a74bb9029f23ea41682c0ce423b872af.ppt

- Количество слайдов: 42

From debt reduction to a pathway towards development Cases in debt and debt work-out Roma. Tre - HDFS January 2015 Massimo Pallottino maxpallottino@gmail. com

Cu tr rre en nt ds Preconditions for new debt crisis…? At least four elements may favour new overindebtedness trends n n The low level of residual external debt, at least in its appearance The internal and private debt, that often hides an external debt in commercial terms. Macroeconomic performances are often on the positive side, although not much understood in detail New actors, such as China and India, which are not part of the ‘traditional’ negotiation instances, such as the Paris Club Cases in debt and debt work-out

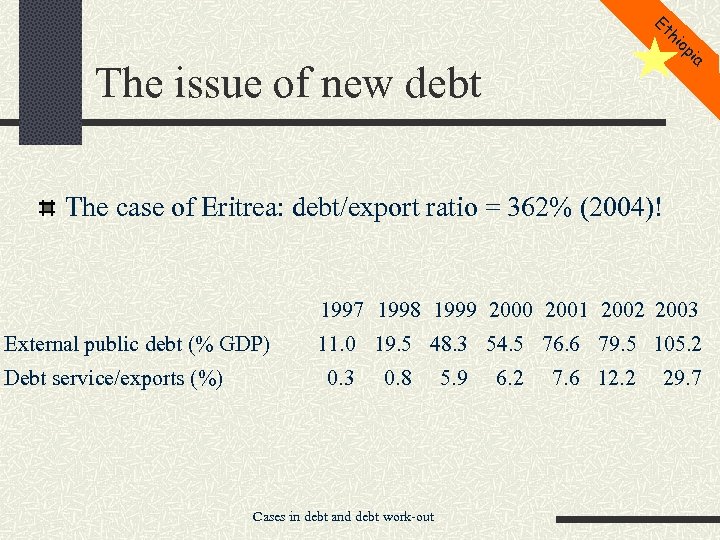

Et hi op ia The issue of new debt The case of Eritrea: debt/export ratio = 362% (2004)! 1997 1998 1999 2000 2001 2002 2003 External public debt (% GDP) Debt service/exports (%) 11. 0 19. 5 48. 3 54. 5 76. 6 79. 5 105. 2 0. 3 0. 8 Cases in debt and debt work-out 5. 9 6. 2 7. 6 12. 2 29. 7

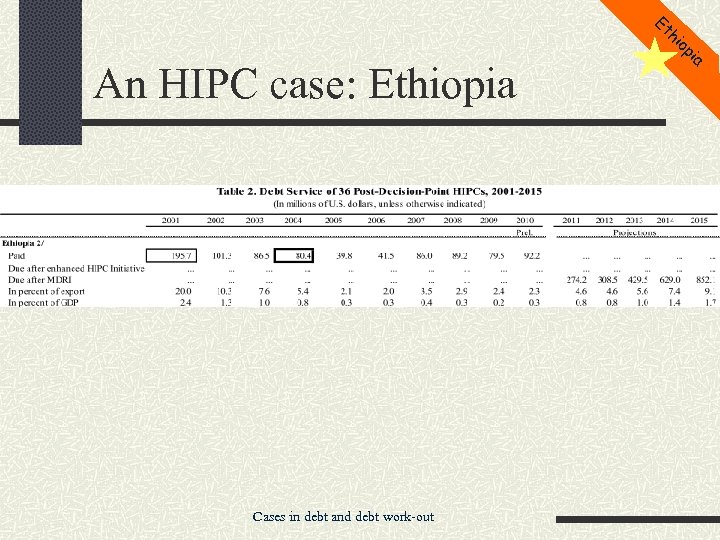

Et hi op An HIPC case: Ethiopia Cases in debt and debt work-out ia

Et hi op An example: the case of Ethiopia Italian debt reduction: 05/06/02: Pre-HIPC restructuring for 10, 99 MEuro 21/03/03: Interim Debt Relief for 23, 94 MEuro 03/01/05: Completion Point agreement for 332, 35 MEuro On the 08/10/04, the ‘Comitato Direzionale ’ of the Ministry of Foreign Affairs approves a concessional credit worth 220 MEuro for the construction of the Gilgel Gibe II dam, which has a total cost of 422 MEuro. Other 550 thousand Euro are provided as a grant Are these important and justified infrastructural investments, or an example of out-of-control financial relations? Cases in debt and debt work-out ia

Et hi op The strange case of Gibe II The amount of the credit for Gibe II is enormous : the total of all concessional credits granted by Italy in 2003 was as much as 180 MEuro; this amount is also 1/3 of all concessional credits granted in 2005 The construction of Gibe II was not part of the national energy plan, until 2004 On 12/05/05, 5 months before the formalisation of the Italian contribution, the company Salini, was able to sign an agreement with the Ethiopian Power Authority (EEPCO) Already the decision of the ‘Comitato Direzionale’ mentioned the indication of the General Contractor, Salini, which should be chosen by the beneficiary of the grant. But the OECD rules would impose for such a big contract, an open international tender No surprise: Salini gets the contract through direct agreement, justified by the urgent need to offer a response to the drought! Cases in debt and debt work-out ia

Et hi op Gibe II: other details… ia The tender notice is regularly published on OECD web site. The dates of the tender are noted as ‘variable’, and no one answer to the telephone number indicated It is not the drought the motivation for Gibe II, but the production of electricity: economic analysis say that Gibe II has no possibility of becoming financially sustainable, other that through a massive export of the electricity produced At least until end-2008, ther is no agreement with Kenya about the price of sale, and no infrastructures for the transportation are in place In November 2005, the ‘Directional Committee’ receives a reply of the ‘Evaluation Nucleus’ about the doubts that had been raised when the credit had been awarded. The remarks confirm the doubts, the project is confirmed, and the components of the EN are changed The history leads to two requests for clarifications by parlamentarians, and several press articles. Cases in debt and debt work-out

Et hi op Ethiopia and debt Ethiopia qualified for debt cancellation through HIPC in 2004, and subsequently MDRI when it was agreed in 2005. Its debt payments fell from averaging 10 per cent of government revenue a year from 1998 -2000 to 4 per cent a year from 2007 -2009. At the same time, combined spending on public health and education increased from 22 per cent of government revenue in 2000 -2001 to 32 per cent by 2006 -2007 Cases in debt and debt work-out Jubilee Debt Campaign (2012) “The State of debt” ia

Et hi op Prospects Since the financial crisis began the government’s foreign owed debt has shot-up from $3 billion to $7 billion, and is predicted to reach $10 billion by 2014. In 2010 the IMF predicted that by 2014 the country would be back to spending 10 per cent of government revenue a year on debt payments. This assumes Ethiopia’s economy grows by 7 -8 per cent a year, and exports by 17 -20 per cent a year. Cases in debt and debt work-out Jubilee Debt Campaign (2012) “The State of debt” ia

Et hi op Debt and politics ia Ethiopian governement has been able to keep the control of external financial flows in relation with the international donors community. The Ethiopian government has become increasingly repressive in recent years. Following elections in May 2011, Amnesty International say that legislation which severely limits human rights activities came into force. “The independent press was severely restricted. State resources, assistance and opportunities were broadly used to control the population” Cases in debt and debt work-out Jubilee Debt Campaign (2012) “The State of debt”

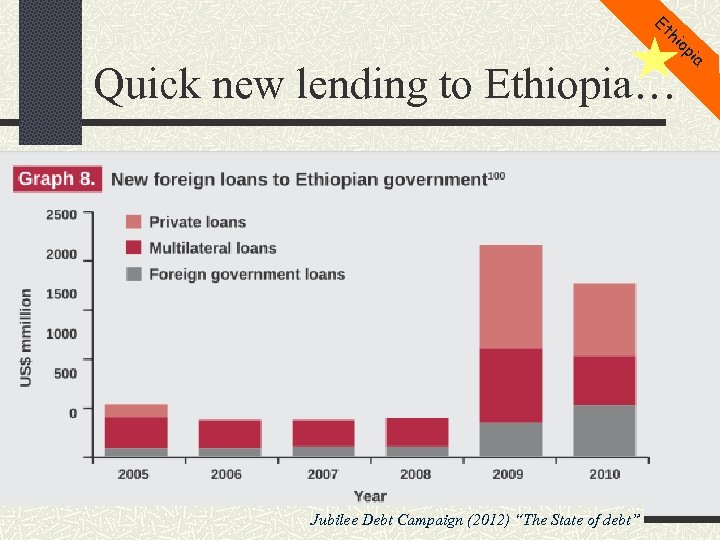

Et hi op Quick new lending to Ethiopia… Cases in debt and debt work-out Jubilee Debt Campaign (2012) “The State of debt” ia

Debt - debts Sovereign debt: public, or publicly guaranteed n n n Domestic, external (currency) Owed to public bodies (governements, multilaterals) Owed to private bodies (banks, investment funds, private equities) Private debt Credit: ODA / Commercial Debt strucure n n n Interest rate Maturity (short/long) Grace period Cases in debt and debt work-out de D eb bt s t

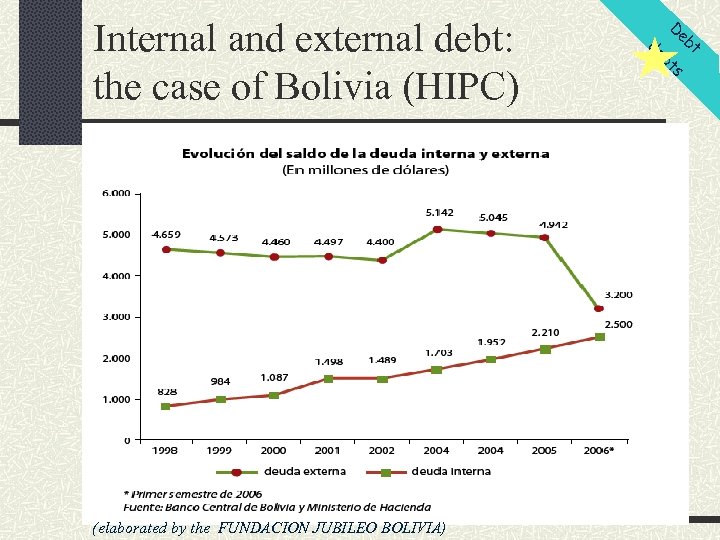

Internal and external debt: the case of Bolivia (HIPC) Cases in debt and debt work-out (elaborated by the FUNDACION JUBILEO BOLIVIA) de D eb bt s t

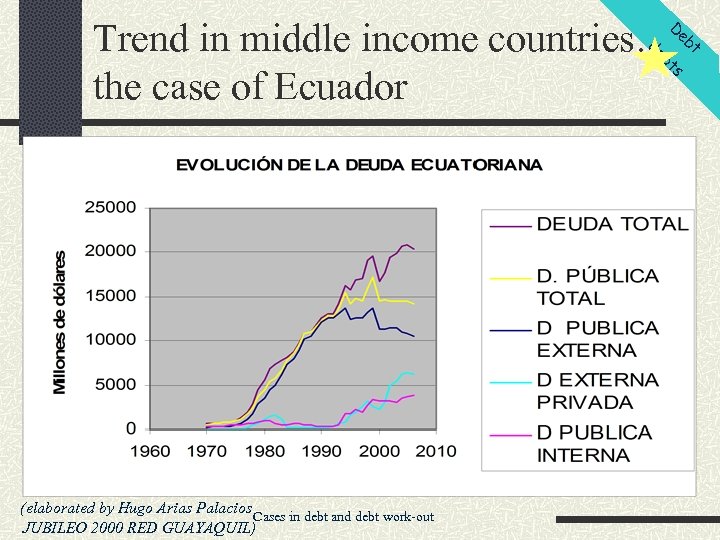

D Trend in middle income countries: debt s the case of Ecuador (elaborated by Hugo Arias Palacios Cases in debt and debt work-out JUBILEO 2000 RED GUAYAQUIL)

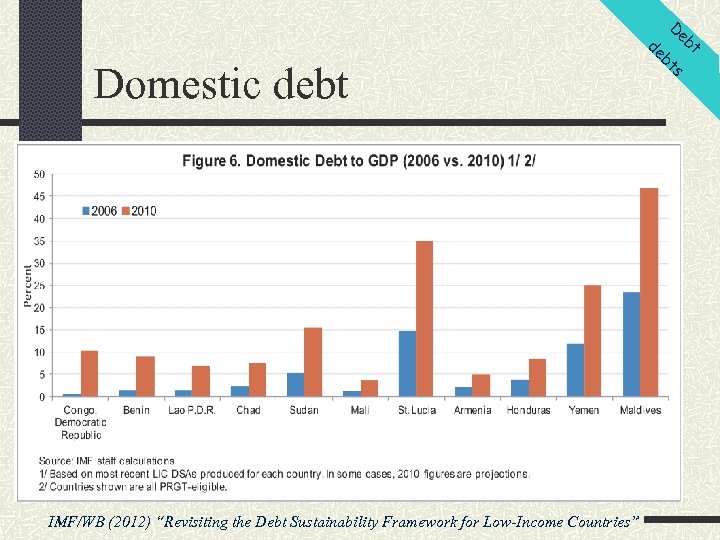

de D Domestic debt IMF/WB (2012) “Revisiting the Cases in debt and debt Framework for Low-Income Countries” Debt Sustainability work-out eb bt s t

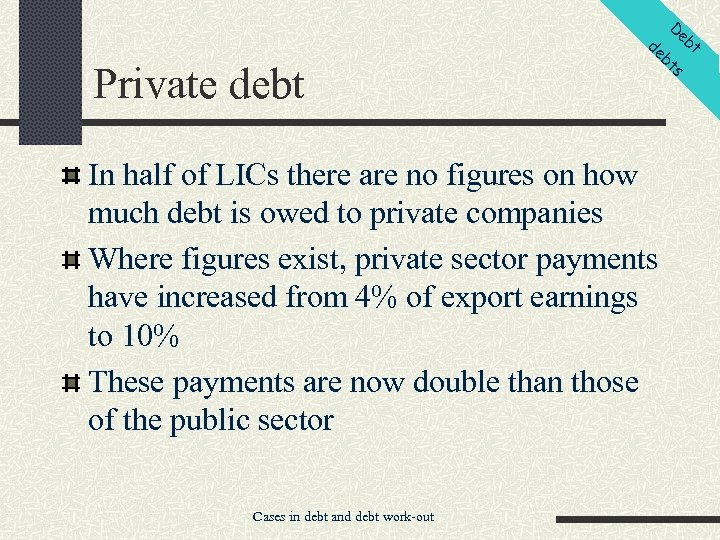

de D Private debt In half of LICs there are no figures on how much debt is owed to private companies Where figures exist, private sector payments have increased from 4% of export earnings to 10% These payments are now double than those of the public sector Cases in debt and debt work-out eb bt s t

Co nt ro ve Debt to honour? Illegitimate debt Odious debt Ecological debt Difficult to make these concepts operational, but… Cases in debt and debt work-out rs ie s

Illegitimate debt: the case of Norway Co nt ro 3 October 2006: Norway announces the unilateral cancellation of a quota of ‘illegitimate debt’ 80 MUSD of non conditional cancellation in favour of Egypt, Ecuador, Peru, Jamaica, and Sierra Leone The debt involved in the initiative concerns the export of fishing vessels, done between 1976 and 1980 This cancellation has not been comprised in the calculation of ODA For Ecuador, the initial debt amounted to 59 MUSD. Ecuador had already paid 100 MUSD, but still 35 MUSD were to be paid Cases in debt and debt work-out ve rs ie s

Co nt ro The case of Ecuador : the investigation commission on external debt ve rs Decreto ejecutivo del 3 de abril del 2006 Art. 3. - Funciones y Facultades Verificar la legitimidad de la deuda pública. Analizar los efectos, e impactos de los procesos de renegociación y emisión de bonos de la deuda pública externa. Verificar el cumplimiento de los proyectos y objetivos para los cuales fueron solicitados los préstamos. Proponer mecanismos de renegociación de la deuda pública externa. , Recomendar los lineamientos y directrices para definir políticas responsables de endeudamiento (elaborato da Hugo Arias Palacios JUBILEO 2000 RED GUAYAQUIL) Cases in debt and debt work-out ie s

Co nt ro Ecuador: hallazgos preliminares respecto al manejo oficial de la información sobre deuda n n n ve rs Dificultades en la obtención de información. La Comisión no ha tenido la colaboración técnica de las instituciones que manejan la información de la deuda: B. Central, MEF, Contraloría, MRE, etc. ; Ausencia de control de los organismos responsables del manejo de la deuda. Discrepancia escandalosa de la información estadística en las publicaciones al interior del Banco Central, en el Ministerio de Economía y Finanzas, el Ministerio de Relaciones Exteriores y las IFIs Los archivos de documentos sobre deuda pública están mal conservados, no ordenados, ni procesados. La “modernización del Estado” eliminó varias instituciones públicas como el Consejo Nacional de Planificación, las unidades de planificación de los ministerios y con ellas desapareció también gran parte de la información. No existen investigaciones y estudios sobre deuda (elaborato da Hugo Arias Palacios JUBILEO 2000 RED GUAYAQUIL) Cases in debt and debt work-out ie s

Odious/illegitimate debt : the case of Nigeria Co nt ro Nigeria has received a cancellation of about 18 MUSD, by the end of 2005 However at the same time, it has renewed its committment to pay immediately 12, 4 MUSD (1/2006; 3/2006) Nigeria had already repaid more than what it had borrowed. The current debt is formed by penalties and interests on arrears (original debt: 17 MUSD, payments already done: about 20 MUSD) Overall yearly debt service was around 3 MUSD, out of which Nigeria was paying about 1, 8 MUSD Opacity of the debt, but strong allegations of illegitimity Cases in debt and debt work-out ve rs ie s

Co nt ro ve The vulture funds Hedge funds, trying to profit of bad debts Between 2010 and 2011 there were 17 ‘recognized’(HIPC Status of Implementation) cases of judicial litigation against HIPC countries, that are requested to pay 1, 8 billion USD, and that have now been concluded for 991 million USD Cases in debt and debt work-out rs ie s

Co nt ro ve The case of Zambia rs 1979: loan from Romania, earmarked for the purchase of agricultural machines 1999: Donegal International anticipates by little the Zambian government, which was about to carry on a buy-back operation, paying about 10% of a face value of 30 million/USD DI (controversially) succeeds in obtaining the ‘acknowledgement’ of the validity of the debt In 2003, a legal action in the British Virgin Islands leads to a seizure action, and pushes the Zambian government to reiterate the engagement for the 33% of a face value, by then increased up to 42 millions USD Zambian Attorney General orders the interruption of the payments after the first instalments, contesting the powers exerced by the Zambian government representatives in signing 2003 agreement DI summons the Zambian government to appear in front of a British Court, and obtains 15 millions USD, against 55 asked for. That is about 1/3 of all benefits gained in 2007 for all the debt reduction initiatives… Cases in debt and debt work-out ie s

Co nt Who are the ‘bad ones’? The vulture funds, for sure. But also… Rumanian government, that has accepted to sell the Zambian sovereign debt to DI The Zambian government, and the way it has managed the issue Within a general framework that is not capable of avoiding this sort of situation Cases in debt and debt work-out ro ve rs ie s

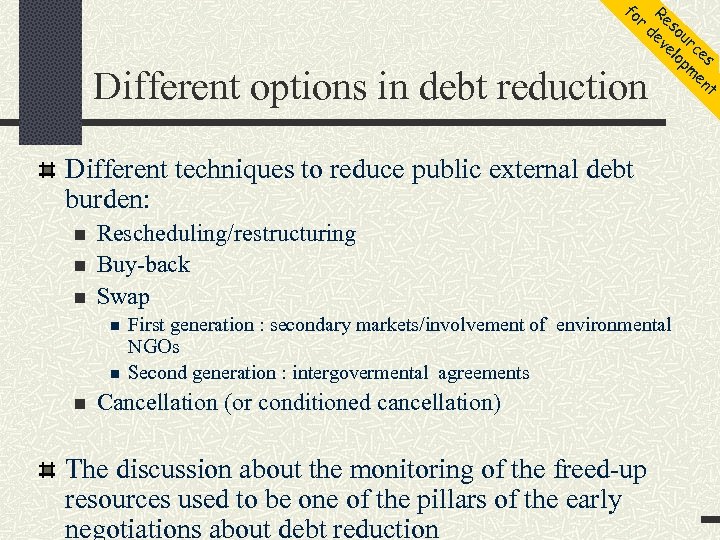

fo r Re de sou ve rc lo es pm en t Different options in debt reduction Different techniques to reduce public external debt burden: n n n Rescheduling/restructuring Buy-back Swap n n n First generation : secondary markets/involvement of environmental NGOs Second generation : intergovermental agreements Cancellation (or conditioned cancellation) The discussion about the monitoring of the freed-up resources used to. Cases inone of the pillars of the early be debt and debt work-out negotiations about debt reduction

fo r Debt reduction in perspective Debt reduction policies have become an additional tool in financing for development Conditionality Earmarking and fungibility Accountability Cases in debt and debt work-out Re de sou ve rc lo es pm en t

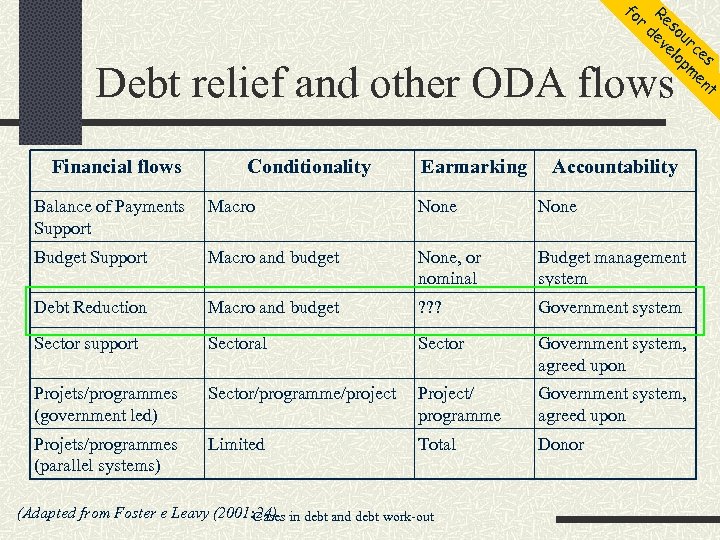

fo r Re de sou ve rc lo es pm en t Debt relief and other ODA flows Financial flows Conditionality Earmarking Accountability Balance of Payments Support Macro None Budget Support Macro and budget None, or nominal Budget management system Debt Reduction Macro and budget ? ? ? Government system Sector support Sectoral Sector Government system, agreed upon Projets/programmes (government led) Sector/programme/project Project/ programme Government system, agreed upon Projets/programmes (parallel systems) Limited Total Donor (Adapted from Foster e Leavy (2001: 24) in debt and debt work-out Cases

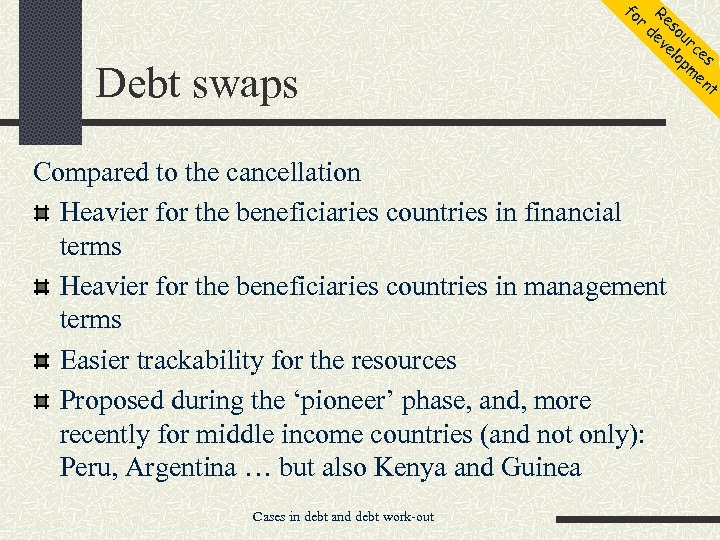

fo r Debt swaps Re de sou ve rc lo es pm en t Compared to the cancellation Heavier for the beneficiaries countries in financial terms Heavier for the beneficiaries countries in management terms Easier trackability for the resources Proposed during the ‘pioneer’ phase, and, more recently for middle income countries (and not only): Peru, Argentina … but also Kenya and Guinea Cases in debt and debt work-out

fo r Aid effectiveness Re de sou ve rc lo es pm en t Rome, Paris, Accra, Busan Alignment of procedures Alignement of priorities Civil society? Forgotten? Debt: trends and options 29

fo r Civil society…. ? Re de sou ve rc lo es pm en t Alongside macroeconoinic conditionalities, 'country ownership' has been a central principle of the HIPC Initiative. PRSs were the major vehicle through which such ownership was to be realised. However, country ownership has, at best, translated into truncaled forms of ownership by governments, with parliaments and other state institutions often being quite marginal. Democratic or citizen ownership has been largely overlooked in discussions of 'country ownership'. Because of this, genuinely democratic oversight of the governance of debt continues to be minimal. This is a major lacuna in the design of contemporary debt-relief schemes. It is surprising that many leading donors strongly espouse 'democracy', 'democratisation' and 'accountability' in other important contexts, but see these principles at best as having only limited or narrow relevance to the governance of debt. Walker B. (2011) "Using Debt Exchanges to Enhance Public Accountability to Citizens", in "Debt-for-Development Exchanges: History and New Debt: trends and options Applications", Buckley R. P. (ed), Cambridge University Press, Cambridge 30

fo r An old new tool: debt swap Debt-for-equity Debt-for-nature Debt-for-education Debt-to-health Debt-to-development Debto-for-security Cases in debt and debt work-out Re de sou ve rc lo es pm en t

Gu in A case of debt swap: Guinea The Jubilee Campaign The Italian Church initiative The forst proposal: the purchase of debt owned by Italy The centrality of the civil society After the approval of the law 209/2000, a proposal of debt swap Cases in debt and debt work-out ea

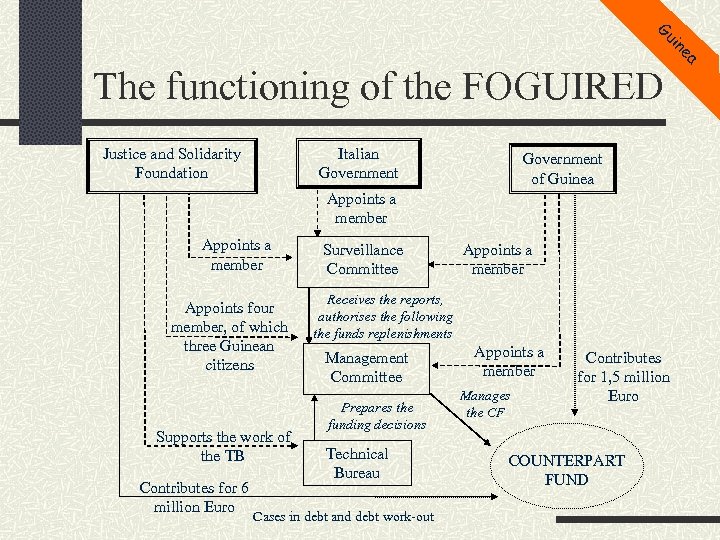

Gu in ea The functioning of the FOGUIRED Justice and Solidarity Foundation Italian Government of Guinea Appoints a member Appoints four member, of which three Guinean citizens Supports the work of the TB Contributes for 6 million Euro Surveillance Committee Appoints a member Receives the reports, authorises the following the funds replenishments Management Committee Prepares the funding decisions Technical Bureau Cases in debt and debt work-out Appoints a member Manages the CF Contributes for 1, 5 million Euro COUNTERPART FUND

Gu in Outcomes Both the Justice and Solidarity Foundation have contributes their part About 720 projects have been funded ‘Qualitative’ outcomes : the support to ‘unstructured’ organisation, value of the synergies The FOGUIRED has been an opportunity for the dialogue between the civil society and the government, one of the few in the country Cases in debt and debt work-out ea

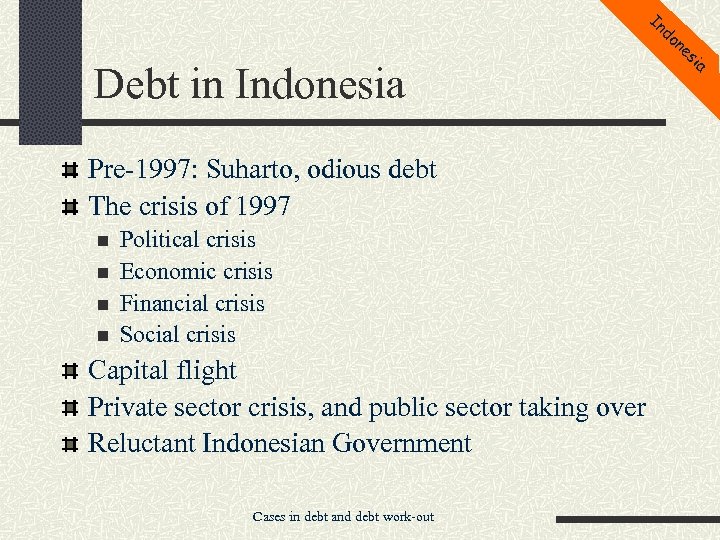

In do Debt in Indonesia Pre-1997: Suharto, odious debt The crisis of 1997 n n Political crisis Economic crisis Financial crisis Social crisis Capital flight Private sector crisis, and public sector taking over Reluctant Indonesian Government Cases in debt and debt work-out ne si a

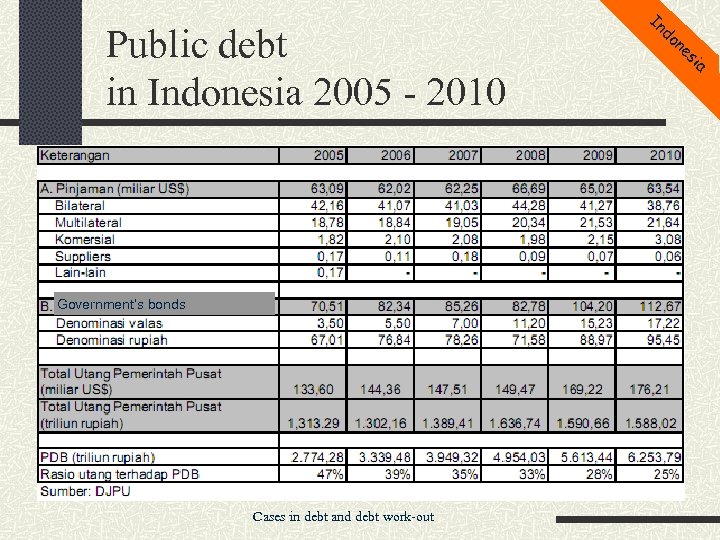

Public debt in Indonesia 2005 - 2010 Government’s bonds Cases in debt and debt work-out In do ne si a

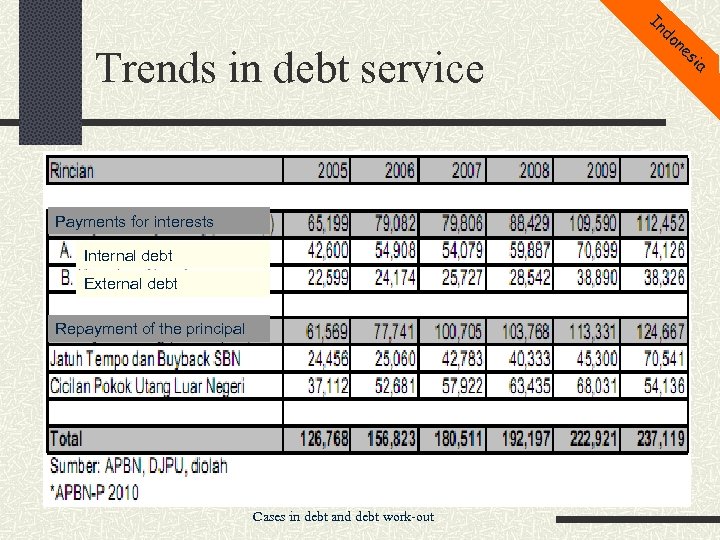

In Trends in debt service Payments for interests Internal debt External debt Repayment of the principal Cases in debt and debt work-out do ne si a

In do ne A remark on the ‘maturity structure’ si a Why is Indonesia paying more for the interests than for the principal repayment? In debt servicing, instalments are formed by a part of ‘principal’, that makes the outstanding debt to decrease, and a part of ‘interests’ paid of outstanding (residual) debt. A repayment at ‘constant instalments’ implies in most cases that the first instalments of the series have a larger part of interests than that of principal. Afterwords, as the outstanding debt decreases, the interests generated are lesser, and each instalment can comprise a larger share of the principal. A situation like the one shown for Indonesia, may indicate that these are ‘recent’ loans, contracted in ‘non concessional’ terms, maybe after the big financial crisis of 1997 -1998, that have ‘behind’ a very large outstanding Cases in debt and debt work-out

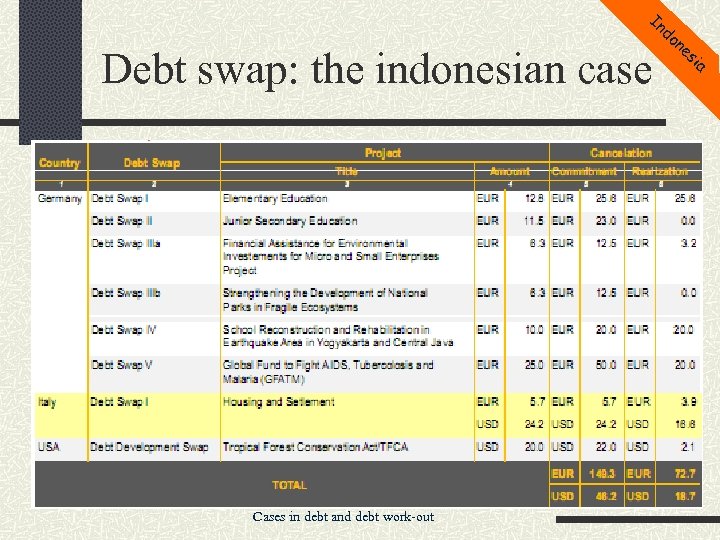

In Debt swap: the indonesian case Cases in debt and debt work-out do ne si a

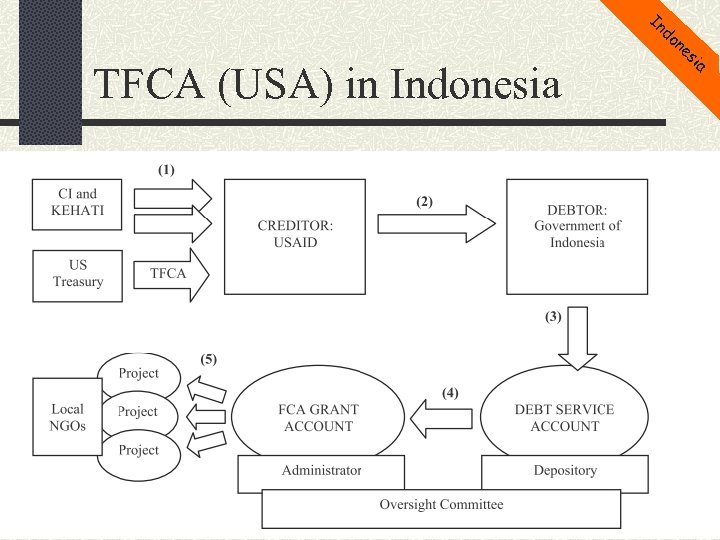

In do TFCA (USA) in Indonesia Cases in debt and debt work-out ne si a

Advantages of debt swaps Advantages Bilateral relations n Creditor’s credibility n Effective earmarking n Reduced financial load (in some cases) n Flexibility n Participation/accountability (in some cases n Cases in debt and debt work-out fo r Re de sou ve rc lo es pm en t

Benchmarking debt swap operation Gradual compared to debt repayment? Saving in foreign currency? Additionality? Alignment of managment systems? Alignment in priorities? Cases in debt and debt work-out fo r Re de sou ve rc lo es pm en t

a74bb9029f23ea41682c0ce423b872af.ppt