aa8707ad8420021b0abad30ca3d9b245.ppt

- Количество слайдов: 83

FORECLORE REPRESENTATION TIPS

FORECLORE REPRESENTATION TIPS

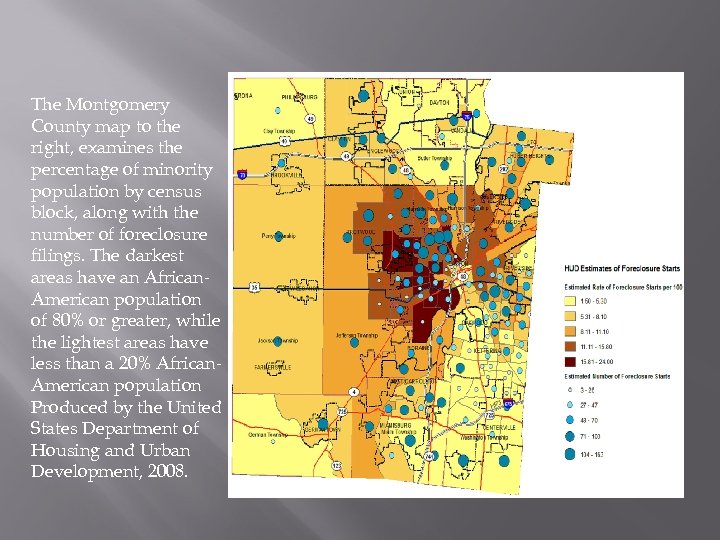

The Montgomery County map to the right, examines the percentage of minority population by census block, along with the number of foreclosure filings. The darkest areas have an African. American population of 80% or greater, while the lightest areas have less than a 20% African. American population Produced by the United States Department of Housing and Urban Development, 2008.

The Montgomery County map to the right, examines the percentage of minority population by census block, along with the number of foreclosure filings. The darkest areas have an African. American population of 80% or greater, while the lightest areas have less than a 20% African. American population Produced by the United States Department of Housing and Urban Development, 2008.

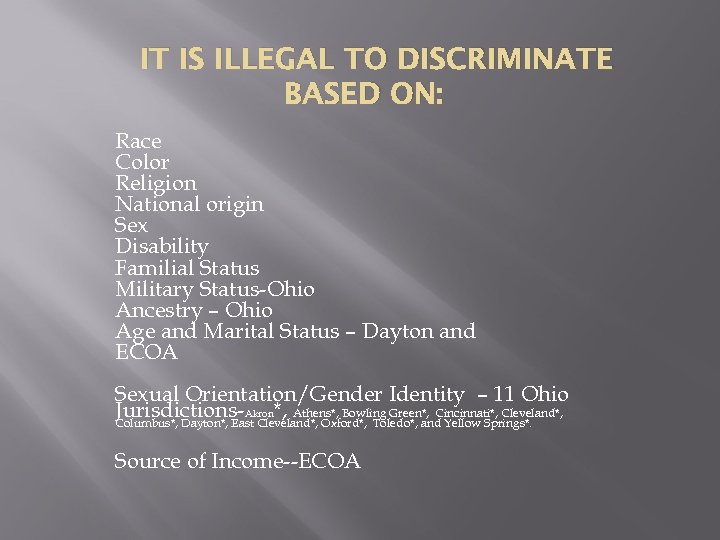

IT IS ILLEGAL TO DISCRIMINATE BASED ON: Race Color Religion National origin Sex Disability Familial Status Military Status-Ohio Ancestry – Ohio Age and Marital Status – Dayton and ECOA Sexual Orientation/Gender Identity – 11 Ohio Jurisdictions-Akron*, Athens*, Bowling Green*, Cincinnati*, Cleveland*, Columbus*, Dayton*, East Cleveland*, Oxford*, Toledo*, and Yellow Springs*. Source of Income--ECOA

IT IS ILLEGAL TO DISCRIMINATE BASED ON: Race Color Religion National origin Sex Disability Familial Status Military Status-Ohio Ancestry – Ohio Age and Marital Status – Dayton and ECOA Sexual Orientation/Gender Identity – 11 Ohio Jurisdictions-Akron*, Athens*, Bowling Green*, Cincinnati*, Cleveland*, Columbus*, Dayton*, East Cleveland*, Oxford*, Toledo*, and Yellow Springs*. Source of Income--ECOA

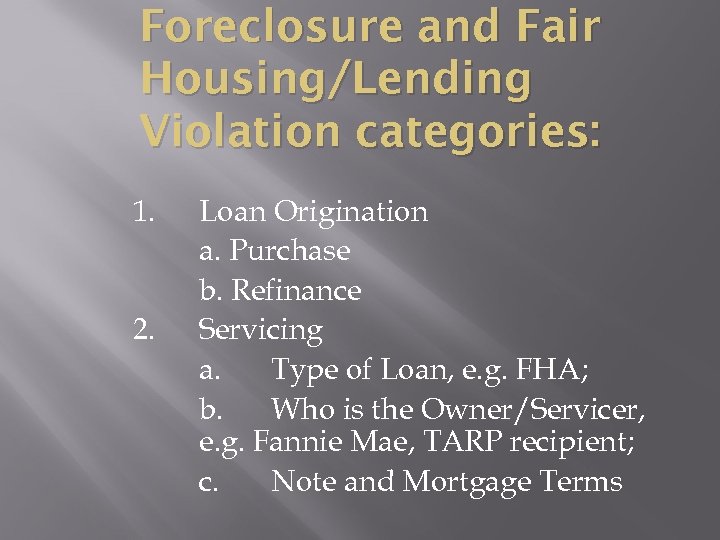

Foreclosure and Fair Housing/Lending Violation categories: 1. 2. Loan Origination a. Purchase b. Refinance Servicing a. Type of Loan, e. g. FHA; b. Who is the Owner/Servicer, e. g. Fannie Mae, TARP recipient; c. Note and Mortgage Terms

Foreclosure and Fair Housing/Lending Violation categories: 1. 2. Loan Origination a. Purchase b. Refinance Servicing a. Type of Loan, e. g. FHA; b. Who is the Owner/Servicer, e. g. Fannie Mae, TARP recipient; c. Note and Mortgage Terms

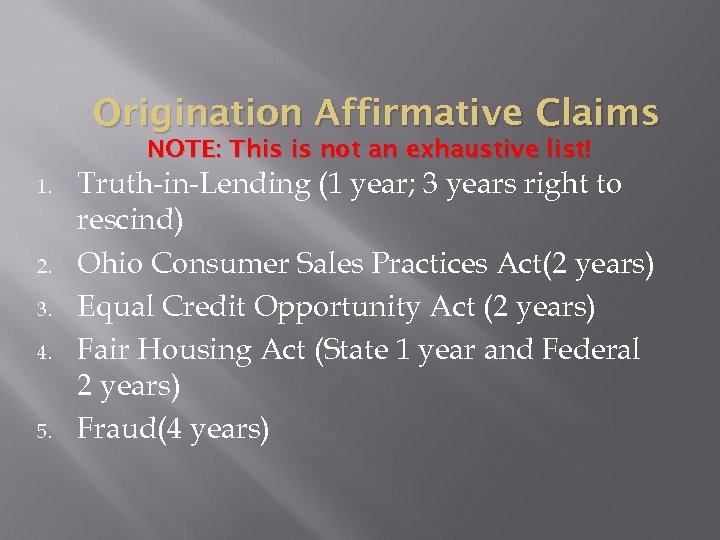

Origination Affirmative Claims NOTE: This is not an exhaustive list! 1. 2. 3. 4. 5. Truth-in-Lending (1 year; 3 years right to rescind) Ohio Consumer Sales Practices Act(2 years) Equal Credit Opportunity Act (2 years) Fair Housing Act (State 1 year and Federal 2 years) Fraud(4 years)

Origination Affirmative Claims NOTE: This is not an exhaustive list! 1. 2. 3. 4. 5. Truth-in-Lending (1 year; 3 years right to rescind) Ohio Consumer Sales Practices Act(2 years) Equal Credit Opportunity Act (2 years) Fair Housing Act (State 1 year and Federal 2 years) Fraud(4 years)

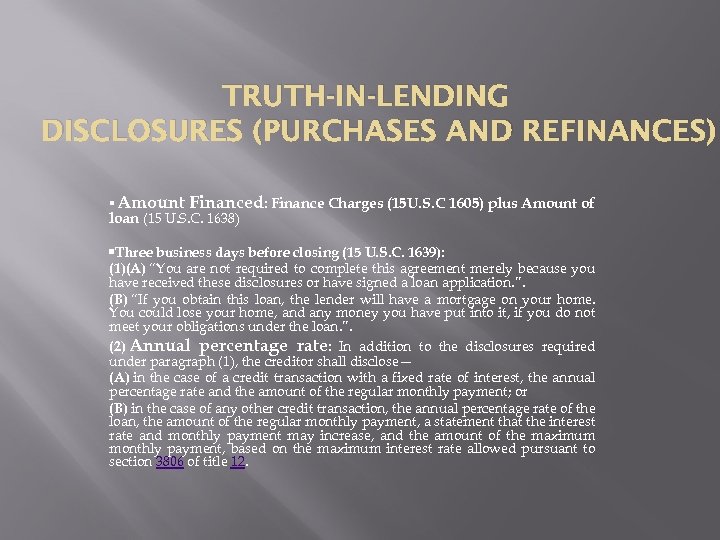

TRUTH-IN-LENDING DISCLOSURES (PURCHASES AND REFINANCES) • Amount Financed: Finance Charges (15 U. S. C 1605) plus Amount of loan (15 U. S. C. 1638) • Three business days before closing (15 U. S. C. 1639): (1)(A) “You are not required to complete this agreement merely because you have received these disclosures or have signed a loan application. ”. (B) “If you obtain this loan, the lender will have a mortgage on your home. You could lose your home, and any money you have put into it, if you do not meet your obligations under the loan. ”. (2) Annual percentage rate: In addition to the disclosures required under paragraph (1), the creditor shall disclose— (A) in the case of a credit transaction with a fixed rate of interest, the annual percentage rate and the amount of the regular monthly payment; or (B) in the case of any other credit transaction, the annual percentage rate of the loan, the amount of the regular monthly payment, a statement that the interest rate and monthly payment may increase, and the amount of the maximum monthly payment, based on the maximum interest rate allowed pursuant to section 3806 of title 12.

TRUTH-IN-LENDING DISCLOSURES (PURCHASES AND REFINANCES) • Amount Financed: Finance Charges (15 U. S. C 1605) plus Amount of loan (15 U. S. C. 1638) • Three business days before closing (15 U. S. C. 1639): (1)(A) “You are not required to complete this agreement merely because you have received these disclosures or have signed a loan application. ”. (B) “If you obtain this loan, the lender will have a mortgage on your home. You could lose your home, and any money you have put into it, if you do not meet your obligations under the loan. ”. (2) Annual percentage rate: In addition to the disclosures required under paragraph (1), the creditor shall disclose— (A) in the case of a credit transaction with a fixed rate of interest, the annual percentage rate and the amount of the regular monthly payment; or (B) in the case of any other credit transaction, the annual percentage rate of the loan, the amount of the regular monthly payment, a statement that the interest rate and monthly payment may increase, and the amount of the maximum monthly payment, based on the maximum interest rate allowed pursuant to section 3806 of title 12.

TILA: ABILITY TO REPAY 1. ”No creditor may make a residential mortgage loan unless the creditor makes a reasonable and good faith determination based on verified and documented information, at the time the loan is consummated, the consumer has a reasonable ability to repay the loan according to its terms, and all applicable taxes, insurance and assessments. ” (except for governmental streamline refinances in certain situations) 15 U. S. C. 1639 c

TILA: ABILITY TO REPAY 1. ”No creditor may make a residential mortgage loan unless the creditor makes a reasonable and good faith determination based on verified and documented information, at the time the loan is consummated, the consumer has a reasonable ability to repay the loan according to its terms, and all applicable taxes, insurance and assessments. ” (except for governmental streamline refinances in certain situations) 15 U. S. C. 1639 c

TILA: HIGH COST LOANS: 15 USC 1639 Loans qualifying as high cost are subject to many restrictions, including prohibitions against: • Balloon payments for loans with less than five-year terms, except for bridge loans of less than one year to buy or build a home • Negative amortization • Higher interest rate if the borrower defaults • A repayment schedule that consolidates more than two periodic payments to be paid in advance from the proceeds of the loan • Prepayment penalties

TILA: HIGH COST LOANS: 15 USC 1639 Loans qualifying as high cost are subject to many restrictions, including prohibitions against: • Balloon payments for loans with less than five-year terms, except for bridge loans of less than one year to buy or build a home • Negative amortization • Higher interest rate if the borrower defaults • A repayment schedule that consolidates more than two periodic payments to be paid in advance from the proceeds of the loan • Prepayment penalties

TILA: HIGH Cost Loans. Continued : • Due-on-demand clause, except for consumer fraud or materialmisrepresentationconnection the in with loan or if the consumer defaults, or the consumer adversely affects the creditor's security • Making loans based solely on the value of the collateral without regard to the borrower's ability to repay the loan • Refinancing a high cost loan into another high cost loan within the first 12 months of origination, unless the new loan is in the borrower's best interest • Wrongfully documenting a closed-end, high-cost loan as an open-end loan.

TILA: HIGH Cost Loans. Continued : • Due-on-demand clause, except for consumer fraud or materialmisrepresentationconnection the in with loan or if the consumer defaults, or the consumer adversely affects the creditor's security • Making loans based solely on the value of the collateral without regard to the borrower's ability to repay the loan • Refinancing a high cost loan into another high cost loan within the first 12 months of origination, unless the new loan is in the borrower's best interest • Wrongfully documenting a closed-end, high-cost loan as an open-end loan.

TRUTH-IN-LENDING AND REFINANCE NOTICE OF RIGHT TO CANCEL (15 U. S. C. 1635) Right to Rescind the Transaction up three days after loan consummation or the delivery of the information or up to three years after notice the right to rescind is actually provided. . . (look at case law—Note: Tender is an issue—providing money back—not including certain charges and interest).

TRUTH-IN-LENDING AND REFINANCE NOTICE OF RIGHT TO CANCEL (15 U. S. C. 1635) Right to Rescind the Transaction up three days after loan consummation or the delivery of the information or up to three years after notice the right to rescind is actually provided. . . (look at case law—Note: Tender is an issue—providing money back—not including certain charges and interest).

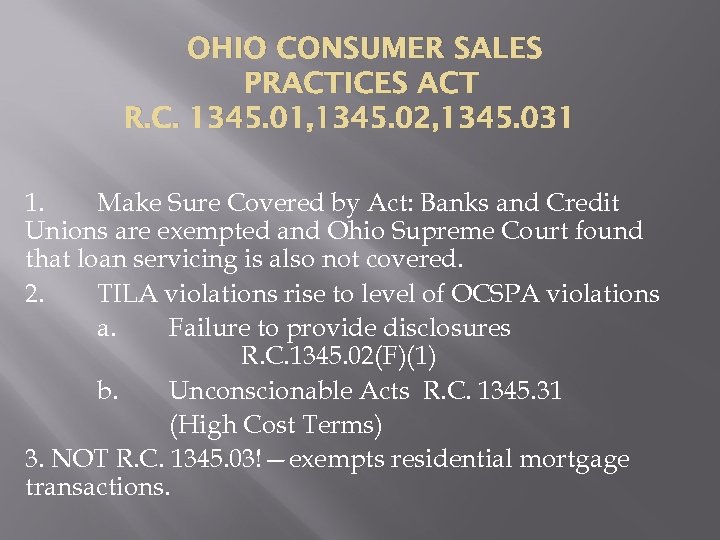

OHIO CONSUMER SALES PRACTICES ACT R. C. 1345. 01, 1345. 02, 1345. 031 1. Make Sure Covered by Act: Banks and Credit Unions are exempted and Ohio Supreme Court found that loan servicing is also not covered. 2. TILA violations rise to level of OCSPA violations a. Failure to provide disclosures R. C. 1345. 02(F)(1) b. Unconscionable Acts R. C. 1345. 31 (High Cost Terms) 3. NOT R. C. 1345. 03!—exempts residential mortgage transactions.

OHIO CONSUMER SALES PRACTICES ACT R. C. 1345. 01, 1345. 02, 1345. 031 1. Make Sure Covered by Act: Banks and Credit Unions are exempted and Ohio Supreme Court found that loan servicing is also not covered. 2. TILA violations rise to level of OCSPA violations a. Failure to provide disclosures R. C. 1345. 02(F)(1) b. Unconscionable Acts R. C. 1345. 31 (High Cost Terms) 3. NOT R. C. 1345. 03!—exempts residential mortgage transactions.

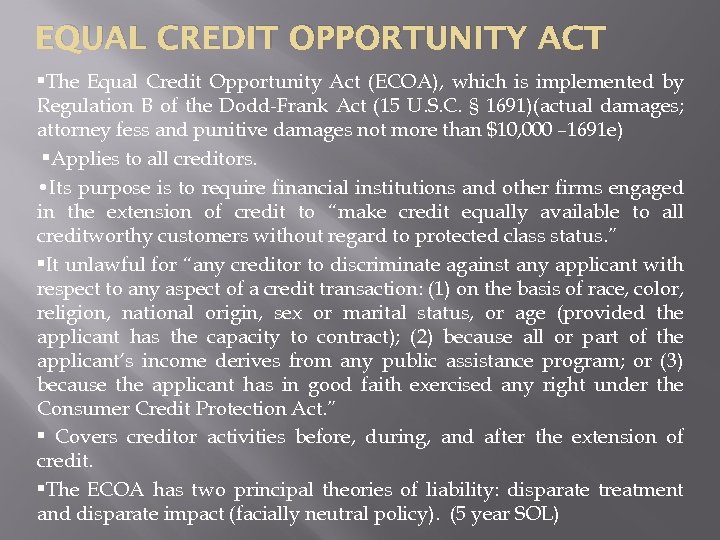

EQUAL CREDIT OPPORTUNITY ACT • The Equal Credit Opportunity Act (ECOA), which is implemented by Regulation B of the Dodd-Frank Act (15 U. S. C. § 1691)(actual damages; attorney fess and punitive damages not more than $10, 000 – 1691 e) • Applies to all creditors. • Its purpose is to require financial institutions and other firms engaged in the extension of credit to “make credit equally available to all creditworthy customers without regard to protected class status. ” • It unlawful for “any creditor to discriminate against any applicant with respect to any aspect of a credit transaction: (1) on the basis of race, color, religion, national origin, sex or marital status, or age (provided the applicant has the capacity to contract); (2) because all or part of the applicant’s income derives from any public assistance program; or (3) because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. ” • Covers creditor activities before, during, and after the extension of credit. • The ECOA has two principal theories of liability: disparate treatment and disparate impact (facially neutral policy). (5 year SOL)

EQUAL CREDIT OPPORTUNITY ACT • The Equal Credit Opportunity Act (ECOA), which is implemented by Regulation B of the Dodd-Frank Act (15 U. S. C. § 1691)(actual damages; attorney fess and punitive damages not more than $10, 000 – 1691 e) • Applies to all creditors. • Its purpose is to require financial institutions and other firms engaged in the extension of credit to “make credit equally available to all creditworthy customers without regard to protected class status. ” • It unlawful for “any creditor to discriminate against any applicant with respect to any aspect of a credit transaction: (1) on the basis of race, color, religion, national origin, sex or marital status, or age (provided the applicant has the capacity to contract); (2) because all or part of the applicant’s income derives from any public assistance program; or (3) because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. ” • Covers creditor activities before, during, and after the extension of credit. • The ECOA has two principal theories of liability: disparate treatment and disparate impact (facially neutral policy). (5 year SOL)

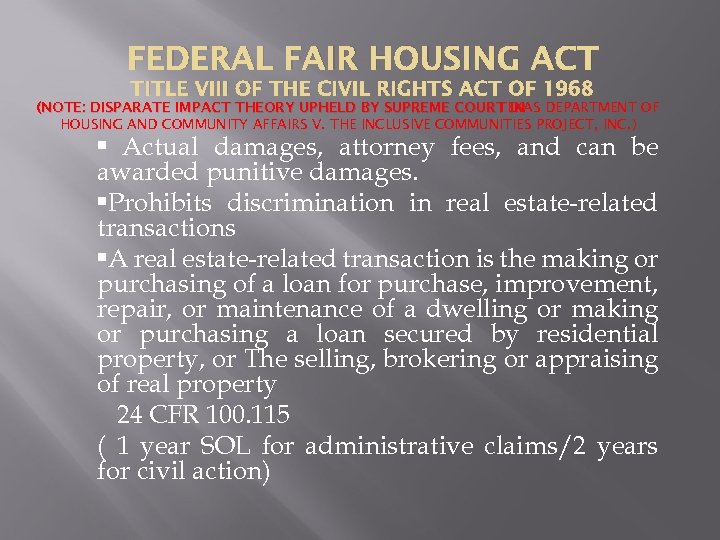

FEDERAL FAIR HOUSING ACT TITLE VIII OF THE CIVIL RIGHTS ACT OF 1968 (NOTE: DISPARATE IMPACT THEORY UPHELD BY SUPREME COURT IN DEPARTMENT OF TEXAS HOUSING AND COMMUNITY AFFAIRS V. THE INCLUSIVE COMMUNITIES PROJECT, INC. ) • Actual damages, attorney fees, and can be awarded punitive damages. • Prohibits discrimination in real estate-related transactions • A real estate-related transaction is the making or purchasing of a loan for purchase, improvement, repair, or maintenance of a dwelling or making or purchasing a loan secured by residential property, or The selling, brokering or appraising of real property 24 CFR 100. 115 ( 1 year SOL for administrative claims/2 years for civil action)

FEDERAL FAIR HOUSING ACT TITLE VIII OF THE CIVIL RIGHTS ACT OF 1968 (NOTE: DISPARATE IMPACT THEORY UPHELD BY SUPREME COURT IN DEPARTMENT OF TEXAS HOUSING AND COMMUNITY AFFAIRS V. THE INCLUSIVE COMMUNITIES PROJECT, INC. ) • Actual damages, attorney fees, and can be awarded punitive damages. • Prohibits discrimination in real estate-related transactions • A real estate-related transaction is the making or purchasing of a loan for purchase, improvement, repair, or maintenance of a dwelling or making or purchasing a loan secured by residential property, or The selling, brokering or appraising of real property 24 CFR 100. 115 ( 1 year SOL for administrative claims/2 years for civil action)

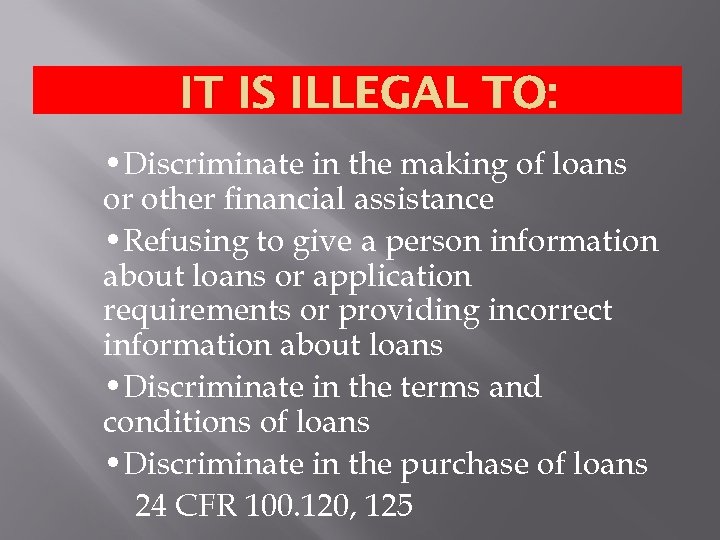

IT IS ILLEGAL TO: • Discriminate in the making of loans or other financial assistance • Refusing to give a person information about loans or application requirements or providing incorrect information about loans • Discriminate in the terms and conditions of loans • Discriminate in the purchase of loans 24 CFR 100. 120, 125

IT IS ILLEGAL TO: • Discriminate in the making of loans or other financial assistance • Refusing to give a person information about loans or application requirements or providing incorrect information about loans • Discriminate in the terms and conditions of loans • Discriminate in the purchase of loans 24 CFR 100. 120, 125

DISCRIMINATORY ADVERTISING AND STATEMENTS ARE ILLEGAL It is illegal to make, print or publish, or cause to be made, printed or published, any notice, statement or advertisement with respect to the sale or rental of a dwelling which indicates a preference, limitation or discrimination. This provision applies to all written or oral statements. 24 CFR 100. 75

DISCRIMINATORY ADVERTISING AND STATEMENTS ARE ILLEGAL It is illegal to make, print or publish, or cause to be made, printed or published, any notice, statement or advertisement with respect to the sale or rental of a dwelling which indicates a preference, limitation or discrimination. This provision applies to all written or oral statements. 24 CFR 100. 75

STEERING IS ILLEGAL • Steering is the restriction or the attempt to restrict a person’s choices in housing by word or conduct. It includes discouraging a person from looking at, buying or renting a dwelling because of race, etc. or because of the race etc. of the persons in a community or neighborhood. • It is also described as directing a person to or away from a particular area or neighborhood based on that person’s race or national origin or based on the racial or ethnic composition of the neighborhood.

STEERING IS ILLEGAL • Steering is the restriction or the attempt to restrict a person’s choices in housing by word or conduct. It includes discouraging a person from looking at, buying or renting a dwelling because of race, etc. or because of the race etc. of the persons in a community or neighborhood. • It is also described as directing a person to or away from a particular area or neighborhood based on that person’s race or national origin or based on the racial or ethnic composition of the neighborhood.

“BLOCKBUSTING” IS ILLEGAL • The practice of manipulating homeowners into selling their home under fair market value by discriminatory means and falsehoods. • Telling homeowners that people who are members of a protected class are moving into their neighborhood and that because of this they should expect a decline in the value of their properties for this reason.

“BLOCKBUSTING” IS ILLEGAL • The practice of manipulating homeowners into selling their home under fair market value by discriminatory means and falsehoods. • Telling homeowners that people who are members of a protected class are moving into their neighborhood and that because of this they should expect a decline in the value of their properties for this reason.

OHIO FAIR HOUSING LAW R. C. 4112. 02, 4112. 021 • If there is a Federal Fair Housing Violation or an ECOA violation, there will most likely be a State violation. • Military Status and Ancestry added protected classes but only one year statute of limitations. • Actual damages, attorney fees, and punitive damages R. C. 4112. 051 • NOTE: Senate Bill No. 134 proposed to limit administrative damage awards, and to award attorney fees to respondents in administrative actions in some instances, and to exempt certain landlords and home sellers from coverage.

OHIO FAIR HOUSING LAW R. C. 4112. 02, 4112. 021 • If there is a Federal Fair Housing Violation or an ECOA violation, there will most likely be a State violation. • Military Status and Ancestry added protected classes but only one year statute of limitations. • Actual damages, attorney fees, and punitive damages R. C. 4112. 051 • NOTE: Senate Bill No. 134 proposed to limit administrative damage awards, and to award attorney fees to respondents in administrative actions in some instances, and to exempt certain landlords and home sellers from coverage.

FRAUD • Detrimental lies that are reasonably relied upon. • Lies in terms and appraised value • Must be fact specific and fact heavy—allege with specificity • actual damages and if prove actual malice, can be awarded punitive damages and if show bad faith, can be awarded attorney fees.

FRAUD • Detrimental lies that are reasonably relied upon. • Lies in terms and appraised value • Must be fact specific and fact heavy—allege with specificity • actual damages and if prove actual malice, can be awarded punitive damages and if show bad faith, can be awarded attorney fees.

SERVICING AND LOSS MITIGATION 1. What type of loan—servicing regulations and guidelines a. FHA b. VA c. Rural Housing Loan d. Conventional—investor guidelines or underwriting standards or trust agreements

SERVICING AND LOSS MITIGATION 1. What type of loan—servicing regulations and guidelines a. FHA b. VA c. Rural Housing Loan d. Conventional—investor guidelines or underwriting standards or trust agreements

WHO OWNS OR IS SERVICING THE LOAN 1. 2. 3. 4. TARP Recipient=HAMP participant Fannie Mae or Freddie Mac— servicing guidelines A Trust—pooling and servicing agreement Do they have their own guidelines you can find out about?

WHO OWNS OR IS SERVICING THE LOAN 1. 2. 3. 4. TARP Recipient=HAMP participant Fannie Mae or Freddie Mac— servicing guidelines A Trust—pooling and servicing agreement Do they have their own guidelines you can find out about?

HOW TO ENFORCE GUIDELINES • Need to have a legal trigger! 1. 2. Included in terms of contract—note, mortgage, loan modification, etc. Sent Notice of Error under RESPA and failed to comply.

HOW TO ENFORCE GUIDELINES • Need to have a legal trigger! 1. 2. Included in terms of contract—note, mortgage, loan modification, etc. Sent Notice of Error under RESPA and failed to comply.

QUALIFIEDWRITTENREQUEST: NOTICE OF ERROR OR REQUEST FOR INFORMATION • Notice of Error can be used to contest allegation of default if entered into loan modification, to contest denial if not permitted by guidelines, and to get information about loan payments. • Under the Real Estate Settlement Procedures Act (RESPA) 12 U. S. C. §§ 2601 -2617, the QWR is split into two categories: Notice of Error (Federal Regulations § 1024. 35) and Request for Information (Federal Regulations § 1024. 36). Servicer has 5 business days to acknowledge request or notice of error and 30 business days to respond. Servicers can request a 15 day extension if notifies borrower of the extension and the reasons. Failure to comply provides individuals with actual damages as a result of the failure and any additional damages, as the court may allow, in the case of a pattern or practice of noncompliance, in an amount not to exceed $2000. Reasonable attorney fees may be awarded as well.

QUALIFIEDWRITTENREQUEST: NOTICE OF ERROR OR REQUEST FOR INFORMATION • Notice of Error can be used to contest allegation of default if entered into loan modification, to contest denial if not permitted by guidelines, and to get information about loan payments. • Under the Real Estate Settlement Procedures Act (RESPA) 12 U. S. C. §§ 2601 -2617, the QWR is split into two categories: Notice of Error (Federal Regulations § 1024. 35) and Request for Information (Federal Regulations § 1024. 36). Servicer has 5 business days to acknowledge request or notice of error and 30 business days to respond. Servicers can request a 15 day extension if notifies borrower of the extension and the reasons. Failure to comply provides individuals with actual damages as a result of the failure and any additional damages, as the court may allow, in the case of a pattern or practice of noncompliance, in an amount not to exceed $2000. Reasonable attorney fees may be awarded as well.

CONSUMER FINANCIAL PROTECTION BUREAU http: //www. consumerfinance. gov/complaint/ THE CFPB creates the mortgage and servicing regulations and provides enforcement and oversight. It is helpful to file a complaint at the same time or before a lawsuit. The CFPB can provide investigate and provide helpful information outside of litigation and will put pressure on the lender/servicer to follow regulations.

CONSUMER FINANCIAL PROTECTION BUREAU http: //www. consumerfinance. gov/complaint/ THE CFPB creates the mortgage and servicing regulations and provides enforcement and oversight. It is helpful to file a complaint at the same time or before a lawsuit. The CFPB can provide investigate and provide helpful information outside of litigation and will put pressure on the lender/servicer to follow regulations.

Where to start

Where to start

COURT DOCUMENTS 1. 2. 3. Complaint: who is Plaintiff; what is being alleged; what is attached to show have right to foreclose; If no Note, but Plaintiff alleges that it is entitled to enforce Note or is Note Holder, but “unavailable” file Motion for Definite Statement requesting Note to be filed (can do with Mortgage Assignment as well if alleging been assigned Mortgage but “unavailable”). Past Foreclosure filings?

COURT DOCUMENTS 1. 2. 3. Complaint: who is Plaintiff; what is being alleged; what is attached to show have right to foreclose; If no Note, but Plaintiff alleges that it is entitled to enforce Note or is Note Holder, but “unavailable” file Motion for Definite Statement requesting Note to be filed (can do with Mortgage Assignment as well if alleging been assigned Mortgage but “unavailable”). Past Foreclosure filings?

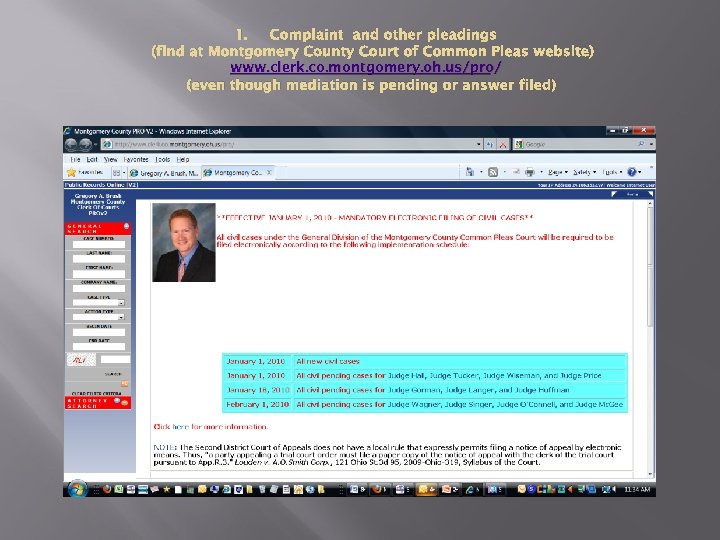

1. Complaint and other pleadings (find at Montgomery County Court of Common Pleas website) www. clerk. co. montgomery. oh. us/pro/ (even though mediation is pending or answer filed)

1. Complaint and other pleadings (find at Montgomery County Court of Common Pleas website) www. clerk. co. montgomery. oh. us/pro/ (even though mediation is pending or answer filed)

LOAN DOCUMENTS 1. Is this a refinance or purchase? 2. Is this a government backed loan?

LOAN DOCUMENTS 1. Is this a refinance or purchase? 2. Is this a government backed loan?

2. Initial Application and Closing documents

2. Initial Application and Closing documents

Application 1. What are the terms? Ø Interest Rate-Fixed or Variable Ø Income (inflated? Fixed income with Variable) Ø Expenses (accurately listed? ) Ø Monthly Payments (paying more-any benefit? ) Ø When was it dated? Ø Handwritten/Typed versions, different? Ø Signed?

Application 1. What are the terms? Ø Interest Rate-Fixed or Variable Ø Income (inflated? Fixed income with Variable) Ø Expenses (accurately listed? ) Ø Monthly Payments (paying more-any benefit? ) Ø When was it dated? Ø Handwritten/Typed versions, different? Ø Signed?

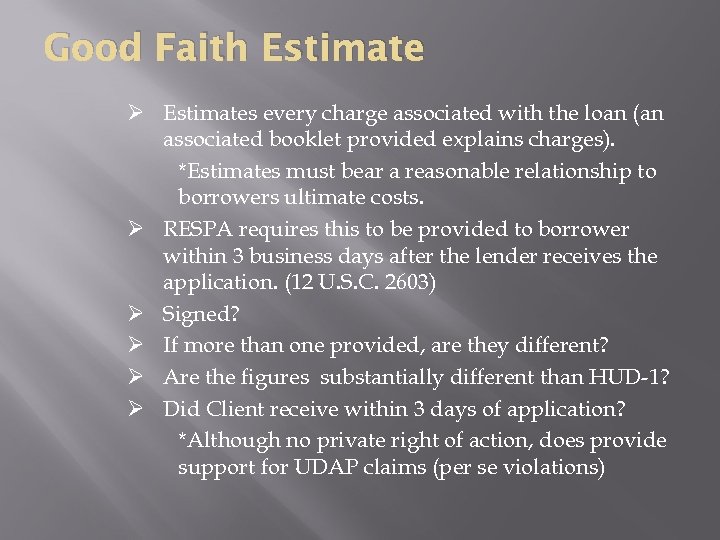

Good Faith Estimate Ø Estimates every charge associated with the loan (an associated booklet provided explains charges). *Estimates must bear a reasonable relationship to borrowers ultimate costs. Ø RESPA requires this to be provided to borrower within 3 business days after the lender receives the application. (12 U. S. C. 2603) Ø Signed? Ø If more than one provided, are they different? Ø Are the figures substantially different than HUD-1? Ø Did Client receive within 3 days of application? *Although no private right of action, does provide support for UDAP claims (per se violations)

Good Faith Estimate Ø Estimates every charge associated with the loan (an associated booklet provided explains charges). *Estimates must bear a reasonable relationship to borrowers ultimate costs. Ø RESPA requires this to be provided to borrower within 3 business days after the lender receives the application. (12 U. S. C. 2603) Ø Signed? Ø If more than one provided, are they different? Ø Are the figures substantially different than HUD-1? Ø Did Client receive within 3 days of application? *Although no private right of action, does provide support for UDAP claims (per se violations)

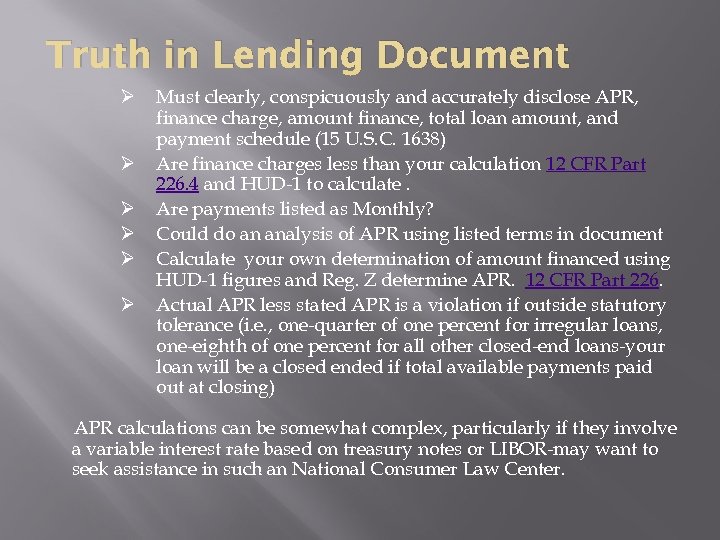

Truth in Lending Document Ø Ø Ø Must clearly, conspicuously and accurately disclose APR, finance charge, amount finance, total loan amount, and payment schedule (15 U. S. C. 1638) Are finance charges less than your calculation 12 CFR Part 226. 4 and HUD-1 to calculate. Are payments listed as Monthly? Could do an analysis of APR using listed terms in document Calculate your own determination of amount financed using HUD-1 figures and Reg. Z determine APR. 12 CFR Part 226. Actual APR less stated APR is a violation if outside statutory tolerance (i. e. , one-quarter of one percent for irregular loans, one-eighth of one percent for all other closed-end loans-your loan will be a closed ended if total available payments paid out at closing) APR calculations can be somewhat complex, particularly if they involve a variable interest rate based on treasury notes or LIBOR-may want to seek assistance in such an National Consumer Law Center.

Truth in Lending Document Ø Ø Ø Must clearly, conspicuously and accurately disclose APR, finance charge, amount finance, total loan amount, and payment schedule (15 U. S. C. 1638) Are finance charges less than your calculation 12 CFR Part 226. 4 and HUD-1 to calculate. Are payments listed as Monthly? Could do an analysis of APR using listed terms in document Calculate your own determination of amount financed using HUD-1 figures and Reg. Z determine APR. 12 CFR Part 226. Actual APR less stated APR is a violation if outside statutory tolerance (i. e. , one-quarter of one percent for irregular loans, one-eighth of one percent for all other closed-end loans-your loan will be a closed ended if total available payments paid out at closing) APR calculations can be somewhat complex, particularly if they involve a variable interest rate based on treasury notes or LIBOR-may want to seek assistance in such an National Consumer Law Center.

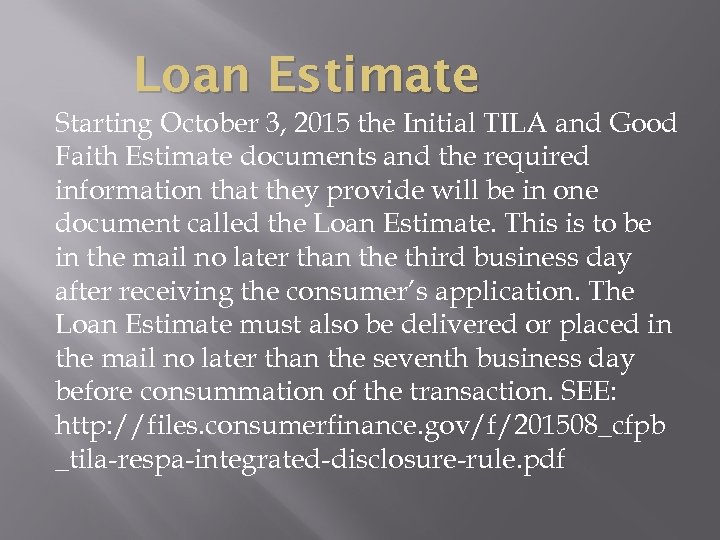

Loan Estimate Starting October 3, 2015 the Initial TILA and Good Faith Estimate documents and the required information that they provide will be in one document called the Loan Estimate. This is to be in the mail no later than the third business day after receiving the consumer’s application. The Loan Estimate must also be delivered or placed in the mail no later than the seventh business day before consummation of the transaction. SEE: http: //files. consumerfinance. gov/f/201508_cfpb _tila-respa-integrated-disclosure-rule. pdf

Loan Estimate Starting October 3, 2015 the Initial TILA and Good Faith Estimate documents and the required information that they provide will be in one document called the Loan Estimate. This is to be in the mail no later than the third business day after receiving the consumer’s application. The Loan Estimate must also be delivered or placed in the mail no later than the seventh business day before consummation of the transaction. SEE: http: //files. consumerfinance. gov/f/201508_cfpb _tila-respa-integrated-disclosure-rule. pdf

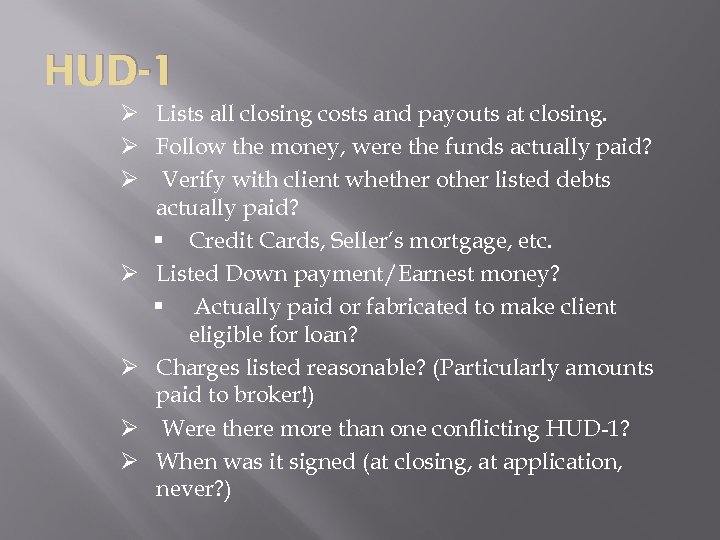

HUD-1 Ø Lists all closing costs and payouts at closing. Ø Follow the money, were the funds actually paid? Ø Verify with client whether other listed debts actually paid? § Credit Cards, Seller’s mortgage, etc. Ø Listed Down payment/Earnest money? § Actually paid or fabricated to make client eligible for loan? Ø Charges listed reasonable? (Particularly amounts paid to broker!) Ø Were there more than one conflicting HUD-1? Ø When was it signed (at closing, at application, never? )

HUD-1 Ø Lists all closing costs and payouts at closing. Ø Follow the money, were the funds actually paid? Ø Verify with client whether other listed debts actually paid? § Credit Cards, Seller’s mortgage, etc. Ø Listed Down payment/Earnest money? § Actually paid or fabricated to make client eligible for loan? Ø Charges listed reasonable? (Particularly amounts paid to broker!) Ø Were there more than one conflicting HUD-1? Ø When was it signed (at closing, at application, never? )

Closing Disclosure Starting October 3, 2015 the HUD-1 and Final TILA disclosures will be in one document called the Closing Disclosure. This is now required to be provided Three Business days before closing—all days except Sunday and 10 Federal Holidays). (Lender keep for Five Years) It also requires more disclosures. For example it provides a page that summarizes mortgage terms in plain language. For more information go to: http: //files. consumerfinance. gov/f/201508_cfpb _tila-respa-integrated-disclosure-rule. pdf

Closing Disclosure Starting October 3, 2015 the HUD-1 and Final TILA disclosures will be in one document called the Closing Disclosure. This is now required to be provided Three Business days before closing—all days except Sunday and 10 Federal Holidays). (Lender keep for Five Years) It also requires more disclosures. For example it provides a page that summarizes mortgage terms in plain language. For more information go to: http: //files. consumerfinance. gov/f/201508_cfpb _tila-respa-integrated-disclosure-rule. pdf

Notice of Right to Cancel (TILA 15 U. S. C. 1635) Ø Is this a refinance? Ø Was the closing within the last three years? Ø If yes, then: v Were two copies provided for each borrower? (Client should have been provided all copies in closing documents) v Proper form? (one for new lender, one for same lender) v Was the listed cancellation date 3 days after closing? (including Saturday-excluding Sunday and Holidays)

Notice of Right to Cancel (TILA 15 U. S. C. 1635) Ø Is this a refinance? Ø Was the closing within the last three years? Ø If yes, then: v Were two copies provided for each borrower? (Client should have been provided all copies in closing documents) v Proper form? (one for new lender, one for same lender) v Was the listed cancellation date 3 days after closing? (including Saturday-excluding Sunday and Holidays)

Notice of Right to. Cancel: Continued If either of the above two apply your client has a right to rescind the loan provided written notice is given within 3 years. --Security interest in property is voided and client’s obligation t o pay finance and other charges eliminated. --Creditor or Assignee has 20 days to refund or credit the amounts paid(including any money given to 3 rd party) and to take steps to void the security interest. --Then client must tender back money or property --Can be a complete defense to foreclosure --Statutory damages of $2, 000 to $4, 000 for failure to respond *****Rebuttable presumption even if client signed receipt*******

Notice of Right to. Cancel: Continued If either of the above two apply your client has a right to rescind the loan provided written notice is given within 3 years. --Security interest in property is voided and client’s obligation t o pay finance and other charges eliminated. --Creditor or Assignee has 20 days to refund or credit the amounts paid(including any money given to 3 rd party) and to take steps to void the security interest. --Then client must tender back money or property --Can be a complete defense to foreclosure --Statutory damages of $2, 000 to $4, 000 for failure to respond *****Rebuttable presumption even if client signed receipt*******

NOTE 1. Represents the Debt; 2. Usually considered a Negotiable Instrument under the U. C. C. ; 3. If not a negotiable instrument, is a contract subject to contract principles( Note defines itself as not being a negotiable instrument); 4. Typically has a waiver of Notice; 5. Is what allows for personal money damage suit;

NOTE 1. Represents the Debt; 2. Usually considered a Negotiable Instrument under the U. C. C. ; 3. If not a negotiable instrument, is a contract subject to contract principles( Note defines itself as not being a negotiable instrument); 4. Typically has a waiver of Notice; 5. Is what allows for personal money damage suit;

Note Continued: 1. Does client have a copy, does the lender? 2. Who signed it? 3. Did client understand terms? 4. Significantly different than application? 5. Balloon payment? 6. Pre-payment penalties during first rate adjustment?

Note Continued: 1. Does client have a copy, does the lender? 2. Who signed it? 3. Did client understand terms? 4. Significantly different than application? 5. Balloon payment? 6. Pre-payment penalties during first rate adjustment?

MORTGAGE 1. Generally Contains Notice and Opportunity to Cure as a condition precedent to filing a foreclosure. This is usually in Paragraph 22; and Right to Reinstate after Acceleration (usually Paragraph 19) 2. Represents an Interest in Land, which triggers Statute of Frauds and Notary Requirements (but Court really doesn’t care if transferred in writing “equitable assignment of mortgage”—PHH Mortgage Corp. v. Unknown Heirs of Cox, 2013 Ohio-4614 (2 nd Dist. ); 3. Provides the Foreclosure remedy

MORTGAGE 1. Generally Contains Notice and Opportunity to Cure as a condition precedent to filing a foreclosure. This is usually in Paragraph 22; and Right to Reinstate after Acceleration (usually Paragraph 19) 2. Represents an Interest in Land, which triggers Statute of Frauds and Notary Requirements (but Court really doesn’t care if transferred in writing “equitable assignment of mortgage”—PHH Mortgage Corp. v. Unknown Heirs of Cox, 2013 Ohio-4614 (2 nd Dist. ); 3. Provides the Foreclosure remedy

MORTGAGE ASSIGNMENT 1. IS THERE ONE? ? 2. Who is it from? MERS? 2. Is it Notarized? 3. Who signed the Assignment and the Notary? 4. Are they robo-signers?

MORTGAGE ASSIGNMENT 1. IS THERE ONE? ? 2. Who is it from? MERS? 2. Is it Notarized? 3. Who signed the Assignment and the Notary? 4. Are they robo-signers?

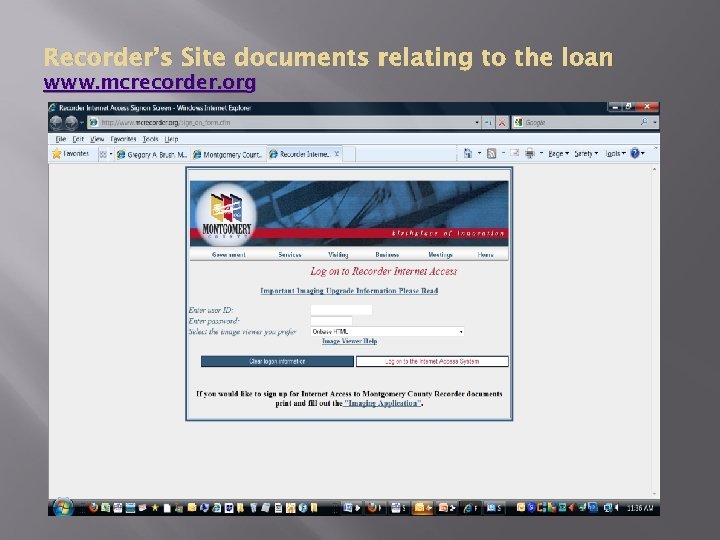

Recorder’s Site documents relating to the loan www. mcrecorder. org

Recorder’s Site documents relating to the loan www. mcrecorder. org

Recorder’s site-continued Here you don’t need password or I. D. to access images 2) Don’t rely upon lender’s title check a) Client who had only 50% interest b) Client whose $175, 000 mortgage was released 3) Evaluate all current mortgages associated with property…. 1) Were they released? 2) Current mortgage assignments? 3) Property in name of Client…other owners? 4) Check for flipping scheme. 1)

Recorder’s site-continued Here you don’t need password or I. D. to access images 2) Don’t rely upon lender’s title check a) Client who had only 50% interest b) Client whose $175, 000 mortgage was released 3) Evaluate all current mortgages associated with property…. 1) Were they released? 2) Current mortgage assignments? 3) Property in name of Client…other owners? 4) Check for flipping scheme. 1)

Client as a resource 1) Get the client’s story a) Review details of loan (and if purchase, how found home) , what was told to client, was the closing at their home, late at night, what documents were provided ? b) Get the details of the closing, who was there, when did it occur, and where, was anything explained, were any representations made (don’t worry about the interest rate increasing, we’ll refinance you in two years). c) Review the application and the HUD-1 with client. Are the figures correct? Was there a down payment listed when none was paid? d) Did the client think they were mislead and why?

Client as a resource 1) Get the client’s story a) Review details of loan (and if purchase, how found home) , what was told to client, was the closing at their home, late at night, what documents were provided ? b) Get the details of the closing, who was there, when did it occur, and where, was anything explained, were any representations made (don’t worry about the interest rate increasing, we’ll refinance you in two years). c) Review the application and the HUD-1 with client. Are the figures correct? Was there a down payment listed when none was paid? d) Did the client think they were mislead and why?

Client as a resource: continued Suggest client start paying into IOLTA-good graces with the judge f) Has the client attempted any resolution with lender? (Modification, forbearance, etc. ? ) g) Is there a pending modification application, and if not should there be? (HAMP? ? If so pending application should have stayed filing of foreclosure ) h) Has client filed bankruptcy, what type and when? Discharge or dismissed? i) Have client contact lender title company and mortgage broker for copies of closing and compare. e)

Client as a resource: continued Suggest client start paying into IOLTA-good graces with the judge f) Has the client attempted any resolution with lender? (Modification, forbearance, etc. ? ) g) Is there a pending modification application, and if not should there be? (HAMP? ? If so pending application should have stayed filing of foreclosure ) h) Has client filed bankruptcy, what type and when? Discharge or dismissed? i) Have client contact lender title company and mortgage broker for copies of closing and compare. e)

Client continued 1. What are the Homeowner’s goals? >Keep Home? >Stay as long as possible? >Leave as soon as possible? 2. What is the Client’s opinion about the Fair Market Value of their home? 3. What is the condition of their home? 4. What is the condition of their neighborhood? 5. Has any homes sold recently on their street?

Client continued 1. What are the Homeowner’s goals? >Keep Home? >Stay as long as possible? >Leave as soon as possible? 2. What is the Client’s opinion about the Fair Market Value of their home? 3. What is the condition of their home? 4. What is the condition of their neighborhood? 5. Has any homes sold recently on their street?

FAIR MARKET VALUE OF HOME 1. 2. 3. Knowing this can help form the homeowner’s goals. Can help determine what options the homeowner may have. Determines what consequences a homeowner may face if a foreclosure judgment is entered.

FAIR MARKET VALUE OF HOME 1. 2. 3. Knowing this can help form the homeowner’s goals. Can help determine what options the homeowner may have. Determines what consequences a homeowner may face if a foreclosure judgment is entered.

Where to Look 1. 2. 3. 4. Client; Internet searches for values: www. zillow. com; www. realtor. com; www. realistate. yahoo. com/homevalues; www. trulia. com Google Map of area Tax Assessed Value

Where to Look 1. 2. 3. 4. Client; Internet searches for values: www. zillow. com; www. realtor. com; www. realistate. yahoo. com/homevalues; www. trulia. com Google Map of area Tax Assessed Value

Auditor’s Site www. mcrecorder. org

Auditor’s Site www. mcrecorder. org

Auditor’s site-continued 1) 2) 3) 4) 5) Provides 10 year history of tax assessed value, providing rough idea of value at time of loan. Provides information as to parcel number to focus recorder search Provides photo of house-verify this is the property with client. Are taxes being paid if escrowed? How to contest tax assessed value.

Auditor’s site-continued 1) 2) 3) 4) 5) Provides 10 year history of tax assessed value, providing rough idea of value at time of loan. Provides information as to parcel number to focus recorder search Provides photo of house-verify this is the property with client. Are taxes being paid if escrowed? How to contest tax assessed value.

Legal Claims and Defenses:

Legal Claims and Defenses:

Standing ) (and other amazing magic acts

Standing ) (and other amazing magic acts

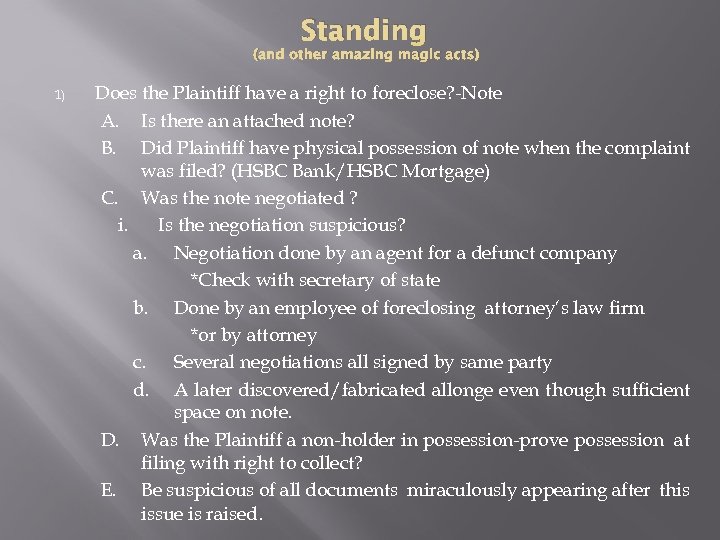

Standing (and other amazing magic acts) 1) Does the Plaintiff have a right to foreclose? -Note A. Is there an attached note? B. Did Plaintiff have physical possession of note when the complaint was filed? (HSBC Bank/HSBC Mortgage) C. Was the note negotiated ? i. Is the negotiation suspicious? a. Negotiation done by an agent for a defunct company *Check with secretary of state b. Done by an employee of foreclosing attorney’s law firm *or by attorney c. Several negotiations all signed by same party d. A later discovered/fabricated allonge even though sufficient space on note. D. Was the Plaintiff a non-holder in possession-prove possession at filing with right to collect? E. Be suspicious of all documents miraculously appearing after this issue is raised.

Standing (and other amazing magic acts) 1) Does the Plaintiff have a right to foreclose? -Note A. Is there an attached note? B. Did Plaintiff have physical possession of note when the complaint was filed? (HSBC Bank/HSBC Mortgage) C. Was the note negotiated ? i. Is the negotiation suspicious? a. Negotiation done by an agent for a defunct company *Check with secretary of state b. Done by an employee of foreclosing attorney’s law firm *or by attorney c. Several negotiations all signed by same party d. A later discovered/fabricated allonge even though sufficient space on note. D. Was the Plaintiff a non-holder in possession-prove possession at filing with right to collect? E. Be suspicious of all documents miraculously appearing after this issue is raised.

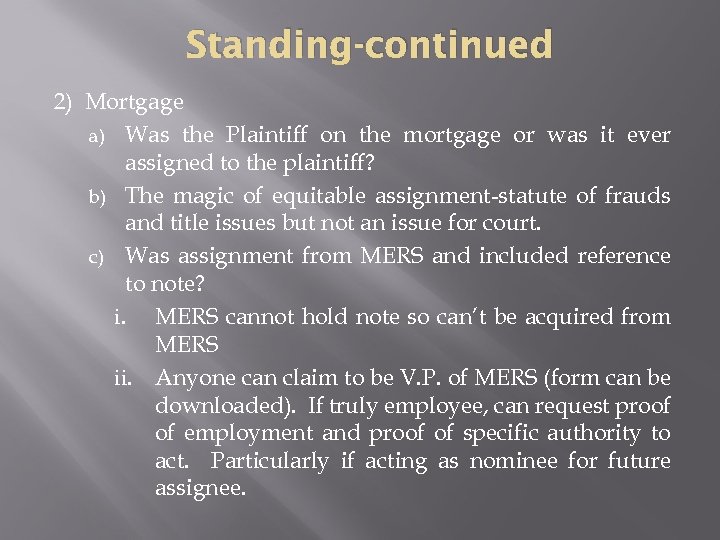

Standing-continued 2) Mortgage a) Was the Plaintiff on the mortgage or was it ever assigned to the plaintiff? b) The magic of equitable assignment-statute of frauds and title issues but not an issue for court. c) Was assignment from MERS and included reference to note? i. MERS cannot hold note so can’t be acquired from MERS ii. Anyone can claim to be V. P. of MERS (form can be downloaded). If truly employee, can request proof of employment and proof of specific authority to act. Particularly if acting as nominee for future assignee.

Standing-continued 2) Mortgage a) Was the Plaintiff on the mortgage or was it ever assigned to the plaintiff? b) The magic of equitable assignment-statute of frauds and title issues but not an issue for court. c) Was assignment from MERS and included reference to note? i. MERS cannot hold note so can’t be acquired from MERS ii. Anyone can claim to be V. P. of MERS (form can be downloaded). If truly employee, can request proof of employment and proof of specific authority to act. Particularly if acting as nominee for future assignee.

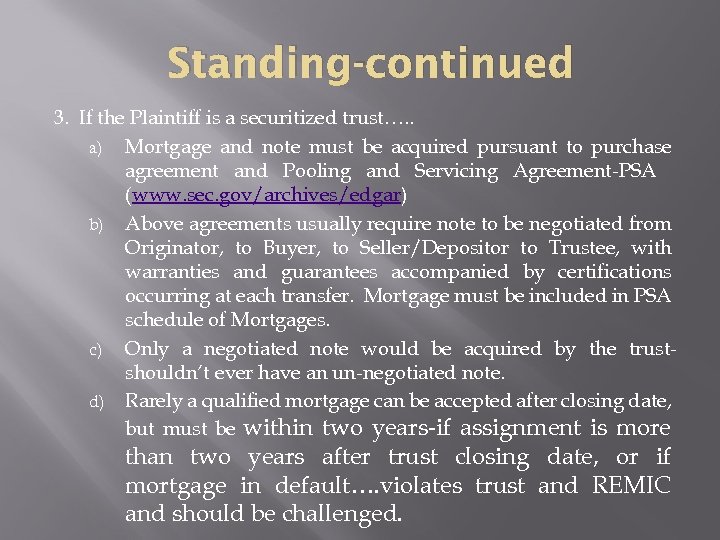

Standing-continued 3. If the Plaintiff is a securitized trust…. . a) Mortgage and note must be acquired pursuant to purchase agreement and Pooling and Servicing Agreement-PSA (www. sec. gov/archives/edgar) b) Above agreements usually require note to be negotiated from Originator, to Buyer, to Seller/Depositor to Trustee, with warranties and guarantees accompanied by certifications occurring at each transfer. Mortgage must be included in PSA schedule of Mortgages. c) Only a negotiated note would be acquired by the trustshouldn’t ever have an un-negotiated note. d) Rarely a qualified mortgage can be accepted after closing date, but must be within two years-if assignment is more than two years after trust closing date, or if mortgage in default…. violates trust and REMIC and should be challenged.

Standing-continued 3. If the Plaintiff is a securitized trust…. . a) Mortgage and note must be acquired pursuant to purchase agreement and Pooling and Servicing Agreement-PSA (www. sec. gov/archives/edgar) b) Above agreements usually require note to be negotiated from Originator, to Buyer, to Seller/Depositor to Trustee, with warranties and guarantees accompanied by certifications occurring at each transfer. Mortgage must be included in PSA schedule of Mortgages. c) Only a negotiated note would be acquired by the trustshouldn’t ever have an un-negotiated note. d) Rarely a qualified mortgage can be accepted after closing date, but must be within two years-if assignment is more than two years after trust closing date, or if mortgage in default…. violates trust and REMIC and should be challenged.

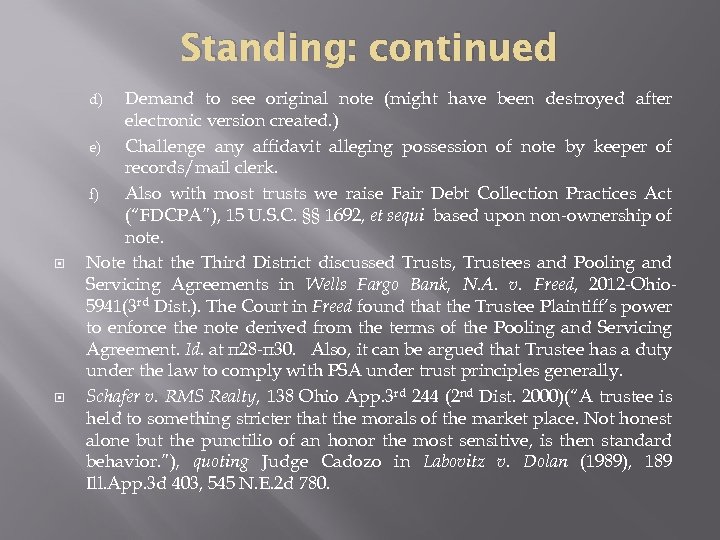

Standing: continued Demand to see original note (might have been destroyed after electronic version created. ) e) Challenge any affidavit alleging possession of note by keeper of records/mail clerk. f) Also with most trusts we raise Fair Debt Collection Practices Act (“FDCPA”), 15 U. S. C. §§ 1692, et sequi based upon non-ownership of note. Note that the Third District discussed Trusts, Trustees and Pooling and Servicing Agreements in Wells Fargo Bank, N. A. v. Freed, 2012 -Ohio 5941(3 rd Dist. ). The Court in Freed found that the Trustee Plaintiff’s power to enforce the note derived from the terms of the Pooling and Servicing Agreement. Id. at π28 -π30. Also, it can be argued that Trustee has a duty under the law to comply with PSA under trust principles generally. Schafer v. RMS Realty, 138 Ohio App. 3 rd 244 (2 nd Dist. 2000)(“A trustee is held to something stricter that the morals of the market place. Not honest alone but the punctilio of an honor the most sensitive, is then standard behavior. ”), quoting Judge Cadozo in Labovitz v. Dolan (1989), 189 Ill. App. 3 d 403, 545 N. E. 2 d 780. d)

Standing: continued Demand to see original note (might have been destroyed after electronic version created. ) e) Challenge any affidavit alleging possession of note by keeper of records/mail clerk. f) Also with most trusts we raise Fair Debt Collection Practices Act (“FDCPA”), 15 U. S. C. §§ 1692, et sequi based upon non-ownership of note. Note that the Third District discussed Trusts, Trustees and Pooling and Servicing Agreements in Wells Fargo Bank, N. A. v. Freed, 2012 -Ohio 5941(3 rd Dist. ). The Court in Freed found that the Trustee Plaintiff’s power to enforce the note derived from the terms of the Pooling and Servicing Agreement. Id. at π28 -π30. Also, it can be argued that Trustee has a duty under the law to comply with PSA under trust principles generally. Schafer v. RMS Realty, 138 Ohio App. 3 rd 244 (2 nd Dist. 2000)(“A trustee is held to something stricter that the morals of the market place. Not honest alone but the punctilio of an honor the most sensitive, is then standard behavior. ”), quoting Judge Cadozo in Labovitz v. Dolan (1989), 189 Ill. App. 3 d 403, 545 N. E. 2 d 780. d)

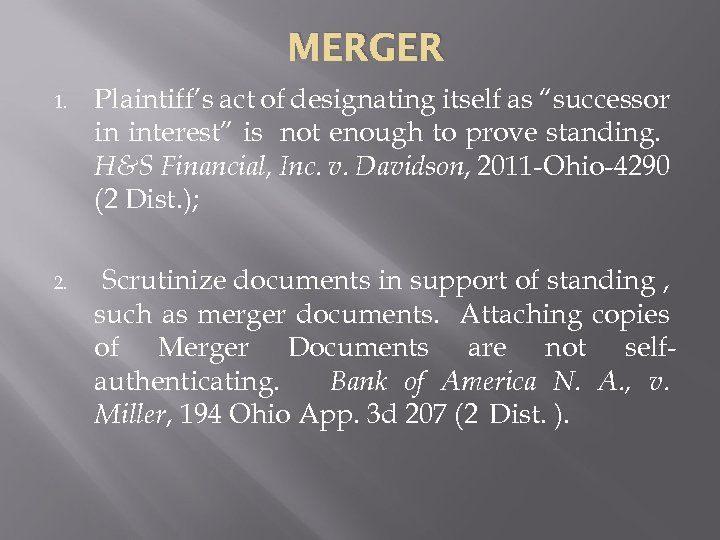

MERGER 1. Plaintiff’s act of designating itself as “successor in interest” is not enough to prove standing. H&S Financial, Inc. v. Davidson, 2011 -Ohio-4290 (2 Dist. ); 2. Scrutinize documents in support of standing , such as merger documents. Attaching copies of Merger Documents are not selfauthenticating. Bank of America N. A. , v. Miller, 194 Ohio App. 3 d 207 (2 Dist. ).

MERGER 1. Plaintiff’s act of designating itself as “successor in interest” is not enough to prove standing. H&S Financial, Inc. v. Davidson, 2011 -Ohio-4290 (2 Dist. ); 2. Scrutinize documents in support of standing , such as merger documents. Attaching copies of Merger Documents are not selfauthenticating. Bank of America N. A. , v. Miller, 194 Ohio App. 3 d 207 (2 Dist. ).

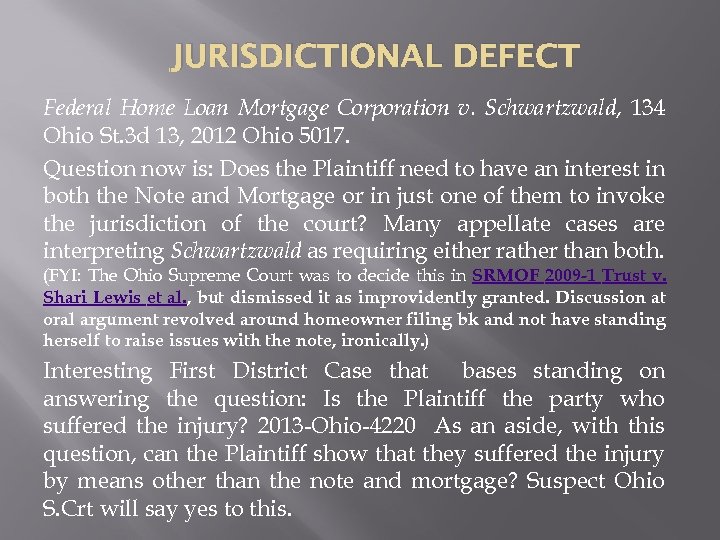

JURISDICTIONAL DEFECT Federal Home Loan Mortgage Corporation v. Schwartzwald, 134 Ohio St. 3 d 13, 2012 Ohio 5017. Question now is: Does the Plaintiff need to have an interest in both the Note and Mortgage or in just one of them to invoke the jurisdiction of the court? Many appellate cases are interpreting Schwartzwald as requiring either rather than both. (FYI: The Ohio Supreme Court was to decide this in SRMOF 2009 -1 Trust v. Shari Lewis et al. , but dismissed it as improvidently granted. Discussion at oral argument revolved around homeowner filing bk and not have standing herself to raise issues with the note, ironically. ) Interesting First District Case that bases standing on answering the question: Is the Plaintiff the party who suffered the injury? 2013 -Ohio-4220 As an aside, with this question, can the Plaintiff show that they suffered the injury by means other than the note and mortgage? Suspect Ohio S. Crt will say yes to this.

JURISDICTIONAL DEFECT Federal Home Loan Mortgage Corporation v. Schwartzwald, 134 Ohio St. 3 d 13, 2012 Ohio 5017. Question now is: Does the Plaintiff need to have an interest in both the Note and Mortgage or in just one of them to invoke the jurisdiction of the court? Many appellate cases are interpreting Schwartzwald as requiring either rather than both. (FYI: The Ohio Supreme Court was to decide this in SRMOF 2009 -1 Trust v. Shari Lewis et al. , but dismissed it as improvidently granted. Discussion at oral argument revolved around homeowner filing bk and not have standing herself to raise issues with the note, ironically. ) Interesting First District Case that bases standing on answering the question: Is the Plaintiff the party who suffered the injury? 2013 -Ohio-4220 As an aside, with this question, can the Plaintiff show that they suffered the injury by means other than the note and mortgage? Suspect Ohio S. Crt will say yes to this.

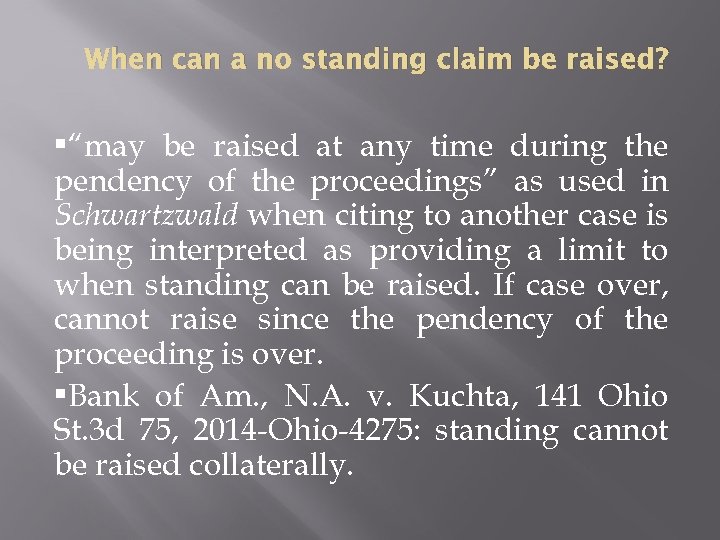

When can a no standing claim be raised? • “may be raised at any time during the pendency of the proceedings” as used in Schwartzwald when citing to another case is being interpreted as providing a limit to when standing can be raised. If case over, cannot raise since the pendency of the proceeding is over. • Bank of Am. , N. A. v. Kuchta, 141 Ohio St. 3 d 75, 2014 -Ohio-4275: standing cannot be raised collaterally.

When can a no standing claim be raised? • “may be raised at any time during the pendency of the proceedings” as used in Schwartzwald when citing to another case is being interpreted as providing a limit to when standing can be raised. If case over, cannot raise since the pendency of the proceeding is over. • Bank of Am. , N. A. v. Kuchta, 141 Ohio St. 3 d 75, 2014 -Ohio-4275: standing cannot be raised collaterally.

CAUSE OF ACTION BASED ON THE DEBT FAIR DEBT COLLECTION PRACTICES ACT

CAUSE OF ACTION BASED ON THE DEBT FAIR DEBT COLLECTION PRACTICES ACT

FDCPA COUNTERCLAIM 15 U. S. C. 1692 Glazer v. Chase Home Finance, 704 F. 3 d 453, 461 (6 th Cir. 2013) (Foreclosure is debt collection) If cannot show have right to collect note debt and to request foreclosure, allege: At all times material, Plaintiff is a “debt collector” as the term is defined under 15 U. S. C. § 1692 a(6 ); And at all material times, the Note debt is a “debt” as defined under 15 U. S. C. § 1692 a(5); Plaintiff violated the Fair Debt Collection Practices Act when it filed a Complaint in Foreclosure against the [homeowner] because it is threatening to take a legal action that it cannot legally take. 15 U. S. C. § 1692(e)(5). Plaintiff does not have the legal right to collect on the Note debt and to Foreclose; Put facts in, example of facts:

FDCPA COUNTERCLAIM 15 U. S. C. 1692 Glazer v. Chase Home Finance, 704 F. 3 d 453, 461 (6 th Cir. 2013) (Foreclosure is debt collection) If cannot show have right to collect note debt and to request foreclosure, allege: At all times material, Plaintiff is a “debt collector” as the term is defined under 15 U. S. C. § 1692 a(6 ); And at all material times, the Note debt is a “debt” as defined under 15 U. S. C. § 1692 a(5); Plaintiff violated the Fair Debt Collection Practices Act when it filed a Complaint in Foreclosure against the [homeowner] because it is threatening to take a legal action that it cannot legally take. 15 U. S. C. § 1692(e)(5). Plaintiff does not have the legal right to collect on the Note debt and to Foreclose; Put facts in, example of facts:

FDCPA COUNTERCLAIM: Continued In order to collect on the Note debt and to bring a foreclosure action, the Plaintiff must be entitled to enforce the Note and have an interest in the Mortgage; Here, Plaintiff is not entitled to enforce the Note and does not have an interest in the Mortgage; Plaintiff is not the Note holder and is not the Mortgagee as it alleges; To be a Note holder, the Plaintiff must have possession of the original Note, along with an endorsement; [Homeowner] has never executed a Note in favor of Plaintiff and the Note has never been endorsed in blank or specifically to Plaintiff; Also, Plaintiff is not the Mortgagee; [Homeowner] has never executed a Mortgage in favor of the Plaintiff and Plaintiff has never received an interest in the Mortgage;

FDCPA COUNTERCLAIM: Continued In order to collect on the Note debt and to bring a foreclosure action, the Plaintiff must be entitled to enforce the Note and have an interest in the Mortgage; Here, Plaintiff is not entitled to enforce the Note and does not have an interest in the Mortgage; Plaintiff is not the Note holder and is not the Mortgagee as it alleges; To be a Note holder, the Plaintiff must have possession of the original Note, along with an endorsement; [Homeowner] has never executed a Note in favor of Plaintiff and the Note has never been endorsed in blank or specifically to Plaintiff; Also, Plaintiff is not the Mortgagee; [Homeowner] has never executed a Mortgage in favor of the Plaintiff and Plaintiff has never received an interest in the Mortgage;

FDCPA COUNTERCLAIM: Continued The chain of Mortgage Assignments was not signed by an authorized party and contains a defective acknowledgment; The Statute of Frauds requires that an interest in land be transferred in writing and signed by an authorized party; A Mortgage is an interest in land; Any attempted transfer of land that violates the Statute of Frauds is void; Ohio law requires that any granting of a mortgage interest be acknowledged by a Notary Public. Ohio Rev. Stat. § 5301. 01 (2008); Homeowner is entitled to an award of actual damages plus up to $1, 000, to an award of costs, attorney fees, and punitive. 15 U. S. C. § 1692(k); Mc. Collough v. Johnson, Rodenburg, & Lauinger, L. L. C. , 637 F. 3 d 939 (9 Cir. 2011).

FDCPA COUNTERCLAIM: Continued The chain of Mortgage Assignments was not signed by an authorized party and contains a defective acknowledgment; The Statute of Frauds requires that an interest in land be transferred in writing and signed by an authorized party; A Mortgage is an interest in land; Any attempted transfer of land that violates the Statute of Frauds is void; Ohio law requires that any granting of a mortgage interest be acknowledged by a Notary Public. Ohio Rev. Stat. § 5301. 01 (2008); Homeowner is entitled to an award of actual damages plus up to $1, 000, to an award of costs, attorney fees, and punitive. 15 U. S. C. § 1692(k); Mc. Collough v. Johnson, Rodenburg, & Lauinger, L. L. C. , 637 F. 3 d 939 (9 Cir. 2011).

DAMAGES EMOTIONAL DISTRESS IS ACTUAL DAMAGES: RECENT 9 TH CIRCUIT CASE JURY AWARDED PLAINTIFF $250, 000 Here: Mc. Collough testified as to the adverse impact of being sued by JRL, including the anxiety, stress, and anger that he felt and the "down time" and severe headaches that he suffered as a result. Mc. Collough testified that the lawsuit JRL prosecuted against him "definitely" caused him anxiety, increasing his temper, pain, adrenaline, and conflict with his wife. Mc. Collough acknowledged his disabling pre-existing condition but characterized the impact of JRL's lawsuit on him as "the straw that broke the camel's back. " He thought that the lawsuit was "frivolous" and "an insult, " and that he was "being shoved around. " We thus must conclude that the award was not based on speculation and guesswork, but rather on the jury's valuation of Mc. Collough's emotional distress. Think how would show this damage to jury—have to have client start documenting and may have to hire expert to show emotional damages(this costs $)

DAMAGES EMOTIONAL DISTRESS IS ACTUAL DAMAGES: RECENT 9 TH CIRCUIT CASE JURY AWARDED PLAINTIFF $250, 000 Here: Mc. Collough testified as to the adverse impact of being sued by JRL, including the anxiety, stress, and anger that he felt and the "down time" and severe headaches that he suffered as a result. Mc. Collough testified that the lawsuit JRL prosecuted against him "definitely" caused him anxiety, increasing his temper, pain, adrenaline, and conflict with his wife. Mc. Collough acknowledged his disabling pre-existing condition but characterized the impact of JRL's lawsuit on him as "the straw that broke the camel's back. " He thought that the lawsuit was "frivolous" and "an insult, " and that he was "being shoved around. " We thus must conclude that the award was not based on speculation and guesswork, but rather on the jury's valuation of Mc. Collough's emotional distress. Think how would show this damage to jury—have to have client start documenting and may have to hire expert to show emotional damages(this costs $)

DEFENSES BASED ON MORTGAGE 1. Failure to provide notice of default and opportunity to cure (if in mortgage terms) (condition precedent) 2. Statute of Frauds bars Plaintiff from attempting to enforce Mortgage it does not have an interest in writing and signed by an authorized party(not a winner). 3. If married couple and one spouse is not on the Note, did both sign the Mortgage? If did not, then spouse who did not sign would not have a lien on their dower right/legal right(if both on deed) 4. Don’t just go along with Plaintiff’s request to Reform Mortgage. Look at case law and facts of situation first. 5. Right to Reinstate (if in terms) (Contract Violation)

DEFENSES BASED ON MORTGAGE 1. Failure to provide notice of default and opportunity to cure (if in mortgage terms) (condition precedent) 2. Statute of Frauds bars Plaintiff from attempting to enforce Mortgage it does not have an interest in writing and signed by an authorized party(not a winner). 3. If married couple and one spouse is not on the Note, did both sign the Mortgage? If did not, then spouse who did not sign would not have a lien on their dower right/legal right(if both on deed) 4. Don’t just go along with Plaintiff’s request to Reform Mortgage. Look at case law and facts of situation first. 5. Right to Reinstate (if in terms) (Contract Violation)

NOTE AND MORTGAGE ARE CONTRACTS NEED TO RAISE CONTRACT DEFENSES Who is entitled to enforce contract? Read the Note and Mortgage terms. Did Plaintiff Mitigate its Damages? 1. 2. 3.

NOTE AND MORTGAGE ARE CONTRACTS NEED TO RAISE CONTRACT DEFENSES Who is entitled to enforce contract? Read the Note and Mortgage terms. Did Plaintiff Mitigate its Damages? 1. 2. 3.

FORECLOSURE DEFENSES TO SERVICER RUN AROUND Principles of Equity bar foreclosure action Foreclosure two step process: 1) default on obligation; and 2) consider equity of the situation in order to decide of foreclosure is appropriate. PHH Mortgage Corporation v. Barker, 190 Ohio App. 3 d 71 (Ohio App. 3 Dist. 2010) Court upheld trial court’s use of equitable principles to reinstatement of homeowner’s loan, because the homeowner made a good faith effort to reinstate, but Plaintiff obfuscated the situation making it impossible for the homeowners to do so. *Others: Contract violations, Estoppel, and Unjust Enrichment

FORECLOSURE DEFENSES TO SERVICER RUN AROUND Principles of Equity bar foreclosure action Foreclosure two step process: 1) default on obligation; and 2) consider equity of the situation in order to decide of foreclosure is appropriate. PHH Mortgage Corporation v. Barker, 190 Ohio App. 3 d 71 (Ohio App. 3 Dist. 2010) Court upheld trial court’s use of equitable principles to reinstatement of homeowner’s loan, because the homeowner made a good faith effort to reinstate, but Plaintiff obfuscated the situation making it impossible for the homeowners to do so. *Others: Contract violations, Estoppel, and Unjust Enrichment

GOVERNMENT INSURED OR GUARANTEED LOAN DEFENSES: 1. National Fair Housing Goals, 42 U. S. C. § 1441 “the realization as soon as feasible of the goal of a decent home and a suitable living environment for every American family. . . ” 2. Federal Housing Administration, Rural Housing Service, and Veteran’s Administration loans all have loss mitigation regulations that must be followed. Failure to follow these results in the plaintiff failing to comply with a condition precedent and the case must be dismissed. Example is FHA’s face to face requirement. But note that regulations that are incorporated into the Note and Mortgage are the only one the Court will recognize and enforce. Would need to use a Notice of Error letter for the others.

GOVERNMENT INSURED OR GUARANTEED LOAN DEFENSES: 1. National Fair Housing Goals, 42 U. S. C. § 1441 “the realization as soon as feasible of the goal of a decent home and a suitable living environment for every American family. . . ” 2. Federal Housing Administration, Rural Housing Service, and Veteran’s Administration loans all have loss mitigation regulations that must be followed. Failure to follow these results in the plaintiff failing to comply with a condition precedent and the case must be dismissed. Example is FHA’s face to face requirement. But note that regulations that are incorporated into the Note and Mortgage are the only one the Court will recognize and enforce. Would need to use a Notice of Error letter for the others.

HAMP 1. 2. 3. 4. 5. HOME AFFORDABLE MODIFICATION PROGRAM Is Plaintiff or Servicer a TARP recipient? If yes, under HAMP regulations prevent a foreclosure from being filed if homeowner is in the process of being reviewed for a HAMP loan modification and prevents Plaintiff from going forward on Sheriff’s Sale if under HAMP review. Can use contract principles and equitable claims if fail to comply: breach of contract; promissory estoppel; intentional infliction of emotional distress. Corvello v. Wells Fargo Bank, N. A. , 9 th Circuit Federal case (August 8, 2013): If homeowner completes trial period plan, bank must offer permanent loan modification. ***Ohio courts really do not follow this though! It is all based on contract law.

HAMP 1. 2. 3. 4. 5. HOME AFFORDABLE MODIFICATION PROGRAM Is Plaintiff or Servicer a TARP recipient? If yes, under HAMP regulations prevent a foreclosure from being filed if homeowner is in the process of being reviewed for a HAMP loan modification and prevents Plaintiff from going forward on Sheriff’s Sale if under HAMP review. Can use contract principles and equitable claims if fail to comply: breach of contract; promissory estoppel; intentional infliction of emotional distress. Corvello v. Wells Fargo Bank, N. A. , 9 th Circuit Federal case (August 8, 2013): If homeowner completes trial period plan, bank must offer permanent loan modification. ***Ohio courts really do not follow this though! It is all based on contract law.

RES JUDICATA If Plaintiff has filed a foreclosure action two times before and the Plaintiff dismissed the past two foreclosures under Rule 41(A)(1), the second dismissal is considered to be dismissed with prejudice and the third action is not allowed. Exception: If homeowner “cured” the default or had the loan reinstated before third foreclosure action. U. S. Bank v. Gullotta, 899 Ohio St. 3 d 399 (Ohio 2008); Note: Plaintiffs are attempting to get around this rule by moving the Court to dismiss the foreclosure under Rule 41(A)(2). Under (A)(2), the Court is suppose to only dismiss “upon such terms and conditions as the court deems proper. ” “Proper” means Plaintiff asked, I would think.

RES JUDICATA If Plaintiff has filed a foreclosure action two times before and the Plaintiff dismissed the past two foreclosures under Rule 41(A)(1), the second dismissal is considered to be dismissed with prejudice and the third action is not allowed. Exception: If homeowner “cured” the default or had the loan reinstated before third foreclosure action. U. S. Bank v. Gullotta, 899 Ohio St. 3 d 399 (Ohio 2008); Note: Plaintiffs are attempting to get around this rule by moving the Court to dismiss the foreclosure under Rule 41(A)(2). Under (A)(2), the Court is suppose to only dismiss “upon such terms and conditions as the court deems proper. ” “Proper” means Plaintiff asked, I would think.

Due Process Claim Plaintiff’s claims are barred by the Defendants’ Constitutional right to Due Process. The Court’s facilitation of a process that allows for property to be taken away by an entity that has failed to show that it has legal right to do so, violates the homeowners’ United States Constitutional due process rights and their Ohio Constitutional Inalienable Rights. U. S. Const. am. 14; Section 1. 01, Art. I, Ohio Constitution.

Due Process Claim Plaintiff’s claims are barred by the Defendants’ Constitutional right to Due Process. The Court’s facilitation of a process that allows for property to be taken away by an entity that has failed to show that it has legal right to do so, violates the homeowners’ United States Constitutional due process rights and their Ohio Constitutional Inalienable Rights. U. S. Const. am. 14; Section 1. 01, Art. I, Ohio Constitution.

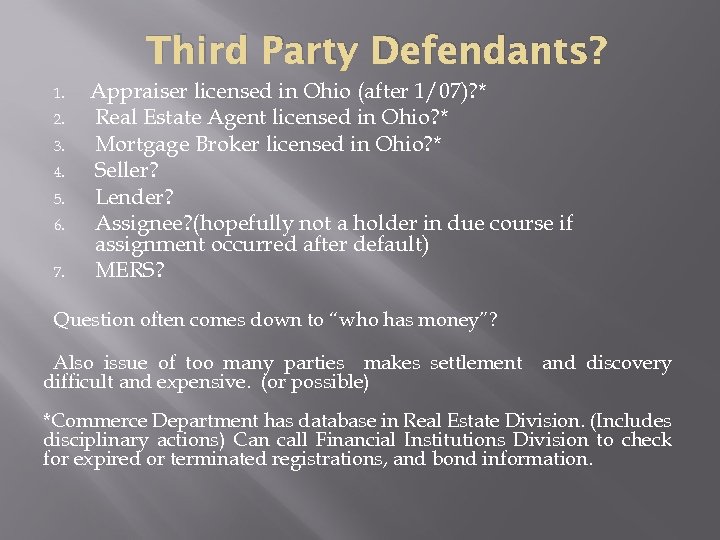

Third Party Defendants? 1. 2. 3. 4. 5. 6. 7. Appraiser licensed in Ohio (after 1/07)? * Real Estate Agent licensed in Ohio? * Mortgage Broker licensed in Ohio? * Seller? Lender? Assignee? (hopefully not a holder in due course if assignment occurred after default) MERS? Question often comes down to “who has money”? Also issue of too many parties makes settlement and discovery difficult and expensive. (or possible) *Commerce Department has database in Real Estate Division. (Includes disciplinary actions) Can call Financial Institutions Division to check for expired or terminated registrations, and bond information.

Third Party Defendants? 1. 2. 3. 4. 5. 6. 7. Appraiser licensed in Ohio (after 1/07)? * Real Estate Agent licensed in Ohio? * Mortgage Broker licensed in Ohio? * Seller? Lender? Assignee? (hopefully not a holder in due course if assignment occurred after default) MERS? Question often comes down to “who has money”? Also issue of too many parties makes settlement and discovery difficult and expensive. (or possible) *Commerce Department has database in Real Estate Division. (Includes disciplinary actions) Can call Financial Institutions Division to check for expired or terminated registrations, and bond information.

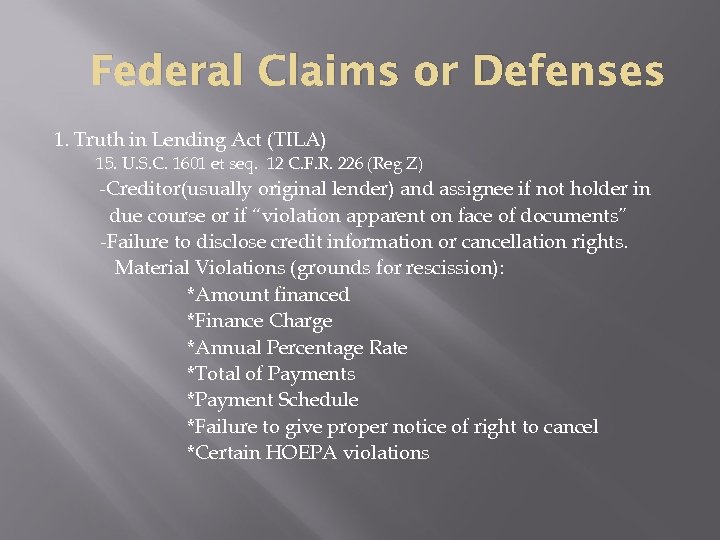

Federal Claims or Defenses 1. Truth in Lending Act (TILA) 15. U. S. C. 1601 et seq. 12 C. F. R. 226 (Reg Z) -Creditor(usually original lender) and assignee if not holder in due course or if “violation apparent on face of documents” -Failure to disclose credit information or cancellation rights. Material Violations (grounds for rescission): *Amount financed *Finance Charge *Annual Percentage Rate *Total of Payments *Payment Schedule *Failure to give proper notice of right to cancel *Certain HOEPA violations

Federal Claims or Defenses 1. Truth in Lending Act (TILA) 15. U. S. C. 1601 et seq. 12 C. F. R. 226 (Reg Z) -Creditor(usually original lender) and assignee if not holder in due course or if “violation apparent on face of documents” -Failure to disclose credit information or cancellation rights. Material Violations (grounds for rescission): *Amount financed *Finance Charge *Annual Percentage Rate *Total of Payments *Payment Schedule *Failure to give proper notice of right to cancel *Certain HOEPA violations

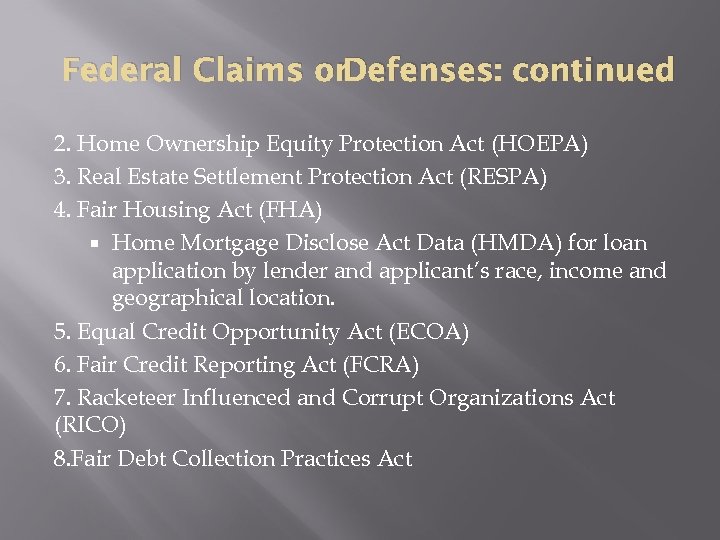

Federal Claims or Defenses: continued 2. Home Ownership Equity Protection Act (HOEPA) 3. Real Estate Settlement Protection Act (RESPA) 4. Fair Housing Act (FHA) Home Mortgage Disclose Act Data (HMDA) for loan application by lender and applicant’s race, income and geographical location. 5. Equal Credit Opportunity Act (ECOA) 6. Fair Credit Reporting Act (FCRA) 7. Racketeer Influenced and Corrupt Organizations Act (RICO) 8. Fair Debt Collection Practices Act

Federal Claims or Defenses: continued 2. Home Ownership Equity Protection Act (HOEPA) 3. Real Estate Settlement Protection Act (RESPA) 4. Fair Housing Act (FHA) Home Mortgage Disclose Act Data (HMDA) for loan application by lender and applicant’s race, income and geographical location. 5. Equal Credit Opportunity Act (ECOA) 6. Fair Credit Reporting Act (FCRA) 7. Racketeer Influenced and Corrupt Organizations Act (RICO) 8. Fair Debt Collection Practices Act

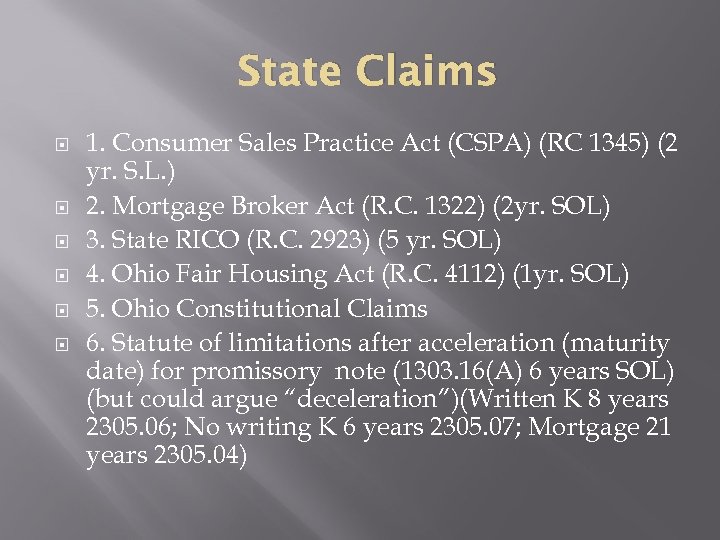

State Claims 1. Consumer Sales Practice Act (CSPA) (RC 1345) (2 yr. S. L. ) 2. Mortgage Broker Act (R. C. 1322) (2 yr. SOL) 3. State RICO (R. C. 2923) (5 yr. SOL) 4. Ohio Fair Housing Act (R. C. 4112) (1 yr. SOL) 5. Ohio Constitutional Claims 6. Statute of limitations after acceleration (maturity date) for promissory note (1303. 16(A) 6 years SOL) (but could argue “deceleration”)(Written K 8 years 2305. 06; No writing K 6 years 2305. 07; Mortgage 21 years 2305. 04)

State Claims 1. Consumer Sales Practice Act (CSPA) (RC 1345) (2 yr. S. L. ) 2. Mortgage Broker Act (R. C. 1322) (2 yr. SOL) 3. State RICO (R. C. 2923) (5 yr. SOL) 4. Ohio Fair Housing Act (R. C. 4112) (1 yr. SOL) 5. Ohio Constitutional Claims 6. Statute of limitations after acceleration (maturity date) for promissory note (1303. 16(A) 6 years SOL) (but could argue “deceleration”)(Written K 8 years 2305. 06; No writing K 6 years 2305. 07; Mortgage 21 years 2305. 04)

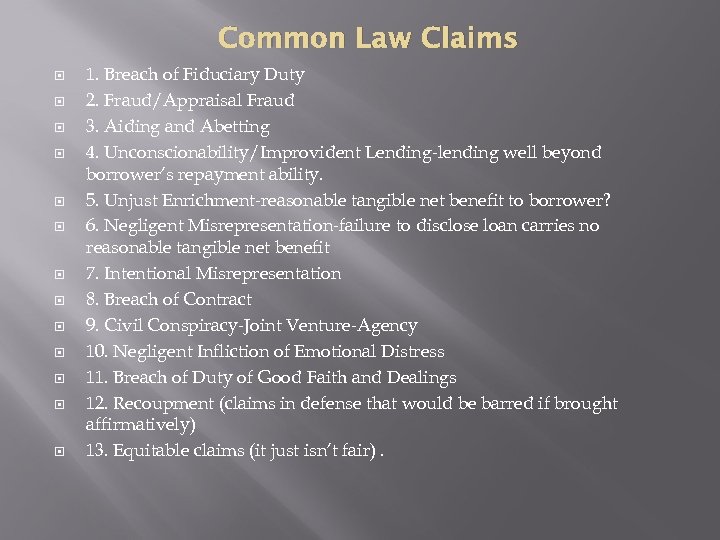

Common Law Claims 1. Breach of Fiduciary Duty 2. Fraud/Appraisal Fraud 3. Aiding and Abetting 4. Unconscionability/Improvident Lending-lending well beyond borrower’s repayment ability. 5. Unjust Enrichment-reasonable tangible net benefit to borrower? 6. Negligent Misrepresentation-failure to disclose loan carries no reasonable tangible net benefit 7. Intentional Misrepresentation 8. Breach of Contract 9. Civil Conspiracy-Joint Venture-Agency 10. Negligent Infliction of Emotional Distress 11. Breach of Duty of Good Faith and Dealings 12. Recoupment (claims in defense that would be barred if brought affirmatively) 13. Equitable claims (it just isn’t fair).

Common Law Claims 1. Breach of Fiduciary Duty 2. Fraud/Appraisal Fraud 3. Aiding and Abetting 4. Unconscionability/Improvident Lending-lending well beyond borrower’s repayment ability. 5. Unjust Enrichment-reasonable tangible net benefit to borrower? 6. Negligent Misrepresentation-failure to disclose loan carries no reasonable tangible net benefit 7. Intentional Misrepresentation 8. Breach of Contract 9. Civil Conspiracy-Joint Venture-Agency 10. Negligent Infliction of Emotional Distress 11. Breach of Duty of Good Faith and Dealings 12. Recoupment (claims in defense that would be barred if brought affirmatively) 13. Equitable claims (it just isn’t fair).

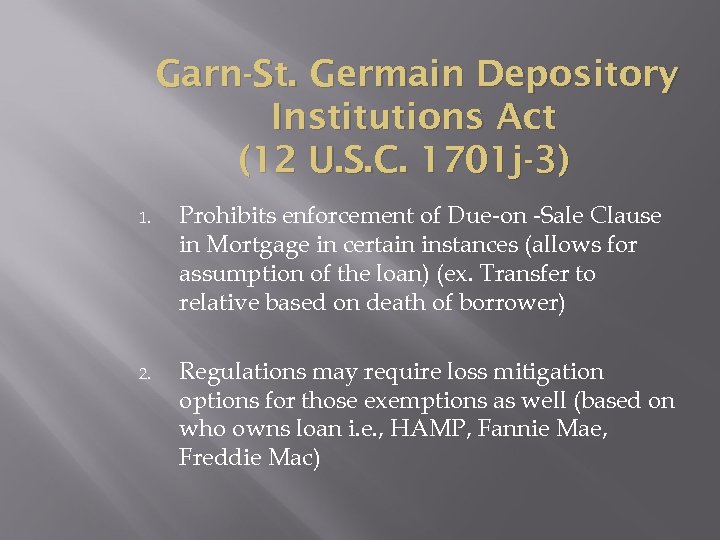

Garn-St. Germain Depository Institutions Act (12 U. S. C. 1701 j-3) 1. Prohibits enforcement of Due-on -Sale Clause in Mortgage in certain instances (allows for assumption of the loan) (ex. Transfer to relative based on death of borrower) 2. Regulations may require loss mitigation options for those exemptions as well (based on who owns loan i. e. , HAMP, Fannie Mae, Freddie Mac)

Garn-St. Germain Depository Institutions Act (12 U. S. C. 1701 j-3) 1. Prohibits enforcement of Due-on -Sale Clause in Mortgage in certain instances (allows for assumption of the loan) (ex. Transfer to relative based on death of borrower) 2. Regulations may require loss mitigation options for those exemptions as well (based on who owns loan i. e. , HAMP, Fannie Mae, Freddie Mac)

CLIENT SAVINGS ACCOUNT We have client save a monthly amount that they can afford for the duration of the foreclosure. Can use this money to show court paying mortgage, to negotiate a settlement, for alternative housing, to file bankruptcy, or for emergencies. Can save enough to be able to offer a short payoff or to buy another house.

CLIENT SAVINGS ACCOUNT We have client save a monthly amount that they can afford for the duration of the foreclosure. Can use this money to show court paying mortgage, to negotiate a settlement, for alternative housing, to file bankruptcy, or for emergencies. Can save enough to be able to offer a short payoff or to buy another house.

NUMBER ONE PRIORITY: CLIENTS’ REALISTIC GOALS

NUMBER ONE PRIORITY: CLIENTS’ REALISTIC GOALS

FORECLOSURE INVOLVES TWO PROCESSES/APPEALABLE ORDERS 1. 2. Process leading to Foreclosure Judgment. Process leading to sale of property with confirmation order.

FORECLOSURE INVOLVES TWO PROCESSES/APPEALABLE ORDERS 1. 2. Process leading to Foreclosure Judgment. Process leading to sale of property with confirmation order.

Sale Process 1. Governed by R. C. 2329. 01 -2329. 61 2. Provides Due Process Rights through statutory requirements: a. R. C. 2329. 17—governs Appraisal (can contest appraisal amount in certain fact situations, i. e. amount too low and “actual view” in this instance means interior view because. . . )-avoid deficiency; b. R. C. 2329. 26 –actual notice of sale (publication not enough); c. R. C. 2329. 27 publicize sale for 3 consecutive weeks; d. 2329. 20—needs to sell for 2/3 rds of appraised value; e. 2329. 31—confirmation (needs to wait 30 days because of borrowers right to redeem) f. 2329. 33—Right to Redeem

Sale Process 1. Governed by R. C. 2329. 01 -2329. 61 2. Provides Due Process Rights through statutory requirements: a. R. C. 2329. 17—governs Appraisal (can contest appraisal amount in certain fact situations, i. e. amount too low and “actual view” in this instance means interior view because. . . )-avoid deficiency; b. R. C. 2329. 26 –actual notice of sale (publication not enough); c. R. C. 2329. 27 publicize sale for 3 consecutive weeks; d. 2329. 20—needs to sell for 2/3 rds of appraised value; e. 2329. 31—confirmation (needs to wait 30 days because of borrowers right to redeem) f. 2329. 33—Right to Redeem