5ac85a8e7e69c8c4fde0a2cb953fa77e.ppt

- Количество слайдов: 58

FORMS OF BUSINESS ORGANIZATION IN THE UNITED STATES Unit 33

Forms of Business Organization • Sole proprietorship (or the individual ownership); sole trader • Partnership • Corporation

Factors taken into consideration • • • Financial responsibility Control of operation Possibilities of growth and expansion Possibilities of capitalization Financial development

Sole proprietorship • Business owned by one person • Owner has relatively unlimited control over the business and enjoys all the profits • Unlimited personal responsibility for the losses, debts and other liabilities • Small retail stores, restaurants, farms etc.

Partnership • Association of two or more persons as coowners to carry on a business for profit • Based upon voluntary agreement of partners • Profits and losses shared equally unless otherwise agreed

Partnership • Every partner liable without limit to creditors for debts of the management with equal authority • Utilize more capital, labor and skill than sole proprietorships

Partnership • Unlike an incorporated company, a partnership does not have a legal personality of its own and therefore partners are liable for the debts of the firm • On leaving the firm they remain liable for debts already incurred; they cease to be liable for future debts if proper notice of retirement has been published

Corporation • Artificial person created under law and empowered to achieve a specific purpose • Formed upon the issuance of a certificate of incorporation by the appropriate government authority

Company formation • Certificate of incorporation – issued upon the filing of the constitutional documents of the company, together with statutory forms and the payment of a filing fee

The ‘constitution’ of a company • Memorandum of association • Articles of association

Memorandum of association • • • States: the objects of the company Details of its authorised capital, known as the nominal capital

Articles of association • Provisions for the internal management of the company (e. g. shareholders’ annual meetings, extraordinary general meegings, the board of directors, corporate contracts and loans) • Structure, procedures and work of the board of directors

Company management • Director: appointed to carry out and control the day-to-day affairs of the company • Manager: supervisory control of the affairs of the company • Secretary • Auditors: do not owe a duty to the company as a legal entity, but to the shareholders, to whom the auditor’s report is addressed

Director • Duty of care: must exercise the care of an ordinarily prudent and diligent person • Fiduciary duty: must act in the best interests of the company and not for any collateral purpose

Corporation • The formation of an association that has corporate personality, i. e. a legal personality distinct from those of its members • Such a body can own property and incur debts • Company members have no liability to company creditors • Incorporated company has its own rights and liabilities and legal proceedings

Salomon v Salomon and Co. (1897) • S converted his existing, successful business into a limited company, of which he was the managing director • S valued his business at $39, 000 and received from the company , in discharge of this sum, a cash amount, a debenture (an acknowledgement of debt) and 20, 001 $1 shares out of the issued capital of 20, 007

Salomon v Salomon and Co. (1897) • S’s wife and five children each held one of the remaining issued shares • The company went into insolvent liquidation within a year with no assets to pay off the unsecured creditors • The issue for the courts: was S liable for the company’s unpaid debts?

Salomon v Salomon and Co. (1897) • the House of Lords, reversing the Court of Appeal, held that the company had been properly formed and was a legal person in its own right, separate from S, notwithstanding his dominant position within the company • The company was not S. ’s agent and, consequently, S’s liability was to be determined solely by reference to the CA 1862

Salomon v Salomon and Co. (1897) • The Act required a shareholder to contribute to the debts of a company only where he held shares in respect of which the full nominal value had not been paid • S had paid his shares in full by transferring the business to the company, so he had no liability to the creditors of the company

Salomon v Salomon and Co. (1897) • The case established that legal personality would be recognized even when one shareholder effectively controlled the company

Attributes of corporations • • • The effects of separate legal personality include: Perpetual life (“perpetual succession”) Limited liability Transferability of shares Access to capital Professional management

Perpetual succession • Any corporate body has a legal existence distinct from the person or persons of whom it is composed • Its lifespan is not limited by that of its members and it is therefore said to have perpetual succession • It continues to exist until wound up in the manner prescribed by law

Limited liability • Members of companies providing the share capital cannot be asked to contribute more than the nominal value of the shares registered in their names • The nominal value of the shares or the amount of the guarantee will appear in the Memorandum of Association and in the Annual Accounts

Transfer of shares • A transaction resulting in a change of share ownership. It traditionally involved: • 1. a contract to sell the shares • 2. their transfer • 3. entry of the transferee’s name on the registrar of members of the company

Corporate veil • In cases when the company is used to perpetrate fraud or acts ultra vires, the court may ‘lift’ the corporate veil and subject the shareholders to personal liability

Legal terms • Sole proprietorship • Isključivo vlasništvo; poduzeće s jednim vlasnikom • Partnership • Partnerstvo, ortaštvo • Corporation • Trgovačko društvo, dioničko društvo, društvo kapitala

Legal terms • • Retail Maloprodaja Liability Obveza (financijska), odgovornost Creditor Vjerovnik, zajmodavac Debtor Dužnik, zajmoprimac

Legal terms • Artificial person (Br. E. ), legal person, legal entity • Pravna osoba • Limited liability • Ograničena odgovornost • Transferability of shares • Prenosivost dionica

Introduction to Company Law: Exercise • Complete the text by using the following words: agreements, borrow, corporations, court, debts, dividends, employees, legal, legislation, liability, limited, objectives, partnership, profits, property, registered (x 2), shareholders, sole trader, sue

Exercise • A company is a ___entity, allowed by ___, which permits a group of people, as___, to create an organization, which can then focus on pursuing set____. It is empowered with legal rights which are usually only reserved for individuals, such as the right to____and be sued, own____, hire____ or loan and ____money.

Exercise • The primary advantage of a company structure is that it provides the shareholders with a right to participate in the_____, a proportionate distribution of profits made in the form of a money payment to shareholders, without any personal____.

Exercise • There are various forms of legal business entities ranging from the____, who alone bears the risk and responsibility of running a business, taking the profits, but as such not forming any association in law and thus not regulated by special rules of law, to the____company with ___liability and to multinational ____.

Exercise • In a ____, members ‘associate’, forming collectively an association in which they all participate in management and sharing____, bearing the liability for the firm’s _____and being sued jointly and severally in relation to the firm’s contracts or tortious acts.

Exercise • Limited-liability companies, or corporations, unlike partnerships, are formed not simply by____entered into between their first members; they must also be_____at a public office or _____designated by law or otherwise obtain official acknowledgement of their existence.

Key • A company is a legal entity, allowed by legislation, which permits a group of people, as shareholders, to create an organization, which can then focus on pursuing set objectives. It is empowered with legal rights which are usually only reserved for individuals, such as the right to sue and be sued, own property, hire emoloyees or loan and borrow money.

Key • The primary advantage of a company structure is that it provides the shareholders with a right to participate in the dividends, a proportionate distribution of profits made in the form of a money payment to shareholders, without any personal liability.

Key • There are various forms of legal business entities ranging from the sole trader, who alone bears the risk and responsibility of running a business, taking the profits, but as such not forming any association in law and thus not regulated by special rules of law, to the registered company with limited liability and to multinational corporations.

Key • In a partnership, members ‘associate’, forming collectively an association in which they all participate in management and sharing profits, bearing the liability for the firm’s debts and being sued jointly and severally in relation to the firm’s contracts or tortious acts.

Key • Limited-liability companies, or corporations, unlike partnerships, are formed not simply by agreements entered into between their first members; they must also be registered at a public office or court designated by law or otherwise obtain official acknowledgement of their existence.

Roles in company management Match the roles with definitions: auditor, company secretary, director, managing director, shareholder • Company director responsible for the day-to-day operation of the company • Person elected by the shareholders to manage the company and decide its general policy • Person appointed by the company to examine the company’s accounts and to report to the shareholders annually on the accounts

Match the roles with definitions: auditor, company secretary, director, managing director, shareholder • Member of the company by virtue of an acquisition of shares in a company • Company’s chief administrative officer, whose responsibilities include accounting and finance duties, personnel administration and compliance with employment legislation security of documentation, insurance and intellectual property rights

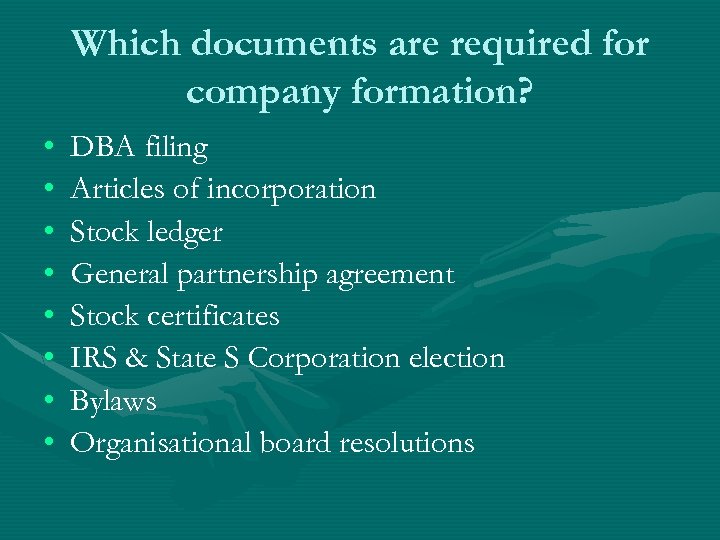

Which documents are required for company formation? • • DBA filing Articles of incorporation Stock ledger General partnership agreement Stock certificates IRS & State S Corporation election Bylaws Organisational board resolutions

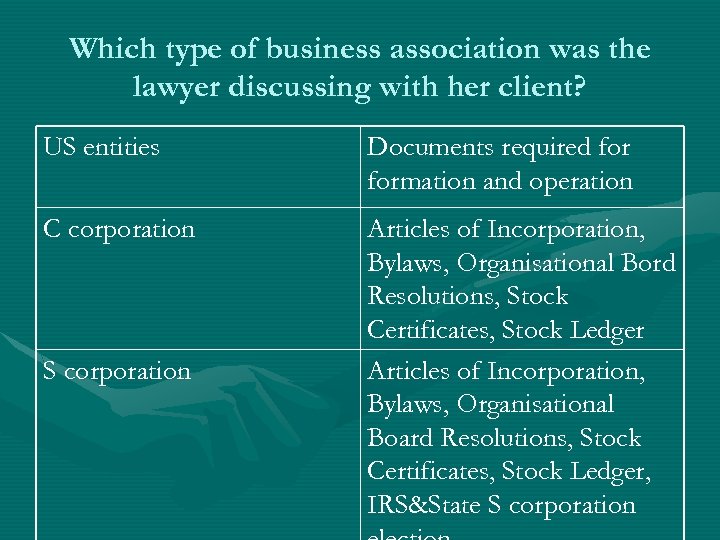

Which type of business association was the lawyer discussing with her client? US entities Documents required formation and operation Sole proprietorship DBA filing General partnership General Partnership Agreement, local filings if partnership holds real estate Limited Partnership Certificate, Limited Partnership Agreement Limited partnership

Which type of business association was the lawyer discussing with her client? US entities Documents required formation and operation C corporation Articles of Incorporation, Bylaws, Organisational Bord Resolutions, Stock Certificates, Stock Ledger Articles of Incorporation, Bylaws, Organisational Board Resolutions, Stock Certificates, Stock Ledger, IRS&State S corporation

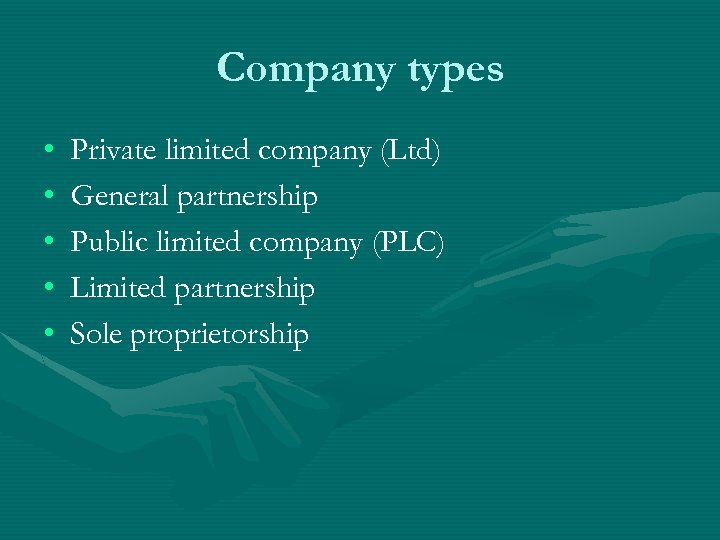

Company types • • • Private limited company (Ltd) General partnership Public limited company (PLC) Limited partnership Sole proprietorship

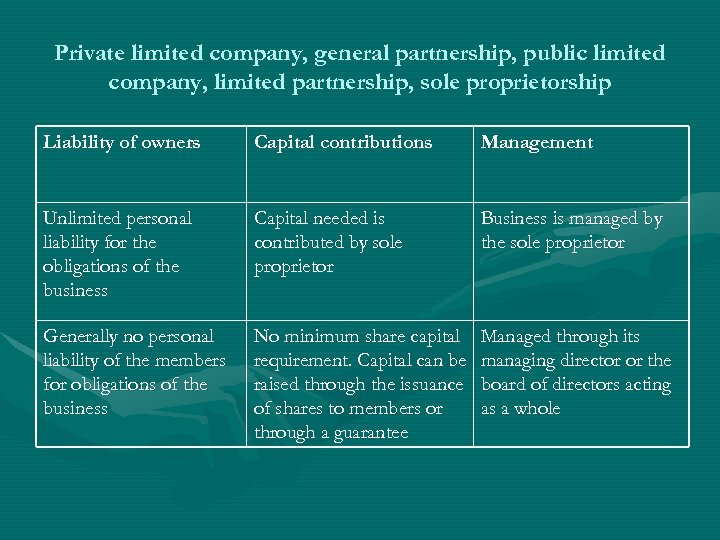

Private limited company, general partnership, public limited company, limited partnership, sole proprietorship Liability of owners Capital contributions Management Unlimited personal liability for the obligations of the business Capital needed is contributed by sole proprietor Business is managed by the sole proprietor Generally no personal liability of the members for obligations of the business No minimum share capital requirement. Capital can be raised through the issuance of shares to members or through a guarantee Managed through its managing director or the board of directors acting as a whole

Private limited company, general partnership, public limited company, limited partnership, sole proprietorship Liability of owners Capital contributions Management No personal liability; Minimum share capital of liability limited to L 50, 000 shareholder contributions Raised through issuance of shares to the public and/or members Managed by the board of directors; shareholders have no power to participate in management Unlimited personal liability of general partners for the obligations of the business Partners have equal management rights, unless they agree otherwise Partners contribute money or services to the partnership; share profits and losses

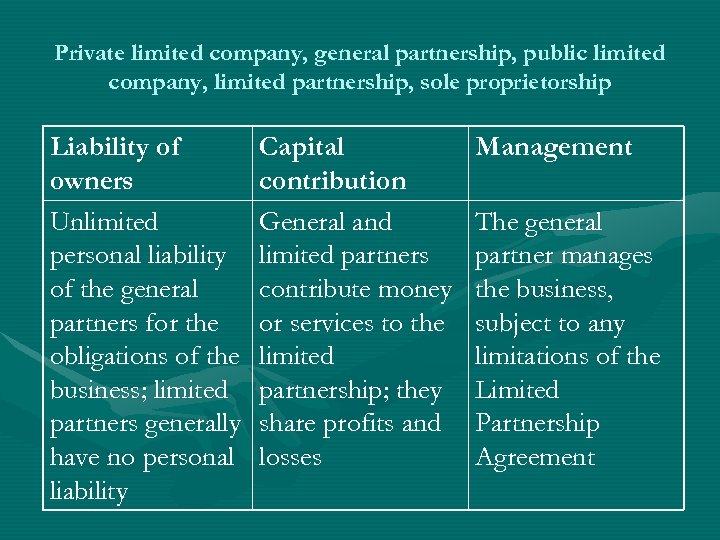

Private limited company, general partnership, public limited company, limited partnership, sole proprietorship Liability of owners Unlimited personal liability of the general partners for the obligations of the business; limited partners generally have no personal liability Capital contribution General and limited partners contribute money or services to the limited partnership; they share profits and losses Management The general partner manages the business, subject to any limitations of the Limited Partnership Agreement

Choose the correct word or phrase: • 1. The constitution of a company comprises/consists/contains of two documents. • 2. The memorandum of association states /provides for / sets up the objects of the company and details its authorised capital. • 3. The articles of association contain arguments / provisions / directives for the internal management of a company

Choose the correct word or phrase • 4. The company is governed by the board of directors, whilst the day-to-day management is delegated upon / to / for the managing director. • 5. In some companies, the articles of association make /give / allow provision for rotation of directors, whereby only a certain portion of the bord must retire and present itself for re-election before the AGM.

Choose the correct word or phrase • 6. Many small shareholders do not bother to attend shareholders’ meetings and will often receive proxy circulars from the board, seeking authorisation to vote on the basis of / in respect of / on behalf of the shareholder.

Complete the following using: in terms of, in the course of, by way of, in response to • 1. _____choosing the name of the company, a number of matters must be considered. • 2. Confidential information acquired_____one’s directorship shall not be used for personal advantage. • 3. I would advise that members of your project group formalise your relationship ____a partnership agreement, incorporation or limited liability company.

Complete the following using: in terms of, in the course of, by way of, in response to • 4. This form of corporation is often considered to be the most flexible body ____corporate structure. • 5. Our company formations expert is unable to provide advice____your query, as there a number of factors which need to be taken into account which do not relate directly to his area of expertise.

Complete the following using: in terms of, in the course of, by way of, in response to • 6. The relationship between management and boards of directors at US multinational companies has been changed dramatically through a series of corporate governance initiatives begun_____corporate scandals, the Sarbanes-Oxley Act and other requirements.

Complete the following using: in terms of, in the course of, by way of, in response to • 7. Shareholders and other investors in corporations tend to view corporate governance_____the corporation’s increasing value over time. • 8. Regular and extraordinary board meetings may be held by telephone, video-telephone and_____written resolutions.

Which of the following can go the verb to file ? • An action, an appeal, an amendment, a breach, a brief, charges, a claim, a complaint, a debt, a defence, a dispute, a document, a fee, an injunction, a motion, provisions, a suit

To file • • • To send a document to court To register something officially Podnijeti (prijavu, tužbu, zahtjev), podići (optužnicu), dostaviti, evidentirati, pokrenuti postupak, urudžbirati, arhivirati

Key • An action, an appeal, an amendment, a brief, charges, an injunction, a motion, a suit

5ac85a8e7e69c8c4fde0a2cb953fa77e.ppt