ebfef15d583ebbdf8233b05969e4fd75.ppt

- Количество слайдов: 7

Flatbush Case Study Team Outliers Josel Cates Danielle Ross Vince Tam Lulu Xu

The Problem • • City of Flatbush, Texas is responsible for decontaminating soil surrounding their petroleum pumping facility Will purchase zero coupon and regular bonds to pay for the clean up

The Problem Cont. • Funding the clean-up Coupon and principal payments, and cash balances carried forward (which earn 4% interest) o Will be self financing o How much of each bond type should Flatbush buy to minimize total costs?

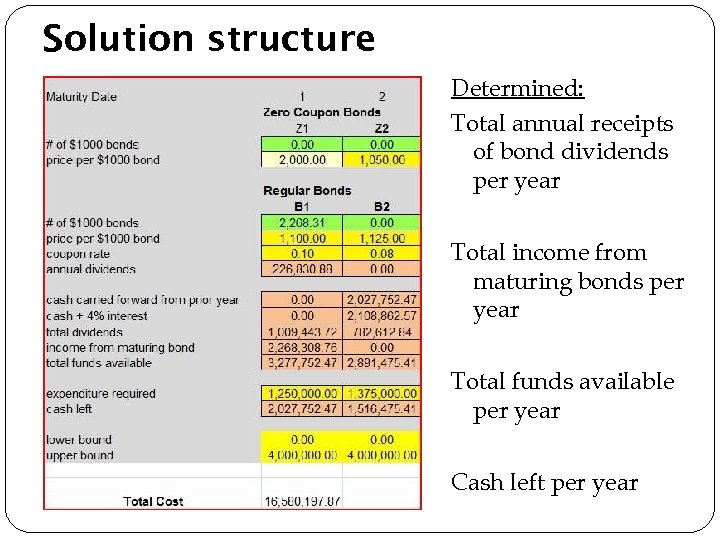

Solution structure Determined: Total annual receipts of bond dividends per year Total income from maturing bonds per year Total funds available per year Cash left per year

Solution • • • Used Solver to minimize Total Cost by changing the number of bonds purchased Subject to constraints: o Cash left is between 0 and 4 million o Cash left in the last period is <25, 000 Optimal Total Cost = $16, 580, 197. 87

Shadow Price • • • Shadow Price is "the marginal utility of relaxing a constraint, or, equivalently, the marginal cost of strengthening a constraint" Can tell us how much we should be willing to pay for additional units of input o Zero shadow price indicates that the constraint is not binding o Strictly positive shadow price indicates potential benefits by increasing amount of input, and vise versa In this nonlinear optimization problem, we look at lagrange multiplier

Shadow Price Cont. • Year 1 cash left (cell B 25) has a shadow price of 0 o • Year 15 cash left (cell P 25) has a shadow price of 0. 178 o • Increasing upper bound constraint by 1, total cost stays the same Increasing upper bound constraint by 1, total cost decreases by 0. 178 Year 4 cash left (cell E 25) has a shadow price of 0. 032 o Increasing lower bound constraint by 1, total cost increases by 0. 032

ebfef15d583ebbdf8233b05969e4fd75.ppt