af5db1ea0d839fa6f3b34b41d0e47509.ppt

- Количество слайдов: 48

Fiscal Policy Chapter 12 Mc. Graw-Hill/Irwin Copyright © 2011 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Fiscal Policy Chapter 12 Mc. Graw-Hill/Irwin Copyright © 2011 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Fiscal Policy • Fiscal policy is the use of government taxes and spending to alter macroeconomic outcomes. • The premise of fiscal policy is that the aggregate demand for goods and services will not always be compatible with economic stability. LO-1 12 -2

Fiscal Policy • Fiscal policy is the use of government taxes and spending to alter macroeconomic outcomes. • The premise of fiscal policy is that the aggregate demand for goods and services will not always be compatible with economic stability. LO-1 12 -2

John Maynard Keynes and Fiscal Policy • John Maynard Keynes explained how a deficiency in demand could arise in a market economy. • He showed how and why the government should intervene to achieve macroeconomic goals. • He also advocated aggressive use of fiscal policy to alter market outcomes. LO-1 12 -3

John Maynard Keynes and Fiscal Policy • John Maynard Keynes explained how a deficiency in demand could arise in a market economy. • He showed how and why the government should intervene to achieve macroeconomic goals. • He also advocated aggressive use of fiscal policy to alter market outcomes. LO-1 12 -3

Components of Aggregate Demand • Aggregate demand is the total quantity of output demanded at alternative price levels in a given time period, ceteris paribus. LO-1 12 -4

Components of Aggregate Demand • Aggregate demand is the total quantity of output demanded at alternative price levels in a given time period, ceteris paribus. LO-1 12 -4

Components of Aggregate Demand • The four major components of aggregate demand are: – Consumption (C) – Investment (I) – Government spending (G) – Net exports (exports minus imports) (XIM) AD = C + I + G + (X - IM) LO-1 12 -5

Components of Aggregate Demand • The four major components of aggregate demand are: – Consumption (C) – Investment (I) – Government spending (G) – Net exports (exports minus imports) (XIM) AD = C + I + G + (X - IM) LO-1 12 -5

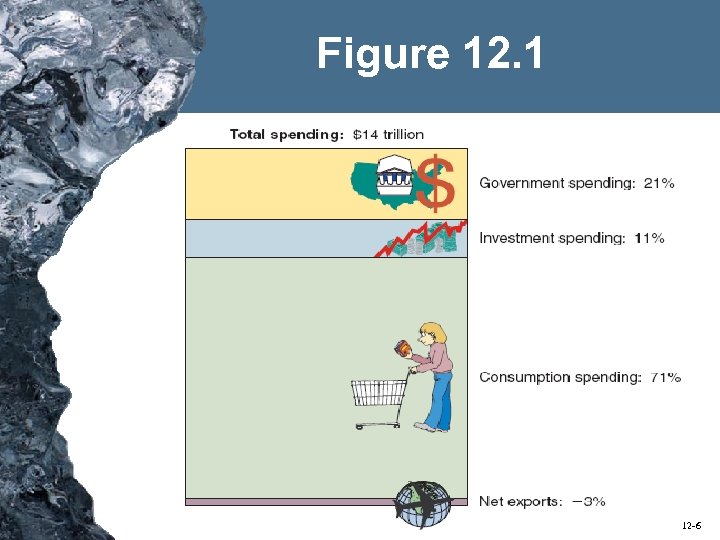

Figure 12. 1 12 -6

Figure 12. 1 12 -6

Consumption (C) • Consumption refers to expenditures by consumers on final goods and services. • Consumption spending accounts for approximately two-thirds of total spending in the U. S. economy. • Consumers often change their spending behavior. LO-1 12 -7

Consumption (C) • Consumption refers to expenditures by consumers on final goods and services. • Consumption spending accounts for approximately two-thirds of total spending in the U. S. economy. • Consumers often change their spending behavior. LO-1 12 -7

Investment (I) • Investment refers to expenditures on (production of) new plant and equipment in a given time period, plus changes in business inventories. LO-1 12 -8

Investment (I) • Investment refers to expenditures on (production of) new plant and equipment in a given time period, plus changes in business inventories. LO-1 12 -8

Government Spending (G) • Government spending includes expenditures on all goods and services provided by the public sector. • Income transfers are not included: – Income transfers are payments to individuals for which no services are exchanged. LO-1 12 -9

Government Spending (G) • Government spending includes expenditures on all goods and services provided by the public sector. • Income transfers are not included: – Income transfers are payments to individuals for which no services are exchanged. LO-1 12 -9

Net Exports (X-IM) • Net exports is the difference between export spending and import spending. • Currently, Americans buy more goods from abroad than foreigners buy from us. • This means that U. S. net exports are negative. LO-1 12 -10

Net Exports (X-IM) • Net exports is the difference between export spending and import spending. • Currently, Americans buy more goods from abroad than foreigners buy from us. • This means that U. S. net exports are negative. LO-1 12 -10

Aggregate Demand in 2008 -09 • A slowdown in consumer spending reversed the growth path of AD. • Businesses decreased inventories and employment. • Government increased spending in an attempt to stimulate the economy. • The trade deficit decreased as buyers in the U. S. bought fewer imported items. LO-1 12 -11

Aggregate Demand in 2008 -09 • A slowdown in consumer spending reversed the growth path of AD. • Businesses decreased inventories and employment. • Government increased spending in an attempt to stimulate the economy. • The trade deficit decreased as buyers in the U. S. bought fewer imported items. LO-1 12 -11

Equilibrium • Aggregate demand is not a single number but instead a schedule of planned purchases. • Macro equilibrium is the combination of price level and real output that is compatible with both aggregate demand aggregate supply. LO-1 12 -12

Equilibrium • Aggregate demand is not a single number but instead a schedule of planned purchases. • Macro equilibrium is the combination of price level and real output that is compatible with both aggregate demand aggregate supply. LO-1 12 -12

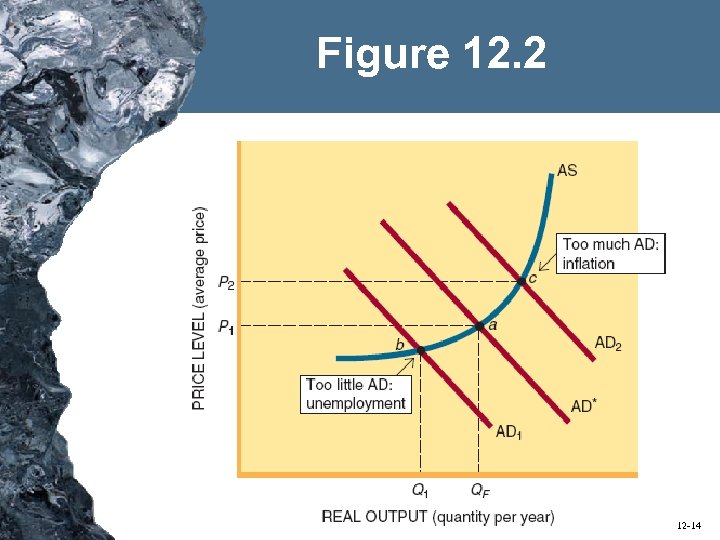

Equilibrium • There is no guarantee that AD will always produce an equilibrium at full employment and price stability. • Sometimes there will be too little demand sometimes there will be too much. LO-2 12 -13

Equilibrium • There is no guarantee that AD will always produce an equilibrium at full employment and price stability. • Sometimes there will be too little demand sometimes there will be too much. LO-2 12 -13

Figure 12. 2 12 -14

Figure 12. 2 12 -14

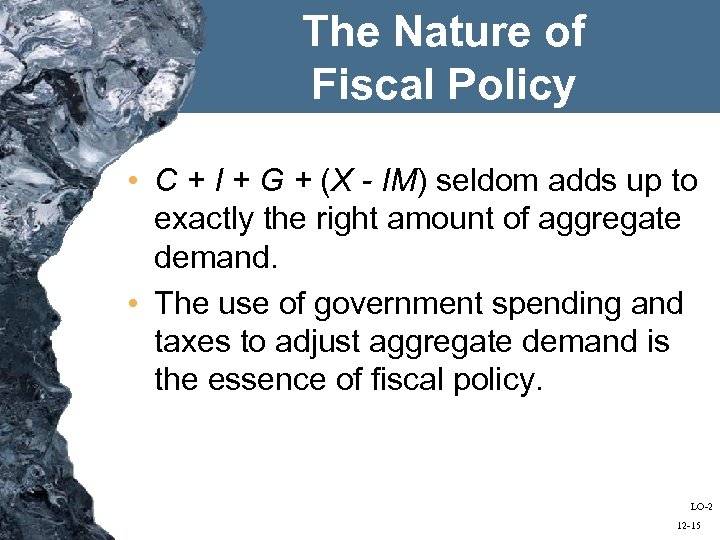

The Nature of Fiscal Policy • C + I + G + (X - IM) seldom adds up to exactly the right amount of aggregate demand. • The use of government spending and taxes to adjust aggregate demand is the essence of fiscal policy. LO-2 12 -15

The Nature of Fiscal Policy • C + I + G + (X - IM) seldom adds up to exactly the right amount of aggregate demand. • The use of government spending and taxes to adjust aggregate demand is the essence of fiscal policy. LO-2 12 -15

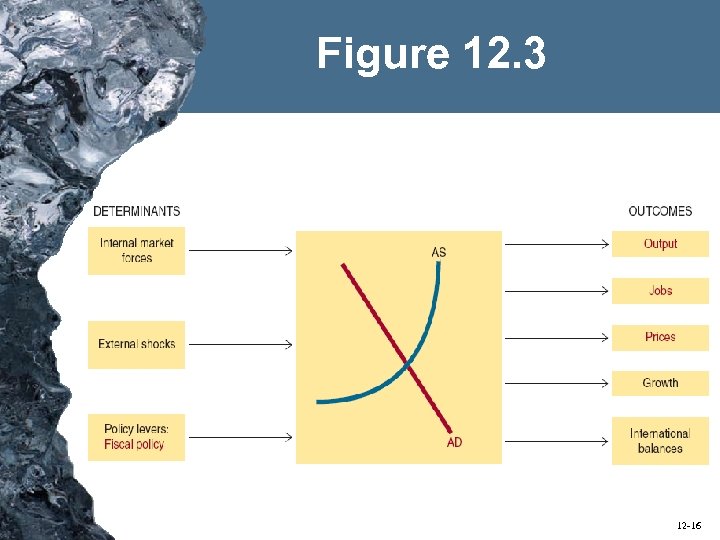

Figure 12. 3 12 -16

Figure 12. 3 12 -16

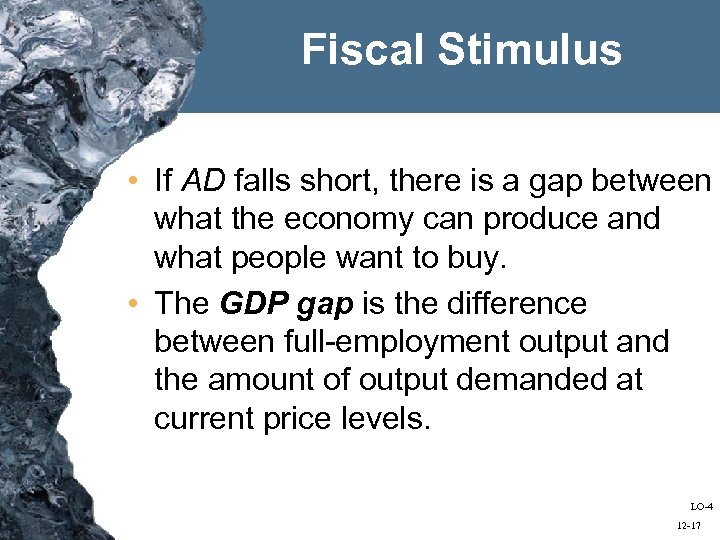

Fiscal Stimulus • If AD falls short, there is a gap between what the economy can produce and what people want to buy. • The GDP gap is the difference between full-employment output and the amount of output demanded at current price levels. LO-4 12 -17

Fiscal Stimulus • If AD falls short, there is a gap between what the economy can produce and what people want to buy. • The GDP gap is the difference between full-employment output and the amount of output demanded at current price levels. LO-4 12 -17

More Government Spending • To help with the 2008 -09 recession, President Obama created huge increases in government spending. • Increased government spending is a form of fiscal stimulus: – Fiscal stimulus–tax cuts or spending hikes intended to increase (shift) aggregate demand. LO-4 12 -18

More Government Spending • To help with the 2008 -09 recession, President Obama created huge increases in government spending. • Increased government spending is a form of fiscal stimulus: – Fiscal stimulus–tax cuts or spending hikes intended to increase (shift) aggregate demand. LO-4 12 -18

Multiplier Effects • An increase in spending results in increased incomes. • All income is either spent or saved: – Saving–Income minus consumption; that part of disposable income not spent. LO-3 12 -19

Multiplier Effects • An increase in spending results in increased incomes. • All income is either spent or saved: – Saving–Income minus consumption; that part of disposable income not spent. LO-3 12 -19

Multiplier Effects • Part of each dollar spent is re-spent several times. • As a result, every dollar has a multiplied impact on aggregate income. LO-3 12 -20

Multiplier Effects • Part of each dollar spent is re-spent several times. • As a result, every dollar has a multiplied impact on aggregate income. LO-3 12 -20

Multiplier Effects • The marginal propensity to consume (MPC) is the fraction of each additional (marginal) dollar of disposable income spent on consumption: LO-3 12 -21

Multiplier Effects • The marginal propensity to consume (MPC) is the fraction of each additional (marginal) dollar of disposable income spent on consumption: LO-3 12 -21

Multiplier Effects • The marginal propensity to save (MPS) is the fraction of each additional (marginal) dollar of disposable income not spent on consumption: LO-3 12 -22

Multiplier Effects • The marginal propensity to save (MPS) is the fraction of each additional (marginal) dollar of disposable income not spent on consumption: LO-3 12 -22

Multiplier Effects • Spending and saving decisions are connected: MPS = 1 – MPC or MPC + MPS = 1 LO-3 12 -23

Multiplier Effects • Spending and saving decisions are connected: MPS = 1 – MPC or MPC + MPS = 1 LO-3 12 -23

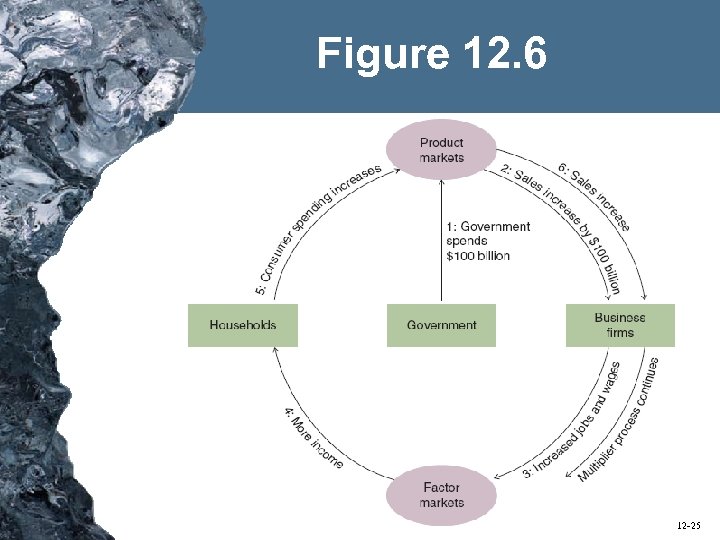

Multiplier Effects and the Circular Flow • The fiscal stimulus to aggregate demand includes: – The initial increase in government spending. – All subsequent increases in consumer spending triggered by the government outlays. • Income gets spent and re-spent in the circular flow. LO-3 12 -24

Multiplier Effects and the Circular Flow • The fiscal stimulus to aggregate demand includes: – The initial increase in government spending. – All subsequent increases in consumer spending triggered by the government outlays. • Income gets spent and re-spent in the circular flow. LO-3 12 -24

Figure 12. 6 12 -25

Figure 12. 6 12 -25

Spending Cycles • The demand stimulus initiated by increased government spending is a multiple of the initial expenditure. LO-3 12 -26

Spending Cycles • The demand stimulus initiated by increased government spending is a multiple of the initial expenditure. LO-3 12 -26

Multiplier Formula • The multiplier is the multiple by which an initial change in aggregate spending will alter total expenditure after an infinite number of spending cycles: Multiplier = 1 / (1 -MPC) LO-3 12 -27

Multiplier Formula • The multiplier is the multiple by which an initial change in aggregate spending will alter total expenditure after an infinite number of spending cycles: Multiplier = 1 / (1 -MPC) LO-3 12 -27

Multiplier Formula • The multiplier process at work: Total change in spending = Multiplier x Initial change in government spending • Every dollar of fiscal stimulus has a multiplied impact on aggregate demand. LO-3 12 -28

Multiplier Formula • The multiplier process at work: Total change in spending = Multiplier x Initial change in government spending • Every dollar of fiscal stimulus has a multiplied impact on aggregate demand. LO-3 12 -28

Tax Cuts • Rather than increasing its own spending, government can cut taxes to increase consumption or investment spending. • A tax cut directly increases disposable income: – Disposable income is the after-tax income of consumers. LO-4 12 -29

Tax Cuts • Rather than increasing its own spending, government can cut taxes to increase consumption or investment spending. • A tax cut directly increases disposable income: – Disposable income is the after-tax income of consumers. LO-4 12 -29

Taxes and Consumption • As long as the MPC is greater than zero, a tax cut will stimulate more consumer spending: Initial increase in consumption = MPC x tax cut LO-3 12 -30

Taxes and Consumption • As long as the MPC is greater than zero, a tax cut will stimulate more consumer spending: Initial increase in consumption = MPC x tax cut LO-3 12 -30

Taxes and Consumption • The cumulative increase in aggregate demand equals a multiple of the taxinduced change in consumption. Cumulative change in spending = multiplier x initial change in consumption LO-3 12 -31

Taxes and Consumption • The cumulative increase in aggregate demand equals a multiple of the taxinduced change in consumption. Cumulative change in spending = multiplier x initial change in consumption LO-3 12 -31

Taxes and Consumption • A tax cut that increases disposable incomes stimulates consumer spending. • The cumulative increase in aggregate demand is a multiple of the initial tax cut. LO-3 12 -32

Taxes and Consumption • A tax cut that increases disposable incomes stimulates consumer spending. • The cumulative increase in aggregate demand is a multiple of the initial tax cut. LO-3 12 -32

Inflation Worries • Whenever the aggregate supply curve is upward-sloping, an increase in aggregate demand increases prices as well as output. • President Clinton raised taxes partly because he feared inflationary pressures were building. LO-4 12 -33

Inflation Worries • Whenever the aggregate supply curve is upward-sloping, an increase in aggregate demand increases prices as well as output. • President Clinton raised taxes partly because he feared inflationary pressures were building. LO-4 12 -33

Fiscal Restraint • Fiscal restraint may be the proper policy when inflation threatens: – Fiscal restraint–tax hikes or spending cuts intended to reduce (shift) aggregate demand. LO-4 12 -34

Fiscal Restraint • Fiscal restraint may be the proper policy when inflation threatens: – Fiscal restraint–tax hikes or spending cuts intended to reduce (shift) aggregate demand. LO-4 12 -34

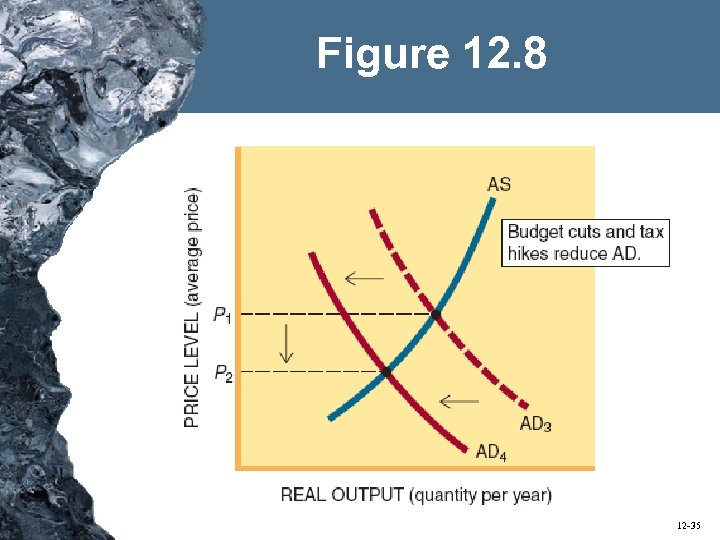

Figure 12. 8 12 -35

Figure 12. 8 12 -35

Budget Cuts • Cutbacks in government spending directly reduce aggregate demand. • As with spending increases, the impact of spending cuts is magnified by the multiplier. LO-3 12 -36

Budget Cuts • Cutbacks in government spending directly reduce aggregate demand. • As with spending increases, the impact of spending cuts is magnified by the multiplier. LO-3 12 -36

Multiplier Cycles • Government cutbacks have a multiplied effect on aggregate demand: Cumulative reduction in spending = multiplier x initial budget cut LO-3 12 -37

Multiplier Cycles • Government cutbacks have a multiplied effect on aggregate demand: Cumulative reduction in spending = multiplier x initial budget cut LO-3 12 -37

Tax Hikes • Tax increases reduce disposable income and thus reduce consumption. • This shifts the aggregate demand curve to the left. • Tax increases have been used to “cool down” the economy. LO-4 12 -38

Tax Hikes • Tax increases reduce disposable income and thus reduce consumption. • This shifts the aggregate demand curve to the left. • Tax increases have been used to “cool down” the economy. LO-4 12 -38

Tax Hikes • The Equity and Fiscal Responsibility Act of 1982 increased taxes to reduce inflationary pressures. • President Clinton restrained aggregate demand in 1993 with a tax increase, but increased aggregate demand in 1997 with a five-year package of tax cuts. LO-4 12 -39

Tax Hikes • The Equity and Fiscal Responsibility Act of 1982 increased taxes to reduce inflationary pressures. • President Clinton restrained aggregate demand in 1993 with a tax increase, but increased aggregate demand in 1997 with a five-year package of tax cuts. LO-4 12 -39

Fiscal Guidelines • The policy goal is to match aggregate demand with the full-employment potential of the economy. • The fiscal strategy for attaining that goal is to shift the aggregate demand curve. LO-4 12 -40

Fiscal Guidelines • The policy goal is to match aggregate demand with the full-employment potential of the economy. • The fiscal strategy for attaining that goal is to shift the aggregate demand curve. LO-4 12 -40

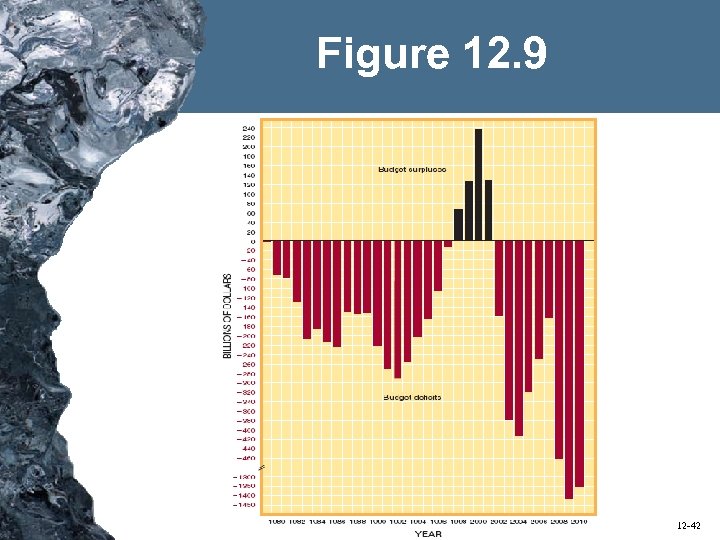

Unbalanced Budgets • The use of the budget to manage aggregate demand implies that the budget will often be unbalanced. LO-5 12 -41

Unbalanced Budgets • The use of the budget to manage aggregate demand implies that the budget will often be unbalanced. LO-5 12 -41

Figure 12. 9 12 -42

Figure 12. 9 12 -42

Budget Deficit • Budget deficit–the amount by which government expenditures exceed government revenues in a given time period: Budget deficit = Government spending > Tax revenues LO-5 12 -43

Budget Deficit • Budget deficit–the amount by which government expenditures exceed government revenues in a given time period: Budget deficit = Government spending > Tax revenues LO-5 12 -43

Budget Deficit • The government borrows money to pay for deficit spending. • The federal government ran significant budget deficits between 1970 and 1997. LO-5 12 -44

Budget Deficit • The government borrows money to pay for deficit spending. • The federal government ran significant budget deficits between 1970 and 1997. LO-5 12 -44

Budget Surplus • Budget surplus–an excess of government revenues over government expenditures in a given time period: Budget surplus = Government spending < Tax revenues LO-5 12 -45

Budget Surplus • Budget surplus–an excess of government revenues over government expenditures in a given time period: Budget surplus = Government spending < Tax revenues LO-5 12 -45

Budget Surplus • By 1998, a combination of growing tax revenues and slower government spending created a budget surplus. • Starting in 2003, however, the budget returned to a deficit due to tax cuts, increased defense spending, and the Iraq War. • By 2010, the federal budget deficit exceeded $1. 3 trillion. LO-5 12 -46

Budget Surplus • By 1998, a combination of growing tax revenues and slower government spending created a budget surplus. • Starting in 2003, however, the budget returned to a deficit due to tax cuts, increased defense spending, and the Iraq War. • By 2010, the federal budget deficit exceeded $1. 3 trillion. LO-5 12 -46

Countercyclical Policy • In Keynes’ view, an unbalanced budget is perfectly appropriate if macro conditions call for a deficit or a surplus. • A balanced budget is appropriate only if the resulting aggregate demand is consistent with full-employment equilibrium. LO-5 12 -47

Countercyclical Policy • In Keynes’ view, an unbalanced budget is perfectly appropriate if macro conditions call for a deficit or a surplus. • A balanced budget is appropriate only if the resulting aggregate demand is consistent with full-employment equilibrium. LO-5 12 -47

End of Chapter 12

End of Chapter 12