011654dc65582cfbdfa6962964c2fd06.ppt

- Количество слайдов: 60

Fixed – income Securities

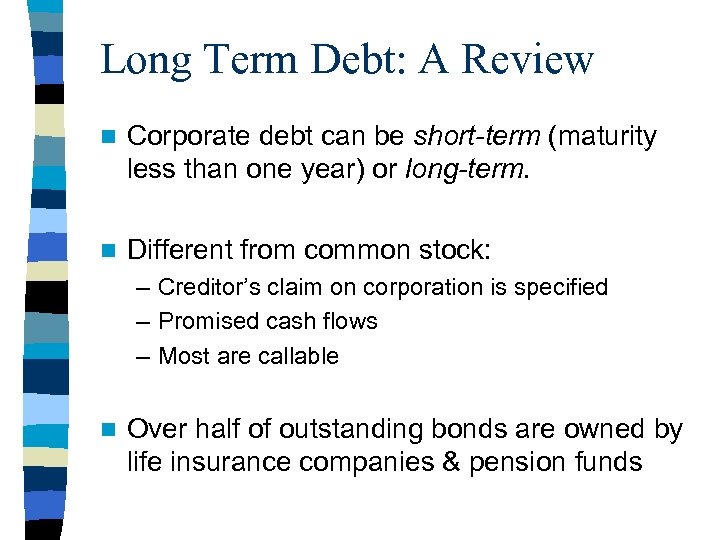

Long Term Debt: A Review n Corporate debt can be short-term (maturity less than one year) or long-term. n Different from common stock: – Creditor’s claim on corporation is specified – Promised cash flows – Most are callable n Over half of outstanding bonds are owned by life insurance companies & pension funds

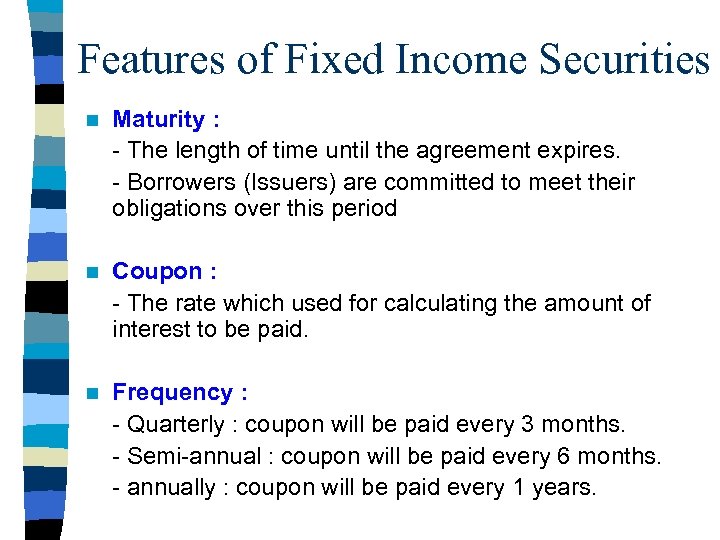

Features of Fixed Income Securities n Maturity : - The length of time until the agreement expires. - Borrowers (Issuers) are committed to meet their obligations over this period n Coupon : - The rate which used for calculating the amount of interest to be paid. n Frequency : - Quarterly : coupon will be paid every 3 months. - Semi-annual : coupon will be paid every 6 months. - annually : coupon will be paid every 1 years.

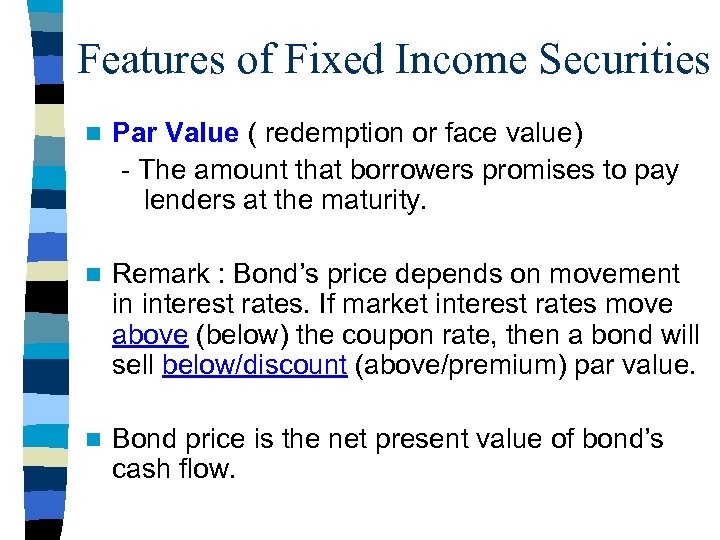

Features of Fixed Income Securities n Par Value ( redemption or face value) - The amount that borrowers promises to pay lenders at the maturity. n Remark : Bond’s price depends on movement in interest rates. If market interest rates move above (below) the coupon rate, then a bond will sell below/discount (above/premium) par value. n Bond price is the net present value of bond’s cash flow.

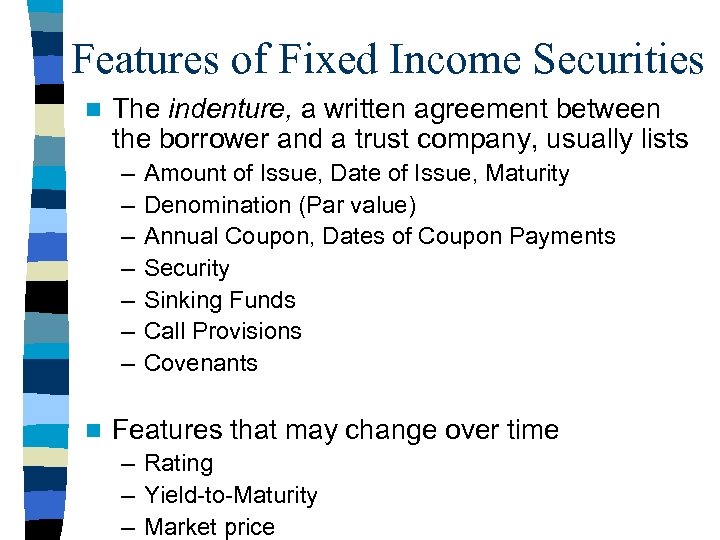

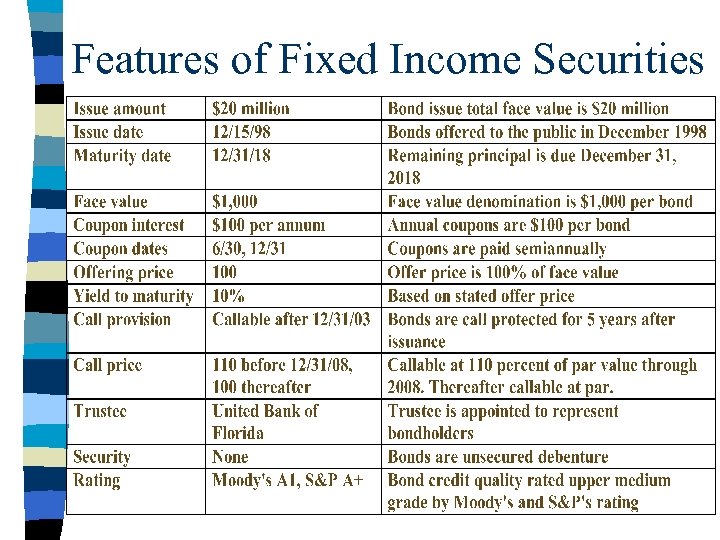

Features of Fixed Income Securities n The indenture, a written agreement between the borrower and a trust company, usually lists – – – – n Amount of Issue, Date of Issue, Maturity Denomination (Par value) Annual Coupon, Dates of Coupon Payments Security Sinking Funds Call Provisions Covenants Features that may change over time – Rating – Yield-to-Maturity – Market price

Features of Fixed Income Securities

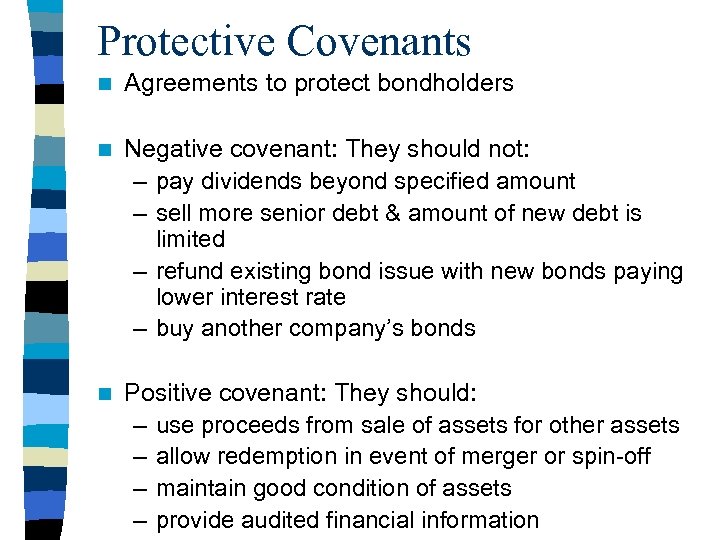

Protective Covenants n Agreements to protect bondholders n Negative covenant: They should not: – pay dividends beyond specified amount – sell more senior debt & amount of new debt is limited – refund existing bond issue with new bonds paying lower interest rate – buy another company’s bonds n Positive covenant: They should: – use proceeds from sale of assets for other assets – allow redemption in event of merger or spin-off – maintain good condition of assets – provide audited financial information

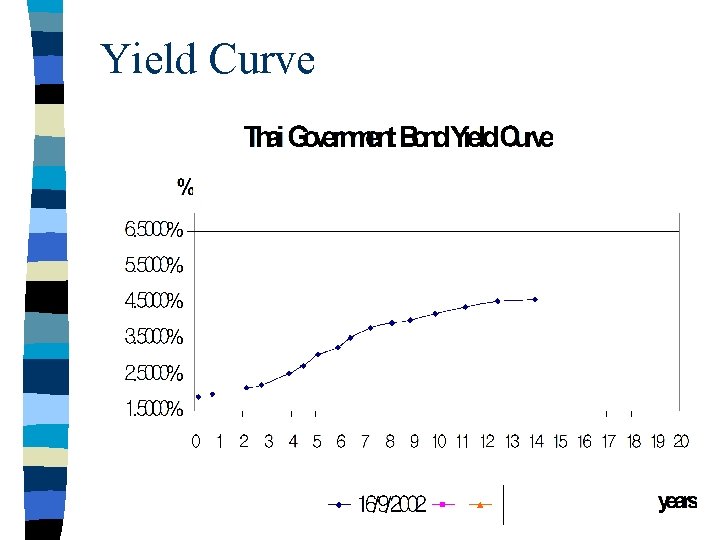

Yield Curve

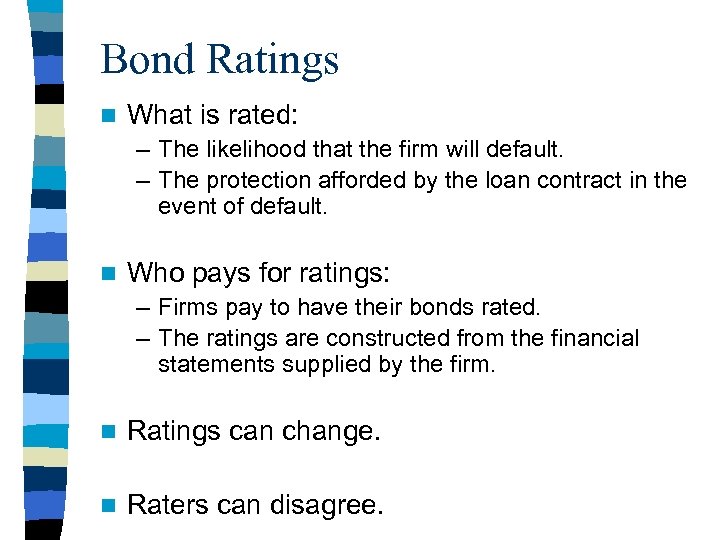

Bond Ratings n What is rated: – The likelihood that the firm will default. – The protection afforded by the loan contract in the event of default. n Who pays for ratings: – Firms pay to have their bonds rated. – The ratings are constructed from the financial statements supplied by the firm. n Ratings can change. n Raters can disagree.

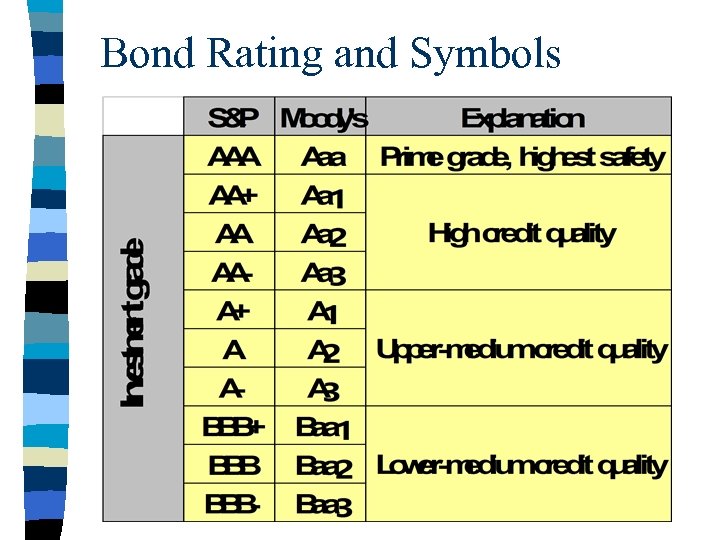

Bond Rating and Symbols

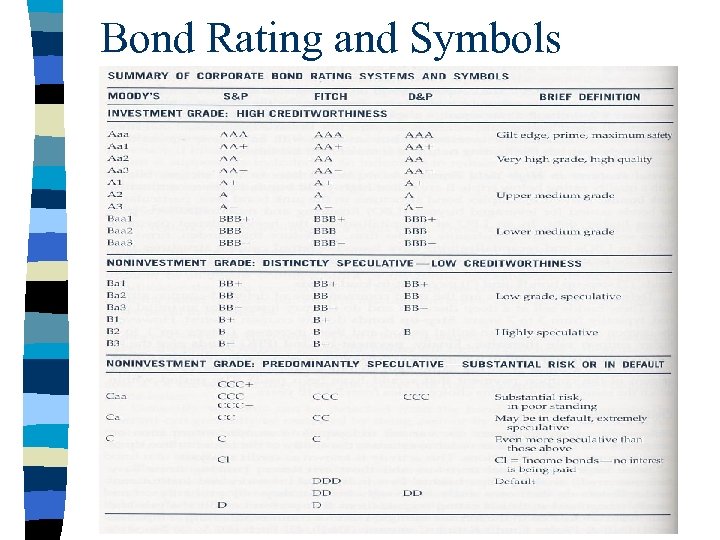

Bond Rating and Symbols

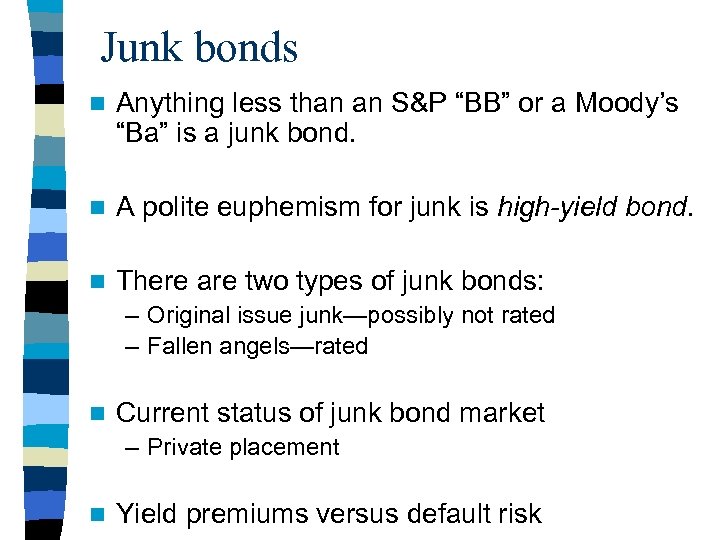

Junk bonds n Anything less than an S&P “BB” or a Moody’s “Ba” is a junk bond. n A polite euphemism for junk is high-yield bond. n There are two types of junk bonds: – Original issue junk—possibly not rated – Fallen angels—rated n Current status of junk bond market – Private placement n Yield premiums versus default risk

Types of Bond n Fixed rate : the coupon rate constantly fixed. n Floating rate : the coupon rate based on a reference rate (i. e. LIBOR) n Amortizing bond : some partial of principle were scheduled to pay out before the maturity. n Zero-coupon bond : pay no interest and are sold at a discount from their par value. The difference represents the interest costs to the borrower.

Types of Bond n Callable bond : issuer has right to redeem a bond before maturity at a formula price. To compensate the call risk, investors usually need additional rate of return which may incur higher cost of borrowing to the issuer. When market interest rate keeps lowing, issuer might execute call since he upsets with his high cost of borrowing

Types of Bond n Puttable bond : investors have right to redeem the bond before maturity at a formula price. Put option is a sweetener which help issuer to lower his cost of borrowing. When market interest keeps soaring, investors might execute put option since they can reinvestment at the higher rate of return.

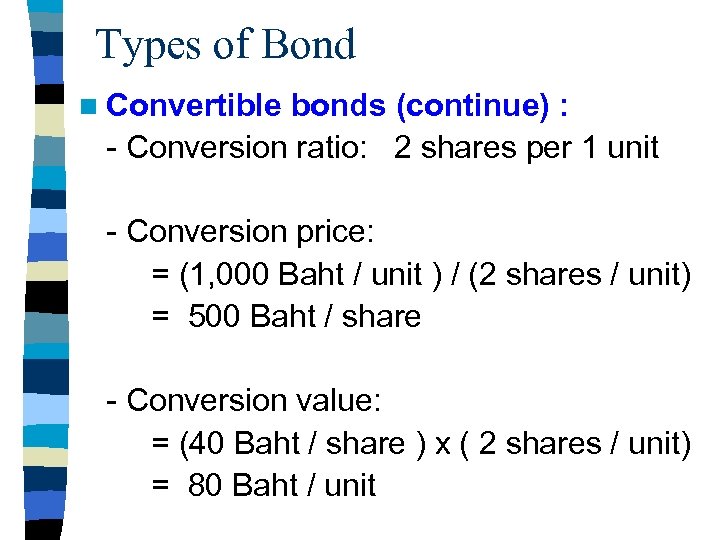

Types of Bond n Convertible bonds : - Why are they issued? Cheap interest burden - Why are they purchased? Right for converting - Conversion ratio: Number of shares of stock acquired by conversion - Conversion price: Bond par value / Conversion ratio - Conversion value: Price per share of stock x Conversion ratio - In-the-money versus out-the-money

Reasons for Issuing Warrants and Convertibles n Convertible debt carries a lower coupon rate than does otherwise-identical straight debt. n Since convertible debt is originally issued with an out -of-the-money call option, one can argue that convertible debt allows the firm to sell equity at a higher price than is available at the time of issuance. However, the same argument can be used to say that it forces the firm to sell equity at a lower price than is available at the time of exercise. n Convertible bonds also allow young firms to delay expensive interest costs until they can afford them

Types of Bond n Convertible bonds (continue) : - Conversion ratio: 2 shares per 1 unit - Conversion price: = (1, 000 Baht / unit ) / (2 shares / unit) = 500 Baht / share - Conversion value: = (40 Baht / share ) x ( 2 shares / unit) = 80 Baht / unit

Types of Bond n Convertible bonds (continue) : -The value of a convertible bond has three major components: 1. Straight bond value 2. Option value 3. Conversion value

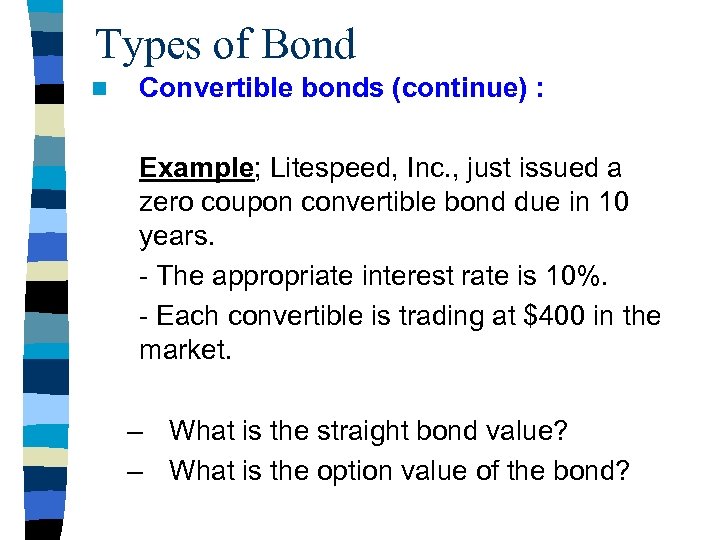

Types of Bond n Convertible bonds (continue) : Example; Litespeed, Inc. , just issued a zero coupon convertible bond due in 10 years. - The appropriate interest rate is 10%. - Each convertible is trading at $400 in the market. – What is the straight bond value? – What is the option value of the bond?

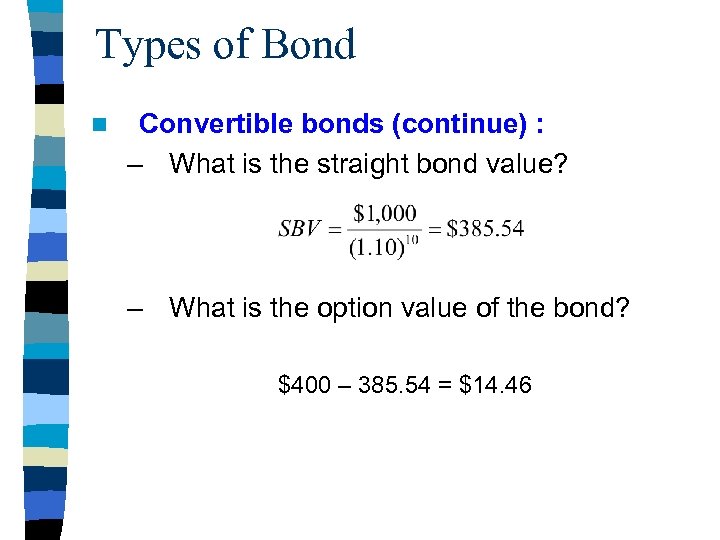

Types of Bond n Convertible bonds (continue) : – What is the straight bond value? – What is the option value of the bond? $400 – 385. 54 = $14. 46

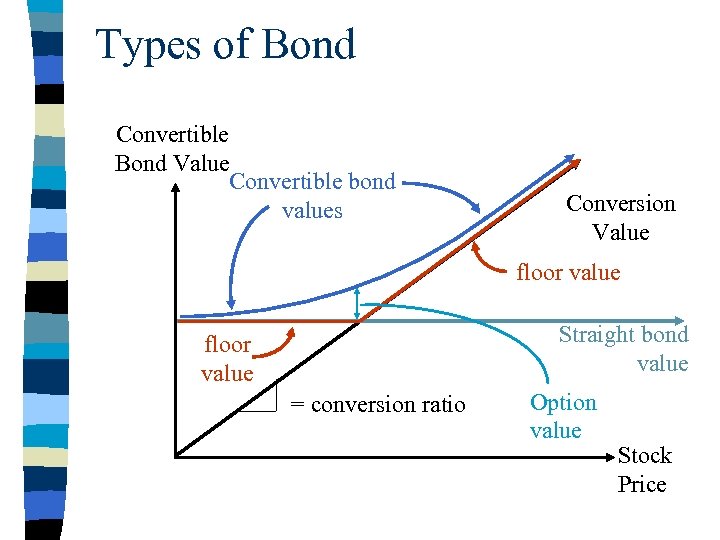

Types of Bond Convertible Bond Value Convertible bond values Conversion Value floor value Straight bond value floor value = conversion ratio Option value Stock Price

Types of Bond n Other Convertible bonds (continue) : Exchangeable bonds – Convertible into a set number of shares of a third company’s common stock.

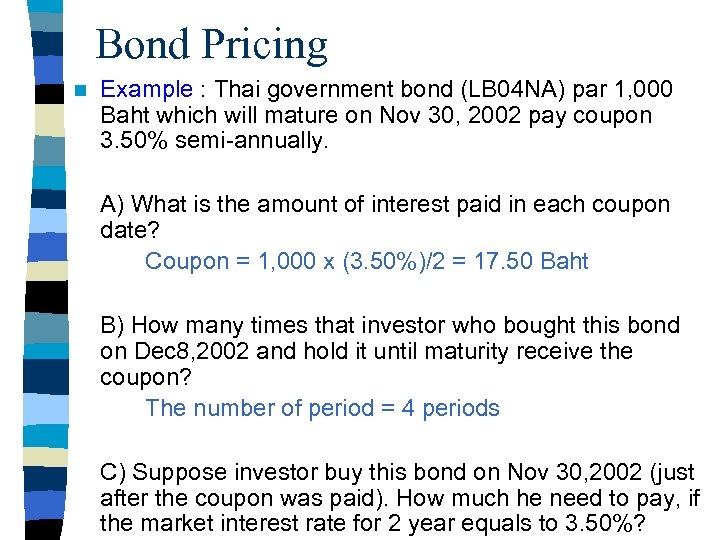

Bond Pricing n Example : Thai government bond (LB 04 NA) par 1, 000 Baht which will mature on Nov 30, 2002 pay coupon 3. 50% semi-annually. A) What is the amount of interest paid in each coupon date? Coupon = 1, 000 x (3. 50%)/2 = 17. 50 Baht B) How many times that investor who bought this bond on Dec 8, 2002 and hold it until maturity receive the coupon? The number of period = 4 periods C) Suppose investor buy this bond on Nov 30, 2002 (just after the coupon was paid). How much he need to pay, if the market interest rate for 2 year equals to 3. 50%?

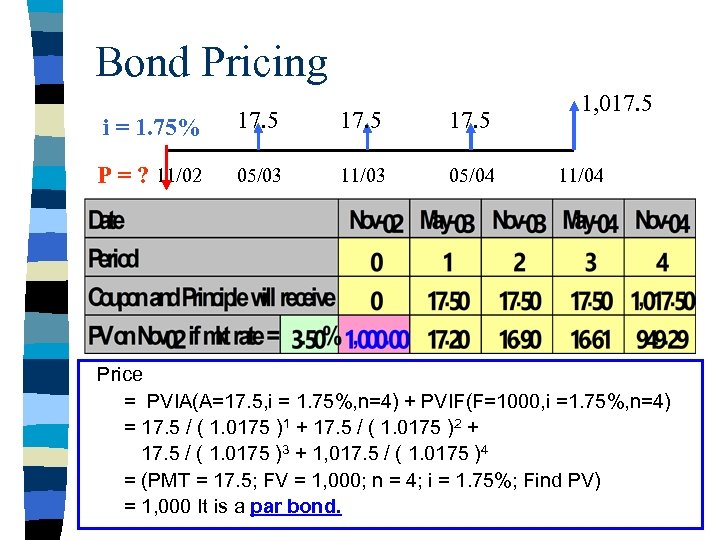

Bond Pricing i = 1. 75% 17. 5 P = ? 11/02 05/03 11/03 05/04 1, 017. 5 11/04 Price = PVIA(A=17. 5, i = 1. 75%, n=4) + PVIF(F=1000, i =1. 75%, n=4) = 17. 5 / ( 1. 0175 )1 + 17. 5 / ( 1. 0175 )2 + 17. 5 / ( 1. 0175 )3 + 1, 017. 5 / ( 1. 0175 )4 = (PMT = 17. 5; FV = 1, 000; n = 4; i = 1. 75%; Find PV) = 1, 000 It is a par bond.

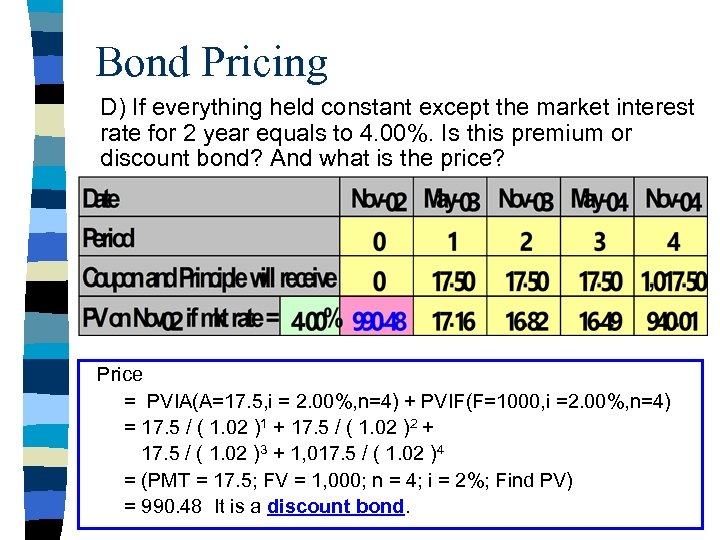

Bond Pricing D) If everything held constant except the market interest rate for 2 year equals to 4. 00%. Is this premium or discount bond? And what is the price? Price = PVIA(A=17. 5, i = 2. 00%, n=4) + PVIF(F=1000, i =2. 00%, n=4) = 17. 5 / ( 1. 02 )1 + 17. 5 / ( 1. 02 )2 + 17. 5 / ( 1. 02 )3 + 1, 017. 5 / ( 1. 02 )4 = (PMT = 17. 5; FV = 1, 000; n = 4; i = 2%; Find PV) = 990. 48 It is a discount bond.

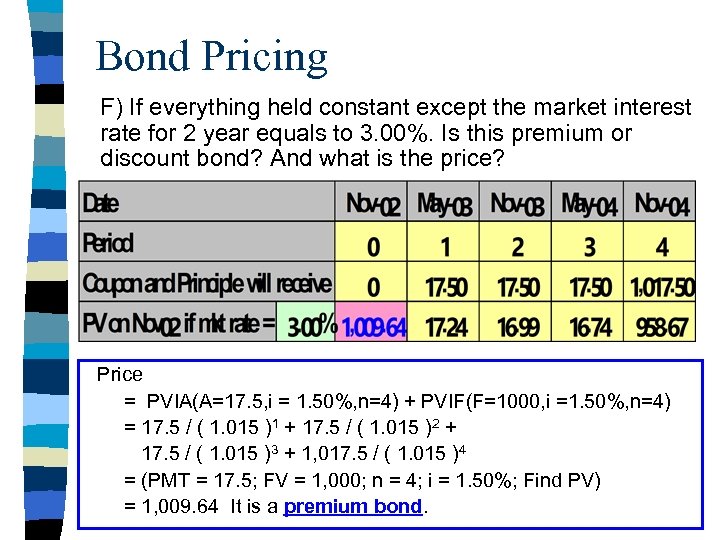

Bond Pricing F) If everything held constant except the market interest rate for 2 year equals to 3. 00%. Is this premium or discount bond? And what is the price? Price = PVIA(A=17. 5, i = 1. 50%, n=4) + PVIF(F=1000, i =1. 50%, n=4) = 17. 5 / ( 1. 015 )1 + 17. 5 / ( 1. 015 )2 + 17. 5 / ( 1. 015 )3 + 1, 017. 5 / ( 1. 015 )4 = (PMT = 17. 5; FV = 1, 000; n = 4; i = 1. 50%; Find PV) = 1, 009. 64 It is a premium bond.

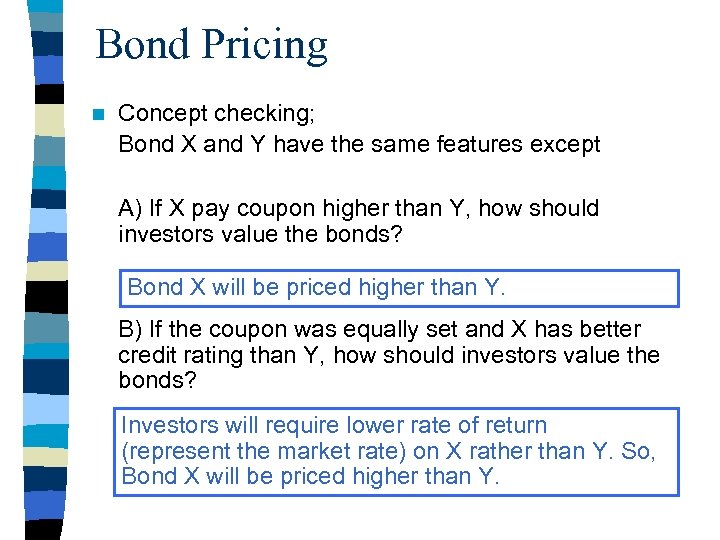

Bond Pricing n Concept checking; Bond X and Y have the same features except A) If X pay coupon higher than Y, how should investors value the bonds? Bond X will be priced higher than Y. B) If the coupon was equally set and X has better credit rating than Y, how should investors value the bonds? Investors will require lower rate of return (represent the market rate) on X rather than Y. So, Bond X will be priced higher than Y.

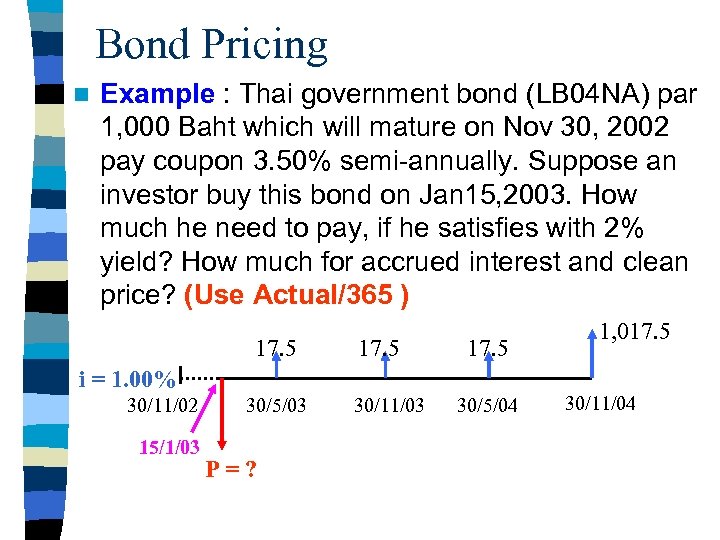

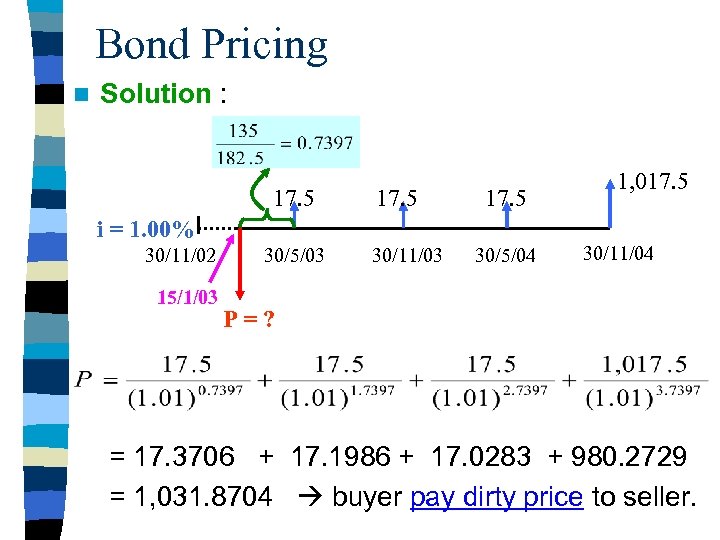

Bond Pricing n Example : Thai government bond (LB 04 NA) par 1, 000 Baht which will mature on Nov 30, 2002 pay coupon 3. 50% semi-annually. Suppose an investor buy this bond on Jan 15, 2003. How much he need to pay, if he satisfies with 2% yield? How much for accrued interest and clean price? (Use Actual/365 ) 17. 5 i = 1. 00% 30/11/02 15/1/03 30/5/03 P=? 30/11/03 30/5/04 1, 017. 5 30/11/04

Bond Pricing n Solution : 17. 5 i = 1. 00% 30/11/02 15/1/03 30/5/03 30/11/03 30/5/04 1, 017. 5 30/11/04 P=? = 17. 3706 + 17. 1986 + 17. 0283 + 980. 2729 = 1, 031. 8704 buyer pay dirty price to seller.

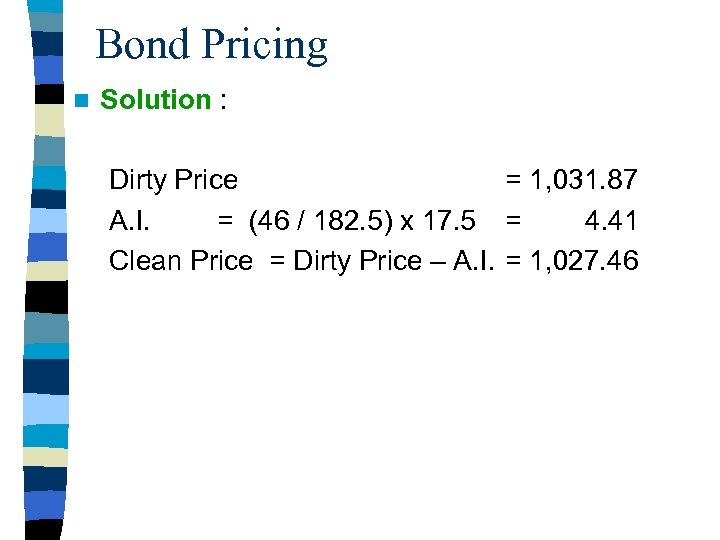

Bond Pricing n Solution : Dirty Price = 1, 031. 87 A. I. = (46 / 182. 5) x 17. 5 = 4. 41 Clean Price = Dirty Price – A. I. = 1, 027. 46

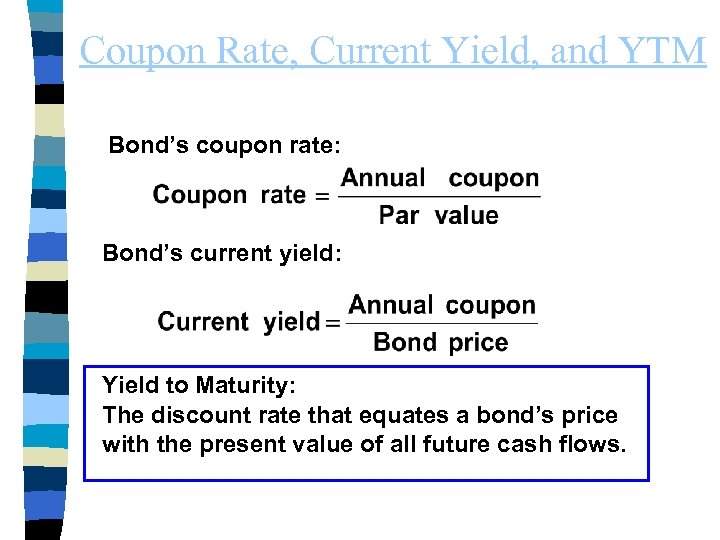

Coupon Rate, Current Yield, and YTM Bond’s coupon rate: Bond’s current yield: Yield to Maturity: The discount rate that equates a bond’s price with the present value of all future cash flows.

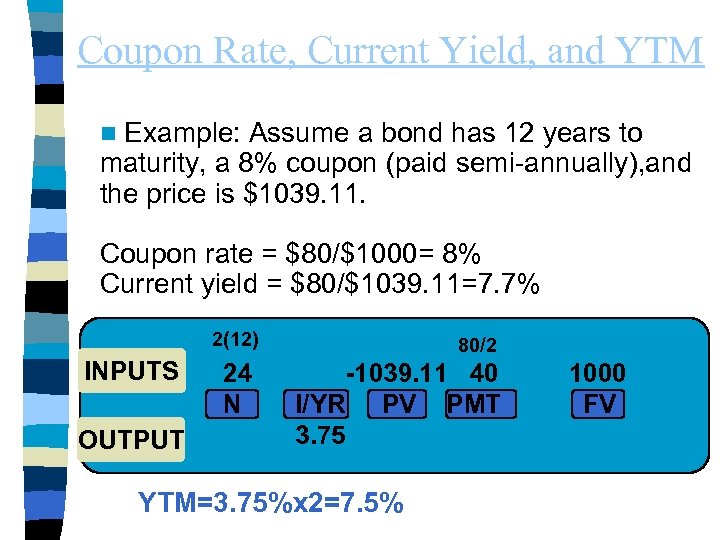

Coupon Rate, Current Yield, and YTM Example: Assume a bond has 12 years to maturity, a 8% coupon (paid semi-annually), and the price is $1039. 11. n Coupon rate = $80/$1000= 8% Current yield = $80/$1039. 11=7. 7% 2(12) INPUTS OUTPUT 24 N 80/2 -1039. 11 40 I/YR PV PMT 3. 75 YTM=3. 75%x 2=7. 5% 1000 FV

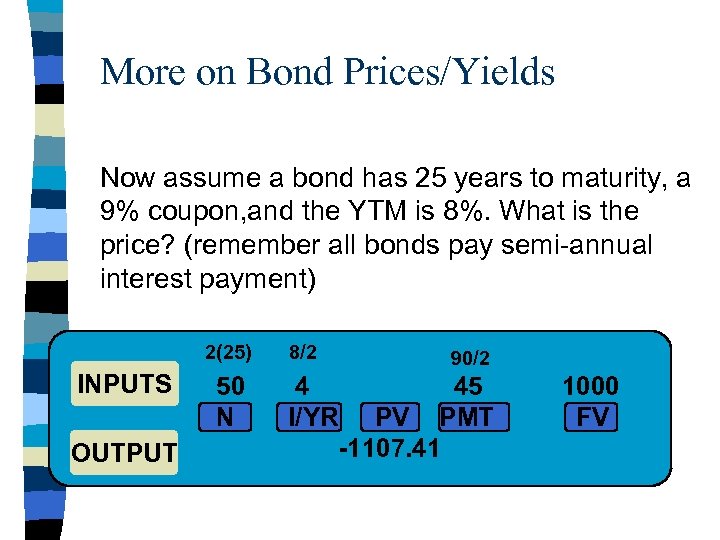

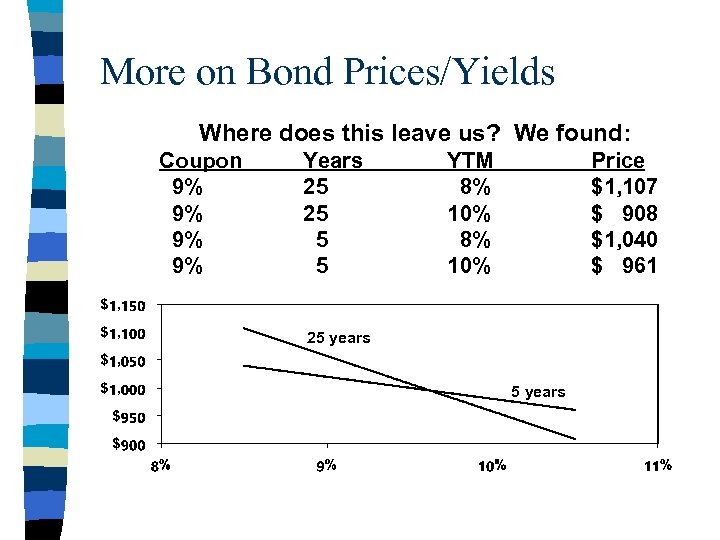

More on Bond Prices/Yields Now assume a bond has 25 years to maturity, a 9% coupon, and the YTM is 8%. What is the price? (remember all bonds pay semi-annual interest payment) 2(25) INPUTS OUTPUT 50 N 8/2 90/2 4 45 I/YR PV PMT -1107. 41 1000 FV

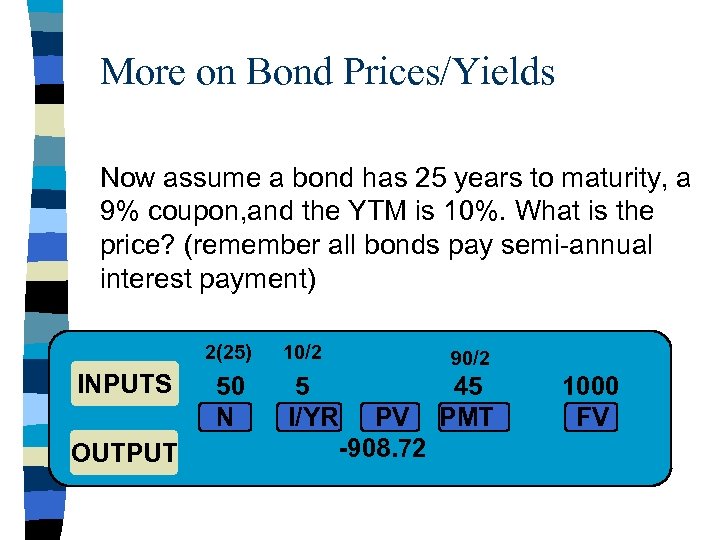

More on Bond Prices/Yields Now assume a bond has 25 years to maturity, a 9% coupon, and the YTM is 10%. What is the price? (remember all bonds pay semi-annual interest payment) 2(25) INPUTS OUTPUT 50 N 10/2 90/2 5 45 I/YR PV PMT -908. 72 1000 FV

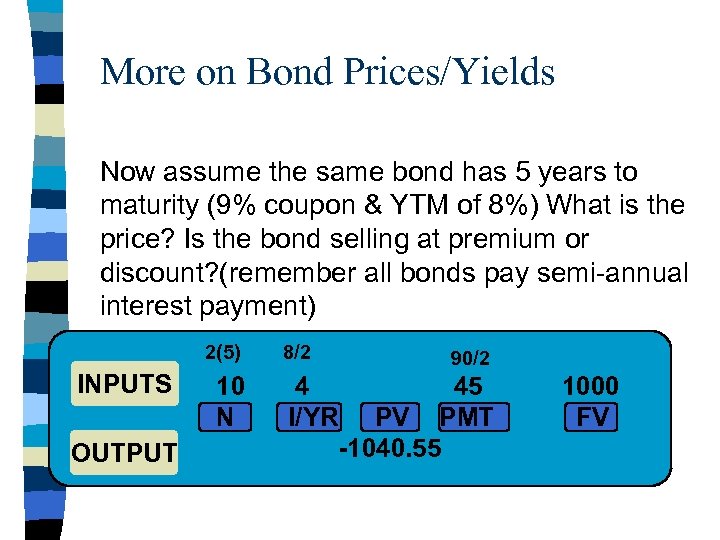

More on Bond Prices/Yields Now assume the same bond has 5 years to maturity (9% coupon & YTM of 8%) What is the price? Is the bond selling at premium or discount? (remember all bonds pay semi-annual interest payment) 2(5) INPUTS OUTPUT 10 N 8/2 90/2 4 45 I/YR PV PMT -1040. 55 1000 FV

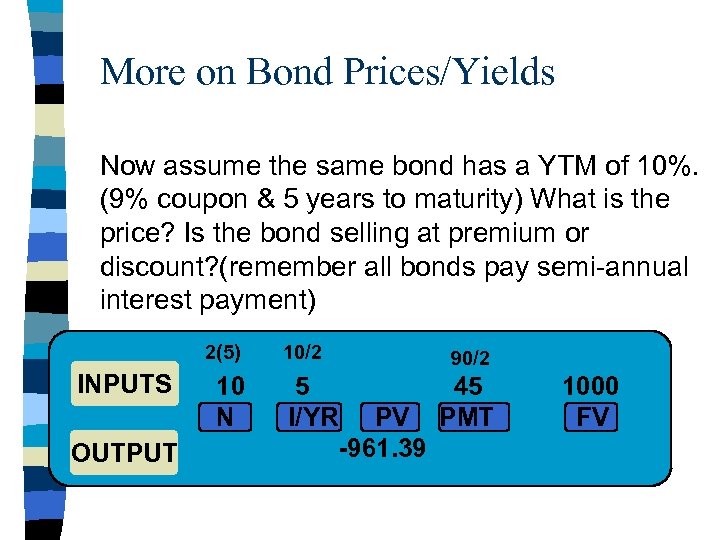

More on Bond Prices/Yields Now assume the same bond has a YTM of 10%. (9% coupon & 5 years to maturity) What is the price? Is the bond selling at premium or discount? (remember all bonds pay semi-annual interest payment) 2(5) INPUTS OUTPUT 10 N 10/2 90/2 5 45 I/YR PV PMT -961. 39 1000 FV

More on Bond Prices/Yields Where does this leave us? We found: Coupon 9% 9% Years 25 25 5 5 YTM 8% 10% Price $1, 107 $ 908 $1, 040 $ 961 25 years

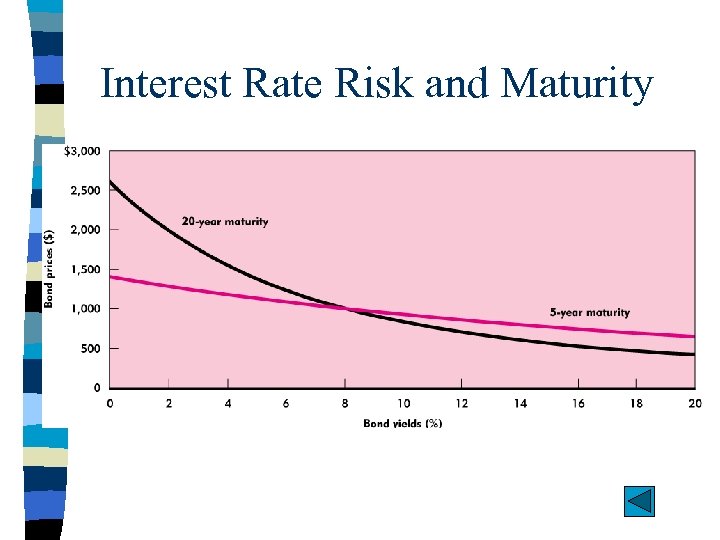

Interest Rate Risk and Maturity

Malkiel’s Theorems Summarizes the relationship among bond prices, yields, coupons, and maturity: (all theorems hold assuming everything else constant): 1) Bond prices move inversely with interest rates. 2) The longer the maturity of a bond, the more sensitive is it’s price to a change in interest rates. 3) The price sensitivity of any bond increases with it’s maturity, but the increase occurs at a decreasing rate. 4) The lower the coupon rate on a bond, the more sensitive is it’s price to a change in interest rates. 5) For a given bond, the volatility of a bond is not symmetrical, i. e. a decrease in interest rates raises bond prices more than a corresponding increase in interest rates lower prices.

Duration n Duration (Macaulay’s duration) : A widely used measure of a bond's sensitivity to a 1% (1% = 100 bps) changes in interest rate (yield). n The 1 st derivative of the bond’s price function with respect to yield. It’s the slope of bond price curve. n The present value-weighted number of years to maturity

Duration n Although modified duration allows us to estimates of price change in a bond’s price for a small change in required yield, it does not provide good estimates of a large price change in required yield. This is because of the convexity in the price/yield relation ship. n Convexity: a measure of the degree of curvature or convexity in the price/yield relationship.

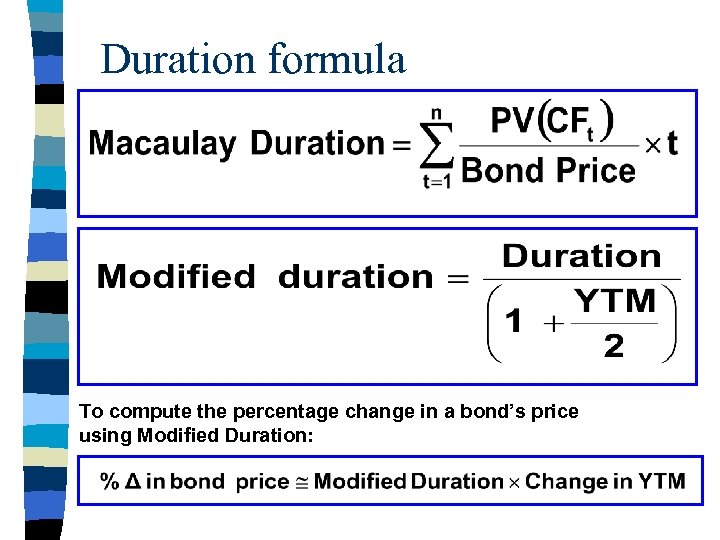

Duration formula To compute the percentage change in a bond’s price using Modified Duration:

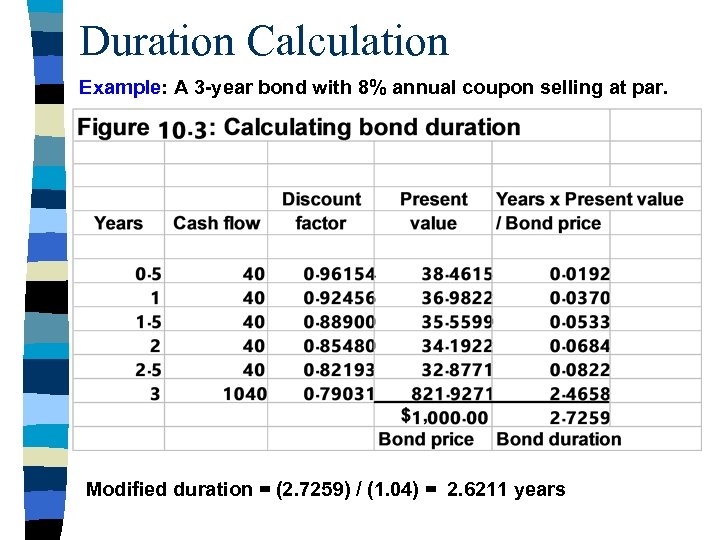

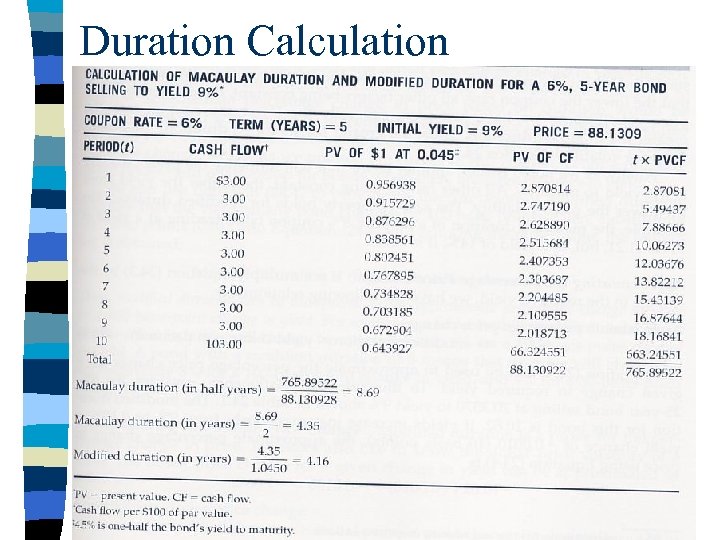

Duration Calculation Example: A 3 -year bond with 8% annual coupon selling at par. Modified duration = (2. 7259) / (1. 04) = 2. 6211 years

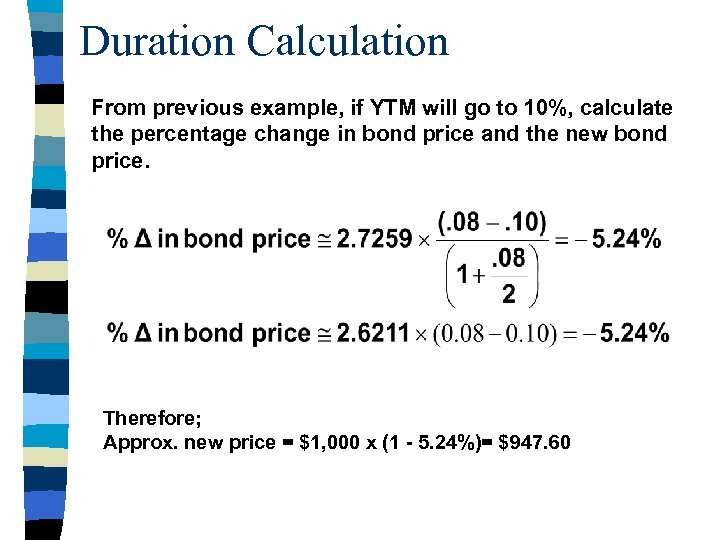

Duration Calculation From previous example, if YTM will go to 10%, calculate the percentage change in bond price and the new bond price. Therefore; Approx. new price = $1, 000 x (1 - 5. 24%)= $947. 60

Duration Calculation

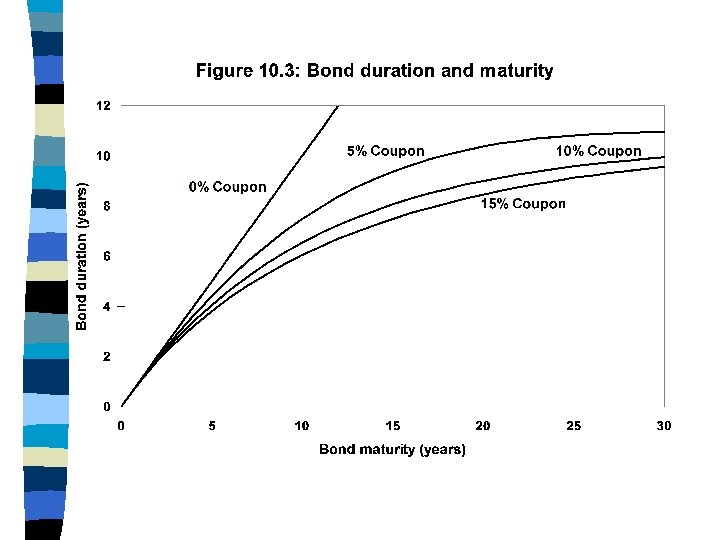

Properties of Duration All else the same, the longer a bond’s maturity, the longer is its duration. All else the same, a bond’s duration increases at a decreasing rate as maturity lengthens. All else the same, the higher a bond’s coupon, the shorter is its duration. All else the same, a higher yield to maturity implies a shorter duration, and a lower yield to maturity implies a longer duration.

FRN Pricing n Under the assumption of no default risk, the bond should always be 100% on reset dates. n Once the coupon is fixed on a reset date, the bond tends to behave like a ST fixed-coupon bond until the next reset date. n FRN prices are more volatile just after the reset date, because that is when they have the longest fixed-coupon maturity.

Dedicated Portfolios Dedicated portfolio A bond portfolio created to prepare for a future cash outlay, e. g. pension funds. The date the payment is due is commonly called the portfolio’s target date.

Immunization n Interest rate risk: The possibility that changes in interest rates will result in losses in a bond's value. n Reinvestment rate risk: The uncertainty about target date portfolio value that results from the need to reinvest bond coupons at yields not known in advance. n Price risk: The risk that bond prices will decrease, which arises in dedicated portfolios when the target date value of a bond or bond portfolio is not known with certainty n Immunization: Constructing a portfolio to minimize the uncertainty surrounding its target date value.

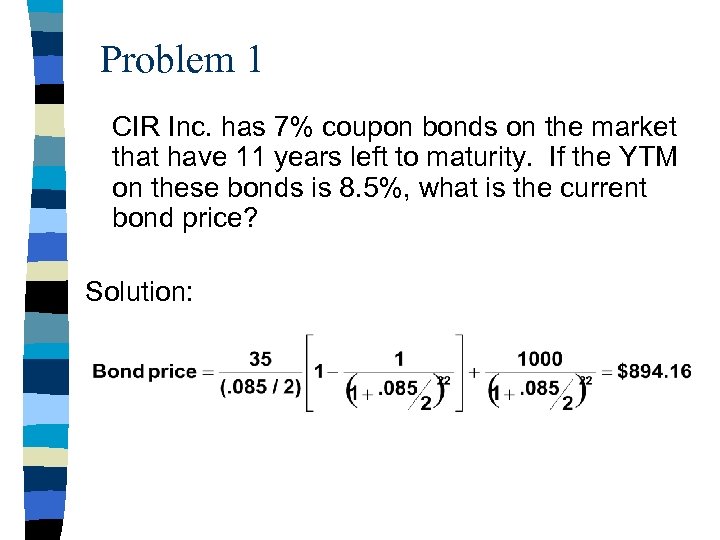

Problem 1 CIR Inc. has 7% coupon bonds on the market that have 11 years left to maturity. If the YTM on these bonds is 8. 5%, what is the current bond price? Solution:

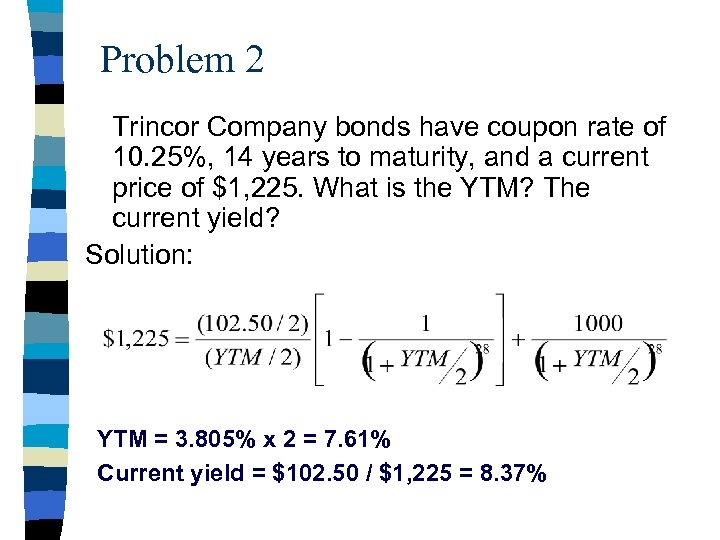

Problem 2 Trincor Company bonds have coupon rate of 10. 25%, 14 years to maturity, and a current price of $1, 225. What is the YTM? The current yield? Solution: YTM = 3. 805% x 2 = 7. 61% Current yield = $102. 50 / $1, 225 = 8. 37%

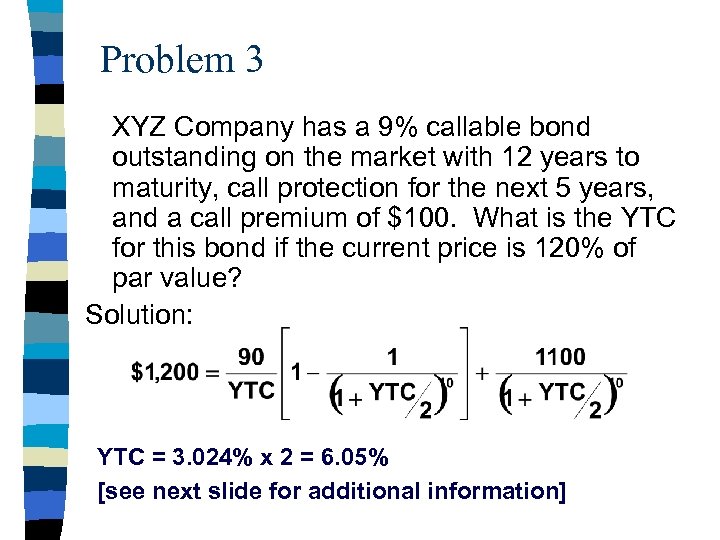

Problem 3 XYZ Company has a 9% callable bond outstanding on the market with 12 years to maturity, call protection for the next 5 years, and a call premium of $100. What is the YTC for this bond if the current price is 120% of par value? Solution: YTC = 3. 024% x 2 = 6. 05% [see next slide for additional information]

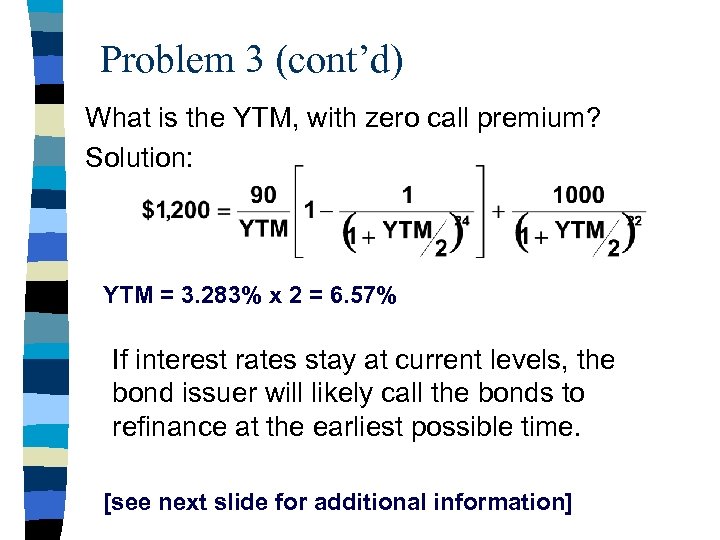

Problem 3 (cont’d) What is the YTM, with zero call premium? Solution: YTM = 3. 283% x 2 = 6. 57% If interest rates stay at current levels, the bond issuer will likely call the bonds to refinance at the earliest possible time. [see next slide for additional information]

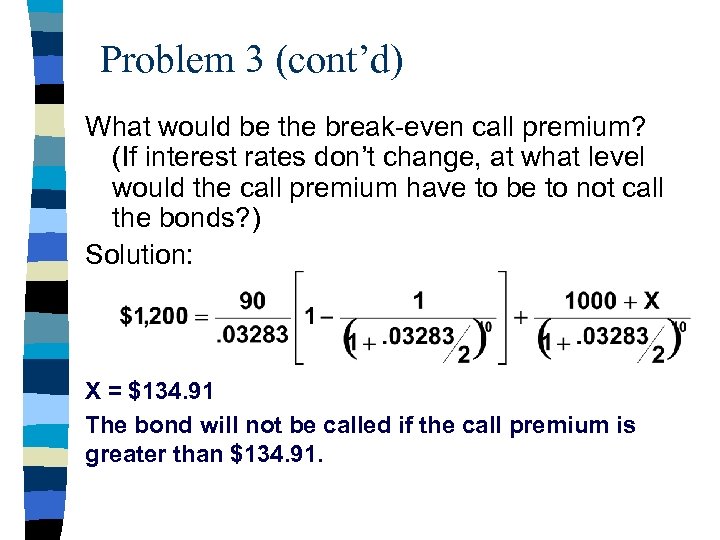

Problem 3 (cont’d) What would be the break-even call premium? (If interest rates don’t change, at what level would the call premium have to be to not call the bonds? ) Solution: X = $134. 91 The bond will not be called if the call premium is greater than $134. 91.

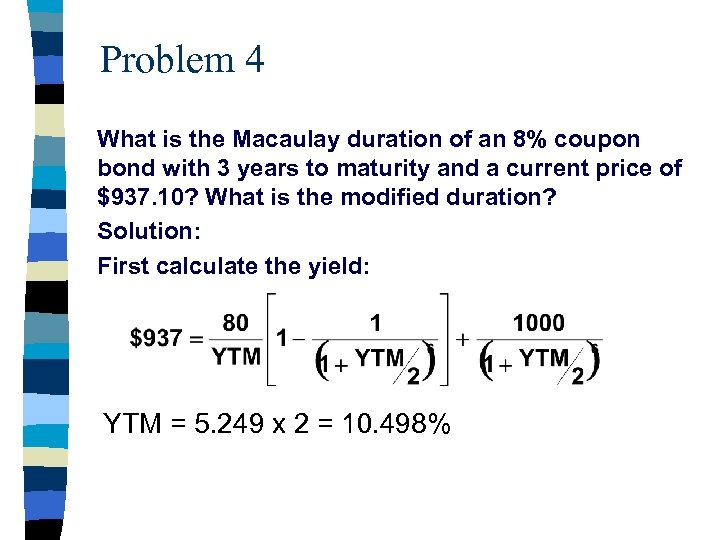

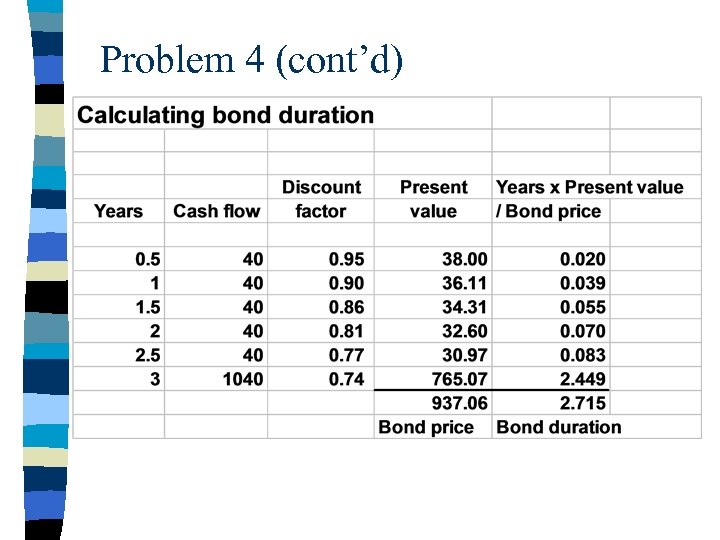

Problem 4 What is the Macaulay duration of an 8% coupon bond with 3 years to maturity and a current price of $937. 10? What is the modified duration? Solution: First calculate the yield: YTM = 5. 249 x 2 = 10. 498%

Problem 4 (cont’d)

Problem 4 (cont’d) Mac. Duration = 2. 715 years Modified duration = 2. 715 / (1 +. 10498/2) = 2. 58 years

011654dc65582cfbdfa6962964c2fd06.ppt