Flowcharts of Paulson Plan Why it won’t work Steve Keen www. debtdeflation. com/blogs

Flowcharts of Paulson Plan Why it won’t work Steve Keen www. debtdeflation. com/blogs

Precis • • • This is just a very fast sketch of the probable feedback effects from the Paulson Plan, prepared to guide comments to a the Australian Channel Nine TV Today show I used US$2 trillion as my ballpark, both because US$700 billion seemed just too small in the light of the scale of US private debt—US$25 trillion for households and business, and $41 trillion when financial sector debt is included—and because I expect the “Plan” to blow out over time anyway to much this level. This analysis is a long way short of the type of dynamic modeling I prefer to do to consider the consequences of economic policies; – but with less than a day’s notice of the interview, it’s the best I could come up with. • Mind you, it doesn’t look too bad in the light of the “Say What? ” comment posted on the Doonesbury site today (http: //www. doonesbury. com/strip/dailydose): – “It's not based on any particular data point. We just wanted to choose a really large number. “—Treasury spokeswoman on the $700 B bailout figure

Precis • • • This is just a very fast sketch of the probable feedback effects from the Paulson Plan, prepared to guide comments to a the Australian Channel Nine TV Today show I used US$2 trillion as my ballpark, both because US$700 billion seemed just too small in the light of the scale of US private debt—US$25 trillion for households and business, and $41 trillion when financial sector debt is included—and because I expect the “Plan” to blow out over time anyway to much this level. This analysis is a long way short of the type of dynamic modeling I prefer to do to consider the consequences of economic policies; – but with less than a day’s notice of the interview, it’s the best I could come up with. • Mind you, it doesn’t look too bad in the light of the “Say What? ” comment posted on the Doonesbury site today (http: //www. doonesbury. com/strip/dailydose): – “It's not based on any particular data point. We just wanted to choose a really large number. “—Treasury spokeswoman on the $700 B bailout figure

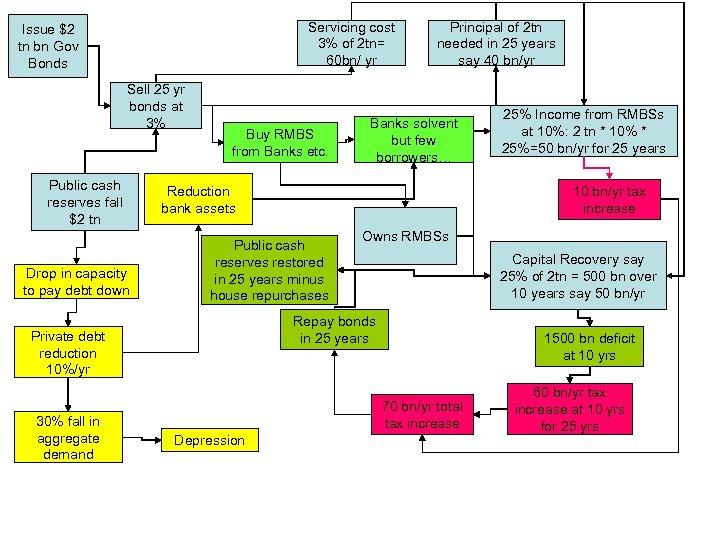

Servicing cost 3% of 2 tn= 60 bn/ yr Issue $2 tn bn Gov Bonds Sell 25 yr bonds at 3% Public cash reserves fall $2 tn Drop in capacity to pay debt down Buy RMBS from Banks etc. Banks solvent but few borrowers… Public cash reserves restored in 25 years minus house repurchases Owns RMBSs Capital Recovery say 25% of 2 tn = 500 bn over 10 years say 50 bn/yr Repay bonds in 25 years 1500 bn deficit at 10 yrs 70 bn/yr total tax increase Depression 25% Income from RMBSs at 10%: 2 tn * 10% * 25%=50 bn/yr for 25 years 10 bn/yr tax increase Reduction bank assets Private debt reduction 10%/yr 30% fall in aggregate demand Principal of 2 tn needed in 25 years say 40 bn/yr 60 bn/yr tax increase at 10 yrs for 25 yrs

Servicing cost 3% of 2 tn= 60 bn/ yr Issue $2 tn bn Gov Bonds Sell 25 yr bonds at 3% Public cash reserves fall $2 tn Drop in capacity to pay debt down Buy RMBS from Banks etc. Banks solvent but few borrowers… Public cash reserves restored in 25 years minus house repurchases Owns RMBSs Capital Recovery say 25% of 2 tn = 500 bn over 10 years say 50 bn/yr Repay bonds in 25 years 1500 bn deficit at 10 yrs 70 bn/yr total tax increase Depression 25% Income from RMBSs at 10%: 2 tn * 10% * 25%=50 bn/yr for 25 years 10 bn/yr tax increase Reduction bank assets Private debt reduction 10%/yr 30% fall in aggregate demand Principal of 2 tn needed in 25 years say 40 bn/yr 60 bn/yr tax increase at 10 yrs for 25 yrs

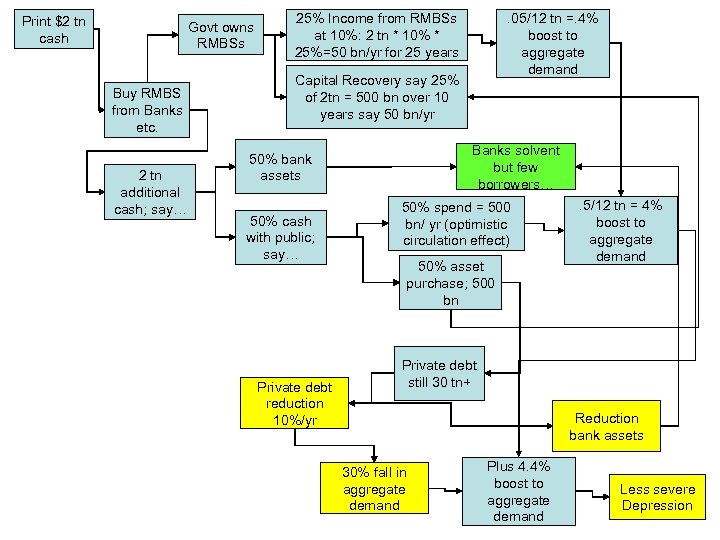

Print $2 tn cash Govt owns RMBSs Buy RMBS from Banks etc. 2 tn additional cash; say… 25% Income from RMBSs at 10%: 2 tn * 10% * 25%=50 bn/yr for 25 years . 05/12 tn =. 4% boost to aggregate demand Capital Recovery say 25% of 2 tn = 500 bn over 10 years say 50 bn/yr Banks solvent but few borrowers… 50% bank assets 50% cash with public; say… Private debt reduction 10%/yr 50% spend = 500 bn/ yr (optimistic circulation effect) 50% asset purchase; 500 bn . 5/12 tn = 4% boost to aggregate demand Private debt still 30 tn+ Reduction bank assets 30% fall in aggregate demand Plus 4. 4% boost to aggregate demand Less severe Depression

Print $2 tn cash Govt owns RMBSs Buy RMBS from Banks etc. 2 tn additional cash; say… 25% Income from RMBSs at 10%: 2 tn * 10% * 25%=50 bn/yr for 25 years . 05/12 tn =. 4% boost to aggregate demand Capital Recovery say 25% of 2 tn = 500 bn over 10 years say 50 bn/yr Banks solvent but few borrowers… 50% bank assets 50% cash with public; say… Private debt reduction 10%/yr 50% spend = 500 bn/ yr (optimistic circulation effect) 50% asset purchase; 500 bn . 5/12 tn = 4% boost to aggregate demand Private debt still 30 tn+ Reduction bank assets 30% fall in aggregate demand Plus 4. 4% boost to aggregate demand Less severe Depression