51da7c2a12303d92689d23776c06c808.ppt

- Количество слайдов: 20

Four Market Structures The focus of this lecture is the four market structures. Students will learn the characteristics of pure competition, pure monopoly, monopolistic competition, and oligopoly. Using the cost schedule from the previous lecture, the idea of profit maximization is explored. OBJECTIVES 1. Identify various market structures and their characteristics. 2. Be able to category firms into four market structures. 3. Describe the effects of imperfect competition upon the market and the firm. 4. Understand the pricing structure of the four structures. TOPICS Please read all the following topics. PERFECT COMPETITION CONT. PERFECT COMPETITION EXAMPLE PURE MONOPOLY EXAMPLE PRICE DISCRIMINATION MONOPOLISTIC COMPETITION OLIGOPOLY TECHNOLOGICAL DEVELOPMENT ECONOMIC EFFICIENCY

Four Market Structures The focus of this lecture is the four market structures. Students will learn the characteristics of pure competition, pure monopoly, monopolistic competition, and oligopoly. Using the cost schedule from the previous lecture, the idea of profit maximization is explored. OBJECTIVES 1. Identify various market structures and their characteristics. 2. Be able to category firms into four market structures. 3. Describe the effects of imperfect competition upon the market and the firm. 4. Understand the pricing structure of the four structures. TOPICS Please read all the following topics. PERFECT COMPETITION CONT. PERFECT COMPETITION EXAMPLE PURE MONOPOLY EXAMPLE PRICE DISCRIMINATION MONOPOLISTIC COMPETITION OLIGOPOLY TECHNOLOGICAL DEVELOPMENT ECONOMIC EFFICIENCY

Perfect Competition Pure or perfect competition is rare in the real world, but the model is important because it helps analyze industries with characteristics similar to pure competition. This model provides a context in which to apply revenue and cost concepts developed in the previous lecture. Examples of this model are stock market and agricultural industries. Characteristics 1. Many sellers: there are enough so that a single seller’s decision has no impact on market price. 2. Homogenous or standardized products: each seller’s product is identical to its competitors’. 3. Firms are price takers: individual firms must accept the market price and can exert no influence on price. 4. Free entry and exit: no significant barriers prevent firms from entering or leaving the industry. Demand The individual firm will view its demand as perfectly elastic. A perfectly elastic demand curve is a horizontal line at the price. The demand curve for the industry is not perfectly elastic, it only appears that way to the individual firms, since they must take the market price no matter what quantity they produce. Therefore, the firm’s demand curve is a horizontal line at the market price. Marginal revenue (MR) is the increase in total revenue resulting from a one-unit increase in output. Since the price is constant in the perfect competition. The increase in total revenue from producing 1 extra unit will equal to the price. Therefore, P= MR in perfect competition.

Perfect Competition Pure or perfect competition is rare in the real world, but the model is important because it helps analyze industries with characteristics similar to pure competition. This model provides a context in which to apply revenue and cost concepts developed in the previous lecture. Examples of this model are stock market and agricultural industries. Characteristics 1. Many sellers: there are enough so that a single seller’s decision has no impact on market price. 2. Homogenous or standardized products: each seller’s product is identical to its competitors’. 3. Firms are price takers: individual firms must accept the market price and can exert no influence on price. 4. Free entry and exit: no significant barriers prevent firms from entering or leaving the industry. Demand The individual firm will view its demand as perfectly elastic. A perfectly elastic demand curve is a horizontal line at the price. The demand curve for the industry is not perfectly elastic, it only appears that way to the individual firms, since they must take the market price no matter what quantity they produce. Therefore, the firm’s demand curve is a horizontal line at the market price. Marginal revenue (MR) is the increase in total revenue resulting from a one-unit increase in output. Since the price is constant in the perfect competition. The increase in total revenue from producing 1 extra unit will equal to the price. Therefore, P= MR in perfect competition.

Profit-Maximizing Output Short Run Analysis In the short run, the firm has fixed resources and maximizes profit or minimizes loss by adjusting output. Firms should produce if the difference between total revenue and total cost is profitable (EP >0), or if the loss is less than the fixed cost (EP>- FC). The firm should not produce, but should shut down in the short run if its loss exceeds its fixed costs. By shutting down, its loss will just equal those fixed costs. Fixed cost in real life would be rent of the office, business license fees, equipment lease, etc. These cost would have to be paid with or without any output. Therefore, fixed cost would be the loss of shut down at any time. If by producing one unit of output, this loss could be lowered, then this unit should be produced to minimize the loss. However, if by producing one unit of output, this loss would be higher , then this unit should not be produced. The firm should shut down, just pay for the fixed cost. If EP< - FC firm should shut down. Then its lost will be the Fixed cost. EP = - FC. In order for EP < - FC, market price, P, must be lower than the minimum AVC. If EP> - FC, firm should produce. That is when market price is greater than minimum AVC. Marginal revenue and marginal cost (MC) are compared to decide the profit-maximizing output. If MR > MC, then the firm should continue to produce. If MR = MC, then the firm should stop producing the additional unit. As the additional unit’s MC would be higher according to law of diminishing returns, MR would be less than MC; that is, the firm would loss profit by producing additional units. Therefore, this is the profit maximizing output level. If MR < MC, then the firm should lower its output. In conclusion: The shutdown point is the level of output and price at which the firm just covers its total variable cost. If the MR of the product is less than the minimum average variable cost (min AVC), the firm will shut down because this action minimizes the firm’s loss. In this case, the firm’s economic loss equals its total fixed costs. If MR < min AVC, then each additional unit produced would increase the loss. For pure competition, MR is equal to price as the firm is facing a perfectly elastic demand. Therefore, for short run, if Price < min AVC, then the firm should shut down. If Price > min AVC, then the firm should produce. Price and MC are compared to find the profit maximizing or loss minimizing output level. The supply curve of the pure competition firms would be the portion of the MC curve above the min AVC. 1. If EP < - FC or Market P < Min AVC, firm should shut down. Output = 0 , and EP = -FC 2. If EP > - FC or Market P > Min AVC, firm should produce. Firm's output level should be at where MR=MC or P=MC. Use EP = TR - TC to get economic profit of the firm.

Profit-Maximizing Output Short Run Analysis In the short run, the firm has fixed resources and maximizes profit or minimizes loss by adjusting output. Firms should produce if the difference between total revenue and total cost is profitable (EP >0), or if the loss is less than the fixed cost (EP>- FC). The firm should not produce, but should shut down in the short run if its loss exceeds its fixed costs. By shutting down, its loss will just equal those fixed costs. Fixed cost in real life would be rent of the office, business license fees, equipment lease, etc. These cost would have to be paid with or without any output. Therefore, fixed cost would be the loss of shut down at any time. If by producing one unit of output, this loss could be lowered, then this unit should be produced to minimize the loss. However, if by producing one unit of output, this loss would be higher , then this unit should not be produced. The firm should shut down, just pay for the fixed cost. If EP< - FC firm should shut down. Then its lost will be the Fixed cost. EP = - FC. In order for EP < - FC, market price, P, must be lower than the minimum AVC. If EP> - FC, firm should produce. That is when market price is greater than minimum AVC. Marginal revenue and marginal cost (MC) are compared to decide the profit-maximizing output. If MR > MC, then the firm should continue to produce. If MR = MC, then the firm should stop producing the additional unit. As the additional unit’s MC would be higher according to law of diminishing returns, MR would be less than MC; that is, the firm would loss profit by producing additional units. Therefore, this is the profit maximizing output level. If MR < MC, then the firm should lower its output. In conclusion: The shutdown point is the level of output and price at which the firm just covers its total variable cost. If the MR of the product is less than the minimum average variable cost (min AVC), the firm will shut down because this action minimizes the firm’s loss. In this case, the firm’s economic loss equals its total fixed costs. If MR < min AVC, then each additional unit produced would increase the loss. For pure competition, MR is equal to price as the firm is facing a perfectly elastic demand. Therefore, for short run, if Price < min AVC, then the firm should shut down. If Price > min AVC, then the firm should produce. Price and MC are compared to find the profit maximizing or loss minimizing output level. The supply curve of the pure competition firms would be the portion of the MC curve above the min AVC. 1. If EP < - FC or Market P < Min AVC, firm should shut down. Output = 0 , and EP = -FC 2. If EP > - FC or Market P > Min AVC, firm should produce. Firm's output level should be at where MR=MC or P=MC. Use EP = TR - TC to get economic profit of the firm.

Perfect Competition Cont. Following the rules discussed in the previous section. Here is an example. Firms fixed cost is $100, its min AVC is $55. If market price is 50 which is less than min AVC, the firm would loss $5 more by producing each unit. If the firm produces one unit, its total loss would be $5 plus $100 fixed cost. If the firm decides to shut down, its loss would be only $100 as the firm does not need to pay for the variable cost. Shut down would be the loss minimization strategy. If the market price is 60, the firm would lose $5 less by producing each unit. If the firm produces one unit, its total cost would be fixed cost less $5, which is $95. The firm is better off by producing, not shutting down. When the market price is higher than the minimum AVC, MR and MC should be compared to find out the optimal level of output. Long Run Analysis Obviously, the firm cannot be in loss for long. Three assumptions are made for the long run analysis: 1. Entry and exit are the only long run adjustments. 2. Firms in the industry have identical cost curves. 3. The industry is in constant return to scale. In long run, if economic profits are earned, firms enter the industry, which increases the market supply, causing the product price to go down. Until zero economic profits are earned, then the supply will be steady. If losses are incurred in the short run, firms will leave the industry which decreases the market supply, causing the product price to rise until losses disappear. This model is one of zero economic profits in long run. The long run equilibrium is achieved, the product price will be exactly equal to, and production will occur at, each firm’s point of minimum average total cost.

Perfect Competition Cont. Following the rules discussed in the previous section. Here is an example. Firms fixed cost is $100, its min AVC is $55. If market price is 50 which is less than min AVC, the firm would loss $5 more by producing each unit. If the firm produces one unit, its total loss would be $5 plus $100 fixed cost. If the firm decides to shut down, its loss would be only $100 as the firm does not need to pay for the variable cost. Shut down would be the loss minimization strategy. If the market price is 60, the firm would lose $5 less by producing each unit. If the firm produces one unit, its total cost would be fixed cost less $5, which is $95. The firm is better off by producing, not shutting down. When the market price is higher than the minimum AVC, MR and MC should be compared to find out the optimal level of output. Long Run Analysis Obviously, the firm cannot be in loss for long. Three assumptions are made for the long run analysis: 1. Entry and exit are the only long run adjustments. 2. Firms in the industry have identical cost curves. 3. The industry is in constant return to scale. In long run, if economic profits are earned, firms enter the industry, which increases the market supply, causing the product price to go down. Until zero economic profits are earned, then the supply will be steady. If losses are incurred in the short run, firms will leave the industry which decreases the market supply, causing the product price to rise until losses disappear. This model is one of zero economic profits in long run. The long run equilibrium is achieved, the product price will be exactly equal to, and production will occur at, each firm’s point of minimum average total cost.

Efficiency Analysis 1. Productive efficiency: occurs where P= min ATC. Perfect competitive firms will achieve productive efficiency as firms must use the least-cost technology or they won't survive. 2. Allocative efficiency: occurs where P = MC. Price represent the benefit that society gets from additional units of a product, MC represents the cost to society of other goods given up to produce this product. Dynamic adjustments will occur in this market structure when changes in demand, supply or technology occurs. Perfect competitive firms will achieve this efficiency. Since no explicit orders are given to the industry, "the Invisible Hand" works in this system. Even though both efficiencies are achieved in this system, the consumers are facing standard products, making shopping to be no fun at all. On the other hand, the consumers will receive the highest consumer surplus in this structure as the long run market price will be at the min ATC. Producers will receive the lowest producer surplus as consumers can easily find substitutes.

Efficiency Analysis 1. Productive efficiency: occurs where P= min ATC. Perfect competitive firms will achieve productive efficiency as firms must use the least-cost technology or they won't survive. 2. Allocative efficiency: occurs where P = MC. Price represent the benefit that society gets from additional units of a product, MC represents the cost to society of other goods given up to produce this product. Dynamic adjustments will occur in this market structure when changes in demand, supply or technology occurs. Perfect competitive firms will achieve this efficiency. Since no explicit orders are given to the industry, "the Invisible Hand" works in this system. Even though both efficiencies are achieved in this system, the consumers are facing standard products, making shopping to be no fun at all. On the other hand, the consumers will receive the highest consumer surplus in this structure as the long run market price will be at the min ATC. Producers will receive the lowest producer surplus as consumers can easily find substitutes.

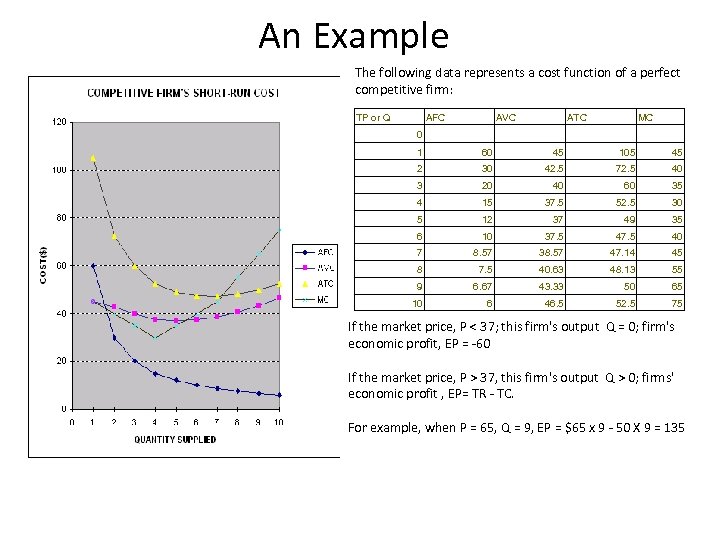

An Example The following data represents a cost function of a perfect competitive firm: TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 If the market price, P < 37; this firm's output Q = 0; firm's economic profit, EP = -60 If the market price, P > 37, this firm's output Q > 0; firms' economic profit , EP= TR - TC. For example, when P = 65, Q = 9, EP = $65 x 9 - 50 X 9 = 135

An Example The following data represents a cost function of a perfect competitive firm: TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 If the market price, P < 37; this firm's output Q = 0; firm's economic profit, EP = -60 If the market price, P > 37, this firm's output Q > 0; firms' economic profit , EP= TR - TC. For example, when P = 65, Q = 9, EP = $65 x 9 - 50 X 9 = 135

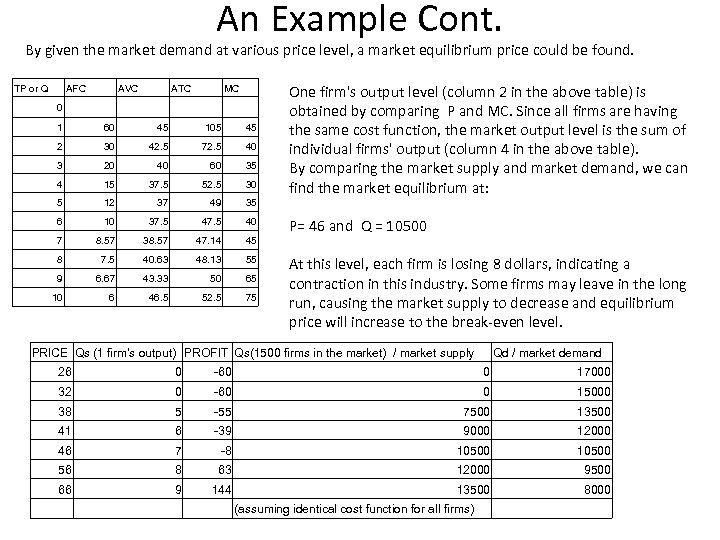

An Example Cont. By given the market demand at various price level, a market equilibrium price could be found. TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 One firm's output level (column 2 in the above table) is obtained by comparing P and MC. Since all firms are having the same cost function, the market output level is the sum of individual firms' output (column 4 in the above table). By comparing the market supply and market demand, we can find the market equilibrium at: P= 46 and Q = 10500 At this level, each firm is losing 8 dollars, indicating a contraction in this industry. Some firms may leave in the long run, causing the market supply to decrease and equilibrium price will increase to the break-even level. PRICE Qs (1 firm's output) PROFIT Qs(1500 firms in the market) / market supply Qd / market demand 26 0 -60 0 17000 32 0 -60 0 15000 38 5 -55 7500 13500 41 6 -39 9000 12000 46 7 -8 10500 56 8 63 12000 9500 66 9 144 13500 8000 (assuming identical cost function for all firms)

An Example Cont. By given the market demand at various price level, a market equilibrium price could be found. TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 One firm's output level (column 2 in the above table) is obtained by comparing P and MC. Since all firms are having the same cost function, the market output level is the sum of individual firms' output (column 4 in the above table). By comparing the market supply and market demand, we can find the market equilibrium at: P= 46 and Q = 10500 At this level, each firm is losing 8 dollars, indicating a contraction in this industry. Some firms may leave in the long run, causing the market supply to decrease and equilibrium price will increase to the break-even level. PRICE Qs (1 firm's output) PROFIT Qs(1500 firms in the market) / market supply Qd / market demand 26 0 -60 0 17000 32 0 -60 0 15000 38 5 -55 7500 13500 41 6 -39 9000 12000 46 7 -8 10500 56 8 63 12000 9500 66 9 144 13500 8000 (assuming identical cost function for all firms)

Pure Monopoly Pure monopoly exists when a single firm is the sole producer of a product for which there are no close substitutes. Examples are public utilities and professional sports leagues. Characteristics 1. A single seller: the firm and industry are synonymous. 2. Unique product: no close substitutes for the firm’s product. 3. The firm is the price maker: the firm has considerable control over the price because it can control the quantity supplied. 4. Entry or exit is blocked. Barriers to Entry Economies of scale is the major barrier. This occurs where the lowest unit cost and, therefore, low unit prices for consumers depend on the existence of a small number of large firms, or in the case of monopoly, only one firm. Because a very large firm with a large market share is most efficient, new firms cannot afford to start up in industries with economies of scale. Public utilities are known as natural monopolies because they have economies of scale in the extreme case. More than one firm would be inefficient because the maze of pipes or wires that would result if there were competition among water companies or cable companies. Legal barriers also exist in the form of patents and licenses, such as radio and TV stations. Ownership or control of essential resources is another barrier to entry, such as the professional sports leagues that control player contracts and leases on major city stadiums. It has to be noted that barrier is rarely complete. Think about the telephone companies a couple decades ago; there was no substitute for the telephone. Nowadays, cellular phones are very popular. It creates a substitute for your house phone, causing the traditional telephone companies to lose their monopoly position. Demand Curve Monopoly demand is the industry or market demand is therefore downward sloping. Price will exceed marginal revenue because the monopolist must lower price to boost sales and cannot price discriminate in most cases. The added revenue will be the price of the last unit less the sum of the price cuts which must be taken on all prior units of output. The marginal revenue curve is below the demand curve.

Pure Monopoly Pure monopoly exists when a single firm is the sole producer of a product for which there are no close substitutes. Examples are public utilities and professional sports leagues. Characteristics 1. A single seller: the firm and industry are synonymous. 2. Unique product: no close substitutes for the firm’s product. 3. The firm is the price maker: the firm has considerable control over the price because it can control the quantity supplied. 4. Entry or exit is blocked. Barriers to Entry Economies of scale is the major barrier. This occurs where the lowest unit cost and, therefore, low unit prices for consumers depend on the existence of a small number of large firms, or in the case of monopoly, only one firm. Because a very large firm with a large market share is most efficient, new firms cannot afford to start up in industries with economies of scale. Public utilities are known as natural monopolies because they have economies of scale in the extreme case. More than one firm would be inefficient because the maze of pipes or wires that would result if there were competition among water companies or cable companies. Legal barriers also exist in the form of patents and licenses, such as radio and TV stations. Ownership or control of essential resources is another barrier to entry, such as the professional sports leagues that control player contracts and leases on major city stadiums. It has to be noted that barrier is rarely complete. Think about the telephone companies a couple decades ago; there was no substitute for the telephone. Nowadays, cellular phones are very popular. It creates a substitute for your house phone, causing the traditional telephone companies to lose their monopoly position. Demand Curve Monopoly demand is the industry or market demand is therefore downward sloping. Price will exceed marginal revenue because the monopolist must lower price to boost sales and cannot price discriminate in most cases. The added revenue will be the price of the last unit less the sum of the price cuts which must be taken on all prior units of output. The marginal revenue curve is below the demand curve.

Profit –Maximizing Output & Efficiency Profit –Maximizing Output: The MR = MC rule will still tell the monopolist the profit – maximizing output. The monopolist cannot charge the highest price possible, it will maximize profit where TR minus TC is the greatest. This depends on quantity sold as well as on price. The monopolist can charge the price that consumers will pay for that output level. Therefore, the price is on the demand curve. Losses can occur in monopoly, although the monopolist will not persistently operate at loss in the long run. Monopolies will sell at a smaller output and charge a higher price than would pure competitive producers selling in the same market. Income distribution is more unequal than it would be under a more competitive situation, unless the government regulates the monopoly and prevents monopoly profits. If a monopoly creates substantial economic inefficiency and appears to be long-lasting, antitrust laws could be used to break up the monopoly. Efficiency: 1. Productive efficiency: occurs where P= min ATC. Monopoly firms will not achieve productive efficiency as firms will produce at an output which is less than the output of min ATC. X-inefficiency may occur since there is no competitive pressure to produce at the minimum possible costs. 2. Allocative efficiency: occurs where P = MC. This efficiency is not achieved because price( what product is worth to consumers) is above MC (opportunity cost of product). It is possible that monopoly is more efficient than many small firms. Economies of scale (natural monopoly) may make monopoly the most efficient market model in some industries. However, X-inefficiency and rent-seeking cost (lobbying, legal fees, etc. ) can entail substantial costs, causing inefficiency. Producer surplus is significant due to lack of competition, consumer surplus may be minimized. This market structure will not contribute to a fair income distribution of our society.

Profit –Maximizing Output & Efficiency Profit –Maximizing Output: The MR = MC rule will still tell the monopolist the profit – maximizing output. The monopolist cannot charge the highest price possible, it will maximize profit where TR minus TC is the greatest. This depends on quantity sold as well as on price. The monopolist can charge the price that consumers will pay for that output level. Therefore, the price is on the demand curve. Losses can occur in monopoly, although the monopolist will not persistently operate at loss in the long run. Monopolies will sell at a smaller output and charge a higher price than would pure competitive producers selling in the same market. Income distribution is more unequal than it would be under a more competitive situation, unless the government regulates the monopoly and prevents monopoly profits. If a monopoly creates substantial economic inefficiency and appears to be long-lasting, antitrust laws could be used to break up the monopoly. Efficiency: 1. Productive efficiency: occurs where P= min ATC. Monopoly firms will not achieve productive efficiency as firms will produce at an output which is less than the output of min ATC. X-inefficiency may occur since there is no competitive pressure to produce at the minimum possible costs. 2. Allocative efficiency: occurs where P = MC. This efficiency is not achieved because price( what product is worth to consumers) is above MC (opportunity cost of product). It is possible that monopoly is more efficient than many small firms. Economies of scale (natural monopoly) may make monopoly the most efficient market model in some industries. However, X-inefficiency and rent-seeking cost (lobbying, legal fees, etc. ) can entail substantial costs, causing inefficiency. Producer surplus is significant due to lack of competition, consumer surplus may be minimized. This market structure will not contribute to a fair income distribution of our society.

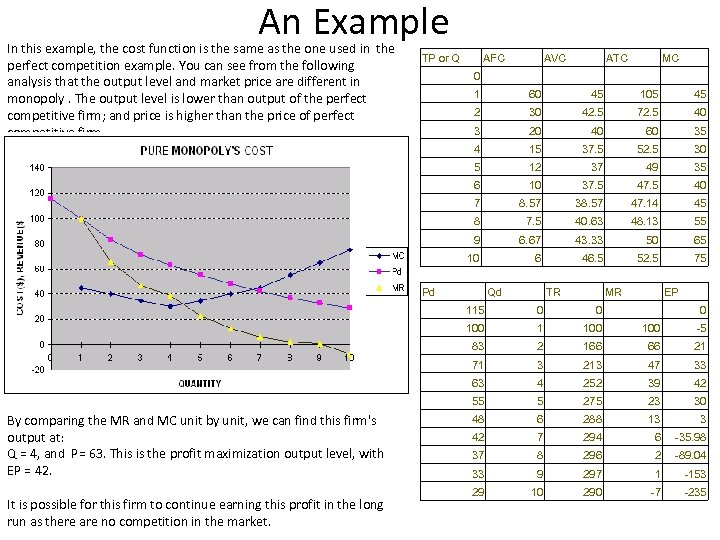

An Example In this example, the cost function is the same as the one used in the perfect competition example. You can see from the following analysis that the output level and market price are different in monopoly. The output level is lower than output of the perfect competitive firm; and price is higher than the price of perfect competitive firm. TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 Pd Qd TR MR EP 115 1 100 -5 83 2 166 66 21 71 3 213 47 33 63 4 252 39 42 55 It is possible for this firm to continue earning this profit in the long run as there are no competition in the market. 0 100 By comparing the MR and MC unit by unit, we can find this firm's output at: Q = 4, and P= 63. This is the profit maximization output level, with EP = 42. 0 0 5 275 23 30 48 6 288 13 3 42 7 294 6 -35. 98 37 8 296 2 -89. 04 33 9 297 1 -153 29 10 290 -7 -235

An Example In this example, the cost function is the same as the one used in the perfect competition example. You can see from the following analysis that the output level and market price are different in monopoly. The output level is lower than output of the perfect competitive firm; and price is higher than the price of perfect competitive firm. TP or Q AFC AVC ATC MC 0 1 60 45 105 45 2 30 42. 5 72. 5 40 3 20 40 60 35 4 15 37. 5 52. 5 30 5 12 37 49 35 6 10 37. 5 40 7 8. 57 38. 57 47. 14 45 8 7. 5 40. 63 48. 13 55 9 6. 67 43. 33 50 65 10 6 46. 5 52. 5 75 Pd Qd TR MR EP 115 1 100 -5 83 2 166 66 21 71 3 213 47 33 63 4 252 39 42 55 It is possible for this firm to continue earning this profit in the long run as there are no competition in the market. 0 100 By comparing the MR and MC unit by unit, we can find this firm's output at: Q = 4, and P= 63. This is the profit maximization output level, with EP = 42. 0 0 5 275 23 30 48 6 288 13 3 42 7 294 6 -35. 98 37 8 296 2 -89. 04 33 9 297 1 -153 29 10 290 -7 -235

Price Discrimination Price discrimination is selling a good or service at a number of different prices, and the price differences is not justified by the cost differences. In order to price discriminate, a monopoly must be able to 1. be able to segregate the market 2. make sure that buyers cannot resell the original product or services. Perfect price discrimination is a price discrimination that extracts the entire consumer surplus by charging the highest price that consumer are willing to pay for each unit. As a result, the demand curve becomes the MR curve for a perfect price discriminator. Firms capture the entire consumer surplus and maximize economic profit.

Price Discrimination Price discrimination is selling a good or service at a number of different prices, and the price differences is not justified by the cost differences. In order to price discriminate, a monopoly must be able to 1. be able to segregate the market 2. make sure that buyers cannot resell the original product or services. Perfect price discrimination is a price discrimination that extracts the entire consumer surplus by charging the highest price that consumer are willing to pay for each unit. As a result, the demand curve becomes the MR curve for a perfect price discriminator. Firms capture the entire consumer surplus and maximize economic profit.

Monopolistic Competition Monopolistic competition refers to a market situation with a relatively large number of sellers offering similar but not identical products. Examples are fast food restaurants and clothing stores. Characteristics 1. A lot of firms: each has a small percentage of the total market. 2. Differentiated products: variety of the product makes this model different from pure competition model. Product differentiated in style, brand name, location, advertisement, packaging, pricing strategies, etc. 3. Easy entry or exit. Demand Curve The firm’s demand curve is highly elastic, but not perfectly elastic. It is more elastic than the monopoly’s demand curve because the seller has many rivals producing close substitutes; it is less elastic than pure competition, because the seller’s product is differentiated from its rivals.

Monopolistic Competition Monopolistic competition refers to a market situation with a relatively large number of sellers offering similar but not identical products. Examples are fast food restaurants and clothing stores. Characteristics 1. A lot of firms: each has a small percentage of the total market. 2. Differentiated products: variety of the product makes this model different from pure competition model. Product differentiated in style, brand name, location, advertisement, packaging, pricing strategies, etc. 3. Easy entry or exit. Demand Curve The firm’s demand curve is highly elastic, but not perfectly elastic. It is more elastic than the monopoly’s demand curve because the seller has many rivals producing close substitutes; it is less elastic than pure competition, because the seller’s product is differentiated from its rivals.

Profit - Maximizing Output The MR = MC rule will give the firms the profit – maximizing output. The price they charge would be on the demand curve. In the long run, the situation will tend to be breaking even for firms. Firms can enter the industry easily and will if the existing firms are making an economic profit. As firms enter the industry, the demand curve facing by an individual firm shift down, as buyers shift some demand to new firms until the firm just breaks even. If the demand shifts below the break-even point, some firms will leave the industry in the long run. Therefore, most monopolistic competitive firms should experience break-even in the long run theoretically. In reality, some firms experience profit as they able to distinguish themselves from the others and build a loyal customer base; such as some name brand apparel companies. Some firms experience lost in long run but may continue the business as they are still earning normal profit. These firm owners usually like the flexible life style and willing to earn a normal profit that is lower than their opportunity cost. Price exceeds marginal cost in the long run, suggesting that society values additional units which are not being produced. Average costs may also be higher than under pure competition, due to advertising cost involved to attract customers from competitors. The various types, styles, brands and quality of products offers consumers choices. However, economic inefficiency is the result. The excess capacity (producing at the quantity that a firm produces is less than the quantity at which ATC is a minimum) exists in this industry.

Profit - Maximizing Output The MR = MC rule will give the firms the profit – maximizing output. The price they charge would be on the demand curve. In the long run, the situation will tend to be breaking even for firms. Firms can enter the industry easily and will if the existing firms are making an economic profit. As firms enter the industry, the demand curve facing by an individual firm shift down, as buyers shift some demand to new firms until the firm just breaks even. If the demand shifts below the break-even point, some firms will leave the industry in the long run. Therefore, most monopolistic competitive firms should experience break-even in the long run theoretically. In reality, some firms experience profit as they able to distinguish themselves from the others and build a loyal customer base; such as some name brand apparel companies. Some firms experience lost in long run but may continue the business as they are still earning normal profit. These firm owners usually like the flexible life style and willing to earn a normal profit that is lower than their opportunity cost. Price exceeds marginal cost in the long run, suggesting that society values additional units which are not being produced. Average costs may also be higher than under pure competition, due to advertising cost involved to attract customers from competitors. The various types, styles, brands and quality of products offers consumers choices. However, economic inefficiency is the result. The excess capacity (producing at the quantity that a firm produces is less than the quantity at which ATC is a minimum) exists in this industry.

Oligopoly exits where few large firms producing a homogeneous or differentiated product dominate a market. Examples are automobile and gasoline industries. Characteristics 1. Few large firms: each must consider its rivals’ reactions in response to its decisions about prices, output, and advertising. 2. Standardized or differentiated products. 3. Entry is hard: economies of scale, huge capital investment may be the barriers to enter. Demand Curve Facing competition or in tacit collusion, oligopolies believe that rivals will match any price cuts and not follow their price rise. Firms view their demands as inelastic for price cuts, and elastic for price rise. Firms face kinked demand curves. This analysis explains the fact that prices tend to be inflexible in some oligopolistic industries.

Oligopoly exits where few large firms producing a homogeneous or differentiated product dominate a market. Examples are automobile and gasoline industries. Characteristics 1. Few large firms: each must consider its rivals’ reactions in response to its decisions about prices, output, and advertising. 2. Standardized or differentiated products. 3. Entry is hard: economies of scale, huge capital investment may be the barriers to enter. Demand Curve Facing competition or in tacit collusion, oligopolies believe that rivals will match any price cuts and not follow their price rise. Firms view their demands as inelastic for price cuts, and elastic for price rise. Firms face kinked demand curves. This analysis explains the fact that prices tend to be inflexible in some oligopolistic industries.

Efficiency & Advertisement 1. Productive efficiency: occurs where P= min ATC. Monopolistic competitive firms will not achieve productive efficiency as firms will produce at an output which is less than the output of min ATC. Product differentiation is the major cause of excess capacity. 2. Allocative efficiency: occurs where P = MC. This efficiency is not achieved because price( what product is worth to consumers) is above MC (opportunity cost of product). Advertisement is very crucial for each firm in this market structure as firms need exposure to get consumer's attention. However, too much spending will result in higher cost, and lower profit. Price, product attributes, and advertisement are three main factors that producers have to consider. The perfect combination cannot be forecasted easily.

Efficiency & Advertisement 1. Productive efficiency: occurs where P= min ATC. Monopolistic competitive firms will not achieve productive efficiency as firms will produce at an output which is less than the output of min ATC. Product differentiation is the major cause of excess capacity. 2. Allocative efficiency: occurs where P = MC. This efficiency is not achieved because price( what product is worth to consumers) is above MC (opportunity cost of product). Advertisement is very crucial for each firm in this market structure as firms need exposure to get consumer's attention. However, too much spending will result in higher cost, and lower profit. Price, product attributes, and advertisement are three main factors that producers have to consider. The perfect combination cannot be forecasted easily.

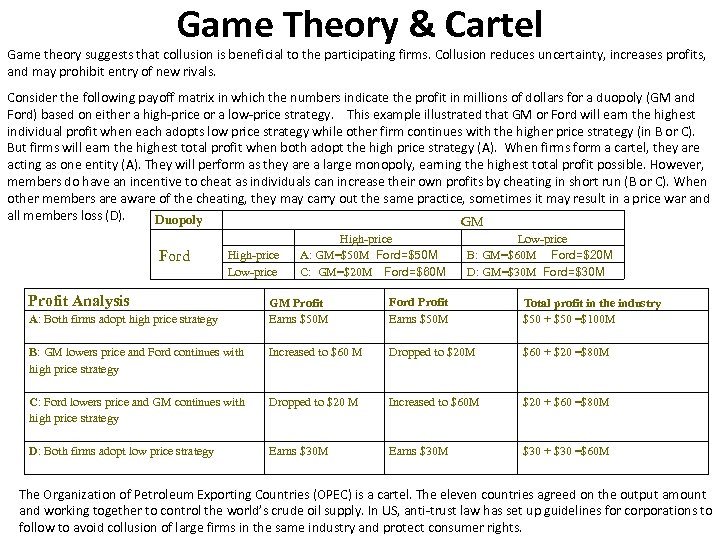

Game Theory & Cartel Game theory suggests that collusion is beneficial to the participating firms. Collusion reduces uncertainty, increases profits, and may prohibit entry of new rivals. Consider the following payoff matrix in which the numbers indicate the profit in millions of dollars for a duopoly (GM and Ford) based on either a high-price or a low-price strategy. This example illustrated that GM or Ford will earn the highest individual profit when each adopts low price strategy while other firm continues with the higher price strategy (in B or C). But firms will earn the highest total profit when both adopt the high price strategy (A). When firms form a cartel, they are acting as one entity (A). They will perform as they are a large monopoly, earning the highest total profit possible. However, members do have an incentive to cheat as individuals can increase their own profits by cheating in short run (B or C). When other members are aware of the cheating, they may carry out the same practice, sometimes it may result in a price war and all members loss (D). Duopoly GM Ford High-price Low-price Profit Analysis High-price A: GM=$50 M Ford=$50 M C: GM=$20 M Ford=$60 M Low-price B: GM=$60 M Ford=$20 M D: GM=$30 M Ford=$30 M GM Profit Earns $50 M Ford Profit Earns $50 M Total profit in the industry $50 + $50 =$100 M B: GM lowers price and Ford continues with high price strategy Increased to $60 M Dropped to $20 M $60 + $20 =$80 M C: Ford lowers price and GM continues with high price strategy Dropped to $20 M Increased to $60 M $20 + $60 =$80 M D: Both firms adopt low price strategy Earns $30 M $30 + $30 =$60 M A: Both firms adopt high price strategy The Organization of Petroleum Exporting Countries (OPEC) is a cartel. The eleven countries agreed on the output amount and working together to control the world’s crude oil supply. In US, anti-trust law has set up guidelines for corporations to follow to avoid collusion of large firms in the same industry and protect consumer rights.

Game Theory & Cartel Game theory suggests that collusion is beneficial to the participating firms. Collusion reduces uncertainty, increases profits, and may prohibit entry of new rivals. Consider the following payoff matrix in which the numbers indicate the profit in millions of dollars for a duopoly (GM and Ford) based on either a high-price or a low-price strategy. This example illustrated that GM or Ford will earn the highest individual profit when each adopts low price strategy while other firm continues with the higher price strategy (in B or C). But firms will earn the highest total profit when both adopt the high price strategy (A). When firms form a cartel, they are acting as one entity (A). They will perform as they are a large monopoly, earning the highest total profit possible. However, members do have an incentive to cheat as individuals can increase their own profits by cheating in short run (B or C). When other members are aware of the cheating, they may carry out the same practice, sometimes it may result in a price war and all members loss (D). Duopoly GM Ford High-price Low-price Profit Analysis High-price A: GM=$50 M Ford=$50 M C: GM=$20 M Ford=$60 M Low-price B: GM=$60 M Ford=$20 M D: GM=$30 M Ford=$30 M GM Profit Earns $50 M Ford Profit Earns $50 M Total profit in the industry $50 + $50 =$100 M B: GM lowers price and Ford continues with high price strategy Increased to $60 M Dropped to $20 M $60 + $20 =$80 M C: Ford lowers price and GM continues with high price strategy Dropped to $20 M Increased to $60 M $20 + $60 =$80 M D: Both firms adopt low price strategy Earns $30 M $30 + $30 =$60 M A: Both firms adopt high price strategy The Organization of Petroleum Exporting Countries (OPEC) is a cartel. The eleven countries agreed on the output amount and working together to control the world’s crude oil supply. In US, anti-trust law has set up guidelines for corporations to follow to avoid collusion of large firms in the same industry and protect consumer rights.

Technological Development Technological advance is a three-step process that shifts the economy‘s production possibilities curve outward enabling more production of goods and services. 1. Invention: is the discovery of a product or process and the proof that it will work. 2. Innovation: is the first successful commercial introduction of a new product, the first use of a new method, or the creation of a new form of business enterprise. 3. Diffusion: is the spread of innovation through imitation or copying. Expenditures on research and development (R&D) include direct efforts by business toward invention, innovation, and diffusion. Government also engages in R&D, particularly for national defense. Finding the optimal amount of R&D is an application of basic economics: marginal benefit and marginal cost analysis. Optimal R&D expenditures occur when the interest rate cost of funds is equal to the expected rate of return. Many projects may be affordable but not worthwhile because the marginal benefit is less than marginal cost. Often the R&D spending decision is complex because the estimation of future benefits is highly uncertain while costs are immediate and more clear-cut.

Technological Development Technological advance is a three-step process that shifts the economy‘s production possibilities curve outward enabling more production of goods and services. 1. Invention: is the discovery of a product or process and the proof that it will work. 2. Innovation: is the first successful commercial introduction of a new product, the first use of a new method, or the creation of a new form of business enterprise. 3. Diffusion: is the spread of innovation through imitation or copying. Expenditures on research and development (R&D) include direct efforts by business toward invention, innovation, and diffusion. Government also engages in R&D, particularly for national defense. Finding the optimal amount of R&D is an application of basic economics: marginal benefit and marginal cost analysis. Optimal R&D expenditures occur when the interest rate cost of funds is equal to the expected rate of return. Many projects may be affordable but not worthwhile because the marginal benefit is less than marginal cost. Often the R&D spending decision is complex because the estimation of future benefits is highly uncertain while costs are immediate and more clear-cut.

The Role of Market Structure 1. Pure competition: the small size of competitive firms and the fact hat they earn zero economic profit in the long run leads to serious questions as to whether such producers can finance substantial R&D programs. The firms in this market structure would spend no significant amount. However, firms of the same industry may gather their resources and develop R&D programs. 2. Monopolistic competition: there is a strong profit incentive to engage in product development in this market structure as the firms depend on product differentiation to stand out from a large number of rivals. However, most firms remain small which limits their ability to secure inexpensive financing for R&D and any economic profits are usually temporary. Therefore, spending on R&D is limited in this market structure. 3. Oligopoly: many of the characteristics of oligopoly are conducive to technical advances including: their large size, ongoing economic profits, the existence of barriers to entry and a large volume of sales. Firms in oligopoly spent the highest amount on R&D among the four different market structures. 4. Pure monopoly: monopoly has little incentive to engage in R&D as the profit is protected by absolute barriers to entry, the only reason for R&D would be defensive – to reduce the risk of a new product or process which would destroy the monopoly.

The Role of Market Structure 1. Pure competition: the small size of competitive firms and the fact hat they earn zero economic profit in the long run leads to serious questions as to whether such producers can finance substantial R&D programs. The firms in this market structure would spend no significant amount. However, firms of the same industry may gather their resources and develop R&D programs. 2. Monopolistic competition: there is a strong profit incentive to engage in product development in this market structure as the firms depend on product differentiation to stand out from a large number of rivals. However, most firms remain small which limits their ability to secure inexpensive financing for R&D and any economic profits are usually temporary. Therefore, spending on R&D is limited in this market structure. 3. Oligopoly: many of the characteristics of oligopoly are conducive to technical advances including: their large size, ongoing economic profits, the existence of barriers to entry and a large volume of sales. Firms in oligopoly spent the highest amount on R&D among the four different market structures. 4. Pure monopoly: monopoly has little incentive to engage in R&D as the profit is protected by absolute barriers to entry, the only reason for R&D would be defensive – to reduce the risk of a new product or process which would destroy the monopoly.

Economic Efficiency Economics is a science of efficiency in the use of scarce resources. Efficiency requires full employment of available resources and full production. Full employment means all available resources should be employed. Full production means that employed resources are providing maximum satisfaction for our material wants. Full production implies two kinds of efficiency: 1. Allocative efficiency means that resources are used for producing the combination of goods and services most wanted by society. For example, producing computers with word processors rather than producing manual typewriters. 2. Productive efficiency means that least costly production techniques are used to produce wanted goods and services. Full efficiency means producing the "right" (Allocative efficiency) amount in the "right "way (productive efficiency). Pure competition: Productive efficiency occurs where price is equal to minimum average total cost (min ATC); at this point firms must use the lease-cost technology or they won’t survive. Under pure competition, this outcome will be achieved, as the long run equilibrium price of pure competitive firms would be at the min ATC. Allocative efficiency occurs where price is equal to marginal cost ( P=MC), because price is society’s measure of relative worth of a product at the margin or its marginal benefit. And the marginal cost of producing product X measures the relative worth of the other goods that the resources used in producing an extra unit of X could otherwise have produced. In short, price measures the benefit that society gets from additional units of good X, and the marginal cost of this unit of X measures the sacrifice or cost to society of other goods given up to produce more of X. Under pure competition, this outcome will be achieved. Dynamic adjustments will occur automatically in pure competition when changes in demand or in resources supply, or in technology occur. Disequilibrium will cause expansion or contraction of the industry until the new equilibrium at P=MC occurs.

Economic Efficiency Economics is a science of efficiency in the use of scarce resources. Efficiency requires full employment of available resources and full production. Full employment means all available resources should be employed. Full production means that employed resources are providing maximum satisfaction for our material wants. Full production implies two kinds of efficiency: 1. Allocative efficiency means that resources are used for producing the combination of goods and services most wanted by society. For example, producing computers with word processors rather than producing manual typewriters. 2. Productive efficiency means that least costly production techniques are used to produce wanted goods and services. Full efficiency means producing the "right" (Allocative efficiency) amount in the "right "way (productive efficiency). Pure competition: Productive efficiency occurs where price is equal to minimum average total cost (min ATC); at this point firms must use the lease-cost technology or they won’t survive. Under pure competition, this outcome will be achieved, as the long run equilibrium price of pure competitive firms would be at the min ATC. Allocative efficiency occurs where price is equal to marginal cost ( P=MC), because price is society’s measure of relative worth of a product at the margin or its marginal benefit. And the marginal cost of producing product X measures the relative worth of the other goods that the resources used in producing an extra unit of X could otherwise have produced. In short, price measures the benefit that society gets from additional units of good X, and the marginal cost of this unit of X measures the sacrifice or cost to society of other goods given up to produce more of X. Under pure competition, this outcome will be achieved. Dynamic adjustments will occur automatically in pure competition when changes in demand or in resources supply, or in technology occur. Disequilibrium will cause expansion or contraction of the industry until the new equilibrium at P=MC occurs.

Efficiency Cont. Non-perfect competition: Price of non-perfect competitive firms will exceed marginal cost, because price exceeds marginal revenue and the firms produce where marginal revenue (MR) and marginal cost are equal. Then the firms can charge the price that consumers will pay for that output level. Allocative efficiency is not achieved because price (what product is worth to consumers) is above marginal cost (opportunity cost of product). Ideally, output should expand to a level where P=MC, but this will occur only under pure competitive conditions where P = MR. Productive efficiency is not achieved because the firms’ output is less than the output at which average total cost is minimum. Economies of scale (natural monopoly) may make monopoly the most efficient market model in some industries. Xinefficiency, the inefficiency that occurs in the absence of fear of entry and rivalry, may occur in monopoly since there is no competitive pressure to produce at the minimum possible costs. Rent-seeking behavior often occurs as monopolies seek to acquire or maintain government –granted monopoly privileges. Such rent-seeking may entail substantial cost (lobbying, legal fees, public relations advertising etc. ) which are inefficient. There are several policy options available when monopoly creates substantial economic inefficiency: 1. Antitrust laws could be used to break up the monopoly if the monopoly’s inefficiency appears to be long-lasting. 2. Society may choose to regulate its prices and operations if it is a natural monopoly. 3. Society may simply ignore it if the monopoly appears to be short-lived because of changing conditions or technology. Efficiency Vs technological advances: Allocative efficiency is improved when technological advance involves a new product that increases the utility consumers can obtain from their limited income. Process innovation can lower production cost and improve productive efficiency. Innovation can create monopoly power through patents or the advantages of being first, reducing the benefit to society from the innovation. Innovation can also reduce or even disintegrate existing monopoly power by providing competition where there was none. In this case economic efficiency is enhanced because the competition drives prices down closer to marginal cost and minimum average total cost.

Efficiency Cont. Non-perfect competition: Price of non-perfect competitive firms will exceed marginal cost, because price exceeds marginal revenue and the firms produce where marginal revenue (MR) and marginal cost are equal. Then the firms can charge the price that consumers will pay for that output level. Allocative efficiency is not achieved because price (what product is worth to consumers) is above marginal cost (opportunity cost of product). Ideally, output should expand to a level where P=MC, but this will occur only under pure competitive conditions where P = MR. Productive efficiency is not achieved because the firms’ output is less than the output at which average total cost is minimum. Economies of scale (natural monopoly) may make monopoly the most efficient market model in some industries. Xinefficiency, the inefficiency that occurs in the absence of fear of entry and rivalry, may occur in monopoly since there is no competitive pressure to produce at the minimum possible costs. Rent-seeking behavior often occurs as monopolies seek to acquire or maintain government –granted monopoly privileges. Such rent-seeking may entail substantial cost (lobbying, legal fees, public relations advertising etc. ) which are inefficient. There are several policy options available when monopoly creates substantial economic inefficiency: 1. Antitrust laws could be used to break up the monopoly if the monopoly’s inefficiency appears to be long-lasting. 2. Society may choose to regulate its prices and operations if it is a natural monopoly. 3. Society may simply ignore it if the monopoly appears to be short-lived because of changing conditions or technology. Efficiency Vs technological advances: Allocative efficiency is improved when technological advance involves a new product that increases the utility consumers can obtain from their limited income. Process innovation can lower production cost and improve productive efficiency. Innovation can create monopoly power through patents or the advantages of being first, reducing the benefit to society from the innovation. Innovation can also reduce or even disintegrate existing monopoly power by providing competition where there was none. In this case economic efficiency is enhanced because the competition drives prices down closer to marginal cost and minimum average total cost.