ac11fc683261bf09b832f46f442161b7.ppt

- Количество слайдов: 40

FROM DIRECT GOVERNMENT SUPPORT OF INNOVATIVE SME’S TO VENTURE CAPITAL/PRIVATE EQUITY(VC/PE) A Three Phase Policy Model based on the Israeli Experience Gil Avnimelech and Morris Teubal 1

FROM DIRECT GOVERNMENT SUPPORT OF INNOVATIVE SME’S TO VENTURE CAPITAL/PRIVATE EQUITY(VC/PE) A Three Phase Policy Model based on the Israeli Experience Gil Avnimelech and Morris Teubal 1

OBJECTIVE • Propose a generic three-phase Innovation & Technology Policy (ITP) ‘model’ for the support of SME’s in Developing Economies • The model refers only to one specific plan of action out of a Multi-pronged Strategy for Economic Development (there are others) • It is based on the Systems of Innovation (SI) or Systems/Evolutionary perspective to ITP 2

OBJECTIVE • Propose a generic three-phase Innovation & Technology Policy (ITP) ‘model’ for the support of SME’s in Developing Economies • The model refers only to one specific plan of action out of a Multi-pronged Strategy for Economic Development (there are others) • It is based on the Systems of Innovation (SI) or Systems/Evolutionary perspective to ITP 2

OBJECTIVE-2 • While initially suggested by the Israeli experience (focusing on R&D and high tech) variants of the model exist or could be developed for various types of industrializing economies • In the model, Innovation is broadly conceived (Schumpeterian perspective) 3

OBJECTIVE-2 • While initially suggested by the Israeli experience (focusing on R&D and high tech) variants of the model exist or could be developed for various types of industrializing economies • In the model, Innovation is broadly conceived (Schumpeterian perspective) 3

BROAD DEFINITION OF INNOVATION • Not only new products/processes resulting from R&D should be supported • Also those resulting from Design, Engineering, Acquisition/Transfer of new Technologies, Production Learning, etc • New Services • New Organizations (“Social Technologies”)/Markets/Strategies 4

BROAD DEFINITION OF INNOVATION • Not only new products/processes resulting from R&D should be supported • Also those resulting from Design, Engineering, Acquisition/Transfer of new Technologies, Production Learning, etc • New Services • New Organizations (“Social Technologies”)/Markets/Strategies 4

Systems of Innovation(SI) or Systems/Evolutionary Perspective to ITP Teubal, M 2002: ”What is the Systems Perspective to Innovation and Technology Policy (ITP) and how can it be applied to Developing and Industrialzing Economies” Journal of Evolutionary Economics, Vol 12, pp. 233 -248 5

Systems of Innovation(SI) or Systems/Evolutionary Perspective to ITP Teubal, M 2002: ”What is the Systems Perspective to Innovation and Technology Policy (ITP) and how can it be applied to Developing and Industrialzing Economies” Journal of Evolutionary Economics, Vol 12, pp. 233 -248 5

The National Innovation System (NIS): Definitions The Complex Network of Agents, Institutions, Organizations and Policy Mechanisms Supporting the Process of Technical Advance in an Economy 6

The National Innovation System (NIS): Definitions The Complex Network of Agents, Institutions, Organizations and Policy Mechanisms Supporting the Process of Technical Advance in an Economy 6

“SI”AGENTS/INSTITUTIONS: Narrow View 1. Organizations and Institutions directly Involved in R&D: Business Firms, Universities and Research Laboratories 2. This was the original view of NSI (during the 1980 s)-a mix between Neoclassical & Structuralist perspectives 7

“SI”AGENTS/INSTITUTIONS: Narrow View 1. Organizations and Institutions directly Involved in R&D: Business Firms, Universities and Research Laboratories 2. This was the original view of NSI (during the 1980 s)-a mix between Neoclassical & Structuralist perspectives 7

SI Agents/Institutions: Broad View In addition to those included in Narrow View of NIS, other Economic, Political, and Social Institutions which indirectly affect Innovation/Technical Change e. g. parts of the Financial System (Venture Capital); the Business Sector & its structure, Users of Innovations; Macroeconomic Policy agencies, etc Relevance: when considering Country/Economy Adaptation to Radical Changes in the Environment 8

SI Agents/Institutions: Broad View In addition to those included in Narrow View of NIS, other Economic, Political, and Social Institutions which indirectly affect Innovation/Technical Change e. g. parts of the Financial System (Venture Capital); the Business Sector & its structure, Users of Innovations; Macroeconomic Policy agencies, etc Relevance: when considering Country/Economy Adaptation to Radical Changes in the Environment 8

Analysis of SI perspective A. Focus & Approach B. “Positive” aspects: B 1: System Components B 2: General Principles C. “Normative” aspects D. Other (e. g. policy process) 9

Analysis of SI perspective A. Focus & Approach B. “Positive” aspects: B 1: System Components B 2: General Principles C. “Normative” aspects D. Other (e. g. policy process) 9

B. POSITIVE ASPECTS: System Components a: Business Sector (Subsystem-BS) b: Supporting Structure (Subsystem-SS) c: Institutions & Markets d: Links & Interactions e: Culture and Social Structure 10

B. POSITIVE ASPECTS: System Components a: Business Sector (Subsystem-BS) b: Supporting Structure (Subsystem-SS) c: Institutions & Markets d: Links & Interactions e: Culture and Social Structure 10

C: Normative Aspects -1: Justifying Government Intervention • System Failure-Example: When the failure to allocate sufficient resources to Innovation/Technology is not due (only) to lack of incentives given to market forces but to more fundamental causes such as: -lack of R&D capabilities when this weakness is (also) due to deficiencies in e. g. the Higher Education System (e. g. low quality engineering graduates) -lack of high tech entrepreneurship [a cultural constraint] -inadequate institutional framework (“rules”) under which market forces operate e. g. intellectual property, corporate governance, regulations concerning capital markets [e. g. accounting & auditing procedures] ; etc 11

C: Normative Aspects -1: Justifying Government Intervention • System Failure-Example: When the failure to allocate sufficient resources to Innovation/Technology is not due (only) to lack of incentives given to market forces but to more fundamental causes such as: -lack of R&D capabilities when this weakness is (also) due to deficiencies in e. g. the Higher Education System (e. g. low quality engineering graduates) -lack of high tech entrepreneurship [a cultural constraint] -inadequate institutional framework (“rules”) under which market forces operate e. g. intellectual property, corporate governance, regulations concerning capital markets [e. g. accounting & auditing procedures] ; etc 11

C: NORMATIVE ASPECTS OF ITP-GENERAL PRINCIPLES-1 Objective of ITP: Promote learning and SI transformation by overcoming System (& Market) Failures. The specific ‘failures’ reflect the strategic priorities of the country (these in turn depend on a process of generating a ‘vision’ and a ‘strategy) ITP should be viewed in an integrated whole-- a portfolio of incentives programs & changes in institutions SI transformation requires looking at the whole system which also means that the success of any one program or policy action will depend on the simultaneous existence or non-existence of other policies. Coordination and appropriate timing of policies are crucial 12

C: NORMATIVE ASPECTS OF ITP-GENERAL PRINCIPLES-1 Objective of ITP: Promote learning and SI transformation by overcoming System (& Market) Failures. The specific ‘failures’ reflect the strategic priorities of the country (these in turn depend on a process of generating a ‘vision’ and a ‘strategy) ITP should be viewed in an integrated whole-- a portfolio of incentives programs & changes in institutions SI transformation requires looking at the whole system which also means that the success of any one program or policy action will depend on the simultaneous existence or non-existence of other policies. Coordination and appropriate timing of policies are crucial 12

C: NORMATIVE ASPECTS- GENERAL PRINCIPLES-2 Nature of Policy Making • ADAPTIVE POLICY MAKER • POLICY AS JUDGEMENT • AN EXPLICIT STRATEGY • POLICY IS CONTEXT SPECIFIC • A PORTFOLIO OF COORDINATED POLICIES & PROGRAMS Learning, Demand Dynamics • STIMULATING DEMAND FOR ‘CRITICAL COMPONENTS’ • LEARNING DURING PROGRAM IMPLEMENTATION • POLICY CYCLE & PROGRAM SEQUENCING • POLICY LEARNING AND POLICY CAPABILITIES • MIX BETWEEN TOP DOWN AND BOTTOM UP INITIATIVES 13

C: NORMATIVE ASPECTS- GENERAL PRINCIPLES-2 Nature of Policy Making • ADAPTIVE POLICY MAKER • POLICY AS JUDGEMENT • AN EXPLICIT STRATEGY • POLICY IS CONTEXT SPECIFIC • A PORTFOLIO OF COORDINATED POLICIES & PROGRAMS Learning, Demand Dynamics • STIMULATING DEMAND FOR ‘CRITICAL COMPONENTS’ • LEARNING DURING PROGRAM IMPLEMENTATION • POLICY CYCLE & PROGRAM SEQUENCING • POLICY LEARNING AND POLICY CAPABILITIES • MIX BETWEEN TOP DOWN AND BOTTOM UP INITIATIVES 13

C: Structure of Policy Portfolio • Mix between Institutions and Incentives (Programs) • Mix between programs directed to BS and those directed to SS • Mix between Horizontal & Targeted programs • R&D versus non-R&D focus • Degree of Coordination among Programs/Policies The policy portfolio of a country may be ‘biased’- relative to the requirements of a ‘reasonable’ path of SI transformation 14

C: Structure of Policy Portfolio • Mix between Institutions and Incentives (Programs) • Mix between programs directed to BS and those directed to SS • Mix between Horizontal & Targeted programs • R&D versus non-R&D focus • Degree of Coordination among Programs/Policies The policy portfolio of a country may be ‘biased’- relative to the requirements of a ‘reasonable’ path of SI transformation 14

D: Other-Policy Process It consists of a number of phases 1)Setting “Strategic” Priorities: Searching for a small number of alternative SI transformations; and focusing on one or a small number of possibilities (a ‘vision/strategy’) 2)Formulating Programs (and/or changes in Institutions) 3)Implementation of Programs 4)Feedback 5)Learning-Evaluation 15

D: Other-Policy Process It consists of a number of phases 1)Setting “Strategic” Priorities: Searching for a small number of alternative SI transformations; and focusing on one or a small number of possibilities (a ‘vision/strategy’) 2)Formulating Programs (and/or changes in Institutions) 3)Implementation of Programs 4)Feedback 5)Learning-Evaluation 15

SYSTEM FAILURES CONFRONTING INNOVATIVE SMEs • Innovation and Learning Externalities-e. g. from R&D, penetration of new markets, management, etc • Collective Learning (also involving issues of critical mass and missing System Components) • Knowledge Based Entrepreneurship (KBE)-e. g. Cultural Constraints; Bankruptcy Laws • Finance and Support (see below) • Creating Networks-recognized by OECD in connection with SU and VC • Other-Reputation, coordination, infrastructure, clusters effects 16

SYSTEM FAILURES CONFRONTING INNOVATIVE SMEs • Innovation and Learning Externalities-e. g. from R&D, penetration of new markets, management, etc • Collective Learning (also involving issues of critical mass and missing System Components) • Knowledge Based Entrepreneurship (KBE)-e. g. Cultural Constraints; Bankruptcy Laws • Finance and Support (see below) • Creating Networks-recognized by OECD in connection with SU and VC • Other-Reputation, coordination, infrastructure, clusters effects 16

SUMMARY 3 -PHASE MODEL* Phase 1: Subsidies or other support to Innovative SMEs (Israel 1969 -1989) Phase 2: Transition Phase-preparing the stage for VC/PE policies (1989 -1992) Phase 2: VC/PE directed Policies (1992 -1997/8) * Avnimlech/Teubal, (1) Economics of Innovation and new Technology, 2004; (2) Revue Economique (forthcoming); (3) submitted to Industrial and Corporate Change 17

SUMMARY 3 -PHASE MODEL* Phase 1: Subsidies or other support to Innovative SMEs (Israel 1969 -1989) Phase 2: Transition Phase-preparing the stage for VC/PE policies (1989 -1992) Phase 2: VC/PE directed Policies (1992 -1997/8) * Avnimlech/Teubal, (1) Economics of Innovation and new Technology, 2004; (2) Revue Economique (forthcoming); (3) submitted to Industrial and Corporate Change 17

PHASE 1: Subsidies (or other Direct Support) to Innovative SMEs Objectives: • Diffusion of Innovation, Learning and generation of Innovation/R&D Capabilities • Creating of an Innovative SME- based segment • Create ‘demand’ for VC, PE (‘private financial infrastructure’) Direct Support-Critical but Not Enough Requires Considering the whole SI • Education, Science and Universities • Links with Business Sector; etc 18

PHASE 1: Subsidies (or other Direct Support) to Innovative SMEs Objectives: • Diffusion of Innovation, Learning and generation of Innovation/R&D Capabilities • Creating of an Innovative SME- based segment • Create ‘demand’ for VC, PE (‘private financial infrastructure’) Direct Support-Critical but Not Enough Requires Considering the whole SI • Education, Science and Universities • Links with Business Sector; etc 18

EXAMPLE-ISRAEL’S GRANTS TO R&D PROGRAM 1969 -- • General • Institutional Background: Creation of OCS in 1969 -a specialized agency in charge of ITS directed to the Business Sector • Focus on direct R&D Grants to business enterprises (initially all were SMEs) • A ‘backbone” Horizontal Program • Weak Budget Constraint till the mid 90 s 19

EXAMPLE-ISRAEL’S GRANTS TO R&D PROGRAM 1969 -- • General • Institutional Background: Creation of OCS in 1969 -a specialized agency in charge of ITS directed to the Business Sector • Focus on direct R&D Grants to business enterprises (initially all were SMEs) • A ‘backbone” Horizontal Program • Weak Budget Constraint till the mid 90 s 19

Learning in Phase 1 (Israel) • Intra-firm Learning • • How to search for market and technological information How to identify, screen, evaluate and choose new innovation projects Learning to generate new projects, including more complex ones Learning how to managed the innovation process (e. g. linking R&D to production/marketing) • Collective Learning • • Importance of marketing Policy learning through an informal policy network involving OCS officials 20

Learning in Phase 1 (Israel) • Intra-firm Learning • • How to search for market and technological information How to identify, screen, evaluate and choose new innovation projects Learning to generate new projects, including more complex ones Learning how to managed the innovation process (e. g. linking R&D to production/marketing) • Collective Learning • • Importance of marketing Policy learning through an informal policy network involving OCS officials 20

GENERAL PRINCIPLES OF HORIZONTAL PROGRAMS • Two sub periods in implementationinfant and mature • infant: focus on learning and capability development (previous slide); Neutral Subsidies • Later/mature: focus on restructuring • Elements of Learning Approach: assuring critical mass of projects; creating a policy implementation network; generating relevant typologies of R&D projects/innovations; codifying and diffusing knowledge; special attention to diffusing R&D/innovation; building policy capabilities; other 21

GENERAL PRINCIPLES OF HORIZONTAL PROGRAMS • Two sub periods in implementationinfant and mature • infant: focus on learning and capability development (previous slide); Neutral Subsidies • Later/mature: focus on restructuring • Elements of Learning Approach: assuring critical mass of projects; creating a policy implementation network; generating relevant typologies of R&D projects/innovations; codifying and diffusing knowledge; special attention to diffusing R&D/innovation; building policy capabilities; other 21

HORIZONTAL PROGRAMSMATURE PHASE • • Reduction in the average subsidy Greater amount of selectivity Identifying areas of competitive advantage Identifying areas for targeted promotion (e. g. selected product areas; and VC/PE) 22

HORIZONTAL PROGRAMSMATURE PHASE • • Reduction in the average subsidy Greater amount of selectivity Identifying areas of competitive advantage Identifying areas for targeted promotion (e. g. selected product areas; and VC/PE) 22

TRANSITION (PHASE 2) Objective: Reinforce Innovative SMEs; and prepare the stage for VC/PE policies In Israel (1989 -1992: Pre-VC Emergence Period) • A set of complementary programs (Incubators; Magnet, Inbal Program-first VC program: failure) • Business Experiments (e. g. SU organization) and Policy Learning (e. g. from failure of Inbal) 23

TRANSITION (PHASE 2) Objective: Reinforce Innovative SMEs; and prepare the stage for VC/PE policies In Israel (1989 -1992: Pre-VC Emergence Period) • A set of complementary programs (Incubators; Magnet, Inbal Program-first VC program: failure) • Business Experiments (e. g. SU organization) and Policy Learning (e. g. from failure of Inbal) 23

Chile in Transition Phase? • Limited Deal Flow hampered creation of a VC/PE industry • Probably: a significant reinforcement of Business Sector Innovation and University training and Research may be required before success with VC. • This may further diffuse of R&D/Innovation and promote the establishment of several hundred new innovative SMEs • Continuation and Expansion of Public/Private Experiments both as regards Innovation and with respect to the future VC/PE industry • Critical Roles played and to be played by CORFO Fundacion Chile 24

Chile in Transition Phase? • Limited Deal Flow hampered creation of a VC/PE industry • Probably: a significant reinforcement of Business Sector Innovation and University training and Research may be required before success with VC. • This may further diffuse of R&D/Innovation and promote the establishment of several hundred new innovative SMEs • Continuation and Expansion of Public/Private Experiments both as regards Innovation and with respect to the future VC/PE industry • Critical Roles played and to be played by CORFO Fundacion Chile 24

ITP MODEL-PHASE 3: TARGETED SUPPORT OF VC/PE Objective • Emergence of an Effective VC/PE industry that could support growth of an innovative SME-sector Conditions for Success • Timing and ‘right’ Context are critical for success. Most VC policies failed not, also in Advanced Countries! • Frequent reasons for failure: Background conditions were not yet ripe (Phases 1 & 2 were not yet completed); Also: VC was considered a pool of money and not an industry 25

ITP MODEL-PHASE 3: TARGETED SUPPORT OF VC/PE Objective • Emergence of an Effective VC/PE industry that could support growth of an innovative SME-sector Conditions for Success • Timing and ‘right’ Context are critical for success. Most VC policies failed not, also in Advanced Countries! • Frequent reasons for failure: Background conditions were not yet ripe (Phases 1 & 2 were not yet completed); Also: VC was considered a pool of money and not an industry 25

VENTURE CAPITAL (VC) & PRIVATE EQUITY (PE) • Specialized , independent financial organizations focusing on equity based investments in high growth companies • VC (‘Strict Definition’) focuses on high tech Start Ups(SU) and on ‘early (R&D) phase’ finance of these SMEs • PE oriented to mid/low tech and to services, with a smaller share of high tech investments (if at all) • PE also invests in mature, ‘public’ companies; and in later phase investments including such things as MBO, MBI, etc • Mix of VC and PE required for Industrializing Economies 26

VENTURE CAPITAL (VC) & PRIVATE EQUITY (PE) • Specialized , independent financial organizations focusing on equity based investments in high growth companies • VC (‘Strict Definition’) focuses on high tech Start Ups(SU) and on ‘early (R&D) phase’ finance of these SMEs • PE oriented to mid/low tech and to services, with a smaller share of high tech investments (if at all) • PE also invests in mature, ‘public’ companies; and in later phase investments including such things as MBO, MBI, etc • Mix of VC and PE required for Industrializing Economies 26

CHARACTERISTICS OF VC (lesser extent -of PE) • Equity Investments, adding value to portfolio companies & exit • Added Value: Management Support, Marketing and Production, Overseas Expansion, Certification, Head Hunting, going public (IPO) • Exit-mostly IPO or Acquisition by another company (also trade sales, repurchase of shares by entrepreneur, etc) 27

CHARACTERISTICS OF VC (lesser extent -of PE) • Equity Investments, adding value to portfolio companies & exit • Added Value: Management Support, Marketing and Production, Overseas Expansion, Certification, Head Hunting, going public (IPO) • Exit-mostly IPO or Acquisition by another company (also trade sales, repurchase of shares by entrepreneur, etc) 27

CHARACTERISTICS OF VC/PE- (2)ORGANIZATIONAL FORMS • • • LIMITED PARTNERSHIPS (LP) Public VCs (quoted in stock market) Government Owned Linked to Banks or Corporations Other (especially PE): Investment Companies; Mutual Funds; Closed Funds; etc 28

CHARACTERISTICS OF VC/PE- (2)ORGANIZATIONAL FORMS • • • LIMITED PARTNERSHIPS (LP) Public VCs (quoted in stock market) Government Owned Linked to Banks or Corporations Other (especially PE): Investment Companies; Mutual Funds; Closed Funds; etc 28

SYSTEM FAILURES CONFRONTING INNOVATIVE SMEs-Limitations of BANKS & BANK LOANS • Pertaining to Innovative SMEs • • Knowledge Asymmetries Uncertainties of Markets and Technology Frequently, unknown entrepreneurs High Share of Intangibles in total Assets • Pertaining to Banks • Knowledge & Capabilities Constraints • Regulatory Constraints(sometimes) • Bank Strategy/Routines 29

SYSTEM FAILURES CONFRONTING INNOVATIVE SMEs-Limitations of BANKS & BANK LOANS • Pertaining to Innovative SMEs • • Knowledge Asymmetries Uncertainties of Markets and Technology Frequently, unknown entrepreneurs High Share of Intangibles in total Assets • Pertaining to Banks • Knowledge & Capabilities Constraints • Regulatory Constraints(sometimes) • Bank Strategy/Routines 29

HOW VC(SOME EXTENT PE) OVERCOME SYSTEM FAILURES • Strong Capabilities: background of entrepreneurs; specialization; learning/experience (screening, due diligence, investment, monitoring, adding value and exit); networks involving suppliers, investors, clients, partners, etc; know-whom • Incentives and Organization: advantages of Limited Partnerships (flexibility, incentives, taxation); proactive role by virtue of owning stock; strategy; etc • Participation in Board of Portfolio SMEs • Access to information within the firms • Phased finance, etc 30

HOW VC(SOME EXTENT PE) OVERCOME SYSTEM FAILURES • Strong Capabilities: background of entrepreneurs; specialization; learning/experience (screening, due diligence, investment, monitoring, adding value and exit); networks involving suppliers, investors, clients, partners, etc; know-whom • Incentives and Organization: advantages of Limited Partnerships (flexibility, incentives, taxation); proactive role by virtue of owning stock; strategy; etc • Participation in Board of Portfolio SMEs • Access to information within the firms • Phased finance, etc 30

EXAMPLE OF PHASE 3 POLICIESISRAEL’S TARGETED SUPPORT OF VC 1993 -8 • Background: late 80 s-lots of companies receiving R&D support failed; lack of VC identified as System Failure • First Attempt-the Inbal Program 1992: support of public VC; failure • 1993 -7: Implementation of Yozma (2 nd successful VC policy attempt) • Specific System Failures dealt by Yozma: world class foreign partners, critical mass, coordination, selection of organization and strategy; promotion of learning; and signaling 31

EXAMPLE OF PHASE 3 POLICIESISRAEL’S TARGETED SUPPORT OF VC 1993 -8 • Background: late 80 s-lots of companies receiving R&D support failed; lack of VC identified as System Failure • First Attempt-the Inbal Program 1992: support of public VC; failure • 1993 -7: Implementation of Yozma (2 nd successful VC policy attempt) • Specific System Failures dealt by Yozma: world class foreign partners, critical mass, coordination, selection of organization and strategy; promotion of learning; and signaling 31

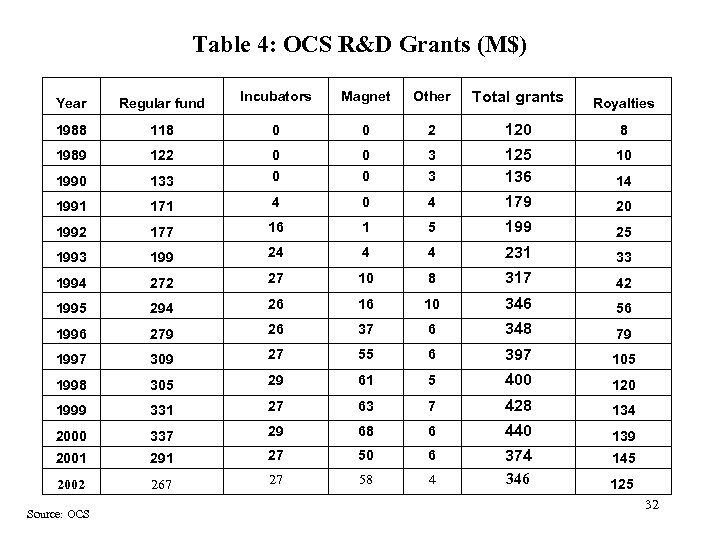

Table 4: OCS R&D Grants (M$) Year Regular fund Incubators Magnet Other Total grants Royalties 1988 118 0 0 2 120 8 1989 122 0 0 3 10 1990 133 0 0 3 125 136 1991 171 4 0 4 179 20 1992 177 16 1 5 199 25 1993 199 24 4 4 231 33 1994 272 27 10 8 317 42 1995 294 26 16 10 346 56 1996 279 26 37 6 348 79 1997 309 27 55 6 397 105 1998 305 29 61 5 400 120 1999 331 27 63 7 428 134 2000 337 29 68 6 440 139 2001 291 27 50 6 145 2002 267 27 58 4 374 346 Source: OCS 14 125 32

Table 4: OCS R&D Grants (M$) Year Regular fund Incubators Magnet Other Total grants Royalties 1988 118 0 0 2 120 8 1989 122 0 0 3 10 1990 133 0 0 3 125 136 1991 171 4 0 4 179 20 1992 177 16 1 5 199 25 1993 199 24 4 4 231 33 1994 272 27 10 8 317 42 1995 294 26 16 10 346 56 1996 279 26 37 6 348 79 1997 309 27 55 6 397 105 1998 305 29 61 5 400 120 1999 331 27 63 7 428 134 2000 337 29 68 6 440 139 2001 291 27 50 6 145 2002 267 27 58 4 374 346 Source: OCS 14 125 32

Table 1: Capital Raised by the Israeli VC industry: 1991 -2002 Source: IVC 33

Table 1: Capital Raised by the Israeli VC industry: 1991 -2002 Source: IVC 33

Table 2: Capital invested in Israeli startups 0022 1997 -: by Israeli and foreign VCs Source: IVC 34

Table 2: Capital invested in Israeli startups 0022 1997 -: by Israeli and foreign VCs Source: IVC 34

VARIANTS TO TWO PHASE MODEL (reflecting different contexts) • Variant 1: Some countries/regions have strong Universities/Science and might have a pool of innovative SMEs---> might start directly at phase 2, but even here the set of public/private experiments required might differ across countries • Variant 2: A minority of countries may not need targeted VC/PE policies since “industry” emergence will occur endogenously e. g. spearheaded by foreign VC/PE • Variant 3: Differences in initial structure of SME segment; and in the broader institutional, capabilities and policy context--->may determine different portfolios of Phase 1 policies( and to scope and variety of system failures to be dealt with) 35

VARIANTS TO TWO PHASE MODEL (reflecting different contexts) • Variant 1: Some countries/regions have strong Universities/Science and might have a pool of innovative SMEs---> might start directly at phase 2, but even here the set of public/private experiments required might differ across countries • Variant 2: A minority of countries may not need targeted VC/PE policies since “industry” emergence will occur endogenously e. g. spearheaded by foreign VC/PE • Variant 3: Differences in initial structure of SME segment; and in the broader institutional, capabilities and policy context--->may determine different portfolios of Phase 1 policies( and to scope and variety of system failures to be dealt with) 35

APPLICABILITY OF THE TWO PHASE ITP ‘MODEL’ TO INDUSTRIALIZING ECONOMIES • There are two categories of reasons why the R&D/VC experience of Israel may be applicable – • Reason 1: Top Tier Industrializing Economies may be interested in Software/IT high tech (the experience would be more directly applicable) • Reason 2: Increasing commonalities between a VC industry serving high tech SU and a PE industry serving a broader segment of innovative SMEs 36

APPLICABILITY OF THE TWO PHASE ITP ‘MODEL’ TO INDUSTRIALIZING ECONOMIES • There are two categories of reasons why the R&D/VC experience of Israel may be applicable – • Reason 1: Top Tier Industrializing Economies may be interested in Software/IT high tech (the experience would be more directly applicable) • Reason 2: Increasing commonalities between a VC industry serving high tech SU and a PE industry serving a broader segment of innovative SMEs 36

REASON 1 • In several countries suitable ‘background conditions’ are emerging for the development of R&D intensive industries • • • Russia, India, China, Singapore, Brazil, Chile etc Some are increasingly involved in Software & IT services; good links with MNEs and their needs; increasing reputation and reliability MNEs are establishing R&D labs, the basis for future spin-offs to high tech industries • Government subsidies to emerging R&D performing companies may accelerate the process (also set the basis for a domestic VC segment) 37

REASON 1 • In several countries suitable ‘background conditions’ are emerging for the development of R&D intensive industries • • • Russia, India, China, Singapore, Brazil, Chile etc Some are increasingly involved in Software & IT services; good links with MNEs and their needs; increasing reputation and reliability MNEs are establishing R&D labs, the basis for future spin-offs to high tech industries • Government subsidies to emerging R&D performing companies may accelerate the process (also set the basis for a domestic VC segment) 37

COMMONALITES BETWEEN A VC-SU SEGMENT AND A PE-INNOVATIVE SME SEGMENT • Increasingly innovative SMEs will operate in a knowledge intensive, global & highly competitive environment-somewhat similar to the environment facing high tech SU • Therefore, PE (or a mix of VC/PE) companies must emerge to provide a profile of support to SMEs which is similar to that which ‘strict’ VCs provide to high tech SU 38

COMMONALITES BETWEEN A VC-SU SEGMENT AND A PE-INNOVATIVE SME SEGMENT • Increasingly innovative SMEs will operate in a knowledge intensive, global & highly competitive environment-somewhat similar to the environment facing high tech SU • Therefore, PE (or a mix of VC/PE) companies must emerge to provide a profile of support to SMEs which is similar to that which ‘strict’ VCs provide to high tech SU 38

WHY IS THIS SO? • Increasing importance of Knowledge • Rapid Deployment in Global Markets • Increased importance of management skills, networking and reputation to compete in the global market • System failures blocking the transformation of traditional SME segments • Advantages of Equity based mechanisms (over traditional mechanisms) in overcoming such failures 39

WHY IS THIS SO? • Increasing importance of Knowledge • Rapid Deployment in Global Markets • Increased importance of management skills, networking and reputation to compete in the global market • System failures blocking the transformation of traditional SME segments • Advantages of Equity based mechanisms (over traditional mechanisms) in overcoming such failures 39

40

40