e97353904d57b507847eda01523983e7.ppt

- Количество слайдов: 100

Foreign Issuer Applying for Listing on Taiwan GTSM and Emerging Stock Market June 12, 2008 1

Foreign Issuer Applying for Listing on Taiwan GTSM and Emerging Stock Market June 12, 2008 1

OUTLINE 1. 2. 3. 4. 5. 6. Snapshot of Taiwan’s Economy The Status of Taiwan’s Capital Market The History & Characteristics of GTSM Securities Market Emerging Stock Board Registration Regular Stock Board Listing Conclusion 2

OUTLINE 1. 2. 3. 4. 5. 6. Snapshot of Taiwan’s Economy The Status of Taiwan’s Capital Market The History & Characteristics of GTSM Securities Market Emerging Stock Board Registration Regular Stock Board Listing Conclusion 2

Snapshot of Taiwan’s Economy 3

Snapshot of Taiwan’s Economy 3

Introduction n Since the 1997 Asian financial crisis, the Taiwan economy has confronted a number of challenges, including, among others, the rise of the Chinese economy, the burst of the dot-com bubble in 2000, and SARS. In response to these challenges, Taiwan has undertaken financial reforms and economic transformation, and emerged stronger. 4

Introduction n Since the 1997 Asian financial crisis, the Taiwan economy has confronted a number of challenges, including, among others, the rise of the Chinese economy, the burst of the dot-com bubble in 2000, and SARS. In response to these challenges, Taiwan has undertaken financial reforms and economic transformation, and emerged stronger. 4

Economic Performance Average growth rate of the economy for the past four years (2004 -2007) was 5. 2%, compared with 4. 7% for Korea, one of its most important competitors. The economy is expected to grow at 4. 5% in 2008 amid growing global concerns about recession. n The subprime mortgage problem has had relatively limited effect on the economy. The FSC put subprime loss at US$741 mn, as per yearend 2007. n The economy is fundamentally strong. n 5

Economic Performance Average growth rate of the economy for the past four years (2004 -2007) was 5. 2%, compared with 4. 7% for Korea, one of its most important competitors. The economy is expected to grow at 4. 5% in 2008 amid growing global concerns about recession. n The subprime mortgage problem has had relatively limited effect on the economy. The FSC put subprime loss at US$741 mn, as per yearend 2007. n The economy is fundamentally strong. n 5

Economic Performance n Although it imports 98% of energy, and global energy prices have been significantly rising recently, Taiwan has been able to maintain price stability. e. g. the CPI growth remains less than 1% in 2001 -06, while it rose to 1. 8% in 2007 due to the surge in global raw material prices. n The unemployment rate peaked at 5. 17% in 2002 due to rapid migration of labor intensive manufacturing industry to China and dot com bubble. It is now at the six year low rate of 3. 9% as a result of economic growth and various government policy of job creation. 6

Economic Performance n Although it imports 98% of energy, and global energy prices have been significantly rising recently, Taiwan has been able to maintain price stability. e. g. the CPI growth remains less than 1% in 2001 -06, while it rose to 1. 8% in 2007 due to the surge in global raw material prices. n The unemployment rate peaked at 5. 17% in 2002 due to rapid migration of labor intensive manufacturing industry to China and dot com bubble. It is now at the six year low rate of 3. 9% as a result of economic growth and various government policy of job creation. 6

![Latest Indicators n GDP Growth Rate [2008 forecast ]: 4. 78% n GNP [ Latest Indicators n GDP Growth Rate [2008 forecast ]: 4. 78% n GNP [](https://present5.com/presentation/e97353904d57b507847eda01523983e7/image-7.jpg) Latest Indicators n GDP Growth Rate [2008 forecast ]: 4. 78% n GNP [ 2007 ] : 12, 933, 890 million NT dollars n Per Capita GNP [ 2007 ] : 566, 566 NT dollars n CPI Change Rate : 3. 86% (Apr. 2008) (compared with the same month last year) n WPI Change Rate : 6. 18% (Apr. 2008) (compared with the same month last year) n Unemployment Rate : 3. 81% (Apr. 2008) n The economic growth of 2008 is forecasted to 4. 53%. 7

Latest Indicators n GDP Growth Rate [2008 forecast ]: 4. 78% n GNP [ 2007 ] : 12, 933, 890 million NT dollars n Per Capita GNP [ 2007 ] : 566, 566 NT dollars n CPI Change Rate : 3. 86% (Apr. 2008) (compared with the same month last year) n WPI Change Rate : 6. 18% (Apr. 2008) (compared with the same month last year) n Unemployment Rate : 3. 81% (Apr. 2008) n The economic growth of 2008 is forecasted to 4. 53%. 7

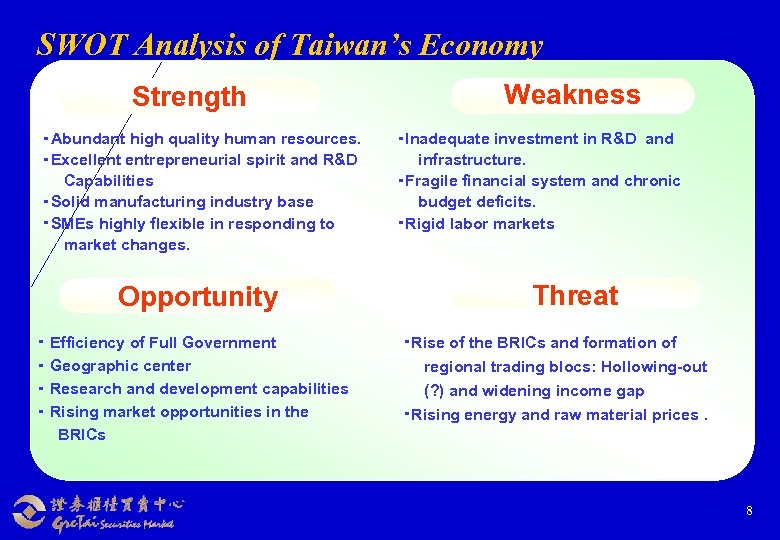

SWOT Analysis of Taiwan’s Economy Strength ‧Abundant high quality human resources. ‧Excellent entrepreneurial spirit and R&D Capabilities ‧Solid manufacturing industry base ‧SMEs highly flexible in responding to market changes. Opportunity ‧ Efficiency of Full Government ‧ Geographic center ‧ Research and development capabilities ‧ Rising market opportunities in the BRICs Weakness ‧Inadequate investment in R&D and infrastructure. ‧Fragile financial system and chronic budget deficits. ‧Rigid labor markets Threat ‧Rise of the BRICs and formation of regional trading blocs: Hollowing-out (? ) and widening income gap ‧Rising energy and raw material prices. 8

SWOT Analysis of Taiwan’s Economy Strength ‧Abundant high quality human resources. ‧Excellent entrepreneurial spirit and R&D Capabilities ‧Solid manufacturing industry base ‧SMEs highly flexible in responding to market changes. Opportunity ‧ Efficiency of Full Government ‧ Geographic center ‧ Research and development capabilities ‧ Rising market opportunities in the BRICs Weakness ‧Inadequate investment in R&D and infrastructure. ‧Fragile financial system and chronic budget deficits. ‧Rigid labor markets Threat ‧Rise of the BRICs and formation of regional trading blocs: Hollowing-out (? ) and widening income gap ‧Rising energy and raw material prices. 8

Taiwan’s Momentum n n the 144 th member of the World Trade Organization (WTO) Taiwan’s overall competitiveness ranked 13, IMD’s report, “World Competitiveness, 2008 ” Rank the top 5 competitive countries according to the WEF Global Competitiveness Report 2005 -2006 By the end of Mar. 2008, the foreign exchange reserves hit US$286. 86 billion 9

Taiwan’s Momentum n n the 144 th member of the World Trade Organization (WTO) Taiwan’s overall competitiveness ranked 13, IMD’s report, “World Competitiveness, 2008 ” Rank the top 5 competitive countries according to the WEF Global Competitiveness Report 2005 -2006 By the end of Mar. 2008, the foreign exchange reserves hit US$286. 86 billion 9

Prospects n n n Speed up the direct transportation across the strait. Relax the upper limit of 40% net value for Taiwanese businesses investing in Mainland China. Study the amendment of“The statues of relationship between the people in Taiwan and Mainland China” and establish as early as possible the cross strait currency exchange mechanism. Aggressively open the door for tourists from Mainland China to visit Taiwan and invest real estate property. Sign the memorandum of cross strait financial market collaboration, allow capital to Mainland China 10

Prospects n n n Speed up the direct transportation across the strait. Relax the upper limit of 40% net value for Taiwanese businesses investing in Mainland China. Study the amendment of“The statues of relationship between the people in Taiwan and Mainland China” and establish as early as possible the cross strait currency exchange mechanism. Aggressively open the door for tourists from Mainland China to visit Taiwan and invest real estate property. Sign the memorandum of cross strait financial market collaboration, allow capital to Mainland China 10

The Status of Taiwan’s Capital Market 11

The Status of Taiwan’s Capital Market 11

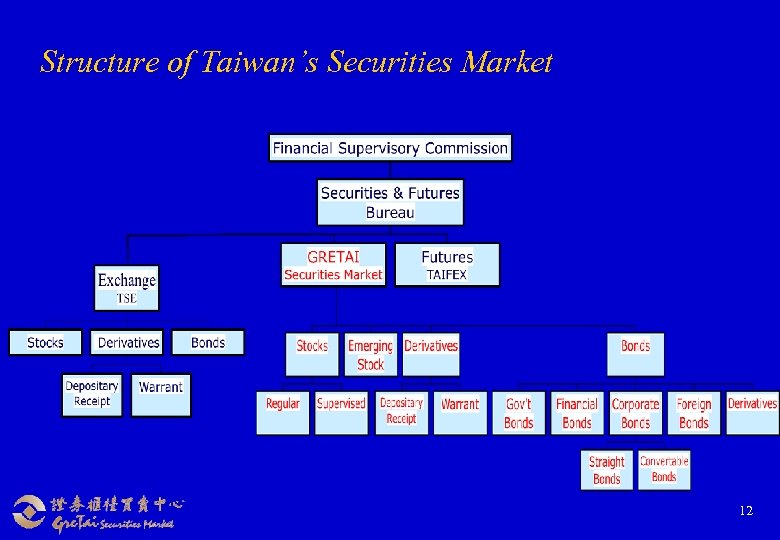

Structure of Taiwan’s Securities Market 12

Structure of Taiwan’s Securities Market 12

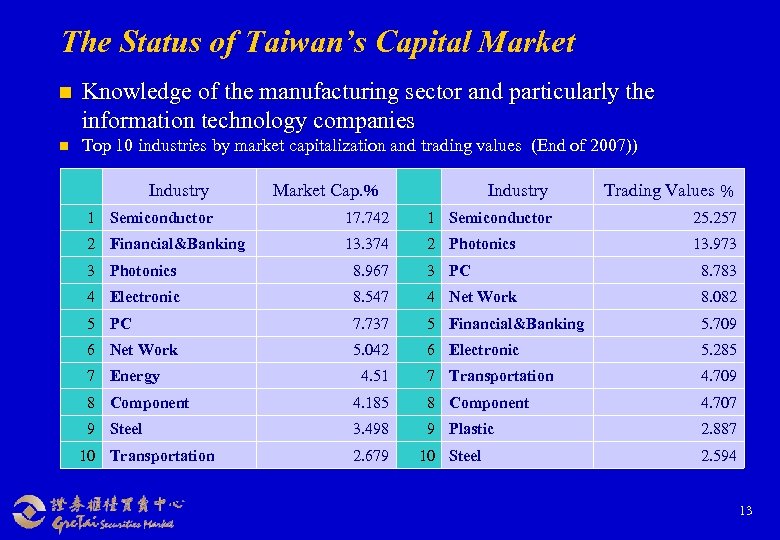

The Status of Taiwan’s Capital Market n Knowledge of the manufacturing sector and particularly the information technology companies n Top 10 industries by market capitalization and trading values (End of 2007)) Industry Market Cap. % Industry Trading Values % 1 Semiconductor 17. 742 1 Semiconductor 25. 257 2 Financial&Banking 13. 374 2 Photonics 13. 973 3 Photonics 8. 967 3 PC 8. 783 4 Electronic 8. 547 4 Net Work 8. 082 5 PC 7. 737 5 Financial&Banking 5. 709 6 Net Work 5. 042 6 Electronic 5. 285 7 Transportation 4. 709 7 Energy 4. 51 8 Component 4. 185 8 Component 4. 707 9 Steel 3. 498 9 Plastic 2. 887 10 Transportation 2. 679 10 Steel 2. 594 13

The Status of Taiwan’s Capital Market n Knowledge of the manufacturing sector and particularly the information technology companies n Top 10 industries by market capitalization and trading values (End of 2007)) Industry Market Cap. % Industry Trading Values % 1 Semiconductor 17. 742 1 Semiconductor 25. 257 2 Financial&Banking 13. 374 2 Photonics 13. 973 3 Photonics 8. 967 3 PC 8. 783 4 Electronic 8. 547 4 Net Work 8. 082 5 PC 7. 737 5 Financial&Banking 5. 709 6 Net Work 5. 042 6 Electronic 5. 285 7 Transportation 4. 709 7 Energy 4. 51 8 Component 4. 185 8 Component 4. 707 9 Steel 3. 498 9 Plastic 2. 887 10 Transportation 2. 679 10 Steel 2. 594 13

Enhancing the Confidence of Foreigners n Foreign ownership of Taiwan stocks as a percentage of total market capitalization rose from 22. 18% at the end of 2004 to 31. 1% at the end of 2007. Year Foreign ownership of Taiwan stocks(%) The cumulated net inward remittance by Foreign Institutional Investors (US$ bn) 2003 21. 46 66. 34 2004 22. 18 80. 09 2005 30. 25 108. 95 2006 31. 90 130. 61 2007 31. 10 137. 60 Apr. 2008 31. 10 153. 20 14

Enhancing the Confidence of Foreigners n Foreign ownership of Taiwan stocks as a percentage of total market capitalization rose from 22. 18% at the end of 2004 to 31. 1% at the end of 2007. Year Foreign ownership of Taiwan stocks(%) The cumulated net inward remittance by Foreign Institutional Investors (US$ bn) 2003 21. 46 66. 34 2004 22. 18 80. 09 2005 30. 25 108. 95 2006 31. 90 130. 61 2007 31. 10 137. 60 Apr. 2008 31. 10 153. 20 14

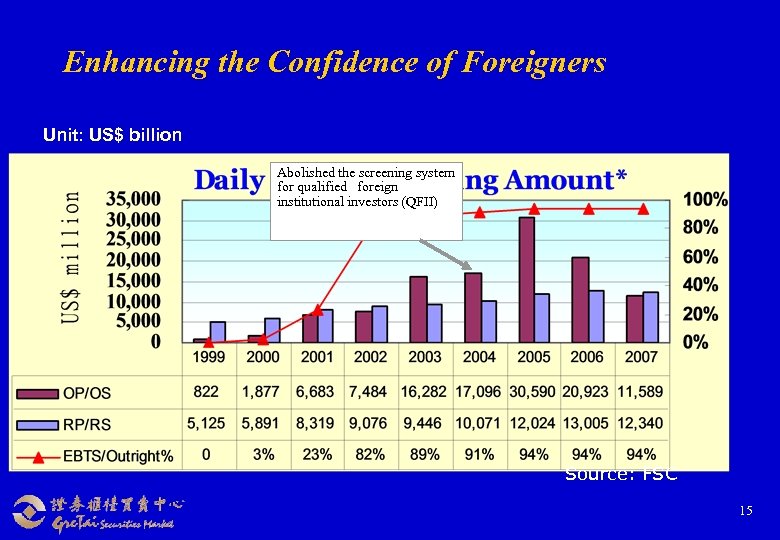

Enhancing the Confidence of Foreigners Unit: US$ billion Abolished the screening system for qualified foreign institutional investors (QFII) Total Accumulated Net Inward Remittance Source: FSC 15

Enhancing the Confidence of Foreigners Unit: US$ billion Abolished the screening system for qualified foreign institutional investors (QFII) Total Accumulated Net Inward Remittance Source: FSC 15

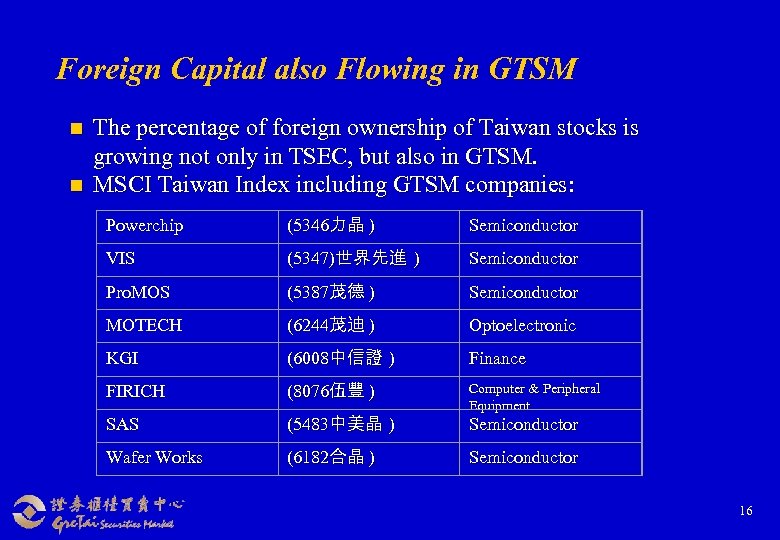

Foreign Capital also Flowing in GTSM n n The percentage of foreign ownership of Taiwan stocks is growing not only in TSEC, but also in GTSM. MSCI Taiwan Index including GTSM companies: Powerchip (5346力晶 ) Semiconductor VIS (5347)世界先進 ) Semiconductor Pro. MOS (5387茂德 ) Semiconductor MOTECH (6244茂迪 ) Optoelectronic KGI (6008中信證 ) Finance FIRICH (8076伍豐 ) SAS (5483中美晶 ) Computer & Peripheral Equipment Wafer Works (6182合晶 ) Semiconductor 16

Foreign Capital also Flowing in GTSM n n The percentage of foreign ownership of Taiwan stocks is growing not only in TSEC, but also in GTSM. MSCI Taiwan Index including GTSM companies: Powerchip (5346力晶 ) Semiconductor VIS (5347)世界先進 ) Semiconductor Pro. MOS (5387茂德 ) Semiconductor MOTECH (6244茂迪 ) Optoelectronic KGI (6008中信證 ) Finance FIRICH (8076伍豐 ) SAS (5483中美晶 ) Computer & Peripheral Equipment Wafer Works (6182合晶 ) Semiconductor 16

Foreign Holding of GTSM Stock Foreign ownership of GTSM stocks (%) Trading percentage by Foreign ownership (%) Trading values by Foreign ownership (NT 100 million) 2003 8. 82 3. 69 1, 517. 9 2004 6. 89 5. 01 3, 476. 0 2005 8. 68 5. 92 3, 744. 2 2006 9. 36 5. 26 5, 391. 2 2007 9. 66 4. 26 7, 264. 6 17

Foreign Holding of GTSM Stock Foreign ownership of GTSM stocks (%) Trading percentage by Foreign ownership (%) Trading values by Foreign ownership (NT 100 million) 2003 8. 82 3. 69 1, 517. 9 2004 6. 89 5. 01 3, 476. 0 2005 8. 68 5. 92 3, 744. 2 2006 9. 36 5. 26 5, 391. 2 2007 9. 66 4. 26 7, 264. 6 17

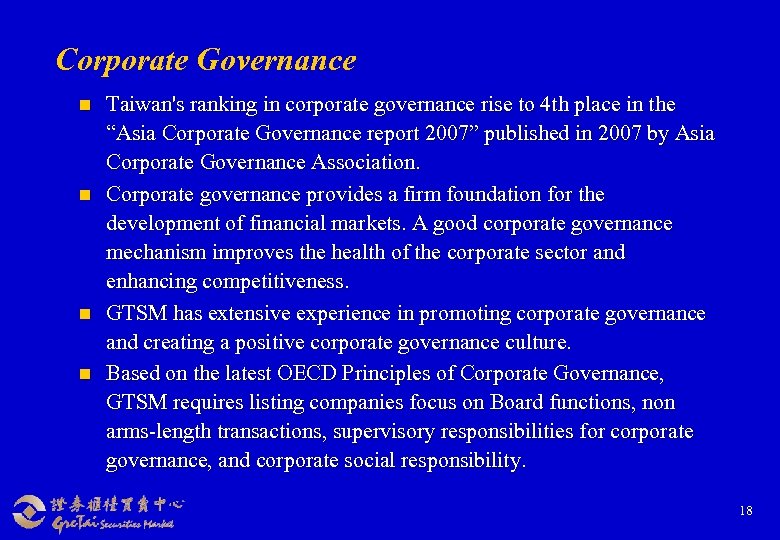

Corporate Governance n n Taiwan's ranking in corporate governance rise to 4 th place in the “Asia Corporate Governance report 2007” published in 2007 by Asia Corporate Governance Association. Corporate governance provides a firm foundation for the development of financial markets. A good corporate governance mechanism improves the health of the corporate sector and enhancing competitiveness. GTSM has extensive experience in promoting corporate governance and creating a positive corporate governance culture. Based on the latest OECD Principles of Corporate Governance, GTSM requires listing companies focus on Board functions, non arms-length transactions, supervisory responsibilities for corporate governance, and corporate social responsibility. 18

Corporate Governance n n Taiwan's ranking in corporate governance rise to 4 th place in the “Asia Corporate Governance report 2007” published in 2007 by Asia Corporate Governance Association. Corporate governance provides a firm foundation for the development of financial markets. A good corporate governance mechanism improves the health of the corporate sector and enhancing competitiveness. GTSM has extensive experience in promoting corporate governance and creating a positive corporate governance culture. Based on the latest OECD Principles of Corporate Governance, GTSM requires listing companies focus on Board functions, non arms-length transactions, supervisory responsibilities for corporate governance, and corporate social responsibility. 18

The History and Characteristics of Gre. Tai Securities Market 19

The History and Characteristics of Gre. Tai Securities Market 19

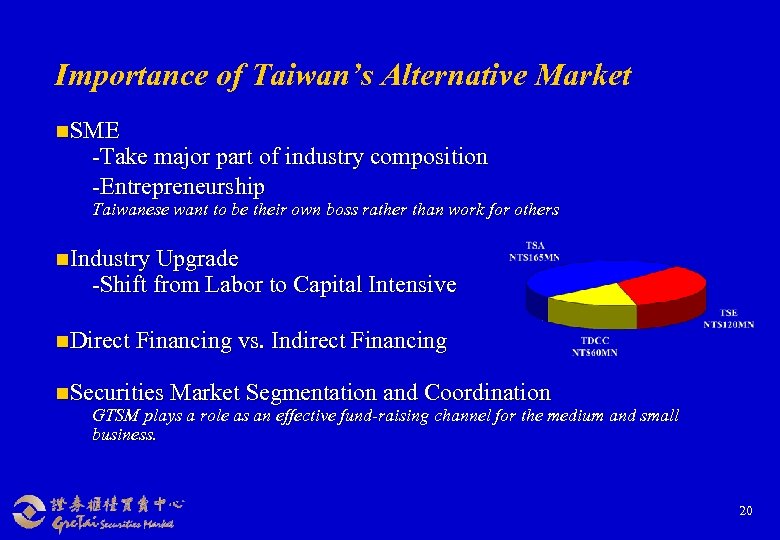

Importance of Taiwan’s Alternative Market n. SME -Take major part of industry composition -Entrepreneurship Taiwanese want to be their own boss rather than work for others n. Industry Upgrade -Shift from Labor to Capital Intensive n. Direct Financing vs. Indirect Financing n. Securities Market Segmentation and Coordination GTSM plays a role as an effective fund-raising channel for the medium and small business. 20

Importance of Taiwan’s Alternative Market n. SME -Take major part of industry composition -Entrepreneurship Taiwanese want to be their own boss rather than work for others n. Industry Upgrade -Shift from Labor to Capital Intensive n. Direct Financing vs. Indirect Financing n. Securities Market Segmentation and Coordination GTSM plays a role as an effective fund-raising channel for the medium and small business. 20

GTSM’s Basics n 14 years old n Non-profit organization with no stock ownership and membership n Quasi official, market-oriented Each 1/3 of board member designated by SFB, appointed by major donators, and third-party respectively n Full time executive n n 3 markets Equities – Regular, Supervised and Emerging stocks, DRs, ETFs and warrants n Bond – Government bonds, financial bonds, foreign bonds, corporate bonds, n convertible bonds n Financial Derivatives – Corporate bond asset swaps, forward rate agreement, index derivatives n Staff n 240 21

GTSM’s Basics n 14 years old n Non-profit organization with no stock ownership and membership n Quasi official, market-oriented Each 1/3 of board member designated by SFB, appointed by major donators, and third-party respectively n Full time executive n n 3 markets Equities – Regular, Supervised and Emerging stocks, DRs, ETFs and warrants n Bond – Government bonds, financial bonds, foreign bonds, corporate bonds, n convertible bonds n Financial Derivatives – Corporate bond asset swaps, forward rate agreement, index derivatives n Staff n 240 21

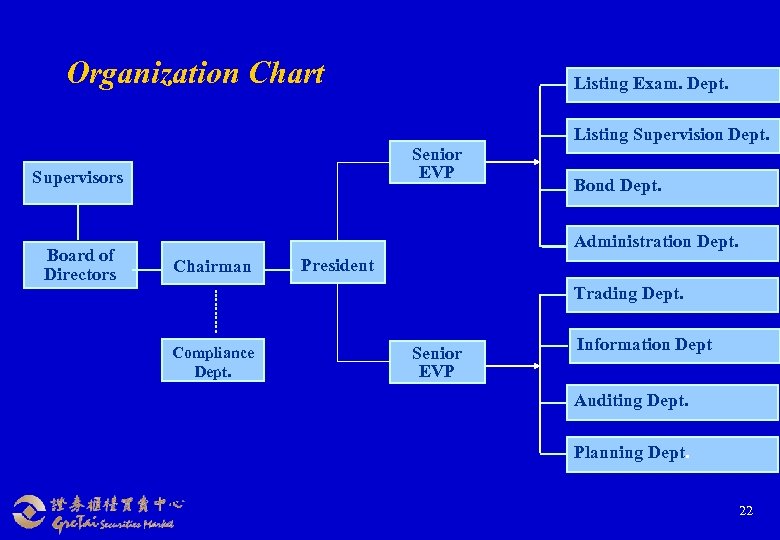

Organization Chart Senior EVP Supervisors Board of Directors Listing Exam. Dept. Listing Supervision Dept. Bond Dept. Administration Dept. Chairman President Trading Dept. Compliance Dept. Senior EVP Information Dept Auditing Dept. Planning Dept. 22

Organization Chart Senior EVP Supervisors Board of Directors Listing Exam. Dept. Listing Supervision Dept. Bond Dept. Administration Dept. Chairman President Trading Dept. Compliance Dept. Senior EVP Information Dept Auditing Dept. Planning Dept. 22

History of GTSM n n n n Nov. 1, 1994 Established as a Government Designated Organization Dec. 1994 QFII Allowed to Invest Sep. 1995 Trading Rules Revised Jan. 1998 Margin Trading Allowed July 24, 2000 Electronic Bond Trading System (EBTS) Jan. 1, 2002 Emerging Stock Market Established May 2002 Joined IOSCO as an Affiliate Member Dec, 2003 Hosted 2 nd Asia Pacific New Market Forum Nov. 2004 Hosted 1 st Int’l Bond Market Conference Mar. 2006 Hosted 2 nd Int’l Bond Market Conference Sep. 2006 Listing of Taiwan’s First Foreign Currency-Denominated Bond Nov. 2006 First GTSM Int’l Bond “Formosa Bond” Listing Embarked Overseas Taiwan Bond Market Roadshows May 2007 Embarked Overseas GTSM Corporate Roadshows Nov. 2007 US Treasury Bond Quote System Go Online Hosted 3 rd Int’l Bond Market Conference 23

History of GTSM n n n n Nov. 1, 1994 Established as a Government Designated Organization Dec. 1994 QFII Allowed to Invest Sep. 1995 Trading Rules Revised Jan. 1998 Margin Trading Allowed July 24, 2000 Electronic Bond Trading System (EBTS) Jan. 1, 2002 Emerging Stock Market Established May 2002 Joined IOSCO as an Affiliate Member Dec, 2003 Hosted 2 nd Asia Pacific New Market Forum Nov. 2004 Hosted 1 st Int’l Bond Market Conference Mar. 2006 Hosted 2 nd Int’l Bond Market Conference Sep. 2006 Listing of Taiwan’s First Foreign Currency-Denominated Bond Nov. 2006 First GTSM Int’l Bond “Formosa Bond” Listing Embarked Overseas Taiwan Bond Market Roadshows May 2007 Embarked Overseas GTSM Corporate Roadshows Nov. 2007 US Treasury Bond Quote System Go Online Hosted 3 rd Int’l Bond Market Conference 23

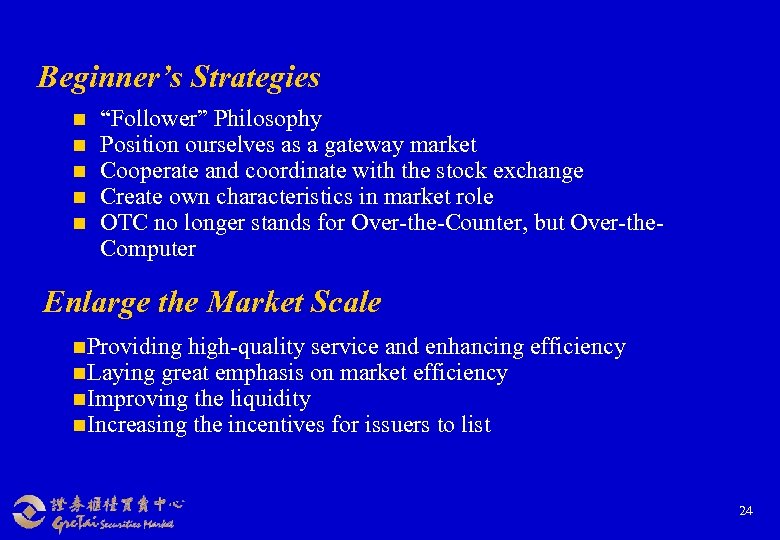

Beginner’s Strategies n n n “Follower” Philosophy Position ourselves as a gateway market Cooperate and coordinate with the stock exchange Create own characteristics in market role OTC no longer stands for Over-the-Counter, but Over-the. Computer Enlarge the Market Scale n. Providing high-quality service and enhancing n. Laying great emphasis on market efficiency n. Improving the liquidity n. Increasing the incentives for issuers to list efficiency 24

Beginner’s Strategies n n n “Follower” Philosophy Position ourselves as a gateway market Cooperate and coordinate with the stock exchange Create own characteristics in market role OTC no longer stands for Over-the-Counter, but Over-the. Computer Enlarge the Market Scale n. Providing high-quality service and enhancing n. Laying great emphasis on market efficiency n. Improving the liquidity n. Increasing the incentives for issuers to list efficiency 24

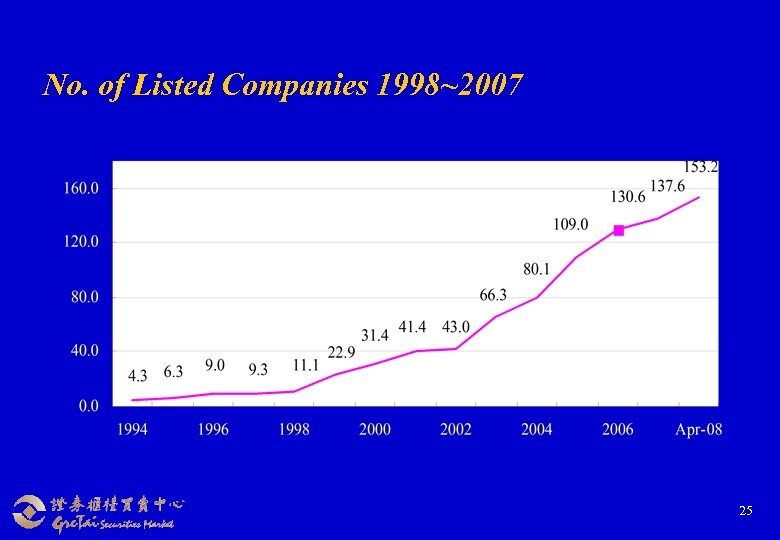

No. of Listed Companies 1998~2007 25

No. of Listed Companies 1998~2007 25

Listed Companies by Industrial Sectorsas of April 30, 2008 26

Listed Companies by Industrial Sectorsas of April 30, 2008 26

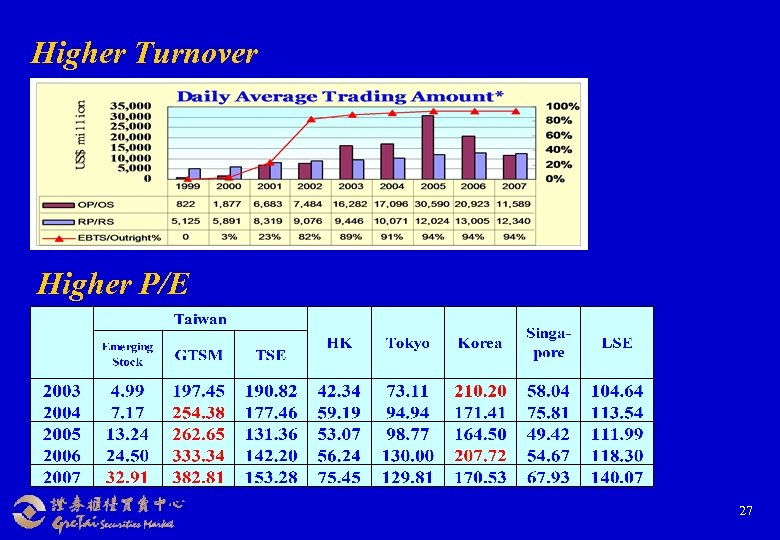

Higher Turnover Higher P/E 27

Higher Turnover Higher P/E 27

Avg. Daily Turnover NT$ Million 28

Avg. Daily Turnover NT$ Million 28

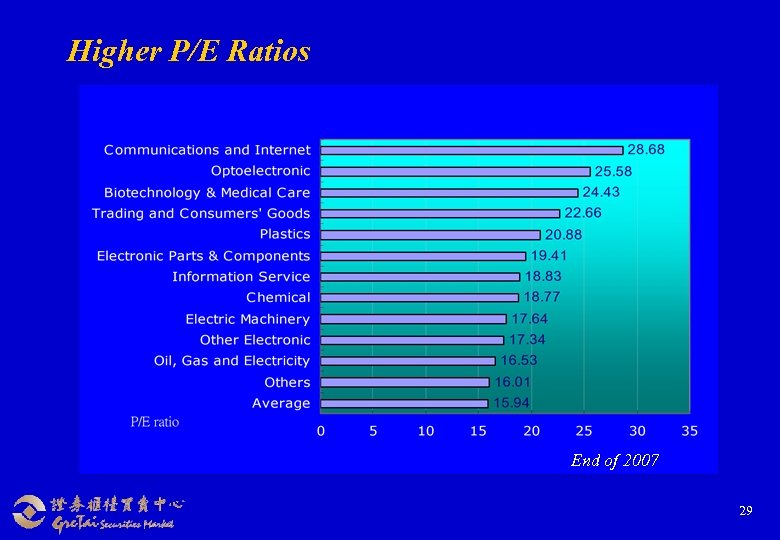

Higher P/E Ratios End of 2007 29

Higher P/E Ratios End of 2007 29

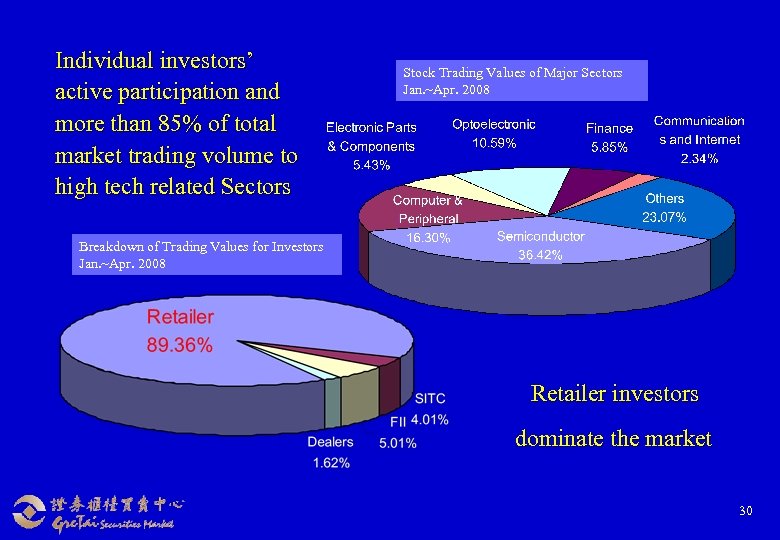

Individual investors’ active participation and more than 85% of total market trading volume to high tech related Sectors Stock Trading Values of Major Sectors Jan. ~Apr. 2008 Breakdown of Trading Values for Investors Jan. ~Apr. 2008 Retailer investors dominate the market 30

Individual investors’ active participation and more than 85% of total market trading volume to high tech related Sectors Stock Trading Values of Major Sectors Jan. ~Apr. 2008 Breakdown of Trading Values for Investors Jan. ~Apr. 2008 Retailer investors dominate the market 30

Characteristics of GTSM n Multiple Trading Approaches 1. Computerized Auto Matching 2. Negotiation Trading 3. Off-Exchange Transaction 31

Characteristics of GTSM n Multiple Trading Approaches 1. Computerized Auto Matching 2. Negotiation Trading 3. Off-Exchange Transaction 31

GTSM Regular Stock n (As end of May 2008) 551 Listed companies § Market Capitalization:NT 1, 766 bn § Daily Trading Value: NT$19. 45 bn § Daily Trading Values in 2007: NT$ 34. 56 bn § Historical High: NT$ 109. 4 bn July 26, 2007 32

GTSM Regular Stock n (As end of May 2008) 551 Listed companies § Market Capitalization:NT 1, 766 bn § Daily Trading Value: NT$19. 45 bn § Daily Trading Values in 2007: NT$ 34. 56 bn § Historical High: NT$ 109. 4 bn July 26, 2007 32

Companies Listing on Gre. Tai Regular Board 33

Companies Listing on Gre. Tai Regular Board 33

Trading Values & Market Cap. on Gre. Tai Regular Board 34

Trading Values & Market Cap. on Gre. Tai Regular Board 34

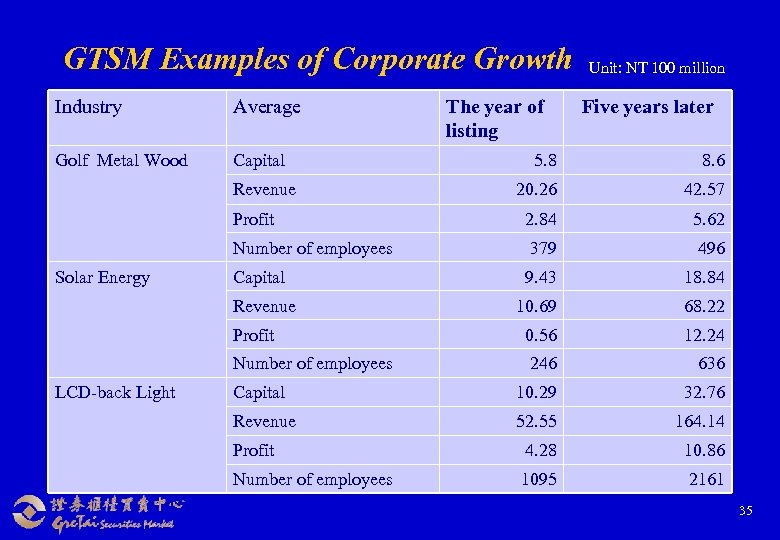

GTSM Examples of Corporate Growth Industry Average Golf Metal Wood Capital The year of listing Unit: NT 100 million Five years later 5. 8 8. 6 20. 26 42. 57 Profit 2. 84 5. 62 Number of employees 379 496 Capital 9. 43 18. 84 10. 69 68. 22 Profit 0. 56 12. 24 Number of employees 246 636 Capital 10. 29 32. 76 Revenue 52. 55 164. 14 Profit 4. 28 10. 86 Number of employees 1095 2161 Revenue Solar Energy Revenue LCD-back Light 35

GTSM Examples of Corporate Growth Industry Average Golf Metal Wood Capital The year of listing Unit: NT 100 million Five years later 5. 8 8. 6 20. 26 42. 57 Profit 2. 84 5. 62 Number of employees 379 496 Capital 9. 43 18. 84 10. 69 68. 22 Profit 0. 56 12. 24 Number of employees 246 636 Capital 10. 29 32. 76 Revenue 52. 55 164. 14 Profit 4. 28 10. 86 Number of employees 1095 2161 Revenue Solar Energy Revenue LCD-back Light 35

Bond - Primary Market Bond market size has grown at average 7% annually for the past 5 years US: NT$=$32. 5 36

Bond - Primary Market Bond market size has grown at average 7% annually for the past 5 years US: NT$=$32. 5 36

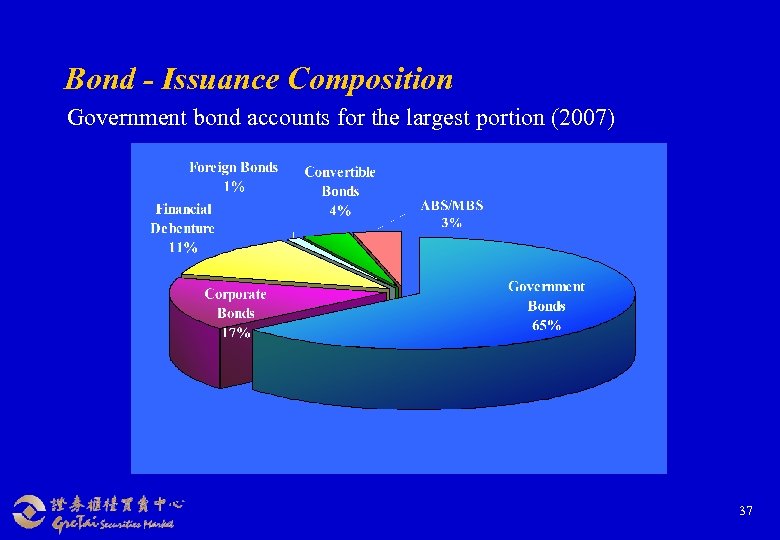

Bond - Issuance Composition Government bond accounts for the largest portion (2007) 37

Bond - Issuance Composition Government bond accounts for the largest portion (2007) 37

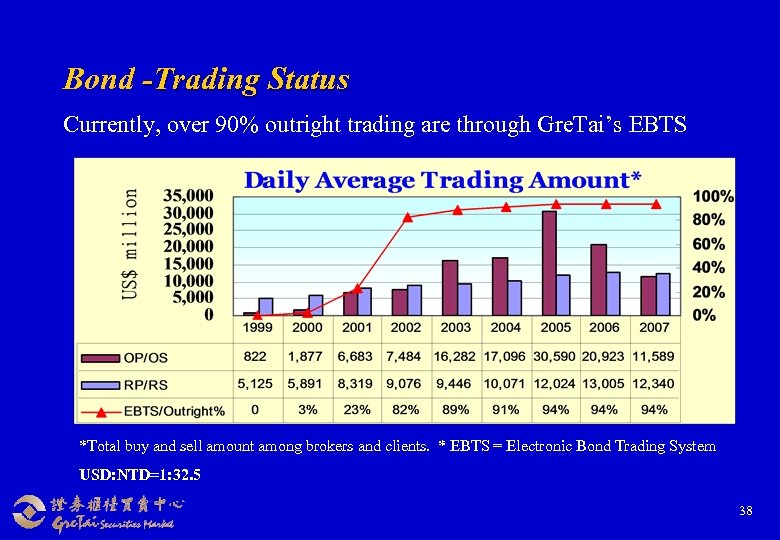

Bond -Trading Status Currently, over 90% outright trading are through Gre. Tai’s EBTS *Total buy and sell amount among brokers and clients. * EBTS = Electronic Bond Trading System USD: NTD=1: 32. 5 38

Bond -Trading Status Currently, over 90% outright trading are through Gre. Tai’s EBTS *Total buy and sell amount among brokers and clients. * EBTS = Electronic Bond Trading System USD: NTD=1: 32. 5 38

Ongoing Missions of GTSM n n n Global Semiconductor ETF, ISO CG ETF Taiwan Supervision Center 監理中心 Operational Property Service Platform 營業用資產 服務平台 VCs Startups IPO 創投投資標的上櫃 Agricultural Technology IPO農業技術上櫃 Development international cooperation -Asia Bond Trading Platform 亞洲債券交易平台 39

Ongoing Missions of GTSM n n n Global Semiconductor ETF, ISO CG ETF Taiwan Supervision Center 監理中心 Operational Property Service Platform 營業用資產 服務平台 VCs Startups IPO 創投投資標的上櫃 Agricultural Technology IPO農業技術上櫃 Development international cooperation -Asia Bond Trading Platform 亞洲債券交易平台 39

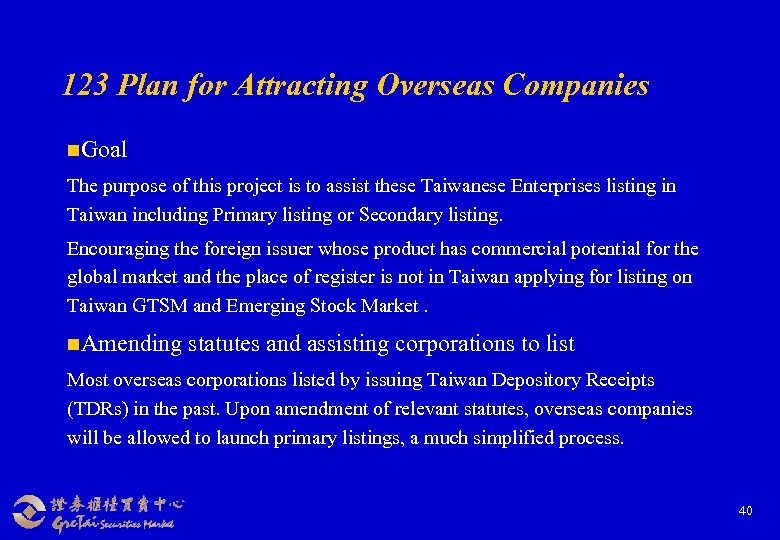

123 Plan for Attracting Overseas Companies n. Goal The purpose of this project is to assist these Taiwanese Enterprises listing in Taiwan including Primary listing or Secondary listing. Encouraging the foreign issuer whose product has commercial potential for the global market and the place of register is not in Taiwan applying for listing on Taiwan GTSM and Emerging Stock Market. n. Amending statutes and assisting corporations to list Most overseas corporations listed by issuing Taiwan Depository Receipts (TDRs) in the past. Upon amendment of relevant statutes, overseas companies will be allowed to launch primary listings, a much simplified process. 40

123 Plan for Attracting Overseas Companies n. Goal The purpose of this project is to assist these Taiwanese Enterprises listing in Taiwan including Primary listing or Secondary listing. Encouraging the foreign issuer whose product has commercial potential for the global market and the place of register is not in Taiwan applying for listing on Taiwan GTSM and Emerging Stock Market. n. Amending statutes and assisting corporations to list Most overseas corporations listed by issuing Taiwan Depository Receipts (TDRs) in the past. Upon amendment of relevant statutes, overseas companies will be allowed to launch primary listings, a much simplified process. 40

Listing on GTSM’s Advantages n Very favorable PE valuations for Silicon Valley SME to raise capital for funding organic growth and sustainable development. n Economic and efficient way close to high-tech and knowledge-based clusters. n A platform quickly raise the issuer’s reputation. n Much easier channel for SPO in stock market. n Attracting outstanding employee and institutional investors. 41

Listing on GTSM’s Advantages n Very favorable PE valuations for Silicon Valley SME to raise capital for funding organic growth and sustainable development. n Economic and efficient way close to high-tech and knowledge-based clusters. n A platform quickly raise the issuer’s reputation. n Much easier channel for SPO in stock market. n Attracting outstanding employee and institutional investors. 41

Emerging Stock Board Registration 42

Emerging Stock Board Registration 42

Purposes of Emerging Stock Board n For Investors: –To establish a legal trading platform for unlisted public companies –To provide investors an legal, safe, visible market n For Issuers: –To raise capital for funding organic growth –To be familiar with Corporate Governance and market rules –To increase visibility to investor public and business partners –To upgrade as a listed company n For GTSM: –To maintain a fair and orderly market for SMEs trading –To provide vital support for the SMEs to upgrade to TSEC/GTSM –To enhance the competitive capability of TW capital market 43

Purposes of Emerging Stock Board n For Investors: –To establish a legal trading platform for unlisted public companies –To provide investors an legal, safe, visible market n For Issuers: –To raise capital for funding organic growth –To be familiar with Corporate Governance and market rules –To increase visibility to investor public and business partners –To upgrade as a listed company n For GTSM: –To maintain a fair and orderly market for SMEs trading –To provide vital support for the SMEs to upgrade to TSEC/GTSM –To enhance the competitive capability of TW capital market 43

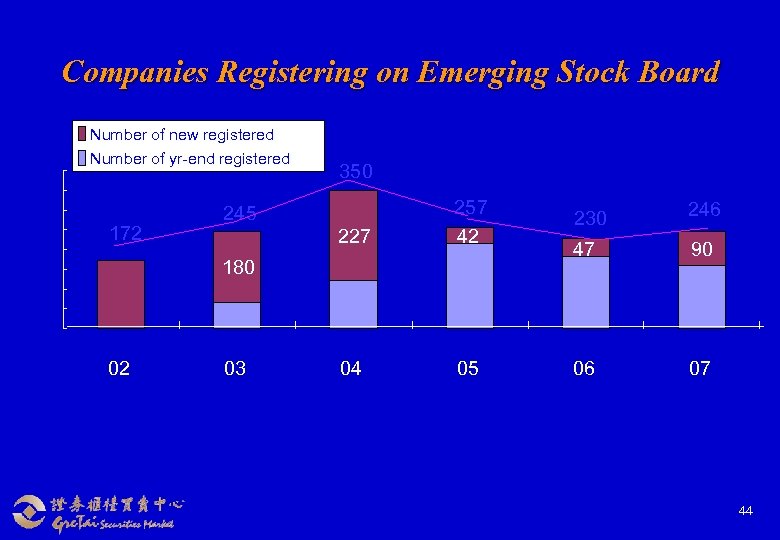

Companies Registering on Emerging Stock Board Number of new registered Number of yr-end registered 172 350 227 257 42 04 05 245 180 02 03 230 246 47 90 06 07 44

Companies Registering on Emerging Stock Board Number of new registered Number of yr-end registered 172 350 227 257 42 04 05 245 180 02 03 230 246 47 90 06 07 44

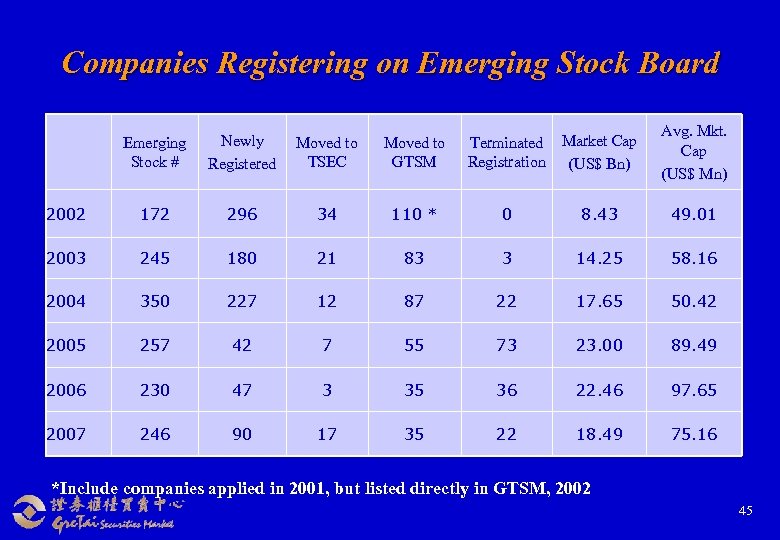

Companies Registering on Emerging Stock Board Terminated Market Cap Registration (US$ Bn) Avg. Mkt. Cap (US$ Mn) Emerging Stock # Newly Registered Moved to TSEC Moved to GTSM 2002 172 296 34 110 * 0 8. 43 49. 01 2003 245 180 21 83 3 14. 25 58. 16 2004 350 227 12 87 22 17. 65 50. 42 2005 257 42 7 55 73 23. 00 89. 49 2006 230 47 3 35 36 22. 46 97. 65 2007 246 90 17 35 22 18. 49 75. 16 *Include companies applied in 2001, but listed directly in GTSM, 2002 45

Companies Registering on Emerging Stock Board Terminated Market Cap Registration (US$ Bn) Avg. Mkt. Cap (US$ Mn) Emerging Stock # Newly Registered Moved to TSEC Moved to GTSM 2002 172 296 34 110 * 0 8. 43 49. 01 2003 245 180 21 83 3 14. 25 58. 16 2004 350 227 12 87 22 17. 65 50. 42 2005 257 42 7 55 73 23. 00 89. 49 2006 230 47 3 35 36 22. 46 97. 65 2007 246 90 17 35 22 18. 49 75. 16 *Include companies applied in 2001, but listed directly in GTSM, 2002 45

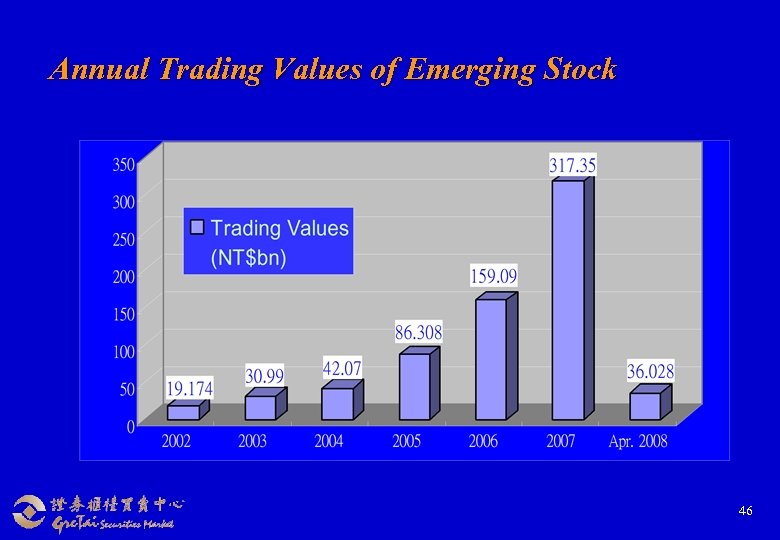

Annual Trading Values of Emerging Stock 46

Annual Trading Values of Emerging Stock 46

Market Peculiarities n Market for not-listed-yet corp. n Quote-driven n Negotiation-based trading(market maker always as counterpart) n No Daily price fluctuation 47

Market Peculiarities n Market for not-listed-yet corp. n Quote-driven n Negotiation-based trading(market maker always as counterpart) n No Daily price fluctuation 47

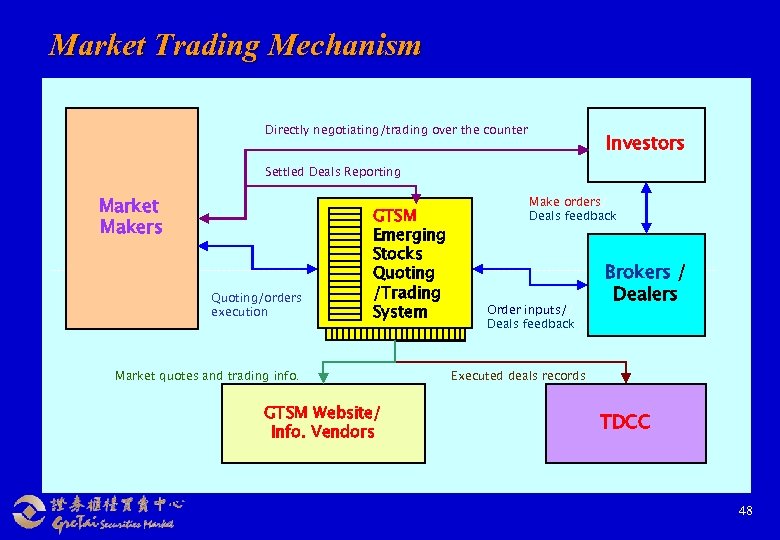

Market Trading Mechanism Directly negotiating/trading over the counter Investors Settled Deals Reporting Market Makers Quoting/orders execution GTSM Emerging Stocks Quoting /Trading System Market quotes and trading info. GTSM Website/ Info. Vendors Make orders/ Deals feedback Order inputs// Deals feedback Brokers / Dealers Executed deals records TDCC 48

Market Trading Mechanism Directly negotiating/trading over the counter Investors Settled Deals Reporting Market Makers Quoting/orders execution GTSM Emerging Stocks Quoting /Trading System Market quotes and trading info. GTSM Website/ Info. Vendors Make orders/ Deals feedback Order inputs// Deals feedback Brokers / Dealers Executed deals records TDCC 48

Trading Stipulations-1 Trading hours n Monday ~ Friday 9: 00 am-3: 00 pm Daily price fluctuation n No limits Market maker’s quotes and investor’s orders Trading unit n Market maker’s quotes shall be firm priced and only on the stocks they recommended. n Tick: NT$0. 01 (Min. ) n Investor’s order shall be limit order. n Negotiation trading via GTSM Emerging Stock Quoting and Trading Platform : -The minimum quoting unit is 1, 000 shares and minimum trading unit is 1 share. -Trading quotes shall be based on a trading unit or integral multiples. n Counter Negotiation: -Every trading shall meet the minimum amount of 100, 000 shares. 49

Trading Stipulations-1 Trading hours n Monday ~ Friday 9: 00 am-3: 00 pm Daily price fluctuation n No limits Market maker’s quotes and investor’s orders Trading unit n Market maker’s quotes shall be firm priced and only on the stocks they recommended. n Tick: NT$0. 01 (Min. ) n Investor’s order shall be limit order. n Negotiation trading via GTSM Emerging Stock Quoting and Trading Platform : -The minimum quoting unit is 1, 000 shares and minimum trading unit is 1 share. -Trading quotes shall be based on a trading unit or integral multiples. n Counter Negotiation: -Every trading shall meet the minimum amount of 100, 000 shares. 49

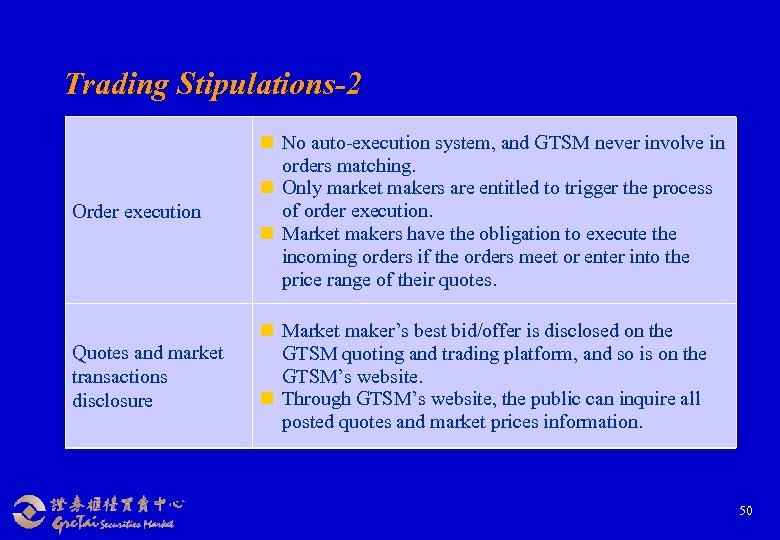

Trading Stipulations-2 Order execution n No auto-execution system, and GTSM never involve in orders matching. n Only market makers are entitled to trigger the process of order execution. n Market makers have the obligation to execute the incoming orders if the orders meet or enter into the price range of their quotes. Quotes and market transactions disclosure n Market maker’s best bid/offer is disclosed on the GTSM quoting and trading platform, and so is on the GTSM’s website. n Through GTSM’s website, the public can inquire all posted quotes and market prices information. 50

Trading Stipulations-2 Order execution n No auto-execution system, and GTSM never involve in orders matching. n Only market makers are entitled to trigger the process of order execution. n Market makers have the obligation to execute the incoming orders if the orders meet or enter into the price range of their quotes. Quotes and market transactions disclosure n Market maker’s best bid/offer is disclosed on the GTSM quoting and trading platform, and so is on the GTSM’s website. n Through GTSM’s website, the public can inquire all posted quotes and market prices information. 50

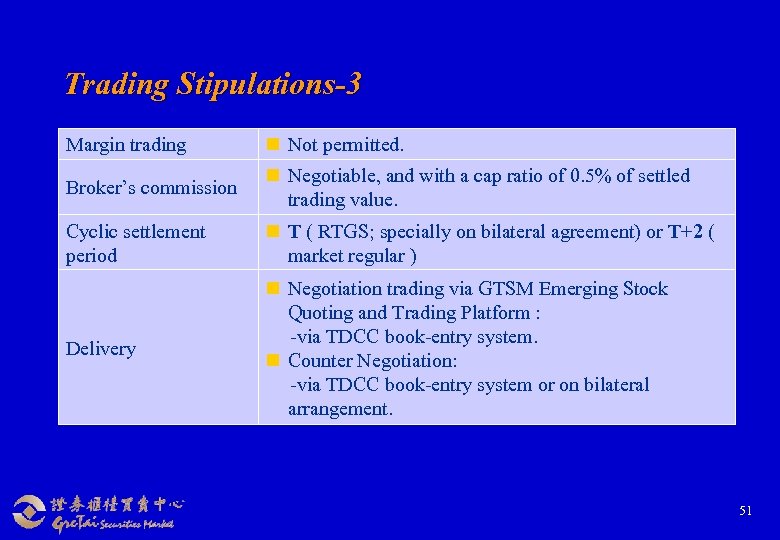

Trading Stipulations-3 Margin trading n Not permitted. Broker’s commission n Negotiable, and with a cap ratio of 0. 5% of settled trading value. Cyclic settlement period n T ( RTGS; specially on bilateral agreement) or T+2 ( market regular ) Delivery n Negotiation trading via GTSM Emerging Stock Quoting and Trading Platform : -via TDCC book-entry system. n Counter Negotiation: -via TDCC book-entry system or on bilateral arrangement. 51

Trading Stipulations-3 Margin trading n Not permitted. Broker’s commission n Negotiable, and with a cap ratio of 0. 5% of settled trading value. Cyclic settlement period n T ( RTGS; specially on bilateral agreement) or T+2 ( market regular ) Delivery n Negotiation trading via GTSM Emerging Stock Quoting and Trading Platform : -via TDCC book-entry system. n Counter Negotiation: -via TDCC book-entry system or on bilateral arrangement. 51

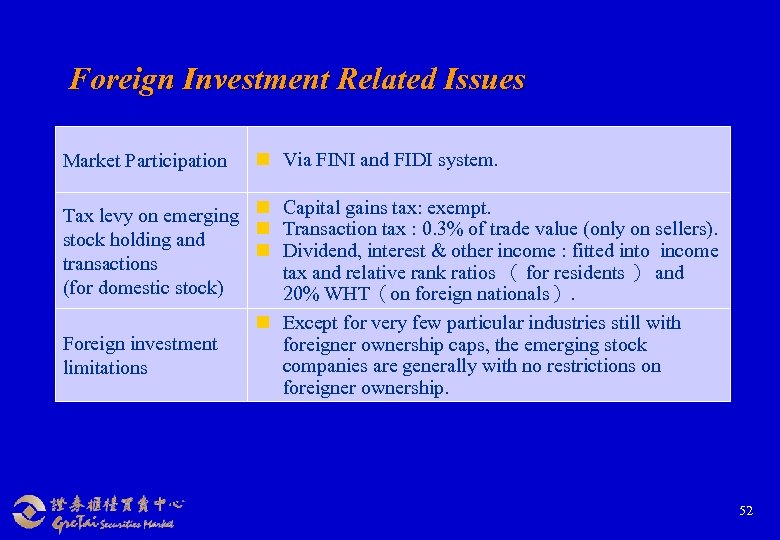

Foreign Investment Related Issues Market Participation n Via FINI and FIDI system. Tax levy on emerging n Capital gains tax: exempt. n Transaction tax : 0. 3% of trade value (only on sellers). stock holding and n Dividend, interest & other income : fitted into income transactions tax and relative rank ratios ( for residents ) and (for domestic stock) 20% WHT(on foreign nationals). n Except for very few particular industries still with Foreign investment foreigner ownership caps, the emerging stock companies are generally with no restrictions on limitations foreigner ownership. 52

Foreign Investment Related Issues Market Participation n Via FINI and FIDI system. Tax levy on emerging n Capital gains tax: exempt. n Transaction tax : 0. 3% of trade value (only on sellers). stock holding and n Dividend, interest & other income : fitted into income transactions tax and relative rank ratios ( for residents ) and (for domestic stock) 20% WHT(on foreign nationals). n Except for very few particular industries still with Foreign investment foreigner ownership caps, the emerging stock companies are generally with no restrictions on limitations foreigner ownership. 52

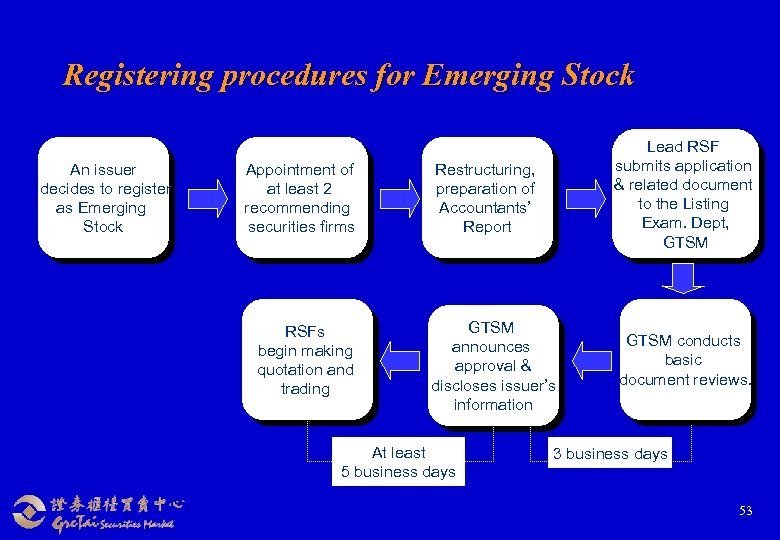

Registering procedures for Emerging Stock An issuer decides to register as Emerging Stock Appointment of at least 2 recommending securities firms RSFs begin making quotation and trading Restructuring, preparation of Accountants’ Report Lead RSF submits application & related document to the Listing Exam. Dept, GTSM announces approval & discloses issuer’s information GTSM conducts basic document reviews. At least 5 business days 3 business days 53

Registering procedures for Emerging Stock An issuer decides to register as Emerging Stock Appointment of at least 2 recommending securities firms RSFs begin making quotation and trading Restructuring, preparation of Accountants’ Report Lead RSF submits application & related document to the Listing Exam. Dept, GTSM announces approval & discloses issuer’s information GTSM conducts basic document reviews. At least 5 business days 3 business days 53

Entity 申請主體 n Company limited by shares, organized and incorporated in accordance with the laws of a foreign country and do not contravene the “Act of Governing Relations between Peoples of the Taiwan Area and the Mainland Area” (台 灣地區與大陸地區人民關係條例 ) and related regulations. n Registered share, and common stock not list on the other foreign stock market. n Company has a consultant agreement 輔導契約 with securities firm. 54

Entity 申請主體 n Company limited by shares, organized and incorporated in accordance with the laws of a foreign country and do not contravene the “Act of Governing Relations between Peoples of the Taiwan Area and the Mainland Area” (台 灣地區與大陸地區人民關係條例 ) and related regulations. n Registered share, and common stock not list on the other foreign stock market. n Company has a consultant agreement 輔導契約 with securities firm. 54

Recommending Securities Firm/Underwriter 推薦證券商 n n n The issuer is recommended in writing by two or more securities firms, one of them shall be designated as lead recommending securities firm. 主辦推薦證券商 RSFs should subscribe not less than 3% of the total number of shares of the applicant company and shall not be less than 500, 000 shares. -provided that if 3% of the total number of shares exceed 1. 5 million shares, not less than 1. 5 million shares shall be allocated for subscription by the securities firms Each recommending securities firm shall severally underwrite not less than 100, 000 shares. 55

Recommending Securities Firm/Underwriter 推薦證券商 n n n The issuer is recommended in writing by two or more securities firms, one of them shall be designated as lead recommending securities firm. 主辦推薦證券商 RSFs should subscribe not less than 3% of the total number of shares of the applicant company and shall not be less than 500, 000 shares. -provided that if 3% of the total number of shares exceed 1. 5 million shares, not less than 1. 5 million shares shall be allocated for subscription by the securities firms Each recommending securities firm shall severally underwrite not less than 100, 000 shares. 55

Professional Agent for Stock Affairs 股務代理機構 n The issuer has established a professional agent for stock affairs unit in Taipei to process stock affairs. Attorney 代理人 n The issuer shall authorize at least one contentious or non contentious attorney 訴訟或非訟代理人 who lives in Taiwan to help the issuer to enter information into the Market Observation Post System (MOPS), submit documents and so on. 56

Professional Agent for Stock Affairs 股務代理機構 n The issuer has established a professional agent for stock affairs unit in Taipei to process stock affairs. Attorney 代理人 n The issuer shall authorize at least one contentious or non contentious attorney 訴訟或非訟代理人 who lives in Taiwan to help the issuer to enter information into the Market Observation Post System (MOPS), submit documents and so on. 56

Market Observance Post System( MOPS) 公開資訊觀測站 n To ensure that investors have complete and timely material information on all listed companies, GTSM and TSEC have established the Market Observation Post System (MOPS), an information disclosure platform. All public-held companies (including TSEC/GTSM listed/registered companies) are required by law to publish basic relevant information such as company profile, operational revenue, financial reports, mergers and acquisitions, convening of shareholders meetings, stock dividends and any other matters which affect companies. 57

Market Observance Post System( MOPS) 公開資訊觀測站 n To ensure that investors have complete and timely material information on all listed companies, GTSM and TSEC have established the Market Observation Post System (MOPS), an information disclosure platform. All public-held companies (including TSEC/GTSM listed/registered companies) are required by law to publish basic relevant information such as company profile, operational revenue, financial reports, mergers and acquisitions, convening of shareholders meetings, stock dividends and any other matters which affect companies. 57

CPA and Financial Reports 簽證會計師和財務報告編製 n n n The issuer’s financial reports shall be audited by the CPA of Taiwan or international accounting firm in alliance with CPA of Taiwan. The final audit report shall be issued by the CPA of Taiwan and without reference to any other accountant's audit. The financial reports shall be denominated in NTD and prepared in Chinese that may be accompanied by an English version. The issuer’s financial reports shall be consolidated financial reports and comparing two consecutive periods. (兩期對照 ) In accordance with one of the following principles: ROC GAAP, US GAAP and IFRS. For accounting principles other than the Taiwan GAAP, the major differences in items and amount should be disclosed. 58

CPA and Financial Reports 簽證會計師和財務報告編製 n n n The issuer’s financial reports shall be audited by the CPA of Taiwan or international accounting firm in alliance with CPA of Taiwan. The final audit report shall be issued by the CPA of Taiwan and without reference to any other accountant's audit. The financial reports shall be denominated in NTD and prepared in Chinese that may be accompanied by an English version. The issuer’s financial reports shall be consolidated financial reports and comparing two consecutive periods. (兩期對照 ) In accordance with one of the following principles: ROC GAAP, US GAAP and IFRS. For accounting principles other than the Taiwan GAAP, the major differences in items and amount should be disclosed. 58

Commitment 應承諾遵守事項 The issuer shall commit to obey the ROC Securities & Exchange Act and related regulations. n Court with jurisdiction over an action 訴訟管轄法院 is the Taiwan Taipei district court. n CPA or professional instrument’s special inspection專案檢 查. n Delivery by book-entry form 帳簿劃撥. n Foreign issuers shall include shareholders protection matters in its Articles of Incorporation公司章程 or organizational documents. n 59

Commitment 應承諾遵守事項 The issuer shall commit to obey the ROC Securities & Exchange Act and related regulations. n Court with jurisdiction over an action 訴訟管轄法院 is the Taiwan Taipei district court. n CPA or professional instrument’s special inspection專案檢 查. n Delivery by book-entry form 帳簿劃撥. n Foreign issuers shall include shareholders protection matters in its Articles of Incorporation公司章程 or organizational documents. n 59

Registration Fees Initial registration handling fee: NT$20, 000 Total Par Value of Shares Traded Annual Trading Fee NT$300 million or less 0. 02 % NT$300 million to NT$500 million 0. 015% More than NT$500 million to NT$1 billion 0. 01% More than NT$1 billion to NT$2 billion 0. 005% More than NT$2 billion to NT$3 billion 0. 0025% More than NT$3 billion 0. 00125% Above Fees collected shall be > NT$50, 000 and < NT$225, 000. 60

Registration Fees Initial registration handling fee: NT$20, 000 Total Par Value of Shares Traded Annual Trading Fee NT$300 million or less 0. 02 % NT$300 million to NT$500 million 0. 015% More than NT$500 million to NT$1 billion 0. 01% More than NT$1 billion to NT$2 billion 0. 005% More than NT$2 billion to NT$3 billion 0. 0025% More than NT$3 billion 0. 00125% Above Fees collected shall be > NT$50, 000 and < NT$225, 000. 60

Others n The stocks and bonds issued by the issuer could have been issued in intangible form 得 無實體發行. n Par value per share will be denominated in NTD 10. n No need for operations in Taiwan. n Issuer should convene shareholder’s meeting in Taiwan, , Taiwan, provided it does not violate the law of the registered country. If law prohibit it hold outside the country, issuer should have in place a proxy or correspondence voting system. 61

Others n The stocks and bonds issued by the issuer could have been issued in intangible form 得 無實體發行. n Par value per share will be denominated in NTD 10. n No need for operations in Taiwan. n Issuer should convene shareholder’s meeting in Taiwan, , Taiwan, provided it does not violate the law of the registered country. If law prohibit it hold outside the country, issuer should have in place a proxy or correspondence voting system. 61

Emerging Stock Supervision 62

Emerging Stock Supervision 62

Regular Information Reporting n. Consolidated Financial report (In Chinese version) Annual /semi-annual financial report by end of April / end of June plus 75 days n Annual report by the shareholders' meeting 63

Regular Information Reporting n. Consolidated Financial report (In Chinese version) Annual /semi-annual financial report by end of April / end of June plus 75 days n Annual report by the shareholders' meeting 63

Irregular Information Reporting n n n Material (Price-Sensitive) Information : Inputting the content or explanations of the information into the MOPS before the commencement of trading hours of the trading day next following the date of occurrence of the event. Press Conference Regarding Material Information: The company shall promptly dispatch a spokesperson or acting spokesperson to a press conference by the trading day next following the occurrence of the event or the broadcast media report, to provide explanations to the news media. Foreign companies can use video conference. The issuer could authorize attorney to help the issuer to enter information (the content should be in Chinese ). 64

Irregular Information Reporting n n n Material (Price-Sensitive) Information : Inputting the content or explanations of the information into the MOPS before the commencement of trading hours of the trading day next following the date of occurrence of the event. Press Conference Regarding Material Information: The company shall promptly dispatch a spokesperson or acting spokesperson to a press conference by the trading day next following the occurrence of the event or the broadcast media report, to provide explanations to the news media. Foreign companies can use video conference. The issuer could authorize attorney to help the issuer to enter information (the content should be in Chinese ). 64

Regular Stock Board Listing 65

Regular Stock Board Listing 65

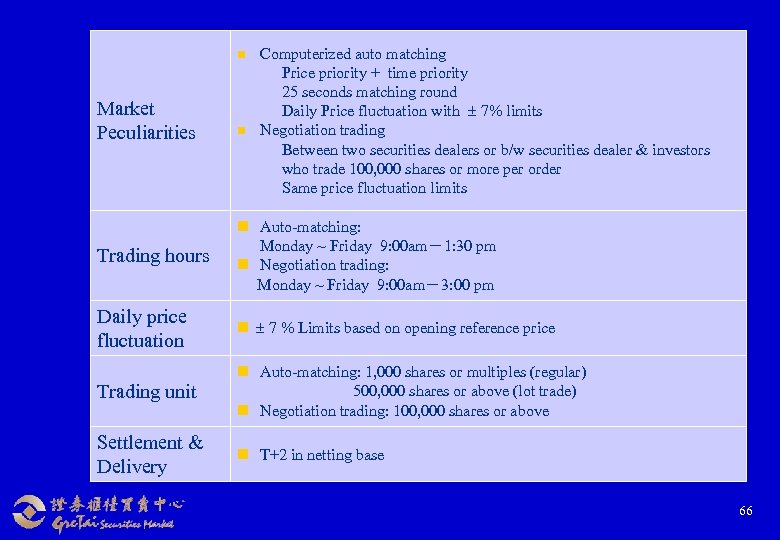

n Market Peculiarities n Computerized auto matching Price priority + time priority 25 seconds matching round Daily Price fluctuation with 7% limits Negotiation trading Between two securities dealers or b/w securities dealer & investors who trade 100, 000 shares or more per order Same price fluctuation limits Trading hours n Auto-matching: Monday ~ Friday 9: 00 am-1: 30 pm n Negotiation trading: Monday ~ Friday 9: 00 am-3: 00 pm Daily price fluctuation n 7 % Limits based on opening reference price Trading unit n Auto-matching: 1, 000 shares or multiples (regular) 500, 000 shares or above (lot trade) n Negotiation trading: 100, 000 shares or above Settlement & Delivery n T+2 in netting base 66

n Market Peculiarities n Computerized auto matching Price priority + time priority 25 seconds matching round Daily Price fluctuation with 7% limits Negotiation trading Between two securities dealers or b/w securities dealer & investors who trade 100, 000 shares or more per order Same price fluctuation limits Trading hours n Auto-matching: Monday ~ Friday 9: 00 am-1: 30 pm n Negotiation trading: Monday ~ Friday 9: 00 am-3: 00 pm Daily price fluctuation n 7 % Limits based on opening reference price Trading unit n Auto-matching: 1, 000 shares or multiples (regular) 500, 000 shares or above (lot trade) n Negotiation trading: 100, 000 shares or above Settlement & Delivery n T+2 in netting base 66

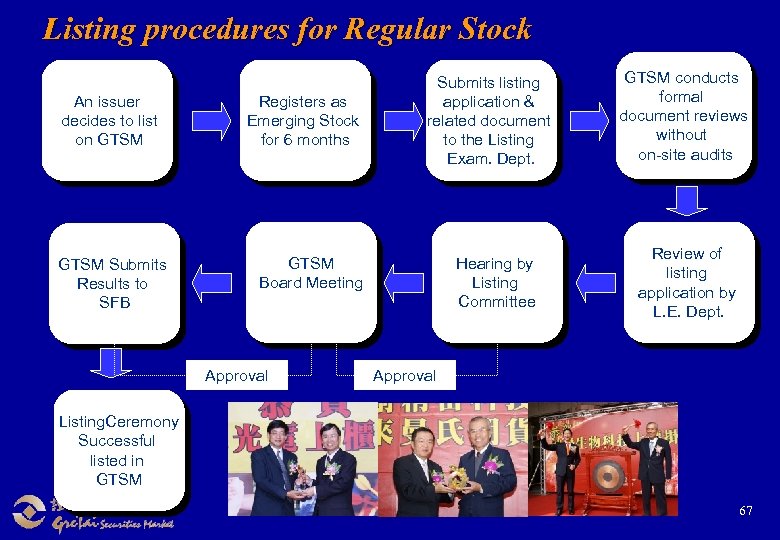

Listing procedures for Regular Stock An issuer decides to list on GTSM Submits Results to SFB Registers as Emerging Stock for 6 months Submits listing application & related document to the Listing Exam. Dept. GTSM Board Meeting Approval Hearing by Listing Committee GTSM conducts formal document reviews without on-site audits Review of listing application by L. E. Dept. Approval Listing. Ceremony Successful listed in GTSM 67

Listing procedures for Regular Stock An issuer decides to list on GTSM Submits Results to SFB Registers as Emerging Stock for 6 months Submits listing application & related document to the Listing Exam. Dept. GTSM Board Meeting Approval Hearing by Listing Committee GTSM conducts formal document reviews without on-site audits Review of listing application by L. E. Dept. Approval Listing. Ceremony Successful listed in GTSM 67

Entity 申請主體 n. Company limited by shares, organized and incorporated in accordance with the laws of a foreign country and do not contravene the “Act Governing Relations between Peoples of the Taiwan Area and the Mainland Area” 台灣地區與 大陸地區人民關係條例 and related regulations. n. Registered share, and common stock not list on other stock market. 68

Entity 申請主體 n. Company limited by shares, organized and incorporated in accordance with the laws of a foreign country and do not contravene the “Act Governing Relations between Peoples of the Taiwan Area and the Mainland Area” 台灣地區與 大陸地區人民關係條例 and related regulations. n. Registered share, and common stock not list on other stock market. 68

Recommending Securities Firms/Underwriter 推薦證券商 The issuer is recommended in writing by two or more securities firms, one of them shall be designated as the lead recommending securities firm. 主辦推薦證券商. n The lead RSF shall be the Compliance Advisor of the issuer and help the issue to obey the ROC Securities and Exchange Act, related regulations and the contract with GTSM within the year of listing till 2 fiscal years. n 69

Recommending Securities Firms/Underwriter 推薦證券商 The issuer is recommended in writing by two or more securities firms, one of them shall be designated as the lead recommending securities firm. 主辦推薦證券商. n The lead RSF shall be the Compliance Advisor of the issuer and help the issue to obey the ROC Securities and Exchange Act, related regulations and the contract with GTSM within the year of listing till 2 fiscal years. n 69

Change of Recommending Securities Firm n If the issuer has changed its lead RSF, the newly appointed lead RSF should take over the advisory work and apply for Gre. Tai listing on behalf of the foreign issuer after another six months on the Emerging Stock Board. n The purpose of such requirements is to make sure that the newly appointed RSF understands the situations of the foreign issuer well before making listing application on its behalf. 70

Change of Recommending Securities Firm n If the issuer has changed its lead RSF, the newly appointed lead RSF should take over the advisory work and apply for Gre. Tai listing on behalf of the foreign issuer after another six months on the Emerging Stock Board. n The purpose of such requirements is to make sure that the newly appointed RSF understands the situations of the foreign issuer well before making listing application on its behalf. 70

Operating History 設立年限 n n The issuer shall have been incorporated and registered under the regulations for no less than two full fiscal years. If company A from Silicon Valley wishes to list in Taiwan, it may establish a holding company B (in places such as the Cayman Islands) and list company B. There is no operation history requirement for company B, as long as the subsidiary company, Company A, has operated more than 2 years. 71

Operating History 設立年限 n n The issuer shall have been incorporated and registered under the regulations for no less than two full fiscal years. If company A from Silicon Valley wishes to list in Taiwan, it may establish a holding company B (in places such as the Cayman Islands) and list company B. There is no operation history requirement for company B, as long as the subsidiary company, Company A, has operated more than 2 years. 71

Profit Test 獲利能力 n n a minimum consolidated income before tax合併稅前純益 of NTD 4 million in the recent fiscal year. the ratio of income before tax against the shareholder's equity on the final accounts: --4% or higher for the most recent fiscal year, no accumulated loss on final account. 無累積虧損 --3% or higher for each of the past two fiscal years. --the average for the last two fiscal years is 3% or higher and the profitability in the most recent year is better year-on-year. CPA and Financial Report n. Same as Emerging Stock 72

Profit Test 獲利能力 n n a minimum consolidated income before tax合併稅前純益 of NTD 4 million in the recent fiscal year. the ratio of income before tax against the shareholder's equity on the final accounts: --4% or higher for the most recent fiscal year, no accumulated loss on final account. 無累積虧損 --3% or higher for each of the past two fiscal years. --the average for the last two fiscal years is 3% or higher and the profitability in the most recent year is better year-on-year. CPA and Financial Report n. Same as Emerging Stock 72

Shareholder‘s Equity 股東權益 n The shareholder's equity as audited and certified for the most recent period by a CPA is valued as equivalent to NT$100 million or more. Attorney 代理人 n Same as Emerging Stock 73

Shareholder‘s Equity 股東權益 n The shareholder's equity as audited and certified for the most recent period by a CPA is valued as equivalent to NT$100 million or more. Attorney 代理人 n Same as Emerging Stock 73

Shareholding Spread 股權分散 n 10% or 5, 000 shares (whichever is smaller) to be held by at least 300 shareholders holding from 1, 000 shares to 50, 000 shares. Lockup 股票集中保管 n Directors, supervisors & major shareholders (holding>10%) should deposit their holding into TDCC. n Duration is 1 years at most. 50% can be withdrawn after 6 months. 74

Shareholding Spread 股權分散 n 10% or 5, 000 shares (whichever is smaller) to be held by at least 300 shareholders holding from 1, 000 shares to 50, 000 shares. Lockup 股票集中保管 n Directors, supervisors & major shareholders (holding>10%) should deposit their holding into TDCC. n Duration is 1 years at most. 50% can be withdrawn after 6 months. 74

Negative Listing Criteria 不宜上櫃條款 1. Against specific article of the Securities and Exchange Act 2. Finance or business cannot be independent 3. Significant abnormal transaction 4. Has committed any act in violation of the principle of honesty and good faith in the last 3 years; 5. Unable to independently perform their functions. 6. Gre. Tai deems it improper 75

Negative Listing Criteria 不宜上櫃條款 1. Against specific article of the Securities and Exchange Act 2. Finance or business cannot be independent 3. Significant abnormal transaction 4. Has committed any act in violation of the principle of honesty and good faith in the last 3 years; 5. Unable to independently perform their functions. 6. Gre. Tai deems it improper 75

Corporate Governance 公司治理 n The issuer shall have at least 3 independent directors and independent directors are more than 1/5 of the number of total board directors. One of independent directors must have household registration in ROC. n The issuer shall prepare self-evaluation report regarding corporate governance and the underwriter shall assess the issuer’s self-evaluation report and prepared the assessment report. 76

Corporate Governance 公司治理 n The issuer shall have at least 3 independent directors and independent directors are more than 1/5 of the number of total board directors. One of independent directors must have household registration in ROC. n The issuer shall prepare self-evaluation report regarding corporate governance and the underwriter shall assess the issuer’s self-evaluation report and prepared the assessment report. 76

Investment Holding Company 投資控股公司 n Definition 1. 2. 3. n n Directly holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %; Indirectly through its subsidiary holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %; or Directly, and indirectly through its subsidiaries, holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %. 70 % of the operating income as reported in the investment holding company’s consolidated financial statements shall come from the held companies. Holds one or more non-professional investment companies that hold no shares in applicant company. 77

Investment Holding Company 投資控股公司 n Definition 1. 2. 3. n n Directly holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %; Indirectly through its subsidiary holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %; or Directly, and indirectly through its subsidiaries, holds more than 50 % of the issued voting shares or has made a capital contribution of more then 50 %. 70 % of the operating income as reported in the investment holding company’s consolidated financial statements shall come from the held companies. Holds one or more non-professional investment companies that hold no shares in applicant company. 77

Due Diligence 專案查核 n In the period of listing examination, GTSM only requires due diligence of documents, but GTSM’s on-site due diligence is currently required for the IPO of domestic companies. n During listing examination and after listing, the company should accept CPA or professional instrument’s special inspection in some special case. 78

Due Diligence 專案查核 n In the period of listing examination, GTSM only requires due diligence of documents, but GTSM’s on-site due diligence is currently required for the IPO of domestic companies. n During listing examination and after listing, the company should accept CPA or professional instrument’s special inspection in some special case. 78

Listing Fees 掛牌費用 Initial examination fee: NT$500, 000 Total Par Value of Shares Traded Annual Listing Fee NT$300 million or less 0. 04 % NT$300 million to NT$500 million 0. 03% More than NT$500 million to NT$1 billion 0. 02% More than NT$1 billion to NT$2 billion 0. 01% More than NT$2 billion to NT$3 billion 0. 005% More than NT$3 billion 0. 0025% Above Fees collected shall be > NT$100, 000 and < NT$450, 000 79

Listing Fees 掛牌費用 Initial examination fee: NT$500, 000 Total Par Value of Shares Traded Annual Listing Fee NT$300 million or less 0. 04 % NT$300 million to NT$500 million 0. 03% More than NT$500 million to NT$1 billion 0. 02% More than NT$1 billion to NT$2 billion 0. 01% More than NT$2 billion to NT$3 billion 0. 005% More than NT$3 billion 0. 0025% Above Fees collected shall be > NT$100, 000 and < NT$450, 000 79

Regular Stock Board Supervision 80

Regular Stock Board Supervision 80

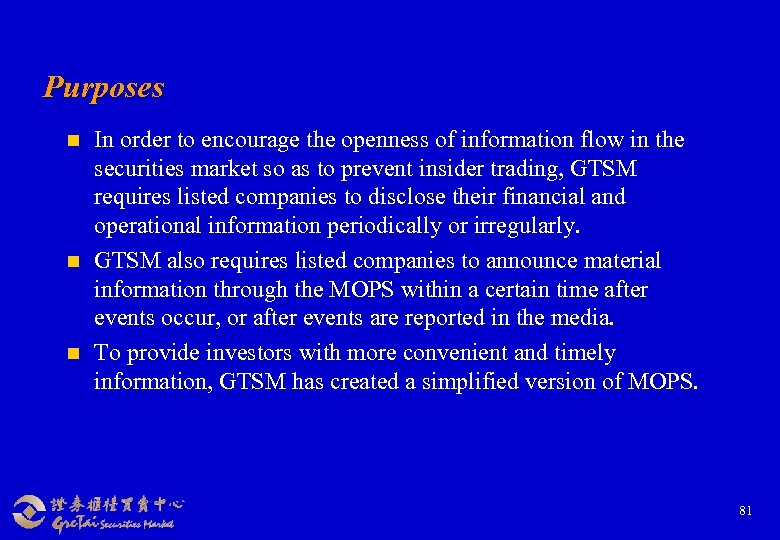

Purposes n n n In order to encourage the openness of information flow in the securities market so as to prevent insider trading, GTSM requires listed companies to disclose their financial and operational information periodically or irregularly. GTSM also requires listed companies to announce material information through the MOPS within a certain time after events occur, or after events are reported in the media. To provide investors with more convenient and timely information, GTSM has created a simplified version of MOPS. 81

Purposes n n n In order to encourage the openness of information flow in the securities market so as to prevent insider trading, GTSM requires listed companies to disclose their financial and operational information periodically or irregularly. GTSM also requires listed companies to announce material information through the MOPS within a certain time after events occur, or after events are reported in the media. To provide investors with more convenient and timely information, GTSM has created a simplified version of MOPS. 81

Listing Supervision Overview n n Implementation of Fair Disclosures Improve in accounting transparency n n n Information disclosure Routine and exceptional administration regarding listed companies Execute disciplinary action of GTSM Tighten Market Surveillance Collate and Announce Data of Listed Companies 82

Listing Supervision Overview n n Implementation of Fair Disclosures Improve in accounting transparency n n n Information disclosure Routine and exceptional administration regarding listed companies Execute disciplinary action of GTSM Tighten Market Surveillance Collate and Announce Data of Listed Companies 82

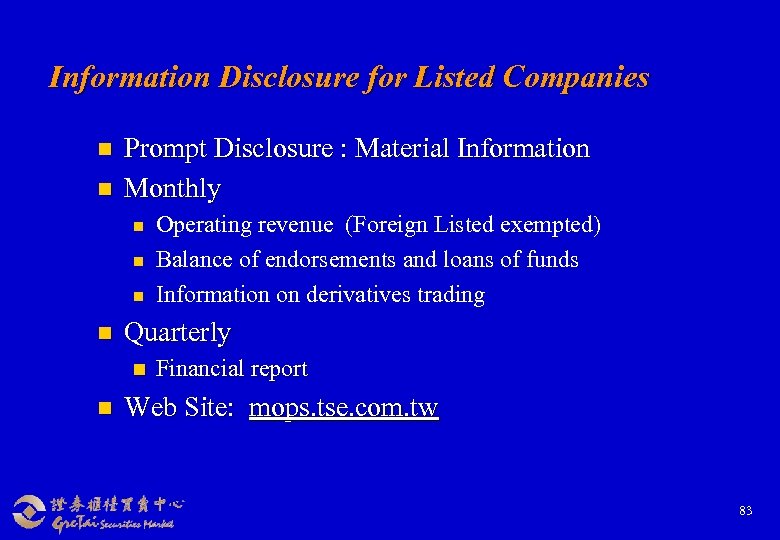

Information Disclosure for Listed Companies n n Prompt Disclosure : Material Information Monthly n n Quarterly n n Operating revenue (Foreign Listed exempted) Balance of endorsements and loans of funds Information on derivatives trading Financial report Web Site: mops. tse. com. tw 83

Information Disclosure for Listed Companies n n Prompt Disclosure : Material Information Monthly n n Quarterly n n Operating revenue (Foreign Listed exempted) Balance of endorsements and loans of funds Information on derivatives trading Financial report Web Site: mops. tse. com. tw 83

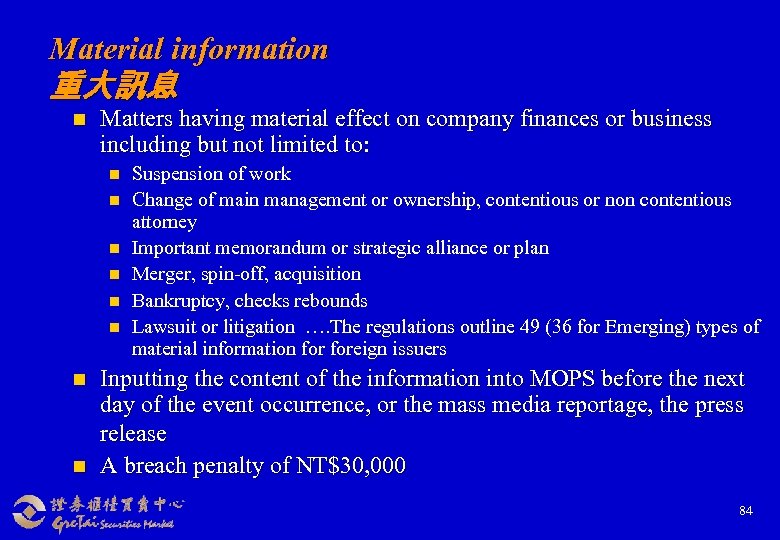

Material information 重大訊息 n Matters having material effect on company finances or business including but not limited to: n n n n Suspension of work Change of main management or ownership, contentious or non contentious attorney Important memorandum or strategic alliance or plan Merger, spin-off, acquisition Bankruptcy, checks rebounds Lawsuit or litigation …. The regulations outline 49 (36 for Emerging) types of material information foreign issuers Inputting the content of the information into MOPS before the next day of the event occurrence, or the mass media reportage, the press release A breach penalty of NT$30, 000 84

Material information 重大訊息 n Matters having material effect on company finances or business including but not limited to: n n n n Suspension of work Change of main management or ownership, contentious or non contentious attorney Important memorandum or strategic alliance or plan Merger, spin-off, acquisition Bankruptcy, checks rebounds Lawsuit or litigation …. The regulations outline 49 (36 for Emerging) types of material information foreign issuers Inputting the content of the information into MOPS before the next day of the event occurrence, or the mass media reportage, the press release A breach penalty of NT$30, 000 84

Press Conference Regarding Material Information 重大訊息說明記者會 n n Press Conference Regarding Material Information: The company shall promptly dispatch a spokesperson or acting spokesperson to a press conference by the trading day next following the occurrence of the event or the broadcast media report, to provide explanations to the news media. Foreign companies can use video conference. The regulations outline 26 (13 for Emerging) types of criteria foreign issuers to hold a press conference. 85

Press Conference Regarding Material Information 重大訊息說明記者會 n n Press Conference Regarding Material Information: The company shall promptly dispatch a spokesperson or acting spokesperson to a press conference by the trading day next following the occurrence of the event or the broadcast media report, to provide explanations to the news media. Foreign companies can use video conference. The regulations outline 26 (13 for Emerging) types of criteria foreign issuers to hold a press conference. 85

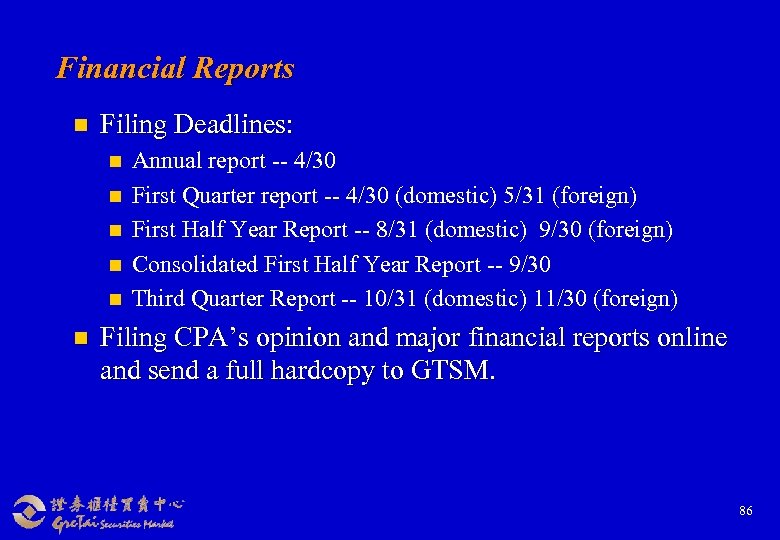

Financial Reports n Filing Deadlines: n n n Annual report -- 4/30 First Quarter report -- 4/30 (domestic) 5/31 (foreign) First Half Year Report -- 8/31 (domestic) 9/30 (foreign) Consolidated First Half Year Report -- 9/30 Third Quarter Report -- 10/31 (domestic) 11/30 (foreign) Filing CPA’s opinion and major financial reports online and send a full hardcopy to GTSM. 86

Financial Reports n Filing Deadlines: n n n Annual report -- 4/30 First Quarter report -- 4/30 (domestic) 5/31 (foreign) First Half Year Report -- 8/31 (domestic) 9/30 (foreign) Consolidated First Half Year Report -- 9/30 Third Quarter Report -- 10/31 (domestic) 11/30 (foreign) Filing CPA’s opinion and major financial reports online and send a full hardcopy to GTSM. 86

Routine and Exceptional Administration n n n Perform after companies have “Critical Events” Critical Events: n Dishonor of checks due to insufficient deposits n Liquidation of insider’s stocks by bank n Implementation of plan for the offering stock or bond seriously delayed or change substantially Analyze Critical Events to understand the impact to the company. Foreign company should accept GTSM appointed CPA or professional instrument’s special inspection in some special case. 87

Routine and Exceptional Administration n n n Perform after companies have “Critical Events” Critical Events: n Dishonor of checks due to insufficient deposits n Liquidation of insider’s stocks by bank n Implementation of plan for the offering stock or bond seriously delayed or change substantially Analyze Critical Events to understand the impact to the company. Foreign company should accept GTSM appointed CPA or professional instrument’s special inspection in some special case. 87

Disciplinary Action of GTSM n Penalty n n Set as altered-trading-method category n n Net worth lower than 50% of paid-in capital CPA issues a qualified audit report Dishonor of checks due to insufficient deposits Termination of trading n n n Upon violation of information disclosure rules Fails to file financial report on time CPA issues an audit report containing a disclaimer of opinion or an adverse opinion Delist from GTSM n n Adjudicated bankrupt by a court Negative net worth 88

Disciplinary Action of GTSM n Penalty n n Set as altered-trading-method category n n Net worth lower than 50% of paid-in capital CPA issues a qualified audit report Dishonor of checks due to insufficient deposits Termination of trading n n n Upon violation of information disclosure rules Fails to file financial report on time CPA issues an audit report containing a disclaimer of opinion or an adverse opinion Delist from GTSM n n Adjudicated bankrupt by a court Negative net worth 88

Market Surveillance of GTSM A healthy and orderly market should be able to protect investors’ rights and privileges and suppress manipulation and insider trading. In accordance with the regulations of Market Surveillance, GTSM discloses information on a daily basis about abnormal securities trading in order to alert investors and protect investors’ rights. GTSM may take disciplinary measures, as defined in the regulations, to constrain abnormal market behavior and prevent possible damage to the market. 89

Market Surveillance of GTSM A healthy and orderly market should be able to protect investors’ rights and privileges and suppress manipulation and insider trading. In accordance with the regulations of Market Surveillance, GTSM discloses information on a daily basis about abnormal securities trading in order to alert investors and protect investors’ rights. GTSM may take disciplinary measures, as defined in the regulations, to constrain abnormal market behavior and prevent possible damage to the market. 89

On-line Surveillance n Operates during trading hours (9: 00~13: 30) n Computer system detects abnormal securities automatically (On-line Automatic Detecting System) n Main detecting targets: n Price fluctuation : over 9%, difference between GTSM index over 5% n Price movement: over 6%, difference between GTSM index over 4% n Turnover rate : over 10% n Trading volume : over 10, 000 units 90

On-line Surveillance n Operates during trading hours (9: 00~13: 30) n Computer system detects abnormal securities automatically (On-line Automatic Detecting System) n Main detecting targets: n Price fluctuation : over 9%, difference between GTSM index over 5% n Price movement: over 6%, difference between GTSM index over 4% n Turnover rate : over 10% n Trading volume : over 10, 000 units 90

On-line Surveillance n Consequent measures, after the abnormal securities found, include: n n Real time analyze (e. g. contiguous price moving, trading concentration … ) Browse market-prevailed information by Cyber-Browsing System Inform related company to clarify or justify critical information on MOPS Notify brokerage firm to watch out the transaction of abnormal customers and prevent their default 91

On-line Surveillance n Consequent measures, after the abnormal securities found, include: n n Real time analyze (e. g. contiguous price moving, trading concentration … ) Browse market-prevailed information by Cyber-Browsing System Inform related company to clarify or justify critical information on MOPS Notify brokerage firm to watch out the transaction of abnormal customers and prevent their default 91

Off-line Surveillance n. Operates after trading hours n. Main projects: n Notify brokerage firm to watch out the transaction and prevent customers’ default (by written notice) n Declare warning name-list of certain securities that meet with alarming criteria n Undertake necessary countermeasures on certain securities that meet with special disposal criteria 92

Off-line Surveillance n. Operates after trading hours n. Main projects: n Notify brokerage firm to watch out the transaction and prevent customers’ default (by written notice) n Declare warning name-list of certain securities that meet with alarming criteria n Undertake necessary countermeasures on certain securities that meet with special disposal criteria 92

Off-line Surveillance n n Warning Information Securities Targeting items: n n n Price movement Trading volume Turnover rate PER, PBR Countermeasures: n n Declare warning name-list of targeted securities Preliminary analysis 93

Off-line Surveillance n n Warning Information Securities Targeting items: n n n Price movement Trading volume Turnover rate PER, PBR Countermeasures: n n Declare warning name-list of targeted securities Preliminary analysis 93

Off-line Surveillance Special Disposal Securities 處置股票 n Been declared as Attention Security 注意股票 for certain amount of days within a certain day period n Countermeasures: Manually matching 人 撮合 with prolonged time interval n Requiring pre-funding and securities pre-collected預收 款券 n Imposing restriction upon total daily order volume n Suspending trading n 94

Off-line Surveillance Special Disposal Securities 處置股票 n Been declared as Attention Security 注意股票 for certain amount of days within a certain day period n Countermeasures: Manually matching 人 撮合 with prolonged time interval n Requiring pre-funding and securities pre-collected預收 款券 n Imposing restriction upon total daily order volume n Suspending trading n 94

Types of Illegal Transactions n Market manipulation n n Fail to perform settlement Matched orders Artificial raising, lowering or fixing price Wash sale (create brisk trading impression) Spread rumors or false information 95

Types of Illegal Transactions n Market manipulation n n Fail to perform settlement Matched orders Artificial raising, lowering or fixing price Wash sale (create brisk trading impression) Spread rumors or false information 95

What is Insider Trading? n Article 157 -1 of the Securities and Exchange Act stipulates that "upon learning any information which will have a material impact on the price of an issuing company's securities, and prior to the public disclosure of such information or within 12 hours after its public disclosure, the person holding such information shall not purchase or sell shares of the company which are listed on an exchange or an overthe-counter market, or any other equity-type security of the company. 96

What is Insider Trading? n Article 157 -1 of the Securities and Exchange Act stipulates that "upon learning any information which will have a material impact on the price of an issuing company's securities, and prior to the public disclosure of such information or within 12 hours after its public disclosure, the person holding such information shall not purchase or sell shares of the company which are listed on an exchange or an overthe-counter market, or any other equity-type security of the company. 96

What is Insider? n n n Director, supervisor, and/or managerial officer of the company, and/or a person designated to exercise powers as representative. Shareholders holding more than 10% of the shares of the company (“Substantial Shareholder”). Any person who has obtained the information by reason of occupational or controlling relationship with the company. For example, employees, attorneys or accountants. Employees or shareholders of a holding company who learn information about a subsidiary A person who, though no longer among those listed in (one of) the preceding statuses, has only lost such status within the last 6 months. Any person who has obtained the information from any of the persons named in the preceding statuses. 97

What is Insider? n n n Director, supervisor, and/or managerial officer of the company, and/or a person designated to exercise powers as representative. Shareholders holding more than 10% of the shares of the company (“Substantial Shareholder”). Any person who has obtained the information by reason of occupational or controlling relationship with the company. For example, employees, attorneys or accountants. Employees or shareholders of a holding company who learn information about a subsidiary A person who, though no longer among those listed in (one of) the preceding statuses, has only lost such status within the last 6 months. Any person who has obtained the information from any of the persons named in the preceding statuses. 97

Insider’s Registration for Transfers 申報持股轉讓 n n At least 3 days prior to transfer, insiders must register their intention of transferring shares that have satisfied the holding period requirement and within the daily transfer allowance ratio following registration, However, this requirement shall not apply to transfers totaling less than 10, 000 shares per exchange day. File a report of the changes in the number of shares they held during the preceding month The insiders shall file, by the fifth day of each month, a report with the issuer of the changes in the number of shares they held during the preceding month. The issuer shall compile and file such report of changes by the fifteenth day of each month. 98

Insider’s Registration for Transfers 申報持股轉讓 n n At least 3 days prior to transfer, insiders must register their intention of transferring shares that have satisfied the holding period requirement and within the daily transfer allowance ratio following registration, However, this requirement shall not apply to transfers totaling less than 10, 000 shares per exchange day. File a report of the changes in the number of shares they held during the preceding month The insiders shall file, by the fifth day of each month, a report with the issuer of the changes in the number of shares they held during the preceding month. The issuer shall compile and file such report of changes by the fifteenth day of each month. 98

Conclusion 99

Conclusion 99

Thank You !!! 100

Thank You !!! 100