ae19d398ae2419933c5b27efb0aa2888.ppt

- Количество слайдов: 28

FIRST TELECOMMUNICATION REGULATORY MEETING FOR THE ARAB REGION CORPORATE NETWORKS AND OPENING OF FIXED SERVICES Mostafa TERRAB Lead Regulatory Specialist ALGIERS, April 19, 2003

OUTLINE • Why are competitive fixed-services and corporate networks important? • Regional telecom specificities • Options for improving fixed-services and corporate network provision

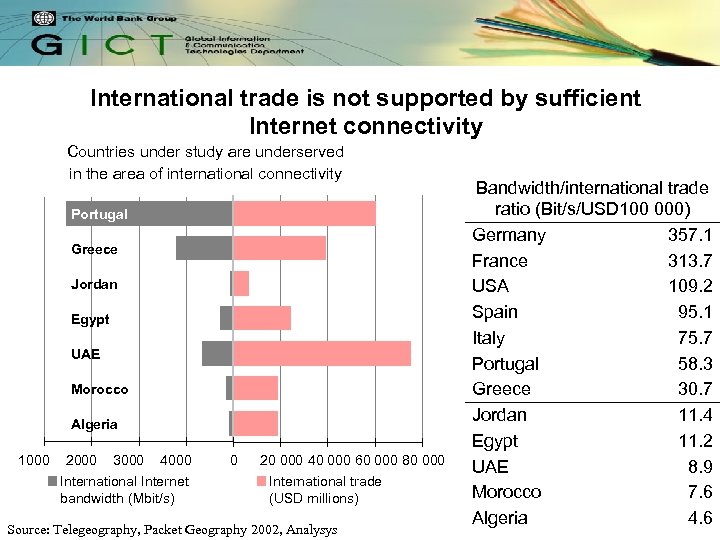

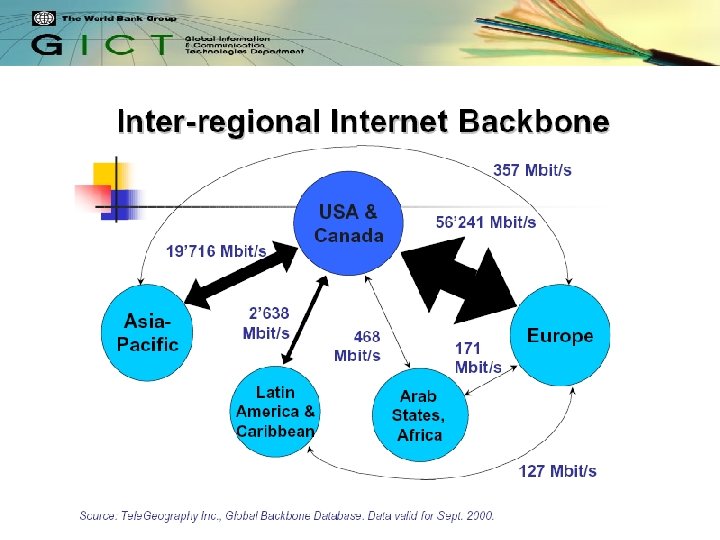

International trade is not supported by sufficient Internet connectivity Countries under study are underserved in the area of international connectivity Portugal Greece Jordan Egypt UAE Morocco Algeria 1000 2000 3000 4000 International Internet bandwidth (Mbit/s) 0 20 000 40 000 60 000 80 000 International trade (USD millions) Source: Telegeography, Packet Geography 2002, Analysys Bandwidth/international trade ratio (Bit/s/USD 100 000) Germany 357. 1 France 313. 7 USA 109. 2 Spain 95. 1 Italy 75. 7 Portugal 58. 3 Greece 30. 7 Jordan 11. 4 Egypt 11. 2 UAE 8. 9 Morocco 7. 6 Algeria 4. 6

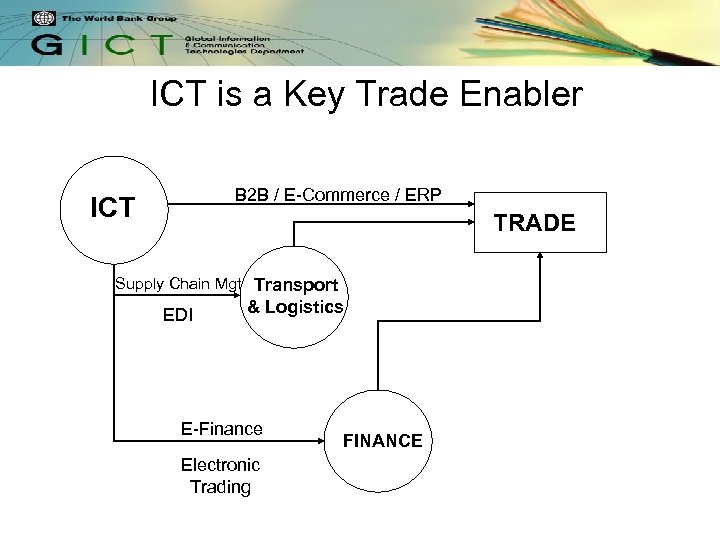

ICT is a Key Trade Enabler B 2 B / E-Commerce / ERP ICT TRADE Supply Chain Mgt Transport EDI & Logistics E-Finance Electronic Trading FINANCE

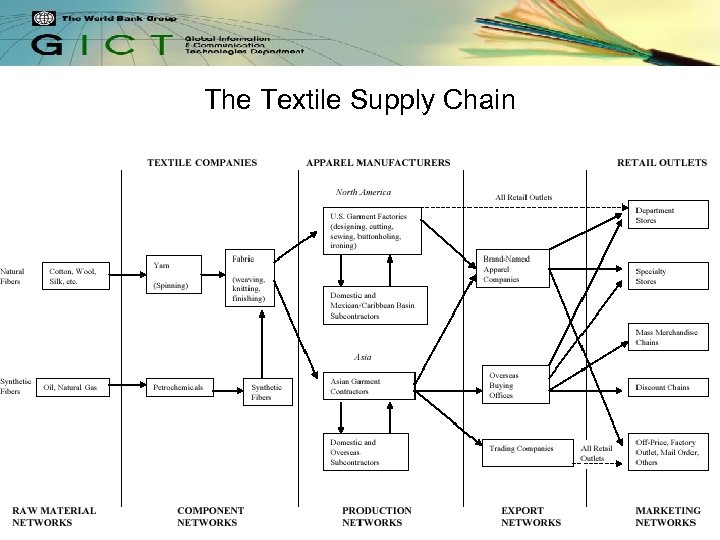

The Textile Supply Chain

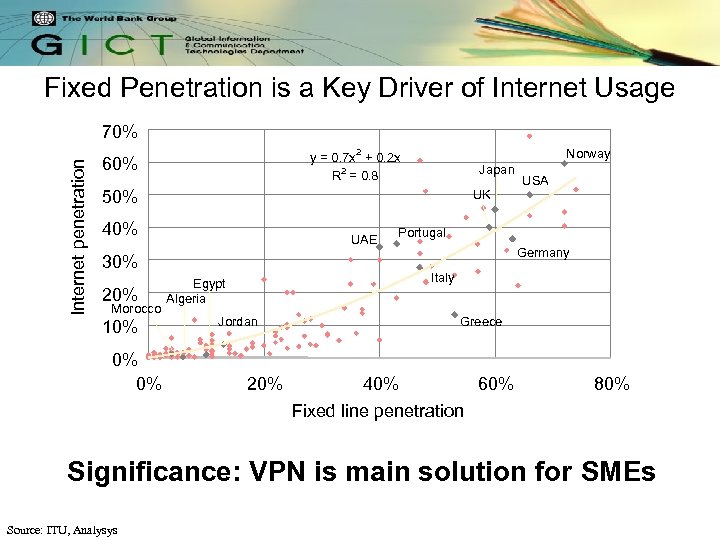

Fixed Penetration is a Key Driver of Internet Usage Internet penetration 70% Norway 2 y = 0. 7 x + 0. 2 x 2 R = 0. 8 60% Japan 50% UK 40% UAE Portugal 30% 20% Morocco 10% 0% 0% USA Germany Italy Egypt Algeria Jordan 20% Greece 40% 60% 80% Fixed line penetration Significance: VPN is main solution for SMEs Source: ITU, Analysys

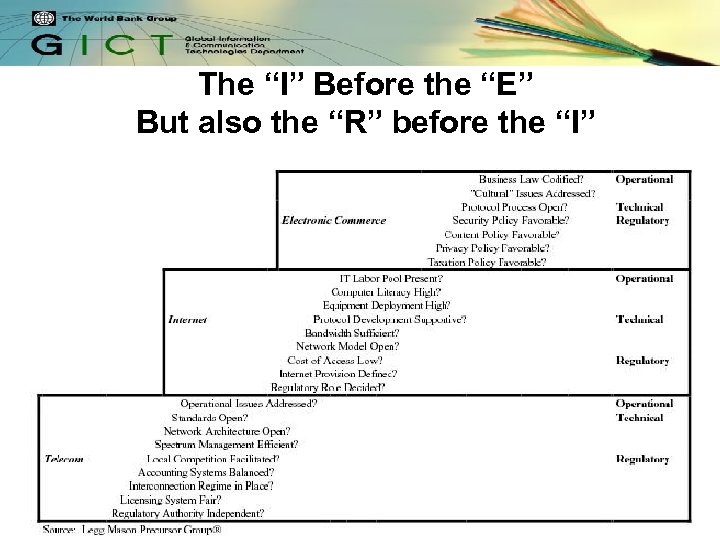

The “I” Before the “E” But also the “R” before the “I”

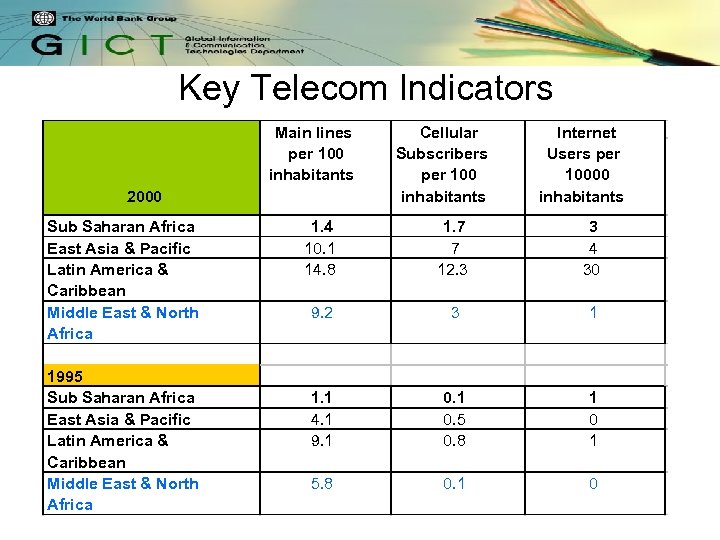

Key Telecom Indicators Main lines per 100 inhabitants 2000 Sub Saharan Africa East Asia & Pacific Latin America & Caribbean Middle East & North Africa 1995 Sub Saharan Africa East Asia & Pacific Latin America & Caribbean Middle East & North Africa Cellular Subscribers per 100 inhabitants Internet Users per 10000 inhabitants 1. 4 10. 1 14. 8 1. 7 7 12. 3 3 4 30 9. 2 3 1 1. 1 4. 1 9. 1 0. 5 0. 8 1 0 1 5. 8 0. 1 0

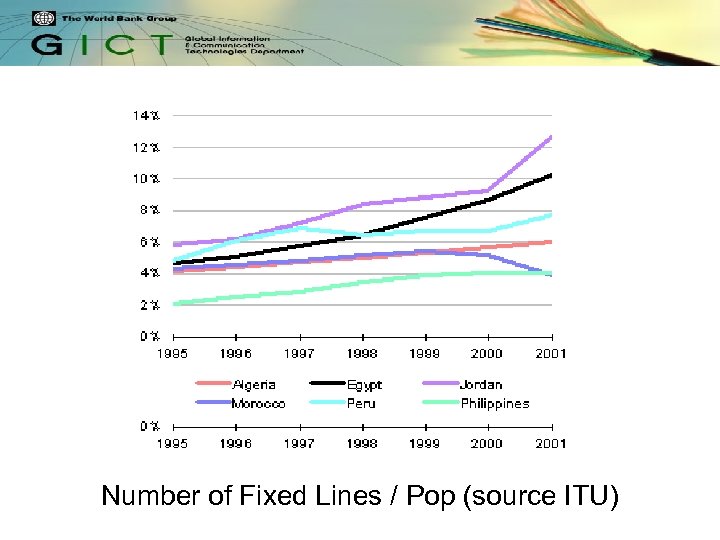

Number of Fixed Lines / Pop (source ITU)

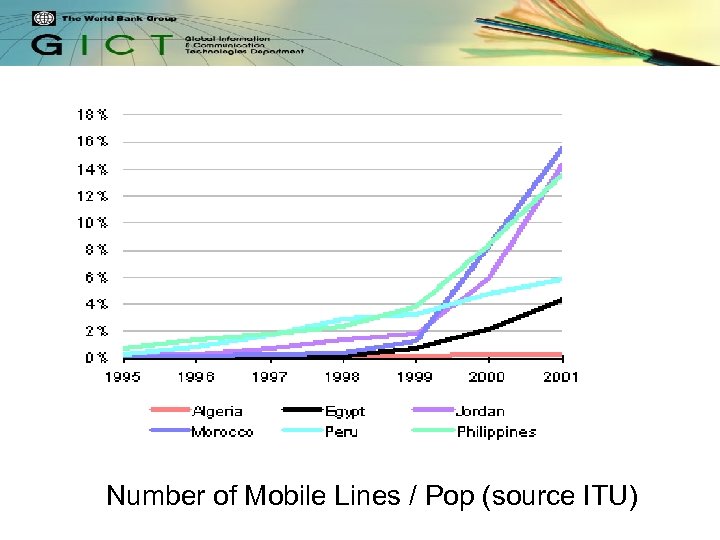

Number of Mobile Lines / Pop (source ITU)

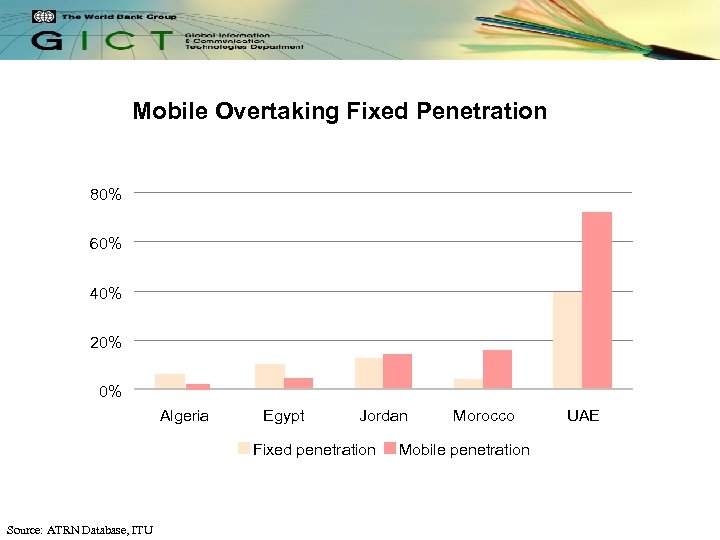

Mobile Overtaking Fixed Penetration 80% 60% 40% 20% 0% Algeria Egypt Jordan Fixed penetration Source: ATRN Database, ITU Morocco Mobile penetration UAE

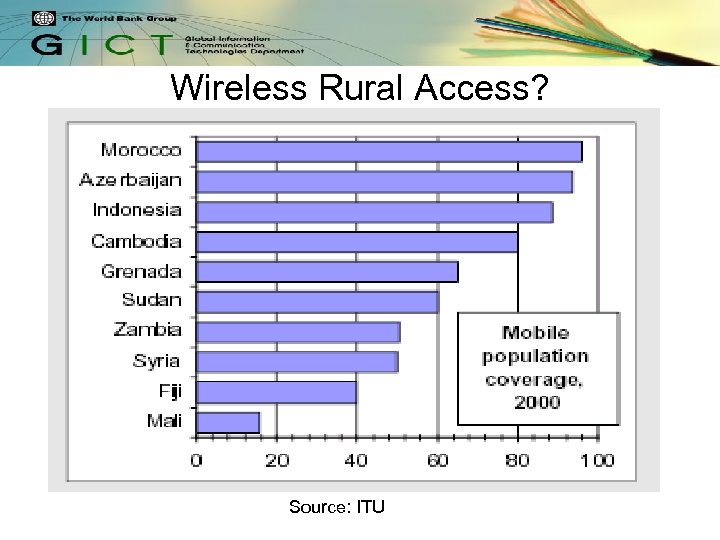

Wireless Rural Access? Source: ITU

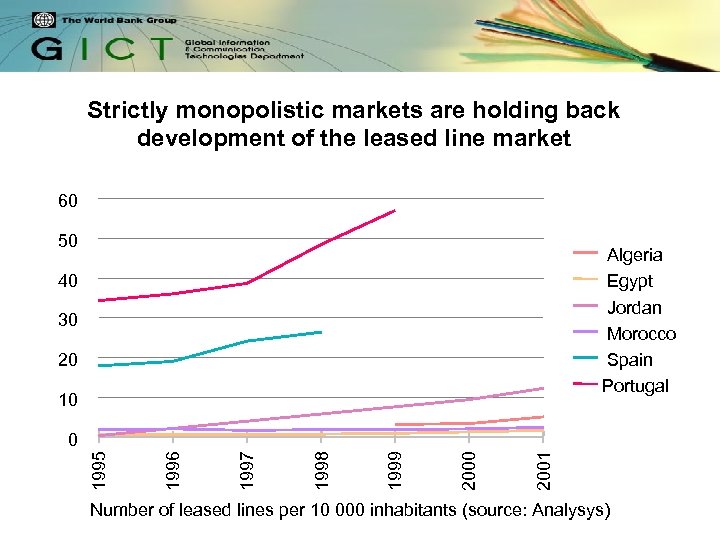

Strictly monopolistic markets are holding back development of the leased line market 60 50 Algeria Egypt Jordan Morocco Spain Portugal 40 30 20 10 2001 2000 1999 1998 1997 1996 1995 0 Number of leased lines per 10 000 inhabitants (source: Analysys)

Companies interviewed (Analysys 2002) revealed service can be improved • Poor service quality: Lack of Service Level Agreements • Long lead times for corporate users: Algeria Egypt Jordan Morocco 3 months 2– 3 months 6 months 3 months UAE 1– 1. 5 months • Companies (that can afford it) often prefer to use their own private links (low degree of infrastructure sharing) Source: Analysys Interviews

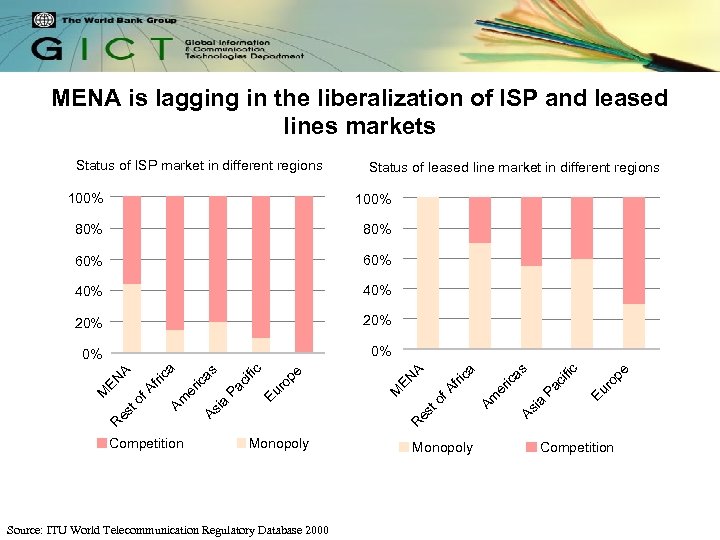

MENA is lagging in the liberalization of ISP and leased lines markets Status of ISP market in different regions Status of leased line market in different regions 0% Eu ro ca fri R es to f. A EN M Eu ro Pa ci fi as As ia er ic Am f. A fri A EN R es to M Competition ci fi 0% pe 20% Pa 20% c 40% As ia 40% er ic as 60% Am 60% A 80% pe 80% c 100% ca 100% Monopoly Source: ITU World Telecommunication Regulatory Database 2000 Monopoly Competition

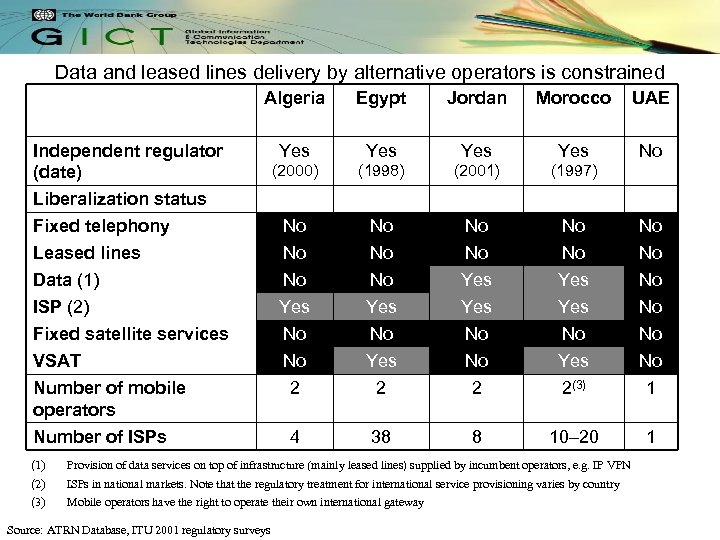

Data and leased lines delivery by alternative operators is constrained Algeria Egypt Jordan Morocco UAE No Independent regulator (date) Liberalization status Yes Yes (2000) (1998) (2001) (1997) Fixed telephony Leased lines Data (1) ISP (2) Fixed satellite services No No No Yes Yes No No VSAT Number of mobile operators No 2 Yes 2(3) No 1 4 38 8 10– 20 1 Number of ISPs (1) (2) (3) Provision of data services on top of infrastructure (mainly leased lines) supplied by incumbent operators, e. g. IP VPN ISPs in national markets. Note that the regulatory treatment for international service provisioning varies by country Mobile operators have the right to operate their own international gateway Source: ATRN Database, ITU 2001 regulatory surveys

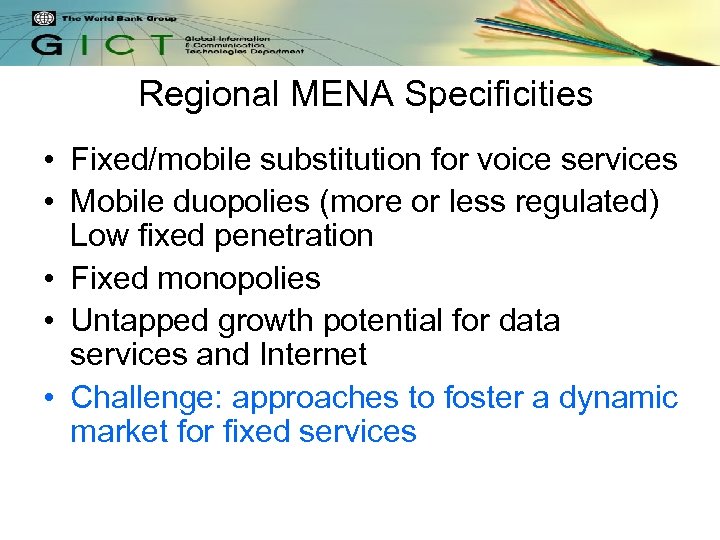

Regional MENA Specificities • Fixed/mobile substitution for voice services • Mobile duopolies (more or less regulated) Low fixed penetration • Fixed monopolies • Untapped growth potential for data services and Internet • Challenge: approaches to foster a dynamic market for fixed services

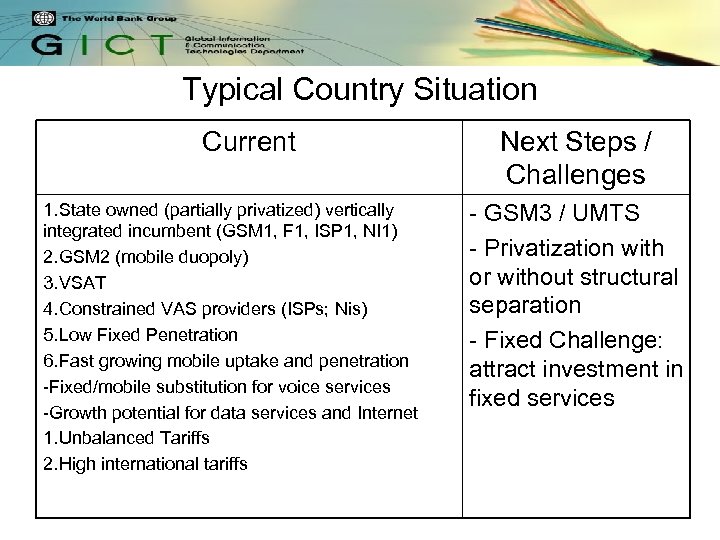

Typical Country Situation Current 1. State owned (partially privatized) vertically integrated incumbent (GSM 1, F 1, ISP 1, NI 1) 2. GSM 2 (mobile duopoly) 3. VSAT 4. Constrained VAS providers (ISPs; Nis) 5. Low Fixed Penetration 6. Fast growing mobile uptake and penetration -Fixed/mobile substitution for voice services -Growth potential for data services and Internet 1. Unbalanced Tariffs 2. High international tariffs Next Steps / Challenges - GSM 3 / UMTS - Privatization with or without structural separation - Fixed Challenge: attract investment in fixed services

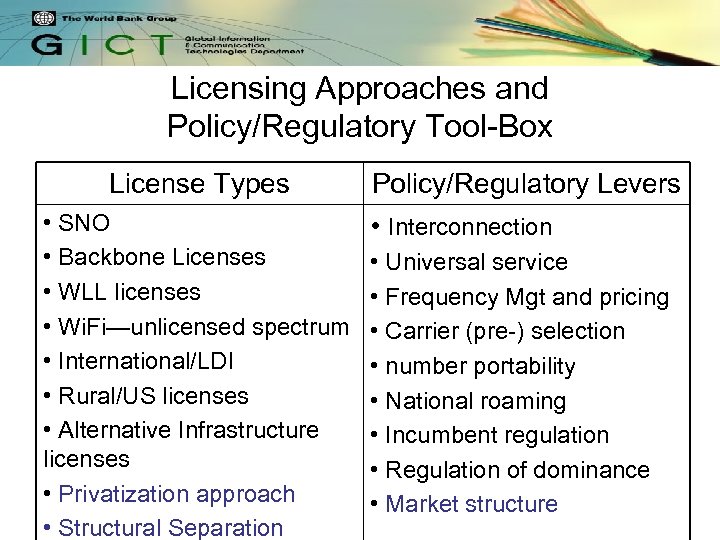

Licensing Approaches and Policy/Regulatory Tool-Box License Types • SNO • Backbone Licenses • WLL licenses • Wi. Fi—unlicensed spectrum • International/LDI • Rural/US licenses • Alternative Infrastructure licenses • Privatization approach • Structural Separation Policy/Regulatory Levers • Interconnection • Universal service • Frequency Mgt and pricing • Carrier (pre-) selection • number portability • National roaming • Incumbent regulation • Regulation of dominance • Market structure

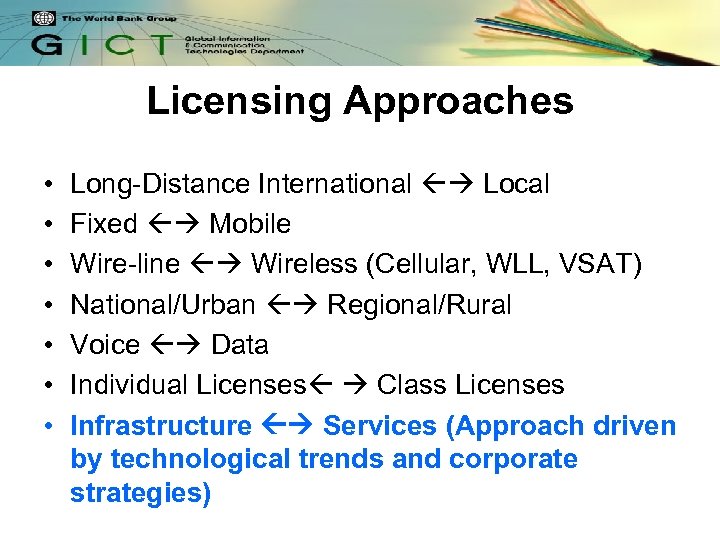

Licensing Approaches • • Long-Distance International Local Fixed Mobile Wire-line Wireless (Cellular, WLL, VSAT) National/Urban Regional/Rural Voice Data Individual Licenses Class Licenses Infrastructure Services (Approach driven by technological trends and corporate strategies)

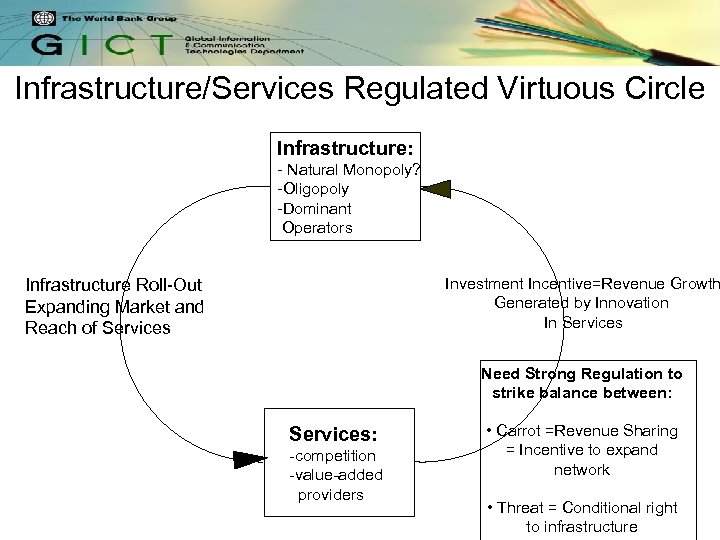

Infrastructure/Services Regulated Virtuous Circle Infrastructure: - Natural Monopoly? -Oligopoly -Dominant Operators Investment Incentive=Revenue Growth Generated by Innovation In Services Infrastructure Roll-Out Expanding Market and Reach of Services Need Strong Regulation to strike balance between: Services: -competition -value-added providers • Carrot =Revenue Sharing = Incentive to expand network • Threat = Conditional right to infrastructure

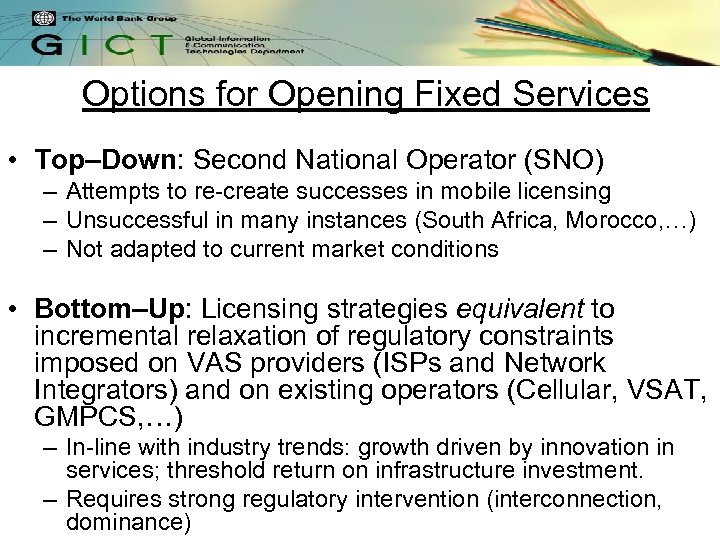

Options for Opening Fixed Services • Top–Down: Second National Operator (SNO) – Attempts to re-create successes in mobile licensing – Unsuccessful in many instances (South Africa, Morocco, …) – Not adapted to current market conditions • Bottom–Up: Licensing strategies equivalent to incremental relaxation of regulatory constraints imposed on VAS providers (ISPs and Network Integrators) and on existing operators (Cellular, VSAT, GMPCS, …) – In-line with industry trends: growth driven by innovation in services; threshold return on infrastructure investment. – Requires strong regulatory intervention (interconnection, dominance)

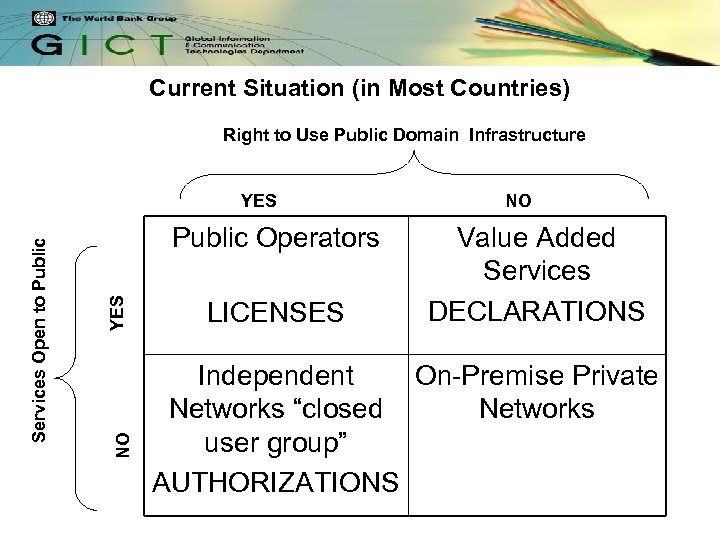

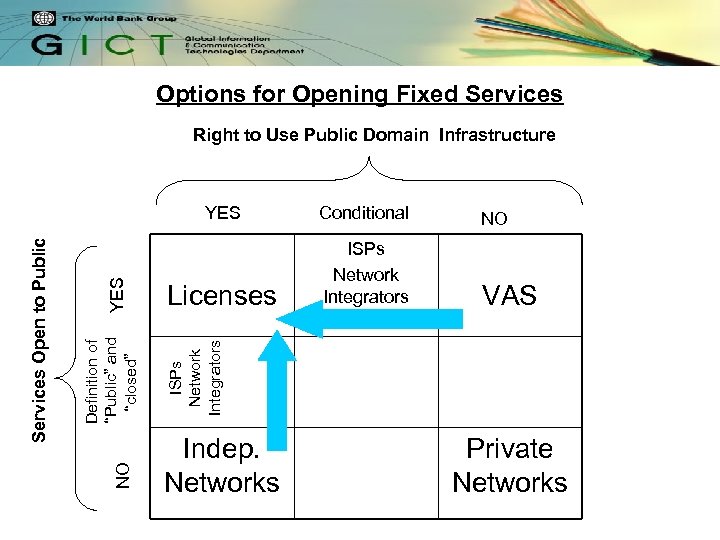

Current Situation (in Most Countries) Right to Use Public Domain Infrastructure YES Public Operators NO Services Open to Public YES LICENSES NO Value Added Services DECLARATIONS Independent On-Premise Private Networks “closed Networks user group” AUTHORIZATIONS

Options for Opening Fixed Services Right to Use Public Domain Infrastructure Conditional NO Licenses ISPs Network Integrators VAS ISPs Network Integrators YES NO Definition of “Public” and “closed” Services Open to Public YES Indep. Networks Private Networks

Licensing / Regulatory Principles • Technological neutrality s. t. spectrum • Simplify Market Structure – Maximize regulatory readability – Avoid intractable regulatory complexity, given degree of tariff rebalancing and infrastructure roll-out imperative (squeeze; predation; …) • Best candidates are “local” candidates: – Know the market – Capacity to assess risk – Can leverage existing investments (e. g. , GSM 2; ISPs; INCUMBENT; Alternative Infrastructure) – risk management

ae19d398ae2419933c5b27efb0aa2888.ppt