18c6bd7ef29e031a753a9da325ddd472.ppt

- Количество слайдов: 11

FMCG Monitor Taiwan 2013 Quarter 4 © Kantar Worldpanel

FMCG Monitor Taiwan 2013 Quarter 4 © Kantar Worldpanel

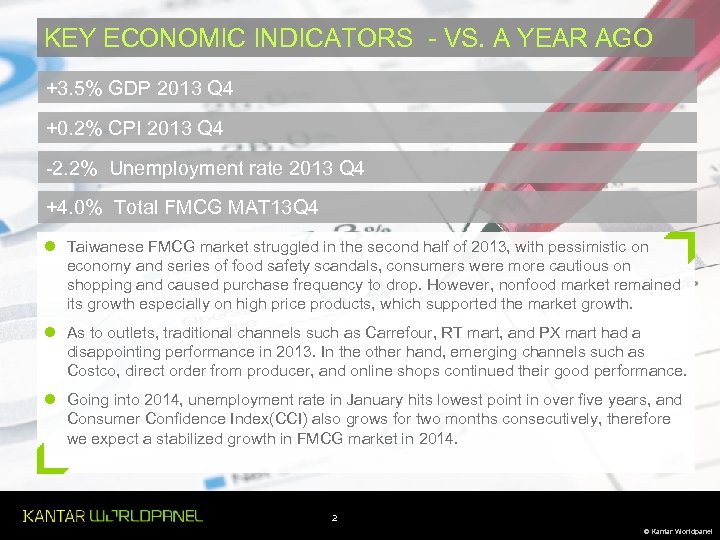

KEY ECONOMIC INDICATORS - VS. A YEAR AGO +3. 5% GDP 2013 Q 4 +0. 2% CPI 2013 Q 4 -2. 2% Unemployment rate 2013 Q 4 +4. 0% Total FMCG MAT 13 Q 4 l Taiwanese FMCG market struggled in the second half of 2013, with pessimistic on economy and series of food safety scandals, consumers were more cautious on shopping and caused purchase frequency to drop. However, nonfood market remained its growth especially on high price products, which supported the market growth. l As to outlets, traditional channels such as Carrefour, RT mart, and PX mart had a disappointing performance in 2013. In the other hand, emerging channels such as Costco, direct order from producer, and online shops continued their good performance. l Going into 2014, unemployment rate in January hits lowest point in over five years, and Consumer Confidence Index(CCI) also grows for two months consecutively, therefore we expect a stabilized growth in FMCG market in 2014. 2 © Kantar Worldpanel

KEY ECONOMIC INDICATORS - VS. A YEAR AGO +3. 5% GDP 2013 Q 4 +0. 2% CPI 2013 Q 4 -2. 2% Unemployment rate 2013 Q 4 +4. 0% Total FMCG MAT 13 Q 4 l Taiwanese FMCG market struggled in the second half of 2013, with pessimistic on economy and series of food safety scandals, consumers were more cautious on shopping and caused purchase frequency to drop. However, nonfood market remained its growth especially on high price products, which supported the market growth. l As to outlets, traditional channels such as Carrefour, RT mart, and PX mart had a disappointing performance in 2013. In the other hand, emerging channels such as Costco, direct order from producer, and online shops continued their good performance. l Going into 2014, unemployment rate in January hits lowest point in over five years, and Consumer Confidence Index(CCI) also grows for two months consecutively, therefore we expect a stabilized growth in FMCG market in 2014. 2 © Kantar Worldpanel

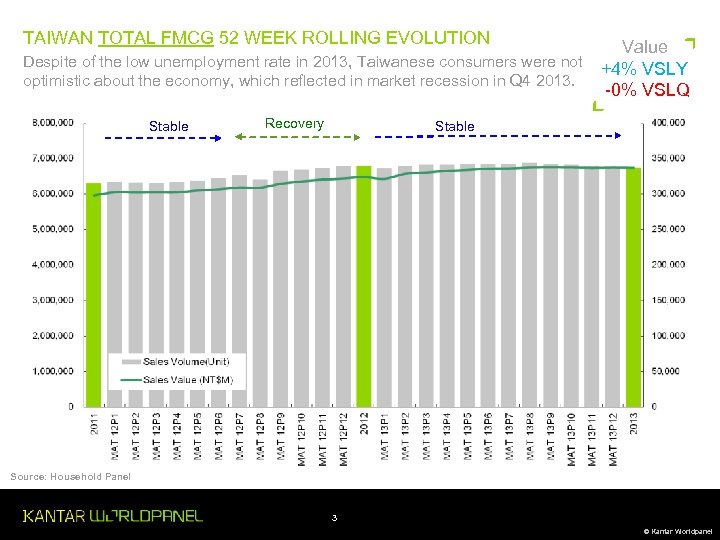

TAIWAN TOTAL FMCG 52 WEEK ROLLING EVOLUTION Value Despite of the low unemployment rate in 2013, Taiwanese consumers were not +4% VSLY optimistic about the economy, which reflected in market recession in Q 4 2013. -0% VSLQ Stable Recovery Stable Source: Household Panel 3 © Kantar Worldpanel

TAIWAN TOTAL FMCG 52 WEEK ROLLING EVOLUTION Value Despite of the low unemployment rate in 2013, Taiwanese consumers were not +4% VSLY optimistic about the economy, which reflected in market recession in Q 4 2013. -0% VSLQ Stable Recovery Stable Source: Household Panel 3 © Kantar Worldpanel

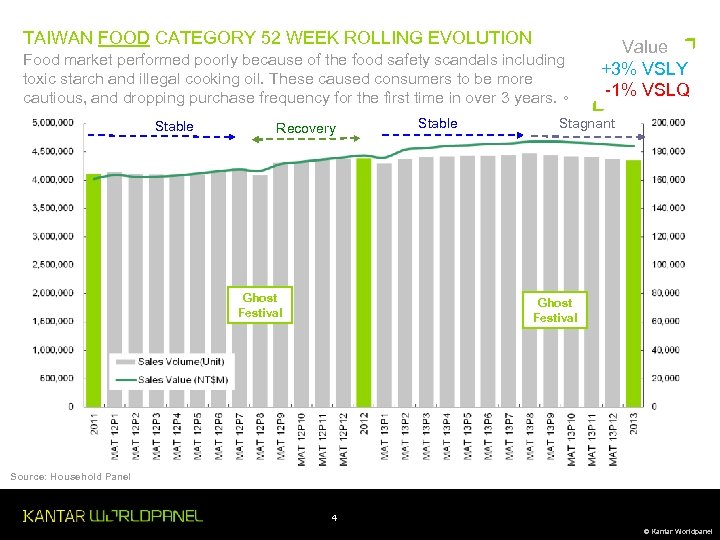

TAIWAN FOOD CATEGORY 52 WEEK ROLLING EVOLUTION Food market performed poorly because of the food safety scandals including toxic starch and illegal cooking oil. These caused consumers to be more cautious, and dropping purchase frequency for the first time in over 3 years. 。 Stable Recovery Ghost Festival Stable Value +3% VSLY -1% VSLQ Stagnant Ghost Festival Source: Household Panel 4 © Kantar Worldpanel

TAIWAN FOOD CATEGORY 52 WEEK ROLLING EVOLUTION Food market performed poorly because of the food safety scandals including toxic starch and illegal cooking oil. These caused consumers to be more cautious, and dropping purchase frequency for the first time in over 3 years. 。 Stable Recovery Ghost Festival Stable Value +3% VSLY -1% VSLQ Stagnant Ghost Festival Source: Household Panel 4 © Kantar Worldpanel

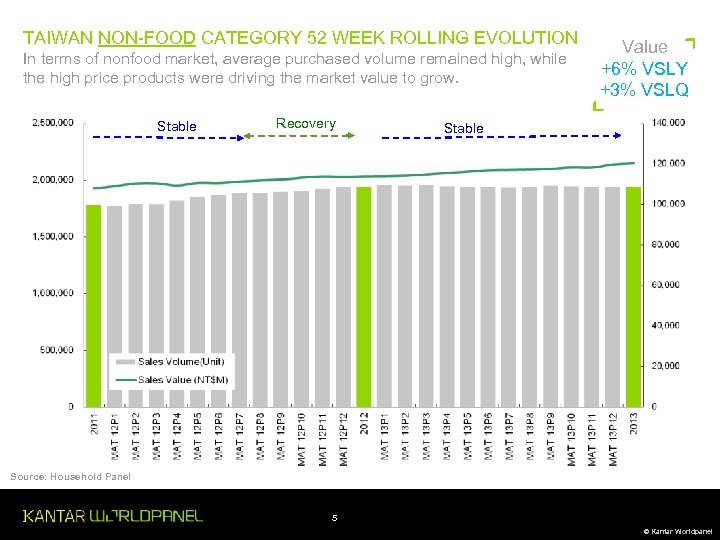

TAIWAN NON-FOOD CATEGORY 52 WEEK ROLLING EVOLUTION In terms of nonfood market, average purchased volume remained high, while the high price products were driving the market value to grow. Stable Recovery Value +6% VSLY +3% VSLQ Stable Source: Household Panel 5 © Kantar Worldpanel

TAIWAN NON-FOOD CATEGORY 52 WEEK ROLLING EVOLUTION In terms of nonfood market, average purchased volume remained high, while the high price products were driving the market value to grow. Stable Recovery Value +6% VSLY +3% VSLQ Stable Source: Household Panel 5 © Kantar Worldpanel

DECLINED FOOD CATEGORIES COOKING OIL FROZEN FOOD NOODLES Growth>5% DESSERT 0. 5%

DECLINED FOOD CATEGORIES COOKING OIL FROZEN FOOD NOODLES Growth>5% DESSERT 0. 5%

HOT NON-FOOD CATEGORIES SKINCARE(AA) PREMIUM SHAMPOO ORAL CARE Growth>5% INTERFOLD PAPER 0. 5%

HOT NON-FOOD CATEGORIES SKINCARE(AA) PREMIUM SHAMPOO ORAL CARE Growth>5% INTERFOLD PAPER 0. 5%

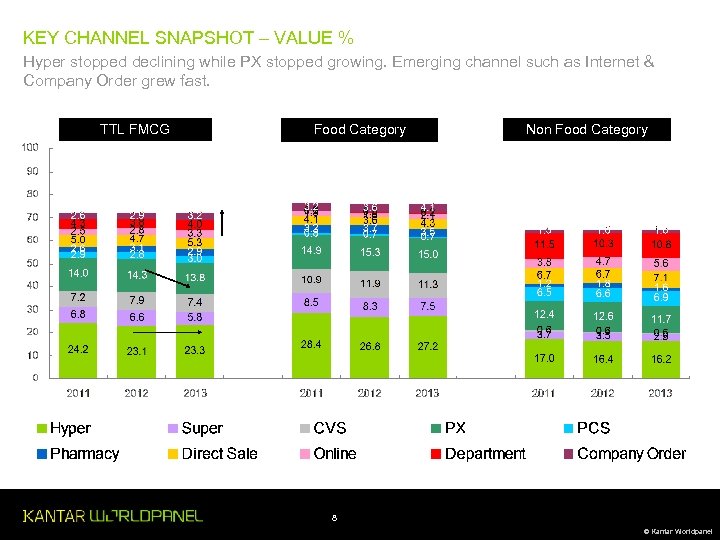

KEY CHANNEL SNAPSHOT – VALUE % Hyper stopped declining while PX stopped growing. Emerging channel such as Internet & Company Order grew fast. TTL FMCG Food Category Non Food Category 8 © Kantar Worldpanel

KEY CHANNEL SNAPSHOT – VALUE % Hyper stopped declining while PX stopped growing. Emerging channel such as Internet & Company Order grew fast. TTL FMCG Food Category Non Food Category 8 © Kantar Worldpanel

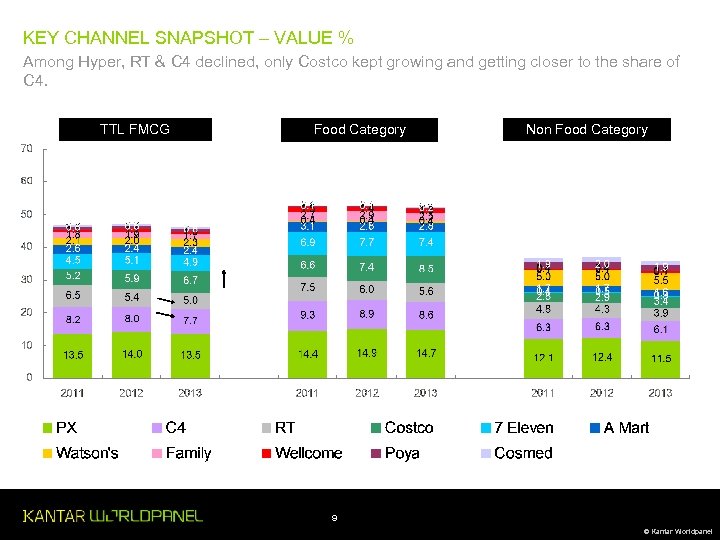

KEY CHANNEL SNAPSHOT – VALUE % Among Hyper, RT & C 4 declined, only Costco kept growing and getting closer to the share of C 4. TTL FMCG Food Category Non Food Category 9 © Kantar Worldpanel

KEY CHANNEL SNAPSHOT – VALUE % Among Hyper, RT & C 4 declined, only Costco kept growing and getting closer to the share of C 4. TTL FMCG Food Category Non Food Category 9 © Kantar Worldpanel

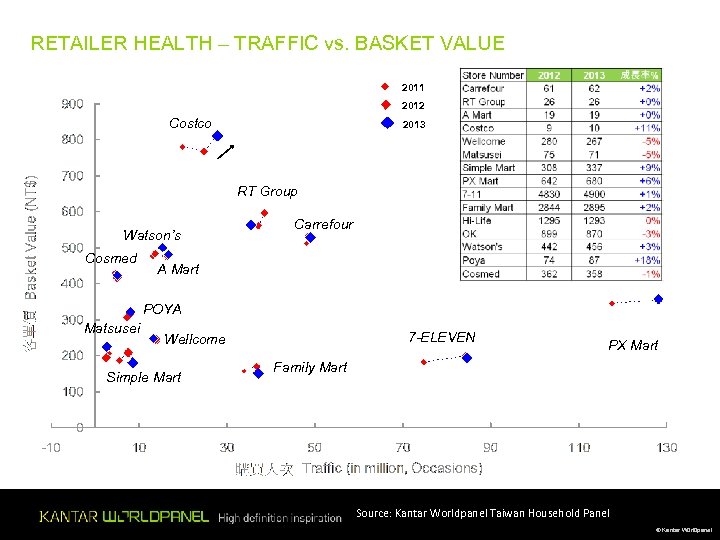

RETAILER HEALTH – TRAFFIC vs. BASKET VALUE 2011 2012 Costco 2013 RT Group Watson’s Cosmed Carrefour A Mart POYA Matsusei 7 -ELEVEN Wellcome Simple Mart PX Mart Family Mart Source: Kantar Worldpanel Taiwan Household Panel © Kantar Worldpanel

RETAILER HEALTH – TRAFFIC vs. BASKET VALUE 2011 2012 Costco 2013 RT Group Watson’s Cosmed Carrefour A Mart POYA Matsusei 7 -ELEVEN Wellcome Simple Mart PX Mart Family Mart Source: Kantar Worldpanel Taiwan Household Panel © Kantar Worldpanel

About Kantar Worldpanel is the world leader in consumer knowledge and insights based on continuous consumer panels. Combining market monitoring, advanced analytics and tailored market research solutions we deliver both the big picture and the fine detail that inspire successful actions by our clients. Our expertise about what people buy or use – and why – has become the market currency for brand owners, retailers, market analysts and government organisations internationally. With over 60 years’ experience, a team of 3, 000, and services covering more than 50 countries directly or through partners, we deliver High Definition Inspiration™ in fields as diverse as FMCG, impulse products, fashion, baby, telecommunications and entertainment, among many others. Kantar Worldpanel is part of the Kantar Group, one of the world's largest insight, information and consultancy networks. The Kantar Group is the data investment management division of WPP. Contact us Kantar Worldpanel Taiwan 7 F, 34, Sec 3, Bade Road. , Taipei Taiwan, R. O. C. 105 T +886 2 2570 0556 F + 886 2 2579 6911 E Taiwan@kantarworldpanel. com W www. kantarworldpanel. com/tw-en 11 © Kantar Worldpanel

About Kantar Worldpanel is the world leader in consumer knowledge and insights based on continuous consumer panels. Combining market monitoring, advanced analytics and tailored market research solutions we deliver both the big picture and the fine detail that inspire successful actions by our clients. Our expertise about what people buy or use – and why – has become the market currency for brand owners, retailers, market analysts and government organisations internationally. With over 60 years’ experience, a team of 3, 000, and services covering more than 50 countries directly or through partners, we deliver High Definition Inspiration™ in fields as diverse as FMCG, impulse products, fashion, baby, telecommunications and entertainment, among many others. Kantar Worldpanel is part of the Kantar Group, one of the world's largest insight, information and consultancy networks. The Kantar Group is the data investment management division of WPP. Contact us Kantar Worldpanel Taiwan 7 F, 34, Sec 3, Bade Road. , Taipei Taiwan, R. O. C. 105 T +886 2 2570 0556 F + 886 2 2579 6911 E Taiwan@kantarworldpanel. com W www. kantarworldpanel. com/tw-en 11 © Kantar Worldpanel