Food Projects LINDUM JV PROPERTY FOOD PROPERTY MARKET OVERVIEW

Food Projects LINDUM JV PROPERTY FOOD PROPERTY MARKET OVERVIEW

Food Projects Food Industry Fact Box • • It is the country’s largest manufacturing sector It generates a turnover of £ 74 billion It has a gross value added of £ 22. 7 billion It accounts for 14% of the UK’s total manufacturing gross value added • It exports £ 13. 2 billion of products • It directly employs around 410, 000 people • It comprises 6, 745 enterprises

Food Projects Food Industry Fact Box • • It is the country’s largest manufacturing sector It generates a turnover of £ 74 billion It has a gross value added of £ 22. 7 billion It accounts for 14% of the UK’s total manufacturing gross value added • It exports £ 13. 2 billion of products • It directly employs around 410, 000 people • It comprises 6, 745 enterprises

Food Projects English Farming and Food Partnerships (EFFP) 70 senior agri-food executives surveyed in May 2010 • • 90% increasingly confident 70% ready to invest significant sums 21% would be pumping in more than £ 5 million 50% would be pumping in between £ 500 k and £ 5 million • 83% confident they can raise cash or already have cash reserves

Food Projects English Farming and Food Partnerships (EFFP) 70 senior agri-food executives surveyed in May 2010 • • 90% increasingly confident 70% ready to invest significant sums 21% would be pumping in more than £ 5 million 50% would be pumping in between £ 500 k and £ 5 million • 83% confident they can raise cash or already have cash reserves

Food Projects Industrial Property Sector Overall Picture: • Little speculative development • Large regional variations – London and South East -v- rest of UK • Good value second hand stock – but still relatively scarce • ‘Odd’ bargain to be had • Investment market yields much higher, (better returns required) • Reversionary value of property a greater consideration • Longer lease periods being requested

Food Projects Industrial Property Sector Overall Picture: • Little speculative development • Large regional variations – London and South East -v- rest of UK • Good value second hand stock – but still relatively scarce • ‘Odd’ bargain to be had • Investment market yields much higher, (better returns required) • Reversionary value of property a greater consideration • Longer lease periods being requested

Food Projects Supply Factors 1. Low interest rates 2. Banks less keen to lend; higher equity required 3. Land still in relatively few hands 4. Planning uncertainty/delays 5. Empty Business Rates 6. Landowners keen to receive income rather than capital receipts 7. Banks do not wish to realise further losses

Food Projects Supply Factors 1. Low interest rates 2. Banks less keen to lend; higher equity required 3. Land still in relatively few hands 4. Planning uncertainty/delays 5. Empty Business Rates 6. Landowners keen to receive income rather than capital receipts 7. Banks do not wish to realise further losses

Food Projects Tenure Options 1. Freehold 2. Leasehold 3. Lease with option to buy 4. Sale and Leaseback 5. Joint Ventures eg spv holds asset, reduced rent, more flexible terms

Food Projects Tenure Options 1. Freehold 2. Leasehold 3. Lease with option to buy 4. Sale and Leaseback 5. Joint Ventures eg spv holds asset, reduced rent, more flexible terms

Food Projects Food Sector – Specific Considerations 1. Location 2. Alternative uses – reversionary value 3. Covenant Strength – investors/banks view on sector 4. High level of fit out 5. Opportunities to rationalise portfolio, consider valuable sites 6. Asset -v- means of production

Food Projects Food Sector – Specific Considerations 1. Location 2. Alternative uses – reversionary value 3. Covenant Strength – investors/banks view on sector 4. High level of fit out 5. Opportunities to rationalise portfolio, consider valuable sites 6. Asset -v- means of production

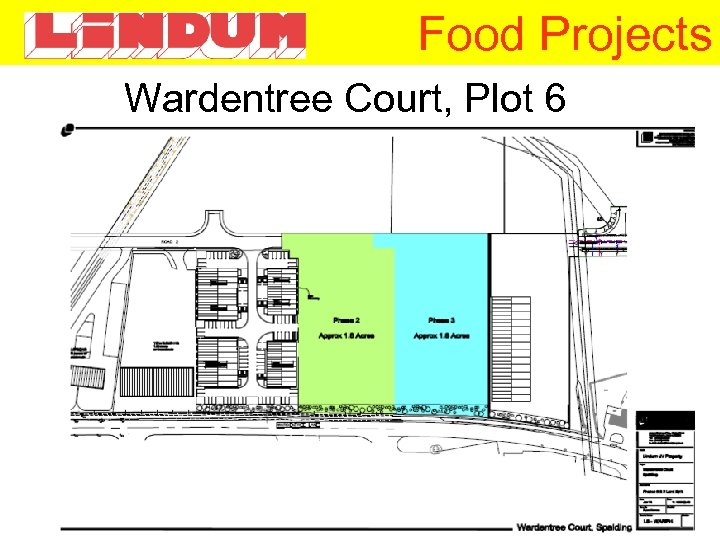

Food Projects Wardentree Court, Plot 6

Food Projects Wardentree Court, Plot 6

Food Projects Property Procurement Opportunities 1. Joint Ventures 2. Funding Streams 3. Strategic Property Reviews 4. Bullet/Deferred payments

Food Projects Property Procurement Opportunities 1. Joint Ventures 2. Funding Streams 3. Strategic Property Reviews 4. Bullet/Deferred payments

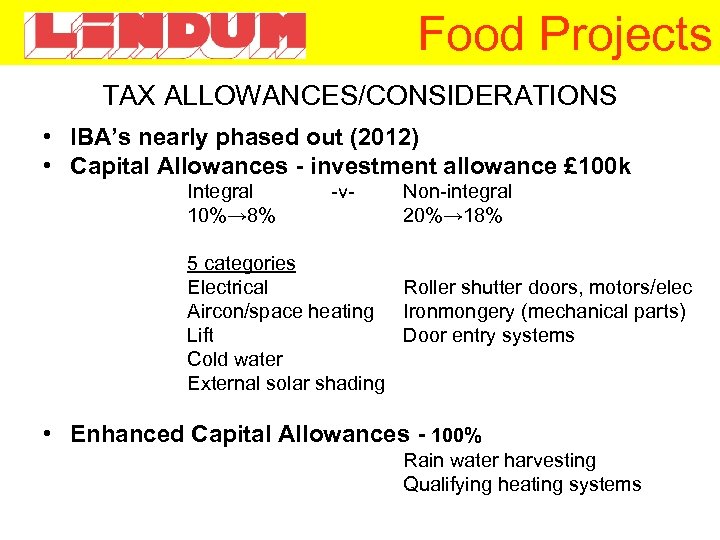

Food Projects TAX ALLOWANCES/CONSIDERATIONS • IBA’s nearly phased out (2012) • Capital Allowances - investment allowance £ 100 k Integral 10%→ 8% -v- Non-integral 20%→ 18% 5 categories Electrical Roller shutter doors, motors/elec Aircon/space heating Ironmongery (mechanical parts) Lift Door entry systems Cold water External solar shading • Enhanced Capital Allowances - 100% Rain water harvesting Qualifying heating systems

Food Projects TAX ALLOWANCES/CONSIDERATIONS • IBA’s nearly phased out (2012) • Capital Allowances - investment allowance £ 100 k Integral 10%→ 8% -v- Non-integral 20%→ 18% 5 categories Electrical Roller shutter doors, motors/elec Aircon/space heating Ironmongery (mechanical parts) Lift Door entry systems Cold water External solar shading • Enhanced Capital Allowances - 100% Rain water harvesting Qualifying heating systems

Food Projects ANY QUESTIONS?

Food Projects ANY QUESTIONS?