8265e41272251d0ab0b48b69598241de.ppt

- Количество слайдов: 35

Flood Insurance Changes Expect higher premiums, but not as high as they might have been. New fees, too. Expect more private insurance availability. Why and how it's changing.

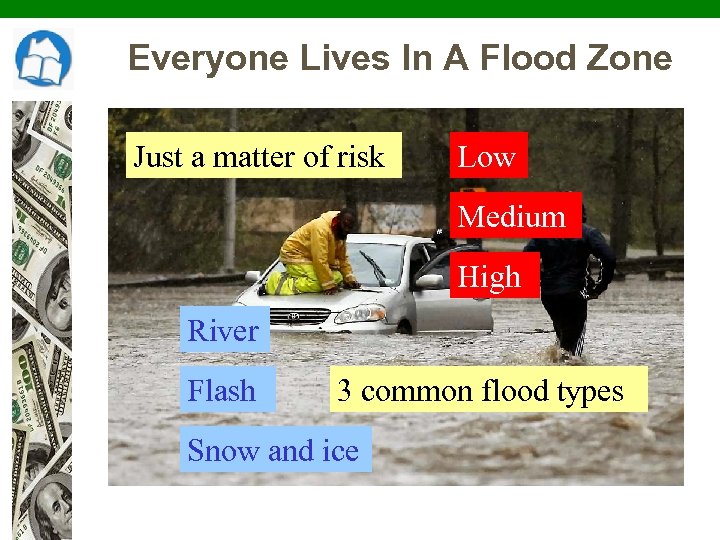

Everyone Lives In A Flood Zone Just a matter of risk Low Medium High River Flash 3 common flood types Snow and ice

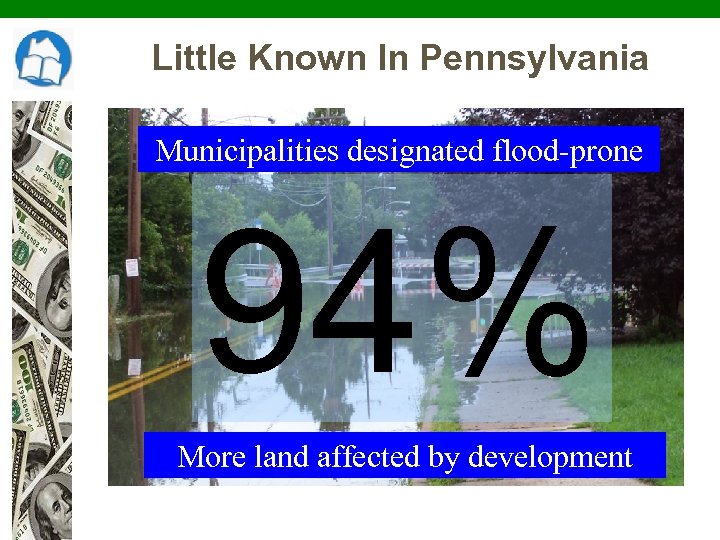

Little Known In Pennsylvania Municipalities designated flood-prone 94% More land affected by development

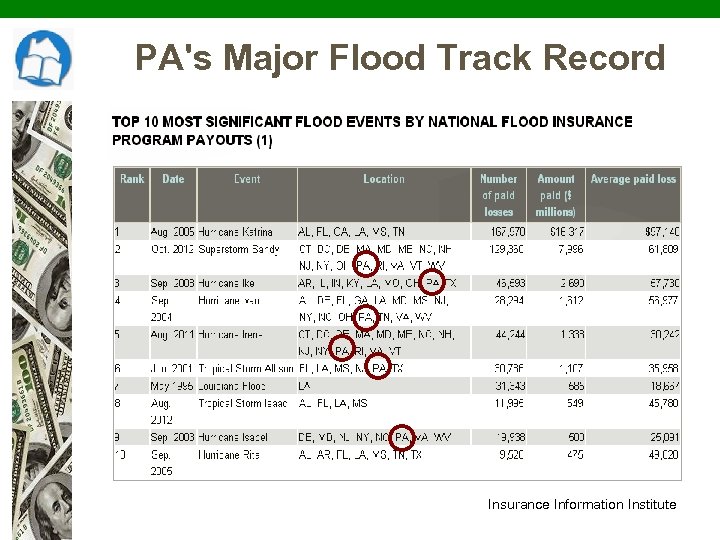

PA's Major Flood Track Record Insurance Information Institute

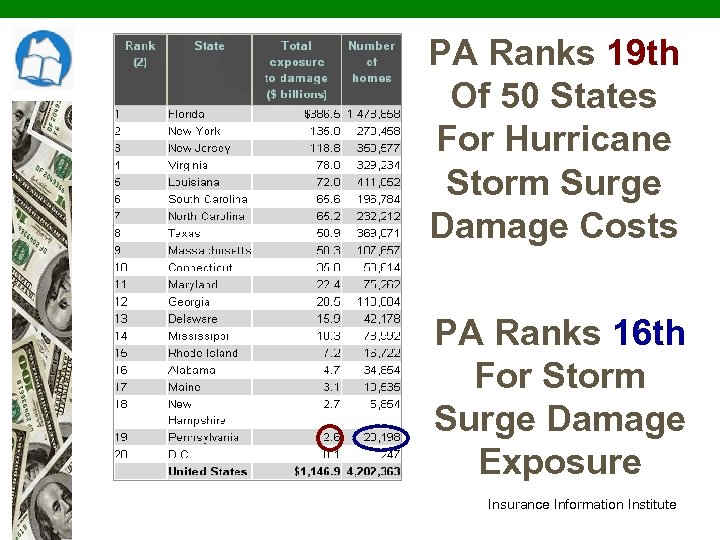

PA Ranks 19 th Of 50 States For Hurricane Storm Surge Damage Costs PA Ranks 16 th For Storm Surge Damage Exposure Insurance Information Institute

Who's Marketed In Flood Plains?

Flood Insurance Handles Risk The answer? NO What does? NFIP, created 1968

Flood Insurance Handles Risk Limits? $250, 000 structure $100, 000 possessions

Flood Insurance Handles Risk Providers? FEMA administered Private insurers (WYO)

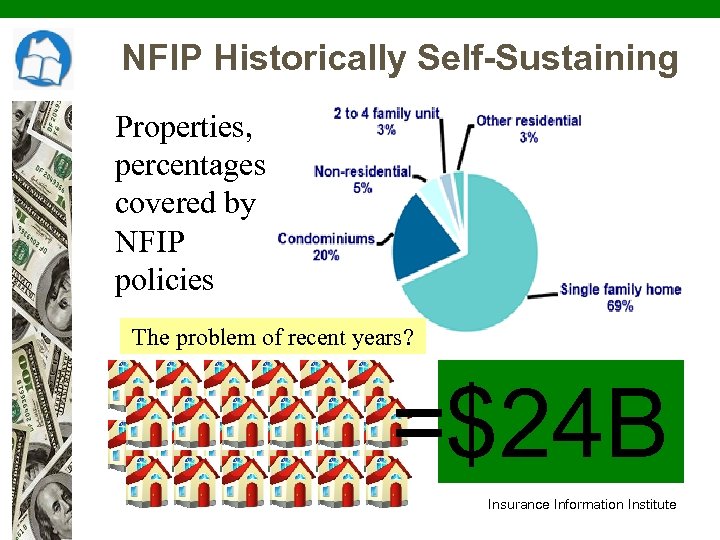

NFIP Historically Self-Sustaining Properties, percentages covered by NFIP policies The problem of recent years? =$24 B Insurance Information Institute

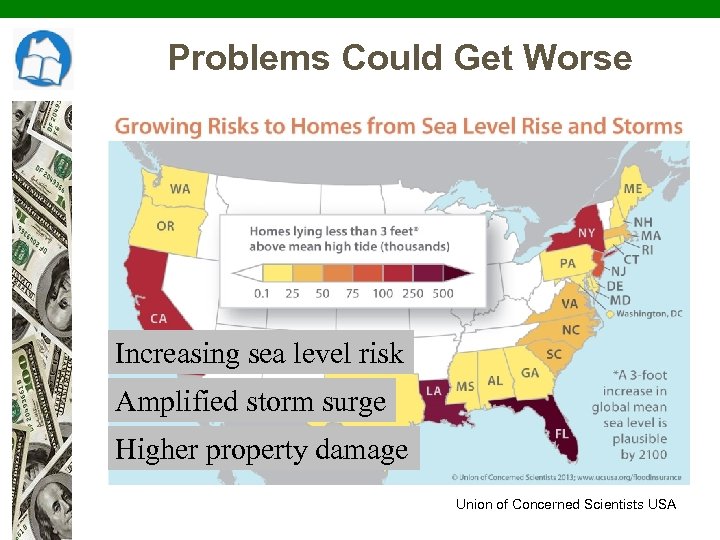

Problems Could Get Worse Increasing sea level risk Amplified storm surge Higher property damage Union of Concerned Scientists USA

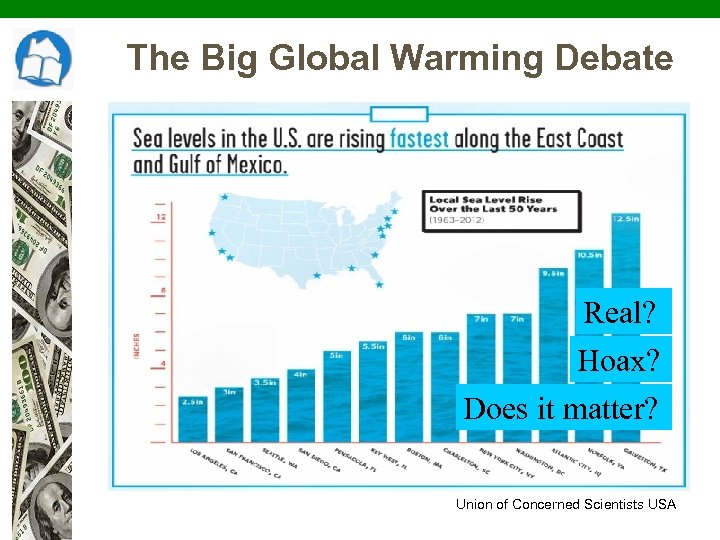

The Big Global Warming Debate Real? Hoax? Does it matter? Union of Concerned Scientists USA

From 2012 -14, Biggert-Waters

NAR Initially Liked The Act 40, 000 estimated lost sales monthly without insurance Insurance accessible to all Phased out subsidies $5 B debt pay-back

NAR Criticized Implementation Failed to eliminate subsidies gradually; huge premium increases Left the bad news to agents to deliver Disclosed potential rates too late Rate ranges too wide Inaccurate quotes

High Premiums, Lowered Value $500 premium increase = $10, 000 property value drop Created pressure for newer law

Result: 2015 Affordability Act Limits premium hikes 18% max In cost analysis, hikes est. 5% Lower closing costs; premium spread out Even high end, savings for most

1 st Change: 'Grandfathering' Continues subsidies for older homes Met code when built decades ago Later re-mapped, considered flood risk Their relief restored

2 nd Change: Pass-Along Policies Continues subsidies for new buyers Subsidized premiums of home sellers. . . get passed along to property buyers Rates rise annually, not immediately

3 rd Change: Fees, Not Hikes Adds new assessments for all policies $25 annually for homes Must be verified primary residences $250 yearly for businesses, vacation homes

4 th Change: Deductibles Option $10 K deductible allows lower rates Raises minimum deductibles other policies

The Goals All Along Make the program pay for itself Eliminate taxpayer subsidies, debt Keep home sale market productive

The Rise Of New Players 1973 mandated insurance 85 providers purchase in flood zones under contract $1. 3 trillion in coverage Experienced Did NOT require government to cover

WYOs Already In The Market Profitable Specialty coverage too Provide excess coverage Private carriers = Write Your Own(s)

Not A Level Playing Field Private carrier expansion supported Carriers' problem: can't compete NFIP subsidies lower premiums

FL, Other States Press The Case FL law encourages WYOs Some policies at NFIP rates 3 types from Flood. Choice

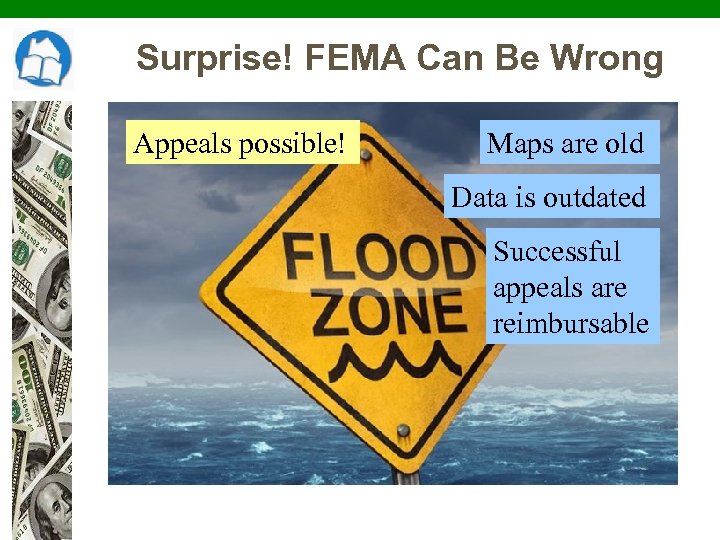

Surprise! FEMA Can Be Wrong Appeals possible! Maps are old Data is outdated Successful appeals are reimbursable

Surprise! FEMA Can Be Wrong Advocate's help Employees in place already: 800 -611 -6122 Required by act Answers questions, explain the process

Best Licensee Flood Zone Advice 'Disclosure of Flood Insurance Requirements, Rates, and Rate Increases'

A Duty To Disclose To Buyers Not required to 'investigate' Required to disclose actual knowledge of flood insurance need Required to disclose knowledge of previous flooding, insurance buy

If Disclosed, Warn About Costs Rates likely to be higher than past Rates might be lower than otherwise because of reforms Goal to reach full market-based premium

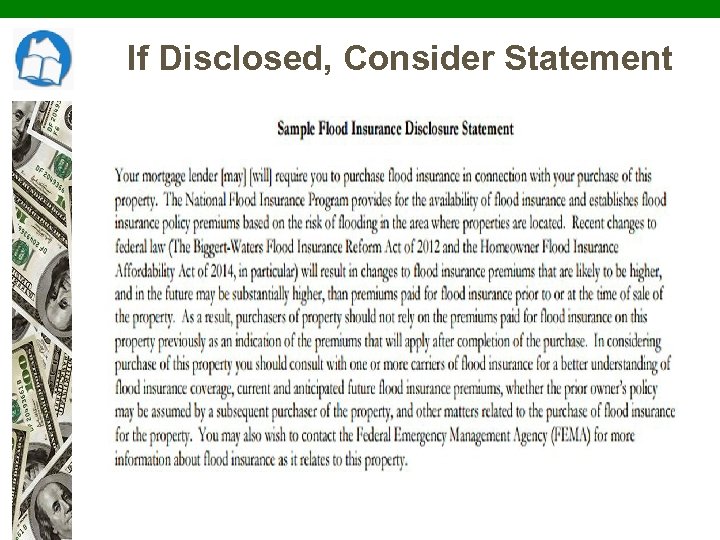

If Disclosed, Consider Statement

Be Prepared With Information Supply them, or Show where to get Acknowledgement of receipt!

Identify Insurance Suppliers Don't endorse! Don't recommend! Who can provide information on coverage and rates? Identify more than one!

What To Advise Sellers, If. . . May qualify for refund on earlier premium They may be unable to collect at closing Advise they consult an attorney

8265e41272251d0ab0b48b69598241de.ppt