Topic 7.pptx

- Количество слайдов: 56

Fixed assets, intangible assets and other long-term assets of enterprise 1. Fixed assets as a part of long-term assets of enterprise. Definition & meaning and structure of assets. 2. Wear and tear, depreciation of assets. 3. Indexes of assets usage. Ways for enhancement of assets usage. 4. Intangible resources and assets of enterprise 1

1. Assents (fixed) as a part of longterm assets of enterprise Definition & meaning and structure of assets. 2

Long Term Assets - On a balance sheet, the value of a company’s property, equipment and other capital assets expected to be useable for more than one year (minus depreciation). 3

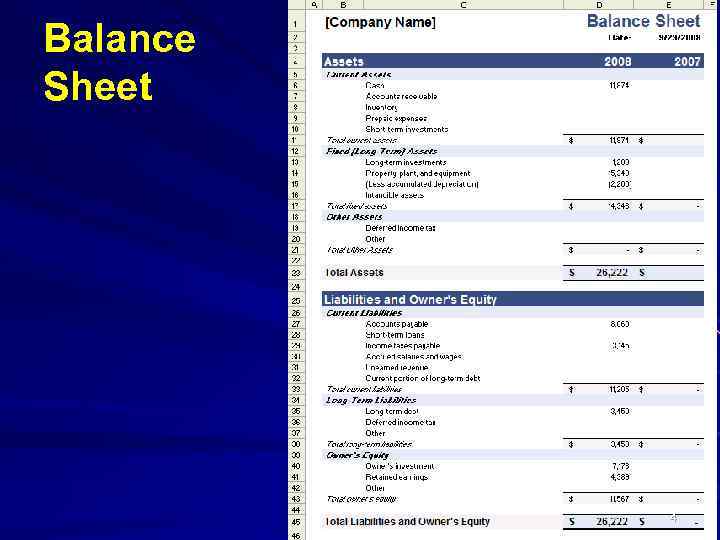

Balance Sheet 4

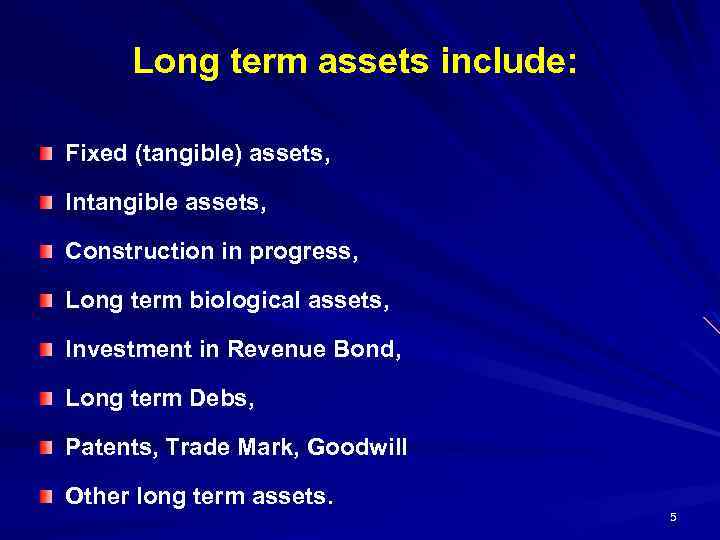

Long term assets include: Fixed (tangible) assets, Intangible assets, Construction in progress, Long term biological assets, Investment in Revenue Bond, Long term Debs, Patents, Trade Mark, Goodwill Other long term assets. 5

Fixed Assets - A resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. - Key point: long term assets are used in multiple operating cycles 6

Classification of Assets 7

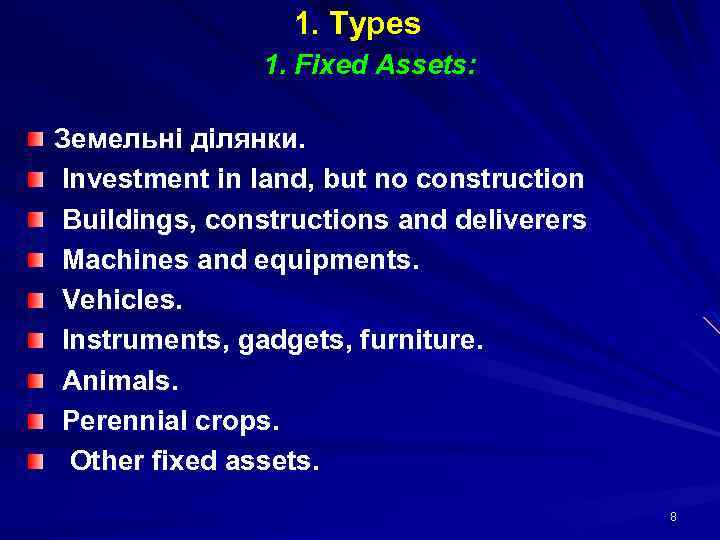

1. Types 1. Fixed Assets: Земельні ділянки. Investment in land, but no construction Buildings, constructions and deliverers Machines and equipments. Vehicles. Instruments, gadgets, furniture. Animals. Perennial crops. Other fixed assets. 8

1. Types 2. Other long term tangible assets: Library Funds. Noncurrent tangible assets of low value. Temporary constructions. Natural resources. Inventory containers Other noncurrent tangible assets. 9

2. Belonging own; Leased (rented). 10

3. Usage: operative; non operative. 11

4. Involvement in Manufacturing Processes: Non manufacturing assets (funds); Manufacturing assets (assets). 5. Influence on work object: active passive 12

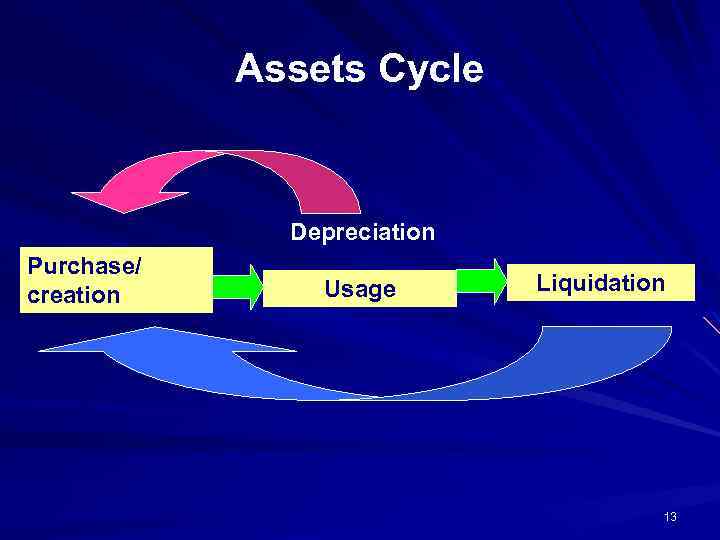

Assets Cycle Depreciation Purchase/ creation Usage Liquidation 13

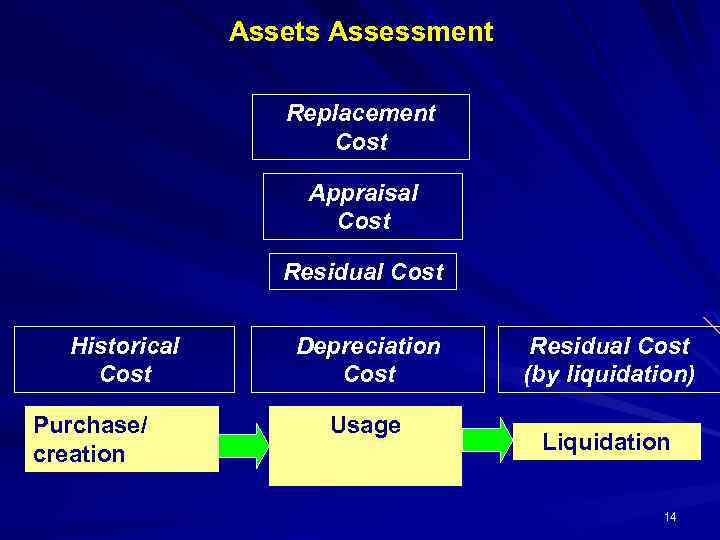

Assets Assessment Replacement Cost Appraisal Cost Residual Cost Historical Cost Purchase/ creation Depreciation Cost Usage Residual Cost (by liquidation) Liquidation 14

2. Wear and tear, depreciation of assets. 15

Wear and Tear - The gradual deterioration of an asset which results naturally from use and/or age. . 16

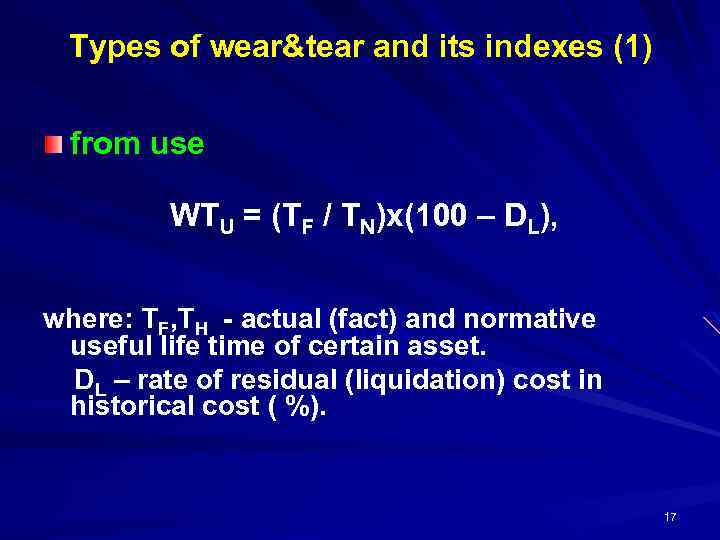

Types of wear&tear and its indexes (1) from use WTU = (ТF / ТN)х(100 – DL), where: ТF, ТH - actual (fact) and normative useful life time of certain asset. DL – rate of residual (liquidation) cost in historical cost ( %). 17

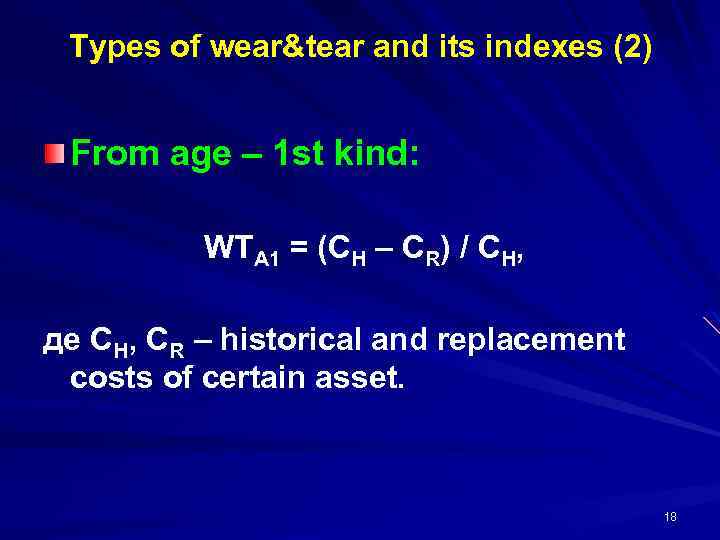

Types of wear&tear and its indexes (2) From age – 1 st kind: WTA 1 = (CH – CR) / CH, де CH, CR – historical and replacement costs of certain asset. 18

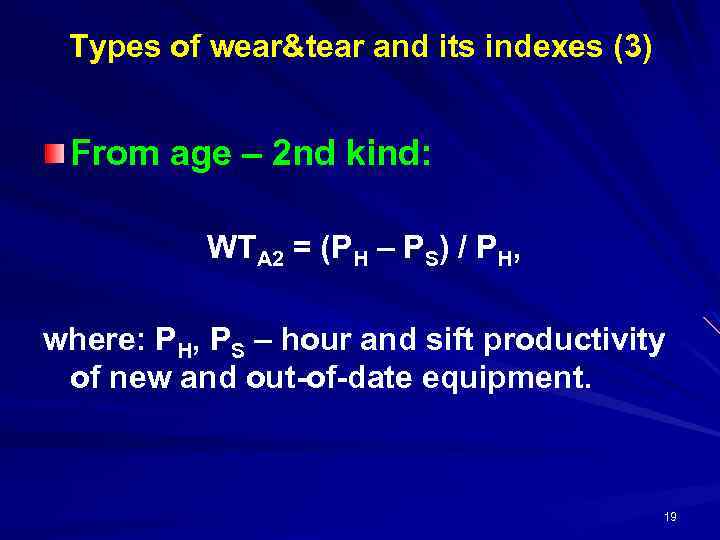

Types of wear&tear and its indexes (3) From age – 2 nd kind: WTA 2 = (PH – PS) / PH, where: PH, PS – hour and sift productivity of new and out-of-date equipment. 19

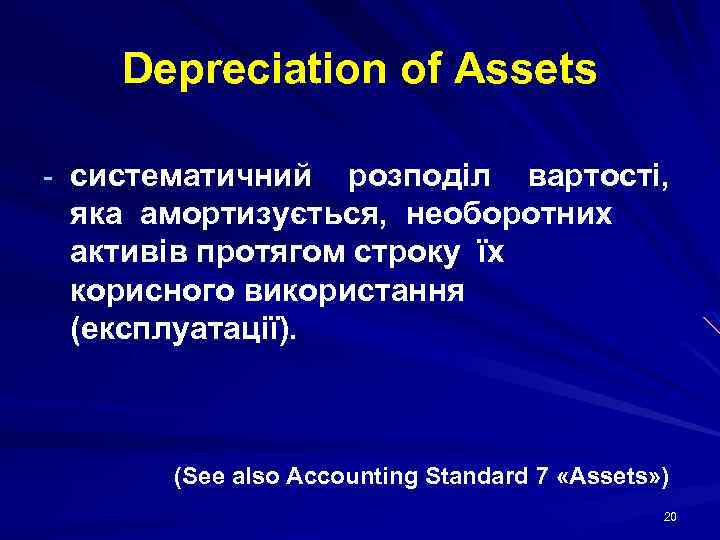

Depreciation of Assets - систематичний розподіл вартості, яка амортизується, необоротних активів протягом строку їх корисного використання (експлуатації). (See also Accounting Standard 7 «Assets» ) 20

Depreciation of Assets is suspended during reconstruction, modernization, completion, rust-prevented storage of assets. (according Accounting Standard 7 «Assets» ) 21

Non Depreciable Assets: Land lots; Natural resources; Capital Investment (according Accounting Standard 7 «Assets» ) 22

Depreciation Rate –the percentage at which the value of an asset decreases each year in business accounts… . . because of transition of costs into goods. 23

Depreciation Methods in Ukraine Straight-line Depreciation Method; Reducing Balance Depreciation Method; Accelerated Reducing Balance Depreciation Method; Sum-of-Years’ Digit Depreciation Method; Units-of-Production Depreciation Method. 24

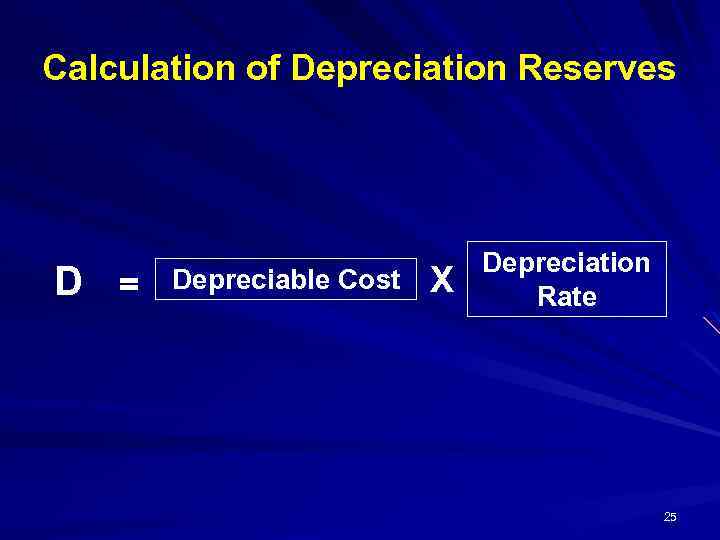

Calculation of Depreciation Reserves D = Depreciable Cost Х Depreciation Rate 25

CASE STUDY Suppose: Historical Cost of the purchased device is 20 000 HRN. Its useful live time is 4 years. It is expected that the residual cost by liquidation will be 2000 HRN. 26

Straight-Line Depreciation Method 27

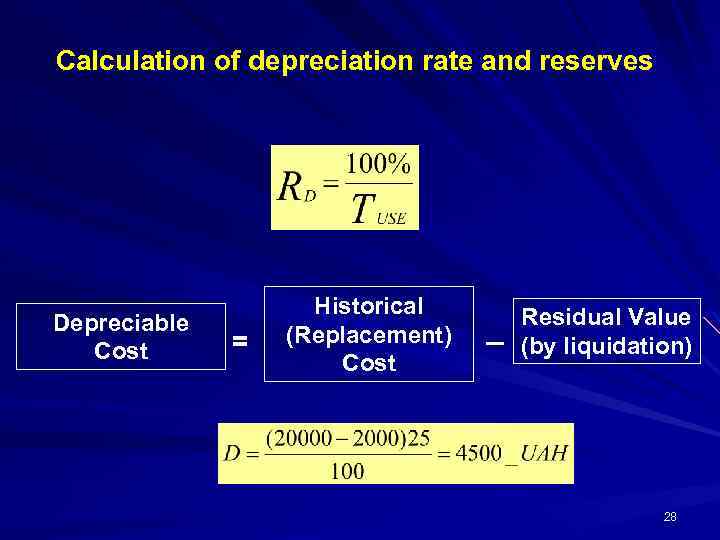

Calculation of depreciation rate and reserves Depreciable Cost = Historical (Replacement) Cost _ Residual Value (by liquidation) 28

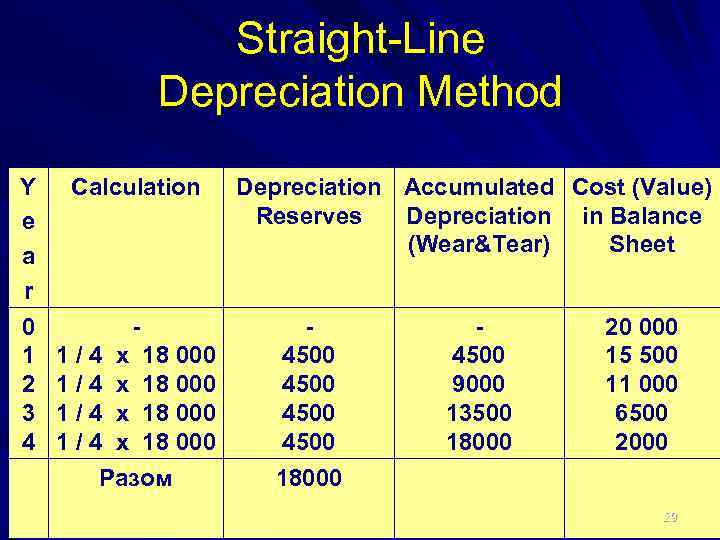

Straight-Line Depreciation Method Y e a r Calculation 0 1 2 3 4 1/4 1/4 х х 18 000 Разом Depreciation Accumulated Cost (Value) Reserves Depreciation in Balance (Wear&Tear) Sheet 4500 4500 9000 13500 18000 20 000 15 500 11 000 6500 2000 18000 29

Sum-of-years' digits method 30

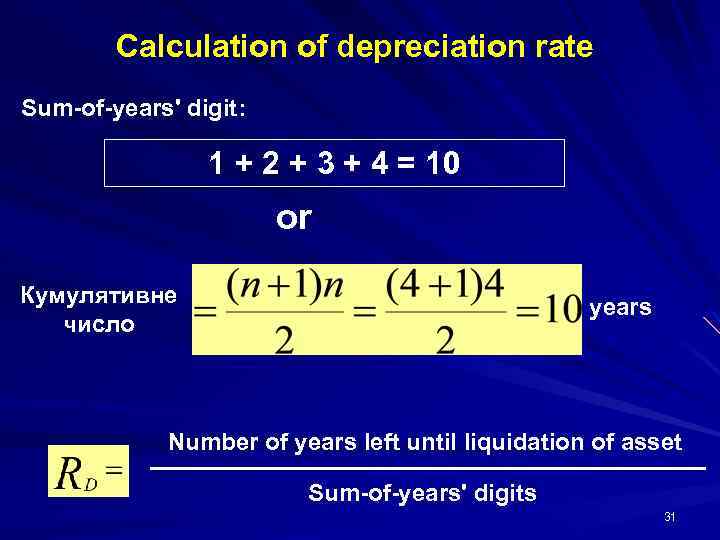

Calculation of depreciation rate Sum-of-years' digit: 1 + 2 + 3 + 4 = 10 or Кумулятивне число years Number of years left until liquidation of asset Sum-of-years' digits 31

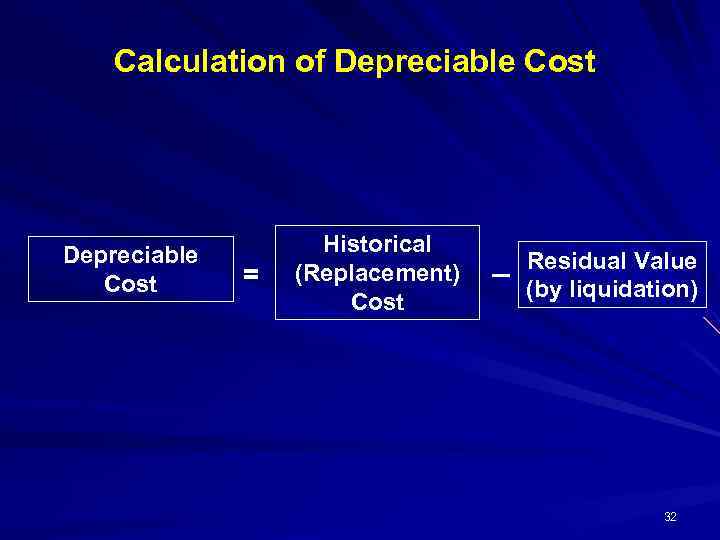

Calculation of Depreciable Cost = Historical (Replacement) Cost _ Residual Value (by liquidation) 32

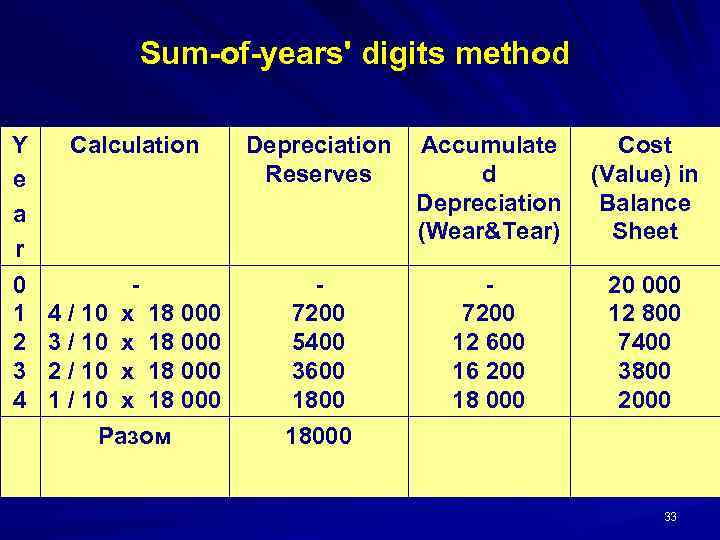

Sum-of-years' digits method Y e a r Calculation Depreciation Reserves Accumulate d Depreciation (Wear&Tear) Cost (Value) in Balance Sheet 0 1 2 3 4 х х 7200 5400 3600 1800 7200 12 600 16 200 18 000 20 000 12 800 7400 3800 2000 4 / 10 3 / 10 2 / 10 18 000 18 000 Разом 18000 33

Reducing Balance Method Accelerated Reducing Balance Method 34

Units-of-Production Depreciation Method 35

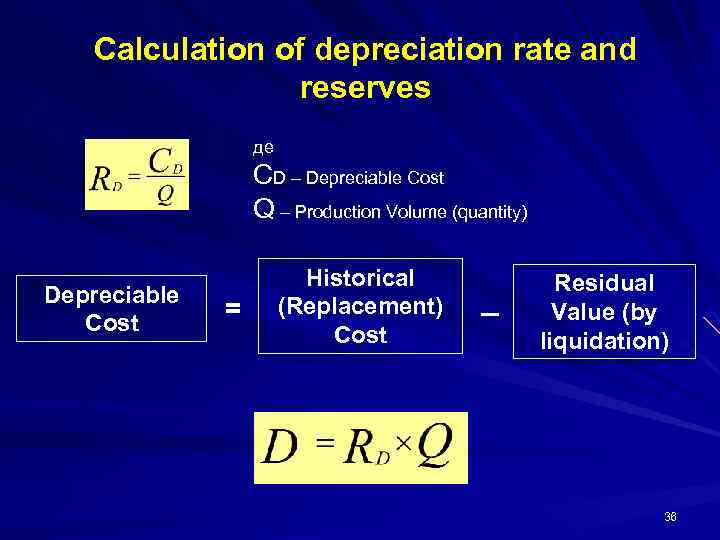

Calculation of depreciation rate and reserves де CD – Depreciable Cost Q – Production Volume (quantity) Depreciable Cost = Historical (Replacement) Cost _ Residual Value (by liquidation) 36

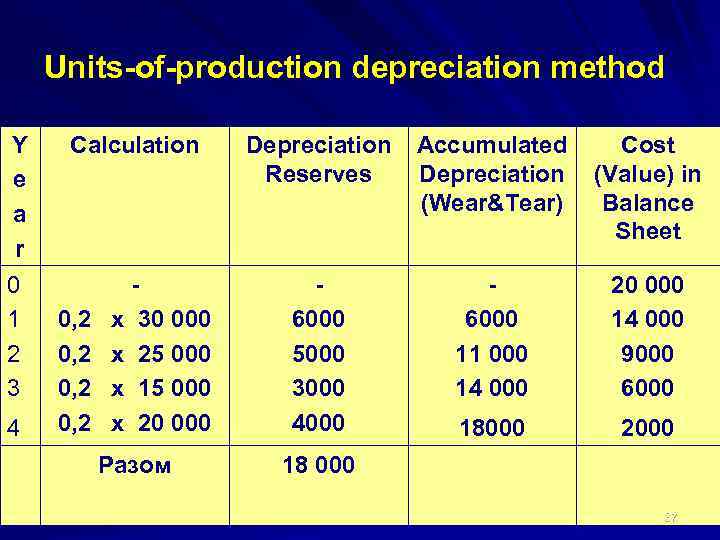

Units-of-production depreciation method Y e a r 0 1 2 3 4 Calculation 0, 2 х 30 000 х 25 000 х 15 000 х 20 000 Разом Depreciation Reserves Accumulated Depreciation (Wear&Tear) Cost (Value) in Balance Sheet 6000 5000 3000 4000 6000 11 000 14 000 20 000 14 000 9000 6000 18000 2000 18 000 37

3. Indexes of assets usage. Ways for enhancement of assets usage. 38

Показники ефективності використання ОЗ підприємства 1. Показники стану ОЗ: коефіцієнт зносу основних засобів; коефіцієнт придатності основних засобів. 39

Показники ефективності використання ОЗ підприємства 2. Показники динаміки ОЗ: коефіцієнт вибуття основних засобів; коефіцієнт вводу основних засобів. 40

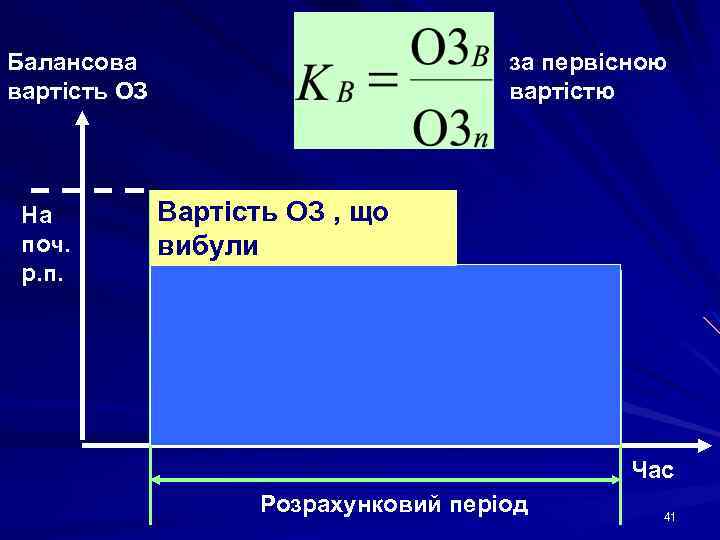

Балансова вартість ОЗ На поч. р. п. за первісною вартістю Вартість ОЗ , що вибули Час Розрахунковий період 41

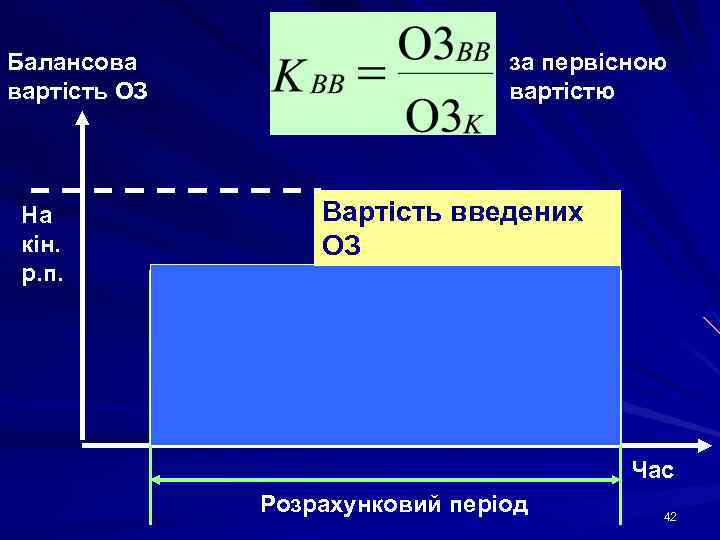

Балансова вартість ОЗ На кін. р. п. за первісною вартістю Вартість введених ОЗ Час Розрахунковий період 42

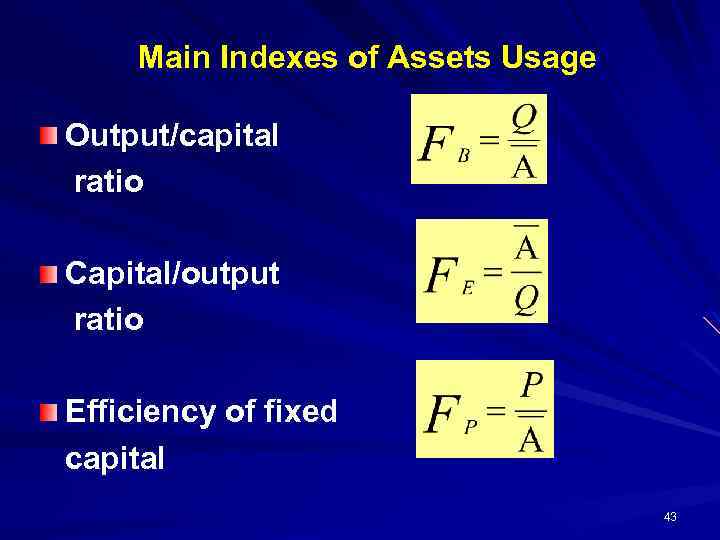

Main Indexes of Assets Usage Output/capital ratio Capital/output ratio Efficiency of fixed capital 43

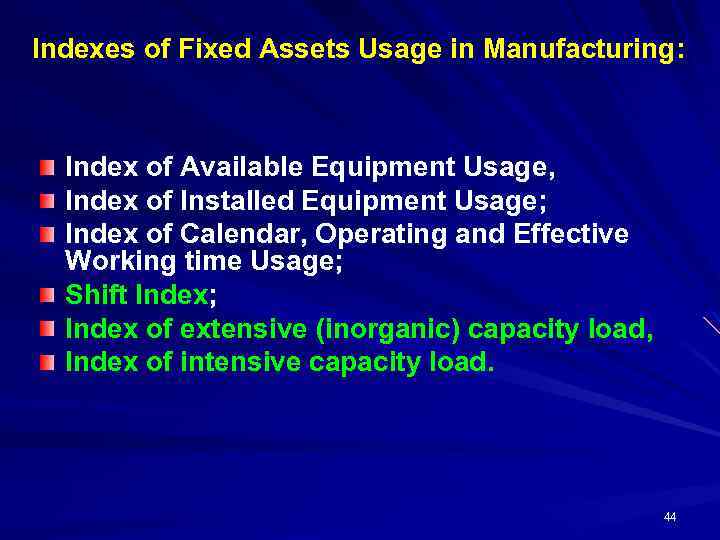

Indexes of Fixed Assets Usage in Manufacturing: Index of Available Equipment Usage, Index of Installed Equipment Usage; Index of Calendar, Operating and Effective Working time Usage; Shift Index; Index of extensive (inorganic) capacity load, Index of intensive capacity load. 44

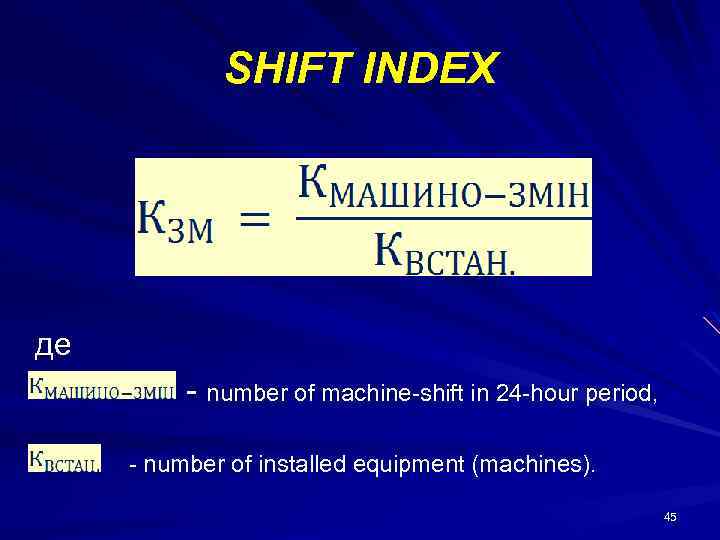

SHIFT INDEX де • - number of machine-shift in 24 -hour period, number of machine-shift in 24 -hour period - number of installed equipment (machines). 45

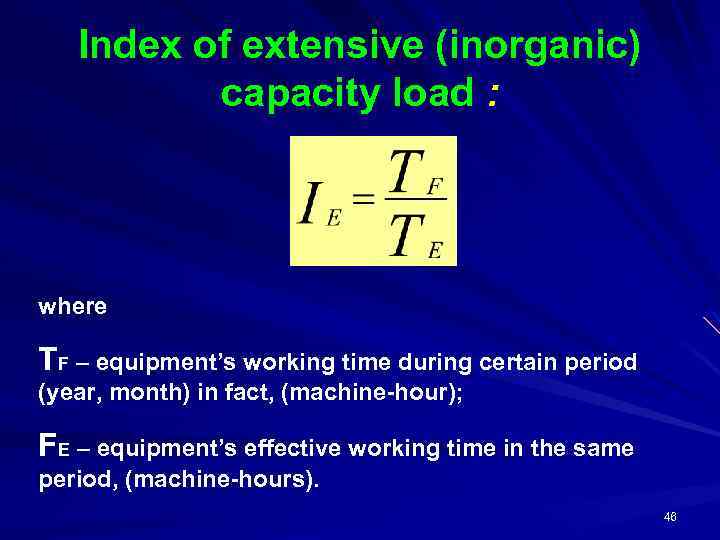

Index of extensive (inorganic) capacity load : where TF – equipment’s working time during certain period (year, month) in fact, (machine-hour); FE – equipment’s effective working time in the same period, (machine-hours). 46

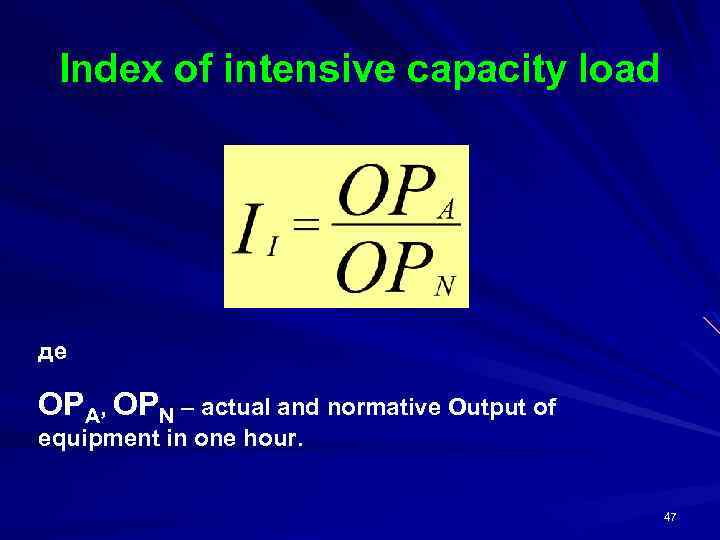

Index of intensive capacity load де OPA, OPN – actual and normative Output of equipment in one hour. 47

Ways to enhance the usage of assets. intensive extensive 48

4. Intangible resources and assets of enterprise 49

Intangible resources part of enterprise’s economic potential everything of immaterial existence used or potentially usable for whatever purpose that is renewable after use and decreases, remains or increases in quantity and/or quality while being used. 50

Intangible resources- objects of intellectual property. Intangible assets are intellectual or legal rights on intellectual property on (copyrights) 51

Intangible Assets - are the long-term resources of an entity, that have no physical existence. They derive their value from intellectual or legal rights, and from the value they add to the other assets. -. (See also Accounting Standard 8 «Intangible Assets» ) 52

International Classification of Intangible Assets Limited-life intangible assets e. g. patents, copyrights, goodwill Unlimited-life intangible assets e. g. trademark 53

Intangible resources: 1. Об'єкти промислової власності Винахід Корисна модель Промислові зразки Товарні знаки або знаки обслуговування Фірмове найменування Способи захисту від недобросовісної конкуренції 54

Види нематеріальних ресурсів: 2. Об'єкти, що охороняються авторським правом та суміжними правами; Твори в галузі науки, мистецтва, літератури (існують в таких формах; письмовій, усній, образотворчій, об'ємно – просторовій, тощо. Комп'ютерні програми Бази даних Типологія інтегральних мікросхем Суміжні програми (права виконавців, права виробників фонограм, права організацій мовлення) 55

Види нематеріальних ресурсів: З. Інші об'єкти інтелектуальної власності: Раціоналізаторська пропозиція Комерційна таємниця, зокрема ноу хау 56

Topic 7.pptx