Forward Contract Quantitative Analysis April 15, 2008

Forward Contract Quantitative Analysis April 15, 2008

Overview 1. PG&E’s Power Mix 2. What is a Forward Contract 3. Some features of Forward Contract 4. Why do we use Forward Contracts? 5. Pricing Forward Contract 6. Valuing Forward Contract 7. Swaps 1

Overview 1. PG&E’s Power Mix 2. What is a Forward Contract 3. Some features of Forward Contract 4. Why do we use Forward Contracts? 5. Pricing Forward Contract 6. Valuing Forward Contract 7. Swaps 1

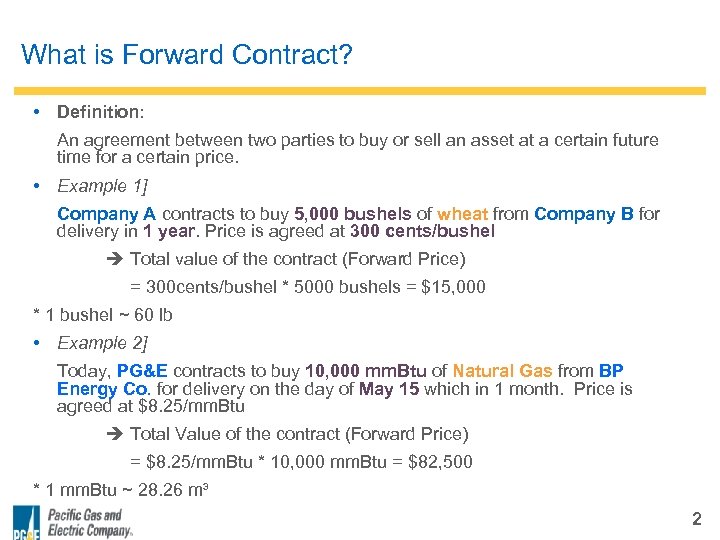

What is Forward Contract? • Definition: An agreement between two parties to buy or sell an asset at a certain future time for a certain price. • Example 1] Company A contracts to buy 5, 000 bushels of wheat from Company B for delivery in 1 year. Price is agreed at 300 cents/bushel Total value of the contract (Forward Price) = 300 cents/bushel * 5000 bushels = $15, 000 * 1 bushel ~ 60 lb • Example 2] Today, PG&E contracts to buy 10, 000 mm. Btu of Natural Gas from BP Energy Co. for delivery on the day of May 15 which in 1 month. Price is agreed at $8. 25/mm. Btu Total Value of the contract (Forward Price) = $8. 25/mm. Btu * 10, 000 mm. Btu = $82, 500 * 1 mm. Btu ~ 28. 26 m³ 2

What is Forward Contract? • Definition: An agreement between two parties to buy or sell an asset at a certain future time for a certain price. • Example 1] Company A contracts to buy 5, 000 bushels of wheat from Company B for delivery in 1 year. Price is agreed at 300 cents/bushel Total value of the contract (Forward Price) = 300 cents/bushel * 5000 bushels = $15, 000 * 1 bushel ~ 60 lb • Example 2] Today, PG&E contracts to buy 10, 000 mm. Btu of Natural Gas from BP Energy Co. for delivery on the day of May 15 which in 1 month. Price is agreed at $8. 25/mm. Btu Total Value of the contract (Forward Price) = $8. 25/mm. Btu * 10, 000 mm. Btu = $82, 500 * 1 mm. Btu ~ 28. 26 m³ 2

Some Features of Forward Contract • No money or goods change hands before maturity • Can buy and sell risk without holding the physical • Good for hedging (or speculating) 3

Some Features of Forward Contract • No money or goods change hands before maturity • Can buy and sell risk without holding the physical • Good for hedging (or speculating) 3

Why do we use Forward Contracts? PG&E Power Mix 4

Why do we use Forward Contracts? PG&E Power Mix 4

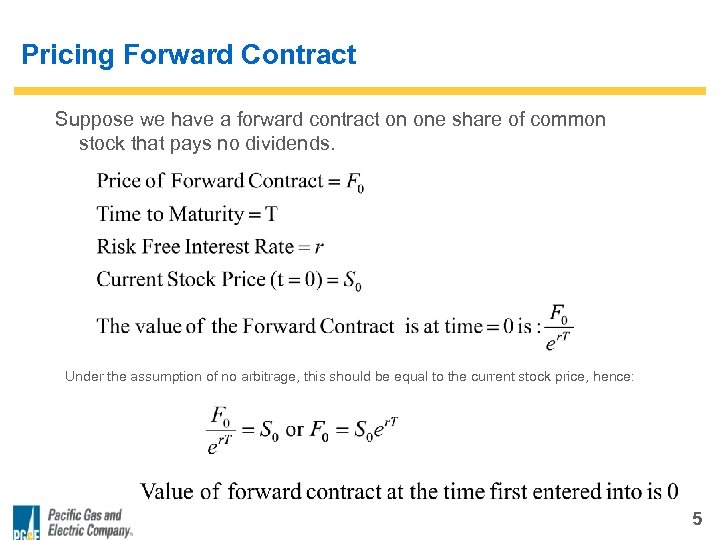

Pricing Forward Contract Suppose we have a forward contract on one share of common stock that pays no dividends. Under the assumption of no arbitrage, this should be equal to the current stock price, hence: 5

Pricing Forward Contract Suppose we have a forward contract on one share of common stock that pays no dividends. Under the assumption of no arbitrage, this should be equal to the current stock price, hence: 5

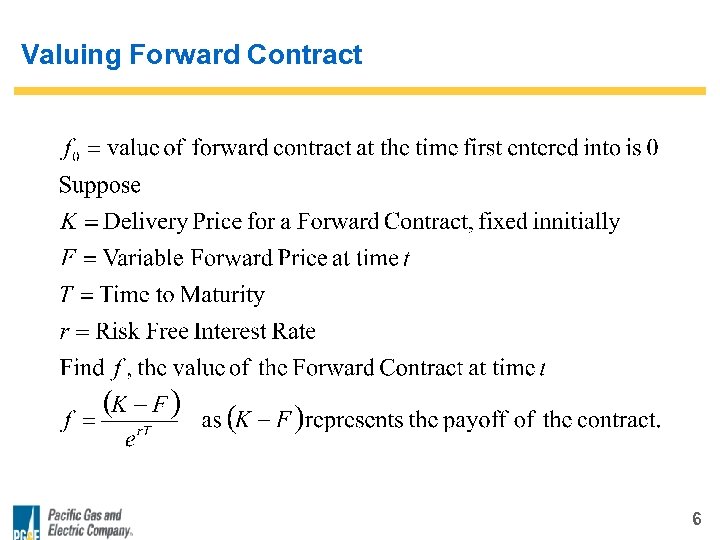

Valuing Forward Contract 6

Valuing Forward Contract 6

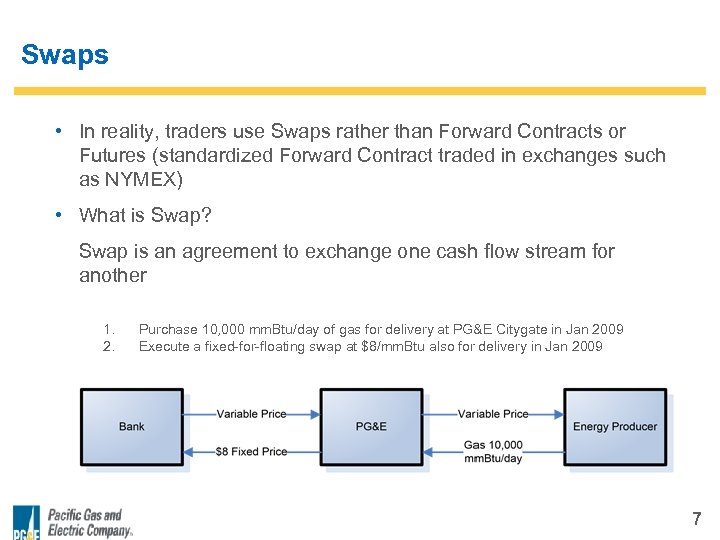

Swaps • In reality, traders use Swaps rather than Forward Contracts or Futures (standardized Forward Contract traded in exchanges such as NYMEX) • What is Swap? Swap is an agreement to exchange one cash flow stream for another 1. 2. Purchase 10, 000 mm. Btu/day of gas for delivery at PG&E Citygate in Jan 2009 Execute a fixed-for-floating swap at $8/mm. Btu also for delivery in Jan 2009 7

Swaps • In reality, traders use Swaps rather than Forward Contracts or Futures (standardized Forward Contract traded in exchanges such as NYMEX) • What is Swap? Swap is an agreement to exchange one cash flow stream for another 1. 2. Purchase 10, 000 mm. Btu/day of gas for delivery at PG&E Citygate in Jan 2009 Execute a fixed-for-floating swap at $8/mm. Btu also for delivery in Jan 2009 7