foreign_exchange_rate[1].pptx

- Количество слайдов: 21

Foreign exchange rate

Foreign exchange rate

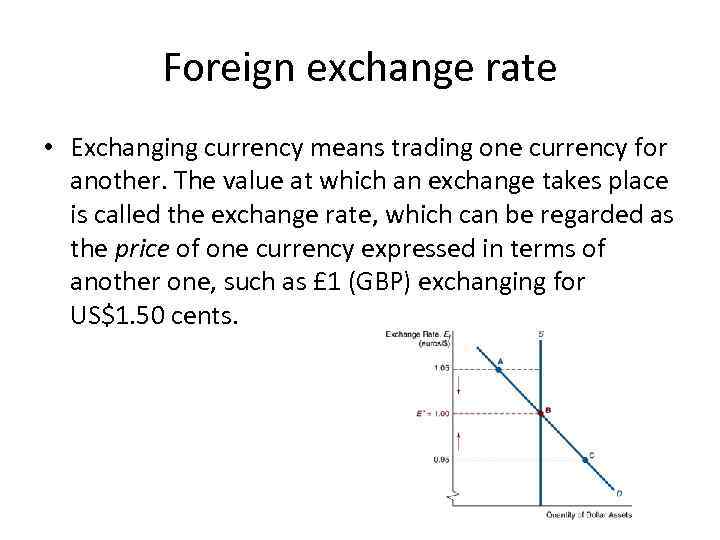

Foreign exchange rate • Exchanging currency means trading one currency for another. The value at which an exchange takes place is called the exchange rate, which can be regarded as the price of one currency expressed in terms of another one, such as £ 1 (GBP) exchanging for US$1. 50 cents.

Foreign exchange rate • Exchanging currency means trading one currency for another. The value at which an exchange takes place is called the exchange rate, which can be regarded as the price of one currency expressed in terms of another one, such as £ 1 (GBP) exchanging for US$1. 50 cents.

Foreign exchange rate

Foreign exchange rate

Appreciate and depreciate in currency • Appreciate: a rise in currency of a country to a foreign currency is appreciate in currency. • Depreciate: relatively, a decline in currency of a country to a foreign currency is depreciate in currency.

Appreciate and depreciate in currency • Appreciate: a rise in currency of a country to a foreign currency is appreciate in currency. • Depreciate: relatively, a decline in currency of a country to a foreign currency is depreciate in currency.

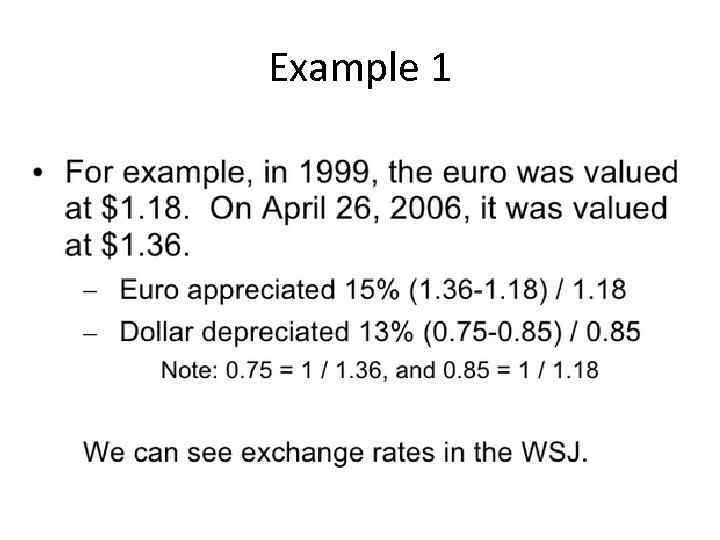

Example 1

Example 1

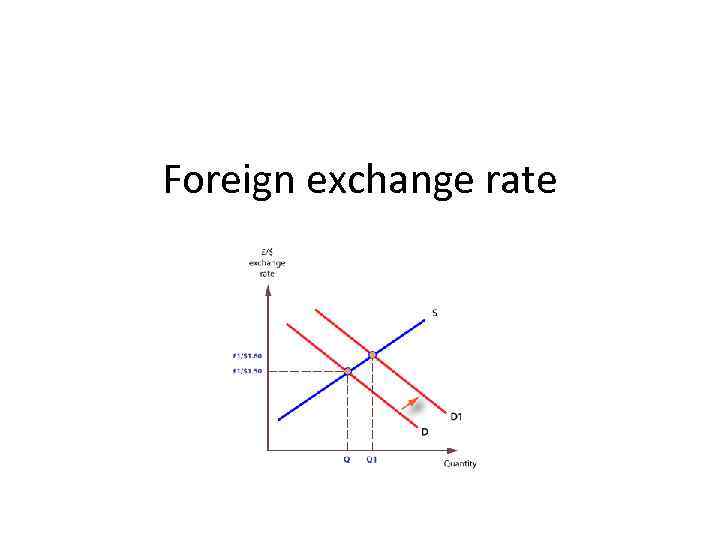

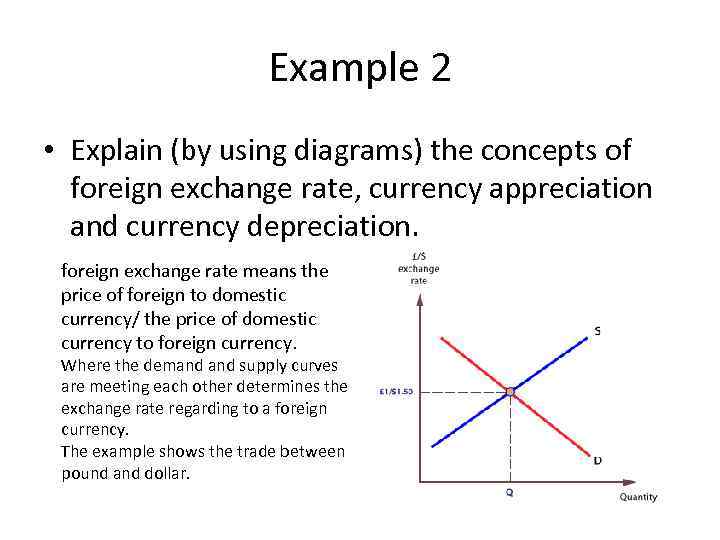

Example 2 • Explain (by using diagrams) the concepts of foreign exchange rate, currency appreciation and currency depreciation. foreign exchange rate means the price of foreign to domestic currency/ the price of domestic currency to foreign currency. Where the demand supply curves are meeting each other determines the exchange rate regarding to a foreign currency. The example shows the trade between pound and dollar.

Example 2 • Explain (by using diagrams) the concepts of foreign exchange rate, currency appreciation and currency depreciation. foreign exchange rate means the price of foreign to domestic currency/ the price of domestic currency to foreign currency. Where the demand supply curves are meeting each other determines the exchange rate regarding to a foreign currency. The example shows the trade between pound and dollar.

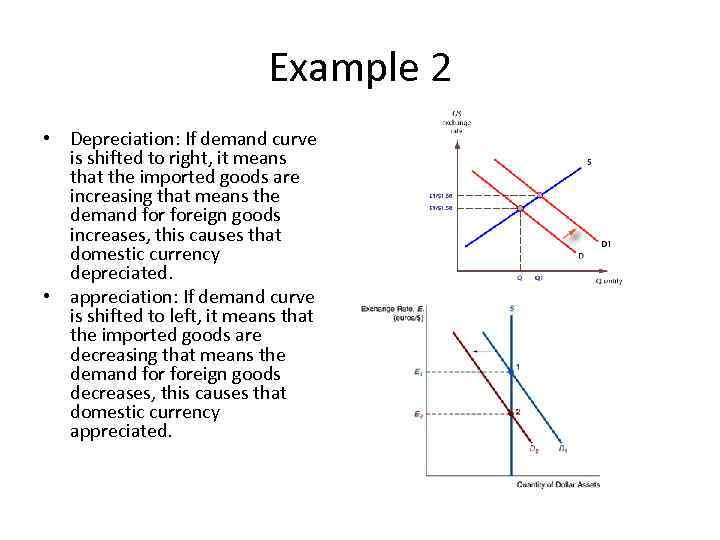

Example 2 • Depreciation: If demand curve is shifted to right, it means that the imported goods are increasing that means the demand foreign goods increases, this causes that domestic currency depreciated. • appreciation: If demand curve is shifted to left, it means that the imported goods are decreasing that means the demand foreign goods decreases, this causes that domestic currency appreciated.

Example 2 • Depreciation: If demand curve is shifted to right, it means that the imported goods are increasing that means the demand foreign goods increases, this causes that domestic currency depreciated. • appreciation: If demand curve is shifted to left, it means that the imported goods are decreasing that means the demand foreign goods decreases, this causes that domestic currency appreciated.

relationship between exchange rate of a country to another currency • The basic relationship between exchange rate of a country to another currency it depends on the demand for domestic good from another country. • Therefore, by increasing the demand of domestic goods, the exchange rate of the country increases.

relationship between exchange rate of a country to another currency • The basic relationship between exchange rate of a country to another currency it depends on the demand for domestic good from another country. • Therefore, by increasing the demand of domestic goods, the exchange rate of the country increases.

Major factors influencing on exchange rate • Domestic price level: If a country's goods are relatively cheap, foreigners will want to buy those goods. In order to buy those goods, they will need to buy the nation's currency. Countries with the lowest price levels will tend to have the strongest currencies (those currencies will be appreciating).

Major factors influencing on exchange rate • Domestic price level: If a country's goods are relatively cheap, foreigners will want to buy those goods. In order to buy those goods, they will need to buy the nation's currency. Countries with the lowest price levels will tend to have the strongest currencies (those currencies will be appreciating).

Major factors influencing on exchange rate • Trade barriers or Monetary Policy : Those countries with restrictive (hard) Trade barriers /monetary policies will be decreasing the supply of their currency and the currency should appreciate. So by providing more trade barriers, internal traders have more difficulty to import, therefore, the exchange rate appreciate.

Major factors influencing on exchange rate • Trade barriers or Monetary Policy : Those countries with restrictive (hard) Trade barriers /monetary policies will be decreasing the supply of their currency and the currency should appreciate. So by providing more trade barriers, internal traders have more difficulty to import, therefore, the exchange rate appreciate.

Major factors influencing on exchange rate • Export and import (domestic good or foreign goods): • Export effect: if demand of domestic goods increases , other nations have to pay with nation’s currency (the currency of country that is selling the good); therefore, the currency is appreciated. • import effect: if demand of foreign goods increases, then the buyer country must pay with seller’s currency, then currency is depreciated

Major factors influencing on exchange rate • Export and import (domestic good or foreign goods): • Export effect: if demand of domestic goods increases , other nations have to pay with nation’s currency (the currency of country that is selling the good); therefore, the currency is appreciated. • import effect: if demand of foreign goods increases, then the buyer country must pay with seller’s currency, then currency is depreciated

Major factors influencing on exchange rate • Productivity: increase in productivity appreciate the currency over foreign currency. for example, Germany has high productivity with producing BMW, BENZ, Volkswagen, Siemens, and etc. therefore, euro appreciates.

Major factors influencing on exchange rate • Productivity: increase in productivity appreciate the currency over foreign currency. for example, Germany has high productivity with producing BMW, BENZ, Volkswagen, Siemens, and etc. therefore, euro appreciates.

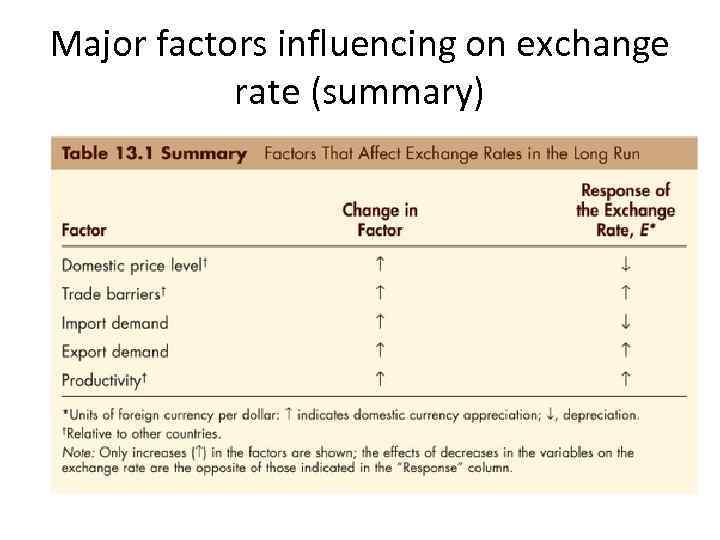

Major factors influencing on exchange rate (summary)

Major factors influencing on exchange rate (summary)

Example 3 (with answer) • What are the determinants of exports (X) and imports (M) of a country? How do these factors affect the net exports (NX)? Exports = factor (exchange rate, prices) - goods/services 1 -lower currency rate – increases in exports High currency rate – decreases exports 2 -High prices – discourage exports Low prices – encourage exports Imports = factors (exchange rate, Domestic income, prices) – 1 -Low exchange rate (domestic money value lower) – discourages imports High exchange rate (domestic currency higher value) – encourages imports 2 -Domestic income high – encourages imports Domestic income low – discourages imports 3 -Domestic prices low – discourage imports Domestic prices high – encourage imports

Example 3 (with answer) • What are the determinants of exports (X) and imports (M) of a country? How do these factors affect the net exports (NX)? Exports = factor (exchange rate, prices) - goods/services 1 -lower currency rate – increases in exports High currency rate – decreases exports 2 -High prices – discourage exports Low prices – encourage exports Imports = factors (exchange rate, Domestic income, prices) – 1 -Low exchange rate (domestic money value lower) – discourages imports High exchange rate (domestic currency higher value) – encourages imports 2 -Domestic income high – encourages imports Domestic income low – discourages imports 3 -Domestic prices low – discourage imports Domestic prices high – encourage imports

Example 3 (answer) A higher price level (price of domestic products in the domestic country) increases the relative price of domestic exports to other countries (decrease in exports) while decreasing the relative price of foreign imports from other countries (increase in imports ). This results in a decrease in net exports. Net exports (NX) = exports – imports = trade balance (surplus/deficit). If net export decreases: deficit If net export decreases: surplus • surplus = revenue - spending, where revenue > spending Capital assets – depends on interest rate ® rd (domestic interest rate ) > rf (foreign interest rate) ---- inflows of capital funds . Demand of domestic currency increases rd < rf --- outflows of capital funds (capital flight) Demand of domestic currency decreases

Example 3 (answer) A higher price level (price of domestic products in the domestic country) increases the relative price of domestic exports to other countries (decrease in exports) while decreasing the relative price of foreign imports from other countries (increase in imports ). This results in a decrease in net exports. Net exports (NX) = exports – imports = trade balance (surplus/deficit). If net export decreases: deficit If net export decreases: surplus • surplus = revenue - spending, where revenue > spending Capital assets – depends on interest rate ® rd (domestic interest rate ) > rf (foreign interest rate) ---- inflows of capital funds . Demand of domestic currency increases rd < rf --- outflows of capital funds (capital flight) Demand of domestic currency decreases

Example 4 • What are the factors that affect the demand for and supply of domestic and foreign currencies? Illustrate by giving examples. (high chance to come in exam)

Example 4 • What are the factors that affect the demand for and supply of domestic and foreign currencies? Illustrate by giving examples. (high chance to come in exam)

Example 4 (answer) Factors affecting demand for domestic currency – Exports of domestic goods Malaysia exports oil to Japan …. . Japan buys ringgit …. . Japan’s demand for ringgit …. Demand for ringgit shifts to the right Malaysia sells ringgit…. Japan supplies Yen in the foreign exchange market …. . Yen’s supply curve Factors affecting demand foreign currency – imports of foreign goods/services Malaysia imports goods/services from Japan …. . Malaysia buys Yen …. Demand for Yen (foreign currency) increases Japan sells Yen …. Factors affecting supply of ringgit – imports of foreign goods …. Malaysia supplies ringgit to the foreign exchange market but Yen ….

Example 4 (answer) Factors affecting demand for domestic currency – Exports of domestic goods Malaysia exports oil to Japan …. . Japan buys ringgit …. . Japan’s demand for ringgit …. Demand for ringgit shifts to the right Malaysia sells ringgit…. Japan supplies Yen in the foreign exchange market …. . Yen’s supply curve Factors affecting demand foreign currency – imports of foreign goods/services Malaysia imports goods/services from Japan …. . Malaysia buys Yen …. Demand for Yen (foreign currency) increases Japan sells Yen …. Factors affecting supply of ringgit – imports of foreign goods …. Malaysia supplies ringgit to the foreign exchange market but Yen ….

Example 4 (answer) • Demand for domestic currency (ringgit) = Japan imports domestic products/services • • Japan imports oil from Malaysia – Japan buys ringgit (demand-side) in exchange for Yen -- Demand for ringgit shifts upward ----- appreciation of ringgit • • Supply of ringgit in the foreign exchange market = Malaysia imports Japanese products/services • • Malaysia demands Yen, Japan supplies Yen • Malaysia sells ringgit in exchange for Yen (supply of ringgit) • Supply curve of ringgit shifts to the right ----- depreciation of ringgit

Example 4 (answer) • Demand for domestic currency (ringgit) = Japan imports domestic products/services • • Japan imports oil from Malaysia – Japan buys ringgit (demand-side) in exchange for Yen -- Demand for ringgit shifts upward ----- appreciation of ringgit • • Supply of ringgit in the foreign exchange market = Malaysia imports Japanese products/services • • Malaysia demands Yen, Japan supplies Yen • Malaysia sells ringgit in exchange for Yen (supply of ringgit) • Supply curve of ringgit shifts to the right ----- depreciation of ringgit

Example 4 (answer) • Capital Assets • • If rd > rf …… capital inflows …. Demand ringgit increases …. demand for ringgit shifts to the right … • Ringgit appreciates • • If rd < rf …… capital outflows …. Demand ringgit decreases …. demand for ringgit shifts to the left … • Ringgit depreciates

Example 4 (answer) • Capital Assets • • If rd > rf …… capital inflows …. Demand ringgit increases …. demand for ringgit shifts to the right … • Ringgit appreciates • • If rd < rf …… capital outflows …. Demand ringgit decreases …. demand for ringgit shifts to the left … • Ringgit depreciates

Example 5 • In the foreign exchange market, explain why a country whose income grows faster than that of its trading partners can expect its exchange rate to fall or the value of its currency to depreciate.

Example 5 • In the foreign exchange market, explain why a country whose income grows faster than that of its trading partners can expect its exchange rate to fall or the value of its currency to depreciate.

Example 5 (answer) • Demand for and supply of domestic currency – • Incomes grow faster – demand for final goods/services from outside markets (imports) – tastes/preference for imported goods ---- supply more domestic currency to the international exchange market --- Supply curve of domestic currency shifts to the right ---- domestic currency depreciates.

Example 5 (answer) • Demand for and supply of domestic currency – • Incomes grow faster – demand for final goods/services from outside markets (imports) – tastes/preference for imported goods ---- supply more domestic currency to the international exchange market --- Supply curve of domestic currency shifts to the right ---- domestic currency depreciates.