5adc1fde20d0dce597dce998ede85163.ppt

- Количество слайдов: 33

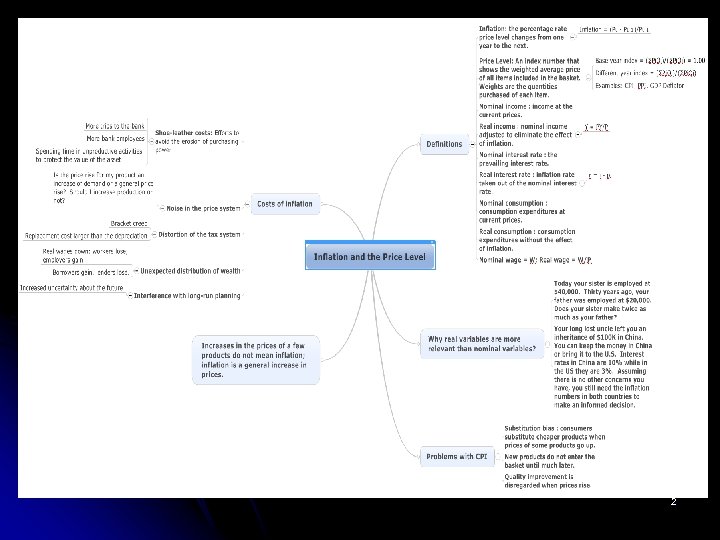

Frank & Bernanke 4 th edition, 2009 Ch. 5: Inflation and the Price Level 1

2

Who Is Making More? • A 2008 graduate of Hiram College got a job that pays $40, 000 per year. • Thirty-four years ago (1974), her father started his career with a $8, 000 job. • Is she making five times as much as her father did? 3

Who Is Making More? • In order to compare the incomes of two different periods we have to eliminate the effect of inflation. • What happened to prices between 1974 and 2008? • Let’s find out the Consumer Price Index (CPI). 4

Who Is Making More? • According to Bureau of Labor Statistics (ftp: //ftp. bls. gov/pub/special. requests/cpi/ cpiai. txt), CPI in 1974 was 49. 3. • CPI in 2008 was 215. 3. Base year was 1982 -84. • If the average price level in 1974 was lower than in 2008, our graduate must not have been five times better off. 5

Who Is Making More? • In real terms: – She made (40, 000/2. 153) = $18, 578. 73 in 1983 dollars. – He made (8, 000/. 493) = $16, 227. 18 in 1983 dollars. • How much was his pay in 2008 dollars? – His pay is (8, 000)(2. 153/. 493) = $34, 937. 12 6

How To Calculate The CPI? • Fix the basket a typical consumer will buy. • Find the prices of the items for different years. • Compute the basket’s cost for each year. • Choose a base year. • Calculate the cost of the basket for other years in terms of the base year. • Calculate inflation rates. 7

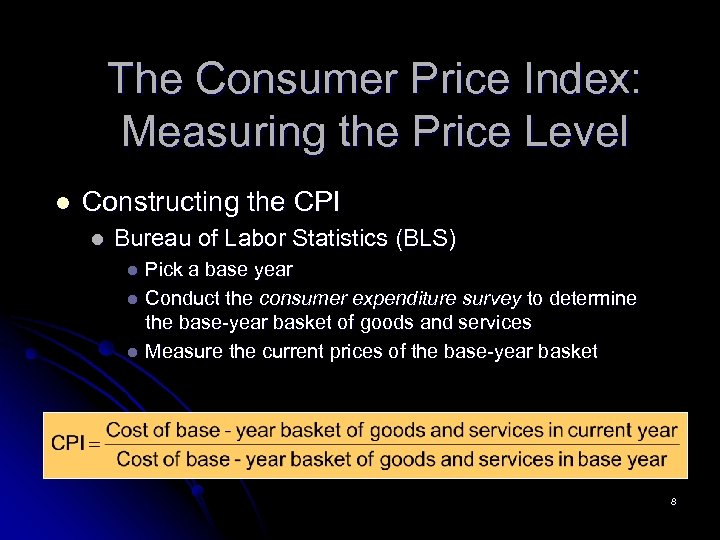

The Consumer Price Index: Measuring the Price Level l Constructing the CPI l Bureau of Labor Statistics (BLS) Pick a base year l Conduct the consumer expenditure survey to determine the base-year basket of goods and services l Measure the current prices of the base-year basket l 8

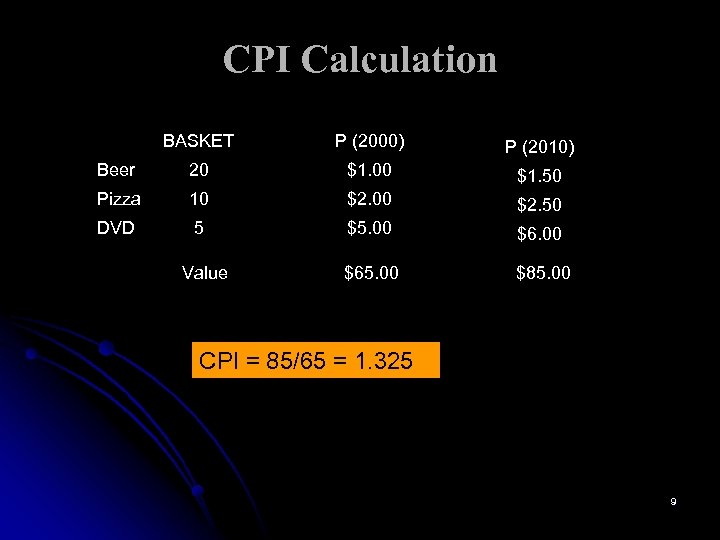

CPI Calculation BASKET P (2000) P (2010) Beer 20 $1. 00 $1. 50 Pizza 10 $2. 00 $2. 50 DVD 5 $5. 00 $65. 00 $85. 00 Value CPI = 85/65 = 1. 325 9

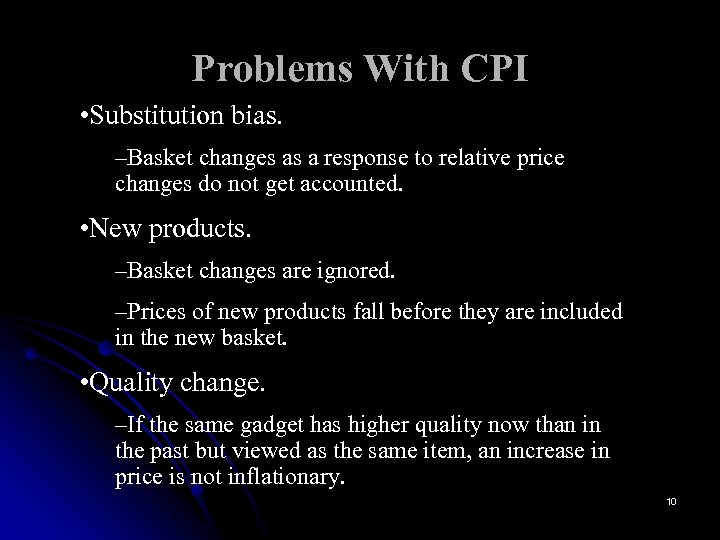

Problems With CPI • Substitution bias. –Basket changes as a response to relative price changes do not get accounted. • New products. –Basket changes are ignored. –Prices of new products fall before they are included in the new basket. • Quality change. –If the same gadget has higher quality now than in the past but viewed as the same item, an increase in price is not inflationary. 10

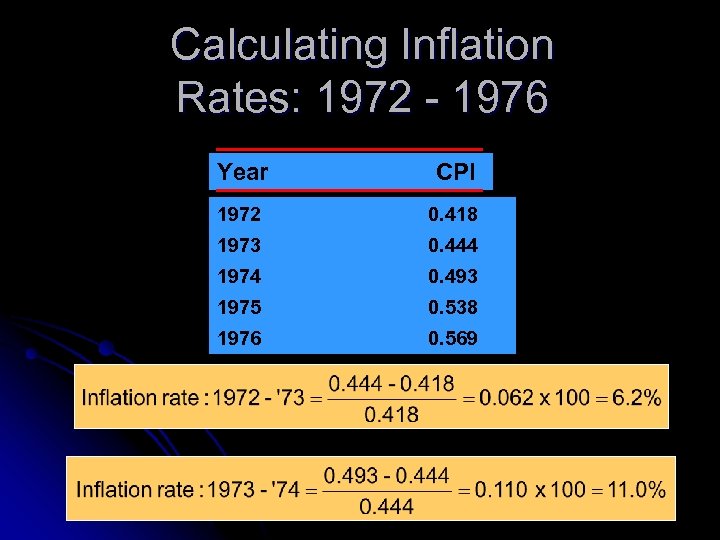

Calculating Inflation Rates: 1972 - 1976 Year CPI 1972 0. 418 1973 0. 444 1974 0. 493 1975 0. 538 1976 0. 569 11

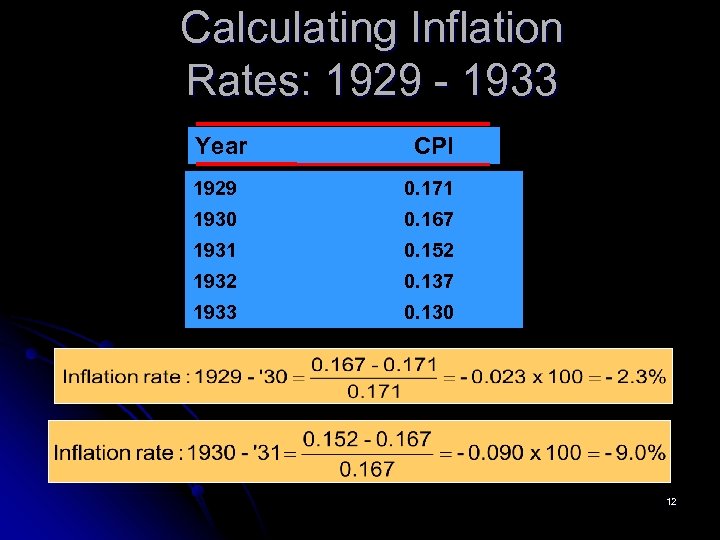

Calculating Inflation Rates: 1929 - 1933 Year CPI 1929 0. 171 1930 0. 167 1931 0. 152 1932 0. 137 1933 0. 130 12

Does the CPI Measure “True” Inflation? l l 1996 report by the Boskin Commission estimated that the CPI overstates inflation by as much as 1 to 2 percentage points a year. Overstating Inflation l l Would unnecessarily increase government spending Underestimate the improvements in the standard of living 13

Adjusting for Inflation l Real Wage l The wage paid to workers measured in terms of real purchasing power l The real wage for any given period is calculated by dividing the nominal (dollar) wage by the CPI for that period 14

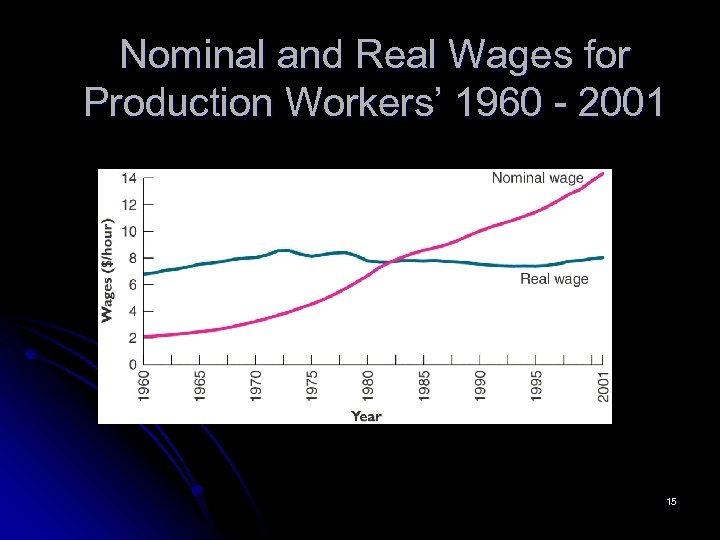

Nominal and Real Wages for Production Workers’ 1960 - 2001 15

GDP Deflator vs. CPI • Space shuttle costs more to operate. – Deflator is up, CPI unchanged. • Antiques cost more. – CPI is up, deflator unchanged. • Porsche increases the price. – CPI is up, deflator unchanged. • New homes cost more. – Both CPI and deflator up. 16

Indexation • If payments are automatically corrected for inflation, they are said to be indexed. – COLA – Social Security – TIPS – Variable mortgage rates 17

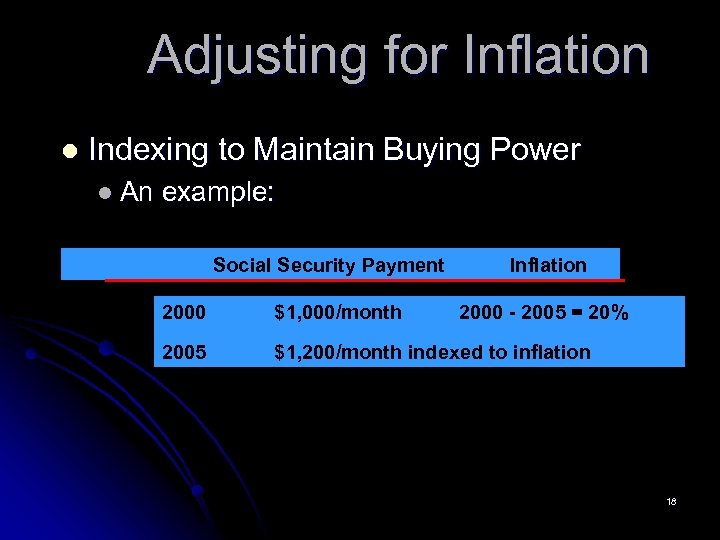

Adjusting for Inflation l Indexing to Maintain Buying Power l An example: Social Security Payment Inflation 2000 $1, 000/month 2000 - 2005 = 20% 2005 $1, 200/month indexed to inflation 18

The Costs of Inflation: Not What You Think l Observations l Changes in relative price do not necessarily imply a significant amount of inflation. l Inflation can be high without affecting relative prices. 19

The Costs of Inflation: Not What You Think l Observations l To counteract relative price changes, government policy would have to affect the market for specific goods. l To counteract inflation, the government must use monetary and fiscal policy. 20

Costs of Inflation l Shoe-leather costs l Economizing on cash l More frequent trips to the bank l More bank employees l Efforts to avoid the erosion of purchasing power 21

Costs of Inflation l Noise in the price system l Is it an increase in the demand for a product or is it a general increase in prices? l Should the supplier increase output or not? 22

Costs of Inflation l Distortions of the tax system l Depreciation allowance and the replacement cost l Bracket creep 23

Costs of Inflation l Unexpected distribution of wealth l Real wage down => workers lose, employers gain l Borrowers gain and creditors lose 24

Costs of Inflation l Interference with long-run planning l Increase uncertainty l Impossible to predict the future 25

Hyperinflation Inflation of 500 or more per cent per year. l Germany in early twenties. l Latin America. l Zimbabwe: 150, 000% in 2007! l 26

Hyperinflation l Economic Naturalist l Fischer, Sahay, and Vegh examined 133 market economies 1960 - 96 l 45 episodes of high inflation (100% +) in 25 countries Real GDP/person fell by an average of 1. 6%/yr l Real consumption/ person fell by an average of 1. 3%/yr l Real investment/person fell by an average of 3. 3%/yr l "Modern Hyper- and High Inflations", Journal of Economic Literature. September 2002, Volume XL, Number 3, 837 -880. 27

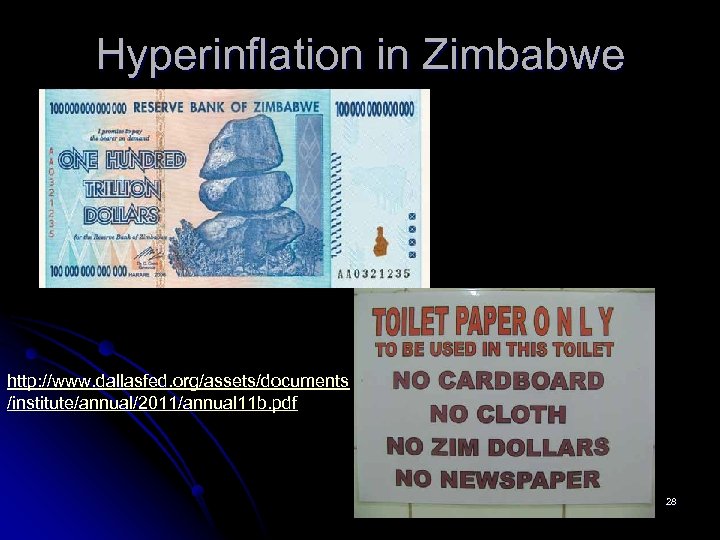

Hyperinflation in Zimbabwe http: //www. dallasfed. org/assets/documents /institute/annual/2011/annual 11 b. pdf 28

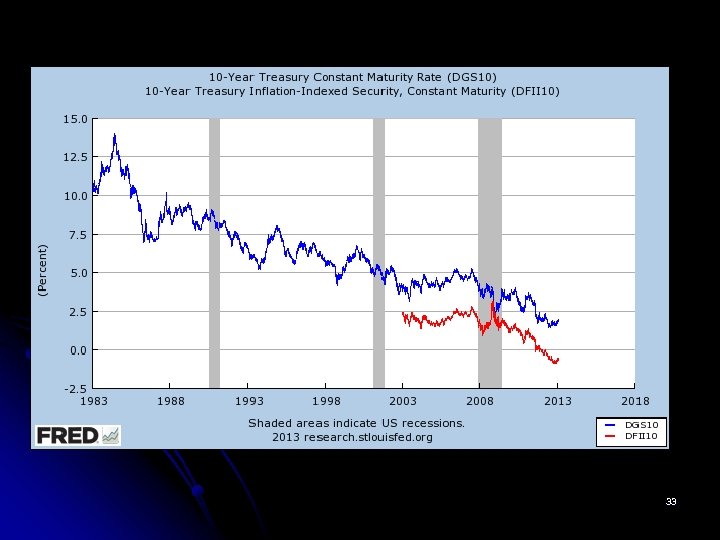

Real and Nominal Interest Rates • If you lend someone $1000 for a year and ask for a 5% interest, you will get $1050 at the end of the year. • If inflation during the year were 10%, the products you could buy with your $1000 at the beginning of the year now costs $1100. • Are you better-off or worse-off? 29

Real and Nominal Interest Rates • Lenders will always ask a higher interest rate than the expected inflation to earn income. • Nominal interest rates are what the bank quotes, what the car dealer quotes. • Real interest rates are nominal rates corrected for inflation. • i=r+π 30

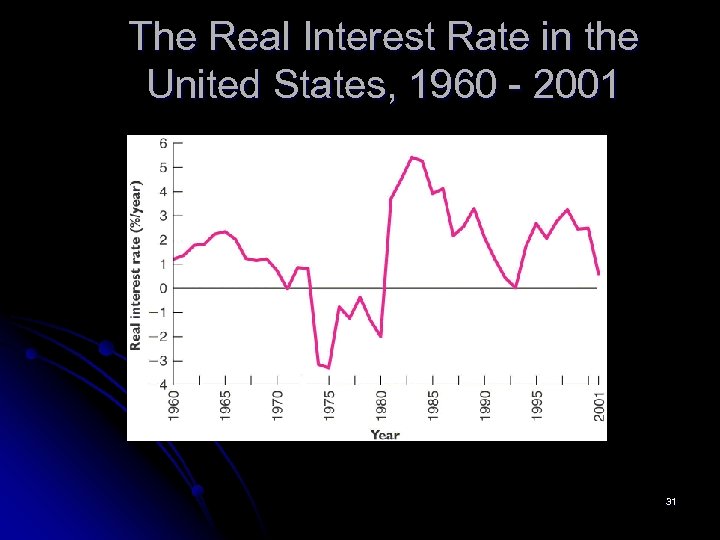

The Real Interest Rate in the United States, 1960 - 2001 31

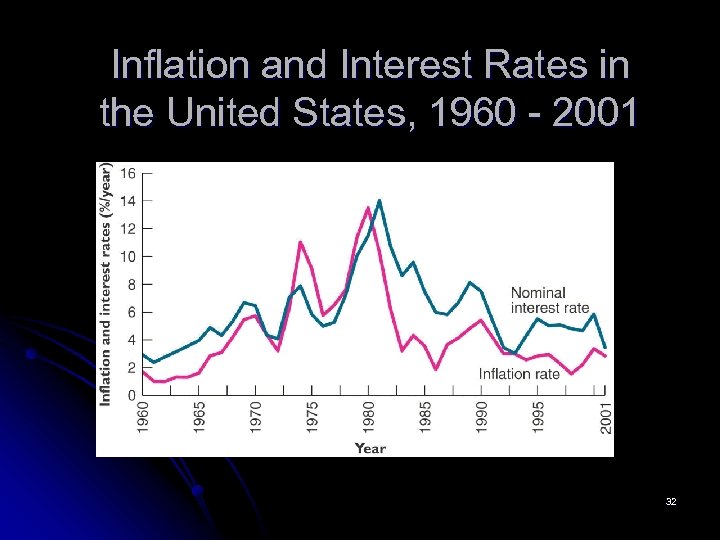

Inflation and Interest Rates in the United States, 1960 - 2001 32

33

5adc1fde20d0dce597dce998ede85163.ppt