semifinal22222222.pptx

- Количество слайдов: 8

, “Fourfold” team

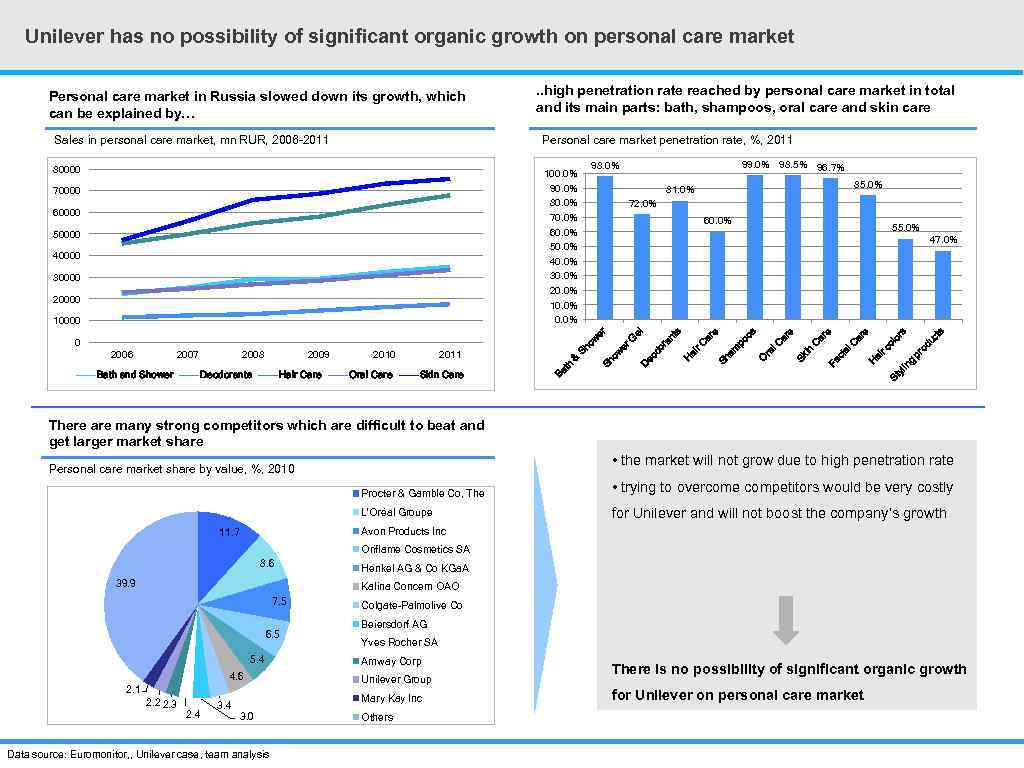

Unilever has no possibility of significant organic growth on personal care market Personal care market in Russia slowed down its growth, which can be explained by… . . high penetration rate reached by personal care market in total and its main parts: bath, shampoos, oral care and skin care Sales in personal care market, mn RUR, 2006 -2011 Personal care market penetration rate, %, 2011 80000 100. 0% 90. 0% 80. 0% 70. 0% 60. 0% 50. 0% 40. 0% 30. 0% 20. 0% 10. 0% ts co od uc lo rs e St yl in g pr ai r Fa H ci al C ar ar e C in Sk ra l C ar e os O am po e ar Sh G r C ai H S ow er Sh Skin Care Oral Care Hair Care 2011 Deodorants 2010 & 2009 th Bath and Shower 2008 Ba 2007 2006 ho 0 el w er 10000 nt s 20000 30000 55. 0% 47. 0% ra 40000 60. 0% do 50000 72. 0% D eo 60000 85. 0% 81. 0% 70000 99. 0% 98. 5% 96. 7% 98. 0% There are many strong competitors which are difficult to beat and get larger market share • the market will not grow due to high penetration rate Personal care market share by value, %, 2010 Procter & Gamble Co, The • trying to overcome competitors would be very costly L'Oréal Groupe for Unilever and will not boost the company’s growth Avon Products Inc 11. 7 Oriflame Cosmetics SA 8. 6 39. 9 Henkel AG & Co KGa. A Kalina Concern OAO 7. 5 6. 5 5. 4 4. 6 2. 1 2. 2 2. 3 2. 4 3. 4 Colgate-Palmolive Co Beiersdorf AG Yves Rocher SA Amway Corp Unilever Group Mary Kay Inc 3. 0 Data source: Euromonitor, , Unilever case, team analysis Others There is no possibility of significant organic growth for Unilever on personal care market

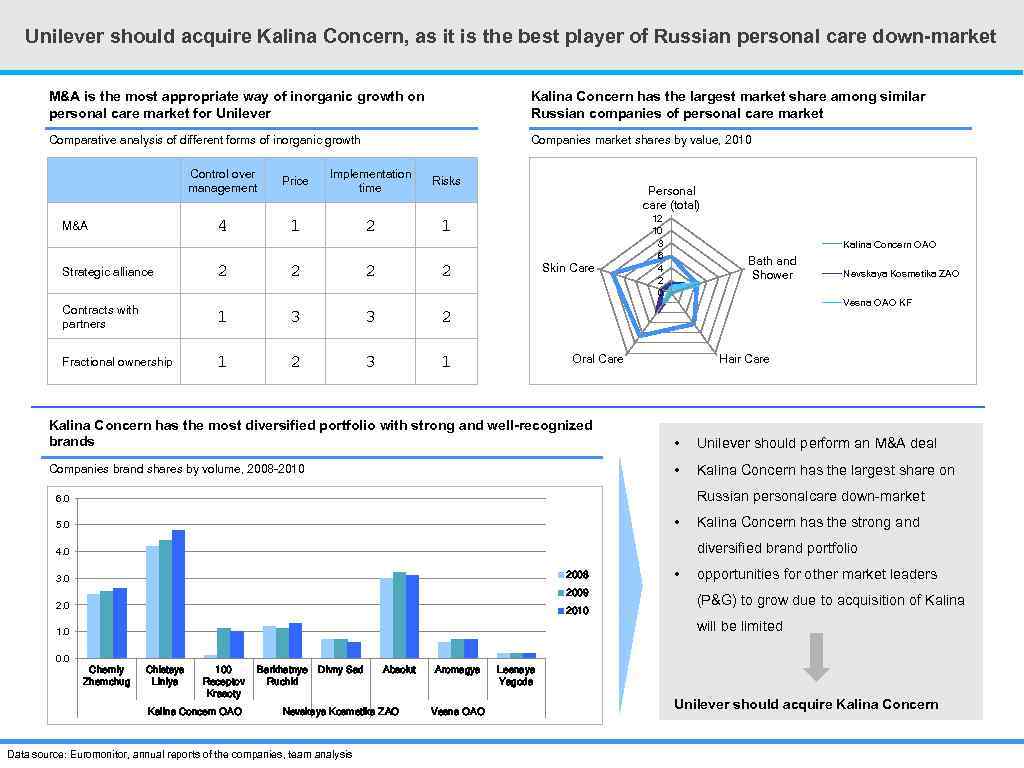

Unilever should acquire Kalina Concern, as it is the best player of Russian personal care down-market M&A is the most appropriate way of inorganic growth on personal care market for Unilever Kalina Concern has the largest market share among similar Russian companies of personal care market Comparative analysis of different forms of inorganic growth Companies market shares by value, 2010 Control over management Price Implementation time Risks 4 1 2 1 M&A Strategic alliance 2 2 2 Personal care (total) 2 Contracts with partners 1 3 3 1 2 3 1 Kalina Concern OAO Bath and Shower Nevskaya Kosmetika ZAO Vesna OAO KF 2 Fractional ownership Skin Care 12 10 8 6 4 2 0 Oral Care Hair Care Kalina Concern has the most diversified portfolio with strong and well-recognized brands • Unilever should perform an M&A deal Companies brand shares by volume, 2008 -2010 • Kalina Concern has the largest share on Russian personalcare down-market 6. 0 • 5. 0 Kalina Concern has the strong and diversified brand portfolio 4. 0 2008 3. 0 2009 2. 0 2010 • opportunities for other market leaders (P&G) to grow due to acquisition of Kalina will be limited 1. 0 0. 0 Cherniy Zhemchug Chistaya Liniya 100 Barkhatnye Divny Sad Receptov Ruchki Krasoty Kalina Concern OAO Absolut Nevskaya Kosmetika ZAO Data source: Euromonitor, annual reports of the companies, team analysis Aromagya Vesna OAO Lesnaya Yagoda Unilever should acquire Kalina Concern

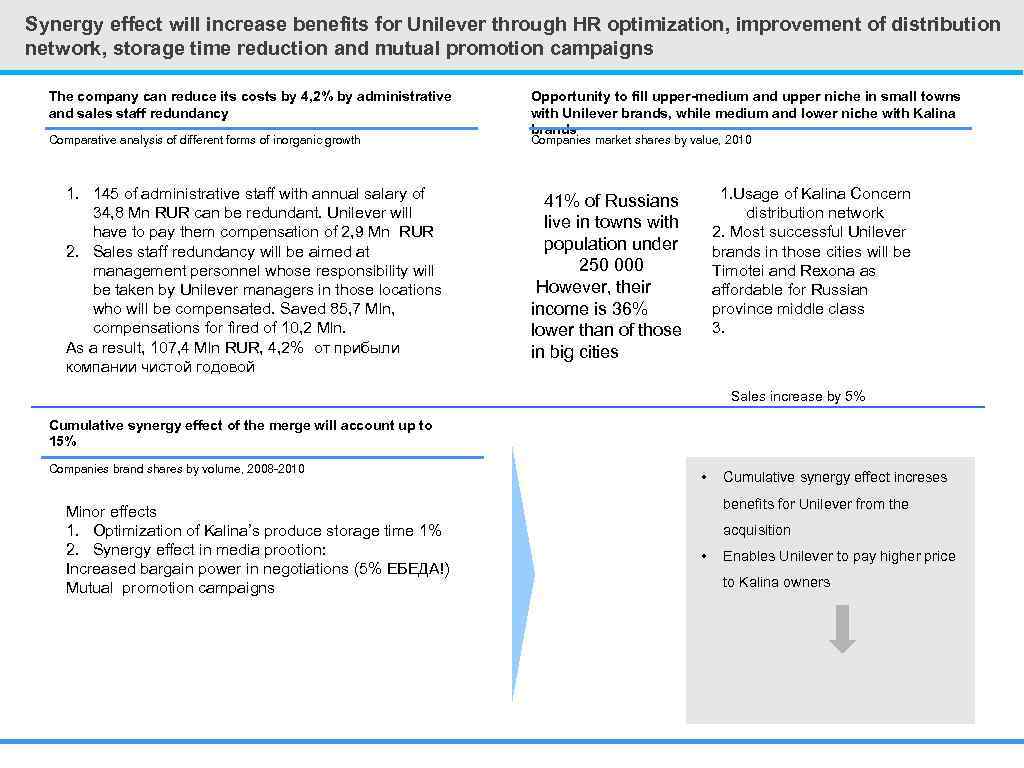

Synergy effect will increase benefits for Unilever through HR optimization, improvement of distribution network, storage time reduction and mutual promotion campaigns The company can reduce its costs by 4, 2% by administrative and sales staff redundancy Comparative analysis of different forms of inorganic growth 1. 145 of administrative staff with annual salary of 34, 8 Mn RUR can be redundant. Unilever will have to pay them compensation of 2, 9 Mn RUR 2. Sales staff redundancy will be aimed at management personnel whose responsibility will be taken by Unilever managers in those locations who will be compensated. Saved 85, 7 Mln, compensations for fired of 10, 2 Mln. As a result, 107, 4 Mln RUR, 4, 2% от прибыли компании чистой годовой Opportunity to fill upper-medium and upper niche in small towns with Unilever brands, while medium and lower niche with Kalina brands Companies market shares by value, 2010 1. Usage of Kalina Concern distribution network 2. Most successful Unilever brands in those cities will be Timotei and Rexona as affordable for Russian province middle class 3. 41% of Russians live in towns with population under 250 000 However, their income is 36% lower than of those in big cities Sales increase by 5% Cumulative synergy effect of the merge will account up to 15% Companies brand shares by volume, 2008 -2010 Minor effects 1. Optimization of Kalina’s produce storage time 1% 2. Synergy effect in media prootion: Increased bargain power in negotiations (5% ЕБЕДА!) Mutual promotion campaigns • Cumulative synergy effect increses benefits for Unilever from the acquisition • Enables Unilever to pay higher price to Kalina owners

M&A is the most appropriate way of inorganic growth on personal care market for Unilever Kalina Concern has the largest market share among similar Russian companies of personal care market Comparative analysis of different forms of inorganic growth Companies market shares by value, 2010 Kalina Concern has the most diversified portfolio with strong and well-recognized brands Companies brand shares by volume, 2008 -2010 • Kalina Concern had sustainable growth of the market and brand share during 5 years • Profit of the company increased yearly Unilever has to concentrate on Kalina Concern OAO and try to merge with this company

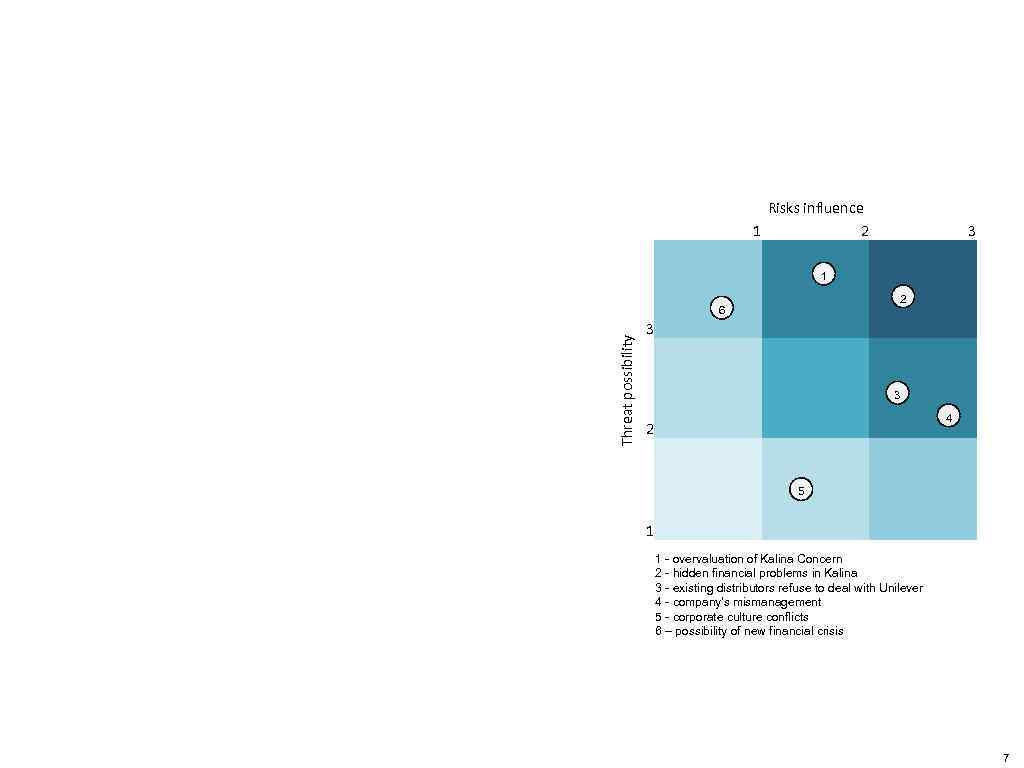

Risks influence 1 2 3 1 2 Threat possibility 6 3 3 2 4 5 1 1 - overvaluation of Kalina Concern 2 - hidden financial problems in Kalina 3 - existing distributors refuse to deal with Unilever 4 - company's mismanagement 5 - corporate culture conflicts 6 – possibility of new financial crisis 7

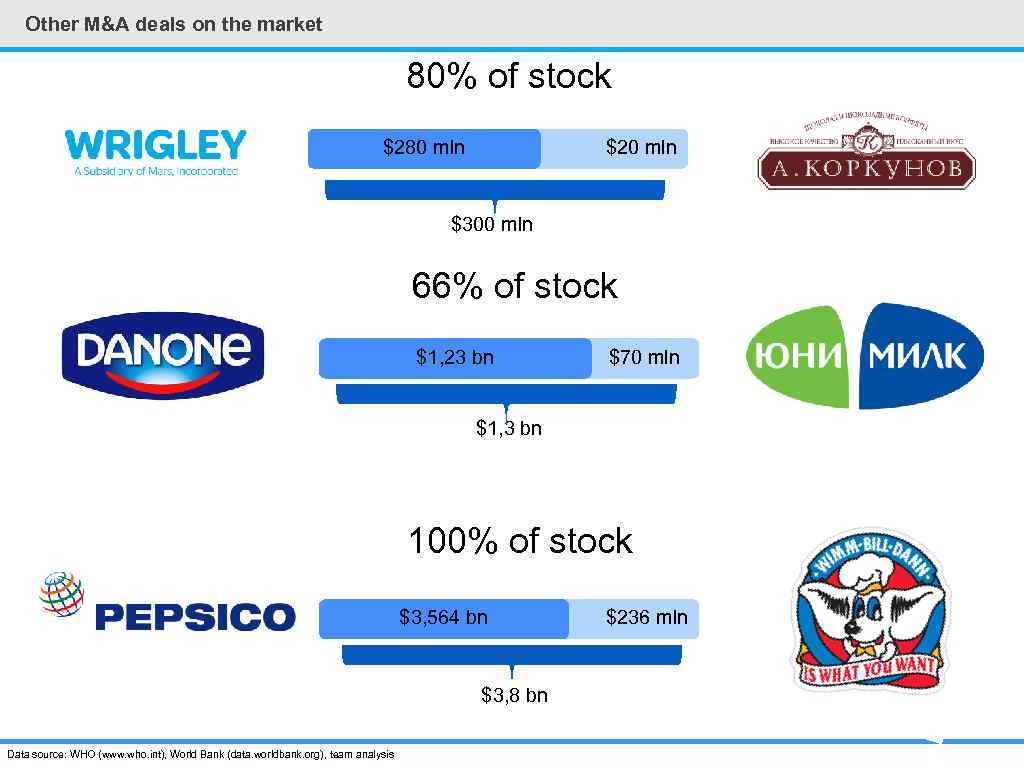

Other M&A deals on the market 80% of stock $280 mln $20 mln $300 mln 66% of stock $1, 23 bn $70 mln $1, 3 bn 100% of stock $3, 564 bn $3, 8 bn Data source: WHO (www. who. int), World Bank (data. worldbank. org), team analysis $236 mln

Our skills, experience and expertise allow us to solve problems of any difficulty Vorobyev Nikita nv 2909@gmail. com Trifanenko Evgeny warriorch@mail. ru Shirokikh Elena Elkind Dmitry lena. shirokikh@gmail. com elkind_dmitrii@mail. ru Responsibilities: analysis of Russian M&A deals and macroeconomic situation of the country Responsibilities: analysis of the alternatives of the deal and Russian personal care market players Responsibilities: personal care market analysis, presentation design Responsibilities: estimation of the synergy effect, defining the price of the deal Education: Higher School of Economics, World Economy & International Affairs department, 3 rd-year student Personal achievements and experience: Changellenge Cup Russia – 2012 – 3 rd place Changellenge Cup Moscow – 2012 – finalist Internship in Sanofi-Aventis Personal achievements and experience: Changellenge Cup Russia – 2012 – 3 rd place Changellenge Cup Moscow – 2012 – finalist Internship in Pw. C Personal achievements and experience: Changellenge Cup Russia – 2012 – 3 rd place Changellenge Cup Moscow – 2012 – finalist

semifinal22222222.pptx