6a1e559d103964e29d83c82f4b4f1d0c.ppt

- Количество слайдов: 32

Forecasting

Forecasting

“Forecasting is very difficult, especially if it’s about the future. ” Niels Bohr

“Forecasting is very difficult, especially if it’s about the future. ” Niels Bohr

Introduction • How do we move from signals to forecast returns? • How do we combine signals? • What is our intuition about the magnitude of our forecasts? • What “real world” issues must we take into account?

Introduction • How do we move from signals to forecast returns? • How do we combine signals? • What is our intuition about the magnitude of our forecasts? • What “real world” issues must we take into account?

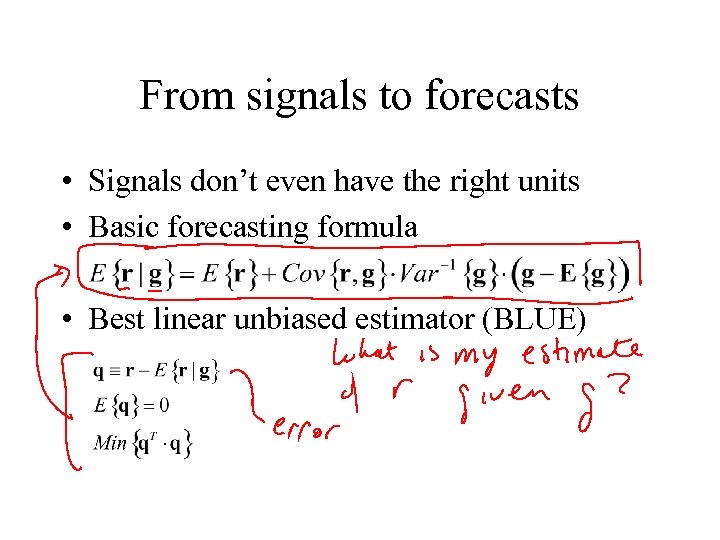

From signals to forecasts • Signals don’t even have the right units • Basic forecasting formula • Best linear unbiased estimator (BLUE)

From signals to forecasts • Signals don’t even have the right units • Basic forecasting formula • Best linear unbiased estimator (BLUE)

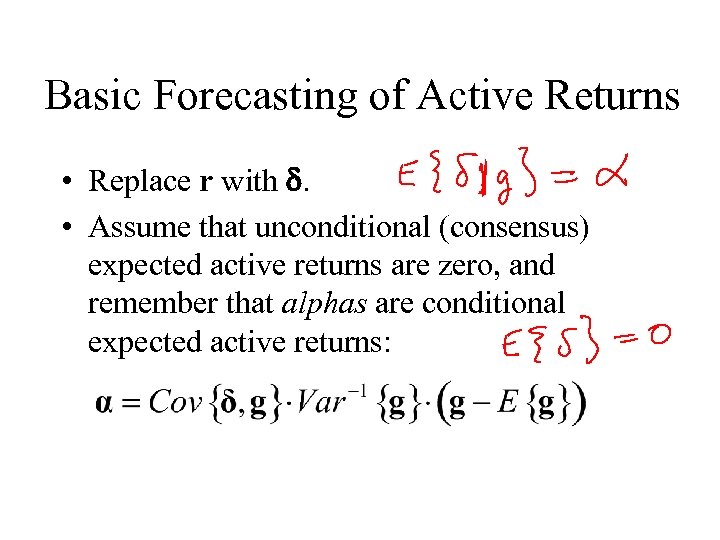

Basic Forecasting of Active Returns • Replace r with d. • Assume that unconditional (consensus) expected active returns are zero, and remember that alphas are conditional expected active returns:

Basic Forecasting of Active Returns • Replace r with d. • Assume that unconditional (consensus) expected active returns are zero, and remember that alphas are conditional expected active returns:

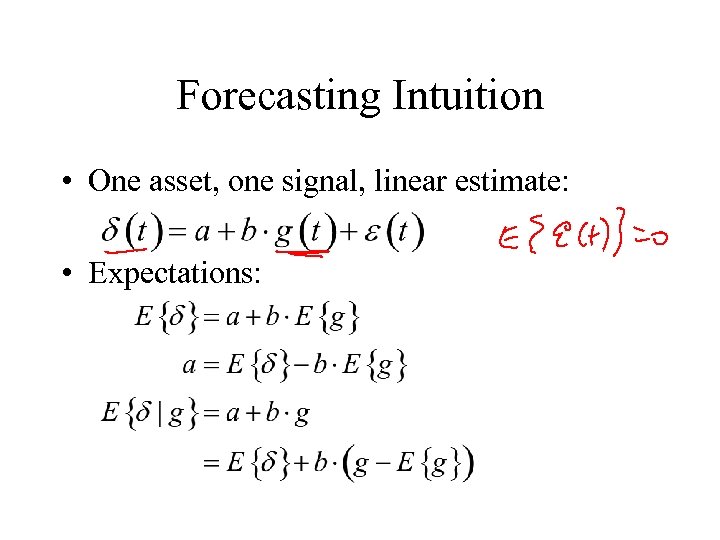

Forecasting Intuition • One asset, one signal, linear estimate: • Expectations:

Forecasting Intuition • One asset, one signal, linear estimate: • Expectations:

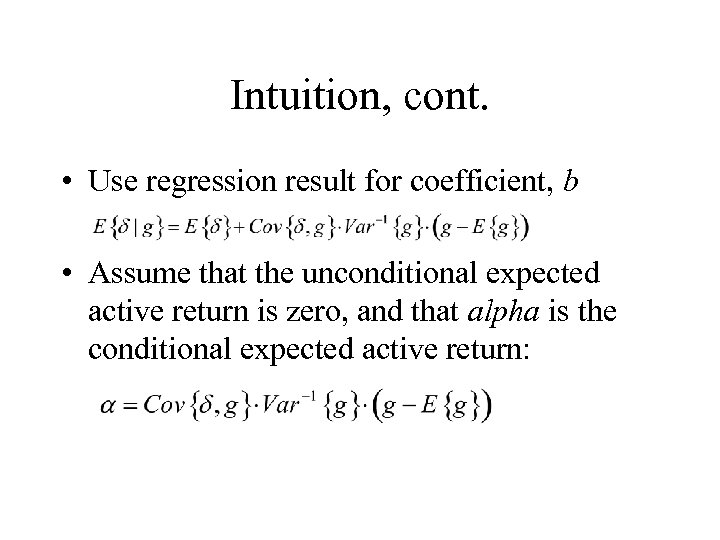

Intuition, cont. • Use regression result for coefficient, b • Assume that the unconditional expected active return is zero, and that alpha is the conditional expected active return:

Intuition, cont. • Use regression result for coefficient, b • Assume that the unconditional expected active return is zero, and that alpha is the conditional expected active return:

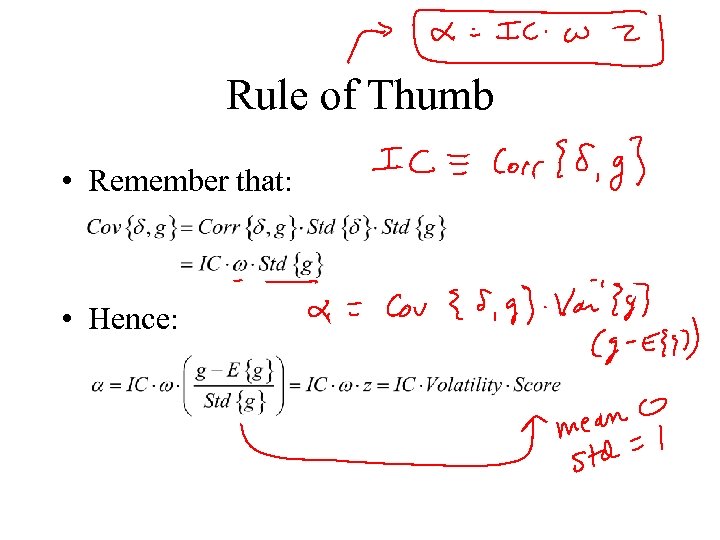

Rule of Thumb • Remember that: • Hence:

Rule of Thumb • Remember that: • Hence:

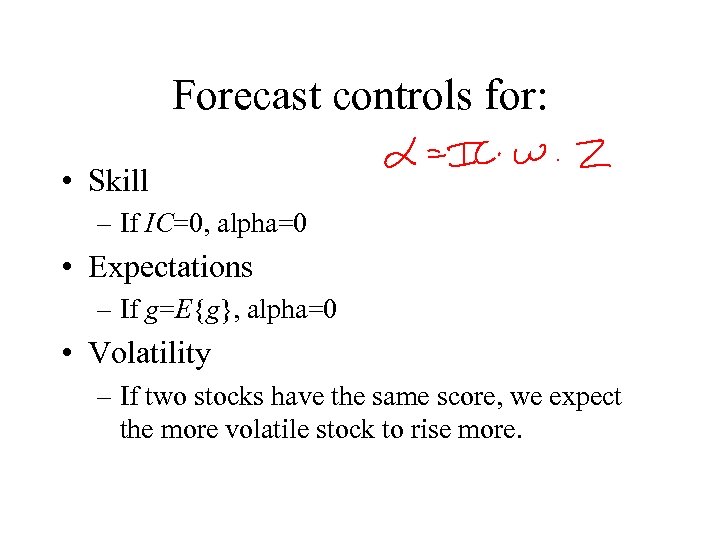

Forecast controls for: • Skill – If IC=0, alpha=0 • Expectations – If g=E{g}, alpha=0 • Volatility – If two stocks have the same score, we expect the more volatile stock to rise more.

Forecast controls for: • Skill – If IC=0, alpha=0 • Expectations – If g=E{g}, alpha=0 • Volatility – If two stocks have the same score, we expect the more volatile stock to rise more.

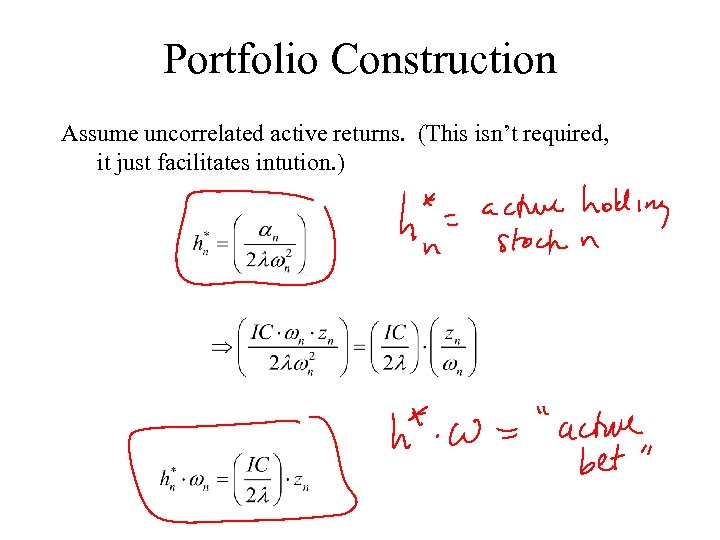

Portfolio Construction Assume uncorrelated active returns. (This isn’t required, it just facilitates intution. )

Portfolio Construction Assume uncorrelated active returns. (This isn’t required, it just facilitates intution. )

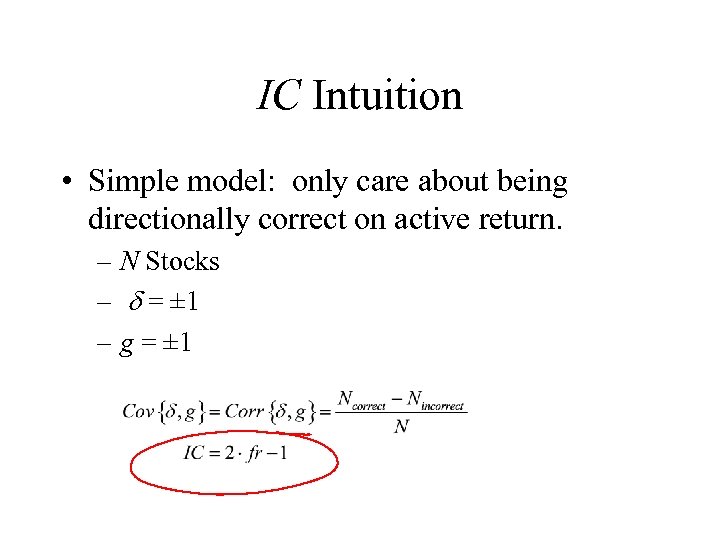

IC Intuition • Simple model: only care about being directionally correct on active return. – N Stocks – d = ± 1 – g = ± 1

IC Intuition • Simple model: only care about being directionally correct on active return. – N Stocks – d = ± 1 – g = ± 1

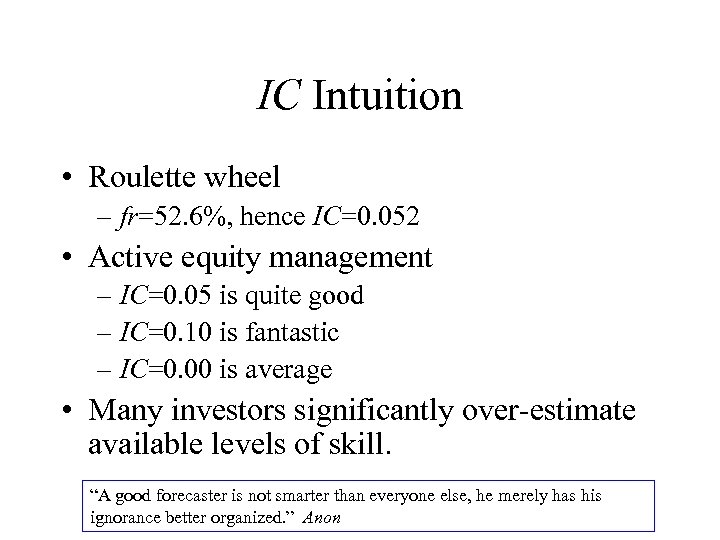

IC Intuition • Roulette wheel – fr=52. 6%, hence IC=0. 052 • Active equity management – IC=0. 05 is quite good – IC=0. 10 is fantastic – IC=0. 00 is average • Many investors significantly over-estimate available levels of skill. “A good forecaster is not smarter than everyone else, he merely has his ignorance better organized. ” Anon

IC Intuition • Roulette wheel – fr=52. 6%, hence IC=0. 052 • Active equity management – IC=0. 05 is quite good – IC=0. 10 is fantastic – IC=0. 00 is average • Many investors significantly over-estimate available levels of skill. “A good forecaster is not smarter than everyone else, he merely has his ignorance better organized. ” Anon

IC Intuition, cont. • What do these IC’s look like? 2 • An IC=0. 1 implies a regression R of 0. 01 • Let’s look at an example of a promising idea.

IC Intuition, cont. • What do these IC’s look like? 2 • An IC=0. 1 implies a regression R of 0. 01 • Let’s look at an example of a promising idea.

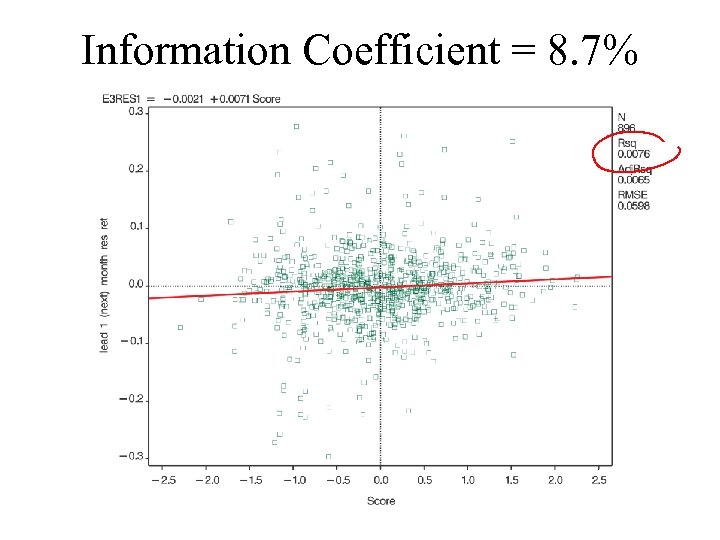

Information Coefficient = 8. 7%

Information Coefficient = 8. 7%

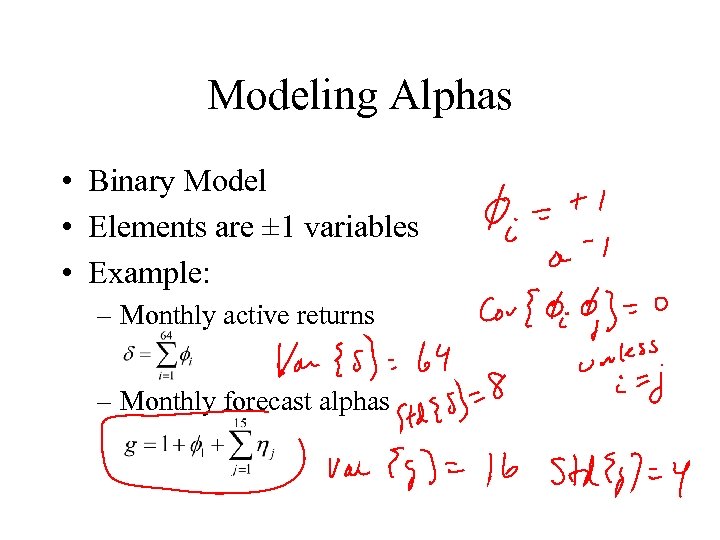

Modeling Alphas • Binary Model • Elements are ± 1 variables • Example: – Monthly active returns – Monthly forecast alphas

Modeling Alphas • Binary Model • Elements are ± 1 variables • Example: – Monthly active returns – Monthly forecast alphas

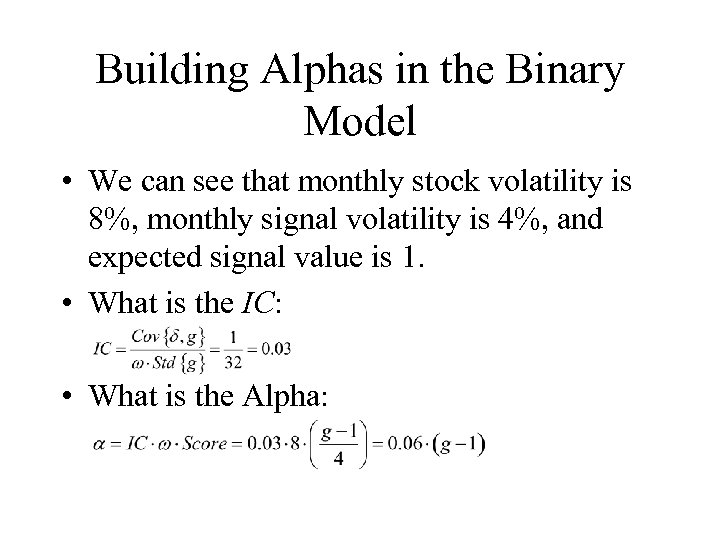

Building Alphas in the Binary Model • We can see that monthly stock volatility is 8%, monthly signal volatility is 4%, and expected signal value is 1. • What is the IC: • What is the Alpha:

Building Alphas in the Binary Model • We can see that monthly stock volatility is 8%, monthly signal volatility is 4%, and expected signal value is 1. • What is the IC: • What is the Alpha:

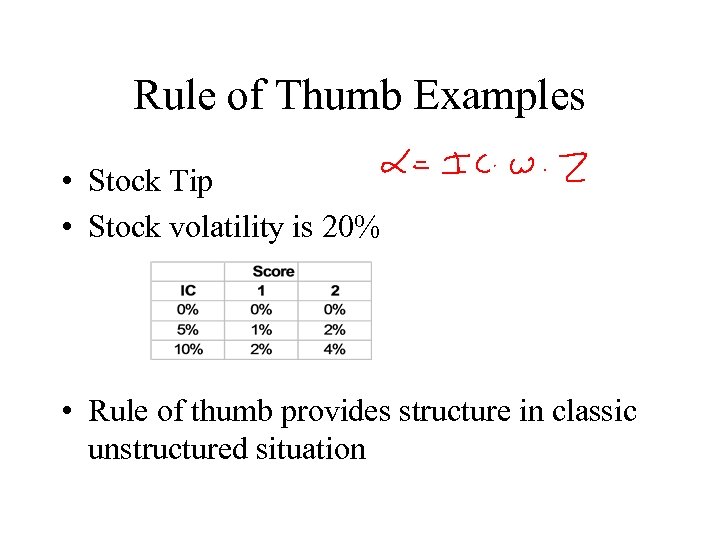

Rule of Thumb Examples • Stock Tip • Stock volatility is 20% • Rule of thumb provides structure in classic unstructured situation

Rule of Thumb Examples • Stock Tip • Stock volatility is 20% • Rule of thumb provides structure in classic unstructured situation

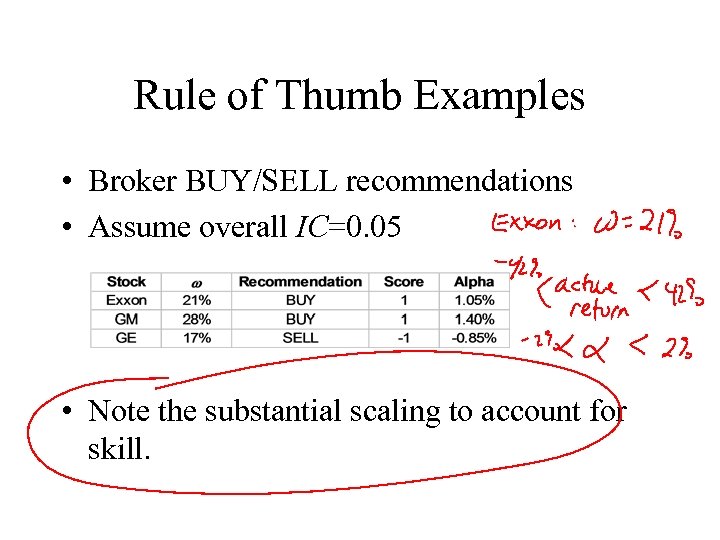

Rule of Thumb Examples • Broker BUY/SELL recommendations • Assume overall IC=0. 05 • Note the substantial scaling to account for skill.

Rule of Thumb Examples • Broker BUY/SELL recommendations • Assume overall IC=0. 05 • Note the substantial scaling to account for skill.

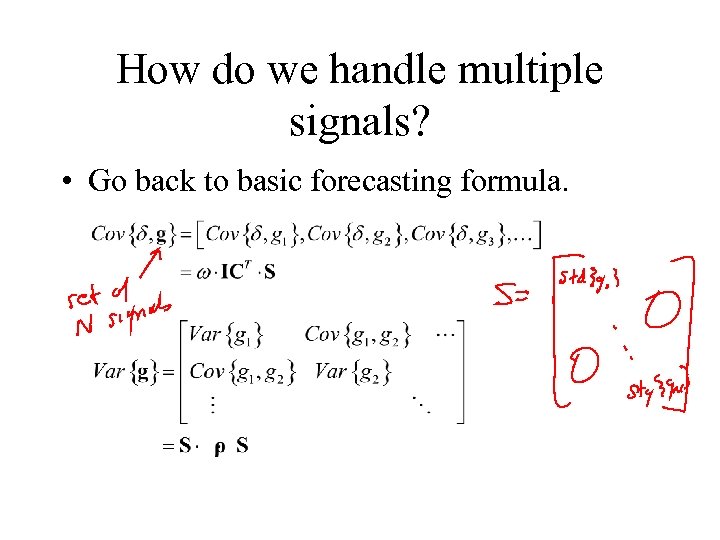

How do we handle multiple signals? • Go back to basic forecasting formula.

How do we handle multiple signals? • Go back to basic forecasting formula.

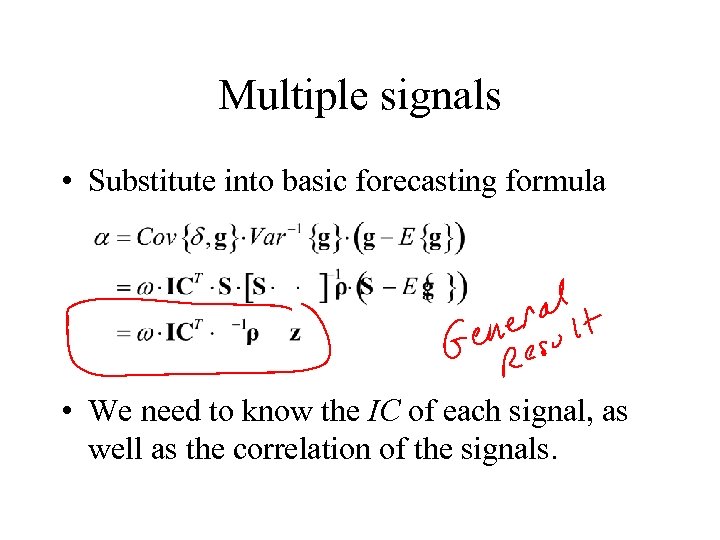

Multiple signals • Substitute into basic forecasting formula • We need to know the IC of each signal, as well as the correlation of the signals.

Multiple signals • Substitute into basic forecasting formula • We need to know the IC of each signal, as well as the correlation of the signals.

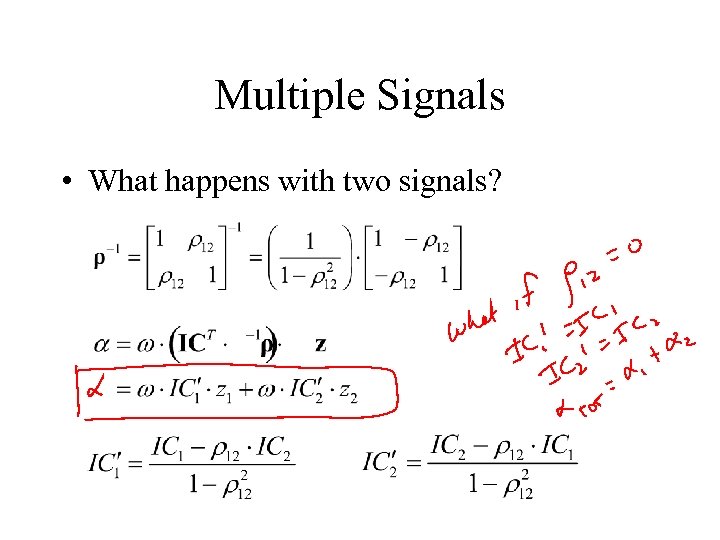

Multiple Signals • What happens with two signals?

Multiple Signals • What happens with two signals?

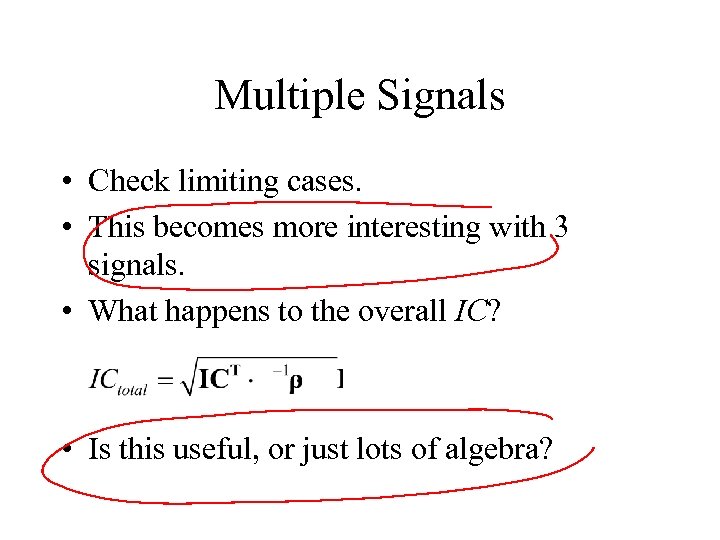

Multiple Signals • Check limiting cases. • This becomes more interesting with 3 signals. • What happens to the overall IC? • Is this useful, or just lots of algebra?

Multiple Signals • Check limiting cases. • This becomes more interesting with 3 signals. • What happens to the overall IC? • Is this useful, or just lots of algebra?

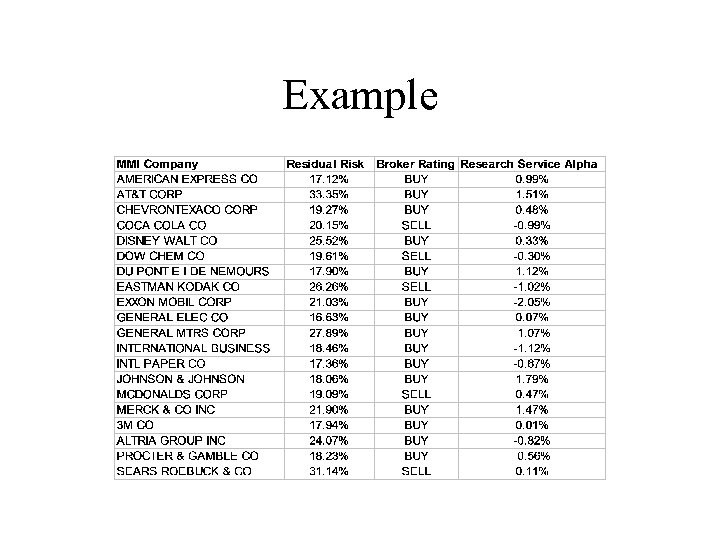

Example

Example

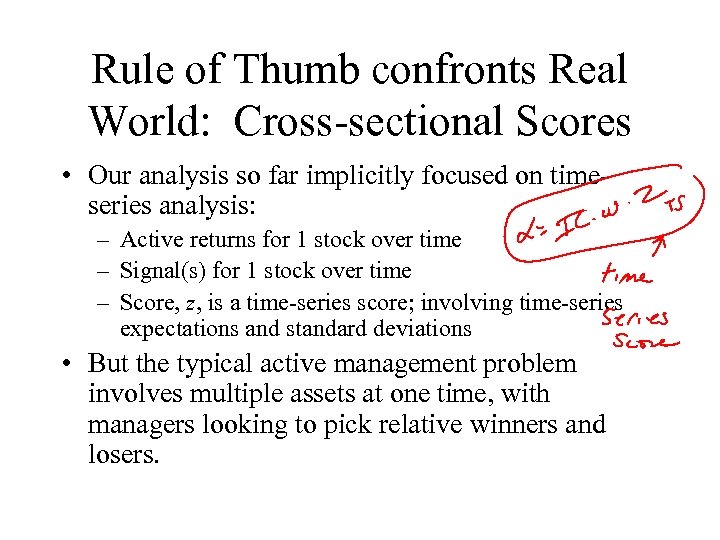

Rule of Thumb confronts Real World: Cross-sectional Scores • Our analysis so far implicitly focused on timeseries analysis: – Active returns for 1 stock over time – Signal(s) for 1 stock over time – Score, z, is a time-series score; involving time-series expectations and standard deviations • But the typical active management problem involves multiple assets at one time, with managers looking to pick relative winners and losers.

Rule of Thumb confronts Real World: Cross-sectional Scores • Our analysis so far implicitly focused on timeseries analysis: – Active returns for 1 stock over time – Signal(s) for 1 stock over time – Score, z, is a time-series score; involving time-series expectations and standard deviations • But the typical active management problem involves multiple assets at one time, with managers looking to pick relative winners and losers.

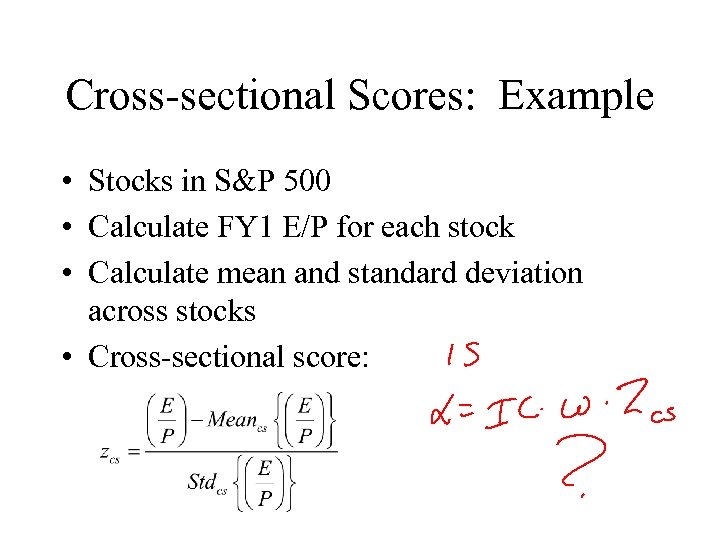

Cross-sectional Scores: Example • Stocks in S&P 500 • Calculate FY 1 E/P for each stock • Calculate mean and standard deviation across stocks • Cross-sectional score:

Cross-sectional Scores: Example • Stocks in S&P 500 • Calculate FY 1 E/P for each stock • Calculate mean and standard deviation across stocks • Cross-sectional score:

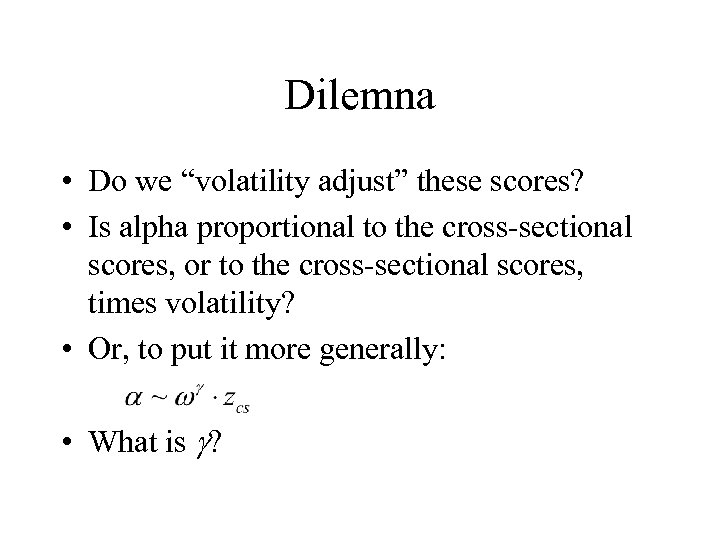

Dilemna • Do we “volatility adjust” these scores? • Is alpha proportional to the cross-sectional scores, or to the cross-sectional scores, times volatility? • Or, to put it more generally: • What is g?

Dilemna • Do we “volatility adjust” these scores? • Is alpha proportional to the cross-sectional scores, or to the cross-sectional scores, times volatility? • Or, to put it more generally: • What is g?

Analysis • The rule of thumb provides alpha as a function of time-series scores. • We need to relate these two statistics. • Ignore mean signal, either time-series or cross-sectional. • Ignore signal correlations across stocks.

Analysis • The rule of thumb provides alpha as a function of time-series scores. • We need to relate these two statistics. • Ignore mean signal, either time-series or cross-sectional. • Ignore signal correlations across stocks.

Two Cases • Compare Std. TS{g} across stocks • Case 1: Same for each stock • Case 2: Proportional to stock volatility

Two Cases • Compare Std. TS{g} across stocks • Case 1: Same for each stock • Case 2: Proportional to stock volatility

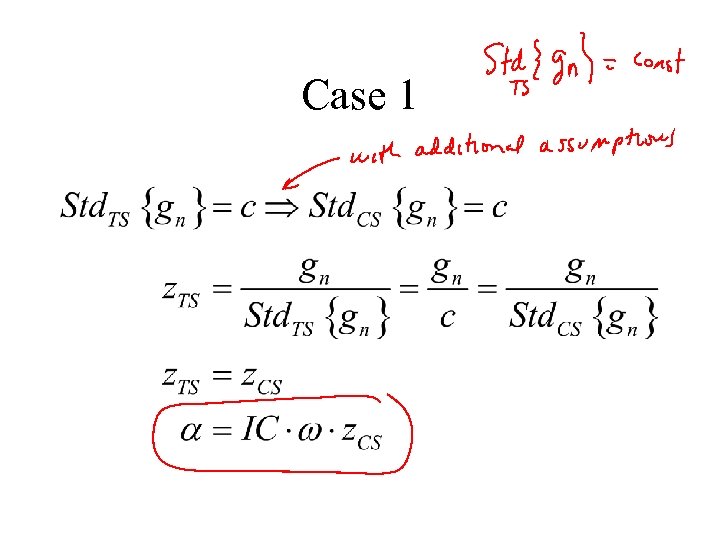

Case 1

Case 1

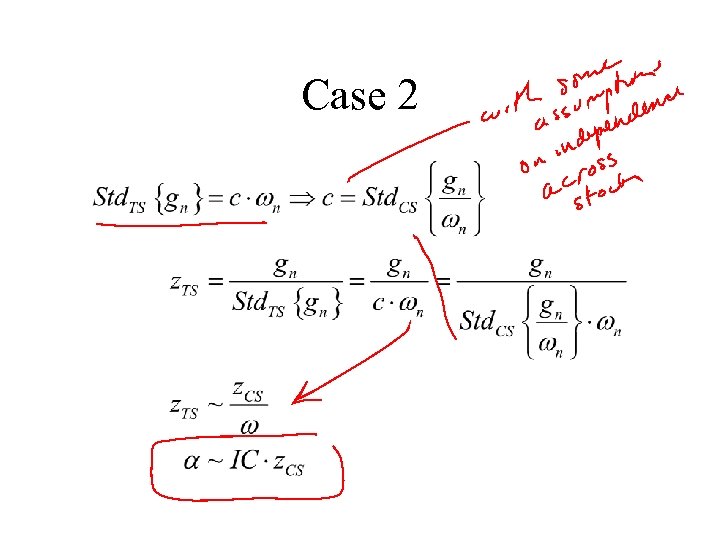

Case 2

Case 2

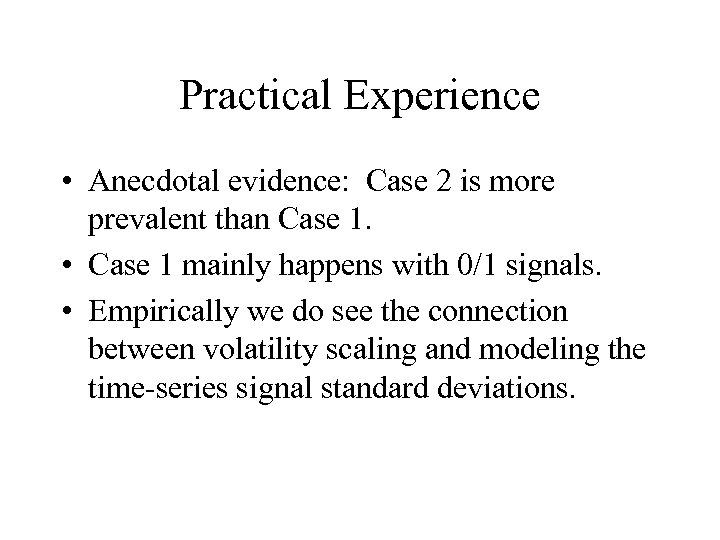

Practical Experience • Anecdotal evidence: Case 2 is more prevalent than Case 1. • Case 1 mainly happens with 0/1 signals. • Empirically we do see the connection between volatility scaling and modeling the time-series signal standard deviations.

Practical Experience • Anecdotal evidence: Case 2 is more prevalent than Case 1. • Case 1 mainly happens with 0/1 signals. • Empirically we do see the connection between volatility scaling and modeling the time-series signal standard deviations.

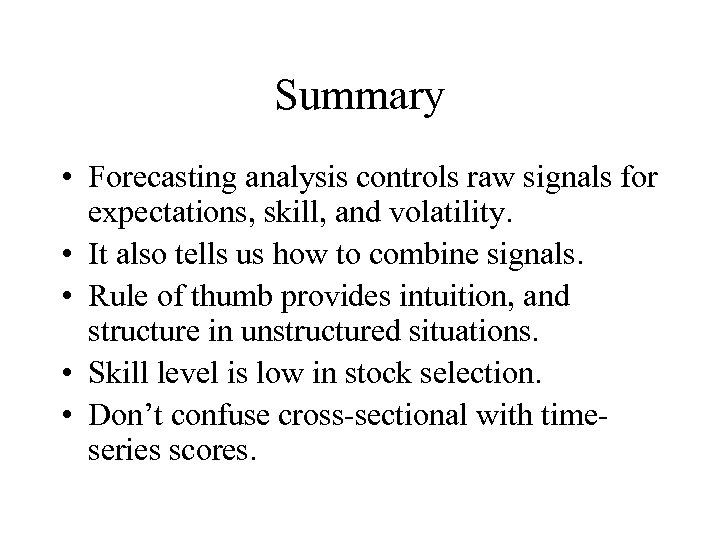

Summary • Forecasting analysis controls raw signals for expectations, skill, and volatility. • It also tells us how to combine signals. • Rule of thumb provides intuition, and structure in unstructured situations. • Skill level is low in stock selection. • Don’t confuse cross-sectional with timeseries scores.

Summary • Forecasting analysis controls raw signals for expectations, skill, and volatility. • It also tells us how to combine signals. • Rule of thumb provides intuition, and structure in unstructured situations. • Skill level is low in stock selection. • Don’t confuse cross-sectional with timeseries scores.