ce43533a28df8c3aca68b2756410363b.ppt

- Количество слайдов: 48

Fixed Income Instruments 1 Zvi Wiener 02 -588 -3049 mswiener@mscc. huji. ac. il Fall-01 http: //pluto. mscc. huji. ac. il/~mswiener/zvi. html FIBI

Fixed Income Instruments 1 Zvi Wiener 02 -588 -3049 mswiener@mscc. huji. ac. il Fall-01 http: //pluto. mscc. huji. ac. il/~mswiener/zvi. html FIBI

Plan • Pricing of Bonds • Measuring yield • Bond Price Volatility • Factors Affecting Yields and the Term Structure of IR • Treasury and Agency Securities Markets • Corporate Debt Instruments • Municipals Zvi Wiener FIFIBI - 1 2

Plan • Pricing of Bonds • Measuring yield • Bond Price Volatility • Factors Affecting Yields and the Term Structure of IR • Treasury and Agency Securities Markets • Corporate Debt Instruments • Municipals Zvi Wiener FIFIBI - 1 2

Plan • Non-US Bonds • Mortgage Loans • Mortgage Pass-Through Securities • CMO and Stripped MBS • ABS • Bonds with Embedded Options • Analysis of MBS • Analysis of Convertible Bonds Zvi Wiener FIFIBI - 1 3

Plan • Non-US Bonds • Mortgage Loans • Mortgage Pass-Through Securities • CMO and Stripped MBS • ABS • Bonds with Embedded Options • Analysis of MBS • Analysis of Convertible Bonds Zvi Wiener FIFIBI - 1 3

Plan • Active Bond Portfolio Management • Indexing • Liability Funding Strategies • Bond Performance Measurement • Interest Rate Futures • Interest Rate Options • Interest Rate Swaps, Caps, Floors Zvi Wiener FIFIBI - 1 4

Plan • Active Bond Portfolio Management • Indexing • Liability Funding Strategies • Bond Performance Measurement • Interest Rate Futures • Interest Rate Options • Interest Rate Swaps, Caps, Floors Zvi Wiener FIFIBI - 1 4

Characteristics of a Bond • Issuer • Time to maturity • Coupon rate, type and frequency • Linkage • Embedded options • Indentures • Guarantees or collateral Zvi Wiener FIFIBI - 1 5

Characteristics of a Bond • Issuer • Time to maturity • Coupon rate, type and frequency • Linkage • Embedded options • Indentures • Guarantees or collateral Zvi Wiener FIFIBI - 1 5

Sources • Fabozzi, “Bond Markets, Analysis and Strategies”, Prentice Hall. • P. Wilmott, Derivatives, Wiley. • Hull, White, Manuscript. Zvi Wiener FIFIBI - 1 6

Sources • Fabozzi, “Bond Markets, Analysis and Strategies”, Prentice Hall. • P. Wilmott, Derivatives, Wiley. • Hull, White, Manuscript. Zvi Wiener FIFIBI - 1 6

Sectors • Treasury sector: bills, notes, bonds • Agency sector: debentures (no collateral) • Municipal sector: tax exempt • Corporate sector: US and Yankee issues – bonds, notes, structured notes, CP – investment grade and noninvestment grade • Asset-backed securities sector • MBS sector Zvi Wiener FIFIBI - 1 7

Sectors • Treasury sector: bills, notes, bonds • Agency sector: debentures (no collateral) • Municipal sector: tax exempt • Corporate sector: US and Yankee issues – bonds, notes, structured notes, CP – investment grade and noninvestment grade • Asset-backed securities sector • MBS sector Zvi Wiener FIFIBI - 1 7

Basic terms • Principal • Coupon, discount and premium bonds • Zero coupon bonds • Floating rate bonds • Inverse floaters • Deferred coupon bonds • Amortization schedule • Convertible bonds Zvi Wiener FIFIBI - 1 8

Basic terms • Principal • Coupon, discount and premium bonds • Zero coupon bonds • Floating rate bonds • Inverse floaters • Deferred coupon bonds • Amortization schedule • Convertible bonds Zvi Wiener FIFIBI - 1 8

Basic Terms • The Money Market Account • LIBOR = London Interbank Offer Rate, see BBA Internet site • FRA = Forward Rate Agreement • Repos, reverse repos • Strips = Separate Trading of Registeres Interest and Principal of Securities Zvi Wiener FIFIBI - 1 9

Basic Terms • The Money Market Account • LIBOR = London Interbank Offer Rate, see BBA Internet site • FRA = Forward Rate Agreement • Repos, reverse repos • Strips = Separate Trading of Registeres Interest and Principal of Securities Zvi Wiener FIFIBI - 1 9

Basic Terms • gilts (bonds issued by the UK government) • JGB = Japanese Government Bonds • Yen denominated issued by non-Japanese institutions are called Samurai bonds Zvi Wiener FIFIBI - 1 10

Basic Terms • gilts (bonds issued by the UK government) • JGB = Japanese Government Bonds • Yen denominated issued by non-Japanese institutions are called Samurai bonds Zvi Wiener FIFIBI - 1 10

Major risks • Interest rate risk • Default risk • Reinvestment risk • Currency risk • Liquidity risk Zvi Wiener FIFIBI - 1 11

Major risks • Interest rate risk • Default risk • Reinvestment risk • Currency risk • Liquidity risk Zvi Wiener FIFIBI - 1 11

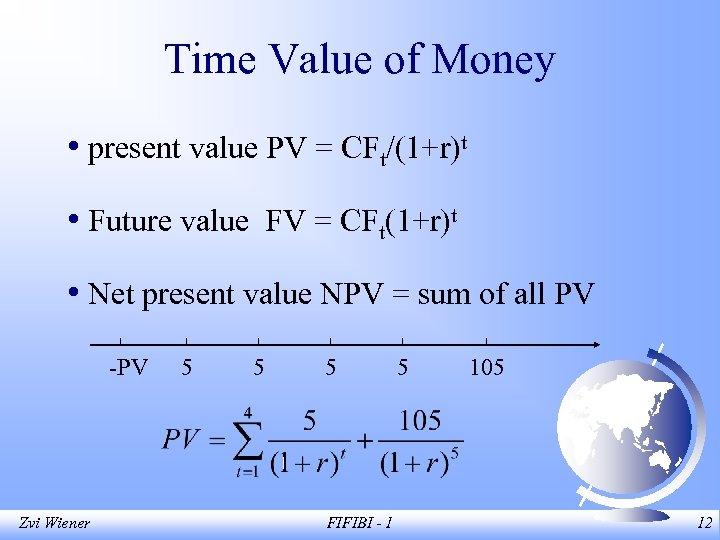

Time Value of Money • present value PV = CFt/(1+r)t • Future value FV = CFt(1+r)t • Net present value NPV = sum of all PV -PV Zvi Wiener 5 5 5 FIFIBI - 1 5 105 12

Time Value of Money • present value PV = CFt/(1+r)t • Future value FV = CFt(1+r)t • Net present value NPV = sum of all PV -PV Zvi Wiener 5 5 5 FIFIBI - 1 5 105 12

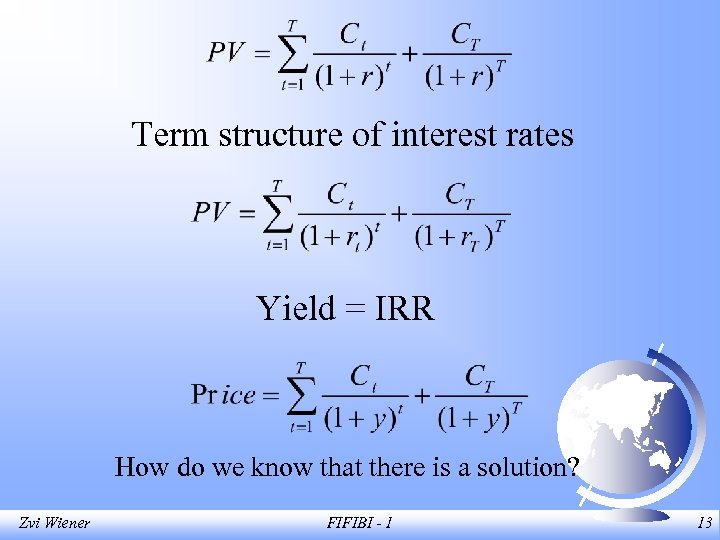

Term structure of interest rates Yield = IRR How do we know that there is a solution? Zvi Wiener FIFIBI - 1 13

Term structure of interest rates Yield = IRR How do we know that there is a solution? Zvi Wiener FIFIBI - 1 13

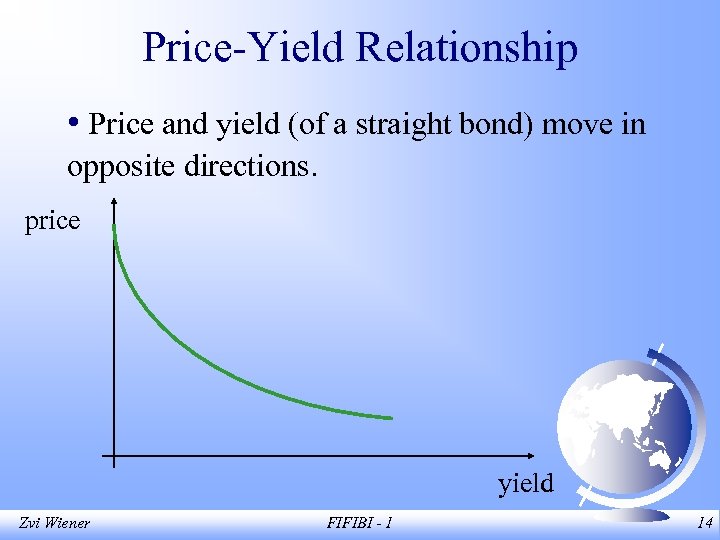

Price-Yield Relationship • Price and yield (of a straight bond) move in opposite directions. price yield Zvi Wiener FIFIBI - 1 14

Price-Yield Relationship • Price and yield (of a straight bond) move in opposite directions. price yield Zvi Wiener FIFIBI - 1 14

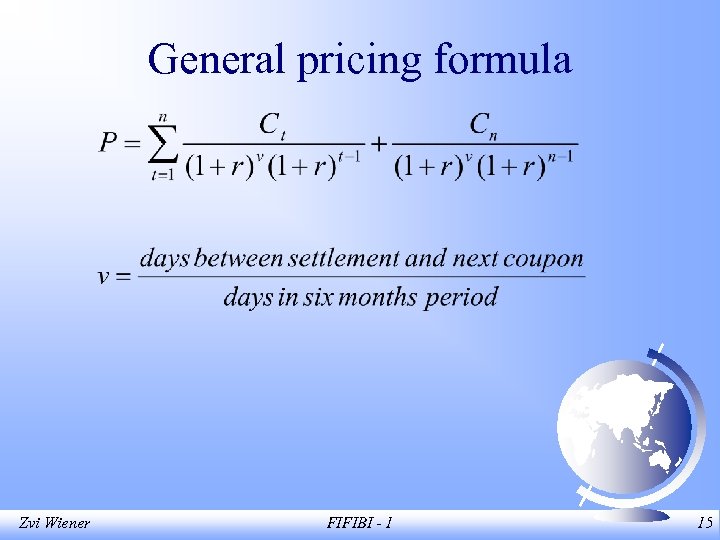

General pricing formula Zvi Wiener FIFIBI - 1 15

General pricing formula Zvi Wiener FIFIBI - 1 15

Accrued Interest Accrued interest = interest due in full period* (number of days since last coupon)/ (number of days in period between coupon payments) Zvi Wiener FIFIBI - 1 16

Accrued Interest Accrued interest = interest due in full period* (number of days since last coupon)/ (number of days in period between coupon payments) Zvi Wiener FIFIBI - 1 16

Day Count Convention Actual/Actual - true number of days 30/360 - assume that there are 30 days in each month and 360 days in a year. Actual/360 Zvi Wiener FIFIBI - 1 17

Day Count Convention Actual/Actual - true number of days 30/360 - assume that there are 30 days in each month and 360 days in a year. Actual/360 Zvi Wiener FIFIBI - 1 17

Floater The coupon rate of a floater is equal to a reference rate plus a spread. For example LIBOR + 50 bp. Sometimes it has a cap or a floor. Zvi Wiener FIFIBI - 1 18

Floater The coupon rate of a floater is equal to a reference rate plus a spread. For example LIBOR + 50 bp. Sometimes it has a cap or a floor. Zvi Wiener FIFIBI - 1 18

Inverse Floater Is usually created from a fixed rate security. Floater coupon = LIBOR + 1% Inverse Floater coupon = 10% - LIBOR Note that the sum is a fixed rate security. If LIBOR>10% there is typically a floor. Zvi Wiener FIFIBI - 1 19

Inverse Floater Is usually created from a fixed rate security. Floater coupon = LIBOR + 1% Inverse Floater coupon = 10% - LIBOR Note that the sum is a fixed rate security. If LIBOR>10% there is typically a floor. Zvi Wiener FIFIBI - 1 19

Price Quotes and Accrued Interest Assume that the par value of a bond is $1, 000. Price quote is in % of par + accrued interest the accrued interest must compensate the seller for the next coupon. Zvi Wiener FIFIBI - 1 20

Price Quotes and Accrued Interest Assume that the par value of a bond is $1, 000. Price quote is in % of par + accrued interest the accrued interest must compensate the seller for the next coupon. Zvi Wiener FIFIBI - 1 20

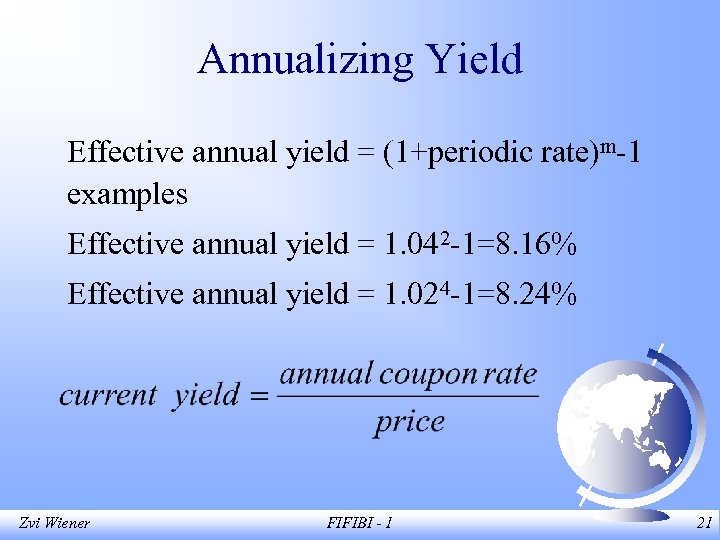

Annualizing Yield Effective annual yield = (1+periodic rate)m-1 examples Effective annual yield = 1. 042 -1=8. 16% Effective annual yield = 1. 024 -1=8. 24% Zvi Wiener FIFIBI - 1 21

Annualizing Yield Effective annual yield = (1+periodic rate)m-1 examples Effective annual yield = 1. 042 -1=8. 16% Effective annual yield = 1. 024 -1=8. 24% Zvi Wiener FIFIBI - 1 21

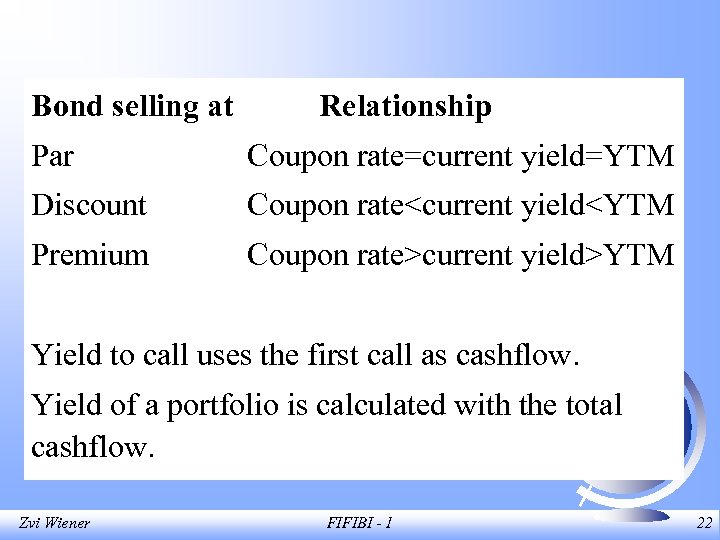

Bond selling at Relationship Par Coupon rate=current yield=YTM Discount Coupon rate

Bond selling at Relationship Par Coupon rate=current yield=YTM Discount Coupon rate

YTM and Reinvestment Risk • YTM assumes that all coupon (and amortizing) payments will be invested at the same yield. Zvi Wiener FIFIBI - 1 23

YTM and Reinvestment Risk • YTM assumes that all coupon (and amortizing) payments will be invested at the same yield. Zvi Wiener FIFIBI - 1 23

YTM and Reinvestment Risk • An investor has a 5 years horizon Bond A B C D Coupon 5% 6% 11% 8% Maturity 3 20 15 5 YTM 9. 0% 8. 6% 9. 2% 8. 0% What is the best choice? Zvi Wiener FIFIBI - 1 24

YTM and Reinvestment Risk • An investor has a 5 years horizon Bond A B C D Coupon 5% 6% 11% 8% Maturity 3 20 15 5 YTM 9. 0% 8. 6% 9. 2% 8. 0% What is the best choice? Zvi Wiener FIFIBI - 1 24

Bond Price Volatility Consider only IR as a risk factor Longer TTM means higher volatility Lower coupons means higher volatility Floaters have a very low price volatility Price is also affected by coupon payments Price value of a Basis Point = price change resulting from a change of 0. 01% in the yield. Zvi Wiener FIFIBI - 1 25

Bond Price Volatility Consider only IR as a risk factor Longer TTM means higher volatility Lower coupons means higher volatility Floaters have a very low price volatility Price is also affected by coupon payments Price value of a Basis Point = price change resulting from a change of 0. 01% in the yield. Zvi Wiener FIFIBI - 1 25

Duration and IR sensitivity Zvi Wiener FIFIBI - 1 26

Duration and IR sensitivity Zvi Wiener FIFIBI - 1 26

Duration Zvi Wiener FIFIBI - 1 27

Duration Zvi Wiener FIFIBI - 1 27

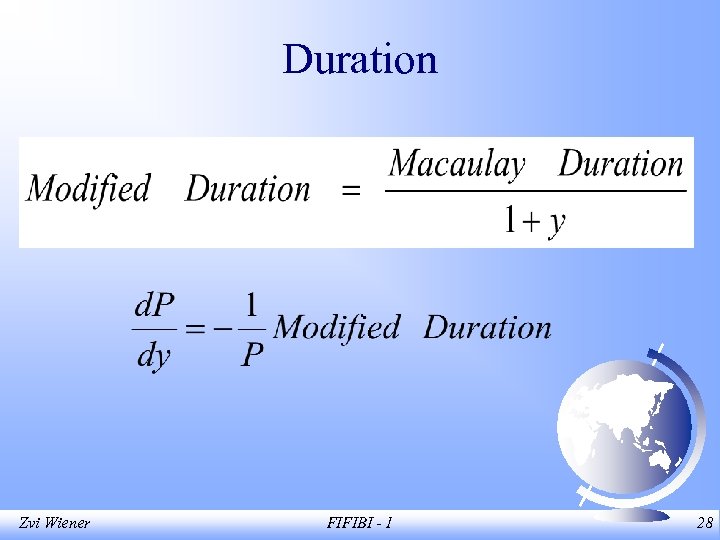

Duration Zvi Wiener FIFIBI - 1 28

Duration Zvi Wiener FIFIBI - 1 28

Duration Bond duration A 3 yr -3% B 1 yr -1% C 10 yr -10% D 20 yr -20% Zvi Wiener price impact of +1% YTM FIFIBI - 1 29

Duration Bond duration A 3 yr -3% B 1 yr -1% C 10 yr -10% D 20 yr -20% Zvi Wiener price impact of +1% YTM FIFIBI - 1 29

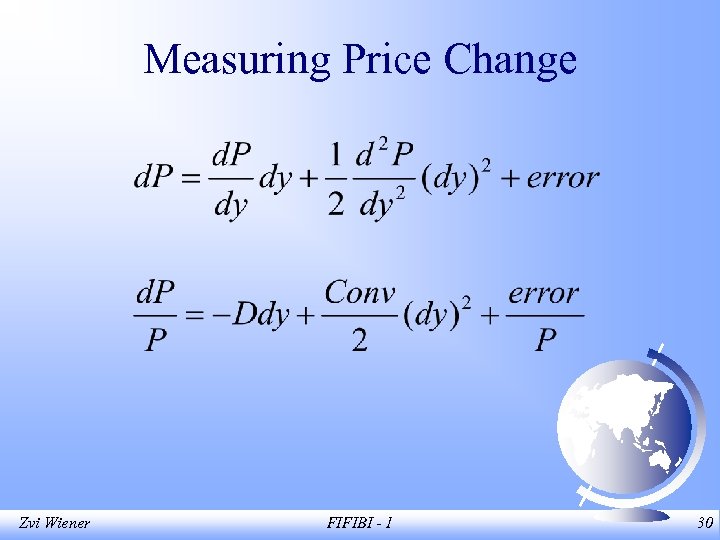

Measuring Price Change Zvi Wiener FIFIBI - 1 30

Measuring Price Change Zvi Wiener FIFIBI - 1 30

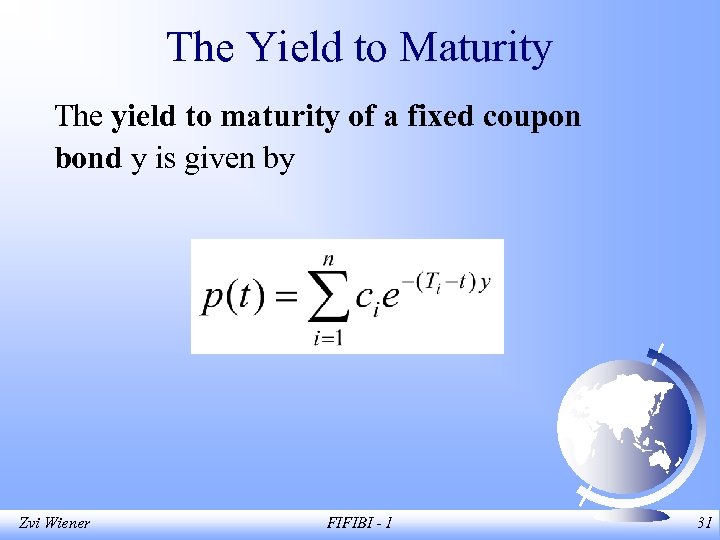

The Yield to Maturity The yield to maturity of a fixed coupon bond y is given by Zvi Wiener FIFIBI - 1 31

The Yield to Maturity The yield to maturity of a fixed coupon bond y is given by Zvi Wiener FIFIBI - 1 31

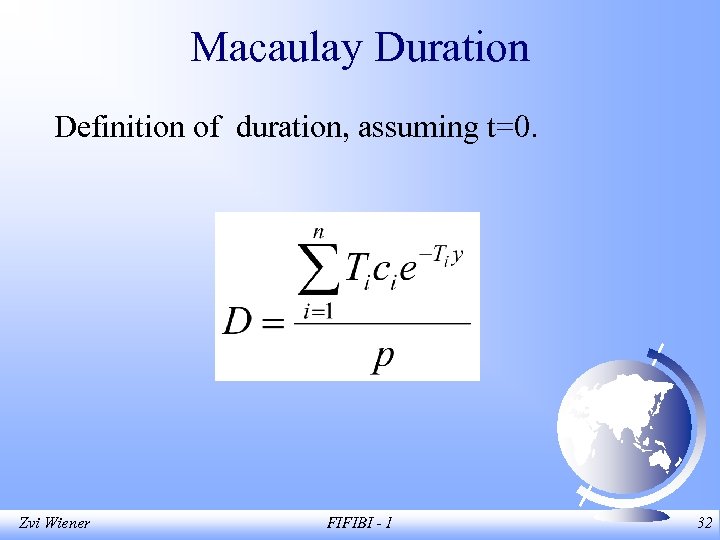

Macaulay Duration Definition of duration, assuming t=0. Zvi Wiener FIFIBI - 1 32

Macaulay Duration Definition of duration, assuming t=0. Zvi Wiener FIFIBI - 1 32

Macaulay Duration A weighted sum of times to maturities of each coupon. What is the duration of a zero coupon bond? Zvi Wiener FIFIBI - 1 33

Macaulay Duration A weighted sum of times to maturities of each coupon. What is the duration of a zero coupon bond? Zvi Wiener FIFIBI - 1 33

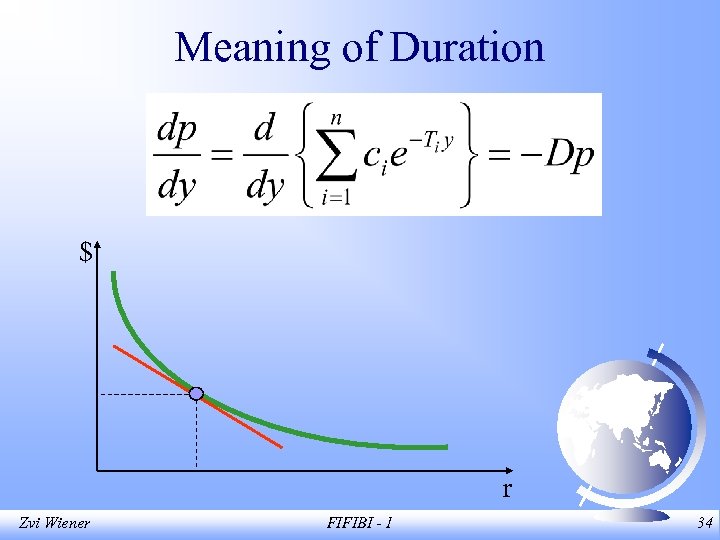

Meaning of Duration $ r Zvi Wiener FIFIBI - 1 34

Meaning of Duration $ r Zvi Wiener FIFIBI - 1 34

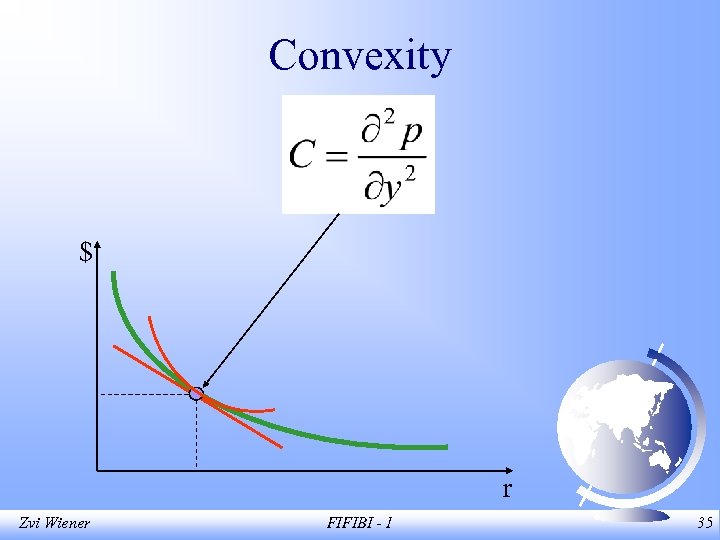

Convexity $ r Zvi Wiener FIFIBI - 1 35

Convexity $ r Zvi Wiener FIFIBI - 1 35

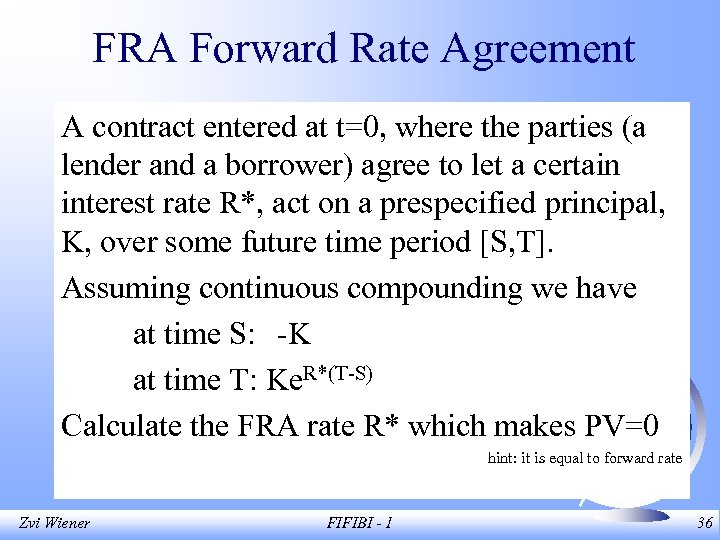

FRA Forward Rate Agreement A contract entered at t=0, where the parties (a lender and a borrower) agree to let a certain interest rate R*, act on a prespecified principal, K, over some future time period [S, T]. Assuming continuous compounding we have at time S: -K at time T: Ke. R*(T-S) Calculate the FRA rate R* which makes PV=0 hint: it is equal to forward rate Zvi Wiener FIFIBI - 1 36

FRA Forward Rate Agreement A contract entered at t=0, where the parties (a lender and a borrower) agree to let a certain interest rate R*, act on a prespecified principal, K, over some future time period [S, T]. Assuming continuous compounding we have at time S: -K at time T: Ke. R*(T-S) Calculate the FRA rate R* which makes PV=0 hint: it is equal to forward rate Zvi Wiener FIFIBI - 1 36

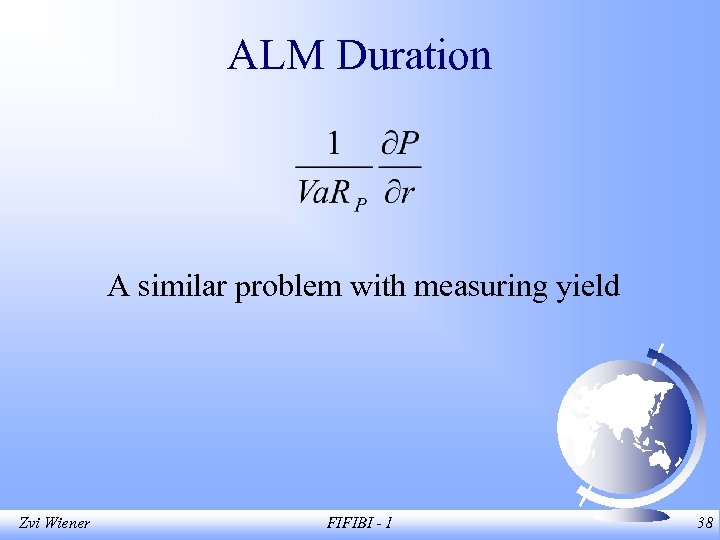

ALM Duration • Does NOT work! • Wrong units of measurement • Division by a small number Zvi Wiener FIFIBI - 1 37

ALM Duration • Does NOT work! • Wrong units of measurement • Division by a small number Zvi Wiener FIFIBI - 1 37

ALM Duration A similar problem with measuring yield Zvi Wiener FIFIBI - 1 38

ALM Duration A similar problem with measuring yield Zvi Wiener FIFIBI - 1 38

Do not think of duration as a measure of time! Zvi Wiener FIFIBI - 1 39

Do not think of duration as a measure of time! Zvi Wiener FIFIBI - 1 39

• Key rate duration • Principal component duration • Partial duration Zvi Wiener FIFIBI - 1 40

• Key rate duration • Principal component duration • Partial duration Zvi Wiener FIFIBI - 1 40

Factors affecting Bond yields and TS • Base interest rate - benchmark interest rate • Risk Premium - spread • Expected liquidity • Market forces - Demand supply Zvi Wiener FIFIBI - 1 41

Factors affecting Bond yields and TS • Base interest rate - benchmark interest rate • Risk Premium - spread • Expected liquidity • Market forces - Demand supply Zvi Wiener FIFIBI - 1 41

Taxability of interest • qualified municipal bonds are exempts from federal taxes. After tax yield = pretax yield (1 - marginal tax rate( Zvi Wiener FIFIBI - 1 42

Taxability of interest • qualified municipal bonds are exempts from federal taxes. After tax yield = pretax yield (1 - marginal tax rate( Zvi Wiener FIFIBI - 1 42

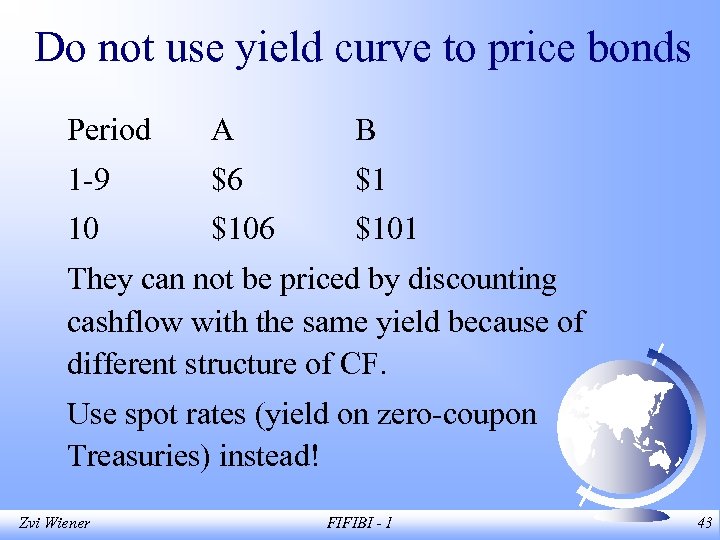

Do not use yield curve to price bonds Period A B 1 -9 $6 $1 10 $106 $101 They can not be priced by discounting cashflow with the same yield because of different structure of CF. Use spot rates (yield on zero-coupon Treasuries) instead! Zvi Wiener FIFIBI - 1 43

Do not use yield curve to price bonds Period A B 1 -9 $6 $1 10 $106 $101 They can not be priced by discounting cashflow with the same yield because of different structure of CF. Use spot rates (yield on zero-coupon Treasuries) instead! Zvi Wiener FIFIBI - 1 43

On-the-run Treasury issues Off-the-run Treasury issues Special securities Lending Repos and reverse repos Zvi Wiener FIFIBI - 1 44

On-the-run Treasury issues Off-the-run Treasury issues Special securities Lending Repos and reverse repos Zvi Wiener FIFIBI - 1 44

Forward Rates Buy a two years bond Buy a one year bond and then use the money to buy another bond (the price can be fixed today). (1+r 2)=(1+r 1)(1+f 12) Zvi Wiener FIFIBI - 1 45

Forward Rates Buy a two years bond Buy a one year bond and then use the money to buy another bond (the price can be fixed today). (1+r 2)=(1+r 1)(1+f 12) Zvi Wiener FIFIBI - 1 45

Forward Rates 1+)r 3)=(1+r 1)(1+f 13)= (1+r 1)(1+f 12)(1+f 13) Term structure of instantaneous forward rates. Zvi Wiener FIFIBI - 1 46

Forward Rates 1+)r 3)=(1+r 1)(1+f 13)= (1+r 1)(1+f 12)(1+f 13) Term structure of instantaneous forward rates. Zvi Wiener FIFIBI - 1 46

Determinants of the Term Structure Expectation theory Market segmentation theory Liquidity theory Mathematical models: Ho-Lee, Vasichek, Hull -White, HJM, etc. Zvi Wiener FIFIBI - 1 47

Determinants of the Term Structure Expectation theory Market segmentation theory Liquidity theory Mathematical models: Ho-Lee, Vasichek, Hull -White, HJM, etc. Zvi Wiener FIFIBI - 1 47

Home Assignment • What is the duration of a floater? • What is the duration of an inverse floater? • How coupon payments affect duration? • Why modified duration is better than Macaulay duration? • How duration can be used for hedging ? Zvi Wiener FIFIBI - 1 48

Home Assignment • What is the duration of a floater? • What is the duration of an inverse floater? • How coupon payments affect duration? • Why modified duration is better than Macaulay duration? • How duration can be used for hedging ? Zvi Wiener FIFIBI - 1 48