Fiscal Policy Wrap-up Multiplier Effect, Policy Lag & Automatic Stabilizers

Fiscal Policy Wrap-up Multiplier Effect, Policy Lag & Automatic Stabilizers

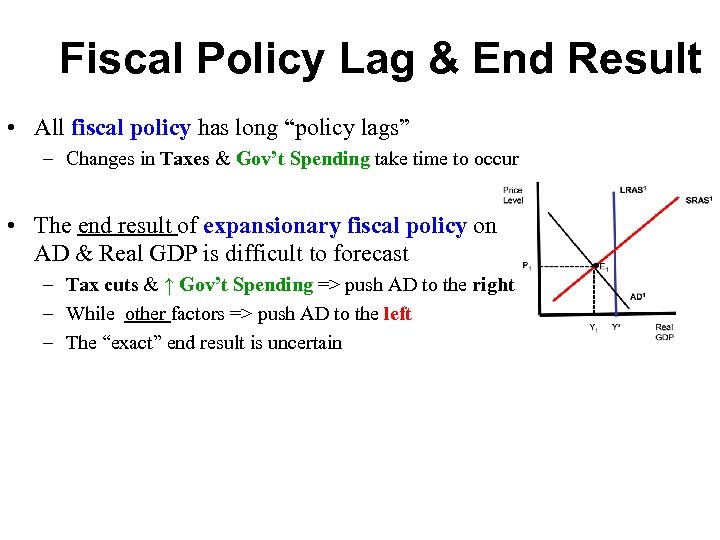

Fiscal Policy Lag & End Result • All fiscal policy has long “policy lags” – Changes in Taxes & Gov’t Spending take time to occur • The end result of expansionary fiscal policy on AD & Real GDP is difficult to forecast – Tax cuts & ↑ Gov’t Spending => push AD to the right – While other factors => push AD to the left – The “exact” end result is uncertain

Fiscal Policy Lag & End Result • All fiscal policy has long “policy lags” – Changes in Taxes & Gov’t Spending take time to occur • The end result of expansionary fiscal policy on AD & Real GDP is difficult to forecast – Tax cuts & ↑ Gov’t Spending => push AD to the right – While other factors => push AD to the left – The “exact” end result is uncertain

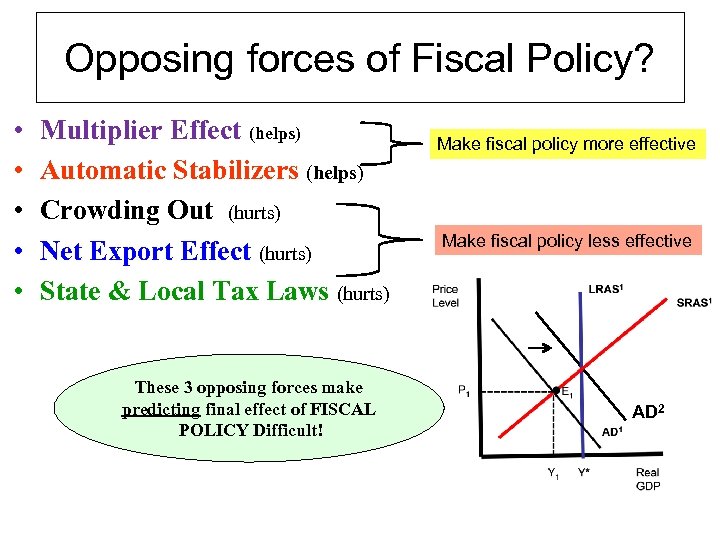

Opposing forces of Fiscal Policy? • • • Multiplier Effect (helps) Automatic Stabilizers (helps) Crowding Out (hurts) Net Export Effect (hurts) State & Local Tax Laws (hurts) These 3 opposing forces make predicting final effect of FISCAL POLICY Difficult! Make fiscal policy more effective Make fiscal policy less effective AD 2

Opposing forces of Fiscal Policy? • • • Multiplier Effect (helps) Automatic Stabilizers (helps) Crowding Out (hurts) Net Export Effect (hurts) State & Local Tax Laws (hurts) These 3 opposing forces make predicting final effect of FISCAL POLICY Difficult! Make fiscal policy more effective Make fiscal policy less effective AD 2

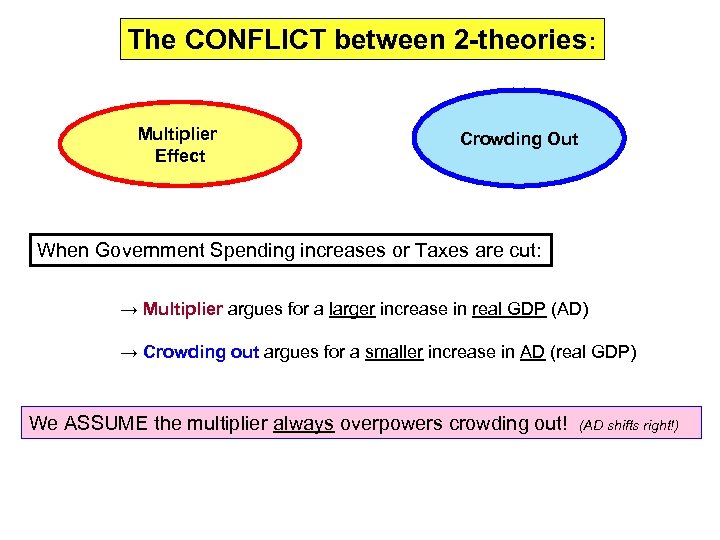

The CONFLICT between 2 -theories: Multiplier Effect Crowding Out When Government Spending increases or Taxes are cut: → Multiplier argues for a larger increase in real GDP (AD) → Crowding out argues for a smaller increase in AD (real GDP) We ASSUME the multiplier always overpowers crowding out! (AD shifts right!)

The CONFLICT between 2 -theories: Multiplier Effect Crowding Out When Government Spending increases or Taxes are cut: → Multiplier argues for a larger increase in real GDP (AD) → Crowding out argues for a smaller increase in AD (real GDP) We ASSUME the multiplier always overpowers crowding out! (AD shifts right!)

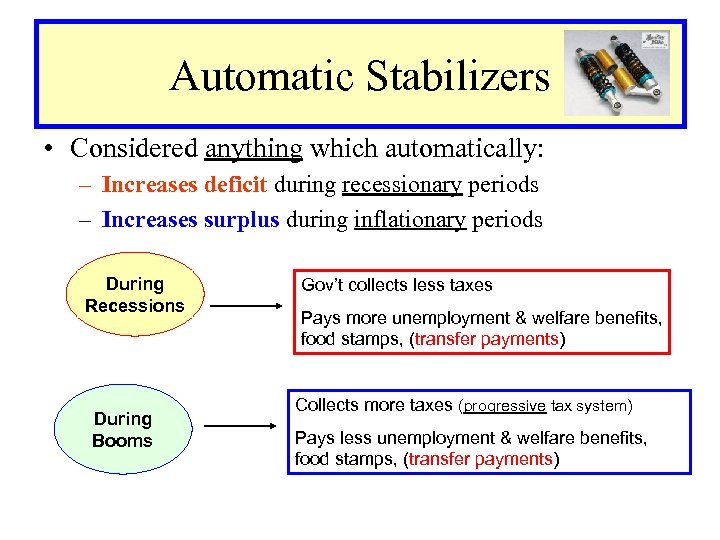

Automatic Stabilizers • Considered anything which automatically: – Increases deficit during recessionary periods – Increases surplus during inflationary periods During Recessions During Booms Gov’t collects less taxes Pays more unemployment & welfare benefits, food stamps, (transfer payments) Collects more taxes (progressive tax system) Pays less unemployment & welfare benefits, food stamps, (transfer payments)

Automatic Stabilizers • Considered anything which automatically: – Increases deficit during recessionary periods – Increases surplus during inflationary periods During Recessions During Booms Gov’t collects less taxes Pays more unemployment & welfare benefits, food stamps, (transfer payments) Collects more taxes (progressive tax system) Pays less unemployment & welfare benefits, food stamps, (transfer payments)

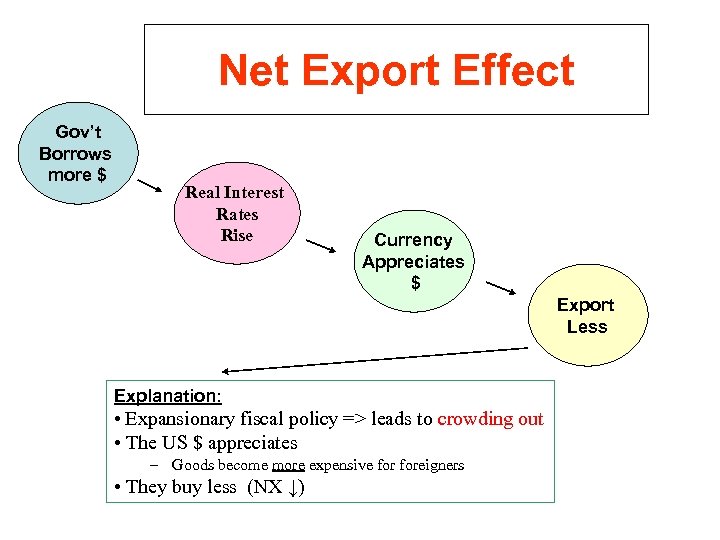

Net Export Effect Gov’t Borrows more $ Real Interest Rates Rise Currency Appreciates $ Export Less Explanation: • Expansionary fiscal policy => leads to crowding out • The US $ appreciates – Goods become more expensive foreigners • They buy less (NX ↓)

Net Export Effect Gov’t Borrows more $ Real Interest Rates Rise Currency Appreciates $ Export Less Explanation: • Expansionary fiscal policy => leads to crowding out • The US $ appreciates – Goods become more expensive foreigners • They buy less (NX ↓)

State & Local Taxes • States & Local Governments are required to balance budget – California was in a budget crisis in 2010! • Proposition 30 helped • Deficits can only exist in short run! • Therefore, states often raise taxes as federal government cuts taxes – This partially offsets expansionary fiscal policy

State & Local Taxes • States & Local Governments are required to balance budget – California was in a budget crisis in 2010! • Proposition 30 helped • Deficits can only exist in short run! • Therefore, states often raise taxes as federal government cuts taxes – This partially offsets expansionary fiscal policy

Practice Free Response

Practice Free Response

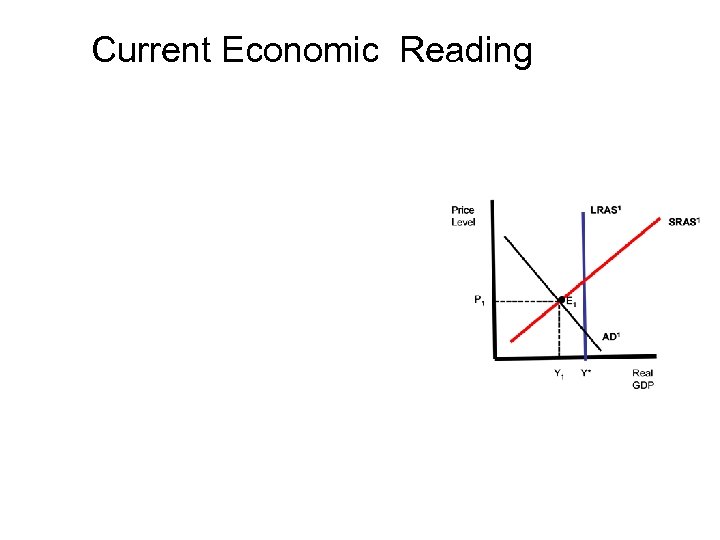

Current Economic Reading

Current Economic Reading