of debt 69. 7 64. 1 -5. 6 • Stockholders gain: Dividend + Change in market value = + 5. 6 • Bondholders are Financing real options 9

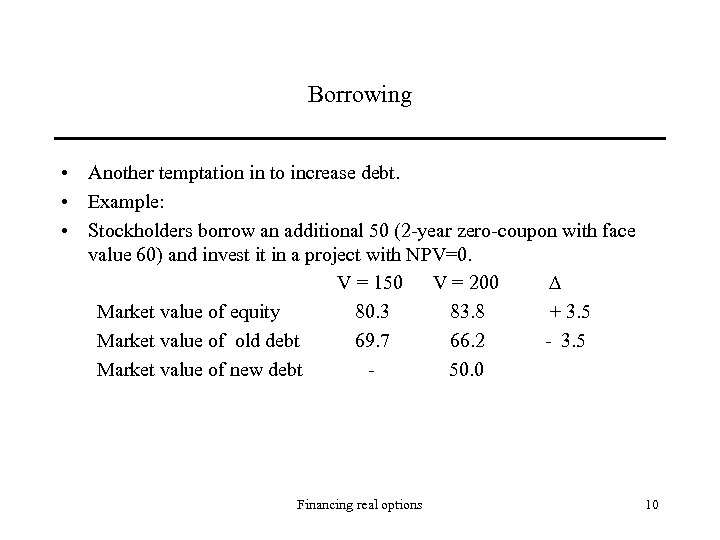

Borrowing • Another temptation in to increase debt. • Example: • Stockholders borrow an additional 50 (2 -year zero-coupon with face value 60) and invest it in a project with NPV=0. V = 150 V = 200 Market value of equity 80. 3 83. 8 + 3. 5 Market value of old debt 69. 7 66. 2 - 3. 5 Market value of new debt 50. 0 Financing real options 10

Borrowing • Another temptation in to increase debt. • Example: • Stockholders borrow an additional 50 (2 -year zero-coupon with face value 60) and invest it in a project with NPV=0. V = 150 V = 200 Market value of equity 80. 3 83. 8 + 3. 5 Market value of old debt 69. 7 66. 2 - 3. 5 Market value of new debt 50. 0 Financing real options 10

Controling conflicts of interests • Bondholders should keep a close eye on the company • They will impose bond covenants • • • dividends sales of assets issuing new debt minimum working capital providing information to lender. Financing real options 11

Controling conflicts of interests • Bondholders should keep a close eye on the company • They will impose bond covenants • • • dividends sales of assets issuing new debt minimum working capital providing information to lender. Financing real options 11

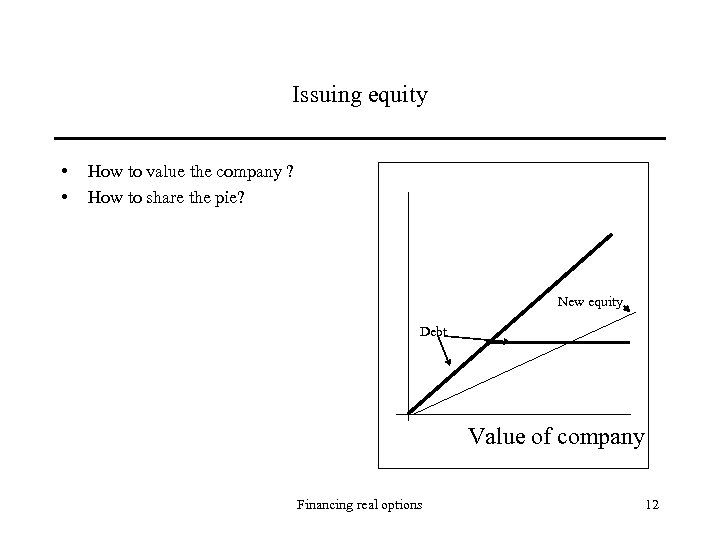

Issuing equity • • How to value the company ? How to share the pie? New equity Debt Value of company Financing real options 12

Issuing equity • • How to value the company ? How to share the pie? New equity Debt Value of company Financing real options 12

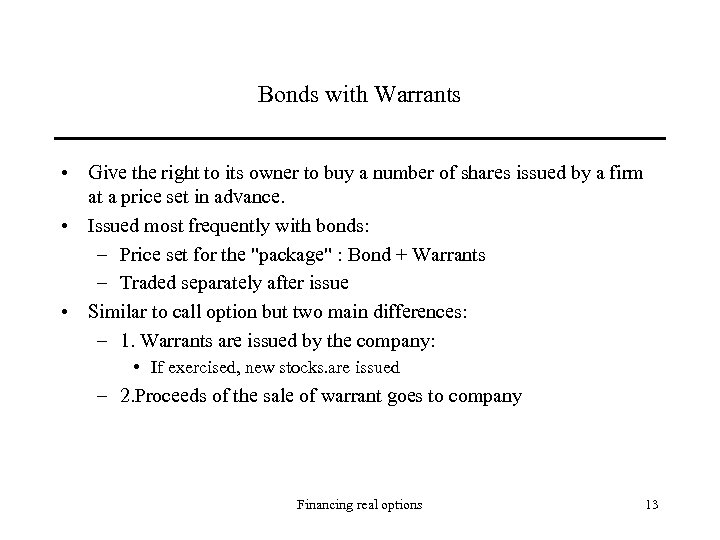

Bonds with Warrants • Give the right to its owner to buy a number of shares issued by a firm at a price set in advance. • Issued most frequently with bonds: – Price set for the "package" : Bond + Warrants – Traded separately after issue • Similar to call option but two main differences: – 1. Warrants are issued by the company: • If exercised, new stocks. are issued – 2. Proceeds of the sale of warrant goes to company Financing real options 13

Bonds with Warrants • Give the right to its owner to buy a number of shares issued by a firm at a price set in advance. • Issued most frequently with bonds: – Price set for the "package" : Bond + Warrants – Traded separately after issue • Similar to call option but two main differences: – 1. Warrants are issued by the company: • If exercised, new stocks. are issued – 2. Proceeds of the sale of warrant goes to company Financing real options 13

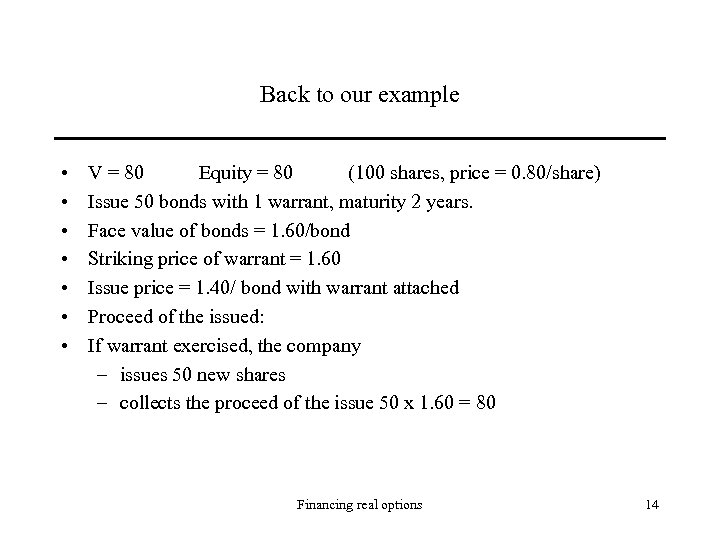

Back to our example • • V = 80 Equity = 80 (100 shares, price = 0. 80/share) Issue 50 bonds with 1 warrant, maturity 2 years. Face value of bonds = 1. 60/bond Striking price of warrant = 1. 60 Issue price = 1. 40/ bond with warrant attached Proceed of the issued: If warrant exercised, the company – issues 50 new shares – collects the proceed of the issue 50 x 1. 60 = 80 Financing real options 14

Back to our example • • V = 80 Equity = 80 (100 shares, price = 0. 80/share) Issue 50 bonds with 1 warrant, maturity 2 years. Face value of bonds = 1. 60/bond Striking price of warrant = 1. 60 Issue price = 1. 40/ bond with warrant attached Proceed of the issued: If warrant exercised, the company – issues 50 new shares – collects the proceed of the issue 50 x 1. 60 = 80 Financing real options 14

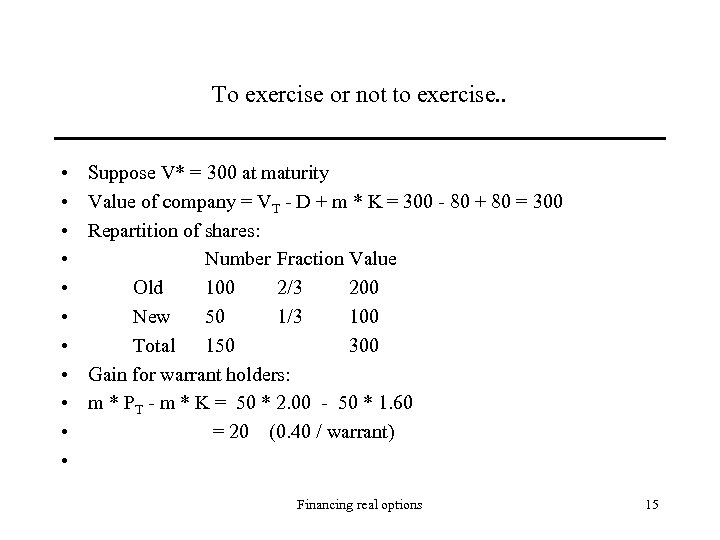

To exercise or not to exercise. . • • • Suppose V* = 300 at maturity Value of company = VT - D + m * K = 300 - 80 + 80 = 300 Repartition of shares: Number Fraction Value Old 100 2/3 200 New 50 1/3 100 Total 150 300 Gain for warrant holders: m * PT - m * K = 50 * 2. 00 - 50 * 1. 60 = 20 (0. 40 / warrant) Financing real options 15

To exercise or not to exercise. . • • • Suppose V* = 300 at maturity Value of company = VT - D + m * K = 300 - 80 + 80 = 300 Repartition of shares: Number Fraction Value Old 100 2/3 200 New 50 1/3 100 Total 150 300 Gain for warrant holders: m * PT - m * K = 50 * 2. 00 - 50 * 1. 60 = 20 (0. 40 / warrant) Financing real options 15

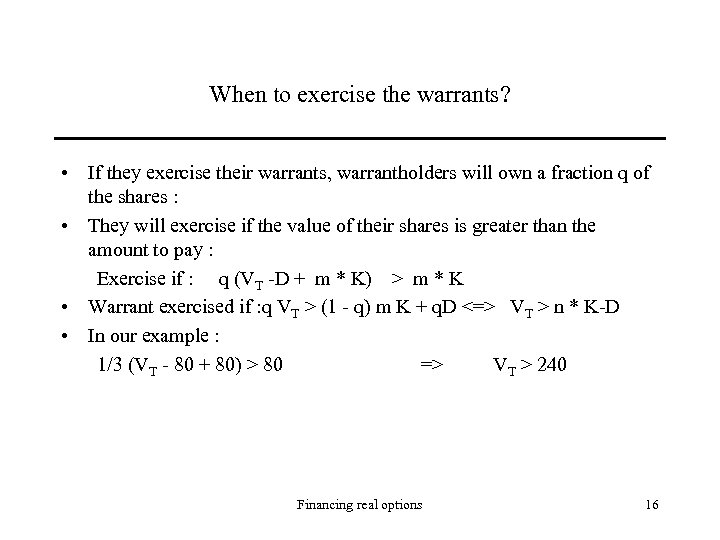

When to exercise the warrants? • If they exercise their warrants, warrantholders will own a fraction q of the shares : • They will exercise if the value of their shares is greater than the amount to pay : Exercise if : q (VT -D + m * K) > m * K • Warrant exercised if : q VT > (1 - q) m K + q. D <=> VT > n * K-D • In our example : 1/3 (VT - 80 + 80) > 80 => VT > 240 Financing real options 16

When to exercise the warrants? • If they exercise their warrants, warrantholders will own a fraction q of the shares : • They will exercise if the value of their shares is greater than the amount to pay : Exercise if : q (VT -D + m * K) > m * K • Warrant exercised if : q VT > (1 - q) m K + q. D <=> VT > n * K-D • In our example : 1/3 (VT - 80 + 80) > 80 => VT > 240 Financing real options 16

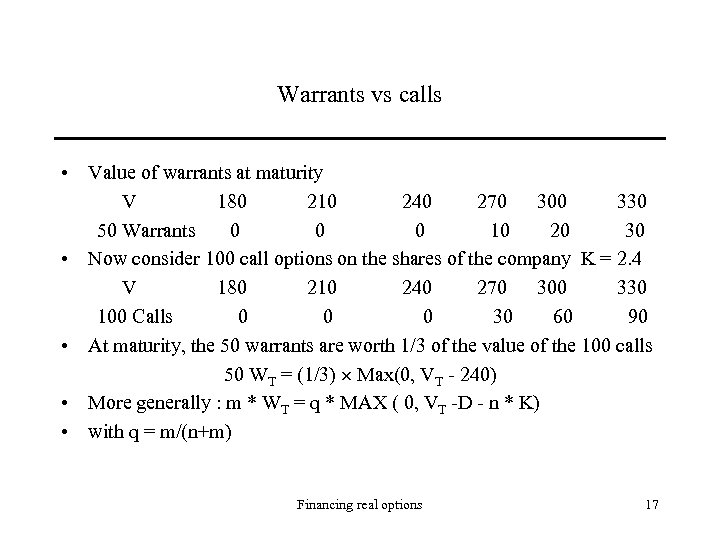

Warrants vs calls • Value of warrants at maturity V 180 210 240 270 300 330 50 Warrants 0 0 0 10 20 30 • Now consider 100 call options on the shares of the company K = 2. 4 V 180 210 240 270 300 330 100 Calls 0 0 0 30 60 90 • At maturity, the 50 warrants are worth 1/3 of the value of the 100 calls 50 WT = (1/3) Max(0, VT - 240) • More generally : m * WT = q * MAX ( 0, VT -D - n * K) • with q = m/(n+m) Financing real options 17

Warrants vs calls • Value of warrants at maturity V 180 210 240 270 300 330 50 Warrants 0 0 0 10 20 30 • Now consider 100 call options on the shares of the company K = 2. 4 V 180 210 240 270 300 330 100 Calls 0 0 0 30 60 90 • At maturity, the 50 warrants are worth 1/3 of the value of the 100 calls 50 WT = (1/3) Max(0, VT - 240) • More generally : m * WT = q * MAX ( 0, VT -D - n * K) • with q = m/(n+m) Financing real options 17

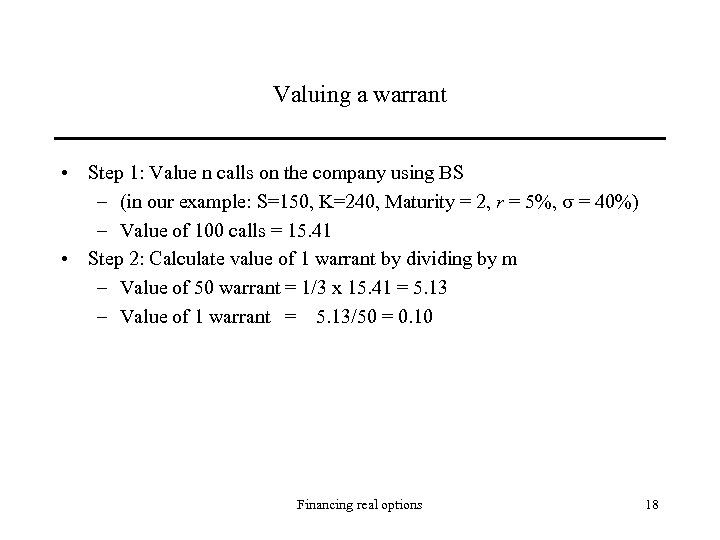

Valuing a warrant • Step 1: Value n calls on the company using BS – (in our example: S=150, K=240, Maturity = 2, r = 5%, = 40%) – Value of 100 calls = 15. 41 • Step 2: Calculate value of 1 warrant by dividing by m – Value of 50 warrant = 1/3 x 15. 41 = 5. 13 – Value of 1 warrant = 5. 13/50 = 0. 10 Financing real options 18

Valuing a warrant • Step 1: Value n calls on the company using BS – (in our example: S=150, K=240, Maturity = 2, r = 5%, = 40%) – Value of 100 calls = 15. 41 • Step 2: Calculate value of 1 warrant by dividing by m – Value of 50 warrant = 1/3 x 15. 41 = 5. 13 – Value of 1 warrant = 5. 13/50 = 0. 10 Financing real options 18

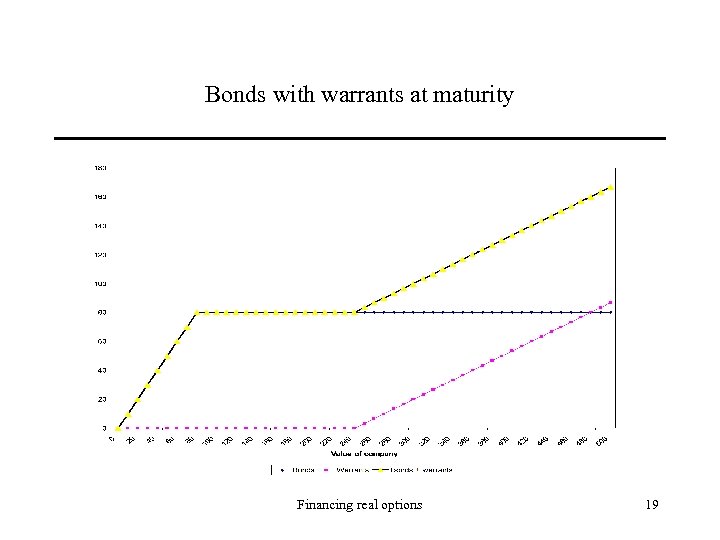

Bonds with warrants at maturity Financing real options 19

Bonds with warrants at maturity Financing real options 19

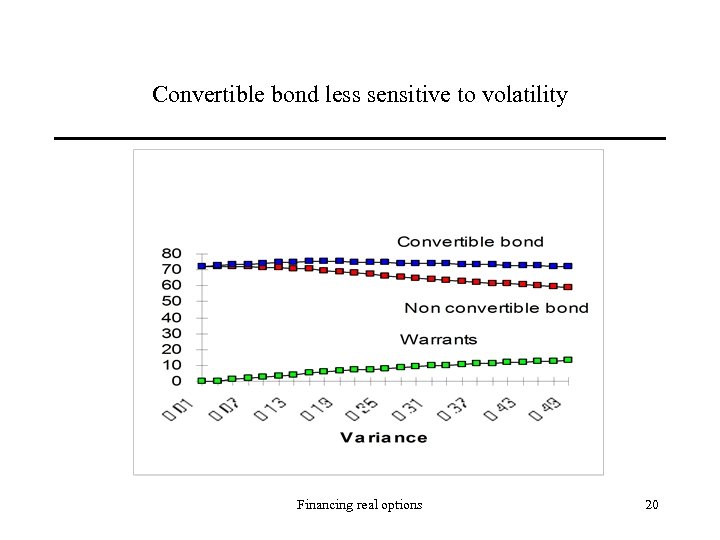

Convertible bond less sensitive to volatility Financing real options 20

Convertible bond less sensitive to volatility Financing real options 20