19c579589462ef22abe841d59781d628.ppt

- Количество слайдов: 14

Fox Horan & Camerini LLP The U. S. Business Partner’s Mindset Structuring Joint Ventures in Latin America from the Outside Investor’s Perspective AIJA Latin America Conference March 18, 2011 Eric D. Kuhn, Partner (Corporate Department) Kathleen M. Kundar, Partner (Litigation Department) © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP The U. S. Business Partner’s Mindset Structuring Joint Ventures in Latin America from the Outside Investor’s Perspective AIJA Latin America Conference March 18, 2011 Eric D. Kuhn, Partner (Corporate Department) Kathleen M. Kundar, Partner (Litigation Department) © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP I) Hypothetical Joint Venture between US and Lat. Am Partners • JV Purpose: – Manufacturing or services? – Enter local market for production and/or sale of product – Avoid high tariffs, access local distribution channels for market – Risk and cost sharing (particularly with manufacturing JV) • US Partner – – Financial or strategic? Financial partner has unique set of objectives Contribution: Capital Managerial/training Technical IP/know-how • – Lat. Am partner Contribution: Capital and property Knowledge of local market and customs, logistical support Workforce Political access and regulatory acceptability • • – – Government participation as JV partner or source of credit? Bank or other outside lending sources required? Bank requirements (e. g. , parent guarantees or other credit support) Other investors: require a more complicated capital structure? © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP I) Hypothetical Joint Venture between US and Lat. Am Partners • JV Purpose: – Manufacturing or services? – Enter local market for production and/or sale of product – Avoid high tariffs, access local distribution channels for market – Risk and cost sharing (particularly with manufacturing JV) • US Partner – – Financial or strategic? Financial partner has unique set of objectives Contribution: Capital Managerial/training Technical IP/know-how • – Lat. Am partner Contribution: Capital and property Knowledge of local market and customs, logistical support Workforce Political access and regulatory acceptability • • – – Government participation as JV partner or source of credit? Bank or other outside lending sources required? Bank requirements (e. g. , parent guarantees or other credit support) Other investors: require a more complicated capital structure? © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals • Mindset – Accustomed to business relationships based on principles of contractual law and freedom – Expects JV agreement to provide for all material aspects of JV relationship – Contrary to M&A context, US Partner will not want to sue (“nuclear option”)— tantamount to terminating JV – US Partner will seek extensive rights to build negotiating leverage – US Partner development officer negotiating the deal may have personal stake in JV outcome – Impact on Process: Outgrowth of mindset of US Partner Extensive Due diligence Long-form documentation (US Partner will want to prepare first drafts of key documents) Considerable additional expense for JV transaction and operation © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals • Mindset – Accustomed to business relationships based on principles of contractual law and freedom – Expects JV agreement to provide for all material aspects of JV relationship – Contrary to M&A context, US Partner will not want to sue (“nuclear option”)— tantamount to terminating JV – US Partner will seek extensive rights to build negotiating leverage – US Partner development officer negotiating the deal may have personal stake in JV outcome – Impact on Process: Outgrowth of mindset of US Partner Extensive Due diligence Long-form documentation (US Partner will want to prepare first drafts of key documents) Considerable additional expense for JV transaction and operation © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals (continued) • Goals – Governance: Majority control (perhaps take 100% over time, if – permissible) Economic return: During JV lifetime: maximize efficiency of distributions flotation or trade sale location, US Partner sale/exit rights) Exit: US Partner will want to maximize likelihood of ■ Structure of investment (entity type and ■ transparency and compliance with US laws Operation of JV company to ensure Act (See next slide) • Foreign Corrupt Practices • Sarbanes-Oxley • Hart-Scott Rodino/Antitrust • Act/OFAC environmental and other norms and standards ■ cost and process Trading with the Enemy • • Export Controls Other: Fair trade, Implications: considerable additional – Protect technology, trade secrets and other IP – Limited liability (vis-à-vis third parties, government, employees, etc. ) 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383 © 2011 Fox Horan & Camerini LLP | Avoid Nightmare! –

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals (continued) • Goals – Governance: Majority control (perhaps take 100% over time, if – permissible) Economic return: During JV lifetime: maximize efficiency of distributions flotation or trade sale location, US Partner sale/exit rights) Exit: US Partner will want to maximize likelihood of ■ Structure of investment (entity type and ■ transparency and compliance with US laws Operation of JV company to ensure Act (See next slide) • Foreign Corrupt Practices • Sarbanes-Oxley • Hart-Scott Rodino/Antitrust • Act/OFAC environmental and other norms and standards ■ cost and process Trading with the Enemy • • Export Controls Other: Fair trade, Implications: considerable additional – Protect technology, trade secrets and other IP – Limited liability (vis-à-vis third parties, government, employees, etc. ) 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383 © 2011 Fox Horan & Camerini LLP | Avoid Nightmare! –

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals (continued) ― U. S. Legal Considerations • Foreign Corrupt Practices Act (FCPA) – Prohibits payments to foreign officials or candidates for public office with intention to obtain, direct or preserve business – Imposes records keeping obligations of all transactions conducted in foreign countries – Covers activities of agents of US companies. May subject JV or parent to civil and criminal liability. US Partner likely to require: Due diligence and representations and warranties on past practices, and forward-looking covenants Written internal guidelines for the JV company • Export Controls – May affect where JV Company can do business and to whom disclosure of information is made – Regulations regarding export of certain commodities with military or other applications • Sarbanes-Oxley: Requires certain internal controls and procedures on financial reporting • Hart-Scott Rodino and foreign antitrust law – Sharing by competitors of proprietary information relevant to core competition concerns such as pricing, customer and introduction of new products can lead to criminal liability and treble damages – US notification requirements if size-of-party/size-of-transaction thresholds are met (DOJ and FTC) • Trading with the Enemy Act/United States Treasury Department's Office of Foreign Assets Control (OFAC)/Anti-boycott laws – Due diligence on business partners – Representations and warranties on no transactions with nations sanctioned by the U. S. or individuals on the Specially Designated Nationals and Blocked Persons ("SDN List") • Other: child labor, environmental laws and similar norms (particularly for US public company or financial investor) – US Partner may require that JV company adhere to certain guidelines and standards in these areas as a public © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383 relations matter, particularly if publicly traded in the United States

Fox Horan & Camerini LLP II) The US Partner’s Mindset and Goals (continued) ― U. S. Legal Considerations • Foreign Corrupt Practices Act (FCPA) – Prohibits payments to foreign officials or candidates for public office with intention to obtain, direct or preserve business – Imposes records keeping obligations of all transactions conducted in foreign countries – Covers activities of agents of US companies. May subject JV or parent to civil and criminal liability. US Partner likely to require: Due diligence and representations and warranties on past practices, and forward-looking covenants Written internal guidelines for the JV company • Export Controls – May affect where JV Company can do business and to whom disclosure of information is made – Regulations regarding export of certain commodities with military or other applications • Sarbanes-Oxley: Requires certain internal controls and procedures on financial reporting • Hart-Scott Rodino and foreign antitrust law – Sharing by competitors of proprietary information relevant to core competition concerns such as pricing, customer and introduction of new products can lead to criminal liability and treble damages – US notification requirements if size-of-party/size-of-transaction thresholds are met (DOJ and FTC) • Trading with the Enemy Act/United States Treasury Department's Office of Foreign Assets Control (OFAC)/Anti-boycott laws – Due diligence on business partners – Representations and warranties on no transactions with nations sanctioned by the U. S. or individuals on the Specially Designated Nationals and Blocked Persons ("SDN List") • Other: child labor, environmental laws and similar norms (particularly for US public company or financial investor) – US Partner may require that JV company adhere to certain guidelines and standards in these areas as a public © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383 relations matter, particularly if publicly traded in the United States

Fox Horan & Camerini LLP III) JV Structure – What, Where, and under What Law? • US Partner will want a legally distinct JV entity – Standard reasons (i. e. , limited liability) • US Partner (or local partner) may seek – Host country JV entity and operative agreements under host country law (most common) – of another jurisdiction (e. g. , Cayman Islands) Alternatives: Offshore JV entity and operative agreement governed by law Delaware/USA, U. K. , Spain, Host country JV entity with quotaholders’/shareholders’ agreement governed by other law ■ Likely scenario: JV partner has assets offshore against which to enforce a judgment ■ New York General Obligations Law § 5 -1401: Choice of New York law upheld in commercial contracts of at least US $250, 000 • Factors – Taxes – Pass-through taxation desirable for net income and losses – directors Enforceability of JV agreement (perceived risk of adverse local outcome) Governance issues examples may include: ■ minority consent rights ■ right to appoint independent auditor ■ obligation to have employees on board of – Exit and participation issues (put and call, drag along rights) Up-front financing; future access of equity markets (is IPO planned? ) – Host country stability, potential for change in tax law/expropriation © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP III) JV Structure – What, Where, and under What Law? • US Partner will want a legally distinct JV entity – Standard reasons (i. e. , limited liability) • US Partner (or local partner) may seek – Host country JV entity and operative agreements under host country law (most common) – of another jurisdiction (e. g. , Cayman Islands) Alternatives: Offshore JV entity and operative agreement governed by law Delaware/USA, U. K. , Spain, Host country JV entity with quotaholders’/shareholders’ agreement governed by other law ■ Likely scenario: JV partner has assets offshore against which to enforce a judgment ■ New York General Obligations Law § 5 -1401: Choice of New York law upheld in commercial contracts of at least US $250, 000 • Factors – Taxes – Pass-through taxation desirable for net income and losses – directors Enforceability of JV agreement (perceived risk of adverse local outcome) Governance issues examples may include: ■ minority consent rights ■ right to appoint independent auditor ■ obligation to have employees on board of – Exit and participation issues (put and call, drag along rights) Up-front financing; future access of equity markets (is IPO planned? ) – Host country stability, potential for change in tax law/expropriation © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? • Governance: US Partner will predictably seek majority control – Board: US Partner will likely request ability to appoint a majority of directors or chairman with tie-breaking vote – Consent rights: US Partner to negotiate for short list, with high thresholds Sale of business/assets/change in control Change in nature of business Change in share capital Liquidation/dissolution Material acquisitions and capital expenditures Material debt/guarantees Related party transactions Change in auditors Business plan (US Partner to resist) © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? • Governance: US Partner will predictably seek majority control – Board: US Partner will likely request ability to appoint a majority of directors or chairman with tie-breaking vote – Consent rights: US Partner to negotiate for short list, with high thresholds Sale of business/assets/change in control Change in nature of business Change in share capital Liquidation/dissolution Material acquisitions and capital expenditures Material debt/guarantees Related party transactions Change in auditors Business plan (US Partner to resist) © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Management Retention and Motivation – US Partner relies on local management to develop JV business Consider whether local law requires a resident CEO – US Partner will want final control and to provide appropriate incentives – covenants (non- Traditional method in the US – employment agreement for salary, fixed term with negative competition/solicitation/disclosure) – to unavailable US company likely to prefer: Employment agreement for a short period of time Incentives through share option plans tied to results Alternatives to actual stock (e. g. , phantom stock or cash payments) may be preferable having minority shareholders, particularly if a squeeze-out merger © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Management Retention and Motivation – US Partner relies on local management to develop JV business Consider whether local law requires a resident CEO – US Partner will want final control and to provide appropriate incentives – covenants (non- Traditional method in the US – employment agreement for salary, fixed term with negative competition/solicitation/disclosure) – to unavailable US company likely to prefer: Employment agreement for a short period of time Incentives through share option plans tied to results Alternatives to actual stock (e. g. , phantom stock or cash payments) may be preferable having minority shareholders, particularly if a squeeze-out merger © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Capital Structure; Funding Requirements – contributions (technology) – Up-front capital sources and amounts of initial contributions; valuation of in-kind Ongoing: US Partner may request funding obligations (plus guarantees, etc. ) At issue: Dilutive effect if local partner fails to do so. US Partner’s control over decision • Economic Return/Exit – depletion if provided cash capital During life of the JV Dividend policy: ■ US Partner will want broad discretion ■ Local partner will want to avoid working capital Preferred returns/liquidation preferences? US Partner may request vs. other contributions – Exit: Financial US Partner will want exit rights via trade sale or flotation. US Partner may request: Drag-along rights for sale to a third party Call option tied to specific event, expiration of time period or deadlock on supermajority vote item Right of first offer vs. right of first refusal ■ Question: does host country require local partner, legally or otherwise? © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Capital Structure; Funding Requirements – contributions (technology) – Up-front capital sources and amounts of initial contributions; valuation of in-kind Ongoing: US Partner may request funding obligations (plus guarantees, etc. ) At issue: Dilutive effect if local partner fails to do so. US Partner’s control over decision • Economic Return/Exit – depletion if provided cash capital During life of the JV Dividend policy: ■ US Partner will want broad discretion ■ Local partner will want to avoid working capital Preferred returns/liquidation preferences? US Partner may request vs. other contributions – Exit: Financial US Partner will want exit rights via trade sale or flotation. US Partner may request: Drag-along rights for sale to a third party Call option tied to specific event, expiration of time period or deadlock on supermajority vote item Right of first offer vs. right of first refusal ■ Question: does host country require local partner, legally or otherwise? © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Termination Events: – Generally provide for buy-sell/put-call arrangements/sale/liquidation upon occurrence of specified events: JV dissolution Sale of all/substantially all of assets or change of control Change of control of JV partner IPO or other specific event (or failure to meet targets) Persistent use of vetoes/deadlock on supermajority vote item Nationalization or expropriation of venture or its assets Imposition of price or currency controls in host country – • Issues: Valuation methodology for puts and calls Does host country law require a local partner? Does JV partner have the resources to purchase shares? Non-competition and Exclusivity: – Restrict local partner from competing with JV Company (e. g. , in case of buy-out) – Restrict local partner to contribute/sell business opportunities relating to JV business to the JV company © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Termination Events: – Generally provide for buy-sell/put-call arrangements/sale/liquidation upon occurrence of specified events: JV dissolution Sale of all/substantially all of assets or change of control Change of control of JV partner IPO or other specific event (or failure to meet targets) Persistent use of vetoes/deadlock on supermajority vote item Nationalization or expropriation of venture or its assets Imposition of price or currency controls in host country – • Issues: Valuation methodology for puts and calls Does host country law require a local partner? Does JV partner have the resources to purchase shares? Non-competition and Exclusivity: – Restrict local partner from competing with JV Company (e. g. , in case of buy-out) – Restrict local partner to contribute/sell business opportunities relating to JV business to the JV company © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • IP/Technology/Know-How – For US Partner trying to enforce remedies, either at exit or during lifetime of JV company, it is probably too late Uncertain host country law and biases against US Partner Local remedies hard to obtain and enforce Trust is essential – may not be able to avoid loss of IP − • • Steps to avoid a problem Identify sensitive IP (technology and know-how) and its useful life Due diligence Limited license, not a transfer of IP ■ Duration: co-terminous with JV agreement ■ Improvements: US Partner to own improvements and derivative works ■ Do local technology transfer laws apply (e. g. : deemed transfer after 5 year license term) Does local law give licensee perpetual rights to IP after a certain number of years? Restructure relationship to avoid “license” characterization Covenants by local JV partner not to misappropriate technology JV Personnel: Limit number of people who are provided with IP Strict non-compete/non-disclosure agreements IV) Third Party Consultants/Manufacturers: Ensure work-for-hire doctrine applies or put in place contractual equivalent IV) Enforcement: Determine enforcement potential in host country Keep IP offshore (source codes, software applications) Divide up IP to avoid reverse engineering © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • IP/Technology/Know-How – For US Partner trying to enforce remedies, either at exit or during lifetime of JV company, it is probably too late Uncertain host country law and biases against US Partner Local remedies hard to obtain and enforce Trust is essential – may not be able to avoid loss of IP − • • Steps to avoid a problem Identify sensitive IP (technology and know-how) and its useful life Due diligence Limited license, not a transfer of IP ■ Duration: co-terminous with JV agreement ■ Improvements: US Partner to own improvements and derivative works ■ Do local technology transfer laws apply (e. g. : deemed transfer after 5 year license term) Does local law give licensee perpetual rights to IP after a certain number of years? Restructure relationship to avoid “license” characterization Covenants by local JV partner not to misappropriate technology JV Personnel: Limit number of people who are provided with IP Strict non-compete/non-disclosure agreements IV) Third Party Consultants/Manufacturers: Ensure work-for-hire doctrine applies or put in place contractual equivalent IV) Enforcement: Determine enforcement potential in host country Keep IP offshore (source codes, software applications) Divide up IP to avoid reverse engineering © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Dispute Resolution – How to Enforce the Business Deal − Forum Selection Where assets to satisfy a judgment? Local bias against the US (Venezuela, Bolivia? ) Ability to enforce: Damages vs. injunction NY General Obligations Rule § 1402 − Consent to forum jurisdiction and appoint agent for service of process − Applicable law governing contract: Non-Lat. Am jurisdiction may be preferred − Mediation before adversarial proceedings 90 % of NY litigators had a positive view of mediation in a 2010 NY State Bar Association Survey © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) • Dispute Resolution – How to Enforce the Business Deal − Forum Selection Where assets to satisfy a judgment? Local bias against the US (Venezuela, Bolivia? ) Ability to enforce: Damages vs. injunction NY General Obligations Rule § 1402 − Consent to forum jurisdiction and appoint agent for service of process − Applicable law governing contract: Non-Lat. Am jurisdiction may be preferred − Mediation before adversarial proceedings 90 % of NY litigators had a positive view of mediation in a 2010 NY State Bar Association Survey © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

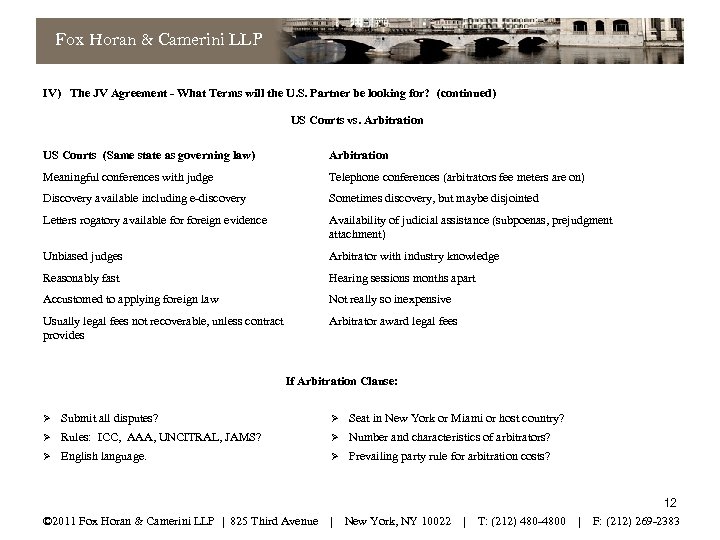

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) US Courts vs. Arbitration US Courts (Same state as governing law) Arbitration Meaningful conferences with judge Telephone conferences (arbitrators fee meters are on) Discovery available including e-discovery Sometimes discovery, but maybe disjointed Letters rogatory available foreign evidence Availability of judicial assistance (subpoenas, prejudgment attachment) Unbiased judges Arbitrator with industry knowledge Reasonably fast Hearing sessions months apart Accustomed to applying foreign law Not really so inexpensive Usually legal fees not recoverable, unless contract provides Arbitrator award legal fees If Arbitration Clause: Submit all disputes? Seat in New York or Miami or host country? Rules: ICC, AAA, UNCITRAL, JAMS? Number and characteristics of arbitrators? English language. Prevailing party rule for arbitration costs? 12 © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP IV) The JV Agreement - What Terms will the U. S. Partner be looking for? (continued) US Courts vs. Arbitration US Courts (Same state as governing law) Arbitration Meaningful conferences with judge Telephone conferences (arbitrators fee meters are on) Discovery available including e-discovery Sometimes discovery, but maybe disjointed Letters rogatory available foreign evidence Availability of judicial assistance (subpoenas, prejudgment attachment) Unbiased judges Arbitrator with industry knowledge Reasonably fast Hearing sessions months apart Accustomed to applying foreign law Not really so inexpensive Usually legal fees not recoverable, unless contract provides Arbitrator award legal fees If Arbitration Clause: Submit all disputes? Seat in New York or Miami or host country? Rules: ICC, AAA, UNCITRAL, JAMS? Number and characteristics of arbitrators? English language. Prevailing party rule for arbitration costs? 12 © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP Eric D. Kuhn’s practice is focused on advising non. Kathleen M. Kundar, a litigation partner of the firm, U. S. corporate clients (primarily from Europe and Latin has handled business disputes relating to international America) on a broad range of matters as they establish their has her of work transactions throughout Much career. her presence and grow their operations in the United States. involved financial services products such as performance bonds, letters of credit, promissory notes, loans, factoring agreements and other instruments and business contracts. As such, Mr. Kuhn advises such clients on extraordinary transactions (e. g. , M&A and joint ventures) and other, often smaller, matters (e. g. , She was a senior member of the firm’s trial team that structuring of entities for inbound investment; obtained a judgment for US $374 million on surety bonds covering preparation of shareholder and operating agreements for such a construction project for Petrobas, the Brazilian oil company. As in entities; and the preparation of commercial and other agreements, that case, her work often presents letters rogatory, concurrent such as manufacturing, distribution, employment, consulting, license proceedings in the U. S. and foreign jurisdictions, procedural treaties and confidentiality agreements). and jurisdictional issues. Before joining the Firm, Mr. Kuhn worked for over five years in the Milan and Rome, Italy offices of two large, multinational U. S. law firms, where he represented industrial clients, banks and private equity and other investment firms in inbound and outbound crossborder transactions, and over six years in the New York offices of such law firms working with similar corporate clientele in international transactions, with an emphasis on Argentina, Mexico and other Latin American jurisdictions. Mr. Kuhn graduated from the University of Pennsylvania (B. A. summa cum laude, 1993) and Boston University School of Law (J. D. magna cum laude, Law Review, 1997). He is admitted to the bar in New York and Massachusetts, serves on the Foreign & Comparative Law Committee of the Bar of the City of New York, of which he is a member, as is a member of the American Bar Association. Mr. Kuhn is fluent in Spanish and Italian and is a dual citizen of the United States and Italy. Ms. Kundar also works regularly on litigation involving issues of commercial fraud. Many of her cases have required obtaining prejudgment attachment of assets, a procedure which often is available under New York law against foreign defendants and when used successfully gives the client a true remedy. Another aspect of business in which she is involved is representing management in employment disputes and in day-to-day advice on discipline, discharge, downsizing, confidentiality, non-competition and other matters involved in the employer-employee relationship. Since her specialty is litigation, her advice to our employment clients is focused on what conduct leads to the courtroom and how the employer can avoid being there. But when a client has been sued on an employment matter, her defense of the client is determined and vigorous. 13 © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383

Fox Horan & Camerini LLP Eric D. Kuhn’s practice is focused on advising non. Kathleen M. Kundar, a litigation partner of the firm, U. S. corporate clients (primarily from Europe and Latin has handled business disputes relating to international America) on a broad range of matters as they establish their has her of work transactions throughout Much career. her presence and grow their operations in the United States. involved financial services products such as performance bonds, letters of credit, promissory notes, loans, factoring agreements and other instruments and business contracts. As such, Mr. Kuhn advises such clients on extraordinary transactions (e. g. , M&A and joint ventures) and other, often smaller, matters (e. g. , She was a senior member of the firm’s trial team that structuring of entities for inbound investment; obtained a judgment for US $374 million on surety bonds covering preparation of shareholder and operating agreements for such a construction project for Petrobas, the Brazilian oil company. As in entities; and the preparation of commercial and other agreements, that case, her work often presents letters rogatory, concurrent such as manufacturing, distribution, employment, consulting, license proceedings in the U. S. and foreign jurisdictions, procedural treaties and confidentiality agreements). and jurisdictional issues. Before joining the Firm, Mr. Kuhn worked for over five years in the Milan and Rome, Italy offices of two large, multinational U. S. law firms, where he represented industrial clients, banks and private equity and other investment firms in inbound and outbound crossborder transactions, and over six years in the New York offices of such law firms working with similar corporate clientele in international transactions, with an emphasis on Argentina, Mexico and other Latin American jurisdictions. Mr. Kuhn graduated from the University of Pennsylvania (B. A. summa cum laude, 1993) and Boston University School of Law (J. D. magna cum laude, Law Review, 1997). He is admitted to the bar in New York and Massachusetts, serves on the Foreign & Comparative Law Committee of the Bar of the City of New York, of which he is a member, as is a member of the American Bar Association. Mr. Kuhn is fluent in Spanish and Italian and is a dual citizen of the United States and Italy. Ms. Kundar also works regularly on litigation involving issues of commercial fraud. Many of her cases have required obtaining prejudgment attachment of assets, a procedure which often is available under New York law against foreign defendants and when used successfully gives the client a true remedy. Another aspect of business in which she is involved is representing management in employment disputes and in day-to-day advice on discipline, discharge, downsizing, confidentiality, non-competition and other matters involved in the employer-employee relationship. Since her specialty is litigation, her advice to our employment clients is focused on what conduct leads to the courtroom and how the employer can avoid being there. But when a client has been sued on an employment matter, her defense of the client is determined and vigorous. 13 © 2011 Fox Horan & Camerini LLP | 825 Third Avenue | New York, NY 10022 | T: (212) 480 -4800 | F: (212) 269 -2383