79686733f9c7278224283f11b2f03858.ppt

- Количество слайдов: 22

Foto gebouw KBC Group Life insurance business Embedded value as at 31 Dec 2005 and analysis of change and sensitivity

Cautionary Statements n n Many assumptions, such as the general economic conditions, performance of financial markets, taxes, changes in laws, frequency and severity of insured loss events, mortality and morbidity levels and trends, and others, are beyond the control of KBC. A modification of assumption can result in a significantly different Embedded Value. Deviations from assumed experience are normal and are to be expected. Even without any change in the parameters, actual results will vary from those projected due to normal random fluctuations. n Embedded Value cannot be considered as an absolute value. This value, together with a sensitivity analysis, enables the recipient to obtain an idea of the magnitude of the expected value created by the insurance activities. n 2 Embedded Value is the result of cash-flow projections with underlying assumptions and expectations. The values in this presentation are calculated on a deterministic basis. Under no circumstances should the inclusion of the projections (including the relevant underlying assumptions and expectations) be regarded as a representation, warranty or prediction that the business will achieve or is likely to achieve any particular results.

Contents n Life insurance activity l l n Embedded Value (EV) l l n l l Scope Assumptions Sensitivities Roll forward, 2004 -2005 Value of New Business (VNB) at date of sale l l 3 Components Roll forward, 2004 -2005 Value of Business In Force (VBI) l n Terminology Overview Adjusted Net Asset Value (ANAV) l n Sales Technical charges Overview Sensitivities

Life insurance activity: Sales Growth in Total Life Sales, 1998 -2005 (in ’ 000 EUR) 6 382 502 582% 3 609 717 2 547 557 329% 1 666 842 152% 1 867 037 1 341 980 170% 2 230 521 203% 1 097 465 122% 100% (Premium income without the application of IFRS deposit accounting) 4 232%

Life insurance activity: Technical provisions Growth in Technical Provisions, Life, 1998 -2005 (in ’ 000 EUR) 7 589 874 6 783 772 174% 5 662 602 155% 129% 4 373 520 100% 5 10 614 953 243% 8 697 296 199% 18 677 101 427% 13 494 338 309%

Embedded Value: Terminology KBC standard “Embedded Value” As investment for Embedded Value VBI** PV Tied Surplus, Life Tied Surplus Life Other Allocated Surplus Free Surplus ANAV Shareholders’ Equity = Economic Adjustments (PVFP- Cost Tied Surplus) Tied Surplus, Life ANAV PVFP* > Equity adjustments > Asset adjustments > Resilience Reserves > Tax assets and liab. 6 or Value In Force (VIF) Other Allocated Surplus = Tied Surplus Non Life + Other Tied Surplus *PVFP = Present Value of Future Profit **VBI = Value of Business In Force

Embedded Value: Overview (in ’ 000 EUR) 31/12/2004 31/12/2005 PVFP Cost of tied surplus Tied Surplus, Life* 420 637 607 844 (187 207) 851 794 restated 405 804 594 265 (188 461) 862 708 468 324 675 107 (206 783) 1 039 861 +15. 4% +13. 6% Value In Force Other Surplus 1 272 431 1 622 660 1 268 512 1 787 225 1 508 185 2 028 302 +18. 9% +13. 5% Embedded Value 2 895 091 3 055 737 3 536 487 +15. 8% VBI Life +20. 5% Remarks: n The value of the Non-Life portfolio is not taken into account. However, Other Surplus includes surplus of both Life and Non-Life activities. n Restatements of the 2004 figures relate to model changes in VBI and IFRS adjustments to the ANAV 7

![Adjusted Net Asset Value (ANAV): Composition “Adjusted Net Asset Value” (ANAV) = [+] Shareholders Adjusted Net Asset Value (ANAV): Composition “Adjusted Net Asset Value” (ANAV) = [+] Shareholders](https://present5.com/presentation/79686733f9c7278224283f11b2f03858/image-8.jpg)

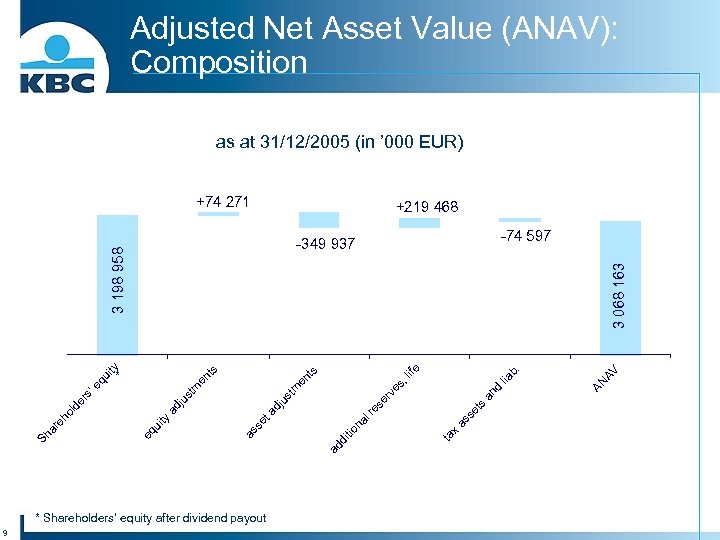

Adjusted Net Asset Value (ANAV): Composition “Adjusted Net Asset Value” (ANAV) = [+] Shareholders Equity [+] Equity Adjustments: l Minority interests [+]/[-] Asset Adjustments: l Excluding unrealised capital gains on AFS bonds backing the life portfolio (“buy-and-hold” philosophy) l Goodwill deducted [+] Additional Reserves: l Additional reserves, life, minus the cost of holding those reserves [-] Tax assets and liabilities on the above 8

Adjusted Net Asset Value (ANAV): Composition as at 31/12/2005 (in ’ 000 EUR) ('000 EUR) +74 271 +219 468 se as ta x AV AN b. lia d an ts se re na l tio ad di as se ta dj us rv tm es en ts tm ju s ad ty eq ui , l ife 3 068 163 3 198 958 ui ty Sh ar eh ol de r s’ eq * * Shareholders’ equity after dividend payout 9 -74 597 -349 937

10 00 5 2/ 2 31 /1 r th e O ts id Pa en tm ju s Ad nd s 05 20 2 474 453 -527 000 3 068 163 +461 852 An av al ue t. V se iv id e D n it i 05 /2 0 /0 1 01 4 20 0 12 / 31 / Pr of An av av An +175 480 As d ta te es R te d ep or R Adjusted Net Asset Value (ANAV): Roll-forward, 2004 – 2005 (in ’ 000 EUR) +454 561+ 28 816

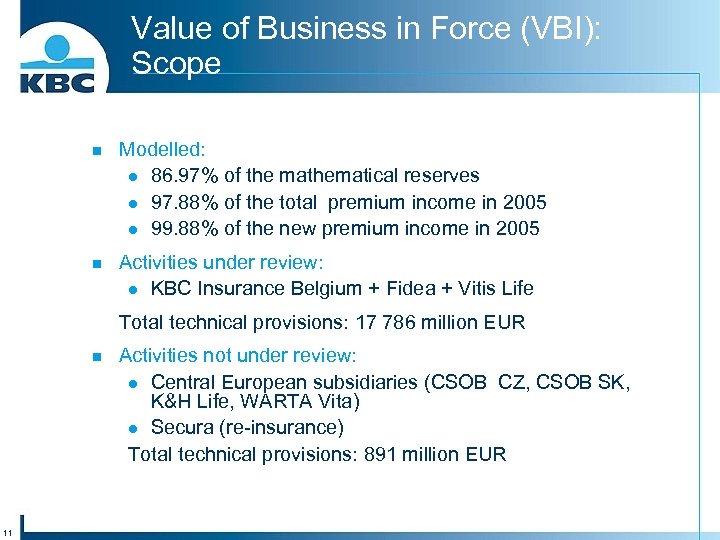

Value of Business in Force (VBI): Scope n Modelled: l 86. 97% of the mathematical reserves l 97. 88% of the total premium income in 2005 l 99. 88% of the new premium income in 2005 n Activities under review: l KBC Insurance Belgium + Fidea + Vitis Life Total technical provisions: 17 786 million EUR n 11 Activities not under review: l Central European subsidiaries (CSOB CZ, CSOB SK, K&H Life, WARTA Vita) l Secura (re-insurance) Total technical provisions: 891 million EUR

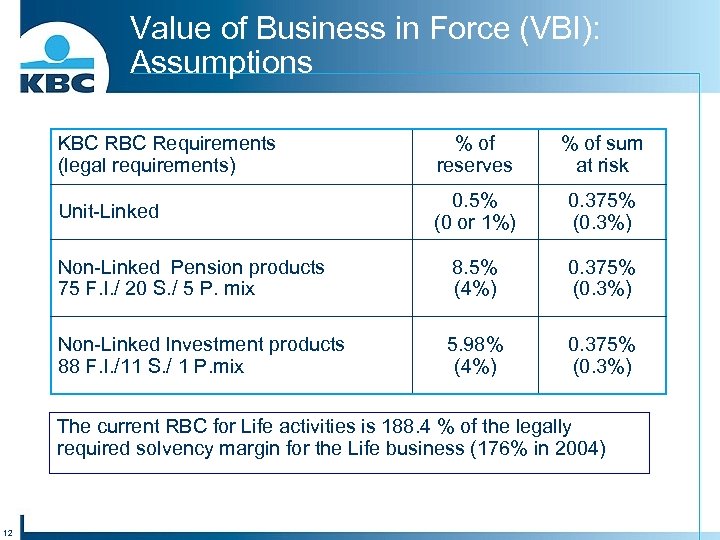

Value of Business in Force (VBI): Assumptions KBC Requirements (legal requirements) % of reserves % of sum at risk Unit-Linked 0. 5% (0 or 1%) 0. 375% (0. 3%) Non-Linked Pension products 75 F. I. / 20 S. / 5 P. mix 8. 5% (4%) 0. 375% (0. 3%) Non-Linked Investment products 88 F. I. /11 S. / 1 P. mix 5. 98% (4%) 0. 375% (0. 3%) The current RBC for Life activities is 188. 4 % of the legally required solvency margin for the Life business (176% in 2004) 12

Value of Business in Force (VBI): Assumptions n n Mortality: l Assumptions based on most recent industry experience were used n 13 Expenses: l Expenses are allocated to the different products and activities in such a way that the total expenses in the study equal the total expenses in the statutory accounts l Expenses increase with expected wage inflation l Future expense reductions programmes and synergies are not taken into account Lapses: l Assumptions based on annual experience, investigations of surrenders and paid-ups, with a reasonable safety margin l Assumptions are set according to product and to distribution channel

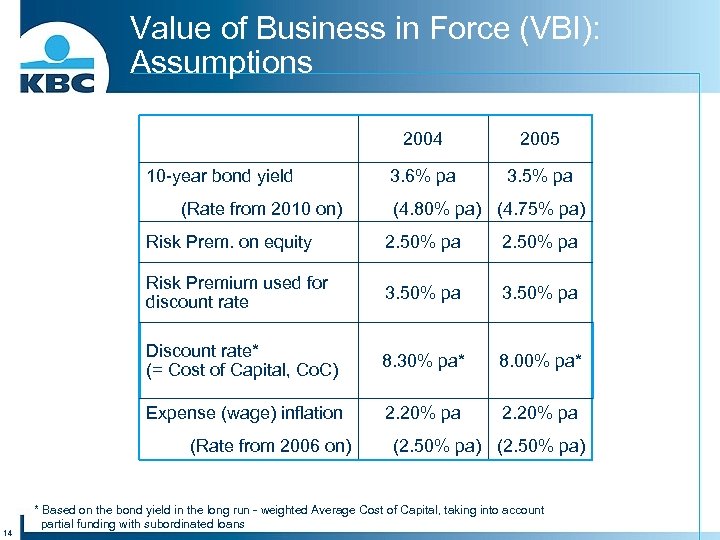

Value of Business in Force (VBI): Assumptions 2004 10 -year bond yield (Rate from 2010 on) 2005 3. 6% pa 3. 5% pa (4. 80% pa) (4. 75% pa) Risk Prem. on equity 2. 50% pa Risk Premium used for discount rate 3. 50% pa Discount rate* (= Cost of Capital, Co. C) 8. 30% pa* 8. 00% pa* Expense (wage) inflation 2. 20% pa (Rate from 2006 on) 14 (2. 50% pa) * Based on the bond yield in the long run - weighted Average Cost of Capital, taking into account partial funding with subordinated loans

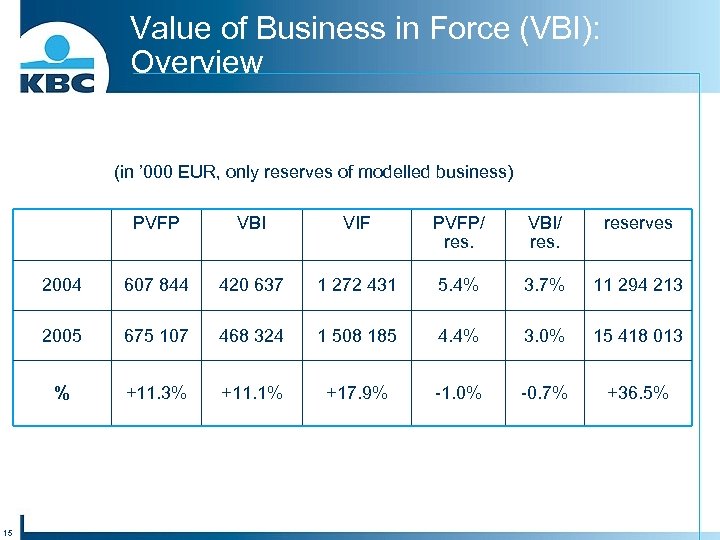

Value of Business in Force (VBI): Overview (in ’ 000 EUR, only reserves of modelled business) PVFP VIF PVFP/ res. VBI/ reserves 2004 607 844 420 637 1 272 431 5. 4% 3. 7% 11 294 213 2005 675 107 468 324 1 508 185 4. 4% 3. 0% 15 418 013 % 15 VBI +11. 3% +11. 1% +17. 9% -1. 0% -0. 7% +36. 5%

Value of Business in Force (VBI): Sensitivities Effect of non-econonmic parameters on VBI: Total + 10% - 10% Expenses -4. 5% +4. 5% Lapses & Dormancy -2. 6% +3. 2% Mortality -2. 9% +2. 9% Effect of economic parameters on VBI: + 1. 0 % Discount rate -14. 8% +16. 7% Investment Return 16 - 1. 0 % +10. 8% -16. 2%

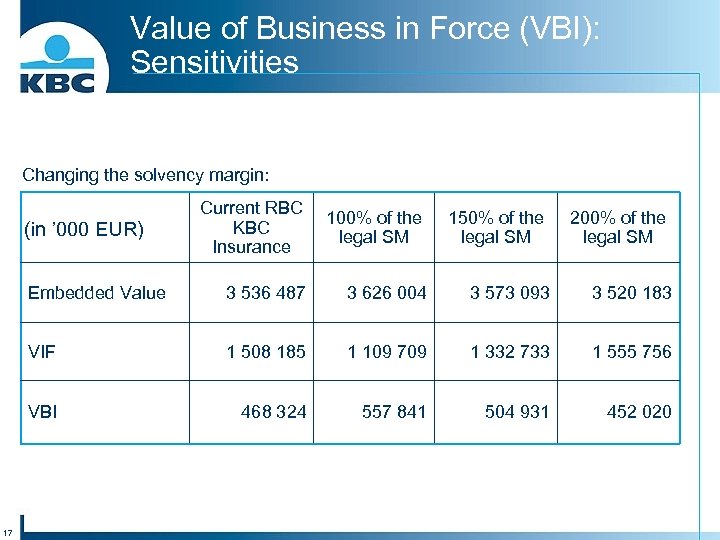

Value of Business in Force (VBI): Sensitivities Changing the solvency margin: Current RBC KBC Insurance 100% of the legal SM Embedded Value 3 536 487 3 626 004 3 573 093 3 520 183 VIF 1 508 185 1 109 709 1 332 733 1 555 756 VBI 468 324 557 841 504 931 452 020 (in ’ 000 EUR) 17 150% of the legal SM 200% of the legal SM

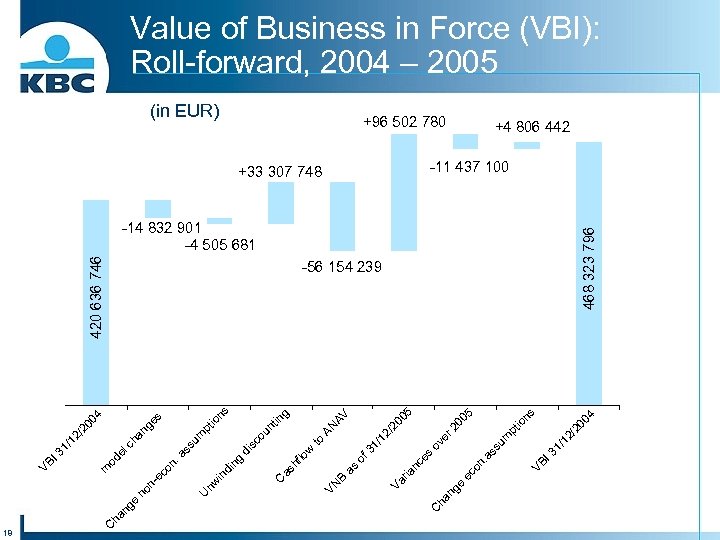

e 04 /2 0 -14 832 901 -4 505 681 -56 154 239 468 323 796 +96 502 780 VB I 3 1/ 12 00 5 io ns pt um ss on. a ec ov er 2 05 /2 0 AV AN 420 636 746 +33 307 748 ha ng to 1/ 12 of 3 nc es as Va ria B VN w in g ou nt pt io ns um ge s ha n di sc hf lo as C in g in d nw U ss on. a no nec el c od 04 (in EUR) C ng e ha C 18 m /2 0 VB I 3 1/ 12 Value of Business in Force (VBI): Roll-forward, 2004 – 2005 +4 806 442 -11 437 100

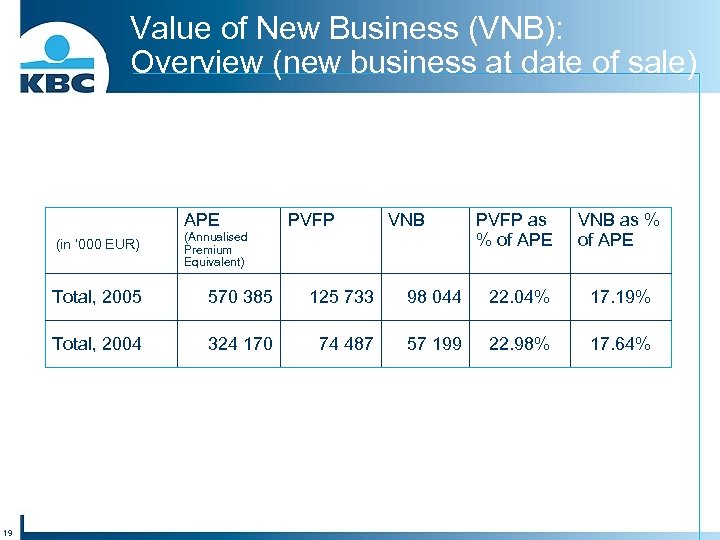

Value of New Business (VNB): Overview (new business at date of sale) APE (in ’ 000 EUR) (Annualised Premium Equivalent) PVFP VNB PVFP as % of APE VNB as % of APE Total, 2005 125 733 98 044 22. 04% 17. 19% Total, 2004 19 570 385 324 170 74 487 57 199 22. 98% 17. 64%

Value of New Business (VNB): Sensitivities (at date of sale) Non-Economic Sensitivities: + 10% - 10% Expenses -5. 93% Lapses -3. 19% 3. 64% Mortality -2. 59% 2. 62% Economic Sensitivities: - 0. 5% Discount rate +5. 86% -6. 27% Investment Return (excl. disc. rate) 20 + 0. 5 % -6. 23% +5. 18%

Review Lane Clark & Peacock Belgium reviewed the methodology and assumptions used by KBC Insurance in the determination of the Embedded Value at 31/12/2005, the Value of 2005 New Business and the analysis of the change in the value of in-force business for the Life Insurance activities of KBC Insurance. It is the view of Lane Clark & Peacock Belgium, based on the data made available, that the assumptions used are reasonable and that the methodology used by KBC Insurance is in line with basic principles described in appropriate literature. Our assignment included a review of the calculations. This review was not a detailed verification of the correctness of all calculations. This review was a limited high-level reasonableness checks on the results and included a detailed review on a limited random sample of contracts of the insurance portfolio of KBC Insurance. No material issues have been discovered. Therefore, based on our work and our validation report on the work carried out by KBC Insurance, we consider the embedded value, the value of new business and the analysis of the change in the value of in-force for the life business to be reasonable and suitable for inclusion as supplementary information to the Group’s consolidated accounts. 21

Contact information Investor Relations Office Luc Cool, Head of IR Luc Albrecht, Financial Communications Officer Tamara Bollaerts, IR Coordinator Marina Kanamori, CSR Communications Officer Nele Kindt, IR Analyst E-mail: investor. relations@kbc. com Surf to www. kbc. com for the latest update. 22

79686733f9c7278224283f11b2f03858.ppt