Founded in 1909 Total Sales = 22. 99 billion euros

Founded in 1909 Total Sales = 22. 99 billion euros

FINANCIAL ANALYSIS AND STOCK OVERVIEW Contents Fiscal year and market capitalization Shareholders Structure Sources of Finance and Capital Structure Financial Ratios/Key statistics Systematic risk and Beta Dividend policy

FINANCIAL ANALYSIS AND STOCK OVERVIEW Contents Fiscal year and market capitalization Shareholders Structure Sources of Finance and Capital Structure Financial Ratios/Key statistics Systematic risk and Beta Dividend policy

1. Fiscal Year and Market Capitalization Fiscal year starts in the beginning of every January and finishes in the end of December. (The last closing date was in Dec 31 st 2012) Market capitalization = 73. 91 billion Current share price = 120. 00 Number of shares outstanding = 596. 73 M Stock markets: L’Oreal Paris is listed on Paris stock exchange market (CAC 40), Eurostoxx 50, and Stock 50.

1. Fiscal Year and Market Capitalization Fiscal year starts in the beginning of every January and finishes in the end of December. (The last closing date was in Dec 31 st 2012) Market capitalization = 73. 91 billion Current share price = 120. 00 Number of shares outstanding = 596. 73 M Stock markets: L’Oreal Paris is listed on Paris stock exchange market (CAC 40), Eurostoxx 50, and Stock 50.

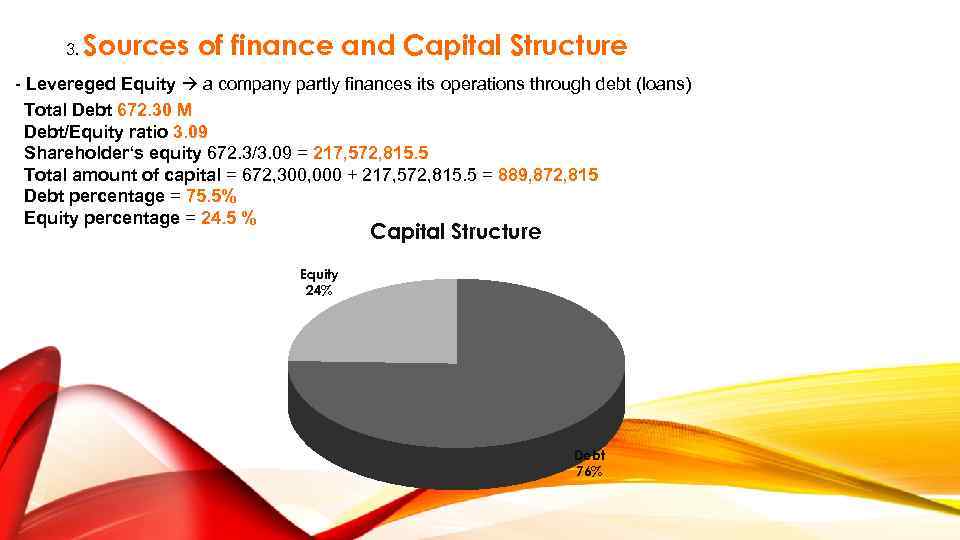

3. Sources of finance and Capital Structure - Levereged Equity a company partly finances its operations through debt (loans) Total Debt 672. 30 M Debt/Equity ratio 3. 09 Shareholder‘s equity 672. 3/3. 09 = 217, 572, 815. 5 Total amount of capital = 672, 300, 000 + 217, 572, 815. 5 = 889, 872, 815 Debt percentage = 75. 5% Equity percentage = 24. 5 % Capital Structure Equity 24% Debt 76%

3. Sources of finance and Capital Structure - Levereged Equity a company partly finances its operations through debt (loans) Total Debt 672. 30 M Debt/Equity ratio 3. 09 Shareholder‘s equity 672. 3/3. 09 = 217, 572, 815. 5 Total amount of capital = 672, 300, 000 + 217, 572, 815. 5 = 889, 872, 815 Debt percentage = 75. 5% Equity percentage = 24. 5 % Capital Structure Equity 24% Debt 76%

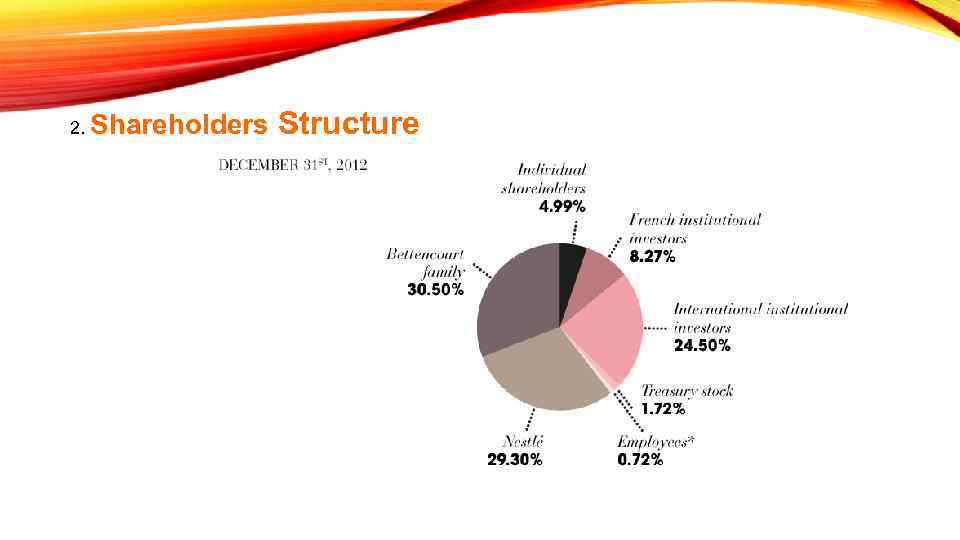

2. Shareholders Structure

2. Shareholders Structure

4. Financial Current ratio (Net Working Capital) =1. 23 Price/Sales ratio = 3. 22 EPS = 4. 86 P/E ratio = 25. 34 50 day average analysis (graph) Ratios and Key Statistics if the price is below average, buying a stock could be dangerous

4. Financial Current ratio (Net Working Capital) =1. 23 Price/Sales ratio = 3. 22 EPS = 4. 86 P/E ratio = 25. 34 50 day average analysis (graph) Ratios and Key Statistics if the price is below average, buying a stock could be dangerous

5. Systematic risk and Beta Market risk – economy wide sources of risk that affect the overall stock market. Also called “systematic risk” Beta – a sensitivity of a security’s return to the return of the overall market. Beta of the market portfolio always equals 1 L’Oreal Beta = 0. 6 - if the market increases by 1% L’Oreal stock will increase by 0. 6% - the current stock is not as strong as market itself, but it just develops in the same direction

5. Systematic risk and Beta Market risk – economy wide sources of risk that affect the overall stock market. Also called “systematic risk” Beta – a sensitivity of a security’s return to the return of the overall market. Beta of the market portfolio always equals 1 L’Oreal Beta = 0. 6 - if the market increases by 1% L’Oreal stock will increase by 0. 6% - the current stock is not as strong as market itself, but it just develops in the same direction

6. Dividend Policy DP = it is the policy a company uses to decide how much it will pay out to shareholders in dividends. Ratios used: Dividend Payout Ratio the percentage of earnings paid to shareholders in dividen Dividend Yield how much income you receive in relation to the price of the stock Dividend Payout Ratio = 2. 30 Dividend Yield = 1. 86

6. Dividend Policy DP = it is the policy a company uses to decide how much it will pay out to shareholders in dividends. Ratios used: Dividend Payout Ratio the percentage of earnings paid to shareholders in dividen Dividend Yield how much income you receive in relation to the price of the stock Dividend Payout Ratio = 2. 30 Dividend Yield = 1. 86

Forward Looking

Forward Looking

MISSION: „Our ambition for the coming years is to win over another one billion consumers around the world by creating the cosmetic products that meet the infinite diversity of their beauty needs and desires. ” L’Oreal plans to raise its investments in India total of 9. 70 billion rupees ($176 million) by 2016 as it moves to raise sales in the country's fastgrowing market for high-end beauty and hair care products. India is one of the main Asia-Pacific growth markets for the group and is a "key contributor to L'Oreal's objective of reaching 1 billion new consumers [globally] in 10 -15 years, "

MISSION: „Our ambition for the coming years is to win over another one billion consumers around the world by creating the cosmetic products that meet the infinite diversity of their beauty needs and desires. ” L’Oreal plans to raise its investments in India total of 9. 70 billion rupees ($176 million) by 2016 as it moves to raise sales in the country's fastgrowing market for high-end beauty and hair care products. India is one of the main Asia-Pacific growth markets for the group and is a "key contributor to L'Oreal's objective of reaching 1 billion new consumers [globally] in 10 -15 years, "

L'Oreal is targeting 70 billion rupees in sales in India by 2020, up from an expected 15. 80 billion rupees in 2012. L'Oreal, with annual global sales exceeding 20 billion euro ($26. 13 billion), is one of the world's largest companies in the beauty, hair and skincare products and services businesses.

L'Oreal is targeting 70 billion rupees in sales in India by 2020, up from an expected 15. 80 billion rupees in 2012. L'Oreal, with annual global sales exceeding 20 billion euro ($26. 13 billion), is one of the world's largest companies in the beauty, hair and skincare products and services businesses.

Chart

Chart

L'OREAL SHARE PRICE PAST 5 YEARS

L'OREAL SHARE PRICE PAST 5 YEARS

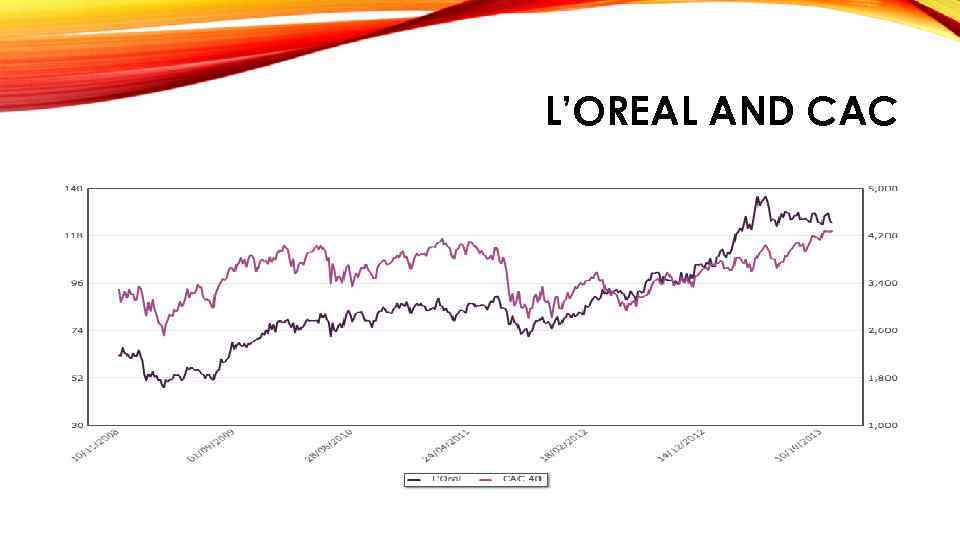

L’OREAL AND CAC

L’OREAL AND CAC

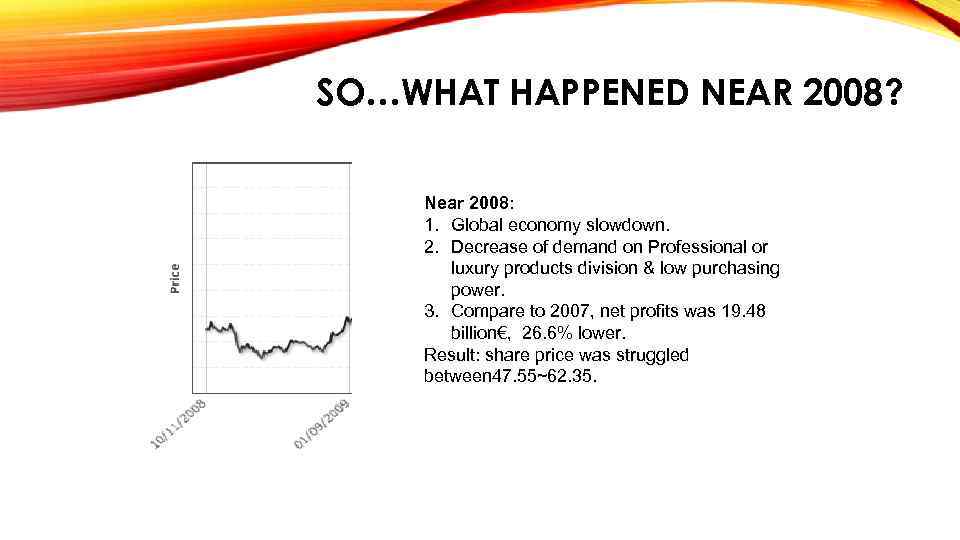

SO…WHAT HAPPENED NEAR 2008? Near 2008: 1. Global economy slowdown. 2. Decrease of demand on Professional or luxury products division & low purchasing power. 3. Compare to 2007, net profits was 19. 48 billion€, 26. 6% lower. Result: share price was struggled between 47. 55~62. 35.

SO…WHAT HAPPENED NEAR 2008? Near 2008: 1. Global economy slowdown. 2. Decrease of demand on Professional or luxury products division & low purchasing power. 3. Compare to 2007, net profits was 19. 48 billion€, 26. 6% lower. Result: share price was struggled between 47. 55~62. 35.

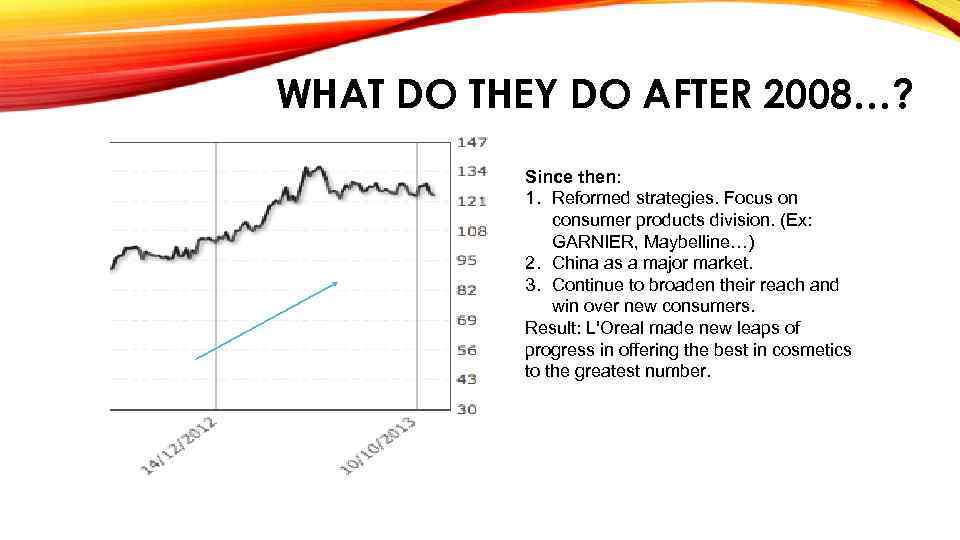

WHAT DO THEY DO AFTER 2008…? Since then: 1. Reformed strategies. Focus on consumer products division. (Ex: GARNIER, Maybelline…) 2. China as a major market. 3. Continue to broaden their reach and win over new consumers. Result: L'Oreal made new leaps of progress in offering the best in cosmetics to the greatest number.

WHAT DO THEY DO AFTER 2008…? Since then: 1. Reformed strategies. Focus on consumer products division. (Ex: GARNIER, Maybelline…) 2. China as a major market. 3. Continue to broaden their reach and win over new consumers. Result: L'Oreal made new leaps of progress in offering the best in cosmetics to the greatest number.

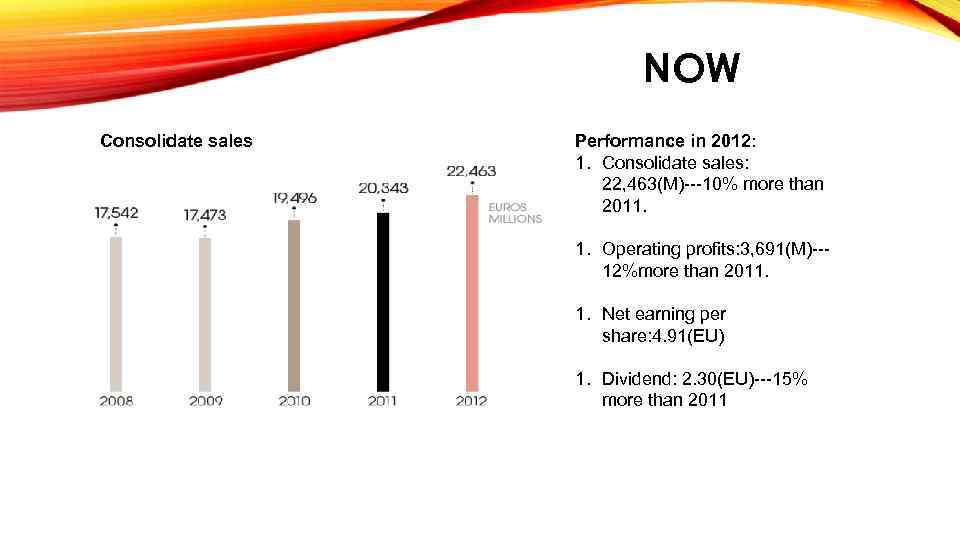

NOW Consolidate sales Performance in 2012: 1. Consolidate sales: 22, 463(M)---10% more than 2011. 1. Operating profits: 3, 691(M)--12%more than 2011. 1. Net earning per share: 4. 91(EU) 1. Dividend: 2. 30(EU)---15% more than 2011

NOW Consolidate sales Performance in 2012: 1. Consolidate sales: 22, 463(M)---10% more than 2011. 1. Operating profits: 3, 691(M)--12%more than 2011. 1. Net earning per share: 4. 91(EU) 1. Dividend: 2. 30(EU)---15% more than 2011