1836a79641b37fb68bbf95c418fdb01e.ppt

- Количество слайдов: 31

Friday September 13 th, 2013 2 nd Meeting of Fall Semester Lafayette College Investment Club

Announcements • Finance Night – October 17 th • Opportunity to network with successful Lafayette Alumni • • Speaker Friday November 8 th 2013 Scott Littlejohn Lafayette, AB, Economics, 1984 NYU Stern, MBA in Finance, 1991 [CPA - NY]

Meeting Agenda 1) Market Update by Othman Guennoun and Ryan Mc. Cormick 2) Waste to Energy Educational presentation by Stacey-Ann Pearson (Engineering Major) 3) Buy Presentation Expedia (EXPE)

MARKET NEWS September 13 TH 2013

Twitter Files for IPO • Twitter has submitted S-1 form to begin IPO “initial public offering” • IPO = Stock Market Launch • Private company Public company • Anyone can buy shares of the company

FED TAPERING • Investors predict that Fed officials will reduce 85 billion a month bond buying at September 17 th-18 th meeting. • Prediction based on the fact that Ben Bernanke will be holding a press conference on Sept 19 th, after meeting (No press conference scheduled after October meeting). • Bond buying by FED also referred to as quantitative easing (QE) has allowed the long term interest rates to remain low, encouraging investors to invest a lot more. EXAMPLE: The 10 year Treasury note’s yield which fell to 2. 936% • Fed official Richard Fisher (Dallas Federal Reserve Bank president): “There is an expectation that we will act in September…” (against program, doesn’t think it does any good.

• Proposed course of action by several Fed officials: * Reduce monthly bond purchases by a small amount. Maybe by 10 billion (from 85 billion to 75 billion) Watch results after action: Job market improvement Inflation rate improvement • Nonfarm payroll figures not as high as expected (169, 000) – Possible reason for Fed not to taper “Today’s data, in combination with Syrian uncertainties are likely to keep the US Fed on the sidelines for now” Douglas Borthwick – Chapdelaine Foreign Exchange NYC

APPLE’s new i. Phones • Apple (AAPL) reveals two new i. Phones • i. Phone 5 C starting at $99 • i. Phone 5 S --- fingerprint scanner and better camera • AAPL shares trade down 2% after announcement.

Dow Jones Industrial Average Drops 3 Companies. • Alcoa (AA), Hewlett-Packard (HPQ), and Bank of America (BAC) dropped • Replaced by Visa (V), Goldman Sachs (GS), and Nike (NKE) • Replaced because of low stock price of existing companies • Change effective Sept 20 th at Market Close.

Walt Disney Co. • Walt Disney Co. stock (DIS) rose 2. 5% yesterday after announcement of buying back $8 billion worth of shares. • Usually buyback at a higher than market price • Shows they have a lot of cash to pay back investors --- more investors interested as a result.

Waste to Energy Technology (Wt. E) How it may affect the energy sector and our investment portfolio?

What is waste-to-energy technology? • A form of clean energy • Conversion of non-recyclable waste materials into electricity, heat or fuel • Turning garbage into electricity!

Advantages of waste-to-energy: Indefinite supply of waste Reduces need for ‘dirty coal’ – cleans up the earth Reduces waste volume of landfill Challenges with waste-to-energy: • High initial cost • Negative image (pollutants, emissions), such as dioxins

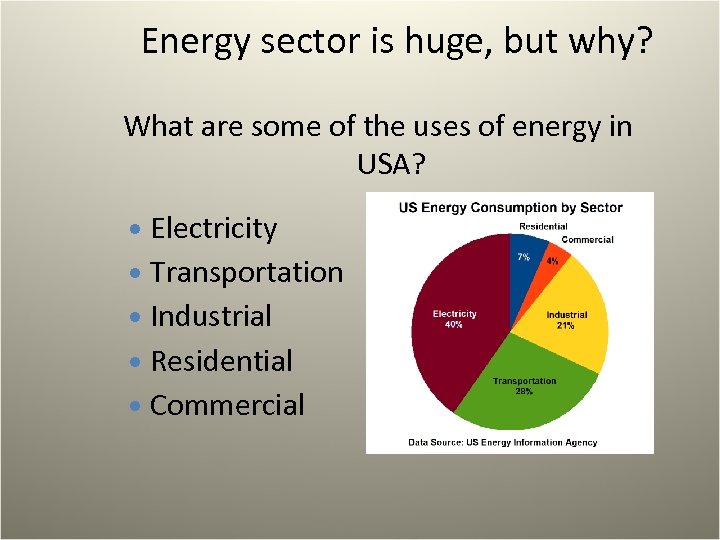

Energy sector is huge, but why? What are some of the uses of energy in USA? Electricity Transportation Industrial Residential Commercial

Energy market in US compared to some other countries: 1 American consumes as much as: • 2 English • 3 Japanese • 6 Mexicans • 13 Chinese • 31 Indians • 307 Tanzanians Washington State University

Related Investment club holdings • • Exxon. Mobil Chevron Dominion Resources Denbury Resources Generated revenue for big players > $175 Billion, 2010

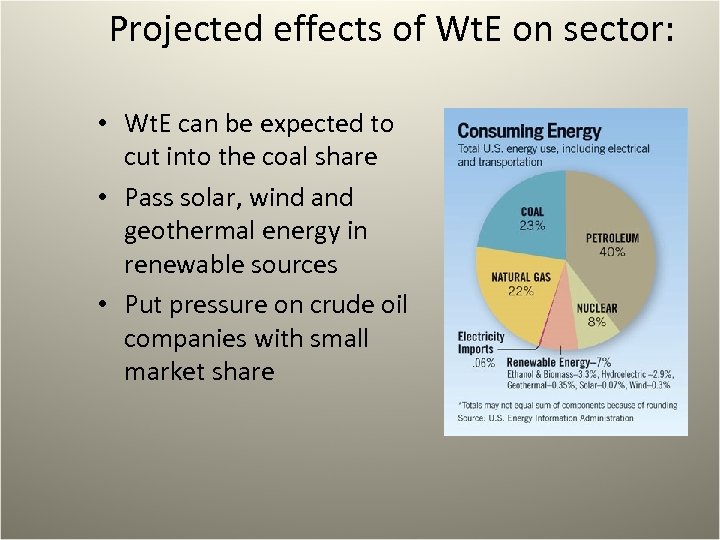

Projected effects of Wt. E on sector: • Wt. E can be expected to cut into the coal share • Pass solar, wind and geothermal energy in renewable sources • Put pressure on crude oil companies with small market share

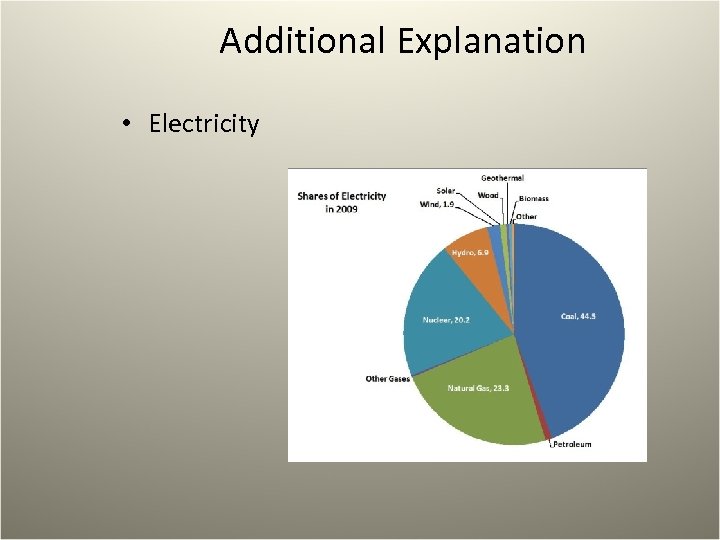

Additional Explanation • Electricity

How is it related to LIC portfolio? Exxon. Mobil Chevron Denbury Dominion Resources • Revenue from electricity generation and natural gas sale • The largest sources for • Electricity generated primarily from coal these three are oil and (46%) and nuclear natural gas (41%) • $12 B plan to improve and explore oil & gas

How is it related to LIC portfolio? Dominion Resources • Revenue from electricity generation and natural gas sale • Electricity generated primarily from coal (46%) and nuclear (41%) • $12 B plan to improve current infras. to and explore oil & gas Denbury Resources • Oil and natural gas company • Devoted to oil, gas market – investment in enhanced oil recovery • Focused on increasing value of oil, gas property

What plans would you make about these holdings if you had them in your portfolio?

A Value Opportunity (EXPE) – BUY 300 SHARES

Expedia Company Overview • Market Cap: 7 Billion Last Sale: 51. 18 • Based on gross bookings, Expedia Inc. is the worlds largest online travel agent (OTA), operating a portfolio of websites. • Hotels. com, Hotwire, Trivago (Europe), Elong • The Expedia Brand is one of the most wellknown and valuable brands in the travel industry.

Stock Got Absolutely Whacked • On July 26 th, Expedia reported a poor Q 2 missing on both EBITDA and Revenue. • Revised Guidance to mid-single digit EBITDA growth and cited headwinds with competition. • Management failed to mention this to investors resulting in a “hate sale”, reducing the market cap of the company by nearly 3 billion (stock down 30%). • Company toured the street talked up back half of year in June (margin story).

Why Now (VALUE) • 1) Managements ability to guide the street going forward is a one time fixable issue, they have set the bar considerably low (single digit EBITDA GROWTH) • 2) The Stock Trades at a steep discount to its competitors, 7. 5 x EBITDA, and 14 x Forward Earnings. • 3) Nothing is fundamentally wrong with the company, they are a brand player in a growing market with investments in MOBILE, ETP PROGRAM, and One time COSTS.

Reason #1 • Management is not in the business of losing money, they are compensated based on growth, if they fail to guide they lose money. – JOHN MALONE LIBERTY MEDIA (12% STAKE) • They have set their forward guidance to mid single digit EBITDA growth (historically midteens). This is a VERY low bar. • Guiding going forward is fixable and management is credible (spoke with PM, trader, analyst).

Reason #2 • On July 26 th, EXPE traded 20 x earnings and 12 x Ebitda. – Currently trades at a steep discount to those levels. • Priceline (main comp), trades 24 times earnings and 14 x Ebitda • Orbitz (2 nd Main comp), trades 23 times earnings, and 15 x Ebitda. • STEEP discount to comps (hence value)

Reason #3 • The reason for the miss was considerable investments into international companies ELONG and Trivago. – Elong is a Chinese search company (second largest), a much needed diversification in a growing market. – Trivago is essential as Expedia is only a 22% market share holder in Europe, also a growing market. • These Investment Costs were front half, back half will be revenue drivers.

Growth Going Forward • ETP Program – Drives Conversion, option to pay at hotel or online (Merchant Program Revolutionary). • Mobile APP – By far the largest investor in mobile growth (50 M app users globally), industry moving that direction. • International Growth – Acquisition of Trivago will prove to be a one time cost and a great investment.

THE RISK STORY • The online travel business and travel demand in general is linked to the economy. The global economy deteriorated rapidly when many of the world’s major economies fell into recession. • High unemployment at 7. 5%, limited credit availability and a cautious consumer may hinder economic recovery. • Management Fails to Guide well, and they miss Q 3.

Conclusion • This is a value opportunity to buy a heavily discounted stock in a volatile market. • 1) Fixable Issue • 2) Discount • 3) Growth Going Forward • We own ZERO travel industry • BUY 300 EXPE (3% allocation), and have a nice Friday knowing you found the gem of the year.

1836a79641b37fb68bbf95c418fdb01e.ppt