920b678ba67f547c29e8d52d780dd4f8.ppt

- Количество слайдов: 39

FPHRA Conference Health Care Reform and Compliance Updates July 2016 Presented by: Kelly M. Davis, AIP Benefits Client Advocate www. bouchardinsurance. com

FPHRA Conference Health Care Reform and Compliance Updates July 2016 Presented by: Kelly M. Davis, AIP Benefits Client Advocate www. bouchardinsurance. com

July Updates EMPLOYER MANDATE – Employer Shared Responsibility – Counting to 50 – “Medium Size” Employers KNOW YOUR EMPLOYEES – Yes, No…Maybe? – Measurement Provisions – Flow Charts – Sample Measurement Calendar EMPLOYER PENALTIES – Pay or Play Recap – Affordability 2

July Updates EMPLOYER MANDATE – Employer Shared Responsibility – Counting to 50 – “Medium Size” Employers KNOW YOUR EMPLOYEES – Yes, No…Maybe? – Measurement Provisions – Flow Charts – Sample Measurement Calendar EMPLOYER PENALTIES – Pay or Play Recap – Affordability 2

July Updates cont… REPORTING OF COVERAGE – Code section 6056 & Code section 6055 RECENT REGULATORY AND LEGAL ACTIVITY – Federal Court will hear new ACA case – Important Numbers for 2016 & 2017 – PCORI Fees Due July 31 st – Employer Appeals of Exchange Subsidy Notices – Medicare Secondary Payer: IRS-SSA-CMS Data Match – EEOC Finalizes Wellness Rules 3

July Updates cont… REPORTING OF COVERAGE – Code section 6056 & Code section 6055 RECENT REGULATORY AND LEGAL ACTIVITY – Federal Court will hear new ACA case – Important Numbers for 2016 & 2017 – PCORI Fees Due July 31 st – Employer Appeals of Exchange Subsidy Notices – Medicare Secondary Payer: IRS-SSA-CMS Data Match – EEOC Finalizes Wellness Rules 3

EMPLOYER MANDATE 4

EMPLOYER MANDATE 4

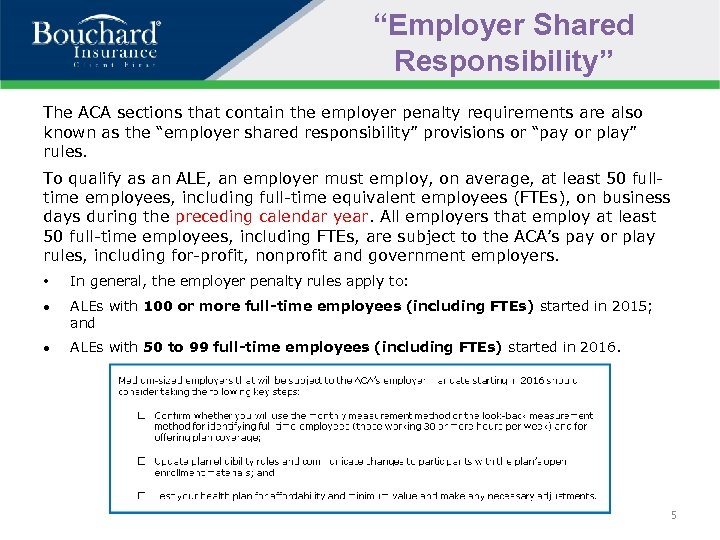

“Employer Shared Responsibility” The ACA sections that contain the employer penalty requirements are also known as the “employer shared responsibility” provisions or “pay or play” rules. To qualify as an ALE, an employer must employ, on average, at least 50 fulltime employees, including full-time equivalent employees (FTEs), on business days during the preceding calendar year. All employers that employ at least 50 full-time employees, including FTEs, are subject to the ACA’s pay or play rules, including for-profit, nonprofit and government employers. • In general, the employer penalty rules apply to: ALEs with 100 or more full-time employees (including FTEs) started in 2015; and ALEs with 50 to 99 full-time employees (including FTEs) started in 2016. 5

“Employer Shared Responsibility” The ACA sections that contain the employer penalty requirements are also known as the “employer shared responsibility” provisions or “pay or play” rules. To qualify as an ALE, an employer must employ, on average, at least 50 fulltime employees, including full-time equivalent employees (FTEs), on business days during the preceding calendar year. All employers that employ at least 50 full-time employees, including FTEs, are subject to the ACA’s pay or play rules, including for-profit, nonprofit and government employers. • In general, the employer penalty rules apply to: ALEs with 100 or more full-time employees (including FTEs) started in 2015; and ALEs with 50 to 99 full-time employees (including FTEs) started in 2016. 5

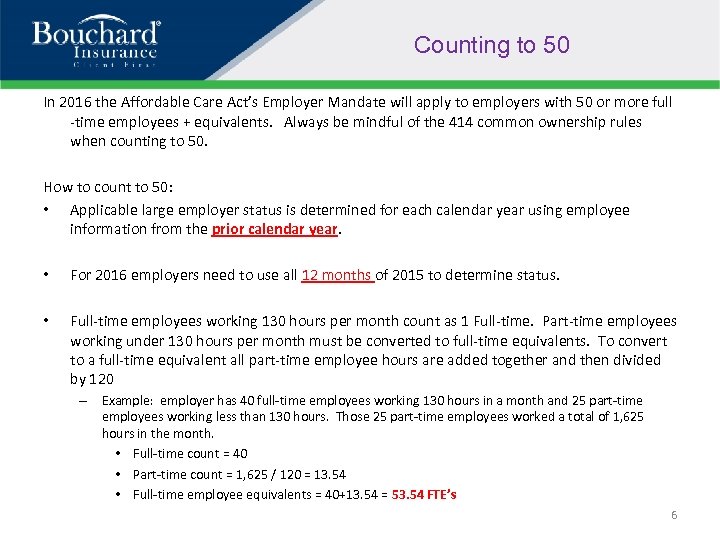

Counting to 50 In 2016 the Affordable Care Act’s Employer Mandate will apply to employers with 50 or more full -time employees + equivalents. Always be mindful of the 414 common ownership rules when counting to 50. How to count to 50: • Applicable large employer status is determined for each calendar year using employee information from the prior calendar year. • For 2016 employers need to use all 12 months of 2015 to determine status. • Full-time employees working 130 hours per month count as 1 Full-time. Part-time employees working under 130 hours per month must be converted to full-time equivalents. To convert to a full-time equivalent all part-time employee hours are added together and then divided by 120 – Example: employer has 40 full-time employees working 130 hours in a month and 25 part-time employees working less than 130 hours. Those 25 part-time employees worked a total of 1, 625 hours in the month. • Full-time count = 40 • Part-time count = 1, 625 / 120 = 13. 54 • Full-time employee equivalents = 40+13. 54 = 53. 54 FTE’s 6

Counting to 50 In 2016 the Affordable Care Act’s Employer Mandate will apply to employers with 50 or more full -time employees + equivalents. Always be mindful of the 414 common ownership rules when counting to 50. How to count to 50: • Applicable large employer status is determined for each calendar year using employee information from the prior calendar year. • For 2016 employers need to use all 12 months of 2015 to determine status. • Full-time employees working 130 hours per month count as 1 Full-time. Part-time employees working under 130 hours per month must be converted to full-time equivalents. To convert to a full-time equivalent all part-time employee hours are added together and then divided by 120 – Example: employer has 40 full-time employees working 130 hours in a month and 25 part-time employees working less than 130 hours. Those 25 part-time employees worked a total of 1, 625 hours in the month. • Full-time count = 40 • Part-time count = 1, 625 / 120 = 13. 54 • Full-time employee equivalents = 40+13. 54 = 53. 54 FTE’s 6

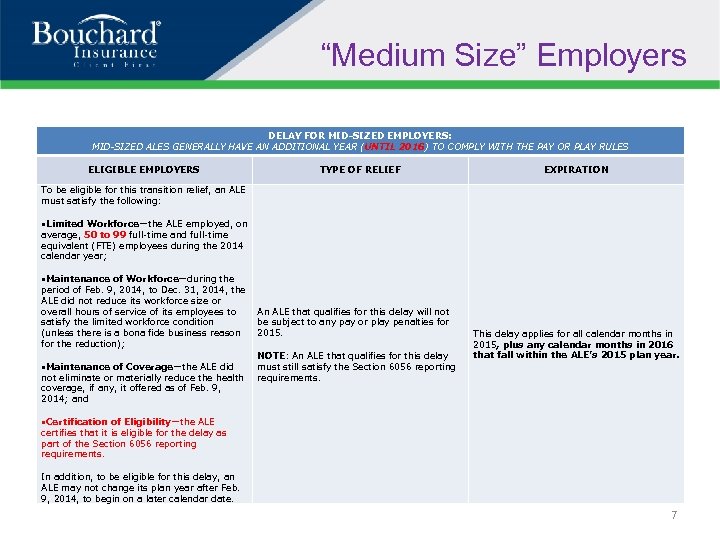

“Medium Size” Employers DELAY FOR MID-SIZED EMPLOYERS: MID-SIZED ALES GENERALLY HAVE AN ADDITIONAL YEAR (UNTIL 2016) TO COMPLY WITH THE PAY OR PLAY RULES ELIGIBLE EMPLOYERS TYPE OF RELIEF EXPIRATION To be eligible for this transition relief, an ALE must satisfy the following: Limited Workforce—the ALE employed, on average, 50 to 99 full-time and full-time equivalent (FTE) employees during the 2014 calendar year; Maintenance of Workforce—during the period of Feb. 9, 2014, to Dec. 31, 2014, the ALE did not reduce its workforce size or overall hours of service of its employees to satisfy the limited workforce condition (unless there is a bona fide business reason for the reduction); Maintenance of Coverage—the ALE did not eliminate or materially reduce the health coverage, if any, it offered as of Feb. 9, 2014; and An ALE that qualifies for this delay will not be subject to any pay or play penalties for 2015. NOTE: An ALE that qualifies for this delay must still satisfy the Section 6056 reporting requirements. This delay applies for all calendar months in 2015, plus any calendar months in 2016 that fall within the ALE’s 2015 plan year. Certification of Eligibility—the ALE certifies that it is eligible for the delay as part of the Section 6056 reporting requirements. In addition, to be eligible for this delay, an ALE may not change its plan year after Feb. 9, 2014, to begin on a later calendar date. 7

“Medium Size” Employers DELAY FOR MID-SIZED EMPLOYERS: MID-SIZED ALES GENERALLY HAVE AN ADDITIONAL YEAR (UNTIL 2016) TO COMPLY WITH THE PAY OR PLAY RULES ELIGIBLE EMPLOYERS TYPE OF RELIEF EXPIRATION To be eligible for this transition relief, an ALE must satisfy the following: Limited Workforce—the ALE employed, on average, 50 to 99 full-time and full-time equivalent (FTE) employees during the 2014 calendar year; Maintenance of Workforce—during the period of Feb. 9, 2014, to Dec. 31, 2014, the ALE did not reduce its workforce size or overall hours of service of its employees to satisfy the limited workforce condition (unless there is a bona fide business reason for the reduction); Maintenance of Coverage—the ALE did not eliminate or materially reduce the health coverage, if any, it offered as of Feb. 9, 2014; and An ALE that qualifies for this delay will not be subject to any pay or play penalties for 2015. NOTE: An ALE that qualifies for this delay must still satisfy the Section 6056 reporting requirements. This delay applies for all calendar months in 2015, plus any calendar months in 2016 that fall within the ALE’s 2015 plan year. Certification of Eligibility—the ALE certifies that it is eligible for the delay as part of the Section 6056 reporting requirements. In addition, to be eligible for this delay, an ALE may not change its plan year after Feb. 9, 2014, to begin on a later calendar date. 7

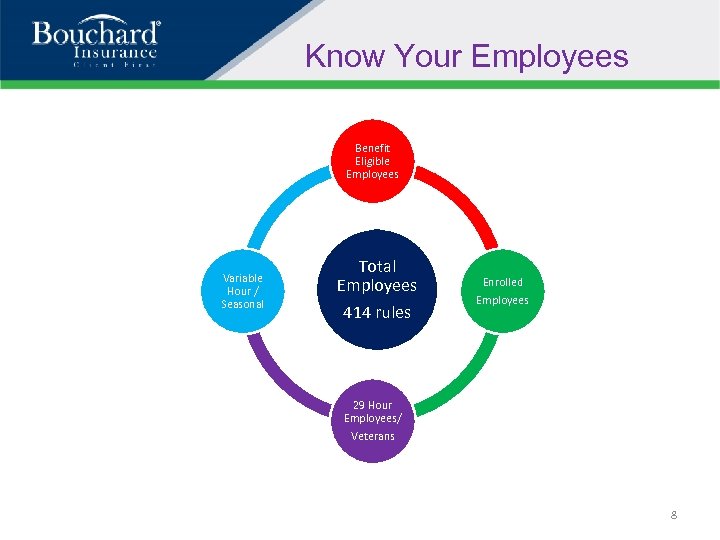

Know Your Employees Benefit Eligible Employees Variable Hour / Seasonal Total Employees 414 rules Enrolled Employees 29 Hour Employees/ Veterans 8

Know Your Employees Benefit Eligible Employees Variable Hour / Seasonal Total Employees 414 rules Enrolled Employees 29 Hour Employees/ Veterans 8

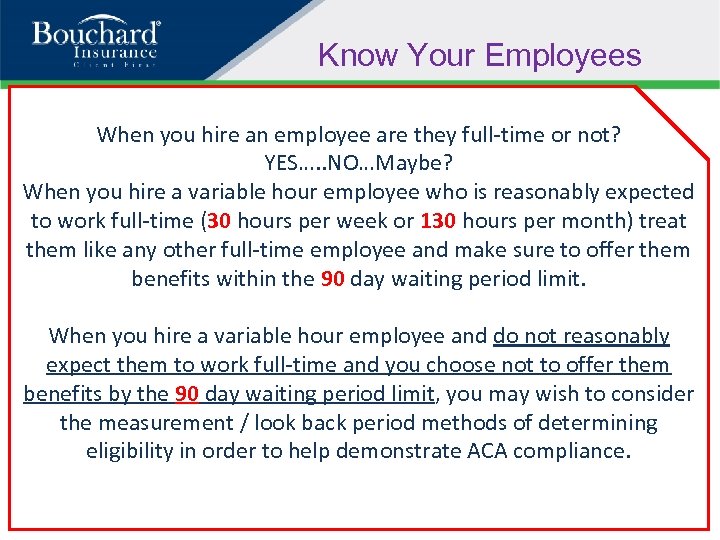

Know Your Employees When you hire an employee are they full-time or not? YES…. . NO…Maybe? When you hire a variable hour employee who is reasonably expected to work full-time (30 hours per week or 130 hours per month) treat them like any other full-time employee and make sure to offer them benefits within the 90 day waiting period limit. When you hire a variable hour employee and do not reasonably expect them to work full-time and you choose not to offer them benefits by the 90 day waiting period limit, you may wish to consider the measurement / look back period methods of determining eligibility in order to help demonstrate ACA compliance.

Know Your Employees When you hire an employee are they full-time or not? YES…. . NO…Maybe? When you hire a variable hour employee who is reasonably expected to work full-time (30 hours per week or 130 hours per month) treat them like any other full-time employee and make sure to offer them benefits within the 90 day waiting period limit. When you hire a variable hour employee and do not reasonably expect them to work full-time and you choose not to offer them benefits by the 90 day waiting period limit, you may wish to consider the measurement / look back period methods of determining eligibility in order to help demonstrate ACA compliance.

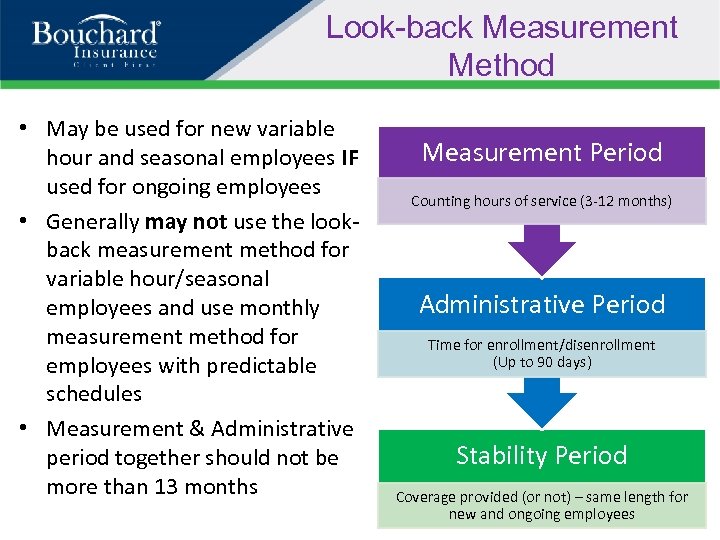

Look-back Measurement Method • May be used for new variable hour and seasonal employees IF used for ongoing employees • Generally may not use the lookback measurement method for variable hour/seasonal employees and use monthly measurement method for employees with predictable schedules • Measurement & Administrative period together should not be more than 13 months Measurement Period Counting hours of service (3 -12 months) Administrative Period Time for enrollment/disenrollment (Up to 90 days) Stability Period Coverage provided (or not) – same length for new and ongoing employees

Look-back Measurement Method • May be used for new variable hour and seasonal employees IF used for ongoing employees • Generally may not use the lookback measurement method for variable hour/seasonal employees and use monthly measurement method for employees with predictable schedules • Measurement & Administrative period together should not be more than 13 months Measurement Period Counting hours of service (3 -12 months) Administrative Period Time for enrollment/disenrollment (Up to 90 days) Stability Period Coverage provided (or not) – same length for new and ongoing employees

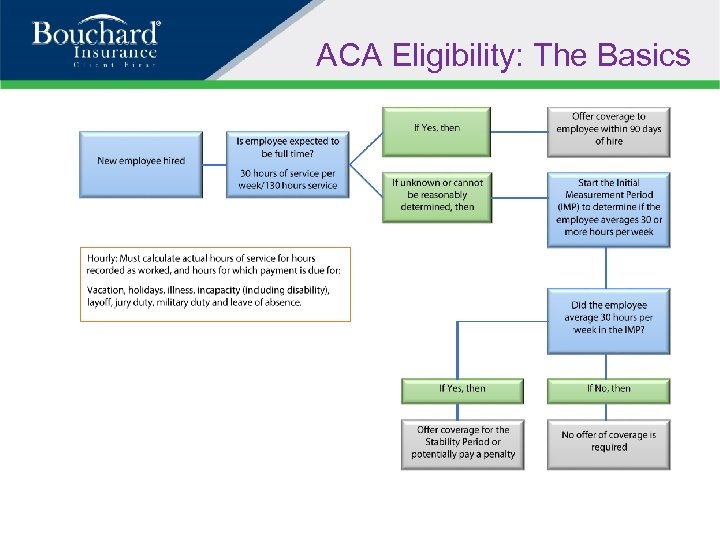

ACA Eligibility: The Basics

ACA Eligibility: The Basics

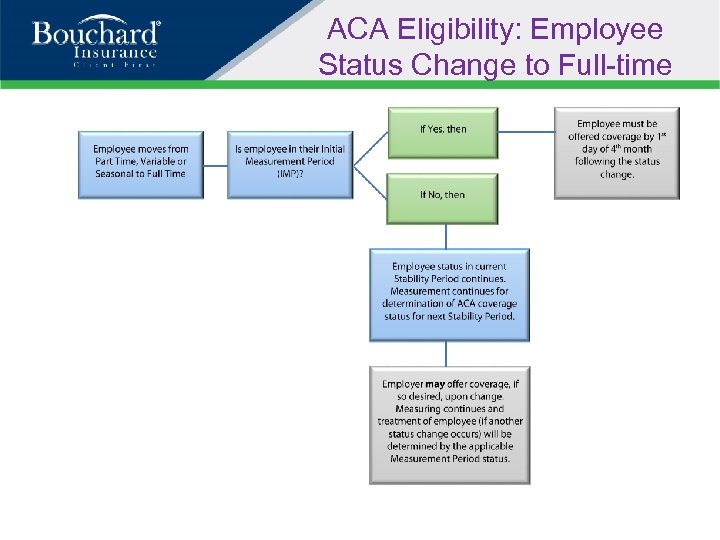

ACA Eligibility: Employee Status Change to Full-time

ACA Eligibility: Employee Status Change to Full-time

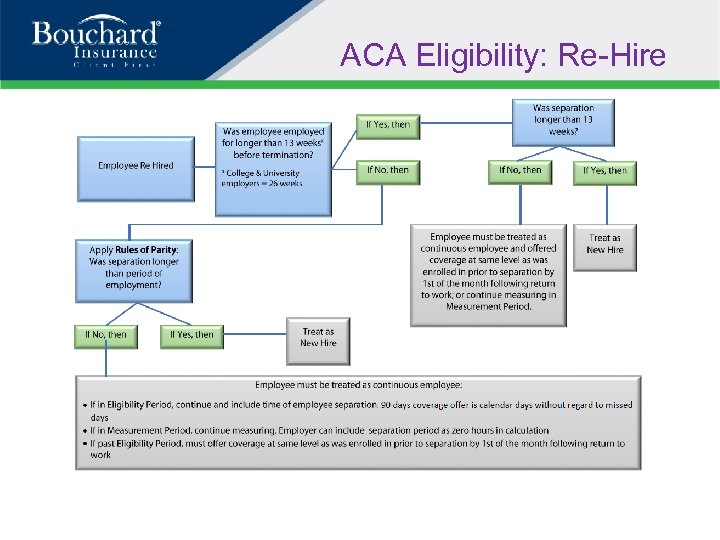

ACA Eligibility: Re-Hire

ACA Eligibility: Re-Hire

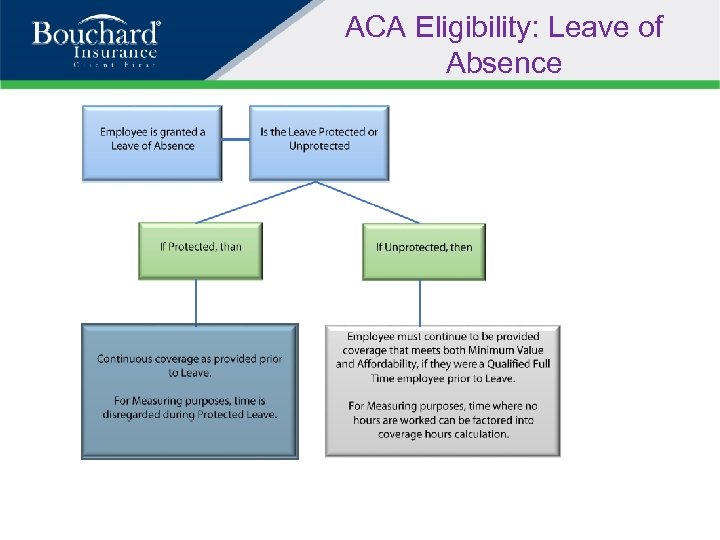

ACA Eligibility: Leave of Absence

ACA Eligibility: Leave of Absence

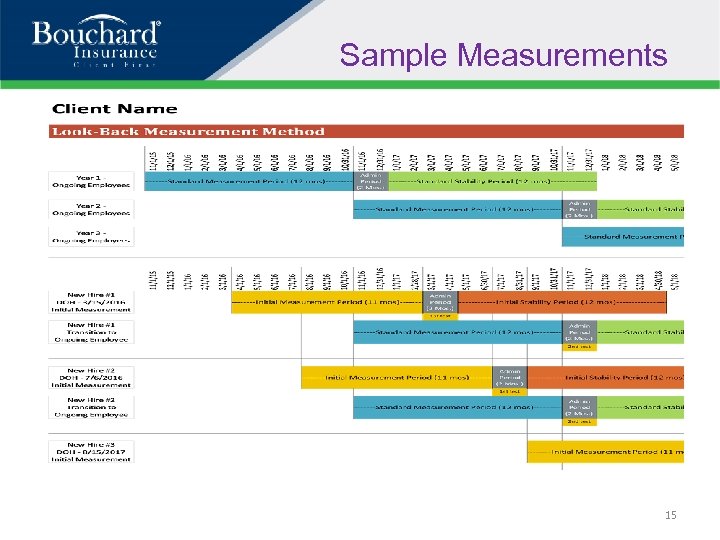

Sample Measurements 15

Sample Measurements 15

EMPLOYER PENALTIES 16

EMPLOYER PENALTIES 16

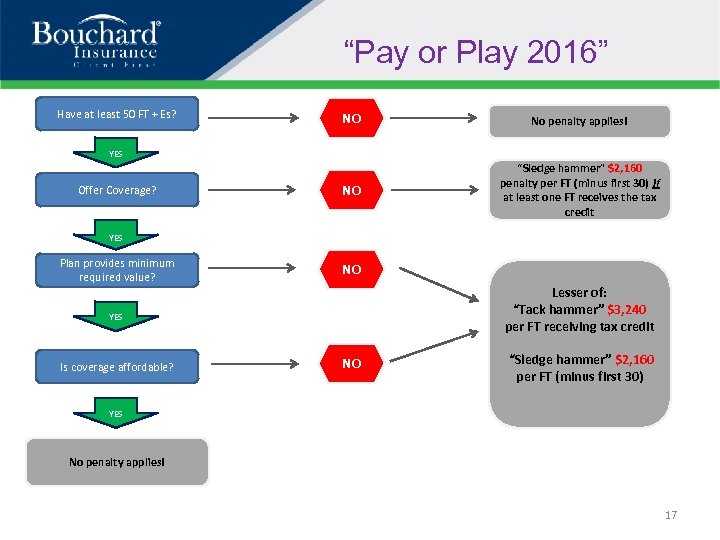

“Pay or Play 2016” Have at least 50 FT + Es? NO No penalty applies! NO “Sledge hammer” $2, 160 penalty per FT (minus first 30) if at least one FT receives the tax credit YES Offer Coverage? YES Plan provides minimum required value? NO Lesser of: “Tack hammer” $3, 240 per FT receiving tax credit YES Is coverage affordable? NO “Sledge hammer” $2, 160 per FT (minus first 30) YES No penalty applies! 17

“Pay or Play 2016” Have at least 50 FT + Es? NO No penalty applies! NO “Sledge hammer” $2, 160 penalty per FT (minus first 30) if at least one FT receives the tax credit YES Offer Coverage? YES Plan provides minimum required value? NO Lesser of: “Tack hammer” $3, 240 per FT receiving tax credit YES Is coverage affordable? NO “Sledge hammer” $2, 160 per FT (minus first 30) YES No penalty applies! 17

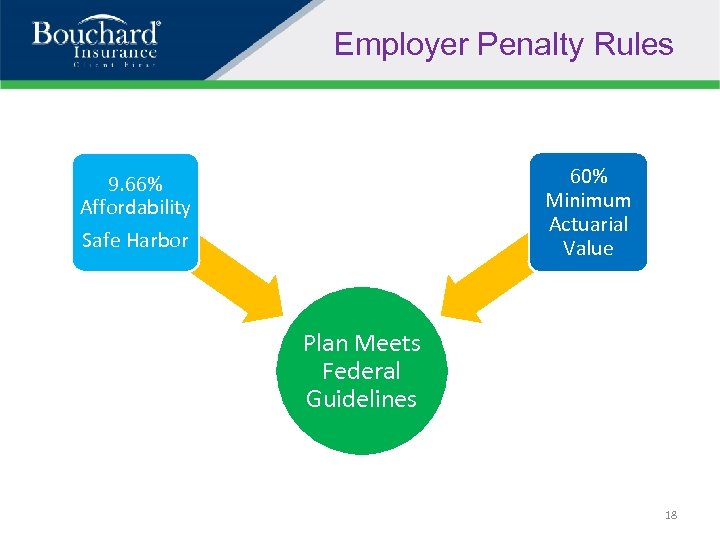

Employer Penalty Rules 60% Minimum Actuarial Value 9. 66% Affordability Safe Harbor Plan Meets Federal Guidelines 18

Employer Penalty Rules 60% Minimum Actuarial Value 9. 66% Affordability Safe Harbor Plan Meets Federal Guidelines 18

Health Plan Affordability An employer’s health coverage was considered affordable in 2015 if the employee’s required contribution to the plan does not exceed 9. 56 percent of the employee’s household income for the taxable year. For 2016 an employer’s coverage will be affordable based on 9. 66 percent. Because an employer generally will not know an employee’s household income, the IRS provides three affordability safe harbors that employers may use to determine affordability based on information that is available to them. These safe harbors allow an employer to measure affordability based on: • the employee’s W-2 wages; • the employee’s rate-of-pay income; • or the federal poverty level for a single individual. For 2016, the mainland single FPL is $11, 880. https: //aspe. hhs. gov/poverty-guidelines 19

Health Plan Affordability An employer’s health coverage was considered affordable in 2015 if the employee’s required contribution to the plan does not exceed 9. 56 percent of the employee’s household income for the taxable year. For 2016 an employer’s coverage will be affordable based on 9. 66 percent. Because an employer generally will not know an employee’s household income, the IRS provides three affordability safe harbors that employers may use to determine affordability based on information that is available to them. These safe harbors allow an employer to measure affordability based on: • the employee’s W-2 wages; • the employee’s rate-of-pay income; • or the federal poverty level for a single individual. For 2016, the mainland single FPL is $11, 880. https: //aspe. hhs. gov/poverty-guidelines 19

REPORTING OF COVERAGE 20

REPORTING OF COVERAGE 20

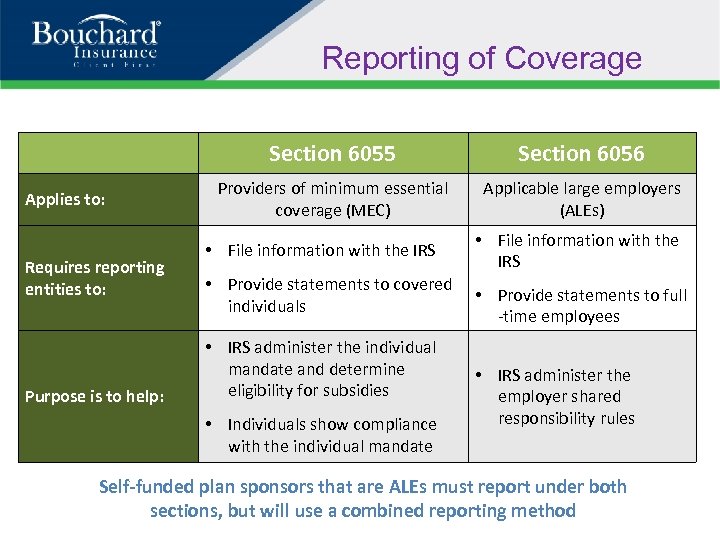

Reporting of Coverage Section 6055 Applies to: Requires reporting entities to: Purpose is to help: Section 6056 Providers of minimum essential coverage (MEC) Applicable large employers (ALEs) • File information with the IRS • Provide statements to covered individuals • IRS administer the individual mandate and determine eligibility for subsidies • Individuals show compliance with the individual mandate • File information with the IRS • Provide statements to full -time employees • IRS administer the employer shared responsibility rules Self-funded plan sponsors that are ALEs must report under both sections, but will use a combined reporting method

Reporting of Coverage Section 6055 Applies to: Requires reporting entities to: Purpose is to help: Section 6056 Providers of minimum essential coverage (MEC) Applicable large employers (ALEs) • File information with the IRS • Provide statements to covered individuals • IRS administer the individual mandate and determine eligibility for subsidies • Individuals show compliance with the individual mandate • File information with the IRS • Provide statements to full -time employees • IRS administer the employer shared responsibility rules Self-funded plan sponsors that are ALEs must report under both sections, but will use a combined reporting method

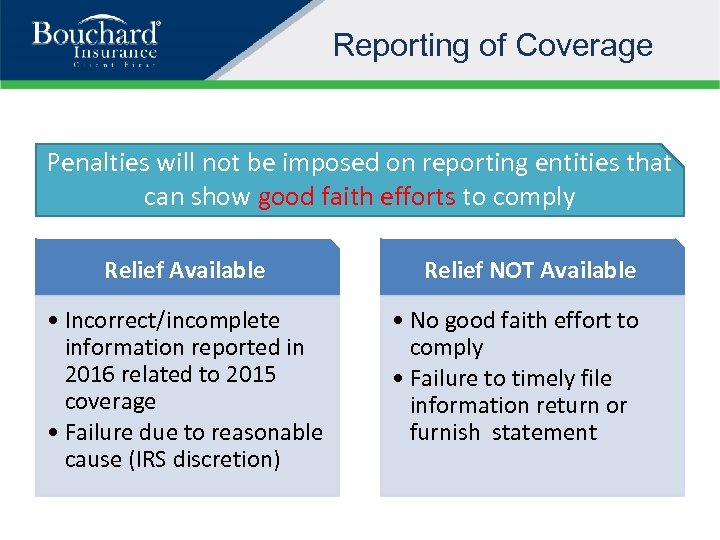

Reporting of Coverage Penalties will not be imposed on reporting entities that can show good faith efforts to comply Relief Available • Incorrect/incomplete information reported in 2016 related to 2015 coverage • Failure due to reasonable cause (IRS discretion) Relief NOT Available • No good faith effort to comply • Failure to timely file information return or furnish statement

Reporting of Coverage Penalties will not be imposed on reporting entities that can show good faith efforts to comply Relief Available • Incorrect/incomplete information reported in 2016 related to 2015 coverage • Failure due to reasonable cause (IRS discretion) Relief NOT Available • No good faith effort to comply • Failure to timely file information return or furnish statement

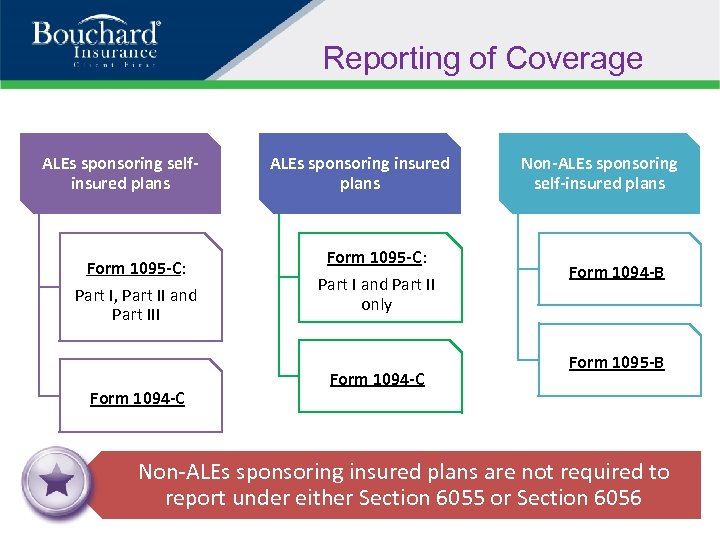

Reporting of Coverage ALEs sponsoring selfinsured plans Form 1095 -C: Part I, Part II and Part III Form 1094 -C ALEs sponsoring insured plans Form 1095 -C: Part I and Part II only Form 1094 -C Non-ALEs sponsoring self-insured plans Form 1094 -B Form 1095 -B Non-ALEs sponsoring insured plans are not required to report under either Section 6055 or Section 6056

Reporting of Coverage ALEs sponsoring selfinsured plans Form 1095 -C: Part I, Part II and Part III Form 1094 -C ALEs sponsoring insured plans Form 1095 -C: Part I and Part II only Form 1094 -C Non-ALEs sponsoring self-insured plans Form 1094 -B Form 1095 -B Non-ALEs sponsoring insured plans are not required to report under either Section 6055 or Section 6056

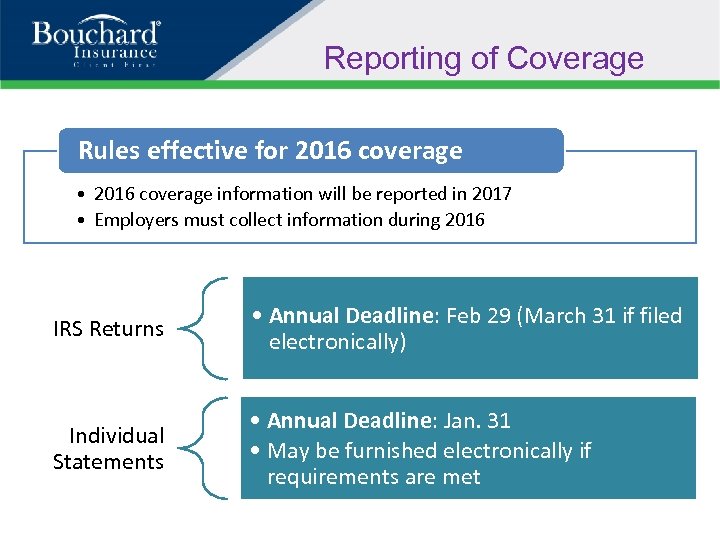

Reporting of Coverage Rules effective for 2016 coverage • 2016 coverage information will be reported in 2017 • Employers must collect information during 2016 IRS Returns • Annual Deadline: Feb 29 (March 31 if filed electronically) Individual Statements • Annual Deadline: Jan. 31 • May be furnished electronically if requirements are met

Reporting of Coverage Rules effective for 2016 coverage • 2016 coverage information will be reported in 2017 • Employers must collect information during 2016 IRS Returns • Annual Deadline: Feb 29 (March 31 if filed electronically) Individual Statements • Annual Deadline: Jan. 31 • May be furnished electronically if requirements are met

Recent Regulatory and Legal Activity • Federal Courts Will Hear 2 New ACA Cases – Marin v. Dave & Buster’s • Important Numbers for 2016 & 2017 • PCORI Fees Due July 31 st • Employer Appeals of Exchange Subsidy Notices • Medicare Secondary Payer: IRS-SSA-CMS Data Match 25

Recent Regulatory and Legal Activity • Federal Courts Will Hear 2 New ACA Cases – Marin v. Dave & Buster’s • Important Numbers for 2016 & 2017 • PCORI Fees Due July 31 st • Employer Appeals of Exchange Subsidy Notices • Medicare Secondary Payer: IRS-SSA-CMS Data Match 25

Marin v. Dave & Buster’s is a class action lawsuit alleging that the restaurant chain reduced their employees’ work hours in order to avoid providing health benefits, as required under the ACA. According to the group of about 10, 000 employees who filed suit, beginning in June 2013, Dave & Buster’s implemented “a nationwide effort to ‘right size’ the number of full-time and part-time employees[…]so as to avoid the costs associated with providing insurance that complied with the requirements of the ACA. ” As a result, a large number of Dave & Buster’s employees saw their hours significantly reduced, seemingly for the purpose of keeping them below the ACA’s “fulltime employee” threshold. Dave & Busters moved to have the case dismissed, arguing that their specific intention was only to avoid anticipated future costs, not to interfere with their employee’s health benefits. However, the federal District Court disagreed, allowing the case to continue to trial. According to the court, the group of employees presented enough evidence to make a claim that Dave & Buster’s “intentionally interfered with [the employees’] right to health-care coverage, motivated by [their] concern about future costs that would become associated with the plan's health-care coverage. ” Impact on Employers This case is the first of its kind, and will set a precedent for other employers who are considering or have implemented similar strategies for their employees’ work hours as a result of the ACA. While some workforce changes may not pose legal issues, employers should carefully consider any overt employment actions they may wish to take as a direct result of the ACA and its health coverage requirements. 26

Marin v. Dave & Buster’s is a class action lawsuit alleging that the restaurant chain reduced their employees’ work hours in order to avoid providing health benefits, as required under the ACA. According to the group of about 10, 000 employees who filed suit, beginning in June 2013, Dave & Buster’s implemented “a nationwide effort to ‘right size’ the number of full-time and part-time employees[…]so as to avoid the costs associated with providing insurance that complied with the requirements of the ACA. ” As a result, a large number of Dave & Buster’s employees saw their hours significantly reduced, seemingly for the purpose of keeping them below the ACA’s “fulltime employee” threshold. Dave & Busters moved to have the case dismissed, arguing that their specific intention was only to avoid anticipated future costs, not to interfere with their employee’s health benefits. However, the federal District Court disagreed, allowing the case to continue to trial. According to the court, the group of employees presented enough evidence to make a claim that Dave & Buster’s “intentionally interfered with [the employees’] right to health-care coverage, motivated by [their] concern about future costs that would become associated with the plan's health-care coverage. ” Impact on Employers This case is the first of its kind, and will set a precedent for other employers who are considering or have implemented similar strategies for their employees’ work hours as a result of the ACA. While some workforce changes may not pose legal issues, employers should carefully consider any overt employment actions they may wish to take as a direct result of the ACA and its health coverage requirements. 26

Important Numbers for 2016 & 2017 Annual Limitations on Cost-sharing – Maximum Out of Pockets: • Effective for plan years beginning on or after Jan. 1, 2014, the ACA requires nongrandfathered plans to comply with an overall annual limit—or an out-of-pocket maximum—on essential health benefits (EHB). • The ACA requires the out-of-pocket maximum to be updated annually based on the percent increase in average premiums person for health insurance coverage. • For 2016, the out-of-pocket maximum is $6, 850 for self-only coverage and $13, 700 for family coverage. • Under the final rule, the out-of-pocket maximum increases for 2017 to $7, 150 for selfonly coverage and $14, 300 for family coverage. 27

Important Numbers for 2016 & 2017 Annual Limitations on Cost-sharing – Maximum Out of Pockets: • Effective for plan years beginning on or after Jan. 1, 2014, the ACA requires nongrandfathered plans to comply with an overall annual limit—or an out-of-pocket maximum—on essential health benefits (EHB). • The ACA requires the out-of-pocket maximum to be updated annually based on the percent increase in average premiums person for health insurance coverage. • For 2016, the out-of-pocket maximum is $6, 850 for self-only coverage and $13, 700 for family coverage. • Under the final rule, the out-of-pocket maximum increases for 2017 to $7, 150 for selfonly coverage and $14, 300 for family coverage. 27

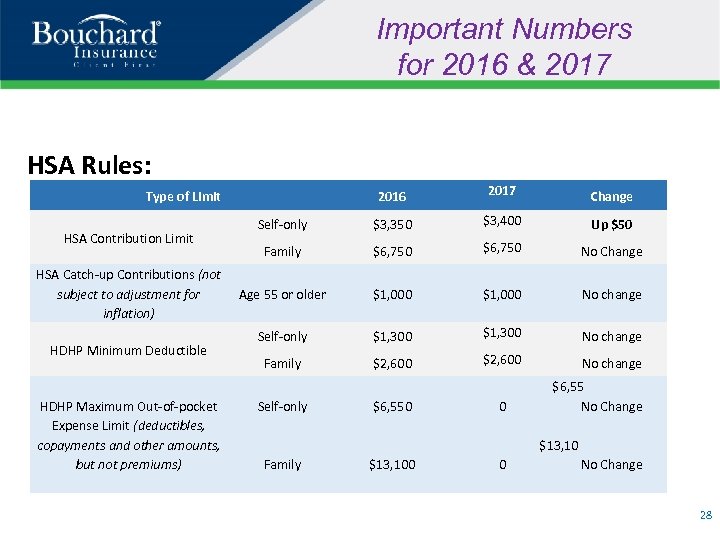

Important Numbers for 2016 & 2017 HSA Rules: 2016 2017 Change Self-only $3, 350 $3, 400 Up $50 Family $6, 750 No Change Age 55 or older $1, 000 No change Self-only $1, 300 No change Family $2, 600 No change Type of Limit HSA Contribution Limit HSA Catch-up Contributions (not subject to adjustment for inflation) HDHP Minimum Deductible HDHP Maximum Out-of-pocket Expense Limit (deductibles, copayments and other amounts, but not premiums) Self-only $6, 550 0 $6, 55 No Change $13, 10 Family $13, 100 0 No Change 28

Important Numbers for 2016 & 2017 HSA Rules: 2016 2017 Change Self-only $3, 350 $3, 400 Up $50 Family $6, 750 No Change Age 55 or older $1, 000 No change Self-only $1, 300 No change Family $2, 600 No change Type of Limit HSA Contribution Limit HSA Catch-up Contributions (not subject to adjustment for inflation) HDHP Minimum Deductible HDHP Maximum Out-of-pocket Expense Limit (deductibles, copayments and other amounts, but not premiums) Self-only $6, 550 0 $6, 55 No Change $13, 10 Family $13, 100 0 No Change 28

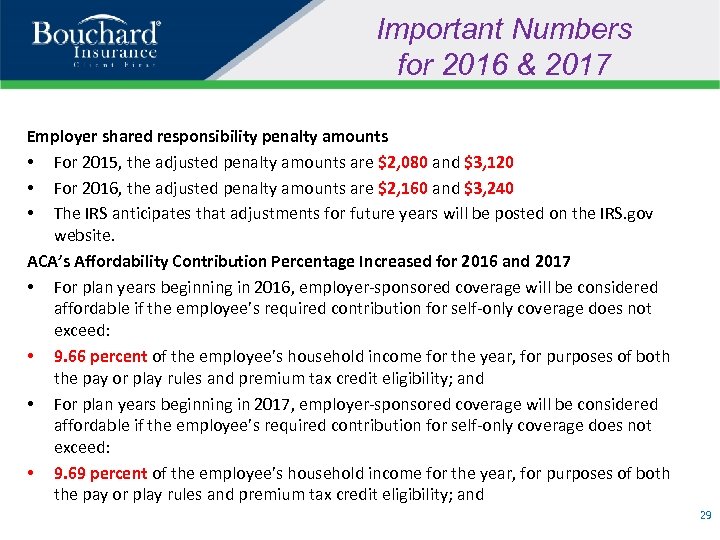

Important Numbers for 2016 & 2017 Employer shared responsibility penalty amounts • For 2015, the adjusted penalty amounts are $2, 080 and $3, 120 • For 2016, the adjusted penalty amounts are $2, 160 and $3, 240 • The IRS anticipates that adjustments for future years will be posted on the IRS. gov website. ACA’s Affordability Contribution Percentage Increased for 2016 and 2017 • For plan years beginning in 2016, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed: • 9. 66 percent of the employee’s household income for the year, for purposes of both the pay or play rules and premium tax credit eligibility; and • For plan years beginning in 2017, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed: • 9. 69 percent of the employee’s household income for the year, for purposes of both the pay or play rules and premium tax credit eligibility; and 29

Important Numbers for 2016 & 2017 Employer shared responsibility penalty amounts • For 2015, the adjusted penalty amounts are $2, 080 and $3, 120 • For 2016, the adjusted penalty amounts are $2, 160 and $3, 240 • The IRS anticipates that adjustments for future years will be posted on the IRS. gov website. ACA’s Affordability Contribution Percentage Increased for 2016 and 2017 • For plan years beginning in 2016, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed: • 9. 66 percent of the employee’s household income for the year, for purposes of both the pay or play rules and premium tax credit eligibility; and • For plan years beginning in 2017, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed: • 9. 69 percent of the employee’s household income for the year, for purposes of both the pay or play rules and premium tax credit eligibility; and 29

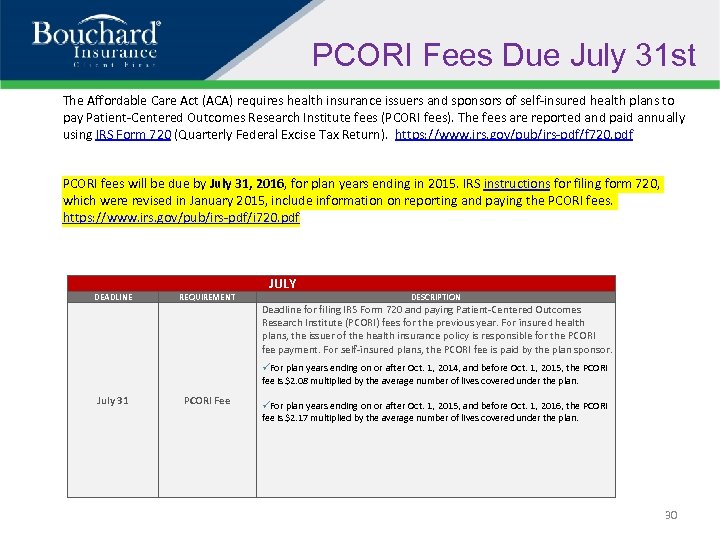

PCORI Fees Due July 31 st The Affordable Care Act (ACA) requires health insurance issuers and sponsors of self-insured health plans to pay Patient-Centered Outcomes Research Institute fees (PCORI fees). The fees are reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return). https: //www. irs. gov/pub/irs-pdf/f 720. pdf PCORI fees will be due by July 31, 2016, for plan years ending in 2015. IRS instructions for filing form 720, which were revised in January 2015, include information on reporting and paying the PCORI fees. https: //www. irs. gov/pub/irs-pdf/i 720. pdf JULY DEADLINE REQUIREMENT DESCRIPTION Deadline for filing IRS Form 720 and paying Patient-Centered Outcomes Research Institute (PCORI) fees for the previous year. For insured health plans, the issuer of the health insurance policy is responsible for the PCORI fee payment. For self-insured plans, the PCORI fee is paid by the plan sponsor. For plan years ending on or after Oct. 1, 2014, and before Oct. 1, 2015, the PCORI fee is $2. 08 multiplied by the average number of lives covered under the plan. July 31 PCORI Fee For plan years ending on or after Oct. 1, 2015, and before Oct. 1, 2016, the PCORI fee is $2. 17 multiplied by the average number of lives covered under the plan. 30

PCORI Fees Due July 31 st The Affordable Care Act (ACA) requires health insurance issuers and sponsors of self-insured health plans to pay Patient-Centered Outcomes Research Institute fees (PCORI fees). The fees are reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return). https: //www. irs. gov/pub/irs-pdf/f 720. pdf PCORI fees will be due by July 31, 2016, for plan years ending in 2015. IRS instructions for filing form 720, which were revised in January 2015, include information on reporting and paying the PCORI fees. https: //www. irs. gov/pub/irs-pdf/i 720. pdf JULY DEADLINE REQUIREMENT DESCRIPTION Deadline for filing IRS Form 720 and paying Patient-Centered Outcomes Research Institute (PCORI) fees for the previous year. For insured health plans, the issuer of the health insurance policy is responsible for the PCORI fee payment. For self-insured plans, the PCORI fee is paid by the plan sponsor. For plan years ending on or after Oct. 1, 2014, and before Oct. 1, 2015, the PCORI fee is $2. 08 multiplied by the average number of lives covered under the plan. July 31 PCORI Fee For plan years ending on or after Oct. 1, 2015, and before Oct. 1, 2016, the PCORI fee is $2. 17 multiplied by the average number of lives covered under the plan. 30

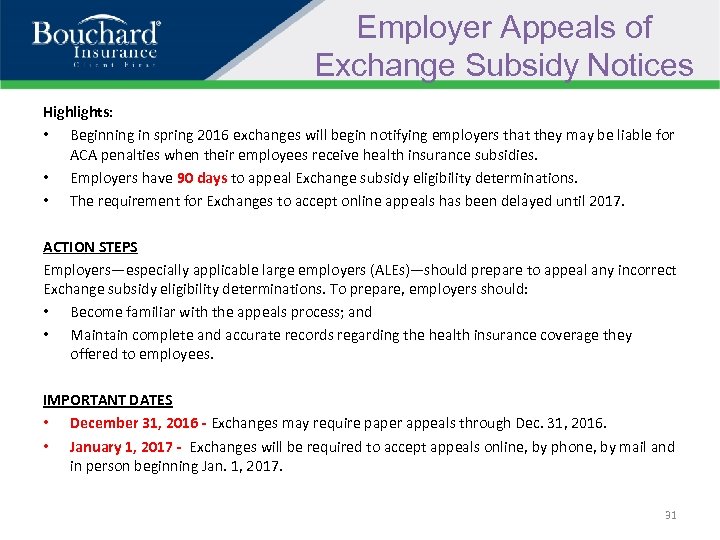

Employer Appeals of Exchange Subsidy Notices Highlights: • Beginning in spring 2016 exchanges will begin notifying employers that they may be liable for ACA penalties when their employees receive health insurance subsidies. • Employers have 90 days to appeal Exchange subsidy eligibility determinations. • The requirement for Exchanges to accept online appeals has been delayed until 2017. ACTION STEPS Employers—especially applicable large employers (ALEs)—should prepare to appeal any incorrect Exchange subsidy eligibility determinations. To prepare, employers should: • Become familiar with the appeals process; and • Maintain complete and accurate records regarding the health insurance coverage they offered to employees. IMPORTANT DATES • December 31, 2016 - Exchanges may require paper appeals through Dec. 31, 2016. • January 1, 2017 - Exchanges will be required to accept appeals online, by phone, by mail and in person beginning Jan. 1, 2017. 31

Employer Appeals of Exchange Subsidy Notices Highlights: • Beginning in spring 2016 exchanges will begin notifying employers that they may be liable for ACA penalties when their employees receive health insurance subsidies. • Employers have 90 days to appeal Exchange subsidy eligibility determinations. • The requirement for Exchanges to accept online appeals has been delayed until 2017. ACTION STEPS Employers—especially applicable large employers (ALEs)—should prepare to appeal any incorrect Exchange subsidy eligibility determinations. To prepare, employers should: • Become familiar with the appeals process; and • Maintain complete and accurate records regarding the health insurance coverage they offered to employees. IMPORTANT DATES • December 31, 2016 - Exchanges may require paper appeals through Dec. 31, 2016. • January 1, 2017 - Exchanges will be required to accept appeals online, by phone, by mail and in person beginning Jan. 1, 2017. 31

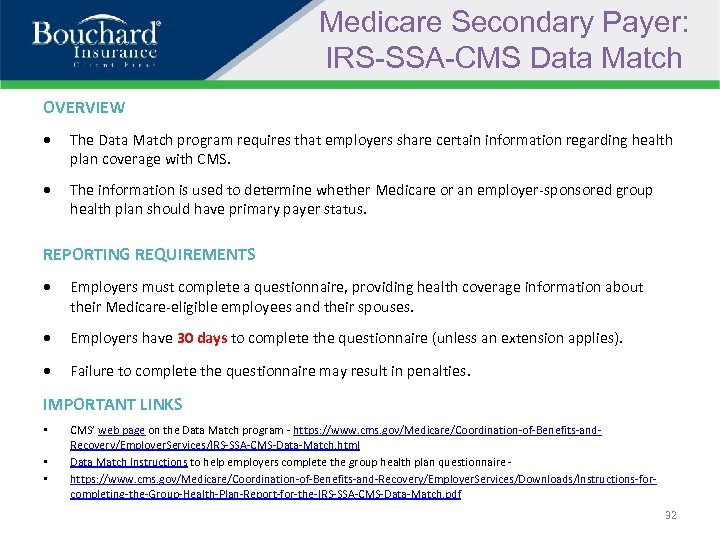

Medicare Secondary Payer: IRS-SSA-CMS Data Match OVERVIEW The Data Match program requires that employers share certain information regarding health plan coverage with CMS. The information is used to determine whether Medicare or an employer-sponsored group health plan should have primary payer status. REPORTING REQUIREMENTS Employers must complete a questionnaire, providing health coverage information about their Medicare-eligible employees and their spouses. Employers have 30 days to complete the questionnaire (unless an extension applies). Failure to complete the questionnaire may result in penalties. IMPORTANT LINKS • • • CMS’ web page on the Data Match program - https: //www. cms. gov/Medicare/Coordination-of-Benefits-and. Recovery/Employer. Services/IRS-SSA-CMS-Data-Match. html Data Match Instructions to help employers complete the group health plan questionnaire https: //www. cms. gov/Medicare/Coordination-of-Benefits-and-Recovery/Employer. Services/Downloads/Instructions-forcompleting-the-Group-Health-Plan-Report-for-the-IRS-SSA-CMS-Data-Match. pdf 32

Medicare Secondary Payer: IRS-SSA-CMS Data Match OVERVIEW The Data Match program requires that employers share certain information regarding health plan coverage with CMS. The information is used to determine whether Medicare or an employer-sponsored group health plan should have primary payer status. REPORTING REQUIREMENTS Employers must complete a questionnaire, providing health coverage information about their Medicare-eligible employees and their spouses. Employers have 30 days to complete the questionnaire (unless an extension applies). Failure to complete the questionnaire may result in penalties. IMPORTANT LINKS • • • CMS’ web page on the Data Match program - https: //www. cms. gov/Medicare/Coordination-of-Benefits-and. Recovery/Employer. Services/IRS-SSA-CMS-Data-Match. html Data Match Instructions to help employers complete the group health plan questionnaire https: //www. cms. gov/Medicare/Coordination-of-Benefits-and-Recovery/Employer. Services/Downloads/Instructions-forcompleting-the-Group-Health-Plan-Report-for-the-IRS-SSA-CMS-Data-Match. pdf 32

EEOC Finalizes Wellness Rules Under ADA and GINA On May 16, 2016, the Equal Employment Opportunity Commission (EEOC) issued final rules that describe how the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA) apply to employer-sponsored wellness programs. • • The final ADA rule provides guidance on the extent to which employers may offer incentives to employees to participate in wellness programs that ask them to answer disability-related questions or to undergo medical examinations. The final GINA rule clarifies that an employer may offer a limited incentive to an employee whose spouse provides information about his or her current or past health status as part of the employer’s wellness program. 33

EEOC Finalizes Wellness Rules Under ADA and GINA On May 16, 2016, the Equal Employment Opportunity Commission (EEOC) issued final rules that describe how the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA) apply to employer-sponsored wellness programs. • • The final ADA rule provides guidance on the extent to which employers may offer incentives to employees to participate in wellness programs that ask them to answer disability-related questions or to undergo medical examinations. The final GINA rule clarifies that an employer may offer a limited incentive to an employee whose spouse provides information about his or her current or past health status as part of the employer’s wellness program. 33

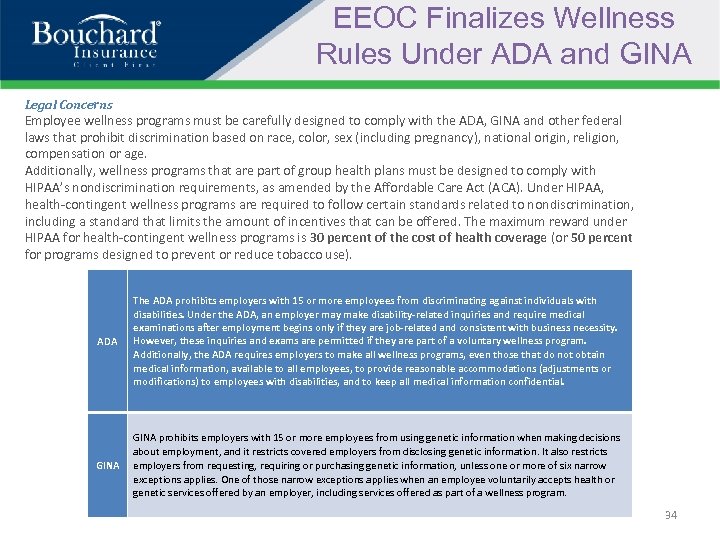

EEOC Finalizes Wellness Rules Under ADA and GINA Legal Concerns Employee wellness programs must be carefully designed to comply with the ADA, GINA and other federal laws that prohibit discrimination based on race, color, sex (including pregnancy), national origin, religion, compensation or age. Additionally, wellness programs that are part of group health plans must be designed to comply with HIPAA’s nondiscrimination requirements, as amended by the Affordable Care Act (ACA). Under HIPAA, health-contingent wellness programs are required to follow certain standards related to nondiscrimination, including a standard that limits the amount of incentives that can be offered. The maximum reward under HIPAA for health-contingent wellness programs is 30 percent of the cost of health coverage (or 50 percent for programs designed to prevent or reduce tobacco use). ADA The ADA prohibits employers with 15 or more employees from discriminating against individuals with disabilities. Under the ADA, an employer may make disability-related inquiries and require medical examinations after employment begins only if they are job-related and consistent with business necessity. However, these inquiries and exams are permitted if they are part of a voluntary wellness program. Additionally, the ADA requires employers to make all wellness programs, even those that do not obtain medical information, available to all employees, to provide reasonable accommodations (adjustments or modifications) to employees with disabilities, and to keep all medical information confidential. GINA prohibits employers with 15 or more employees from using genetic information when making decisions about employment, and it restricts covered employers from disclosing genetic information. It also restricts employers from requesting, requiring or purchasing genetic information, unless one or more of six narrow exceptions applies. One of those narrow exceptions applies when an employee voluntarily accepts health or genetic services offered by an employer, including services offered as part of a wellness program. 34

EEOC Finalizes Wellness Rules Under ADA and GINA Legal Concerns Employee wellness programs must be carefully designed to comply with the ADA, GINA and other federal laws that prohibit discrimination based on race, color, sex (including pregnancy), national origin, religion, compensation or age. Additionally, wellness programs that are part of group health plans must be designed to comply with HIPAA’s nondiscrimination requirements, as amended by the Affordable Care Act (ACA). Under HIPAA, health-contingent wellness programs are required to follow certain standards related to nondiscrimination, including a standard that limits the amount of incentives that can be offered. The maximum reward under HIPAA for health-contingent wellness programs is 30 percent of the cost of health coverage (or 50 percent for programs designed to prevent or reduce tobacco use). ADA The ADA prohibits employers with 15 or more employees from discriminating against individuals with disabilities. Under the ADA, an employer may make disability-related inquiries and require medical examinations after employment begins only if they are job-related and consistent with business necessity. However, these inquiries and exams are permitted if they are part of a voluntary wellness program. Additionally, the ADA requires employers to make all wellness programs, even those that do not obtain medical information, available to all employees, to provide reasonable accommodations (adjustments or modifications) to employees with disabilities, and to keep all medical information confidential. GINA prohibits employers with 15 or more employees from using genetic information when making decisions about employment, and it restricts covered employers from disclosing genetic information. It also restricts employers from requesting, requiring or purchasing genetic information, unless one or more of six narrow exceptions applies. One of those narrow exceptions applies when an employee voluntarily accepts health or genetic services offered by an employer, including services offered as part of a wellness program. 34

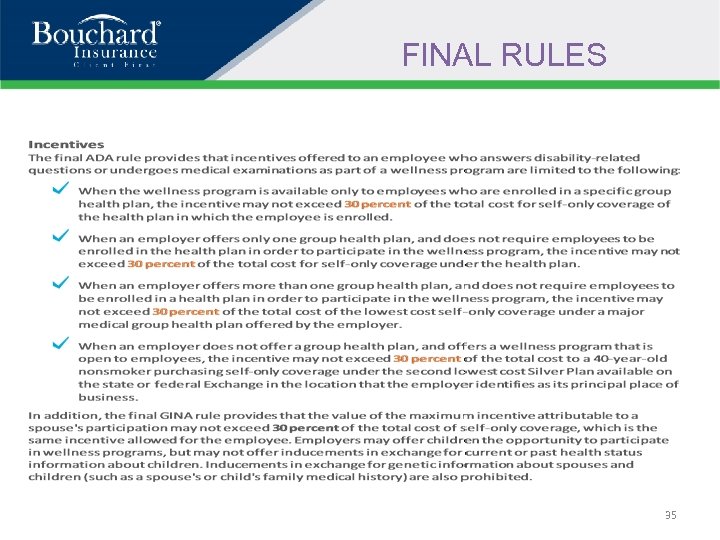

FINAL RULES 35

FINAL RULES 35

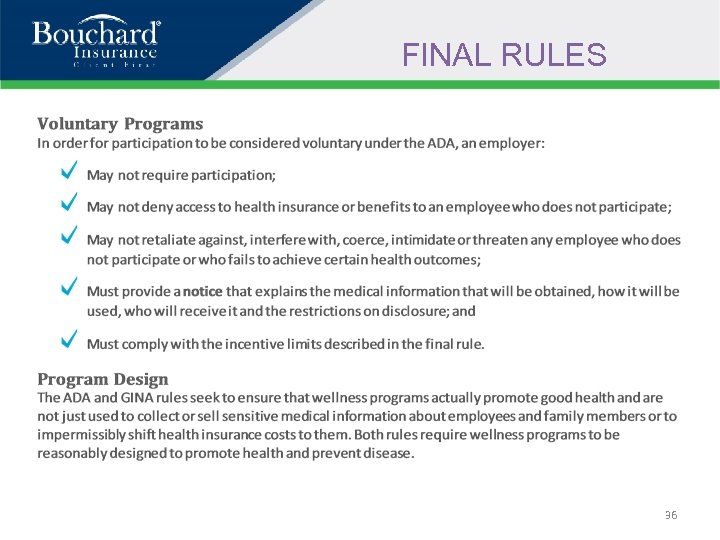

FINAL RULES 36

FINAL RULES 36

FINAL RULES 37

FINAL RULES 37

Additional Questions? 38

Additional Questions? 38

THANK YOU! 39

THANK YOU! 39