079539f8771d33e8af8dad0e23e22c9f.ppt

- Количество слайдов: 22

Foreign Exchange Market Overview Convention and Terminology Mechanics and Operations Instruments ปรทรรศน © 2006 ปรทรรศน เหลองอทย FRM เหลองอทย , CFA, FRM 9 August 2006 , CFA,

Foreign Exchange Market Overview Convention and Terminology Mechanics and Operations Instruments ปรทรรศน © 2006 ปรทรรศน เหลองอทย FRM เหลองอทย , CFA, FRM 9 August 2006 , CFA,

Historical Perspective • 1880 -1914 : Gold Standards • 1918 -1939 : The War Periods • 1944 -1970 : The Gold Exchange Standard • 1971 -1973 : The Collapse of Bretton Woods • 1985 : The Plaza Accord • 1997 : Floatation of Thai Baht • 1999 : Introduction of the Euro • 2002 : Continuous Linked Settlement (CLS) © 2006 ปรทรรศน เหลองอทย , CFA, FRM 2

Historical Perspective • 1880 -1914 : Gold Standards • 1918 -1939 : The War Periods • 1944 -1970 : The Gold Exchange Standard • 1971 -1973 : The Collapse of Bretton Woods • 1985 : The Plaza Accord • 1997 : Floatation of Thai Baht • 1999 : Introduction of the Euro • 2002 : Continuous Linked Settlement (CLS) © 2006 ปรทรรศน เหลองอทย , CFA, FRM 2

Settlement • Every trade executed has to be settled. • Settlement risk is the risk that one side to a transaction pays out its obligation in one time zone but the counterparty to the transaction fails to make the corresponding payment in a different time zone. • A number of initiatives : FXNET, the oldest and the most successful, provides an automated bilateral netting solution, which is a legally binding agreement between pairs of counterparties in which transactions are netted continually throughout the trading day. • Today around 20% of all FX transaction obligations are netted via FXNET. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 3

Settlement • Every trade executed has to be settled. • Settlement risk is the risk that one side to a transaction pays out its obligation in one time zone but the counterparty to the transaction fails to make the corresponding payment in a different time zone. • A number of initiatives : FXNET, the oldest and the most successful, provides an automated bilateral netting solution, which is a legally binding agreement between pairs of counterparties in which transactions are netted continually throughout the trading day. • Today around 20% of all FX transaction obligations are netted via FXNET. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 3

Continuous Linked Settlement • In September 2002, the CLS Bank was launched to provide a solution called Continuous Linked Settlement. • CLS operates by linking all of the world’s settlement periods and indeed, truncating them, into a period of just five hours. • Acting in effect as a clearing hours, CLS receives payments in but does not pay them out until the correspondent payments are also received. • Hence, CLS settles FX transaction on a payment-versuspayment (PVP) basis in the book of CLS Bank. • CLS eliminates settlement risk and reduces the liquidity needed. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 4

Continuous Linked Settlement • In September 2002, the CLS Bank was launched to provide a solution called Continuous Linked Settlement. • CLS operates by linking all of the world’s settlement periods and indeed, truncating them, into a period of just five hours. • Acting in effect as a clearing hours, CLS receives payments in but does not pay them out until the correspondent payments are also received. • Hence, CLS settles FX transaction on a payment-versuspayment (PVP) basis in the book of CLS Bank. • CLS eliminates settlement risk and reduces the liquidity needed. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 4

The Foreign Exchange Market © 2006 ปรทรรศน เหลองอทย , CFA, FRM

The Foreign Exchange Market © 2006 ปรทรรศน เหลองอทย , CFA, FRM

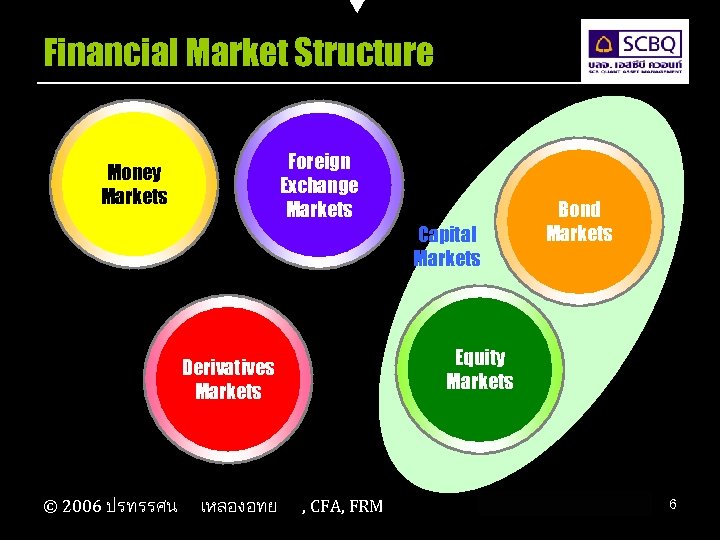

Financial Market Structure Foreign Exchange Markets Money Markets Capital Markets Equity Markets Derivatives Markets © 2006 ปรทรรศน เหลองอทย Bond Markets , CFA, FRM 6

Financial Market Structure Foreign Exchange Markets Money Markets Capital Markets Equity Markets Derivatives Markets © 2006 ปรทรรศน เหลองอทย Bond Markets , CFA, FRM 6

Basic Definition • A Currency is a medium of exchange, coins or notes, used to buy goods or services. Most countries have their own currency, issued by an official agency called a central bank or a monetary authority. • Foreign Exchange (F/X or Forex) is the transaction that involves the purchase of one currency against the sale of another currency for settlement or delivery on a specified date. • The Exchange Rate is the price per unit of one of the currencies expressed in units of the other currency. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 7

Basic Definition • A Currency is a medium of exchange, coins or notes, used to buy goods or services. Most countries have their own currency, issued by an official agency called a central bank or a monetary authority. • Foreign Exchange (F/X or Forex) is the transaction that involves the purchase of one currency against the sale of another currency for settlement or delivery on a specified date. • The Exchange Rate is the price per unit of one of the currencies expressed in units of the other currency. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 7

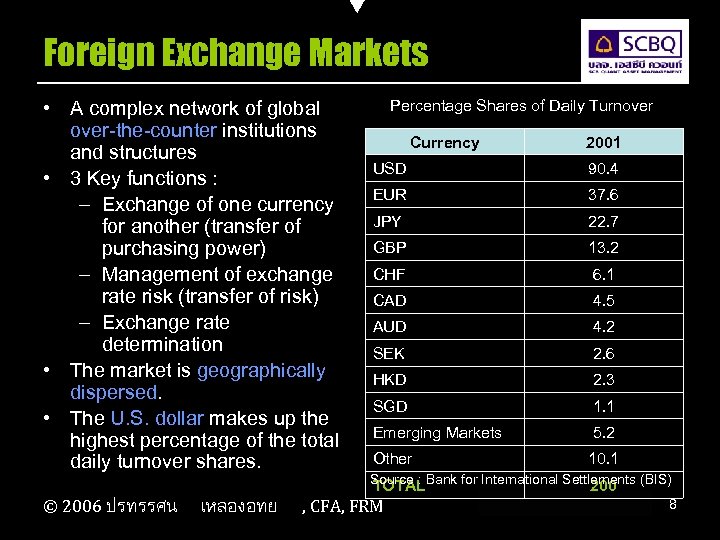

Foreign Exchange Markets • A complex network of global over-the-counter institutions and structures • 3 Key functions : – Exchange of one currency for another (transfer of purchasing power) – Management of exchange rate risk (transfer of risk) – Exchange rate determination • The market is geographically dispersed. • The U. S. dollar makes up the highest percentage of the total daily turnover shares. © 2006 ปรทรรศน เหลองอทย Percentage Shares of Daily Turnover Currency 2001 USD 90. 4 EUR 37. 6 JPY 22. 7 GBP 13. 2 CHF 6. 1 CAD 4. 5 AUD 4. 2 SEK 2. 6 HKD 2. 3 SGD 1. 1 Emerging Markets 5. 2 Other 10. 1 Source : Bank for International Settlements (BIS) TOTAL 200 , CFA, FRM 8

Foreign Exchange Markets • A complex network of global over-the-counter institutions and structures • 3 Key functions : – Exchange of one currency for another (transfer of purchasing power) – Management of exchange rate risk (transfer of risk) – Exchange rate determination • The market is geographically dispersed. • The U. S. dollar makes up the highest percentage of the total daily turnover shares. © 2006 ปรทรรศน เหลองอทย Percentage Shares of Daily Turnover Currency 2001 USD 90. 4 EUR 37. 6 JPY 22. 7 GBP 13. 2 CHF 6. 1 CAD 4. 5 AUD 4. 2 SEK 2. 6 HKD 2. 3 SGD 1. 1 Emerging Markets 5. 2 Other 10. 1 Source : Bank for International Settlements (BIS) TOTAL 200 , CFA, FRM 8

Market Overview • The Foreign Exchange Market allows market participants to exchange one currency for another. It is a communication network linking all participants. • Foreign exchange market is the single largest market in the world. More than USD 1. 2 trillion is traded in the FX market each day. • London (38%) is the largest trading center in the world, followed by New York (22%), Tokyo (10%), and Singapore (9%). © 2006 ปรทรรศน เหลองอทย , CFA, FRM 9

Market Overview • The Foreign Exchange Market allows market participants to exchange one currency for another. It is a communication network linking all participants. • Foreign exchange market is the single largest market in the world. More than USD 1. 2 trillion is traded in the FX market each day. • London (38%) is the largest trading center in the world, followed by New York (22%), Tokyo (10%), and Singapore (9%). © 2006 ปรทรรศน เหลองอทย , CFA, FRM 9

Foreign Exchange Instruments © 2006 ปรทรรศน เหลองอทย , CFA, FRM

Foreign Exchange Instruments © 2006 ปรทรรศน เหลองอทย , CFA, FRM

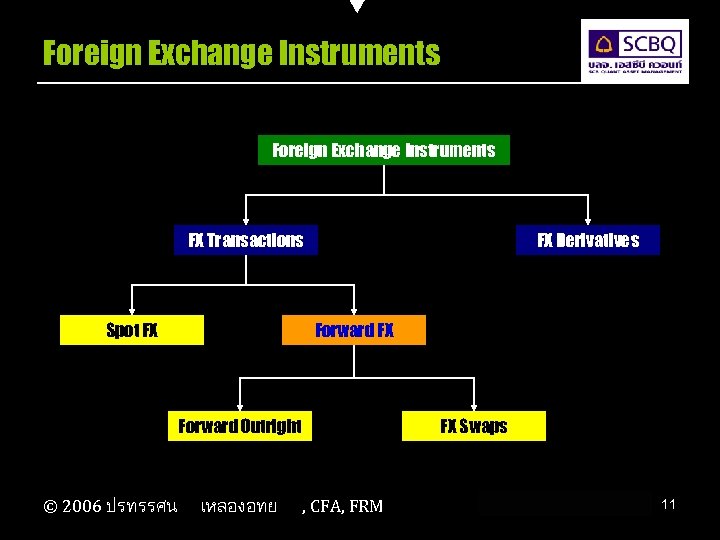

Foreign Exchange Instruments FX Transactions Spot FX FX Derivatives Forward FX Forward Outright © 2006 ปรทรรศน เหลองอทย FX Swaps , CFA, FRM 11

Foreign Exchange Instruments FX Transactions Spot FX FX Derivatives Forward FX Forward Outright © 2006 ปรทรรศน เหลองอทย FX Swaps , CFA, FRM 11

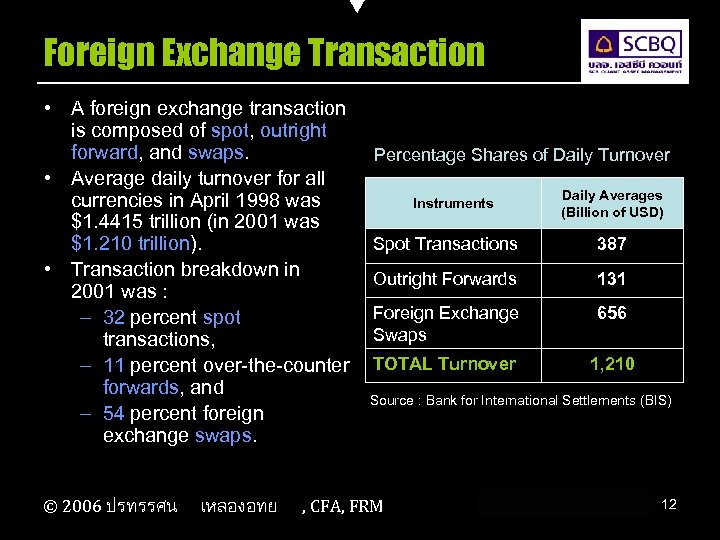

Foreign Exchange Transaction • A foreign exchange transaction is composed of spot, outright forward, and swaps. • Average daily turnover for all currencies in April 1998 was $1. 4415 trillion (in 2001 was $1. 210 trillion). • Transaction breakdown in 2001 was : – 32 percent spot transactions, – 11 percent over-the-counter forwards, and – 54 percent foreign exchange swaps. © 2006 ปรทรรศน เหลองอทย Percentage Shares of Daily Turnover Instruments Daily Averages (Billion of USD) Spot Transactions 387 Outright Forwards 131 Foreign Exchange Swaps 656 TOTAL Turnover 1, 210 Source : Bank for International Settlements (BIS) , CFA, FRM 12

Foreign Exchange Transaction • A foreign exchange transaction is composed of spot, outright forward, and swaps. • Average daily turnover for all currencies in April 1998 was $1. 4415 trillion (in 2001 was $1. 210 trillion). • Transaction breakdown in 2001 was : – 32 percent spot transactions, – 11 percent over-the-counter forwards, and – 54 percent foreign exchange swaps. © 2006 ปรทรรศน เหลองอทย Percentage Shares of Daily Turnover Instruments Daily Averages (Billion of USD) Spot Transactions 387 Outright Forwards 131 Foreign Exchange Swaps 656 TOTAL Turnover 1, 210 Source : Bank for International Settlements (BIS) , CFA, FRM 12

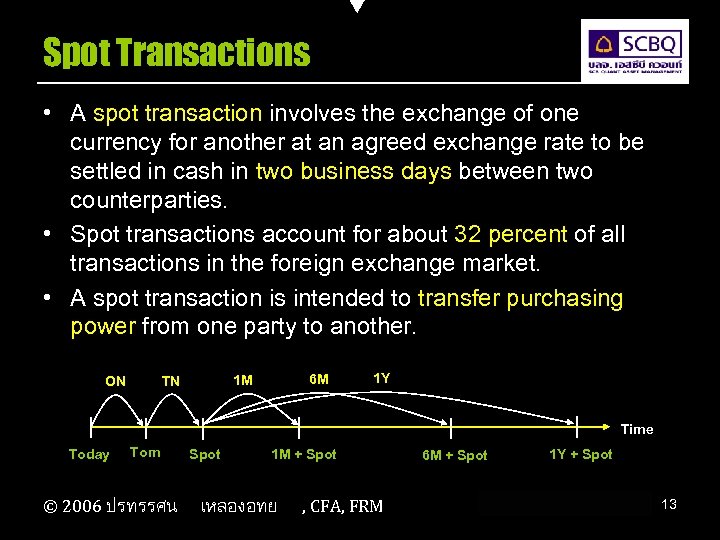

Spot Transactions • A spot transaction involves the exchange of one currency for another at an agreed exchange rate to be settled in cash in two business days between two counterparties. • Spot transactions account for about 32 percent of all transactions in the foreign exchange market. • A spot transaction is intended to transfer purchasing power from one party to another. ON 6 M 1 M TN 1 Y Time Today Tom © 2006 ปรทรรศน Spot 1 M + Spot เหลองอทย , CFA, FRM 6 M + Spot 1 Y + Spot 13

Spot Transactions • A spot transaction involves the exchange of one currency for another at an agreed exchange rate to be settled in cash in two business days between two counterparties. • Spot transactions account for about 32 percent of all transactions in the foreign exchange market. • A spot transaction is intended to transfer purchasing power from one party to another. ON 6 M 1 M TN 1 Y Time Today Tom © 2006 ปรทรรศน Spot 1 M + Spot เหลองอทย , CFA, FRM 6 M + Spot 1 Y + Spot 13

Spot Foreign Exchange • The normal settlement period for “spot” deals is two working or business days. • About one-third of all the business transacted in the foreign exchange market is for settlement or “value date” spot. • For example, if the deal is done on Thursday, then the spot date would be Monday. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 14

Spot Foreign Exchange • The normal settlement period for “spot” deals is two working or business days. • About one-third of all the business transacted in the foreign exchange market is for settlement or “value date” spot. • For example, if the deal is done on Thursday, then the spot date would be Monday. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 14

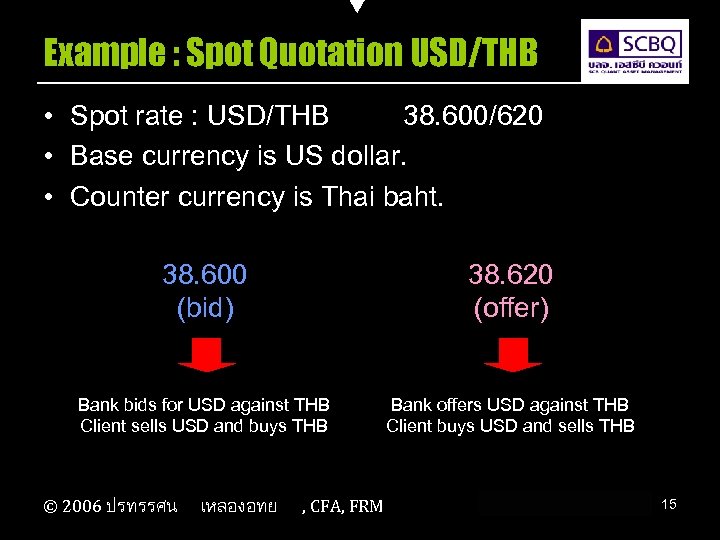

Example : Spot Quotation USD/THB • Spot rate : USD/THB 38. 600/620 • Base currency is US dollar. • Counter currency is Thai baht. 38. 600 (bid) 38. 620 (offer) Bank bids for USD against THB Client sells USD and buys THB Bank offers USD against THB Client buys USD and sells THB © 2006 ปรทรรศน เหลองอทย , CFA, FRM 15

Example : Spot Quotation USD/THB • Spot rate : USD/THB 38. 600/620 • Base currency is US dollar. • Counter currency is Thai baht. 38. 600 (bid) 38. 620 (offer) Bank bids for USD against THB Client sells USD and buys THB Bank offers USD against THB Client buys USD and sells THB © 2006 ปรทรรศน เหลองอทย , CFA, FRM 15

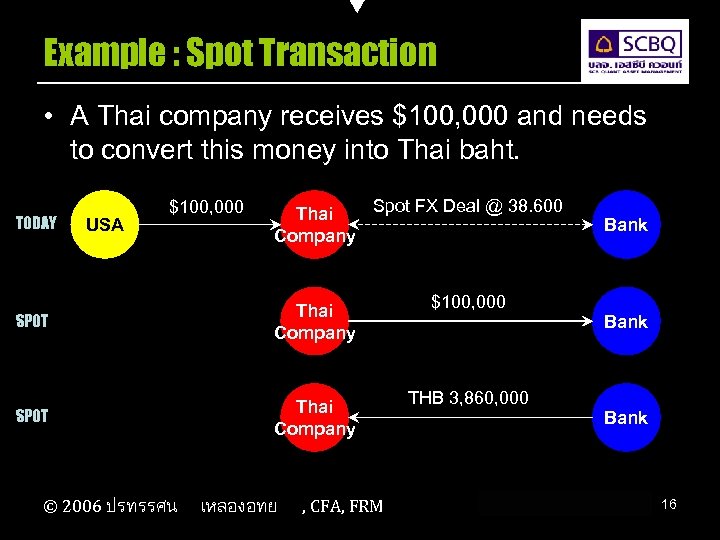

Example : Spot Transaction • A Thai company receives $100, 000 and needs to convert this money into Thai baht. TODAY USA $100, 000 Spot FX Deal @ 38. 600 Thai Company SPOT Thai Company $100, 000 SPOT Thai Company THB 3, 860, 000 © 2006 ปรทรรศน เหลองอทย , CFA, FRM Bank 16

Example : Spot Transaction • A Thai company receives $100, 000 and needs to convert this money into Thai baht. TODAY USA $100, 000 Spot FX Deal @ 38. 600 Thai Company SPOT Thai Company $100, 000 SPOT Thai Company THB 3, 860, 000 © 2006 ปรทรรศน เหลองอทย , CFA, FRM Bank 16

Outright Forwards • An outright forward is an over-the-counter transaction involving the exchange of one currency at the forward exchange rate determined today for the delivery to take place for cash settlement in more than two business days. • About 11 percent of all transactions in the foreign exchange market are forward contracts. • A forward transaction is intended to transfer risk from one party to another. Transferring risk is hedging that is intended to reduce the exposure to foreign exchange risk. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 17

Outright Forwards • An outright forward is an over-the-counter transaction involving the exchange of one currency at the forward exchange rate determined today for the delivery to take place for cash settlement in more than two business days. • About 11 percent of all transactions in the foreign exchange market are forward contracts. • A forward transaction is intended to transfer risk from one party to another. Transferring risk is hedging that is intended to reduce the exposure to foreign exchange risk. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 17

Forward Outright • An outright forward exchange deal is a contract to buy or sell a given amount of currency for settlement at some future date, at a rate of exchange which is agreed at the time of dealing. No money changes hand until the settlement date. • Generally it is possible to obtain a forward rate of exchange for up to one year for most traded currencies. • The purpose of obtaining a forward rate of exchange is simply to establish and fix the cost of exchange for a known foreign currency commitment at some future date. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 18

Forward Outright • An outright forward exchange deal is a contract to buy or sell a given amount of currency for settlement at some future date, at a rate of exchange which is agreed at the time of dealing. No money changes hand until the settlement date. • Generally it is possible to obtain a forward rate of exchange for up to one year for most traded currencies. • The purpose of obtaining a forward rate of exchange is simply to establish and fix the cost of exchange for a known foreign currency commitment at some future date. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 18

Forward F/X Rates Forward Points = Forward Outright – Spot FX Rate Forward Outright = Spot FX Rate +/- Forward Points © 2006 ปรทรรศน เหลองอทย , CFA, FRM 19

Forward F/X Rates Forward Points = Forward Outright – Spot FX Rate Forward Outright = Spot FX Rate +/- Forward Points © 2006 ปรทรรศน เหลองอทย , CFA, FRM 19

Foreign Exchange Swaps • A foreign exchange swap (a spot/forward swap) is a contract to exchange currencies in principal amount only in two business days (the short leg) and reversal of the exchange of the same two currencies at a date in the future (a long leg). • An FX Swap is the combination of a spot deal with a simultaneous forward deal. • A FOREX swap is the portfolio of long and short positions entered simultaneously at two different dates prevailing in the future. • The simultaneous purchase and sale of a specified amount of one currency in exchange for two different value dates. • A swap transaction is essentially a financing at a fully collateralized basis. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 20

Foreign Exchange Swaps • A foreign exchange swap (a spot/forward swap) is a contract to exchange currencies in principal amount only in two business days (the short leg) and reversal of the exchange of the same two currencies at a date in the future (a long leg). • An FX Swap is the combination of a spot deal with a simultaneous forward deal. • A FOREX swap is the portfolio of long and short positions entered simultaneously at two different dates prevailing in the future. • The simultaneous purchase and sale of a specified amount of one currency in exchange for two different value dates. • A swap transaction is essentially a financing at a fully collateralized basis. © 2006 ปรทรรศน เหลองอทย , CFA, FRM 20

Foreign Exchange Swaps • Sell/Buy (S/B) • Near Leg : Sell fixed amount of Base Currency • Far Leg : Buy fixed amount of Base Currency • Buy/Sell (B/S) • Near Leg : Buy fixed amount of Base Currency • Far Leg : Sell fixed amount of Base Currency © 2006 ปรทรรศน เหลองอทย , CFA, FRM 21

Foreign Exchange Swaps • Sell/Buy (S/B) • Near Leg : Sell fixed amount of Base Currency • Far Leg : Buy fixed amount of Base Currency • Buy/Sell (B/S) • Near Leg : Buy fixed amount of Base Currency • Far Leg : Sell fixed amount of Base Currency © 2006 ปรทรรศน เหลองอทย , CFA, FRM 21

Forward-Forwards • When the short leg of the FX swap is more than two business days, then the swap is called a forward/forward swap. • A forward-forward swap is a swap deal between two forward dates rather than from spot to a forward date. • FX forward-forwards are referred to by the beginning and end dates of the forward period, compared with the spot value date. • For example, to sell USD 1 month forward and buy them back 3 months forward. In this case, the swap is for the 2 -month period between the 1 -month date and the 3 month date : “ 1 v 3” © 2006 ปรทรรศน เหลองอทย , CFA, FRM 22

Forward-Forwards • When the short leg of the FX swap is more than two business days, then the swap is called a forward/forward swap. • A forward-forward swap is a swap deal between two forward dates rather than from spot to a forward date. • FX forward-forwards are referred to by the beginning and end dates of the forward period, compared with the spot value date. • For example, to sell USD 1 month forward and buy them back 3 months forward. In this case, the swap is for the 2 -month period between the 1 -month date and the 3 month date : “ 1 v 3” © 2006 ปรทรรศน เหลองอทย , CFA, FRM 22