f0cbbd5721245055cede7a727de13db7.ppt

- Количество слайдов: 21

Foreign Direct Investment in Indian Real Estate Dynamics of the Real Estate Market Dun and Bradstreet Chennai March 2007 Ashwin Ramesh Primary Real Estate Advisors

Foreign Direct Investment in Indian Real Estate Dynamics of the Real Estate Market Dun and Bradstreet Chennai March 2007 Ashwin Ramesh Primary Real Estate Advisors

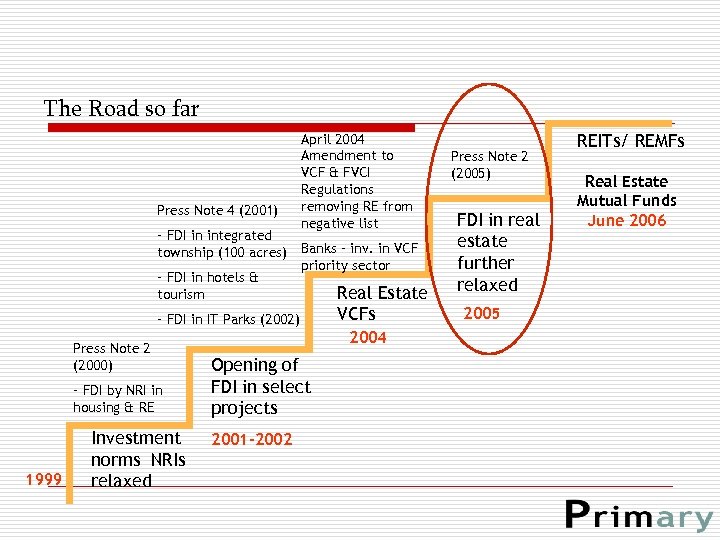

The Road so far Press Note 4 (2001) April 2004 Amendment to VCF & FVCI Regulations removing RE from negative list - FDI in integrated township (100 acres) Banks – inv. in VCF priority sector - FDI in hotels & Real Estate tourism - FDI in IT Parks (2002) Press Note 2 (2000) - FDI by NRI in housing & RE 1999 Investment norms NRIs relaxed VCFs 2004 Opening of FDI in select projects 2001 -2002 Press Note 2 (2005) FDI in real estate further relaxed 2005 REITs/ REMFs Real Estate Mutual Funds June 2006

The Road so far Press Note 4 (2001) April 2004 Amendment to VCF & FVCI Regulations removing RE from negative list - FDI in integrated township (100 acres) Banks – inv. in VCF priority sector - FDI in hotels & Real Estate tourism - FDI in IT Parks (2002) Press Note 2 (2000) - FDI by NRI in housing & RE 1999 Investment norms NRIs relaxed VCFs 2004 Opening of FDI in select projects 2001 -2002 Press Note 2 (2005) FDI in real estate further relaxed 2005 REITs/ REMFs Real Estate Mutual Funds June 2006

Regulatory framework - Press Note 2 (2005) FDI up to 100% is permitted under automatic route Development criteria: o o o Minimum 10 hectares / 25 acres to be developed for serviced housing plots For construction-development projects, minimum built-up area of 50, 000 sq mts In case of a combination project, any one of above two conditions would suffice

Regulatory framework - Press Note 2 (2005) FDI up to 100% is permitted under automatic route Development criteria: o o o Minimum 10 hectares / 25 acres to be developed for serviced housing plots For construction-development projects, minimum built-up area of 50, 000 sq mts In case of a combination project, any one of above two conditions would suffice

Investment conditions o o o Minimum capitalization of US$ 10 Mn for wholly owned subsidiaries & US$ 5 Mn for joint ventures with Indian partners Funds to be brought in within 6 months of commencement of business Original investment cannot be repatriated before a period of 3 years from completion of minimum capitalization. Investor may be permitted to exit earlier with prior Government approval.

Investment conditions o o o Minimum capitalization of US$ 10 Mn for wholly owned subsidiaries & US$ 5 Mn for joint ventures with Indian partners Funds to be brought in within 6 months of commencement of business Original investment cannot be repatriated before a period of 3 years from completion of minimum capitalization. Investor may be permitted to exit earlier with prior Government approval.

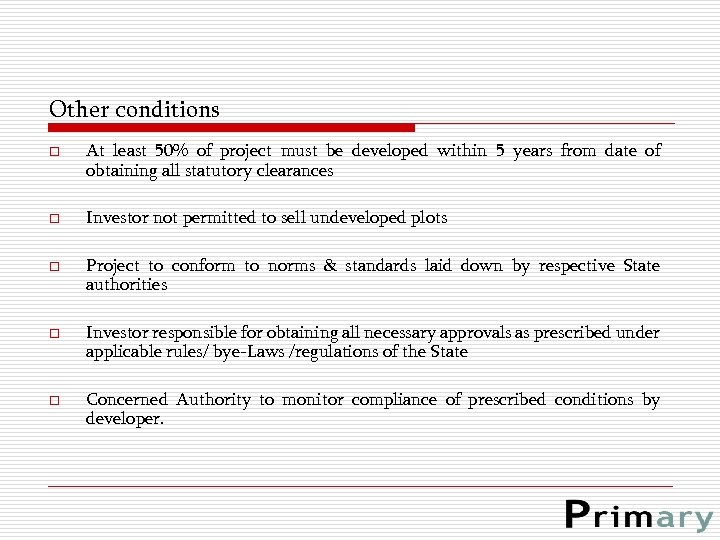

Other conditions o o o At least 50% of project must be developed within 5 years from date of obtaining all statutory clearances Investor not permitted to sell undeveloped plots Project to conform to norms & standards laid down by respective State authorities Investor responsible for obtaining all necessary approvals as prescribed under applicable rules/ bye-Laws /regulations of the State Concerned Authority to monitor compliance of prescribed conditions by developer.

Other conditions o o o At least 50% of project must be developed within 5 years from date of obtaining all statutory clearances Investor not permitted to sell undeveloped plots Project to conform to norms & standards laid down by respective State authorities Investor responsible for obtaining all necessary approvals as prescribed under applicable rules/ bye-Laws /regulations of the State Concerned Authority to monitor compliance of prescribed conditions by developer.

![Press Note 2 [2005] - Unresolved issues…. . o What sort of development is Press Note 2 [2005] - Unresolved issues…. . o What sort of development is](https://present5.com/presentation/f0cbbd5721245055cede7a727de13db7/image-6.jpg) Press Note 2 [2005] - Unresolved issues…. . o What sort of development is envisaged – Greenfield / Brownfield o Up to what stage in a project can a FDI investor participate? o What comprises ‘built-up area’? o Whether USD 5 Mn investment norm applies to each foreign investor in a joint venture (‘JV’) separately or to foreign investors for the JV company as a whole ? - If two foreign partners invest in Indian JV Company: minimum capitalization will be USD 5 million or USD 10 million ?

Press Note 2 [2005] - Unresolved issues…. . o What sort of development is envisaged – Greenfield / Brownfield o Up to what stage in a project can a FDI investor participate? o What comprises ‘built-up area’? o Whether USD 5 Mn investment norm applies to each foreign investor in a joint venture (‘JV’) separately or to foreign investors for the JV company as a whole ? - If two foreign partners invest in Indian JV Company: minimum capitalization will be USD 5 million or USD 10 million ?

![Press Note 2 [2005] - Unresolved issues o o Contd… Whether lock in applies Press Note 2 [2005] - Unresolved issues o o Contd… Whether lock in applies](https://present5.com/presentation/f0cbbd5721245055cede7a727de13db7/image-7.jpg) Press Note 2 [2005] - Unresolved issues o o Contd… Whether lock in applies only to minimum capitalization or entire original investment? When does the 6 -month period for capitalization commence with respect to projects undertaken by existing companies and how is the lock in period determined? – Incorporation Date - January 1, 2006 – Signing of the JV agreement - April 1, 2006 – Minimum capitalization to be completed by what date?

Press Note 2 [2005] - Unresolved issues o o Contd… Whether lock in applies only to minimum capitalization or entire original investment? When does the 6 -month period for capitalization commence with respect to projects undertaken by existing companies and how is the lock in period determined? – Incorporation Date - January 1, 2006 – Signing of the JV agreement - April 1, 2006 – Minimum capitalization to be completed by what date?

![Press Note 2 [2005] - Unresolved issues Contd… – Assuming minimum capitalization completed June Press Note 2 [2005] - Unresolved issues Contd… – Assuming minimum capitalization completed June](https://present5.com/presentation/f0cbbd5721245055cede7a727de13db7/image-8.jpg) Press Note 2 [2005] - Unresolved issues Contd… – Assuming minimum capitalization completed June 1, 2006 – 1 st tranche of USD 10 million brought in June 1, 2006 – 2 nd tranche of USD 100 million brought in January 1, 2007 – Lock in period on what amount and for what period ? o Whether premium on issue of shares part of minimum capitalization? o Whether fully convertible debentures can be considered for the purpose of minimum capitalization?

Press Note 2 [2005] - Unresolved issues Contd… – Assuming minimum capitalization completed June 1, 2006 – 1 st tranche of USD 10 million brought in June 1, 2006 – 2 nd tranche of USD 100 million brought in January 1, 2007 – Lock in period on what amount and for what period ? o Whether premium on issue of shares part of minimum capitalization? o Whether fully convertible debentures can be considered for the purpose of minimum capitalization?

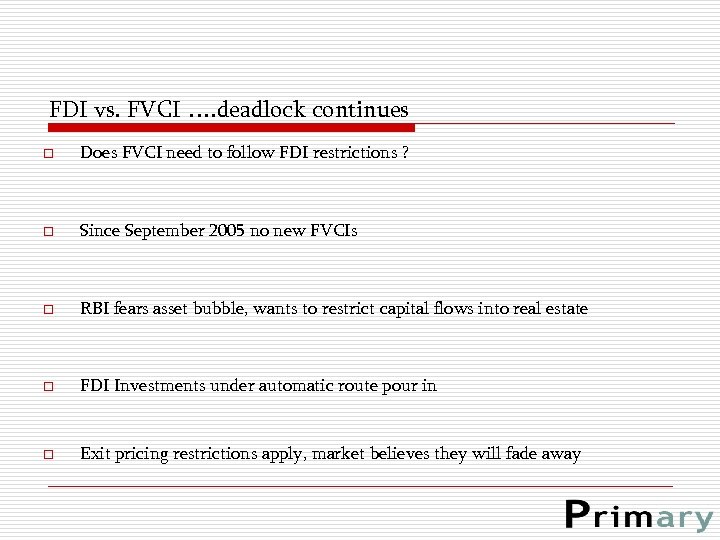

FDI vs. FVCI …. deadlock continues o Does FVCI need to follow FDI restrictions ? o Since September 2005 no new FVCIs o RBI fears asset bubble, wants to restrict capital flows into real estate o FDI Investments under automatic route pour in o Exit pricing restrictions apply, market believes they will fade away

FDI vs. FVCI …. deadlock continues o Does FVCI need to follow FDI restrictions ? o Since September 2005 no new FVCIs o RBI fears asset bubble, wants to restrict capital flows into real estate o FDI Investments under automatic route pour in o Exit pricing restrictions apply, market believes they will fade away

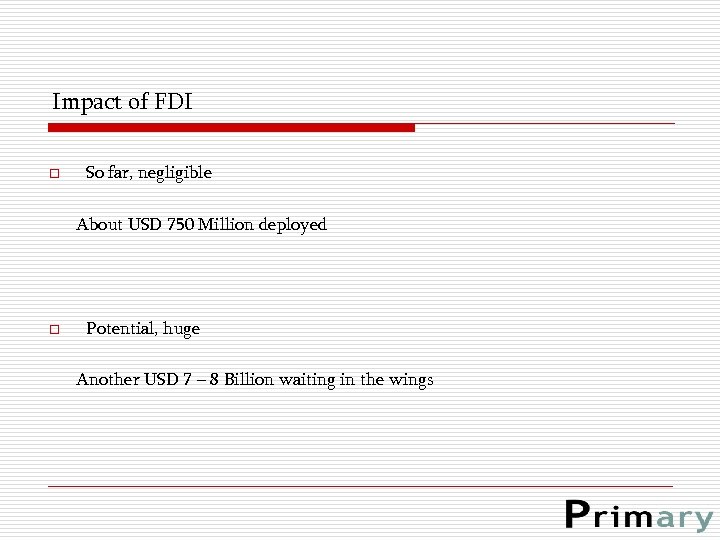

Impact of FDI o So far, negligible About USD 750 Million deployed o Potential, huge Another USD 7 – 8 Billion waiting in the wings

Impact of FDI o So far, negligible About USD 750 Million deployed o Potential, huge Another USD 7 – 8 Billion waiting in the wings

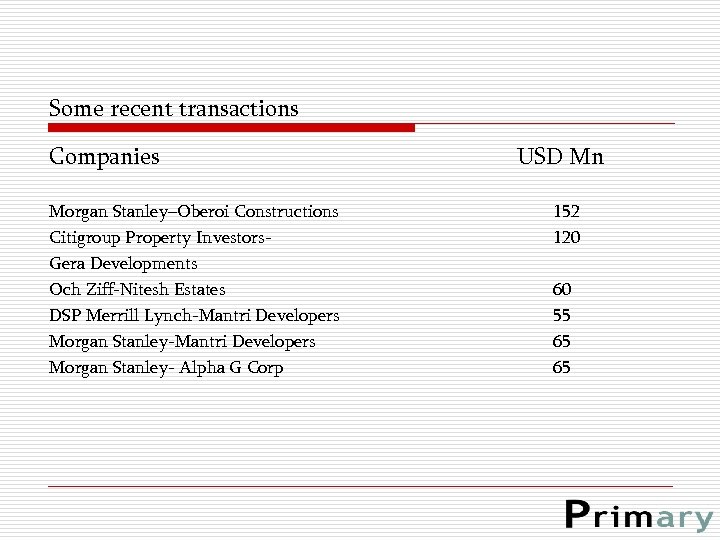

Some recent transactions Companies Morgan Stanley–Oberoi Constructions Citigroup Property Investors. Gera Developments Och Ziff-Nitesh Estates DSP Merrill Lynch-Mantri Developers Morgan Stanley- Alpha G Corp USD Mn 152 120 60 55 65 65

Some recent transactions Companies Morgan Stanley–Oberoi Constructions Citigroup Property Investors. Gera Developments Och Ziff-Nitesh Estates DSP Merrill Lynch-Mantri Developers Morgan Stanley- Alpha G Corp USD Mn 152 120 60 55 65 65

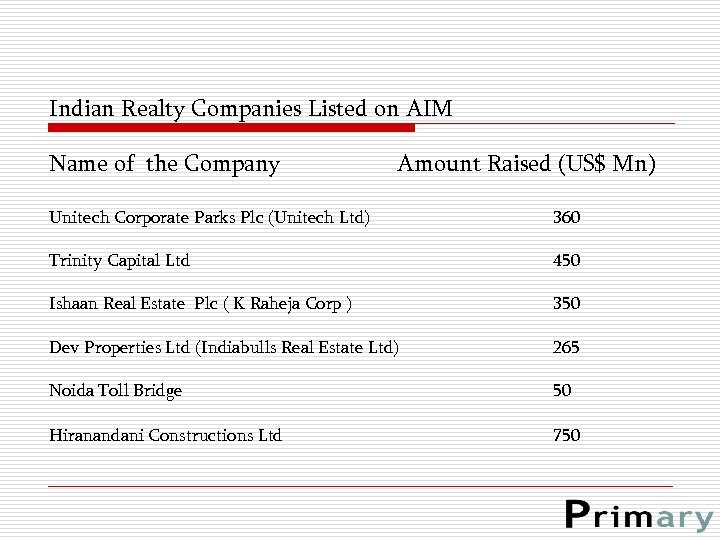

Indian Realty Companies Listed on AIM Name of the Company Amount Raised (US$ Mn) Unitech Corporate Parks Plc (Unitech Ltd) 360 Trinity Capital Ltd 450 Ishaan Real Estate Plc ( K Raheja Corp ) 350 Dev Properties Ltd (Indiabulls Real Estate Ltd) 265 Noida Toll Bridge 50 Hiranandani Constructions Ltd 750

Indian Realty Companies Listed on AIM Name of the Company Amount Raised (US$ Mn) Unitech Corporate Parks Plc (Unitech Ltd) 360 Trinity Capital Ltd 450 Ishaan Real Estate Plc ( K Raheja Corp ) 350 Dev Properties Ltd (Indiabulls Real Estate Ltd) 265 Noida Toll Bridge 50 Hiranandani Constructions Ltd 750

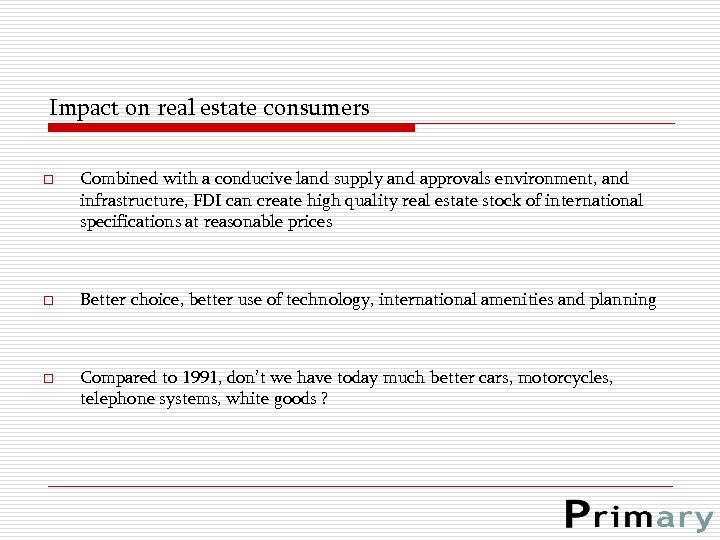

Impact on real estate consumers o o o Combined with a conducive land supply and approvals environment, and infrastructure, FDI can create high quality real estate stock of international specifications at reasonable prices Better choice, better use of technology, international amenities and planning Compared to 1991, don’t we have today much better cars, motorcycles, telephone systems, white goods ?

Impact on real estate consumers o o o Combined with a conducive land supply and approvals environment, and infrastructure, FDI can create high quality real estate stock of international specifications at reasonable prices Better choice, better use of technology, international amenities and planning Compared to 1991, don’t we have today much better cars, motorcycles, telephone systems, white goods ?

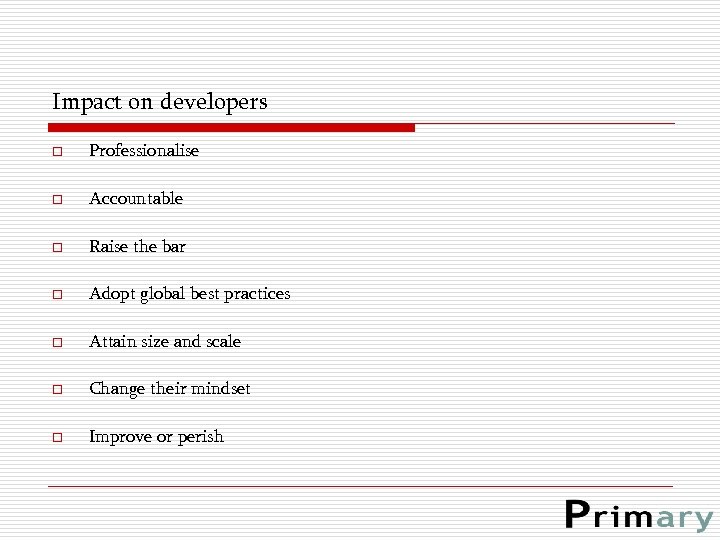

Impact on developers o Professionalise o Accountable o Raise the bar o Adopt global best practices o Attain size and scale o Change their mindset o Improve or perish

Impact on developers o Professionalise o Accountable o Raise the bar o Adopt global best practices o Attain size and scale o Change their mindset o Improve or perish

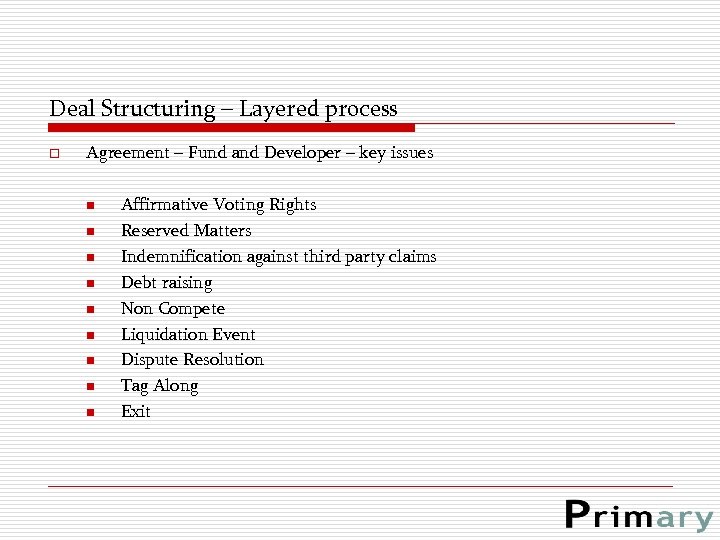

Deal Structuring – Layered process o Agreement – Fund and Developer – key issues n n n n n Affirmative Voting Rights Reserved Matters Indemnification against third party claims Debt raising Non Compete Liquidation Event Dispute Resolution Tag Along Exit

Deal Structuring – Layered process o Agreement – Fund and Developer – key issues n n n n n Affirmative Voting Rights Reserved Matters Indemnification against third party claims Debt raising Non Compete Liquidation Event Dispute Resolution Tag Along Exit

Impact on the industry o Consolidation o Standardisation of product o Tighten and improve supply chain o Convergence of capital markets o Increased participation by the finance community – sophisticated structuring, instruments, retail investor o Environment friendly o Westernised

Impact on the industry o Consolidation o Standardisation of product o Tighten and improve supply chain o Convergence of capital markets o Increased participation by the finance community – sophisticated structuring, instruments, retail investor o Environment friendly o Westernised

First, the roadblocks need to be cleared o Land supply laws o Land Zoning and Approvals Process o Infrastructure – hard and soft o Stable policy that is forward looking

First, the roadblocks need to be cleared o Land supply laws o Land Zoning and Approvals Process o Infrastructure – hard and soft o Stable policy that is forward looking

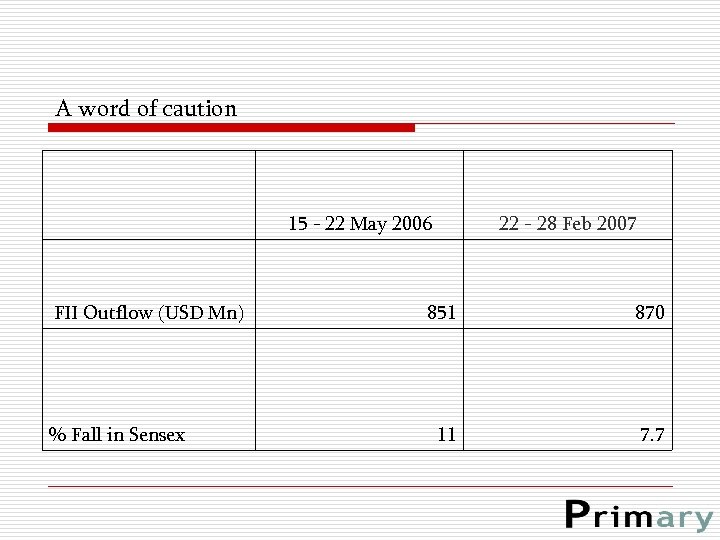

A word of caution FII Outflow (USD Mn) % Fall in Sensex 15 - 22 May 2006 22 - 28 Feb 2007 851 870 11 7. 7

A word of caution FII Outflow (USD Mn) % Fall in Sensex 15 - 22 May 2006 22 - 28 Feb 2007 851 870 11 7. 7

Thank You

Thank You

Contact details If you would like any further information or clarifications, please contact: Name Ashwin Ramesh E-mail Ashwin@Primary. India. com Tel No. 91 -22 -2285 3032 91 -98210 40267 Address: Primary Real Estate Advisors P Ltd Regent Chambers, #107, Nariman Point, Mumbai – 400 021 India Website: www. Primary. India. com

Contact details If you would like any further information or clarifications, please contact: Name Ashwin Ramesh E-mail Ashwin@Primary. India. com Tel No. 91 -22 -2285 3032 91 -98210 40267 Address: Primary Real Estate Advisors P Ltd Regent Chambers, #107, Nariman Point, Mumbai – 400 021 India Website: www. Primary. India. com

Disclaimer - Terms of Use The information contained in this presentation is of a generic nature and is not intended to address the circumstances of any particular situation/person o. We acknowledge that this presentation is merely an overview and has been prepared by us for your benefit and should not be construed as a legal opinion. o. The content provided here treats the subject and issues covered herein in generic form and is purely for academic purposes only o. This presentation does not constitute a public/private offer to sell or a solicitation of an offer to buy the units of the funds described herein. The details of the funds are for example purposes only o. We are relying upon relevant provisions of the laws, and the regulations thereunder, guidelines and the administrative interpretations thereof, which are subject to change or modification by subsequent legislative, regulatory, administrative, or judicial decisions. o. This presentation should not reproduced or distributed or provided to others without the prior consent of Primary Real Estate Advisors Private Limited.

Disclaimer - Terms of Use The information contained in this presentation is of a generic nature and is not intended to address the circumstances of any particular situation/person o. We acknowledge that this presentation is merely an overview and has been prepared by us for your benefit and should not be construed as a legal opinion. o. The content provided here treats the subject and issues covered herein in generic form and is purely for academic purposes only o. This presentation does not constitute a public/private offer to sell or a solicitation of an offer to buy the units of the funds described herein. The details of the funds are for example purposes only o. We are relying upon relevant provisions of the laws, and the regulations thereunder, guidelines and the administrative interpretations thereof, which are subject to change or modification by subsequent legislative, regulatory, administrative, or judicial decisions. o. This presentation should not reproduced or distributed or provided to others without the prior consent of Primary Real Estate Advisors Private Limited.