4ac8e616eb65eea8a57cb053b549f4ee.ppt

- Количество слайдов: 13

fit e ge rin F ax T en B Author : Sachin Gujar, Chartered Accountant

fit e ge rin F ax T en B Author : Sachin Gujar, Chartered Accountant

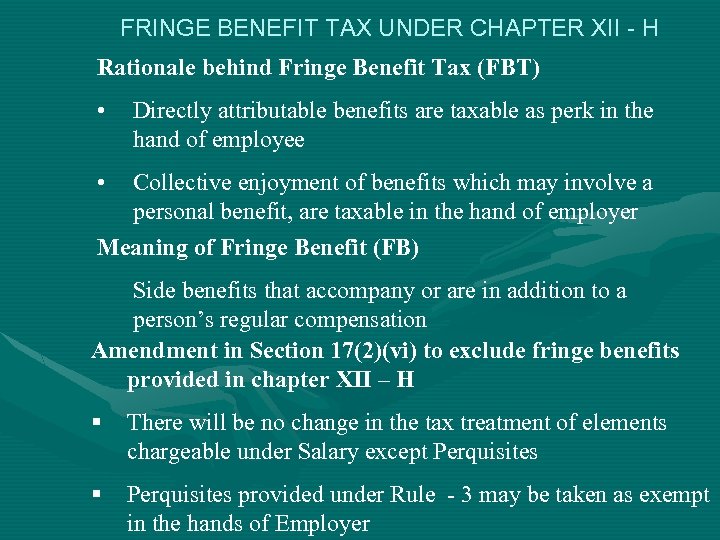

FRINGE BENEFIT TAX UNDER CHAPTER XII - H Rationale behind Fringe Benefit Tax (FBT) • Directly attributable benefits are taxable as perk in the hand of employee • Collective enjoyment of benefits which may involve a personal benefit, are taxable in the hand of employer Meaning of Fringe Benefit (FB) Side benefits that accompany or are in addition to a person’s regular compensation Amendment in Section 17(2)(vi) to exclude fringe benefits provided in chapter XII – H § There will be no change in the tax treatment of elements chargeable under Salary except Perquisites § Perquisites provided under Rule - 3 may be taken as exempt in the hands of Employer

FRINGE BENEFIT TAX UNDER CHAPTER XII - H Rationale behind Fringe Benefit Tax (FBT) • Directly attributable benefits are taxable as perk in the hand of employee • Collective enjoyment of benefits which may involve a personal benefit, are taxable in the hand of employer Meaning of Fringe Benefit (FB) Side benefits that accompany or are in addition to a person’s regular compensation Amendment in Section 17(2)(vi) to exclude fringe benefits provided in chapter XII – H § There will be no change in the tax treatment of elements chargeable under Salary except Perquisites § Perquisites provided under Rule - 3 may be taken as exempt in the hands of Employer

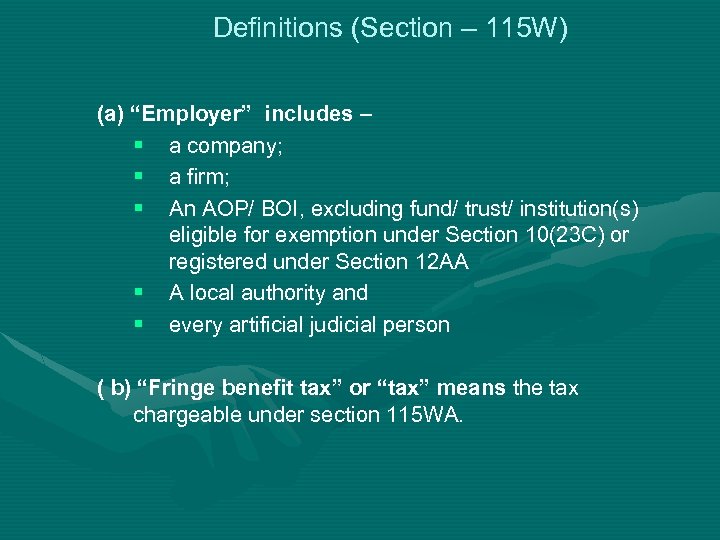

Definitions (Section – 115 W) (a) “Employer” includes – § a company; § a firm; § An AOP/ BOI, excluding fund/ trust/ institution(s) eligible for exemption under Section 10(23 C) or registered under Section 12 AA § A local authority and § every artificial judicial person ( b) “Fringe benefit tax” or “tax” means the tax chargeable under section 115 WA.

Definitions (Section – 115 W) (a) “Employer” includes – § a company; § a firm; § An AOP/ BOI, excluding fund/ trust/ institution(s) eligible for exemption under Section 10(23 C) or registered under Section 12 AA § A local authority and § every artificial judicial person ( b) “Fringe benefit tax” or “tax” means the tax chargeable under section 115 WA.

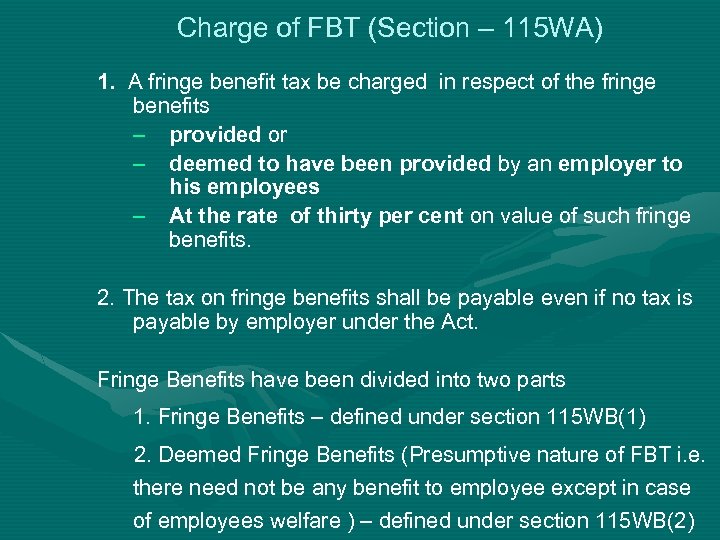

Charge of FBT (Section – 115 WA) 1. A fringe benefit tax be charged in respect of the fringe benefits – provided or – deemed to have been provided by an employer to his employees – At the rate of thirty per cent on value of such fringe benefits. 2. The tax on fringe benefits shall be payable even if no tax is payable by employer under the Act. Fringe Benefits have been divided into two parts 1. Fringe Benefits – defined under section 115 WB(1) 2. Deemed Fringe Benefits (Presumptive nature of FBT i. e. there need not be any benefit to employee except in case of employees welfare ) – defined under section 115 WB(2)

Charge of FBT (Section – 115 WA) 1. A fringe benefit tax be charged in respect of the fringe benefits – provided or – deemed to have been provided by an employer to his employees – At the rate of thirty per cent on value of such fringe benefits. 2. The tax on fringe benefits shall be payable even if no tax is payable by employer under the Act. Fringe Benefits have been divided into two parts 1. Fringe Benefits – defined under section 115 WB(1) 2. Deemed Fringe Benefits (Presumptive nature of FBT i. e. there need not be any benefit to employee except in case of employees welfare ) – defined under section 115 WB(2)

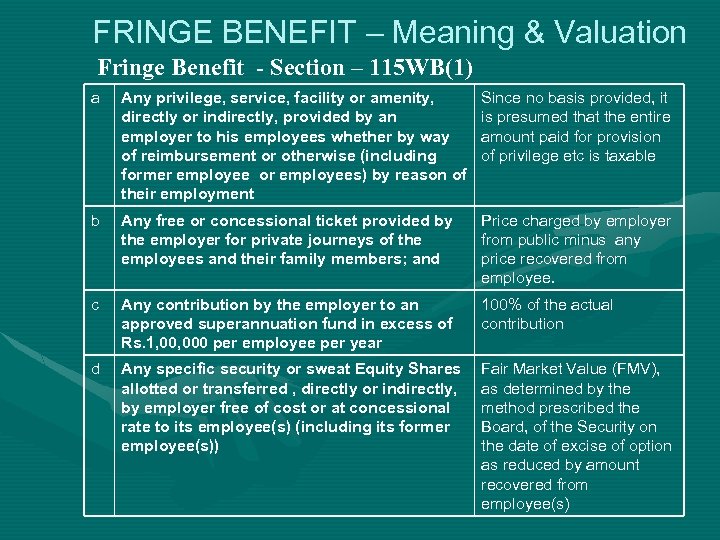

FRINGE BENEFIT – Meaning & Valuation Fringe Benefit - Section – 115 WB(1) a Any privilege, service, facility or amenity, directly or indirectly, provided by an employer to his employees whether by way of reimbursement or otherwise (including former employee or employees) by reason of their employment Since no basis provided, it is presumed that the entire amount paid for provision of privilege etc is taxable b Any free or concessional ticket provided by the employer for private journeys of the employees and their family members; and Price charged by employer from public minus any price recovered from employee. c Any contribution by the employer to an approved superannuation fund in excess of Rs. 1, 000 per employee per year 100% of the actual contribution d Any specific security or sweat Equity Shares allotted or transferred , directly or indirectly, by employer free of cost or at concessional rate to its employee(s) (including its former employee(s)) Fair Market Value (FMV), as determined by the method prescribed the Board, of the Security on the date of excise of option as reduced by amount recovered from employee(s)

FRINGE BENEFIT – Meaning & Valuation Fringe Benefit - Section – 115 WB(1) a Any privilege, service, facility or amenity, directly or indirectly, provided by an employer to his employees whether by way of reimbursement or otherwise (including former employee or employees) by reason of their employment Since no basis provided, it is presumed that the entire amount paid for provision of privilege etc is taxable b Any free or concessional ticket provided by the employer for private journeys of the employees and their family members; and Price charged by employer from public minus any price recovered from employee. c Any contribution by the employer to an approved superannuation fund in excess of Rs. 1, 000 per employee per year 100% of the actual contribution d Any specific security or sweat Equity Shares allotted or transferred , directly or indirectly, by employer free of cost or at concessional rate to its employee(s) (including its former employee(s)) Fair Market Value (FMV), as determined by the method prescribed the Board, of the Security on the date of excise of option as reduced by amount recovered from employee(s)

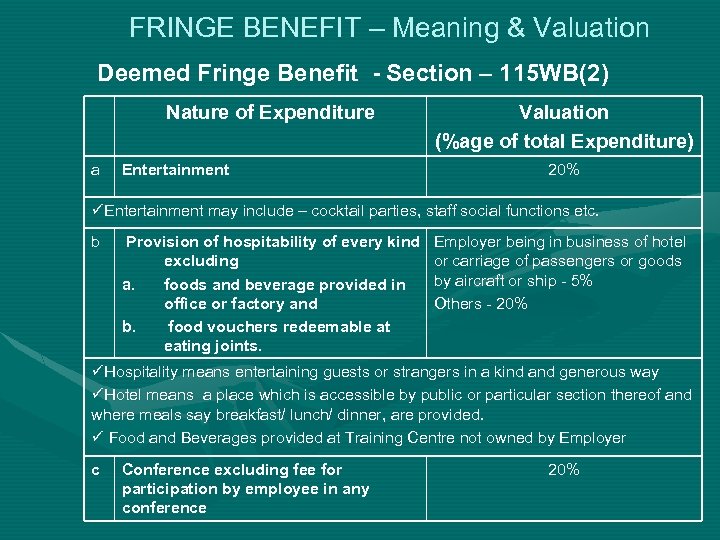

FRINGE BENEFIT – Meaning & Valuation Deemed Fringe Benefit - Section – 115 WB(2) Nature of Expenditure a Entertainment Valuation (%age of total Expenditure) 20% üEntertainment may include – cocktail parties, staff social functions etc. b Provision of hospitability of every kind excluding a. foods and beverage provided in office or factory and b. food vouchers redeemable at eating joints. Employer being in business of hotel or carriage of passengers or goods by aircraft or ship - 5% Others - 20% üHospitality means entertaining guests or strangers in a kind and generous way üHotel means a place which is accessible by public or particular section thereof and where meals say breakfast/ lunch/ dinner, are provided. ü Food and Beverages provided at Training Centre not owned by Employer c Conference excluding fee for participation by employee in any conference 20%

FRINGE BENEFIT – Meaning & Valuation Deemed Fringe Benefit - Section – 115 WB(2) Nature of Expenditure a Entertainment Valuation (%age of total Expenditure) 20% üEntertainment may include – cocktail parties, staff social functions etc. b Provision of hospitability of every kind excluding a. foods and beverage provided in office or factory and b. food vouchers redeemable at eating joints. Employer being in business of hotel or carriage of passengers or goods by aircraft or ship - 5% Others - 20% üHospitality means entertaining guests or strangers in a kind and generous way üHotel means a place which is accessible by public or particular section thereof and where meals say breakfast/ lunch/ dinner, are provided. ü Food and Beverages provided at Training Centre not owned by Employer c Conference excluding fee for participation by employee in any conference 20%

FRINGE BENEFIT – Meaning & Valuation üConference means a formal meeting for discussion or debate üAll expenditure on conveyance, tour and travel (incl. foreign travel), hotel, boarding and lodging in connection with conference except fee for participation, shall be included üIn house employee conference – covered under FBT d Sale promotion including publicity excluding i) Expenditure on advertisement ii) Expenditure on Distribution of samples either free or at concessional rates iii) Expenditure by way of payment to any person of repute for promoting sales of goods or services 20% üSale Promotion is a form of promotion which encourage customers to buy products by offering incentives such as contests, coupons, samples, free gifts etc. üPublicity means brand related communication between entity and public. üSelling Expenditure – not covered e Employee welfare excluding expenditure to fulfill statutory obligation or mitigate occupational hazards or provide first aid facilities in the hospital or dispensary run by employer 20%

FRINGE BENEFIT – Meaning & Valuation üConference means a formal meeting for discussion or debate üAll expenditure on conveyance, tour and travel (incl. foreign travel), hotel, boarding and lodging in connection with conference except fee for participation, shall be included üIn house employee conference – covered under FBT d Sale promotion including publicity excluding i) Expenditure on advertisement ii) Expenditure on Distribution of samples either free or at concessional rates iii) Expenditure by way of payment to any person of repute for promoting sales of goods or services 20% üSale Promotion is a form of promotion which encourage customers to buy products by offering incentives such as contests, coupons, samples, free gifts etc. üPublicity means brand related communication between entity and public. üSelling Expenditure – not covered e Employee welfare excluding expenditure to fulfill statutory obligation or mitigate occupational hazards or provide first aid facilities in the hospital or dispensary run by employer 20%

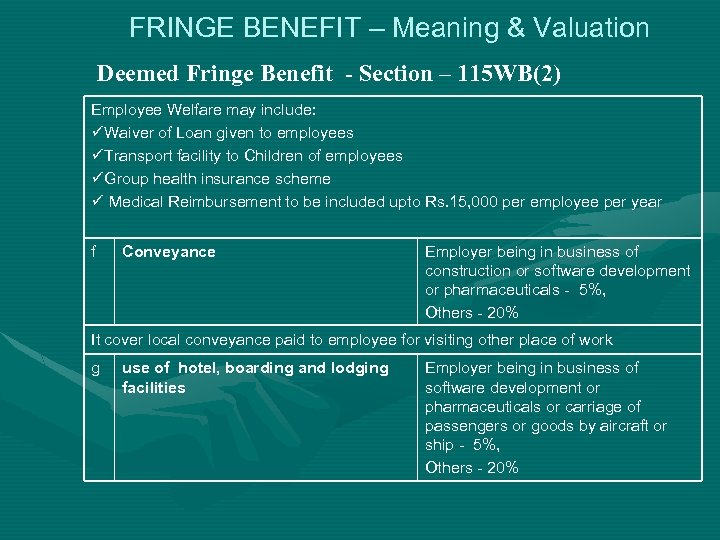

FRINGE BENEFIT – Meaning & Valuation Deemed Fringe Benefit - Section – 115 WB(2) Employee Welfare may include: üWaiver of Loan given to employees üTransport facility to Children of employees üGroup health insurance scheme ü Medical Reimbursement to be included upto Rs. 15, 000 per employee per year f Conveyance Employer being in business of construction or software development or pharmaceuticals - 5%, Others - 20% It cover local conveyance paid to employee for visiting other place of work g use of hotel, boarding and lodging facilities Employer being in business of software development or pharmaceuticals or carriage of passengers or goods by aircraft or ship - 5%, Others - 20%

FRINGE BENEFIT – Meaning & Valuation Deemed Fringe Benefit - Section – 115 WB(2) Employee Welfare may include: üWaiver of Loan given to employees üTransport facility to Children of employees üGroup health insurance scheme ü Medical Reimbursement to be included upto Rs. 15, 000 per employee per year f Conveyance Employer being in business of construction or software development or pharmaceuticals - 5%, Others - 20% It cover local conveyance paid to employee for visiting other place of work g use of hotel, boarding and lodging facilities Employer being in business of software development or pharmaceuticals or carriage of passengers or goods by aircraft or ship - 5%, Others - 20%

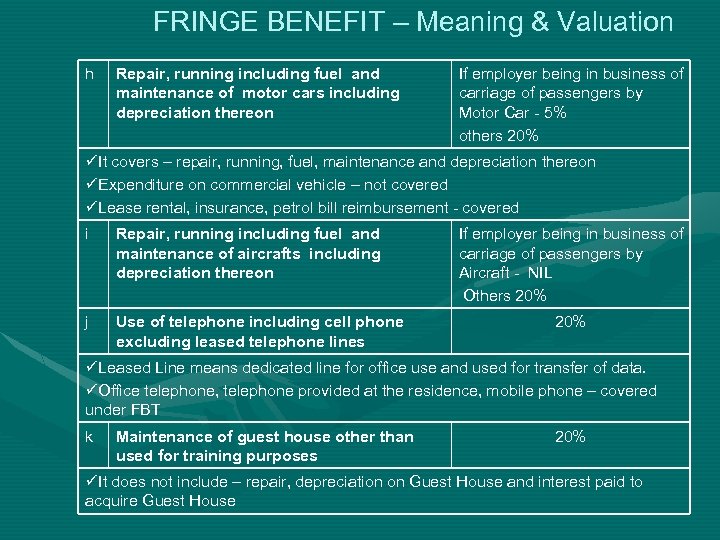

FRINGE BENEFIT – Meaning & Valuation h Repair, running including fuel and maintenance of motor cars including depreciation thereon If employer being in business of carriage of passengers by Motor Car - 5% others 20% üIt covers – repair, running, fuel, maintenance and depreciation thereon üExpenditure on commercial vehicle – not covered üLease rental, insurance, petrol bill reimbursement - covered i Repair, running including fuel and maintenance of aircrafts including depreciation thereon j Use of telephone including cell phone excluding leased telephone lines If employer being in business of carriage of passengers by Aircraft - NIL Others 20% üLeased Line means dedicated line for office use and used for transfer of data. üOffice telephone, telephone provided at the residence, mobile phone – covered under FBT k Maintenance of guest house other than used for training purposes 20% üIt does not include – repair, depreciation on Guest House and interest paid to acquire Guest House

FRINGE BENEFIT – Meaning & Valuation h Repair, running including fuel and maintenance of motor cars including depreciation thereon If employer being in business of carriage of passengers by Motor Car - 5% others 20% üIt covers – repair, running, fuel, maintenance and depreciation thereon üExpenditure on commercial vehicle – not covered üLease rental, insurance, petrol bill reimbursement - covered i Repair, running including fuel and maintenance of aircrafts including depreciation thereon j Use of telephone including cell phone excluding leased telephone lines If employer being in business of carriage of passengers by Aircraft - NIL Others 20% üLeased Line means dedicated line for office use and used for transfer of data. üOffice telephone, telephone provided at the residence, mobile phone – covered under FBT k Maintenance of guest house other than used for training purposes 20% üIt does not include – repair, depreciation on Guest House and interest paid to acquire Guest House

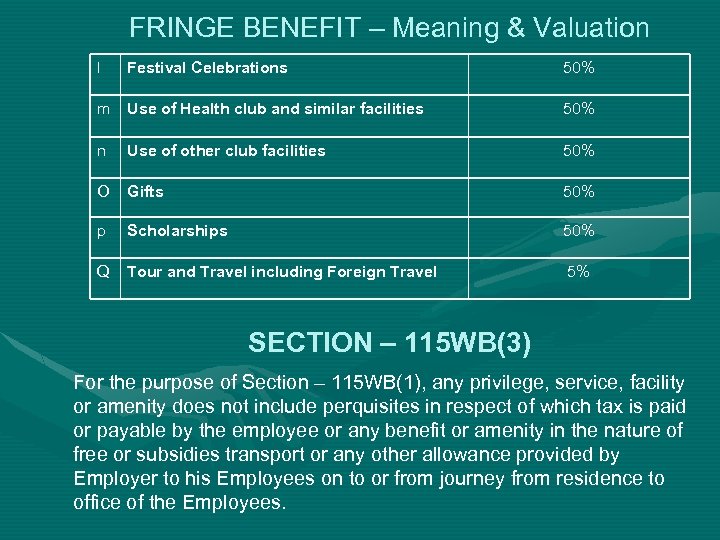

FRINGE BENEFIT – Meaning & Valuation l Festival Celebrations 50% m Use of Health club and similar facilities 50% n Use of other club facilities 50% O Gifts 50% p Scholarships 50% Q Tour and Travel including Foreign Travel 5% SECTION – 115 WB(3) For the purpose of Section – 115 WB(1), any privilege, service, facility or amenity does not include perquisites in respect of which tax is paid or payable by the employee or any benefit or amenity in the nature of free or subsidies transport or any other allowance provided by Employer to his Employees on to or from journey from residence to office of the Employees.

FRINGE BENEFIT – Meaning & Valuation l Festival Celebrations 50% m Use of Health club and similar facilities 50% n Use of other club facilities 50% O Gifts 50% p Scholarships 50% Q Tour and Travel including Foreign Travel 5% SECTION – 115 WB(3) For the purpose of Section – 115 WB(1), any privilege, service, facility or amenity does not include perquisites in respect of which tax is paid or payable by the employee or any benefit or amenity in the nature of free or subsidies transport or any other allowance provided by Employer to his Employees on to or from journey from residence to office of the Employees.

ADVANCE TAX – SECTION 115 WJ Same proportion, same due dates and same method of computing interest for delay in payment of advance tax on Income - will apply to advance FBT. Interest @ 1% per month or part of the month, is to be paid for short fall in tax for the period for which the short fall continues PROCEEDURE FOR FILING RETURN – SECTION 115 WD - For Companies and other entities whose accounts are to be audited – 31 st October - For others - 31 July § One Month from the date of issue of notice where AO issues notice to a defaulting employer. § A defaulting employer may file return up to one year from the end of relevant assessment year or before the completion of assessment whichever is earlier. § A revise return can be filed up to one year from the end of assessment year

ADVANCE TAX – SECTION 115 WJ Same proportion, same due dates and same method of computing interest for delay in payment of advance tax on Income - will apply to advance FBT. Interest @ 1% per month or part of the month, is to be paid for short fall in tax for the period for which the short fall continues PROCEEDURE FOR FILING RETURN – SECTION 115 WD - For Companies and other entities whose accounts are to be audited – 31 st October - For others - 31 July § One Month from the date of issue of notice where AO issues notice to a defaulting employer. § A defaulting employer may file return up to one year from the end of relevant assessment year or before the completion of assessment whichever is earlier. § A revise return can be filed up to one year from the end of assessment year

OTHER PROCEEDURAL REQUIREMENTS 1. Assessment (Section – 115 WE) 2. Best Judgment Assessment (Section – 115 WF) 3. Fringe Benefit Escaping Assessment (Section – 115 WG) 4. Issue of notice where Fringe Benefits have escaped assessment (Section – 115 WH) 5. Payment of Fringe Benefit Tax (Section – 115 WI) 6. Advance Tax in respect of Fringe Benefits (Section – 115 WJ) 7. Interest for default in furnishing return (Section – 115 WK) 8. Application of other provisions of this Act (Section – 115 WL)

OTHER PROCEEDURAL REQUIREMENTS 1. Assessment (Section – 115 WE) 2. Best Judgment Assessment (Section – 115 WF) 3. Fringe Benefit Escaping Assessment (Section – 115 WG) 4. Issue of notice where Fringe Benefits have escaped assessment (Section – 115 WH) 5. Payment of Fringe Benefit Tax (Section – 115 WI) 6. Advance Tax in respect of Fringe Benefits (Section – 115 WJ) 7. Interest for default in furnishing return (Section – 115 WK) 8. Application of other provisions of this Act (Section – 115 WL)

THANK YOU

THANK YOU