f84e1c8d88f081e6b2f804ae213c6c05.ppt

- Количество слайдов: 39

Foreign Direct Investment Georg Andersson Balance of Payments and Financial Market Statistics unit Statistic Sweden

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

Definition of FDI Foreign direct investment reflects the objective of establishing a lasting interest by a resident enterprise in one economy (direct investor) in an enterprise (direct investment enterprise) that is resident in an economy other than that of the direct investor. The direct or indirect ownership of 10% or more of the voting power of an enterprise resident in one economy by an investor resident in another economy is evidence of such a relationship. OECD Benchmark definition 4 th ed

Sources and estimations of FDI data - overview • Annual FDI survey – stocks and income • Monthly reporting – transactions • Trade credits within FDI relationships (quarterly survey) • Estimations • • Reinvested earnings Stocks Holiday homes Market valuation of FDI

Annual FDI survey • Is the source for the foreign direct investment stock in the IIP – also the basis for our stock estimations for periods where no survey data is yet available. • Provides data on foreign direct investment income – also the basis for our estimations of direct investment income for periods where no survey data is yet available. • Source for information about FDI-transactions that should be recorded in direct investments in the financial account. • Identifies companies with large FDI loan positions – that may become reporters of transactions for the financial account on a monthly basis.

Annual FDI survey • Sample survey • Clusters (groups) of legal entities (companies) are used as sample objects • The legal entity is used as the observation object. Within groups of companies, one or more legal entity is observed, depending on the ownership structure within the group

Annual FDI survey • Questionnaries according to the directional principle • Foreign direct investment in Sweden Assets ”OFBV” (Own Funds at Book Value): = Equity in the Swedish direct investment enterprise - claims on the direct investor (and fellow companies) + liabilities to the direct investor (and fellow companies) Income according to ”COPC” (Current Operating Performance Concept): Earnings after net financial items adjusted for capital gains and losses, impairments, reversal of impairments and tax.

Annual FDI survey • Questionnaries according to the directional principle • Swedish direct investment abroad Assets ”OFBV” (Own Funds at Book Value): = Equity in the foreign direct investment enterprise + claims on the foreign direct investment enterprise (and fellow companies) - liabilities to the foreign direct investment enterprise (and fellow companies) Income according to ”COPC” (Current Operating Performance Concept): Earnings after net financial items adjusted for capital gains and losses, impairments, reversal of impairments and tax.

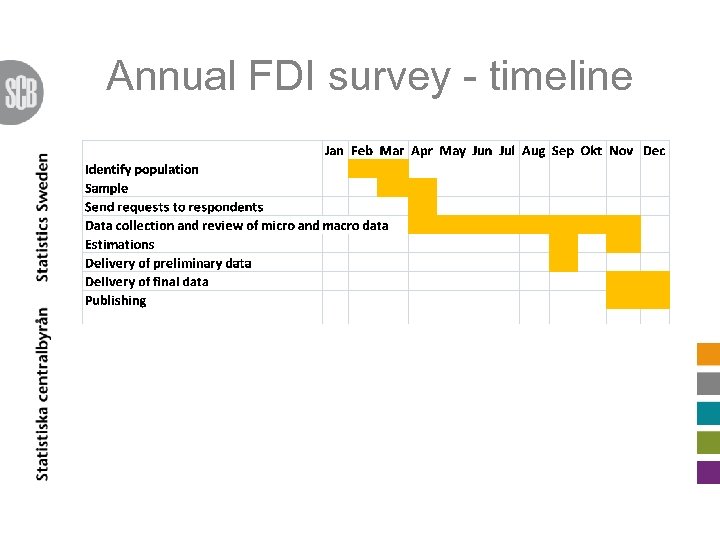

Annual FDI survey - timeline

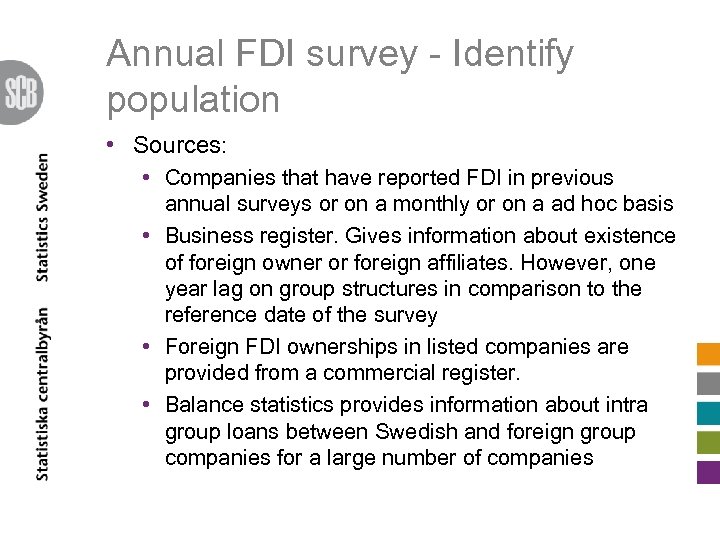

Annual FDI survey - Identify population • Sources: • Companies that have reported FDI in previous annual surveys or on a monthly or on a ad hoc basis • Business register. Gives information about existence of foreign owner or foreign affiliates. However, one year lag on group structures in comparison to the reference date of the survey • Foreign FDI ownerships in listed companies are provided from a commercial register. • Balance statistics provides information about intra group loans between Swedish and foreign group companies for a large number of companies

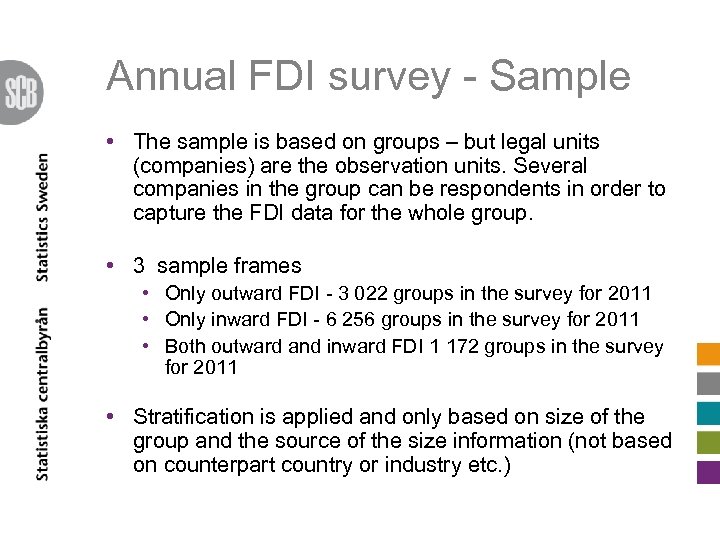

Annual FDI survey - Sample • The sample is based on groups – but legal units (companies) are the observation units. Several companies in the group can be respondents in order to capture the FDI data for the whole group. • 3 sample frames • Only outward FDI - 3 022 groups in the survey for 2011 • Only inward FDI - 6 256 groups in the survey for 2011 • Both outward and inward FDI 1 172 groups in the survey for 2011 • Stratification is applied and only based on size of the group and the source of the size information (not based on counterpart country or industry etc. )

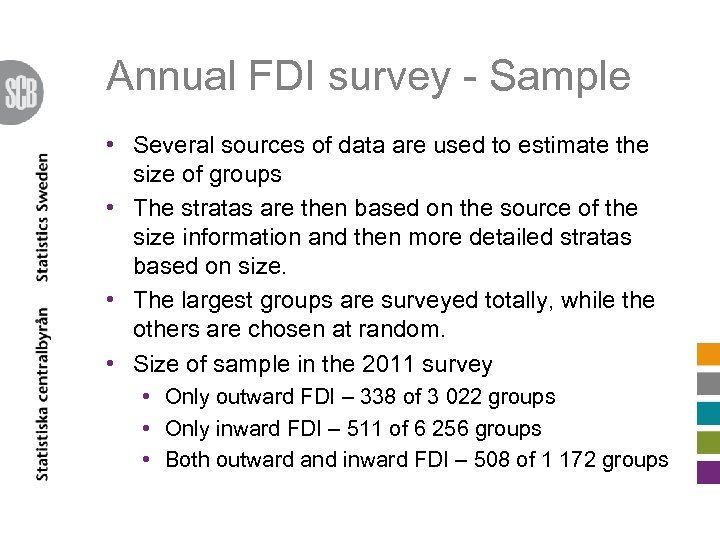

Annual FDI survey - Sample • Several sources of data are used to estimate the size of groups • The stratas are then based on the source of the size information and then more detailed stratas based on size. • The largest groups are surveyed totally, while the others are chosen at random. • Size of sample in the 2011 survey • Only outward FDI – 338 of 3 022 groups • Only inward FDI – 511 of 6 256 groups • Both outward and inward FDI – 508 of 1 172 groups

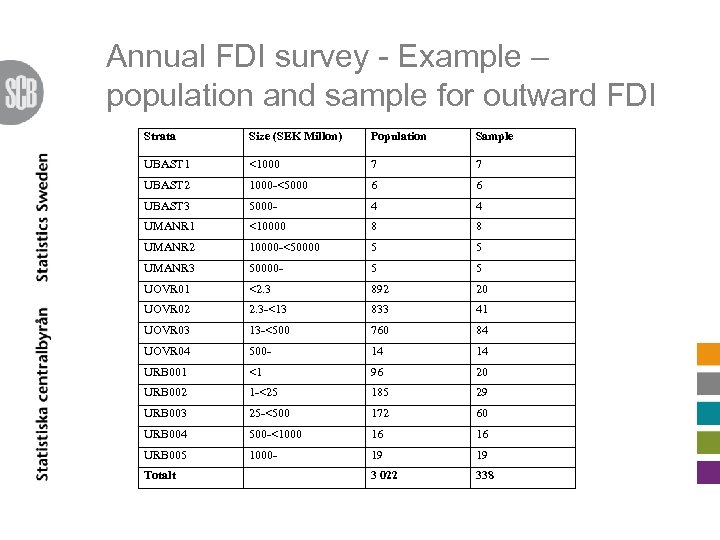

Annual FDI survey - Example – population and sample for outward FDI Strata Size (SEK Millon) Population Sample UBAST 1 <1000 7 7 UBAST 2 1000 -<5000 6 6 UBAST 3 5000 - 4 4 UMANR 1 <10000 8 8 UMANR 2 10000 -<50000 5 5 UMANR 3 50000 - 5 5 UOVR 01 <2. 3 892 20 UOVR 02 2. 3 -<13 833 41 UOVR 03 13 -<500 760 84 UOVR 04 500 - 14 14 URB 001 <1 96 20 URB 002 1 -<25 185 29 URB 003 25 -<500 172 60 URB 004 500 -<1000 16 16 URB 005 1000 - 19 19 3 022 338 Totalt

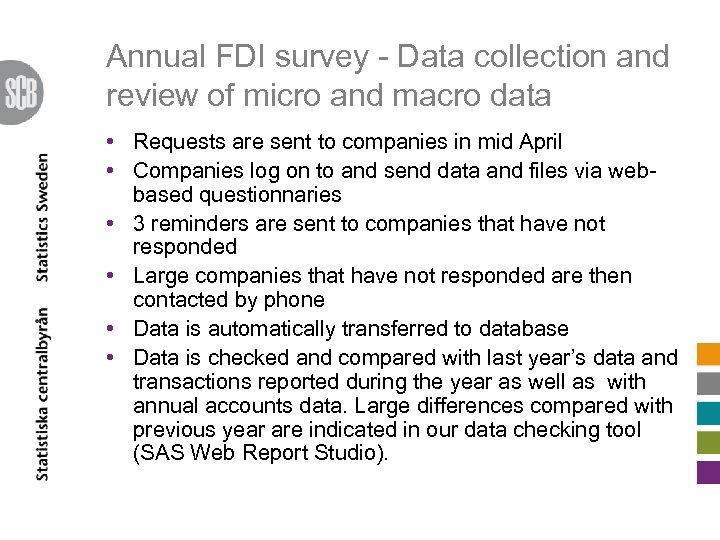

Annual FDI survey - Data collection and review of micro and macro data • Requests are sent to companies in mid April • Companies log on to and send data and files via webbased questionnaries • 3 reminders are sent to companies that have not responded • Large companies that have not responded are then contacted by phone • Data is automatically transferred to database • Data is checked and compared with last year’s data and transactions reported during the year as well as with annual accounts data. Large differences compared with previous year are indicated in our data checking tool (SAS Web Report Studio).

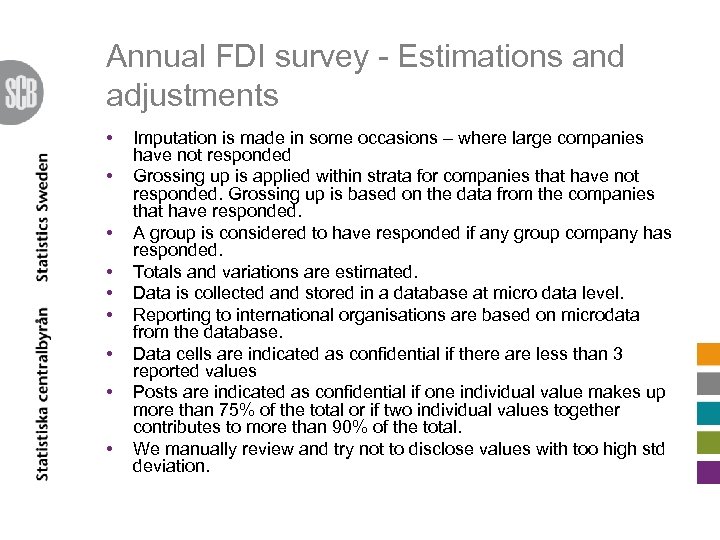

Annual FDI survey - Estimations and adjustments • • • Imputation is made in some occasions – where large companies have not responded Grossing up is applied within strata for companies that have not responded. Grossing up is based on the data from the companies that have responded. A group is considered to have responded if any group company has responded. Totals and variations are estimated. Data is collected and stored in a database at micro data level. Reporting to international organisations are based on microdata from the database. Data cells are indicated as confidential if there are less than 3 reported values Posts are indicated as confidential if one individual value makes up more than 75% of the total or if two individual values together contributes to more than 90% of the total. We manually review and try not to disclose values with too high std deviation.

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

Monthly survey • Monthly reporters report within 15 days after end of reference period. Report: • Equity transactions (for financial account) • Loan transactions (for financial account) • Dividends (for investment income in the current account) • Interests on direct investment loans (for investment income in the current account) • Dividends from companies that are not monthly reporters come from the annual direct investment survey (but then with a considerable delay)

Monthly survey (cont. ) • Loans • Outward FDI – 110 companies • Inward FDI – 140 companies • This covers around 80% of the total FDI loan stock • Equity • Monthly reporters report their FDI transactions • Other transactions are taken in on ad hoc basis based on transactions we find in news articles, press releases from companies, law firms, private equity firms etc.

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

Estimations • Reinvested earnings • A forecast is made for direct investment income for the recent periods where outcome from the annual survey is not yet available. The forecast is based on the latest outcome from the annual direct investment survey taking into account the latest development in income for listed companies • Dividends are deducted from the forecasted income to arrive at reinvested earnings • Reinvested earnings is distributed on a country basis for international reporting. The basis for the distribution is the outcome of income from the annual direct investment survey • Holiday homes • An estimation is made for Swedish holiday homes abroad and foreign owned holiday homes in Sweden.

Estimations (cont. ) • Stocks are estimated for the recent periods where outcome from the annual survey is not yet available • Basis is the latest outcome from the direct investment survey • Adjustment is made for transactions • Adjustment is made for exchange rate fluctuations • Market valuation of FDI is made annually (for FDI totals, not company by company) • Based on earnings and uses p/e ratio to estimate market value

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

Intra group trade credits • Trade Credits – collected on a quarterly basis in the trade credits survey.

Data delivery and publishing • Annual sending of preliminary FDI stock data to the IMF, OECD and Eurostat by September 30 th (T+9) • Results from the annual direct investment survey with FDI stocks by country and economic activity are published annually on Statistics Swedens website www. scb. se (in December) • FDI transactions are published in the quarterly Bo. P • FDI transactions by country and economic activity are published quarterly

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

Swedish direct investment assets abroad 2001 to 2010 SEK billions and percent Note: Net claims are defined as financial claims (current and long-term) on foreign owner groups minus the corresponding liabilities

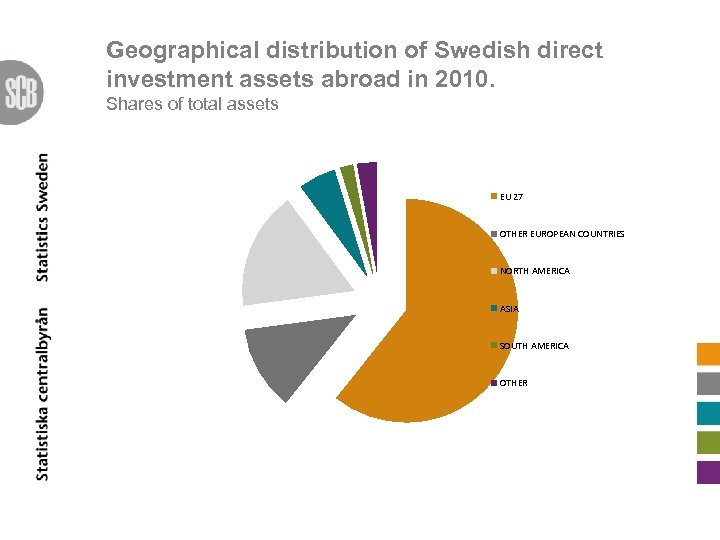

Geographical distribution of Swedish direct investment assets abroad in 2010. Shares of total assets EU 27 OTHER EUROPEAN COUNTRIES NORTH AMERICA ASIA SOUTH AMERICA OTHER

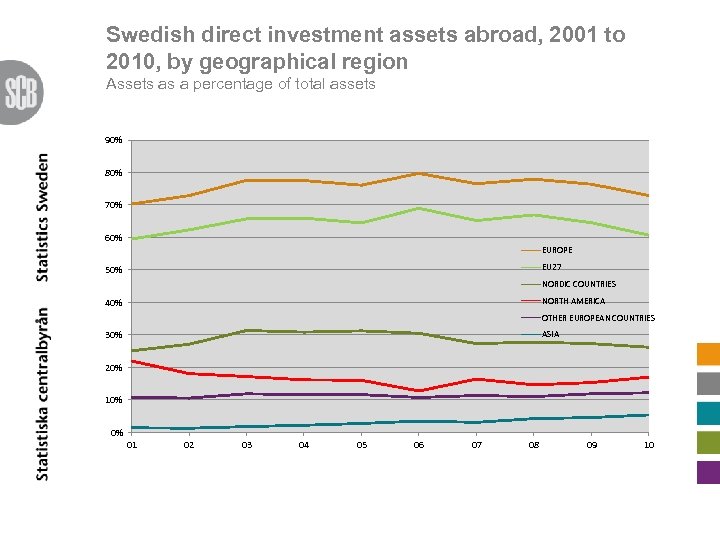

Swedish direct investment assets abroad, 2001 to 2010, by geographical region Assets as a percentage of total assets 90% 80% 70% 60% EUROPE EU 27 50% NORDIC COUNTRIES NORTH AMERICA 40% OTHER EUROPEAN COUNTRIES 30% ASIA 20% 10% 0% 01 02 03 04 05 06 07 08 09 10

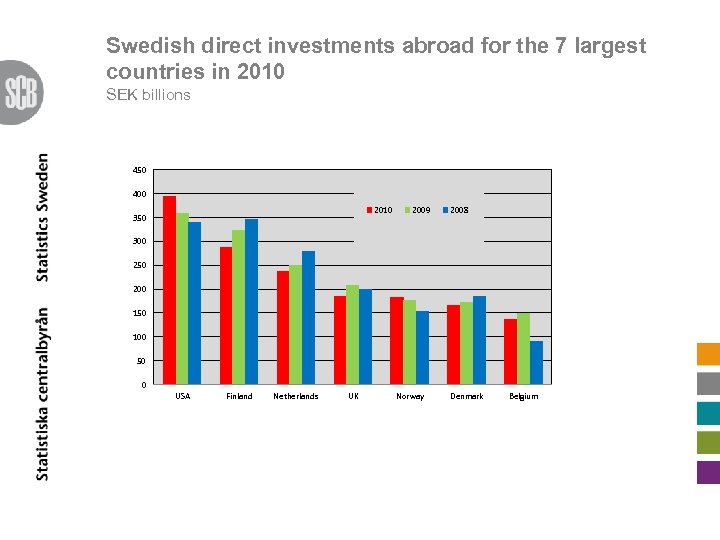

Swedish direct investments abroad for the 7 largest countries in 2010 SEK billions 450 400 2010 350 2009 2008 300 250 200 150 100 50 0 USA Finland Netherlands UK Norway Denmark Belgium

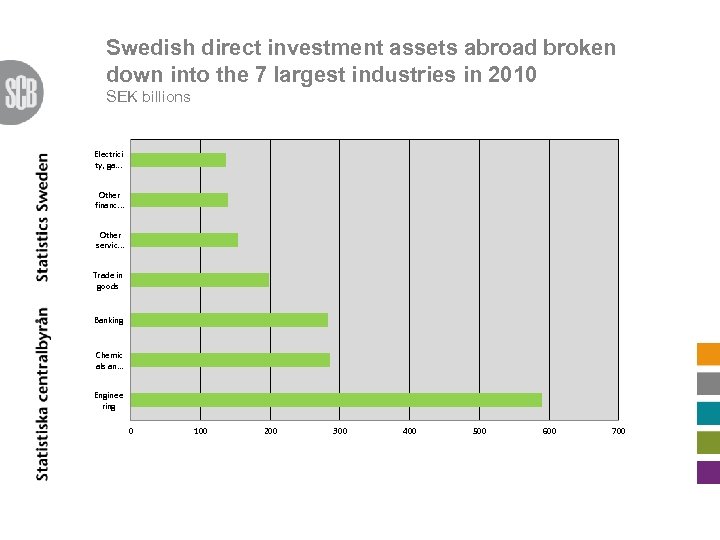

Swedish direct investment assets abroad broken down into the 7 largest industries in 2010 SEK billions Electrici ty, ga. . . Other financ. . . Other servic. . . Trade in goods Banking Chemic als an. . . Enginee ring 0 100 200 300 400 500 600 700

Foreign direct investments in Sweden 2001 to 2010 SEK billions and percent Net liability is defined as financial liabilities (current and long-term) to foreign owner groups minus the corresponding claims.

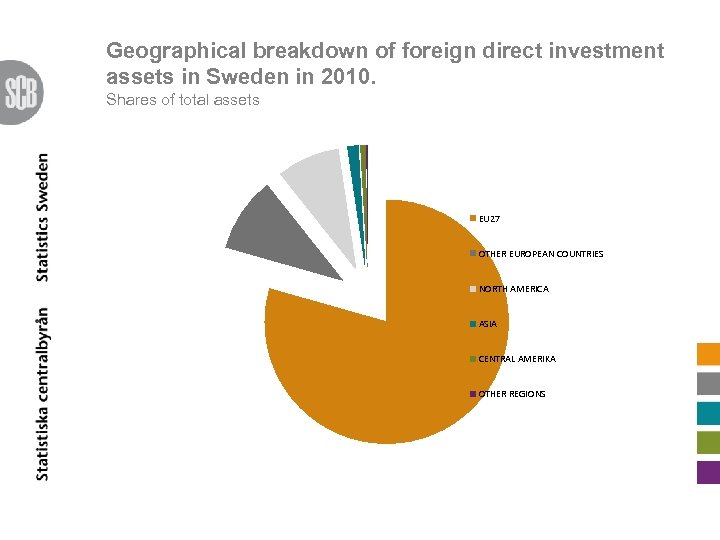

Geographical breakdown of foreign direct investment assets in Sweden in 2010. Shares of total assets EU 27 OTHER EUROPEAN COUNTRIES NORTH AMERICA ASIA CENTRAL AMERIKA OTHER REGIONS

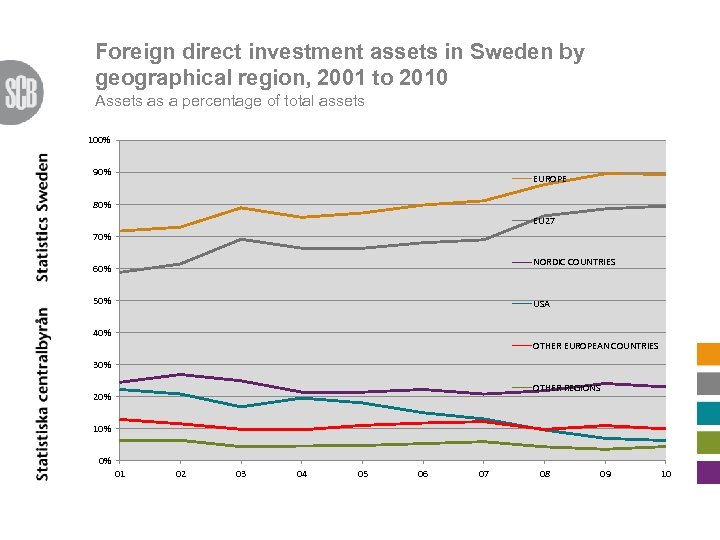

Foreign direct investment assets in Sweden by geographical region, 2001 to 2010 Assets as a percentage of total assets 100% 90% EUROPE 80% EU 27 70% NORDIC COUNTRIES 60% 50% USA 40% OTHER EUROPEAN COUNTRIES 30% OTHER REGIONS 20% 10% 0% 01 02 03 04 05 06 07 08 09 10

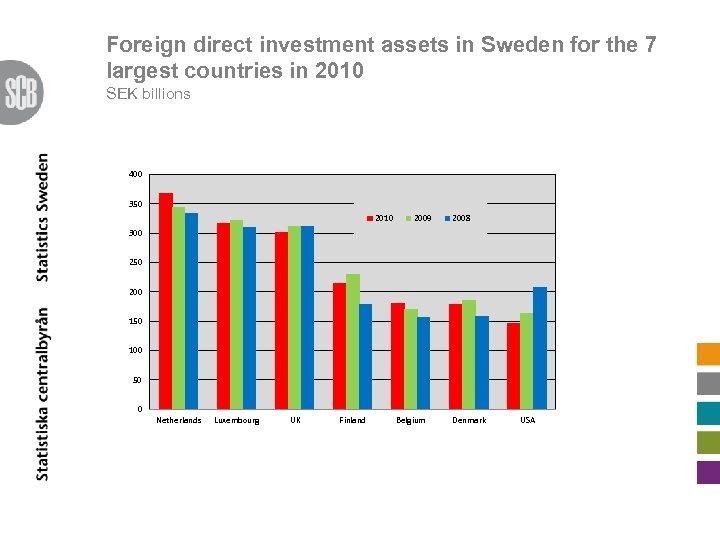

Foreign direct investment assets in Sweden for the 7 largest countries in 2010 SEK billions 400 350 2010 2009 2008 300 250 200 150 100 50 0 Netherlands Luxembourg UK Finland Belgium Denmark USA

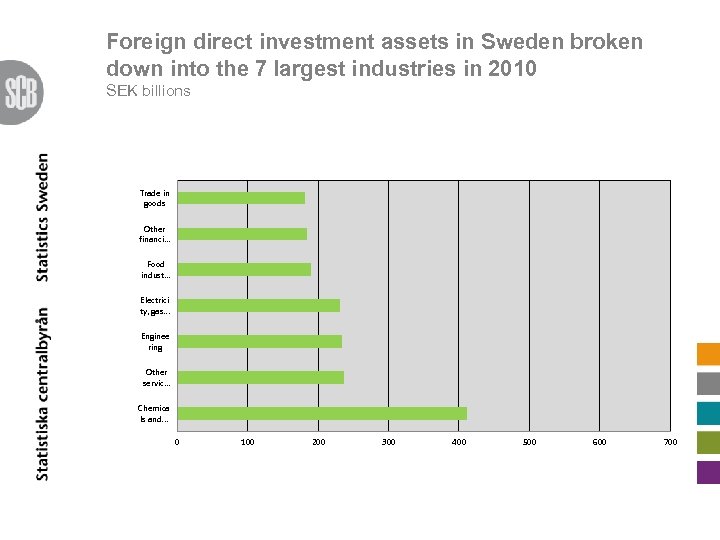

Foreign direct investment assets in Sweden broken down into the 7 largest industries in 2010 SEK billions Trade in goods Other financi. . . Food indust. . . Electrici ty, gas. . . Enginee ring Other servic. . . Chemica ls and. . . 0 100 200 300 400 500 600 700

Outline • • • Overview of sources and estimations Annual FDI survey Monthly survey Estimations Intra group trade credits Data delivery and publishing (Swedish FDI stock data results) FDI Network Future

FDI Network • We participate actively in the FDI Network run by Eurostat and ECB. We exchange large transactions with EU countries with the aim to improve bilateral consistency. • Recently we exchanged positions as well. This has improved the bilateral consistency but has also revealed discrepancies due to the fact that different countries apply different valuation methods.

Future • We follow the manuals from IMF and from OECD and are currently working on the implementation of IMF’s BPM 6 and OECD’s Benchmark Definition 4 • Currently implementing new questionnaries to enable collection and reporting of data in accordance with the extended directional principle advocated by BPM 6. • Going to identify SPEs. • Currently apply PMM (participation multiplication method) for identifying FDI relations – with the implementation of the new manual we will instead apply FDIR (Framework for Direct Investment Relationship).

Thank you! www. scb. se Finding statistics / Statistics by subject area / Financial markets / Balance of Payments (Bo. P)

f84e1c8d88f081e6b2f804ae213c6c05.ppt