286bdb0d8bd5613b2aea9e59e5d7b4b1.ppt

- Количество слайдов: 9

Fiscal Impact Analysis – Reed Putnam Urban Renewal Project Fiscal Impact Analysis – City of Norwalk, Connecticut October 5, 2006 Prepared by: RKG Associates, Inc. Economic, Planning and Real Estate Consultants 277 Mast Road Durham, NH 03824

Presentation Outline n Project Scope and Approach n Methodology and Assumptions n Net Annual Fiscal Impact n Summary 3/17/2018 2

Project Scope and Approach n Purpose – Evaluate the potential fiscal impacts to the City of Norwalk that may be expected to occur under different development scenarios at Reed Putnam parcels 1, 2 & 4 n Approach and Tasks ¨ Compare the municipal costs of providing services to a development to the revenues generated by the proposed development n n 3/17/2018 Determine population, school-age children and employment Project revenues from new taxes, fees, etc. From projected growth, estimate public service costs Compare costs to revenues 3

Methodology and Assumptions Scenario One: (Approved Plan) 1, 000 SF Office Space 50, 000 SF Retail Space Scenario One-A: (Tax Abatement) 1, 000 SF Office Space 50, 000 SF Retail Space (Assuming State of Connecticut Urban Jobs benefit - 40% abatement of property taxes for five years) Scenario Two: (Staff Recommendation) 500, 000 SF Office Space 150, 000 SF Retail Space 80, 000 SF (130 Units) Hotel 300 Condominium Units (Mix of 1 and 2 Bedrooms) Scenario Three: (95/7 Proposal) 485, 000 Office Space 225, 000 SF Retail Space 80, 000 SF (130 Units) Hotel 310 Condominium Units (Mix of 1 and 2 Bedrooms) n Project built in phases (up to ten years) ¨ ¨ ¨ 100, 000 SF office space per year; 85, 000 SF retail space per year; 150 condominium units per year n ¨ Reduced to 60 per year (conservative market repositioning estimate) Hotel absorbed in one year (in Year 10 upon completion of office development) 3/17/2018 4

Methodology Cont’d n Rising costs of providing public services matched by comparable increase in revenues n Per capita method used to allocate costs ¨ Current costs best measure of future costs n Municipal officials interviewed n 6 sources of school-age children multipliers/methods n Constant dollars, tax rates, tax base distribution, etc. n Property values derived from combination of: ¨ Tax assessment data ¨ Comparable properties ¨ Recently completed market studies 3/17/2018 5

Net Annual Fiscal Impact n All scenarios generate an annual fiscal benefit $4. 3 million (Scenario 1 & 1 A) to $5 million (Scenario 2 & 3) ¨ NPV of Scenarios 2 & 3 at least $11 million more than 1 & 1 A over 10 year period ¨ n Impact does not include one-time permit/inspection fees $1. 6 million (Scenario 1 & 1 A) ¨ $1. 8 million (Scenario 2) and $1. 9 million (Scenario 3) ¨ Could serve as (re)development catalyst for neighboring properties n Caution in incentives for large-scale office development n Few “net new” office users in County ¨ Adding more supply could depress current/future lease rates ¨ No indication that incentive will provide marketing advantage to site ¨ 3/17/2018 6

Impact of Tax Abatement 3/17/2018 7

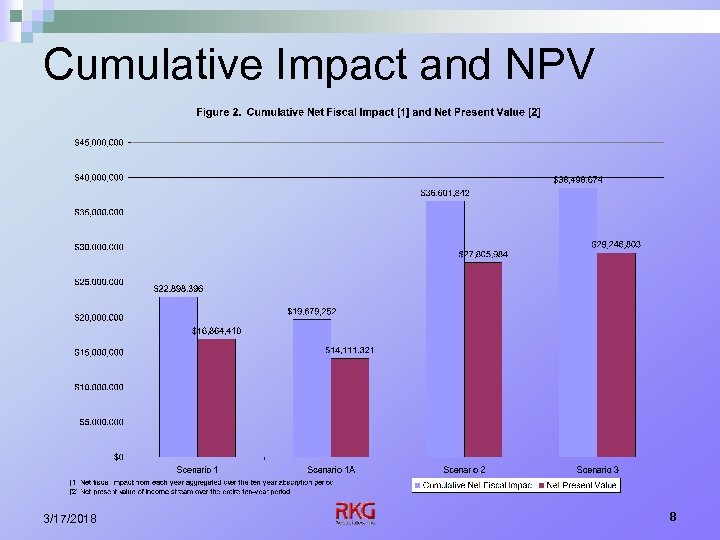

Cumulative Impact and NPV 3/17/2018 8

Summary All scenarios generate (comparable) annual fiscal benefit n Phasing schedule influence n NPV of Scenarios 2 & 3 higher than Scenarios 1 & 1 A n Doesn’t include one-time fees n All scenarios may influence neighboring (re)development n Caution needed re: adding to office supply n n Questions? 3/17/2018 9

286bdb0d8bd5613b2aea9e59e5d7b4b1.ppt