1e673ffe82e76a775d0eb50618d84925.ppt

- Количество слайдов: 41

Foreign Exchange

Foreign Exchange

Foreign exchange rate is the price of one currency in terms of another.

Foreign exchange rate is the price of one currency in terms of another.

Effective Exchange Rate Measure of the exchange rate of a country’s currency against a weighted basket of currencies of that country’s major trading partners.

Effective Exchange Rate Measure of the exchange rate of a country’s currency against a weighted basket of currencies of that country’s major trading partners.

Mexico’s main trading partners United States (71%), Eurozone (6. 7%), Canada (6. 4%), China (2. 0%), Colombia (1. 7%),

Mexico’s main trading partners United States (71%), Eurozone (6. 7%), Canada (6. 4%), China (2. 0%), Colombia (1. 7%),

The foreign exchange market. 1. many buyers and sellers 2. homogeneous product 3. perfect information It’s actually very like……

The foreign exchange market. 1. many buyers and sellers 2. homogeneous product 3. perfect information It’s actually very like……

https: //www. currencyfair. com/

https: //www. currencyfair. com/

We created Currency. Fair because we believe that ordinary people, and businesses, should have access to the same great exchange rates for international currency transfers normally reserved only for banks and market professionals dealing in millions. Three of us are expats, so we'd experienced first-hand what a blatant rip-off international money transfers could be; both in poor exchange rates and high international wire fees. As three of us are also ex-bankers (sorry, sorry!) we felt that we had the knowledge, the experience, and the network to come up with a better system. So that's exactly what we did with Currency. Fair!

We created Currency. Fair because we believe that ordinary people, and businesses, should have access to the same great exchange rates for international currency transfers normally reserved only for banks and market professionals dealing in millions. Three of us are expats, so we'd experienced first-hand what a blatant rip-off international money transfers could be; both in poor exchange rates and high international wire fees. As three of us are also ex-bankers (sorry, sorry!) we felt that we had the knowledge, the experience, and the network to come up with a better system. So that's exactly what we did with Currency. Fair!

The average weekly turnover in global foreign exchange is…. .

The average weekly turnover in global foreign exchange is…. .

$20 trillion. Bigger than the US national debt.

$20 trillion. Bigger than the US national debt.

Floating exchange rate is one where the value of a currency is determined by supply and demand forces.

Floating exchange rate is one where the value of a currency is determined by supply and demand forces.

Fixed exchange rate The value of one currency is maintained at a constant rate against another currency (or within a small margin of fluctuation)

Fixed exchange rate The value of one currency is maintained at a constant rate against another currency (or within a small margin of fluctuation)

Diagram

Diagram

Determinants of exchange rates 1. The demand for exported goods and services When demand for a country’s exports increases, it increases demand for the currency itself.

Determinants of exchange rates 1. The demand for exported goods and services When demand for a country’s exports increases, it increases demand for the currency itself.

Determinants of exchange rates Foreign Direct Investment. If Americans want to invest in Mexico, the value of the Mexican peso will rise.

Determinants of exchange rates Foreign Direct Investment. If Americans want to invest in Mexico, the value of the Mexican peso will rise.

Determinants of exchange rates Interest rate

Determinants of exchange rates Interest rate

Determinants of exchange rates The interest rate can attract or repel foreign financial investors. There would be more capital inflow of _______ in times of high interest rates and capital outflow in times of low interest rates.

Determinants of exchange rates The interest rate can attract or repel foreign financial investors. There would be more capital inflow of _______ in times of high interest rates and capital outflow in times of low interest rates.

QE

QE

QE The buying of government debt by the national bank increases the money supply and therefore devalues the currency.

QE The buying of government debt by the national bank increases the money supply and therefore devalues the currency.

QE has been used by USA, Japan and the UK and the Eurozone. This has been criticised by BRIC economies as a feature of competetive devaluation.

QE has been used by USA, Japan and the UK and the Eurozone. This has been criticised by BRIC economies as a feature of competetive devaluation.

Determinants of exchange rates Speculation. The holders of currencies speculate on their future values. Speculators will buy a currency when they believe it will appreciate and sell it when they believe it has reached its peak.

Determinants of exchange rates Speculation. The holders of currencies speculate on their future values. Speculators will buy a currency when they believe it will appreciate and sell it when they believe it has reached its peak.

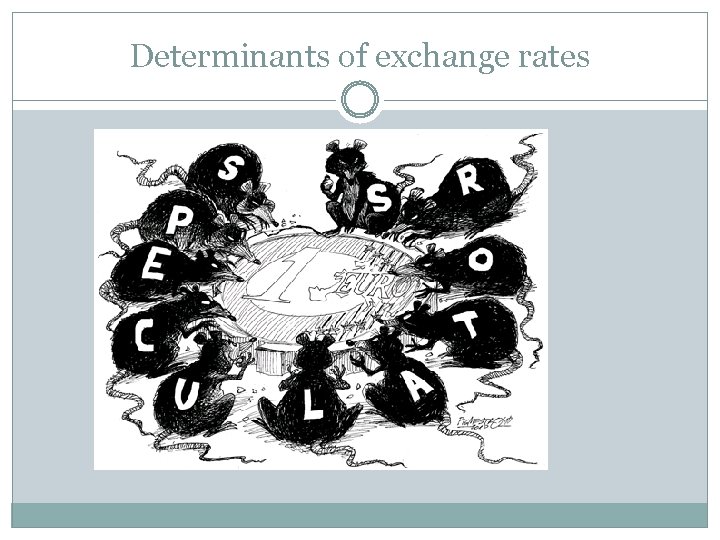

Determinants of exchange rates

Determinants of exchange rates

Determinants of exchange rates Speculators – self serving people who make short term profit at the expence of a country’s macroeconomic objectives. Speculators – they accelerate a process that would otherwise take longer and point out government stupidity. Example: 1992 ECU £ 1 = 2. 5 DM

Determinants of exchange rates Speculators – self serving people who make short term profit at the expence of a country’s macroeconomic objectives. Speculators – they accelerate a process that would otherwise take longer and point out government stupidity. Example: 1992 ECU £ 1 = 2. 5 DM

Related to specualtion…. . Capital Flight.

Related to specualtion…. . Capital Flight.

Determinants of exchange rates Inflation. If you have a high rate of inflation – it becomes less and less possible to sell your goods abroad and more likely that your citizens will buy imported goods.

Determinants of exchange rates Inflation. If you have a high rate of inflation – it becomes less and less possible to sell your goods abroad and more likely that your citizens will buy imported goods.

Determinants of exchange rates But, when that happens, the demand for your currency goes down and the demand for your neighbours’ currencies goes up.

Determinants of exchange rates But, when that happens, the demand for your currency goes down and the demand for your neighbours’ currencies goes up.

Purchasing Power Parity Theory of Exchange Rates So, we have a thing called the Purchasing Power Parity Theory of Exchange Rates This theory states that in the long run exchange rates (in a floating system) are determined by relative inflation rates in different countries.

Purchasing Power Parity Theory of Exchange Rates So, we have a thing called the Purchasing Power Parity Theory of Exchange Rates This theory states that in the long run exchange rates (in a floating system) are determined by relative inflation rates in different countries.

One U. S. Dollar (USD) is currently selling for ten Mexican Pesos (MXN).

One U. S. Dollar (USD) is currently selling for ten Mexican Pesos (MXN).

USA has been experiencing higher inflation than Mexico.

USA has been experiencing higher inflation than Mexico.

In the United States wooden baseball bats sell for $40 while in Mexico they sell for 150 pesos. Since 1 USD = 10 MXN, then the bat costs $40 USD if we buy it in the U. S. but only 15 USD if we buy it in Mexico. Clearly there's an advantage to buying the bat in Mexico, so consumers are much better off going to Mexico to buy their bats. If consumers decide to do this, we should expect to see three things happen:

In the United States wooden baseball bats sell for $40 while in Mexico they sell for 150 pesos. Since 1 USD = 10 MXN, then the bat costs $40 USD if we buy it in the U. S. but only 15 USD if we buy it in Mexico. Clearly there's an advantage to buying the bat in Mexico, so consumers are much better off going to Mexico to buy their bats. If consumers decide to do this, we should expect to see three things happen:

American consumers desire Mexico Pesos in order to buy baseball bats in Mexico.

American consumers desire Mexico Pesos in order to buy baseball bats in Mexico.

The demand for baseball bats sold in the United States decreases, so the price American retailers charge goes down.

The demand for baseball bats sold in the United States decreases, so the price American retailers charge goes down.

The demand for baseball bats sold in Mexico increases, so the price Mexican retailers charge goes up.

The demand for baseball bats sold in Mexico increases, so the price Mexican retailers charge goes up.

Eventually these three factors should cause the exchange rates and the prices in the two countries to change so that we have purchasing power parity. If the U. S. Dollar declines in value to 1 USD = 8 MXN, the price of baseball bats in the United States goes down to $30 each and the price of baseball bats in Mexico goes up to 240 pesos each, we will have purchasing power parity. This is because a consumer can spend $30 in the United States for a baseball bat, or he can take his $30, exchange it for 240 pesos (since 1 USD = 8 MXN) and buy a baseball bat in Mexico and be no better off.

Eventually these three factors should cause the exchange rates and the prices in the two countries to change so that we have purchasing power parity. If the U. S. Dollar declines in value to 1 USD = 8 MXN, the price of baseball bats in the United States goes down to $30 each and the price of baseball bats in Mexico goes up to 240 pesos each, we will have purchasing power parity. This is because a consumer can spend $30 in the United States for a baseball bat, or he can take his $30, exchange it for 240 pesos (since 1 USD = 8 MXN) and buy a baseball bat in Mexico and be no better off.

Assumptions

Assumptions

PPPTOER Assumptions 1. goods must be homogeneous 2. there must be no barriers to trade 3. there must be no transport costs 4. for some goods there is no international competition. Mexico does not and cannot compete for many decades with the USA in information technology and entertainment.

PPPTOER Assumptions 1. goods must be homogeneous 2. there must be no barriers to trade 3. there must be no transport costs 4. for some goods there is no international competition. Mexico does not and cannot compete for many decades with the USA in information technology and entertainment.

Show the effect on the Ghana Cedi (in relation to the dollar) following a boom in demand for cocoa – Ghana’s main export.

Show the effect on the Ghana Cedi (in relation to the dollar) following a boom in demand for cocoa – Ghana’s main export.

Show the effect on the Swiss franc in relation to the euro following the news that George Soros believes that the euro is 40% overvalued.

Show the effect on the Swiss franc in relation to the euro following the news that George Soros believes that the euro is 40% overvalued.