be9cabd7754a92ef3d8396198d927513.ppt

- Количество слайдов: 27

FLEXIBLE BUDGETS, STANDARD COSTS, AND VARIANCES ANALYSIS CHAPTER 8 Introduction to Managerial Accounting Brewer, Garrison, Noreen Power Points from website -adapted by Cynthia Fortin, CPA, CMA http: //highered. mheducation. com/sites/0078025419/stude nt_view 0/chapter 8/index. html 1

Want to compare what actually happened with what should have happened 2

Management Control • Develop Planning budgets before a period begins • Adjust budgets to reflect actual level of activity => Flexible budget • Compare Actual revenue and spending to flexible budgets => Evaluate performance • Compute variances => Highlight significant problems • Take corrective action to solve problems 3

Flexible Budget Computes what revenues and costs would have been given the actual level of activity 4

Flexible budget assumption All costs are either variable or fixed with respect to level of activity 5

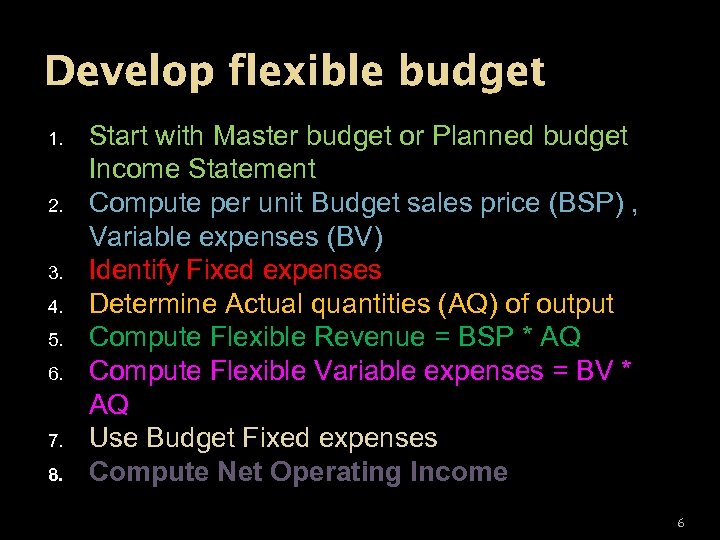

Develop flexible budget 1. 2. 3. 4. 5. 6. 7. 8. Start with Master budget or Planned budget Income Statement Compute per unit Budget sales price (BSP) , Variable expenses (BV) Identify Fixed expenses Determine Actual quantities (AQ) of output Compute Flexible Revenue = BSP * AQ Compute Flexible Variable expenses = BV * AQ Use Budget Fixed expenses Compute Net Operating Income 6

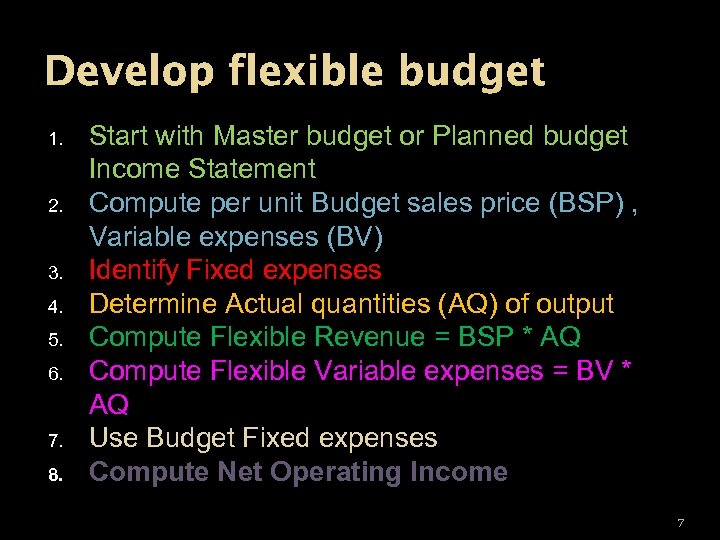

Develop flexible budget 1. 2. 3. 4. 5. 6. 7. 8. Start with Master budget or Planned budget Income Statement Compute per unit Budget sales price (BSP) , Variable expenses (BV) Identify Fixed expenses Determine Actual quantities (AQ) of output Compute Flexible Revenue = BSP * AQ Compute Flexible Variable expenses = BV * AQ Use Budget Fixed expenses Compute Net Operating Income 7

Day 12 mix Chap 08 Qianqianhai fish house. xlsx 8

Variances The Revenue variance = Actual Revenue – Flexible Budget Revenue The Spending variance = Actual spending - Flexible budget spending. 9

Standard costs Developed at all levels during the planning process DM (weight, units, length, price per unit of measure) DL (wages, taxes, benefits, mix of workers, rate per hour, labor time) Variable manufacturing OH (rates, allocation basis) 10

Standard Costing Examples: Standard quantity of materials = 2 kg. per unit Standard cost of materials = $8 per kg. Standard cost of materials = $16 per unit 11

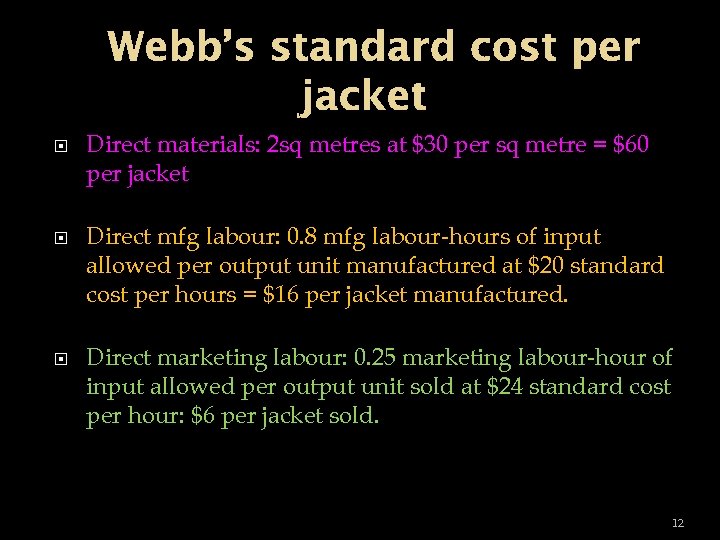

Webb’s standard cost per jacket Direct materials: 2 sq metres at $30 per sq metre = $60 per jacket Direct mfg labour: 0. 8 mfg labour-hours of input allowed per output unit manufactured at $20 standard cost per hours = $16 per jacket manufactured. Direct marketing labour: 0. 25 marketing labour-hour of input allowed per output unit sold at $24 standard cost per hour: $6 per jacket sold. 12

Variable mfg o/h: Allocated based on 1. 20 machine-hours per output unit mfg at $10 standard cost per machine-hour: $12 per unit manufactured. Variable marketing overhead: Allocated based on 0. 125 direct marketing l-h per output unit sold at $40 standard cost per hour: $5 per output unit sold. 13

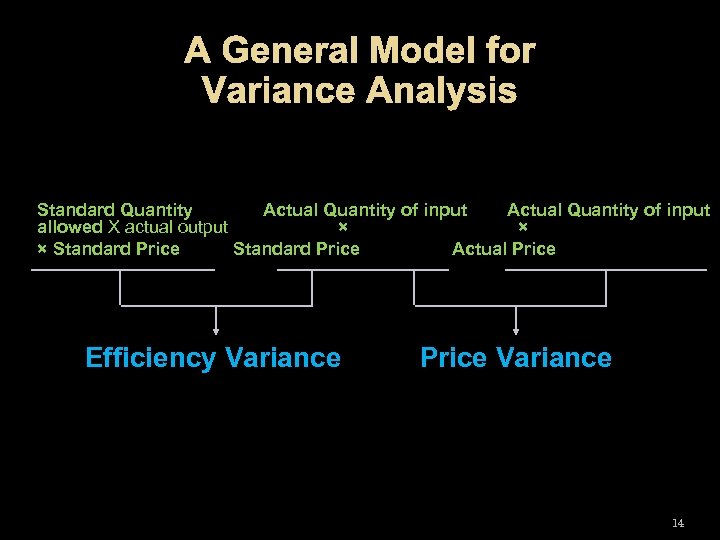

A General Model for Variance Analysis Standard Quantity Actual Quantity of input allowed X actual output × × × Standard Price Actual Price Efficiency Variance Price Variance 14

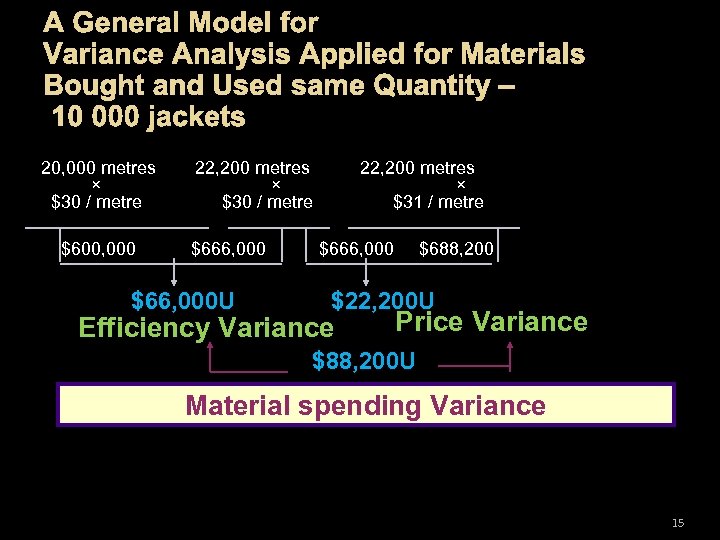

A General Model for Variance Analysis Applied for Materials Bought and Used same Quantity – 10 000 jackets 20, 000 metres × $30 / metre $600, 000 22, 200 metres × $30 / metre $666, 000 $66, 000 U 22, 200 metres × $31 / metre $666, 000 $688, 200 $22, 200 U Efficiency Variance Price Variance $88, 200 U Material spending Variance 15

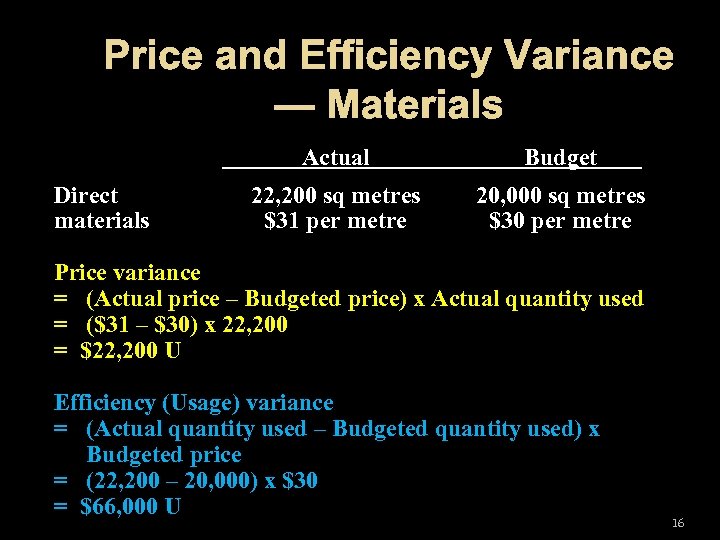

Price and Efficiency Variance — Materials Actual Direct materials Budget 22, 200 sq metres $31 per metre 20, 000 sq metres $30 per metre Price variance = (Actual price – Budgeted price) x Actual quantity used = ($31 – $30) x 22, 200 = $22, 200 U Efficiency (Usage) variance = (Actual quantity used – Budgeted quantity used) x Budgeted price = (22, 200 – 20, 000) x $30 = $66, 000 U 16

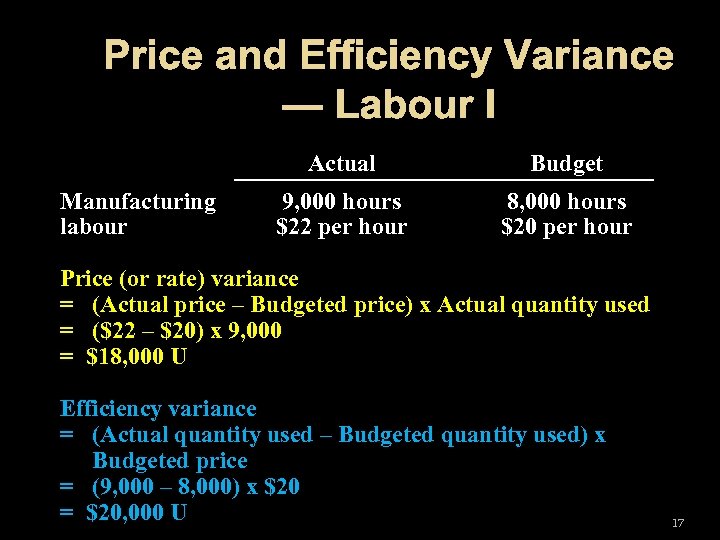

Price and Efficiency Variance — Labour I Actual Manufacturing labour Budget 9, 000 hours $22 per hour 8, 000 hours $20 per hour Price (or rate) variance = (Actual price – Budgeted price) x Actual quantity used = ($22 – $20) x 9, 000 = $18, 000 U Efficiency variance = (Actual quantity used – Budgeted quantity used) x Budgeted price = (9, 000 – 8, 000) x $20 = $20, 000 U 17

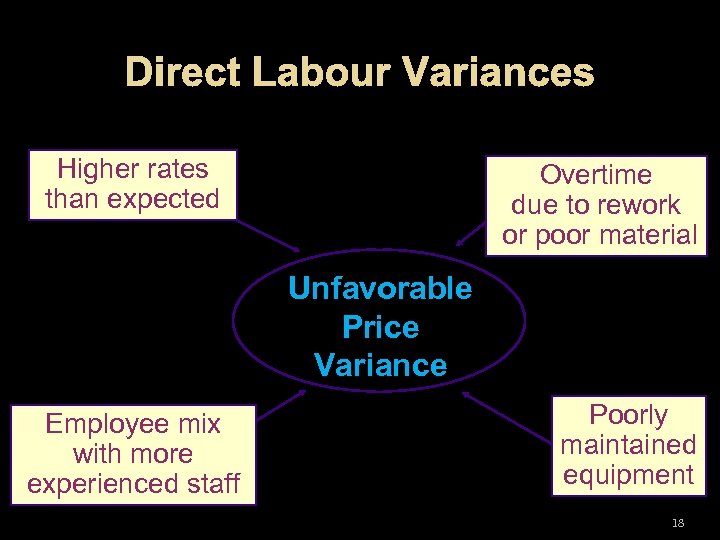

Direct Labour Variances Higher rates than expected Overtime due to rework or poor material Unfavorable Price Variance Employee mix with more experienced staff Poorly maintained equipment 18

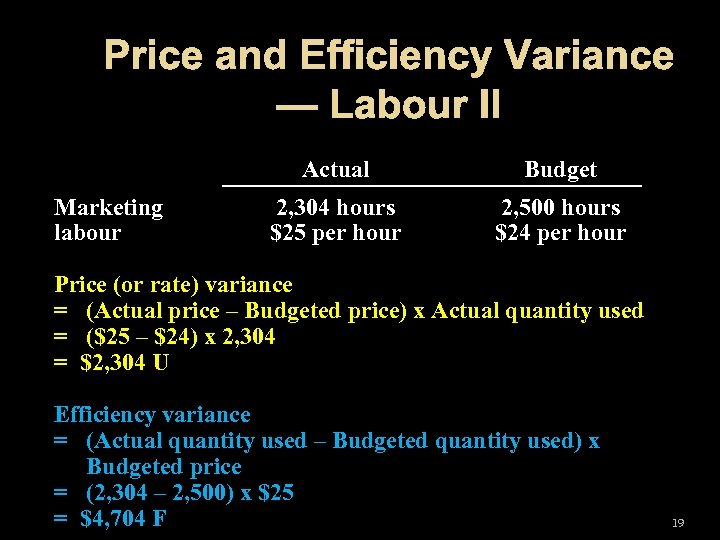

Price and Efficiency Variance — Labour II Actual Marketing labour Budget 2, 304 hours $25 per hour 2, 500 hours $24 per hour Price (or rate) variance = (Actual price – Budgeted price) x Actual quantity used = ($25 – $24) x 2, 304 = $2, 304 U Efficiency variance = (Actual quantity used – Budgeted quantity used) x Budgeted price = (2, 304 – 2, 500) x $25 = $4, 704 F 19

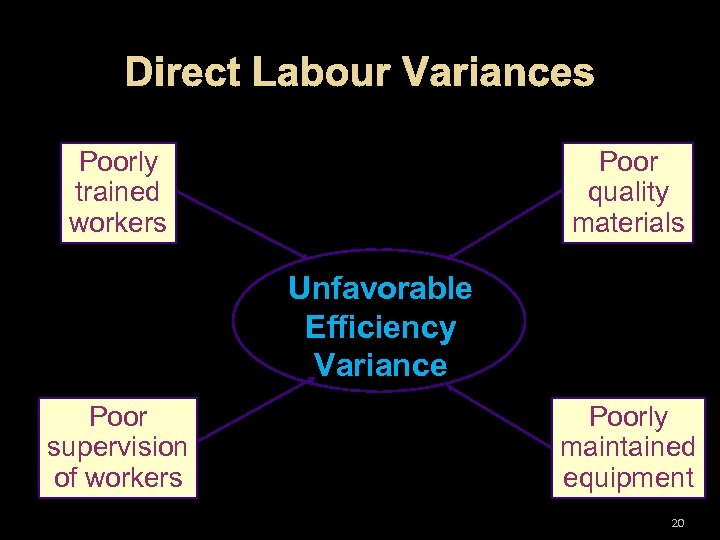

Direct Labour Variances Poorly trained workers Poor quality materials Unfavorable Efficiency Variance Poor supervision of workers Poorly maintained equipment 20

Possible reasons for efficiency variances Webb’s personnel manager hired underskilled workers or their training was inadequate. Webb’s production process is being reorganized or a new machine has been installed, creating addition direct manufacturing time per jacket while the workers learn the new process, etc. 21

Variances and Journal Entries • • Each variance may be journalized. Each variance has its own account. Favorable variances are credits; Unfavorable variances are debits. Variance accounts are generally closed into Cost of Goods Sold at the end of the period, if immaterial. 22

Evaluating Performance Variances Used to evaluate performance Indicate that something was different than expected Critical to understand why ( the causes) significant variances arise and use this knowledge to promote learning and continuous improvement 23

Effectiveness The degree to which organization’s predetermined goals are met Efficiency How well inputs were used in relation to a given level of output 24

Multiple causes of variances 1. Always consider possible interdependencies among variances; do not interpret them in isolation. 2. Use broad perspective of actions taken in the supply chain of organizations (supply chain: flow of goods, services, and information from beginning to end of a product or service). 3. Note that improvements in early stages of supply chain can sizably reduce magnitude of variances in subsequent stages. 25

4. Understand why variances arise and use knowledge to promote learning and continuous improvement –most important task in variance analysis. 5. Emphasize total organizational objectives by design of performance measurement and reward system by top management. 6. Use cost-benefit test to decide when and which variances should be investigated. 7. Realize that the standard is a range of possible acceptable outcomes. 26

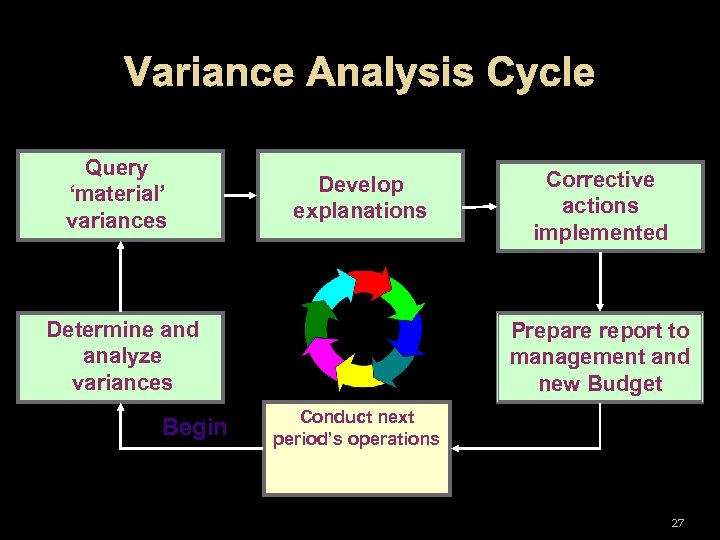

Variance Analysis Cycle Query ‘material’ variances Develop explanations Determine and analyze variances Begin Corrective actions implemented Prepare report to management and new Budget Conduct next period’s operations 27

be9cabd7754a92ef3d8396198d927513.ppt