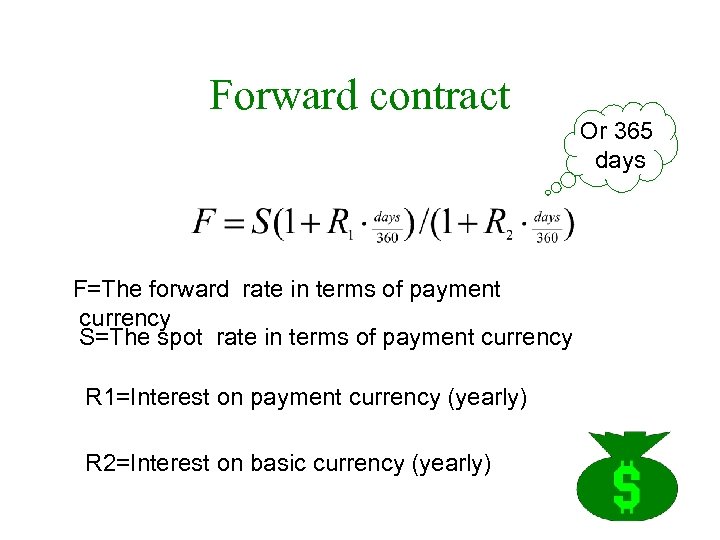

Forward contract F=The forward rate in terms of payment currency S=The spot rate in terms of payment currency R 1=Interest on payment currency (yearly) R 2=Interest on basic currency (yearly) Or 365 days

Forward contract F=The forward rate in terms of payment currency S=The spot rate in terms of payment currency R 1=Interest on payment currency (yearly) R 2=Interest on basic currency (yearly) Or 365 days

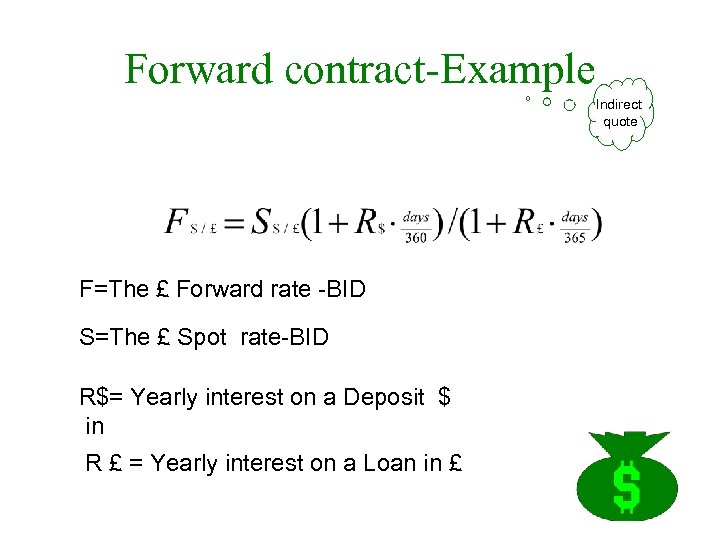

Forward contract-Example Indirect quote F=The £ Forward rate -BID S=The £ Spot rate-BID R$= Yearly interest on a Deposit $ in R £ = Yearly interest on a Loan in £

Forward contract-Example Indirect quote F=The £ Forward rate -BID S=The £ Spot rate-BID R$= Yearly interest on a Deposit $ in R £ = Yearly interest on a Loan in £

Hedge strategy with forward Canceling the risk by getting to opposite position If we long the currency - we would sell the forward contract If we have a loan in the currency we would buy the forward contract

Hedge strategy with forward Canceling the risk by getting to opposite position If we long the currency - we would sell the forward contract If we have a loan in the currency we would buy the forward contract

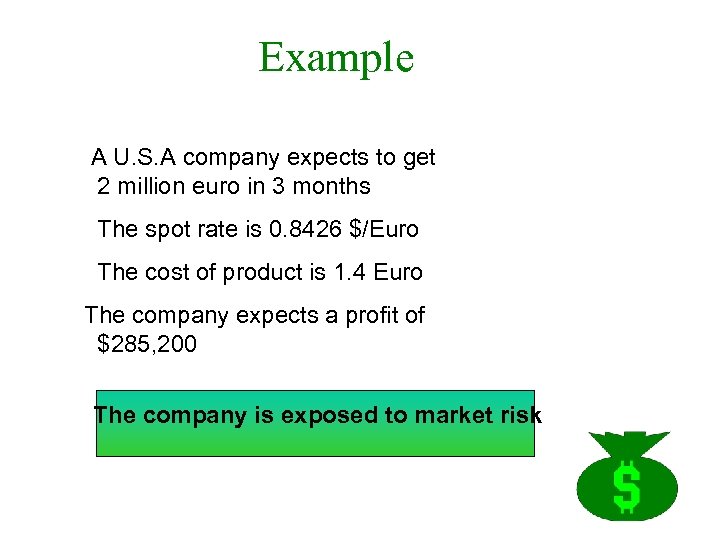

Example A U. S. A company expects to get 2 million euro in 3 months The spot rate is 0. 8426 $/Euro The cost of product is 1. 4 Euro The company expects a profit of $285, 200 The company is exposed to market risk

Example A U. S. A company expects to get 2 million euro in 3 months The spot rate is 0. 8426 $/Euro The cost of product is 1. 4 Euro The company expects a profit of $285, 200 The company is exposed to market risk

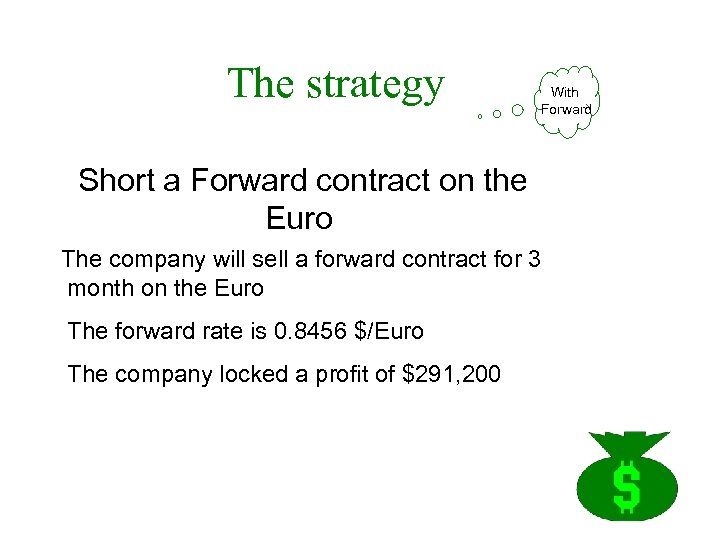

The strategy With Forward Short a Forward contract on the Euro The company will sell a forward contract for 3 month on the Euro The forward rate is 0. 8456 $/Euro The company locked a profit of $291, 200

The strategy With Forward Short a Forward contract on the Euro The company will sell a forward contract for 3 month on the Euro The forward rate is 0. 8456 $/Euro The company locked a profit of $291, 200

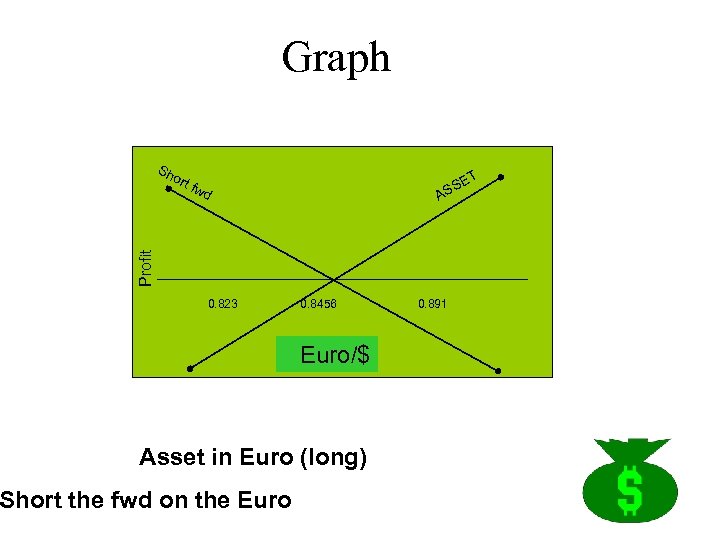

Graph Sh T E SS wd A Profit ort f 0. 823 0. 8456 Euro/$ Asset in Euro (long) Short the fwd on the Euro 0. 891

Graph Sh T E SS wd A Profit ort f 0. 823 0. 8456 Euro/$ Asset in Euro (long) Short the fwd on the Euro 0. 891

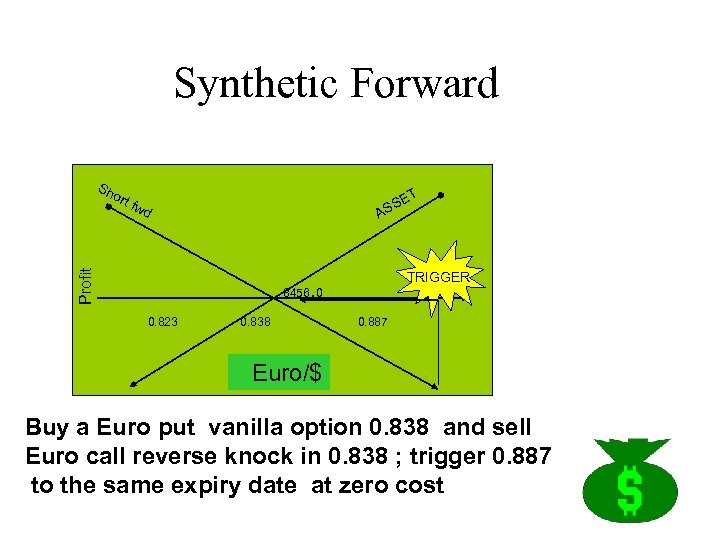

Synthetic Forward Short a Euro Forward = Buy a Euro call and sell a Euro put, the same. strike and the expiry date Buy a Euro put vanilla option, strike. 8380 , expiry 3 months from today Sell a Euro call reverse knock in, strike. 8380 with trigger of. 887 , expiry 3 months from today The price of the strategy - zero cost With Options

Synthetic Forward Short a Euro Forward = Buy a Euro call and sell a Euro put, the same. strike and the expiry date Buy a Euro put vanilla option, strike. 8380 , expiry 3 months from today Sell a Euro call reverse knock in, strike. 8380 with trigger of. 887 , expiry 3 months from today The price of the strategy - zero cost With Options

Synthetic Forward Sh o ET rt f S AS Profit wd TRIGGER . 8456 0 0. 823 0. 838 0. 887 Euro/$ Buy a Euro put vanilla option 0. 838 and sell Euro call reverse knock in 0. 838 ; trigger 0. 887 to the same expiry date at zero cost

Synthetic Forward Sh o ET rt f S AS Profit wd TRIGGER . 8456 0 0. 823 0. 838 0. 887 Euro/$ Buy a Euro put vanilla option 0. 838 and sell Euro call reverse knock in 0. 838 ; trigger 0. 887 to the same expiry date at zero cost