Four tips for bond investors.pptx

- Количество слайдов: 6

FOUR TIPS FOR BOND INVESTORS by Olga Mykolaichuk

1. A bond’s yield can signal opportunity—as well as risk • There are three common measures of a bond’s yield: nominal yield, current yield, and yield to maturity (see table below for brief explanations). • In addition, the yield on certain types of bonds is measured differently: üZero-coupon bonds don’t pay interest. They are purchased at a steep discount to par. Their yield to maturity is the difference between their purchase price and the face value of the bond. üCallable bonds give the issuer the right to redeem the bond before its maturity date, which would unexpectedly give back a large cash flow to investors. These bonds are typically redeemed by the issuer in a low-rate environment, thus increasing an investor’s reinvestment risk, because the returned principal might have to be reinvested at lower rates. üMuni bonds are exempt from federal taxes, so it’s important to also look at their tax-equivalent yield. Consideration should also be given to whether the munis being weighed have their interest payments subject to the alternative minimum tax, as this could affect whether they will help you achieve your goal of minimizing taxes and maximizing returns.

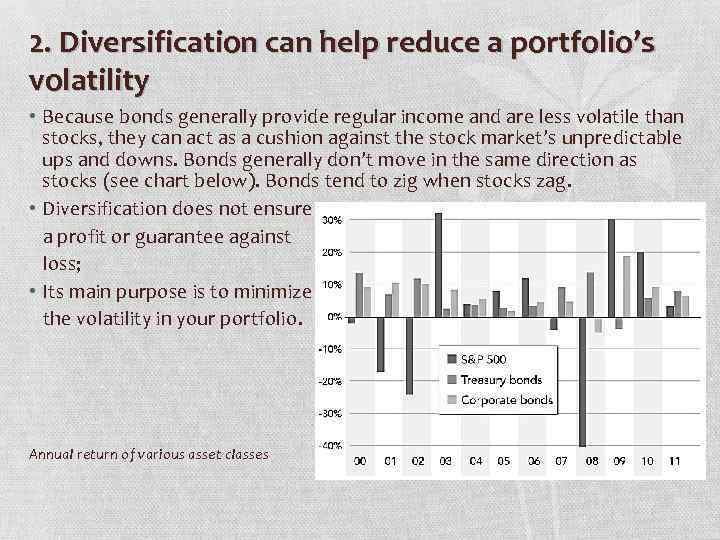

2. Diversification can help reduce a portfolio’s volatility • Because bonds generally provide regular income and are less volatile than stocks, they can act as a cushion against the stock market’s unpredictable ups and downs. Bonds generally don’t move in the same direction as stocks (see chart below). Bonds tend to zig when stocks zag. • Diversification does not ensure a profit or guarantee against loss; • Its main purpose is to minimize the volatility in your portfolio. Annual return of various asset classes

3. Do your research before buying • Investors tend to make the same mistakes when choosing bonds. They allow yield to drive their investment decision, they often don’t read fundamental research on the company or issuer before investing, and they depend too heavily on ratings from a nationally recognized statistical rating organization (NRSRO) such as Moody’s, Standard & Poor’s, or Fitch to make their decisions. • When buying corporate bonds consider: üHow current is the rating? üWhat has been the ratings trend for the issuer or bond? If a rating is old or if there is no pattern of upgrade or downgrade, you might need to do more homework before buying the bond. Then look at your bond’s yield compared with its benchmark or against similarly rated peers available in Fixed Income & Bond Markets research. • When buying muni bonds Unlike corporations, which are required to file financials quarterly, municipalities are required to file only yearly, but they aren’t closely regulated. In looking at muni ratings, note whether or not the bond is insured.

4. Consider liquidity, which varies among bonds • On any given day, a company’s stock or a U. S. Treasury bond can trade as many as 20 times in just a few seconds. • An active corporate bond might get 20 trades in several hours. • Some muni bonds might take several years to get 20 trades. • Most corporations issue debt in one or several maturities. • Also, commercial paper is issued daily, but it is very short term.

Thank you for your attention!

Four tips for bond investors.pptx