e67f1fbebf2cf88fd3c7e8282bc1a3dd.ppt

- Количество слайдов: 69

FMLo. B and BFELo. B Update June 1, 2009

Financial Management Line of Business (FMLo. B) • • • Overview of FMLo. B Overall Goals Stages of FMLo. B Other FMLo. B Activities Specific Goals for 2009

Budget Formulation and Execution Line of Business (BFELo. B) • Overview of BFELo. B • Goals • Activities and Accomplishments

Overview of FMLo. B • In 2001 President Bush created the President’s Management Agenda (PMA) to address the need for citizen-centered, resultsoriented, and market-based Federal government initiatives. • Pursuant to the PMA, the Office of Management and Budget (OMB) created the Lines of Business (LOB) initiatives which address redundant IT investments and business processes across the Federal Government. • The Financial Management Line of Business (FMLo. B) was created as part of these initiatives.

Overview of FMLo. B (cont’d) • The Financial Systems Integration Office (FSIO) within the General Services Administration (GSA) is the program manager for FMLo. B. • The FSIO was formerly known as the Joint Financial Management Improvement Program (JFMIP) staff office.

Overview of FMLo. B (cont’d) • The FSIO has three major areas of responsibilities: – Core financial systems requirements development, testing and product certification. – Supporting the Federal financial community on priority projects. – Conducting outreach through an annual financial management conference and other related activities. • To learn more about FMLo. B visit www. fsio. gov.

Overall Goals The goals of FMLo. B are that Federal agencies are implementing financial systems that: • Provide timely and accurate data available for decision making; • Facilitate stronger internal controls that ensure integrity in accounting and other stewardship activities;

Overall Goals (cont’d) • Reduce costs by providing a competitive alternative for agencies to acquire, develop, implement, and operate financial management systems through shared service solutions; • Standardize systems, business processes and data elements; and • Provide for seamless data exchange between and among Federal agencies by implementing a common language and structure for financial information and system interfaces.

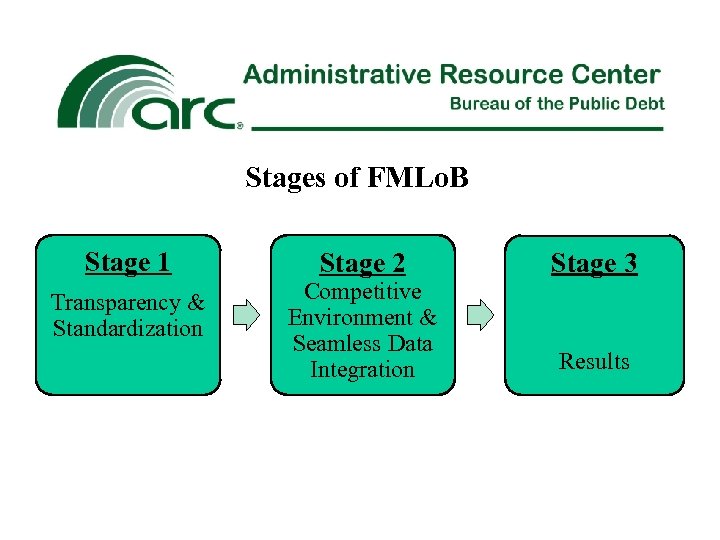

Stages of FMLo. B Stage 1 Transparency & Standardization Stage 2 Competitive Environment & Seamless Data Integration Stage 3 Results

Stage 1 - Transparency • In determining the best options available when modernizing financial systems, the Federal financial community must have sufficient information and clear direction on how to evaluate the performance and cost of shared service alternatives; i. e. , Shared Service Providers (SSP’s) as well as clarity on what steps Federal agencies are expected to undertake in order to migrate to an SSP. • Two specific projects are underway to achieve additional transparency: – Establishment of Common Performance Measures – Development of Migration Planning Guidance

Stage 1 – Transparency (cont’d) Establishment of Common Performance Measures • This project will result in standard quality and cost measures for agencies to benchmark and compare the performance of financial system alternatives.

Stage 1 – Transparency (cont’d) Phase I - IT Infrastructure Hosting & Administration and Application Management Services • Monthly data collection and reporting began in April 2007. • Metrics are collected in a web based environment at the Federal Interagency Databases Online (www. FIDO. gov) as part of the Chief Financial Officers’ Metric Tracking System (MTS). • SSPs and CFO Act Agencies report data. Non-CFO Act agencies are not required to report but are encouraged to participate.

Stage 1 – Transparency (cont’d) Phase II – Business Processes • In August 2008, a panel consisting of Agency CFOs and Deputy CFOs met with members of the FMLo. B Performance Measures work stream to discuss long-term objectives and strategies for development of agency-wide, financial management measures. • Since the August meeting, and based on the feedback received from this panel, the Performance Measures work stream has focused on developing a core repository of all financial management-related measures, including those currently collected and those that should be considered, and industry benchmarks.

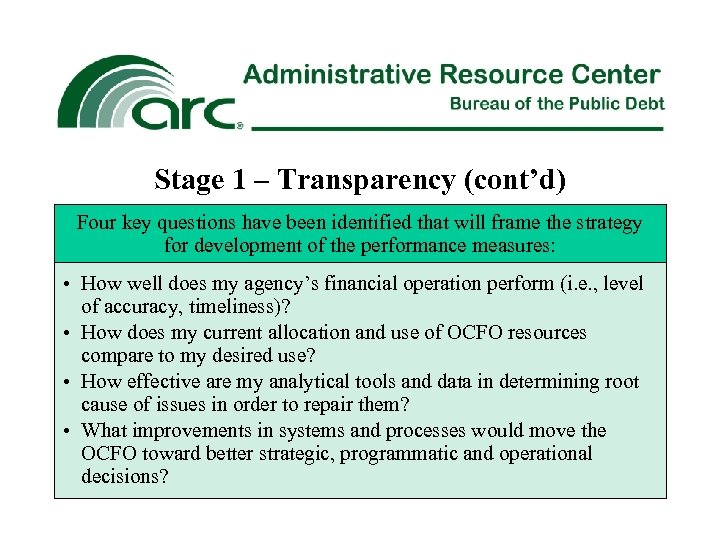

Stage 1 – Transparency (cont’d) Four key questions have been identified that will frame the strategy for development of the performance measures: • How well does my agency’s financial operation perform (i. e. , level of accuracy, timeliness)? • How does my current allocation and use of OCFO resources compare to my desired use? • How effective are my analytical tools and data in determining root cause of issues in order to repair them? • What improvements in systems and processes would move the OCFO toward better strategic, programmatic and operational decisions?

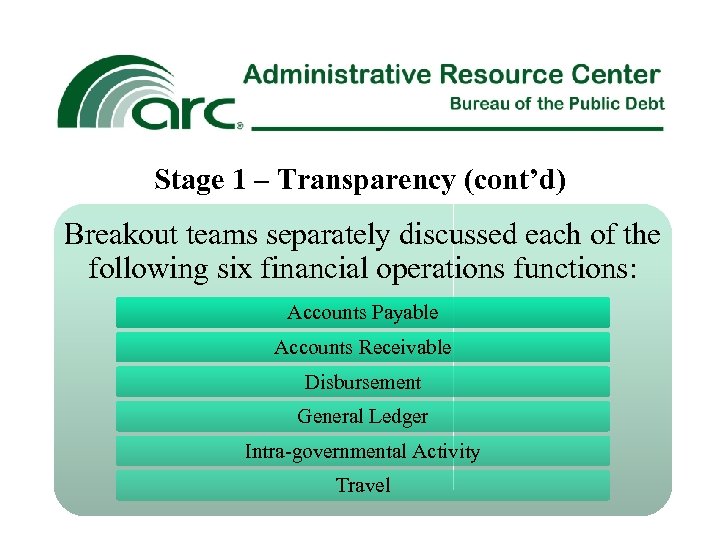

Stage 1 – Transparency (cont’d) Breakout teams separately discussed each of the following six financial operations functions: Accounts Payable Accounts Receivable Disbursement General Ledger Intra-governmental Activity Travel

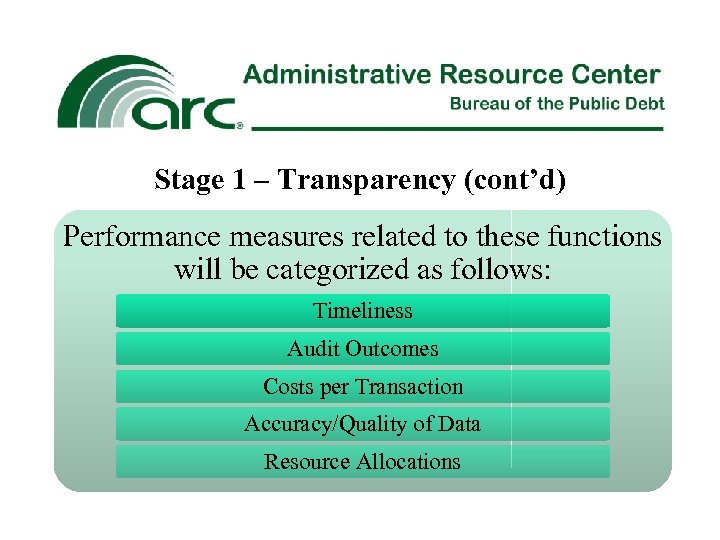

Stage 1 – Transparency (cont’d) Performance measures related to these functions will be categorized as follows: Timeliness Audit Outcomes Costs per Transaction Accuracy/Quality of Data Resource Allocations

Stage 1 – Transparency (cont’d) Development of Migration Planning Guidance • This project will result in comprehensive guidance that helps Federal agencies describe, prepare for, and manage an agency’s migration to an SSP. • This guidance will also include a definition of the full range of services to be provided by all SSPs and a description of the “rules of engagement, ” including templates for service level agreements outlining provider and client responsibilities.

Stage 1 – Transparency (cont’d) Acquisition Advisory Team • Developing tools that will assist agencies in developing solicitations to upgrade or implement financial systems. • These tools are intended to assist agencies by streamlining the process of developing requests for proposals for financial management system shared services including services for hosting, application management, system integration, and transaction processing.

Stage 1 – Standardization • In order to mitigate the cost and risk of migrations to an SSP and to improve the quality and usability of financial data government-wide, the Federal government must ensure greater standardization of business processes, interfaces, and data. • Two specific projects are underway to provide standardization: – Development of Standard Business Processes – Creation of Common Government-wide Accounting Classification Structure (CGAC)

Stage 1 – Standardization (cont’d) • Once established, the standards from these two projects will be incorporated into the existing FSIO core financial systems requirements and be tested during the FSIO software qualification and certification process. • Once the software products are certified as meeting FSIO core financial systems requirements, Federal agencies will only be permitted to purchase, and SSPs required to implement, the certified products as configured with the standards.

Stage 1 – Standardization (cont’d) Development of Standard Business Processes • The Federal Financial Management Standard Business Processes establish the framework for consolidating and optimizing financial accounting practices in the Federal Government to improve cost, quality, and performance government-wide.

Stage 1 – Standardization (cont’d) This project will result in governmentwide common business rules, data components, and policies for • • • Funds management Payables management Receivables management Reimbursables management Reports management

Stage 1 – Standardization (cont’d) Funds management • Includes processes related to the establishment of budgetary authority, funds distribution and funds control.

Stage 1 – Standardization (cont’d) Payables management • Includes processes from requisition to payment for commercial contracts and small acquisitions disbursed by Treasury. • The payables document was developed by conducting weekly focus group and periodic working group meetings with agency representatives, Federal SSPs and commercial software vendors.

Stage 1 – Standardization (cont’d) Receivables management • Includes steps from establishing accounts receivable due from the public, billing, collection and application of receipts, dunning, allowance for loss and write-off, credit memo and returns, waiver of interest, administrative costs and penalties, and installment plans. • The receivables document was developed by conducting weekly focus group and periodic working group meetings with agency representatives, Federal SSPs and commercial software vendors.

Stage 1 – Standardization (cont’d) Reimbursables management • Outlines business processes for administering and managing interagency buy/sell transactions. The document spans the full lifecycle of an Interagency Agreement (IA) from establishing an agreement between a Buyer (requesting agency) and Seller (providing agency) to close out of the IA. • The reimbursables document was developed by conducting weekly focus group and periodic working group meetings with agency representatives, Federal SSPs and commercial software vendors.

Stage 1 – Standardization (cont’d) Changes to Expect as a Result of Reimbursables Management Document • Incorporates an intragovernmental solution system which will house information related to IAs including orders, bills, payments and collections, earned unbilled information and order close out. • Standard of monthly billing. • Recording of earned unbilled amounts.

Stage 1 – Standardization (cont’d) Changes to Expect as a Result of Reimbursables Management Document (cont’d) • Approval/rejection of bills within 7 calendar days or else funds transfer automatically. • Standard of monthly reconciliation with trading partner where work in progress/earned unbilled reporting is completed so both partners record proper accruals.

Stage 1 – Standardization (cont’d) Reports management • FSIO established core reporting and content based reporting groups. • The groups were tasked with reviewing current reporting requirements, identifying reporting deficiencies, recommending changes to existing reporting requirements, defining new reports and identifying changes to existing reports.

Stage 1 – Standardization (cont’d) The Core Reporting Team • Stratified reports into several reporting categories: Financial Statements, General Ledger, Payment Management, Reimbursable Management, Receivable Management, System Management and Treasury Reporting; • Reviewed existing reporting requirements;

Stage 1 – Standardization (cont’d) The Core Reporting Team (cont’d) • Solicited Transformation Team members to identify individuals who could serve on the content based reporting groups; and • Prepared documentation on new, as well as existing reports, for review by the content based reporting groups.

Stage 1 – Standardization (cont’d) Segment Architecture Launch Team (SALT) • This team has been organized to map and standardize data elements used in interfaces. • Agencies, including ARC, have made presentations on their existing interfaces in their core financial system detailing whether they were interfaces in or out and batch or real time.

Stage 1 – Standardization (cont’d) Creation of Common Government-wide Accounting Classification Structure (CGAC) • This project will result in a uniform accounting classification structure, layout and definitions. • Establishes a standard way to classify the financial effects of government business activities. It includes data elements needed for internal and external reporting and provides flexibility for agency mission-specific needs.

Stage 1 – Standardization (cont’d) CGAC (cont’d) • The standard definition process will also require modifications to central agency (i. e. , FMS) reporting systems. • Implementation guidance will be developed to help each agency analyze the gap between existing systems and the FMLo. B standards so that agency-specific implementation plans can be developed.

Stage 1 – Standardization (cont’d) CGAC (cont’d) • Each agency will be required to meet with OMB to discuss current status of CGAC within the agency. • In March 2009 ARC provided our strategy as well as a CGAC gap analysis to Treasury for their meeting with OMB. • ARC's strategy for becoming CGAC complaint is to incorporate CGAC as part of our upgrade to Oracle version R 12 which should occur after the completion of the current commercial hosting migration project.

Stage 1 – Standardization (cont’d) CGAC User Group • Formed in January 2009 to share knowledge and leverage best practices of agencies as they implement CGAC. • Group includes representatives from most of the CFO Act agencies. • After grouping them by software vendor, various agencies have made presentations on their status and plans for implementing CGAC.

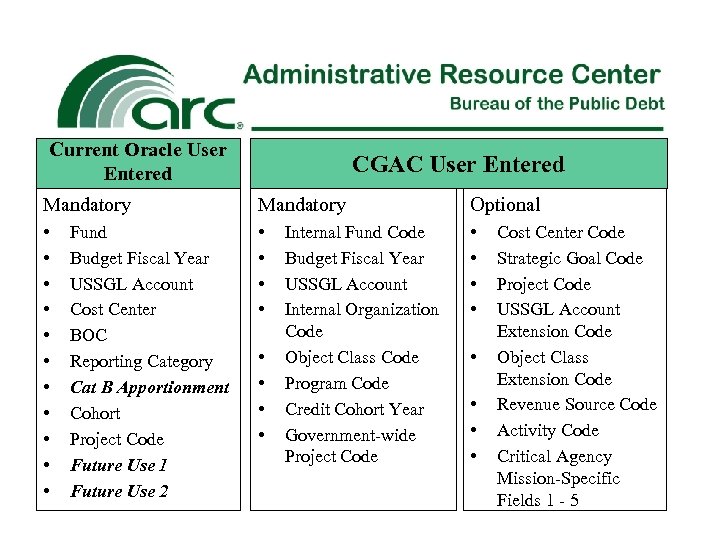

Stage 1 – Standardization (cont’d) CGAC Comparison • CGAC has 74 elements – 20 elements are user entered – 54 elements are derived or based on system configuration • Some of the user entered elements are optional – Ultimately Oracle configuration may make these mandatory • A comparison of elements currently entered by users in Oracle to user entered elements in CGAC follows.

Current Oracle User Entered CGAC User Entered Mandatory Optional • • • • • Fund Budget Fiscal Year USSGL Account Cost Center BOC Reporting Category Cat B Apportionment Cohort Project Code Future Use 1 Future Use 2 • • Internal Fund Code Budget Fiscal Year USSGL Account Internal Organization Code Object Class Code Program Code Credit Cohort Year Government-wide Project Code • • Cost Center Code Strategic Goal Code Project Code USSGL Account Extension Code Object Class Extension Code Revenue Source Code Activity Code Critical Agency Mission-Specific Fields 1 - 5

Stage 2 – Competitive Environment & Seamless Data Integration • In order to enable improved performance of financial systems, the FMLo. B envisions more competitive alternatives for financial systems and an environment where financial data can be more easily compared and aggregated across agencies.

Stage 3 – Results • When the FMLo. B goals are fully realized, agencies’ data will be more timely and accurate for decision-making and there will be improved government-wide stewardship and accounting.

Stage 3 – Results (cont’d) • More timely and accurate data will result from the standardization and seamless data integration efforts, including the implementation of centralized interfaces between core financial systems and other systems. • These efforts will focus on promoting strong internal controls and ensuring the integrity of accounting data.

Other FMLo. B Activities SSP Forums • Brings together FSIO, OMB and senior officials from the Federal SSPs to promote information sharing, improve communication and encourage collaboration between the key FMLo. B stakeholders and designated SSPs in order to foster improvements in Federal financial management.

Other FMLo. B Activities (cont’d) Transformation Team • Includes representatives from most of the 24 CFO Act Agencies who are subject matter experts serving on behalf of their respective agencies. • Members review FMLo. B draft deliverables and monitor ongoing progress.

Other FMLo. B Activities (cont’d) Transformation Team (cont’d) • As an Agency’s financial expert, their guidance and recommendations, as well as communicating agency concerns, are equally essential in driving the success of the FMLo. B and standard business processes development.

Other FMLo. B Activities (cont’d) Transformation Team (cont’d) • Team members carry the dual responsibility of ensuring the successful transformation of the FMLo. B as well as making certain their own Agency will be prepared to implement the process.

Specific Goals for 2009 • Finalize the business process standards for Reports Management and Reimbursables Management. • Complete update of the Core Financial System Requirements.

Specific Goals for 2009 (cont’d) • Develop and begin implementing a change management strategy for agencies implementing the FMLo. B standards. • Develop testing materials that incorporate updated requirements.

Overview of BFELo. B • The initiative began in spring 2005 as a workgroup of the Budget Officers Advisory Council (BOAC) charged with exploring the potential for improving Federal budgeting. • The Budget Formulation and Execution Line of Business (BFELo. B) was officially announced as a formal line of business in February 2006 as part of the President's FY 2007 Budget.

Overview of BFELo. B (cont’d) • The focus is to build a "budget of the future" by promoting information sharing across government agency budget offices and building a "community of practice". • With this collaboration, the budget community can start to identify best practices for all aspects of budget formulation and execution. The BFELo. B strives to find solutions that link budget formulation, execution, planning, performance, and financial information.

Overview of BFELo. B (cont’d) • The BFELo. B taskforce, made up of agency representatives, was formed. • This taskforce meets regularly to identify opportunities for common budgeting solutions as well as automated tools to enhance the agency budget process.

Goals • Improve the efficiency and effectiveness of agency and central processes formulating and executing the Federal Budget. • Improve the integration and standardized exchange of budget formulation, execution, planning, performance measurement and financial management information and activities across government.

Goals (cont’d) • Improve capabilities for analyzing budget, execution, planning, performance, and financial information in support of decision making. • Enhance capabilities for aligning programs and their outputs and outcomes with budget levels and actual costs to institutionalize budget and performance integration. • Enhance the effectiveness of the Federal budgeting workforce.

Activities and Accomplishments • • Decision matrix Budget Formulation and Execution Manager (BFEM) Integration workgroup MAX Federal Community Technologies Budget Human Capital workgroup Training sessions

Activities and Accomplishments (cont’d) Decision matrix • Developed a decision matrix for budget systems requirements and evaluated budgeting systems against the matrix for Government-wide use. • Evaluated nine budget systems against requirements in the decision matrix – 6 Government agency systems – 3 vendor provided systems

Activities and Accomplishments (cont’d) Decision matrix (cont’d) • Released in October 2008, the final product is a compendium of information, in a matrix format, comparing all systems’ ratings for over 50 capabilities, as well as summary and detailed information on each system. • The decision matrix document is available on the Budget Community website at https: //max. omb. gov/community/x/3 w. Gt. Cw

Activities and Accomplishments (cont’d) Budget Formulation and Execution Manager (BFEM) • Supported the first fee-for-service budget system, the BFEM, by the Department of Treasury. The system includes a Formulation Module and a Performance Management Module (PMM). • Currently used by 11 Federal agencies.

Activities and Accomplishments (cont’d) BFEM (cont’d) • In June 2009 BFEM will be upgraded. • The new application will have "Business Intelligence" functionality, allowing users to query the BFEM and PMM database, create ad hoc reports, and track performance results. • It will also allow agencies to transmit data for publication on the Internet, automatically file apportionment requests with OMB and allow users to save documents directly to the database.

Activities and Accomplishments (cont’d) Integration workgroup • Established the Budget Execution and Financial Management Integration workgroup with participation by OMB, Treasury and FMLo. B. • A Touchpoints paper has been developed to highlight key budget and financial management intersections.

Activities and Accomplishments (cont’d) Integration workgroup (cont’d) • The workgroup completed a set of 11 process maps depicting budget execution process flows between agencies, Treasury, OMB and Congress. • The workgroup is also working with the FMLo. B to standardize interagency reimbursable agreements.

Activities and Accomplishments (cont’d) MAX Federal Community • Created a Government-wide, Government-only "Wiki" website, the MAX Federal Community, for information sharing and collaboration. • Current communities include Acquisition, Budget, E -government, Financial Management, Grants, Homeland Security, Human Capital, IT Infrastructure, Management, Open Government, Performance, Planning, Recovery Act and Small Agencies.

Activities and Accomplishments (cont’d) MAX Federal Community (cont’d) • Provision for interdepartmental and agency internal collaborations. • Over 14, 000 users. • Registration for Federal Government agency employees is easy at www. max. omb. gov.

Activities and Accomplishments (cont’d) MAX Federal Community (cont’d) • The BFELo. B's secure online meeting capability is available for member agencies to use for their own meetings, allowing remote meeting attendees to view materials being reviewed and to participate in the conversation. • Allows agencies to establish permanent meeting rooms that can be used for remote access to meetings when personnel are offsite, on travel or working at home.

Activities and Accomplishments (cont’d) Technologies • Identified technologies to provide Governmentwide capabilities for capturing, processing and managing data.

Activities and Accomplishments (cont’d) Budget Human Capital workgroup • Established a Budget Human Capital workgroup to professionalize the budget career by combining agency efforts to define budget career paths, core competencies, leadership development and certification programs.

Activities and Accomplishments (cont’d) Training sessions • Organized training sessions, covering a variety of budget and finance topics, benefiting approximately 1, 800 employees from over 40 agencies/bureaus.

ARC Participation in FMLo. B and BFELo. B • 30 different ARC employees ranging from Accountants to the Executive Director have been involved in FMLo. B and/or BFELo. B teams, work groups and meetings over the past 3 years. • Some employees are involved in multiple activities and meetings. • Many other employees are not involved in formal meetings but contribute to ARC’s efforts by reviewing draft guidance, formulating comments and assisting in the planning for changes.

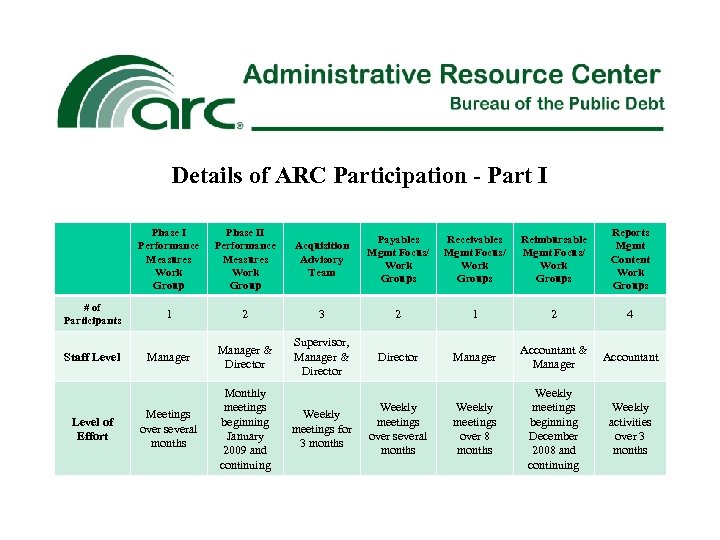

Details of ARC Participation - Part I Phase I Performance Measures Work Group # of Participants Staff Level of Effort Phase II Performance Measures Work Group Acquisition Advisory Team Payables Mgmt Focus/ Work Groups Receivables Mgmt Focus/ Work Groups Reimbursable Mgmt Focus/ Work Groups Reports Mgmt Content Work Groups 1 2 3 2 1 2 4 Manager & Director Supervisor, Manager & Director Manager Accountant & Manager Accountant Meetings over several months Monthly meetings beginning January 2009 and continuing Weekly meetings for 3 months Weekly meetings over several months Weekly meetings over 8 months Weekly meetings beginning December 2008 and continuing Weekly activities over 3 months

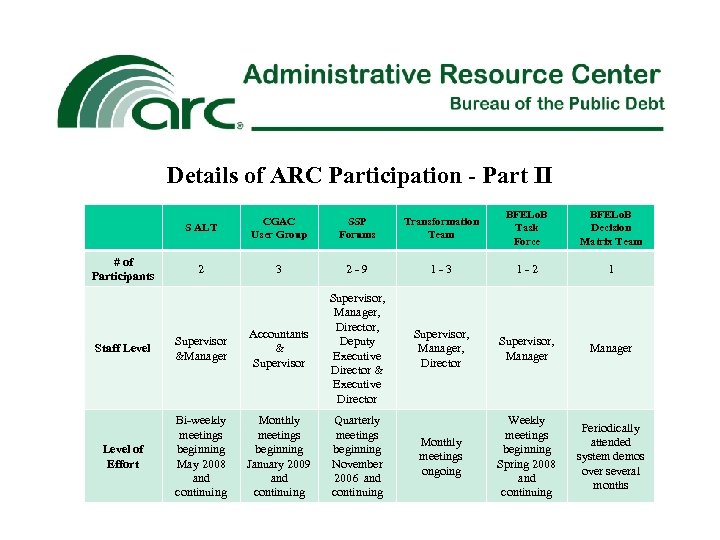

Details of ARC Participation - Part II S ALT CGAC User Group SSP Forums Transformation Team BFELo. B Task Force BFELo. B Decision Matrix Team 2 3 2 - 9 1 - 3 1 - 2 1 Staff Level Supervisor &Manager Accountants & Supervisor, Manager, Director, Deputy Executive Director & Executive Director Supervisor, Manager, Director Supervisor, Manager Level of Effort Bi-weekly meetings beginning May 2008 and continuing Monthly meetings beginning January 2009 and continuing Quarterly meetings beginning November 2006 and continuing Monthly meetings ongoing Weekly meetings beginning Spring 2008 and continuing Periodically attended system demos over several months # of Participants

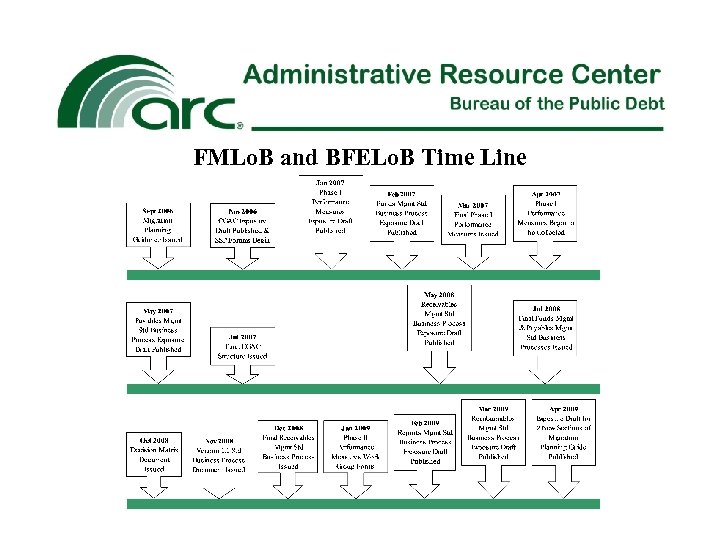

FMLo. B and BFELo. B Time Line

e67f1fbebf2cf88fd3c7e8282bc1a3dd.ppt