3d79d40d835c91d89eedd1deb78426d8.ppt

- Количество слайдов: 22

Foreign Currency Markets Module 1 FX MKTS M 1

Foreign Currency Markets Module 1 FX MKTS M 1

Meaning of FX Rate • FX rate – FX rate between two currencies specifies how much one currency is worth in terms of another currency. – Exchange rate between two currencies are quoted and can be viewed on sites like Bloomberg and Reuters. – For eg. , USD/JPY = 120 • 1 unit of USD is worth 120 units of Japanese Yen FX MKTS M 1

Meaning of FX Rate • FX rate – FX rate between two currencies specifies how much one currency is worth in terms of another currency. – Exchange rate between two currencies are quoted and can be viewed on sites like Bloomberg and Reuters. – For eg. , USD/JPY = 120 • 1 unit of USD is worth 120 units of Japanese Yen FX MKTS M 1

Meaning of FX Rate • Quote (USD/JPY = 120) – Quote Currency • In the above example the price of 1 USD is expressed in terms of Japanese Yen, here Yen is called the Quote Currency or Price Currency. – Base Currency • Since the exchange rate gives the price of one unit of USD, USD is called the base currency. – In general in a currency pair the left hand currency is the base currency and the right hand currency is the quote currency. FX MKTS M 1

Meaning of FX Rate • Quote (USD/JPY = 120) – Quote Currency • In the above example the price of 1 USD is expressed in terms of Japanese Yen, here Yen is called the Quote Currency or Price Currency. – Base Currency • Since the exchange rate gives the price of one unit of USD, USD is called the base currency. – In general in a currency pair the left hand currency is the base currency and the right hand currency is the quote currency. FX MKTS M 1

Meaning of FX Rate • Quote – Direct Quote • Quote for a currency pair where the base currency is USD is called direct quote. • All currencies except GBP, AUD, NZD and EUR are quoted in terms of direct quote. – Indirect Quote • The exchange rate between GBP and USD is expressed as GBP/USD = 2. 0200. • Here the quote currency is USD. • Indirect quotes are given for GBP, AUD, NZD and EUR FX MKTS M 1

Meaning of FX Rate • Quote – Direct Quote • Quote for a currency pair where the base currency is USD is called direct quote. • All currencies except GBP, AUD, NZD and EUR are quoted in terms of direct quote. – Indirect Quote • The exchange rate between GBP and USD is expressed as GBP/USD = 2. 0200. • Here the quote currency is USD. • Indirect quotes are given for GBP, AUD, NZD and EUR FX MKTS M 1

Meaning of FX Rate • Foreign and Domestic Currency – In USD/JPY, USD is the foreign currency – In USD/JPY, JPY is the home currency • Buy USD/JPY – This means that the trader is buying USD by selling JPY. Or the trader is buying USD by paying in JPY. • Sell USD/JPY – Trader sells USD and buys JPY. • In general buy or sell a currency pair means buying or selling the base currency against the quote currency. FX MKTS M 1

Meaning of FX Rate • Foreign and Domestic Currency – In USD/JPY, USD is the foreign currency – In USD/JPY, JPY is the home currency • Buy USD/JPY – This means that the trader is buying USD by selling JPY. Or the trader is buying USD by paying in JPY. • Sell USD/JPY – Trader sells USD and buys JPY. • In general buy or sell a currency pair means buying or selling the base currency against the quote currency. FX MKTS M 1

Meaning of FX Rate • Bid Ask Spread – Market makers always quote two way exchange rate. – For eg. USD/INR = 40. 45/46 – The left hand price is always lower than the right hand price. – The lower price is the bid price ( left hand) and the higher price is the ask or offer price. – Bid is the price at which market makers are ready to buy a currency pair, in other words a seller can sell USD/INR to market maker at 40. 45. FX MKTS M 1

Meaning of FX Rate • Bid Ask Spread – Market makers always quote two way exchange rate. – For eg. USD/INR = 40. 45/46 – The left hand price is always lower than the right hand price. – The lower price is the bid price ( left hand) and the higher price is the ask or offer price. – Bid is the price at which market makers are ready to buy a currency pair, in other words a seller can sell USD/INR to market maker at 40. 45. FX MKTS M 1

Meaning of FX Rate • Bid Ask Spread (USD/INR = 40. 45/46) – Ask or Offer price is the price at which a market maker is ready to sell a currency pair or in other words a buyer can buy a currency pair from the market maker. – In the above example a buyer can buy USD by paying INR 40. 46 to the market maker. • Spread – The difference between the ask and bid price is called spread. Here the spread is 1 paise ( or 1/100 of INR 1). FX MKTS M 1

Meaning of FX Rate • Bid Ask Spread (USD/INR = 40. 45/46) – Ask or Offer price is the price at which a market maker is ready to sell a currency pair or in other words a buyer can buy a currency pair from the market maker. – In the above example a buyer can buy USD by paying INR 40. 46 to the market maker. • Spread – The difference between the ask and bid price is called spread. Here the spread is 1 paise ( or 1/100 of INR 1). FX MKTS M 1

Fluctuations in FX Rate • During the market hours the exchange rate for currency pairs frequently change. • The smallest amount by which the rate of a currency pair can change is called ‘PIPS’. • For eg. GBP/USD = 2. 0201/2. 0202 – Here the smallest amount by which the rate change is 0. 0001 USD. Thus pips for GBP/USD is 0. 0001. – Another measure of change is BPS ( called bips). – 1 BPS = 0. 01 – Pips is often called as small figure and bips as big fig. FX MKTS M 1

Fluctuations in FX Rate • During the market hours the exchange rate for currency pairs frequently change. • The smallest amount by which the rate of a currency pair can change is called ‘PIPS’. • For eg. GBP/USD = 2. 0201/2. 0202 – Here the smallest amount by which the rate change is 0. 0001 USD. Thus pips for GBP/USD is 0. 0001. – Another measure of change is BPS ( called bips). – 1 BPS = 0. 01 – Pips is often called as small figure and bips as big fig. FX MKTS M 1

Fluctuations in FX Rate • Appreciation – If USD/JPY = 120 changes to USD/JPY = 119 then we say that Yen has appreciated against USD. – In other words price of USD has fallen in terms of YEN. – This means YEN has strengthened against USD. – Similarly if GBP/USD = 2. 0201 changes to GBP/USD = 2. 0202 then GBP has appreciated against USD. – The price of GBP has increased in terms of USD. FX MKTS M 1

Fluctuations in FX Rate • Appreciation – If USD/JPY = 120 changes to USD/JPY = 119 then we say that Yen has appreciated against USD. – In other words price of USD has fallen in terms of YEN. – This means YEN has strengthened against USD. – Similarly if GBP/USD = 2. 0201 changes to GBP/USD = 2. 0202 then GBP has appreciated against USD. – The price of GBP has increased in terms of USD. FX MKTS M 1

Fluctuations in FX Rate • Depreciation – If USD/JPY = 120 changes to USD/JPY = 121 then we say that Yen has depreciated against USD. – In other words price of USD has risen in terms of YEN. – This means YEN has weakened against USD. – Similarly if GBP/USD = 2. 0201 changes to GBP/USD = 2. 0200 then GBP has depreciated against USD. – The price of GBP has decreased in terms of USD. FX MKTS M 1

Fluctuations in FX Rate • Depreciation – If USD/JPY = 120 changes to USD/JPY = 121 then we say that Yen has depreciated against USD. – In other words price of USD has risen in terms of YEN. – This means YEN has weakened against USD. – Similarly if GBP/USD = 2. 0201 changes to GBP/USD = 2. 0200 then GBP has depreciated against USD. – The price of GBP has decreased in terms of USD. FX MKTS M 1

Spot and Forward (Fwd) Rates • Spot Rate – Spot exchange rate is the rate at which transactions can be executed instantaneously in the market. – However the transactions are settled 2 days from the transaction date (T+2) in all currencies except CAD/USD where it is settled on T+1 day. – The settlement date is called ‘Spot Date’ or ‘Value Date’. • Forward Rate – Forward exchange rate is the rate at which transactions can be executed at a future date at a rate that is agreed today. • There can be only one two way quote for the spot rate. • There can be many forward rate quotes, each quote corresponds to a different future date. FX MKTS M 1

Spot and Forward (Fwd) Rates • Spot Rate – Spot exchange rate is the rate at which transactions can be executed instantaneously in the market. – However the transactions are settled 2 days from the transaction date (T+2) in all currencies except CAD/USD where it is settled on T+1 day. – The settlement date is called ‘Spot Date’ or ‘Value Date’. • Forward Rate – Forward exchange rate is the rate at which transactions can be executed at a future date at a rate that is agreed today. • There can be only one two way quote for the spot rate. • There can be many forward rate quotes, each quote corresponds to a different future date. FX MKTS M 1

Covered Interest Rate Parity • Assume – The spot exchange rate for USD/JPY = S – 1 year forward exchange rate for USD/JPY = F – 1 year Interest rate in US ( or foreign country) = rf – 1 year Interest rate in Japan (domestic) = rd FX MKTS M 1

Covered Interest Rate Parity • Assume – The spot exchange rate for USD/JPY = S – 1 year forward exchange rate for USD/JPY = F – 1 year Interest rate in US ( or foreign country) = rf – 1 year Interest rate in Japan (domestic) = rd FX MKTS M 1

Covered Interest Rate Parity • Transactions – At t = 0 • Borrow an amount P in USD for 1 year • Sell USD in spot market to buy JPY for spot exchange rate of S = JPY P*S • Lend JPY for 1 year in Japan • Buy a 1 year forward contract in USD/JPY, forward exchange rate = F. FX MKTS M 1

Covered Interest Rate Parity • Transactions – At t = 0 • Borrow an amount P in USD for 1 year • Sell USD in spot market to buy JPY for spot exchange rate of S = JPY P*S • Lend JPY for 1 year in Japan • Buy a 1 year forward contract in USD/JPY, forward exchange rate = F. FX MKTS M 1

Covered Interest Rate Parity • Transactions – At t = 1 yr • Receive Yen amount = P*S(1+ rd) • Convert this into USD at forward rate = USD P*S(1+ rd)/F • Payoff the USD loan, amount = USD P*(1+ rf) • According to No Arbitrage Principle, the value of USD amount received from forward contract should be equal to the value of loan after 1 year. FX MKTS M 1

Covered Interest Rate Parity • Transactions – At t = 1 yr • Receive Yen amount = P*S(1+ rd) • Convert this into USD at forward rate = USD P*S(1+ rd)/F • Payoff the USD loan, amount = USD P*(1+ rf) • According to No Arbitrage Principle, the value of USD amount received from forward contract should be equal to the value of loan after 1 year. FX MKTS M 1

Covered Interest Rate Parity • For no arbitrage P*S(1+ rd)/F = P*(1+ rf) or S/F = (1+ rf)/(1+ rd) …… Eq 1. • The above equation (Eq 1) explains the fundamental relationship between the spot rate, forward rate and the interest rate in two countries. • This concept is called ‘Covered Interest rate Parity’. FX MKTS M 1

Covered Interest Rate Parity • For no arbitrage P*S(1+ rd)/F = P*(1+ rf) or S/F = (1+ rf)/(1+ rd) …… Eq 1. • The above equation (Eq 1) explains the fundamental relationship between the spot rate, forward rate and the interest rate in two countries. • This concept is called ‘Covered Interest rate Parity’. FX MKTS M 1

Forward Rates • One assumption of the covered interest rate parity is that one can borrow as much as one wishes from foreign country and convert it into domestic currency. • In countries where the domestic currency is not fully convertible like India, the relation between forward and spot USD/INR rate does hold. • If the domestic currency is fully convertible, then the forward exchange rate will exactly follow the covered interest rate parity. FX MKTS M 1

Forward Rates • One assumption of the covered interest rate parity is that one can borrow as much as one wishes from foreign country and convert it into domestic currency. • In countries where the domestic currency is not fully convertible like India, the relation between forward and spot USD/INR rate does hold. • If the domestic currency is fully convertible, then the forward exchange rate will exactly follow the covered interest rate parity. FX MKTS M 1

Forward Discount and Premium • From Equation 1. S/F = (1+ rf)/(1+ rd) …… Eq 1. • If rf > rd then S > F – Forward exchange rate will be less than the spot exchange rate. – Or we can say that the forward rate is in discount compared to spot. • If rf < rd then S < F – Forward exchange rate is in premium in comparison to the spot rate. This premium is also referred as forward premia. FX MKTS M 1

Forward Discount and Premium • From Equation 1. S/F = (1+ rf)/(1+ rd) …… Eq 1. • If rf > rd then S > F – Forward exchange rate will be less than the spot exchange rate. – Or we can say that the forward rate is in discount compared to spot. • If rf < rd then S < F – Forward exchange rate is in premium in comparison to the spot rate. This premium is also referred as forward premia. FX MKTS M 1

Forward Discount and Premium • Forward Points – The difference between S and F is called forward points, it can be positive or negative indicating whether the forward is in premium or discount. • Assume USD/INR spot = 40. 45 and 1 yr fwd = 40. 85. – In this currency pair the dollar is in premium against rupee. – However the rupee is in discount against the dollar. FX MKTS M 1

Forward Discount and Premium • Forward Points – The difference between S and F is called forward points, it can be positive or negative indicating whether the forward is in premium or discount. • Assume USD/INR spot = 40. 45 and 1 yr fwd = 40. 85. – In this currency pair the dollar is in premium against rupee. – However the rupee is in discount against the dollar. FX MKTS M 1

FX Terminology • G 3 Currencies – GBP, EUR and USD • G 7 Currencies – GBP, EUR, JPY, CHF, AUD, CAD and USD • Currency Pair Names – The following currency pairs are called by their name • • GBP/USD – Cable USD/CHF – Swissy AUD/USD – Aussie CAD/USD – Loonie/Caddy FX MKTS M 1

FX Terminology • G 3 Currencies – GBP, EUR and USD • G 7 Currencies – GBP, EUR, JPY, CHF, AUD, CAD and USD • Currency Pair Names – The following currency pairs are called by their name • • GBP/USD – Cable USD/CHF – Swissy AUD/USD – Aussie CAD/USD – Loonie/Caddy FX MKTS M 1

Cross Currency • In all exchange rate quotes one of the currency is USD for both direct and indirect quotes. • If in a currency pair none of the currency is USD, then the exchange rate is called ‘Cross Currency’ rate. • The cross currency rate is calculated by combining the quotes of both currency against USD. FX MKTS M 1

Cross Currency • In all exchange rate quotes one of the currency is USD for both direct and indirect quotes. • If in a currency pair none of the currency is USD, then the exchange rate is called ‘Cross Currency’ rate. • The cross currency rate is calculated by combining the quotes of both currency against USD. FX MKTS M 1

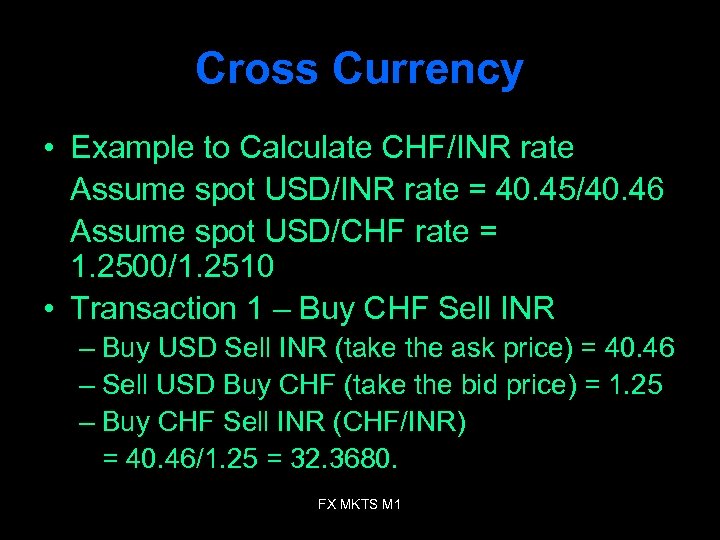

Cross Currency • Example to Calculate CHF/INR rate Assume spot USD/INR rate = 40. 45/40. 46 Assume spot USD/CHF rate = 1. 2500/1. 2510 • Transaction 1 – Buy CHF Sell INR – Buy USD Sell INR (take the ask price) = 40. 46 – Sell USD Buy CHF (take the bid price) = 1. 25 – Buy CHF Sell INR (CHF/INR) = 40. 46/1. 25 = 32. 3680. FX MKTS M 1

Cross Currency • Example to Calculate CHF/INR rate Assume spot USD/INR rate = 40. 45/40. 46 Assume spot USD/CHF rate = 1. 2500/1. 2510 • Transaction 1 – Buy CHF Sell INR – Buy USD Sell INR (take the ask price) = 40. 46 – Sell USD Buy CHF (take the bid price) = 1. 25 – Buy CHF Sell INR (CHF/INR) = 40. 46/1. 25 = 32. 3680. FX MKTS M 1

Cross Currency • Transaction 2 – Sell CHF Buy INR – Buy USD Sell CHF (take the ask price) = 1. 2510 – Sell USD Buy INR ( take the bid price) = 40. 45 – Sell CHF Buy INR (CHF/INR) = 40. 45/1. 2510 = 32. 3341 • CHF/INR = 32. 3341/32. 3680 FX MKTS M 1

Cross Currency • Transaction 2 – Sell CHF Buy INR – Buy USD Sell CHF (take the ask price) = 1. 2510 – Sell USD Buy INR ( take the bid price) = 40. 45 – Sell CHF Buy INR (CHF/INR) = 40. 45/1. 2510 = 32. 3341 • CHF/INR = 32. 3341/32. 3680 FX MKTS M 1