853f1567c1ffd249b91c95a82c5fc83f.ppt

- Количество слайдов: 31

First Pac. Trust Bancorp Greg Bruno Daniel Glotzbach Rajani Meka Drew Osika May 3, 2011

Agenda Industry Overview Industry Outlook Key Industry Drivers Porter’s 5 Forces Recent Industry Performance Company Overview Financial Highlights SWOT Analysis Strategy & Management Team Comparable Analysis Valuation

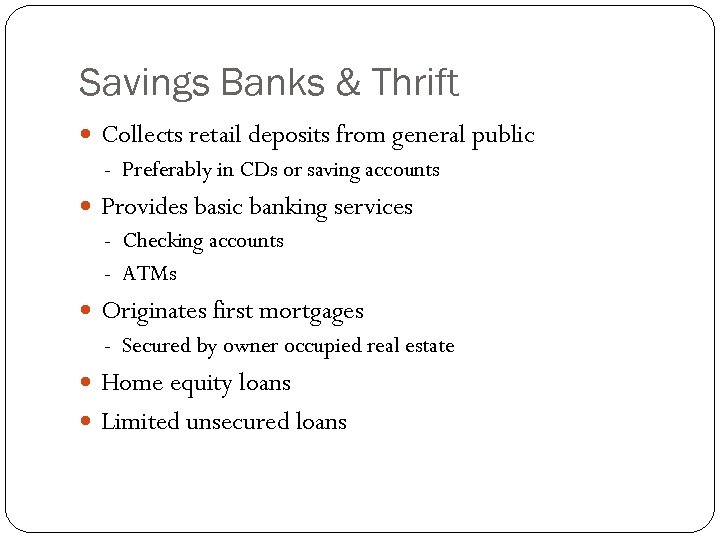

Savings Banks & Thrift Collects retail deposits from general public - Preferably in CDs or saving accounts Provides basic banking services - Checking accounts - ATMs Originates first mortgages - Secured by owner occupied real estate Home equity loans Limited unsecured loans

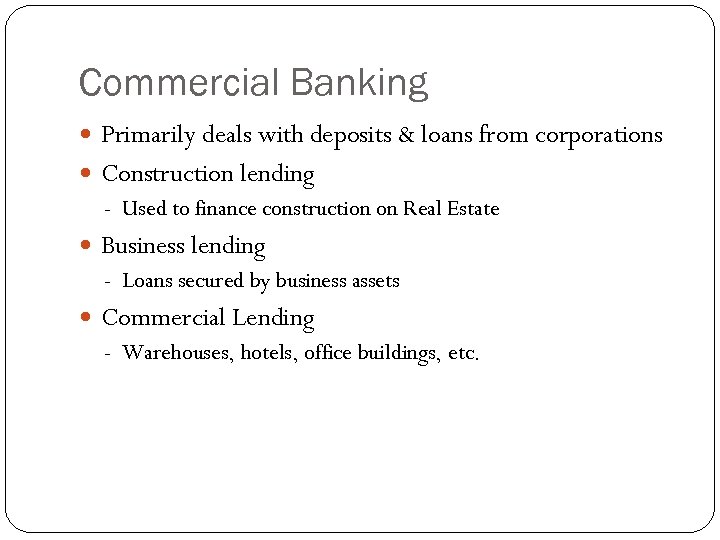

Commercial Banking Primarily deals with deposits & loans from corporations Construction lending - Used to finance construction on Real Estate Business lending - Loans secured by business assets Commercial Lending - Warehouses, hotels, office buildings, etc.

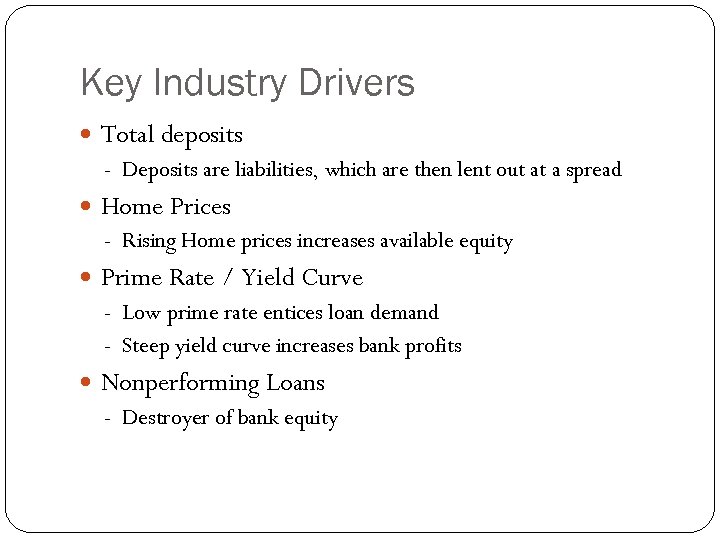

Key Industry Drivers Total deposits - Deposits are liabilities, which are then lent out at a spread Home Prices - Rising Home prices increases available equity Prime Rate / Yield Curve - Low prime rate entices loan demand - Steep yield curve increases bank profits Nonperforming Loans - Destroyer of bank equity

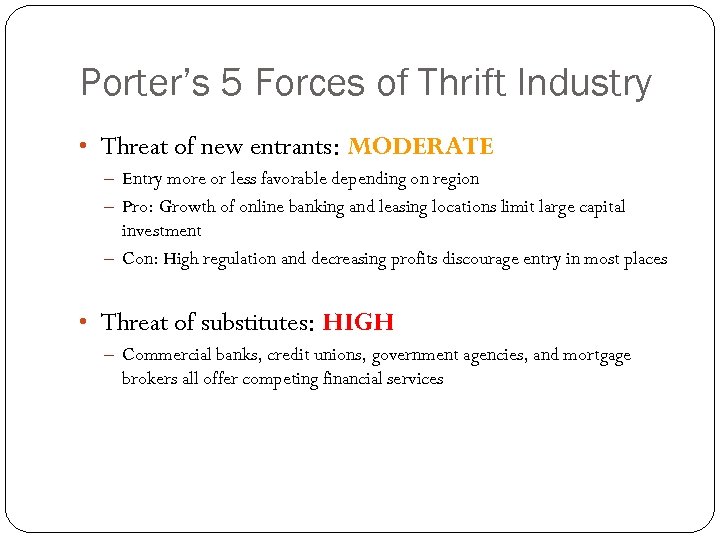

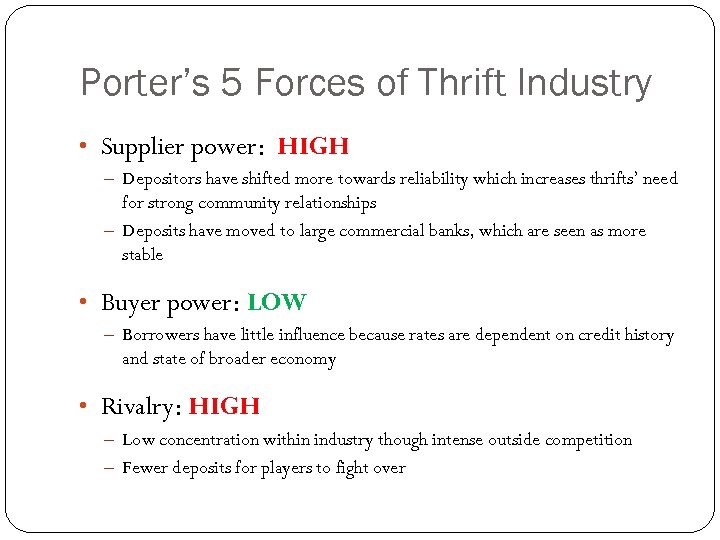

Porter’s 5 Forces of Thrift Industry • Threat of new entrants: MODERATE – Entry more or less favorable depending on region – Pro: Growth of online banking and leasing locations limit large capital investment – Con: High regulation and decreasing profits discourage entry in most places • Threat of substitutes: HIGH – Commercial banks, credit unions, government agencies, and mortgage brokers all offer competing financial services

Porter’s 5 Forces of Thrift Industry • Supplier power: HIGH – Depositors have shifted more towards reliability which increases thrifts’ need for strong community relationships – Deposits have moved to large commercial banks, which are seen as more stable • Buyer power: LOW – Borrowers have little influence because rates are dependent on credit history and state of broader economy • Rivalry: HIGH – Low concentration within industry though intense outside competition – Fewer deposits for players to fight over

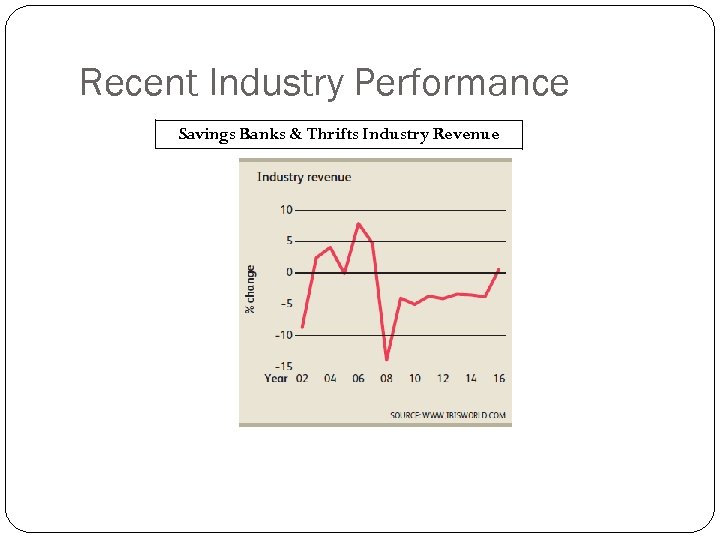

Recent Industry Performance Savings Banks & Thrifts Industry Revenue

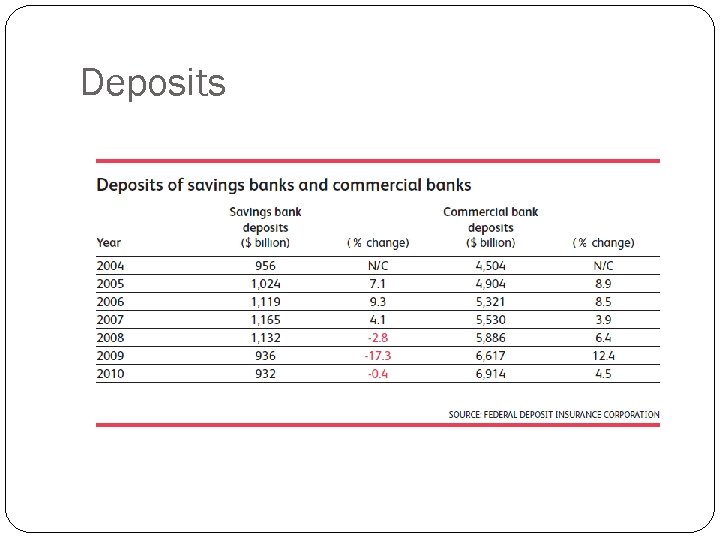

Deposits

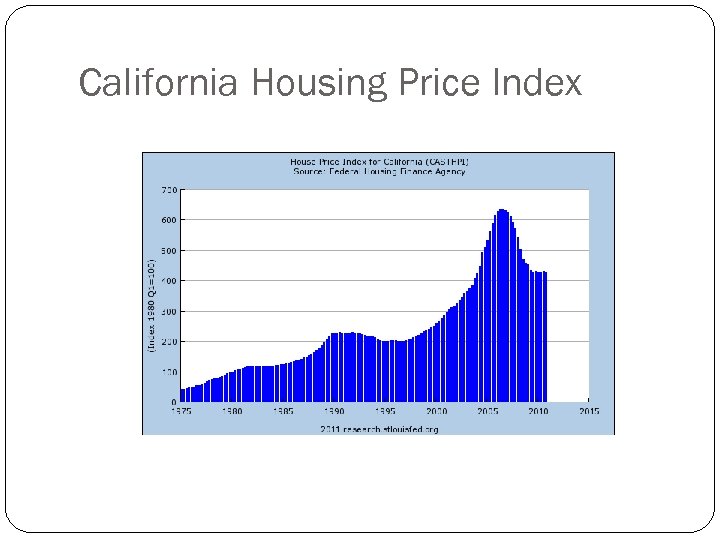

California Housing Price Index

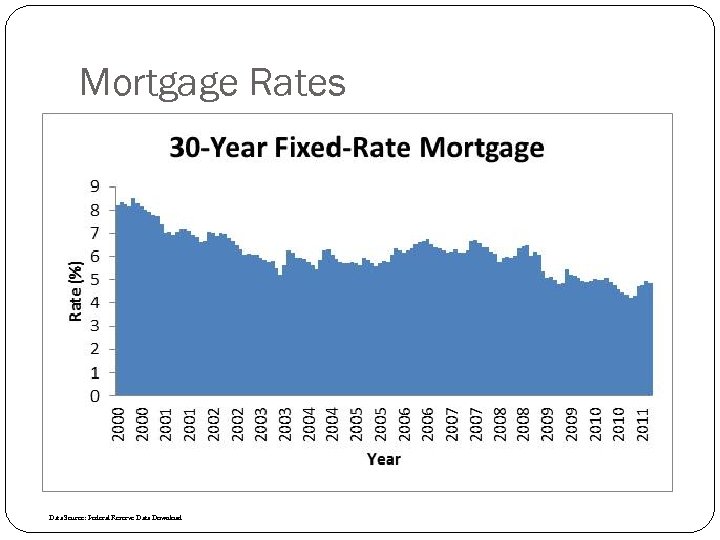

Mortgage Rates Data Source: Federal Reserve Data Download

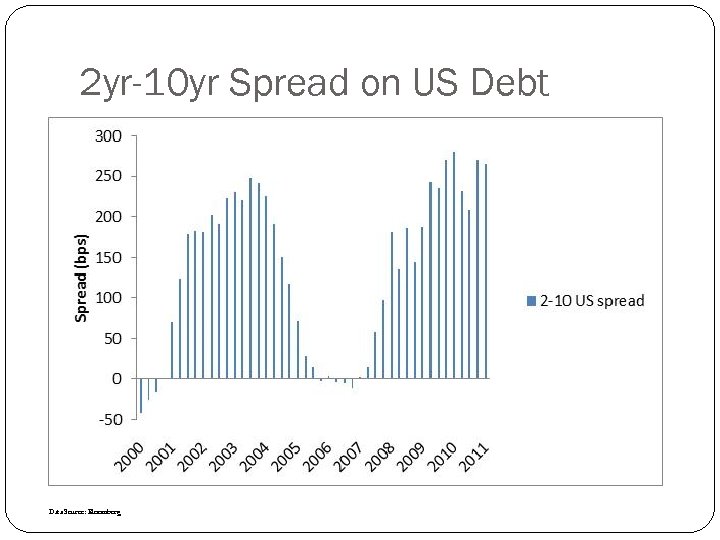

2 yr-10 yr Spread on US Debt Data Source: Bloomberg

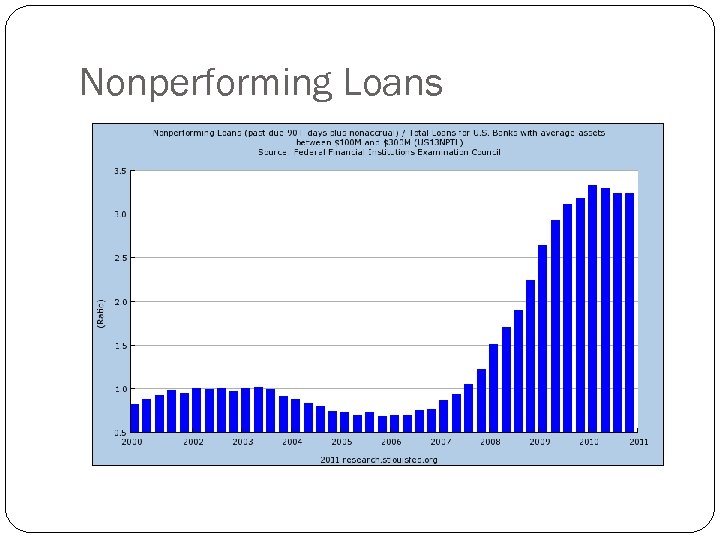

Nonperforming Loans

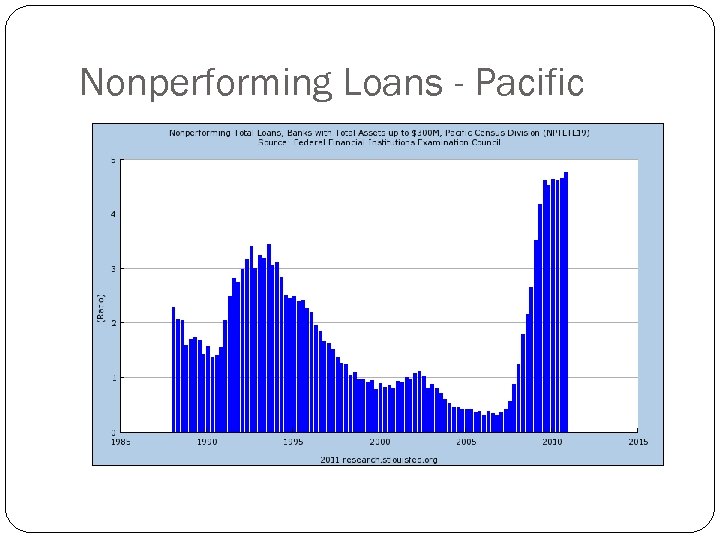

Nonperforming Loans - Pacific

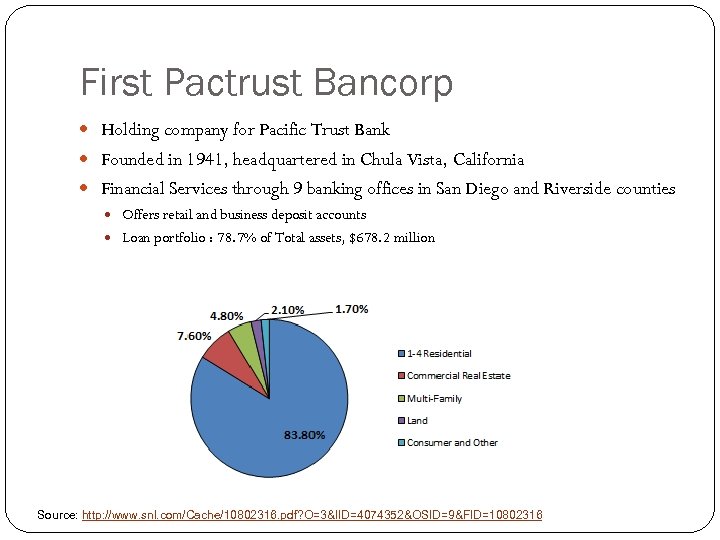

First Pactrust Bancorp Holding company for Pacific Trust Bank Founded in 1941, headquartered in Chula Vista, California Financial Services through 9 banking offices in San Diego and Riverside counties Offers retail and business deposit accounts Loan portfolio : 78. 7% of Total assets, $678. 2 million Source: http: //www. snl. com/Cache/10802316. pdf? O=3&IID=4074352&OSID=9&FID=10802316

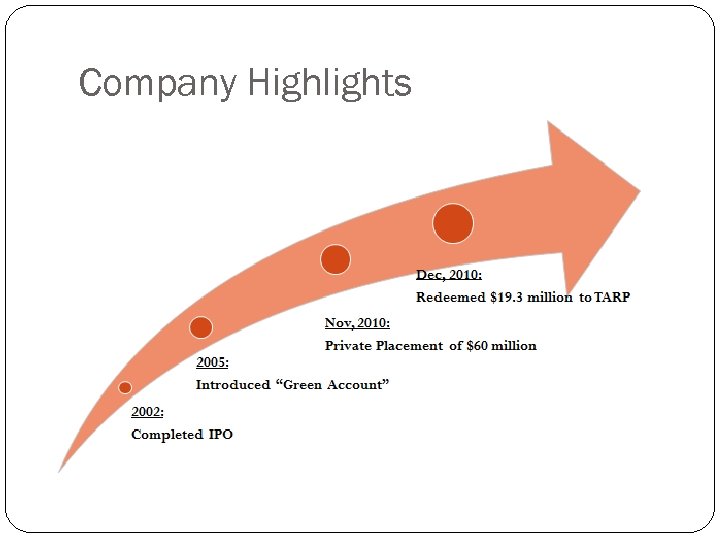

Company Highlights

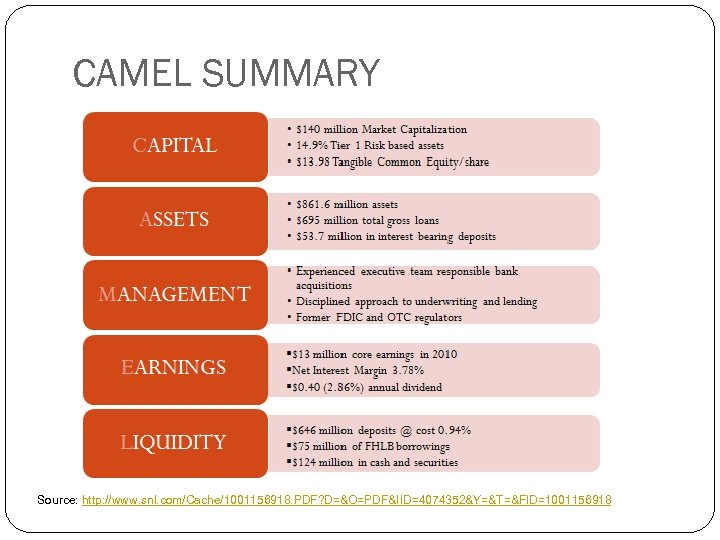

CAMEL SUMMARY Source: http: //www. snl. com/Cache/1001156918. PDF? D=&O=PDF&IID=4074352&Y=&T=&FID=1001156918

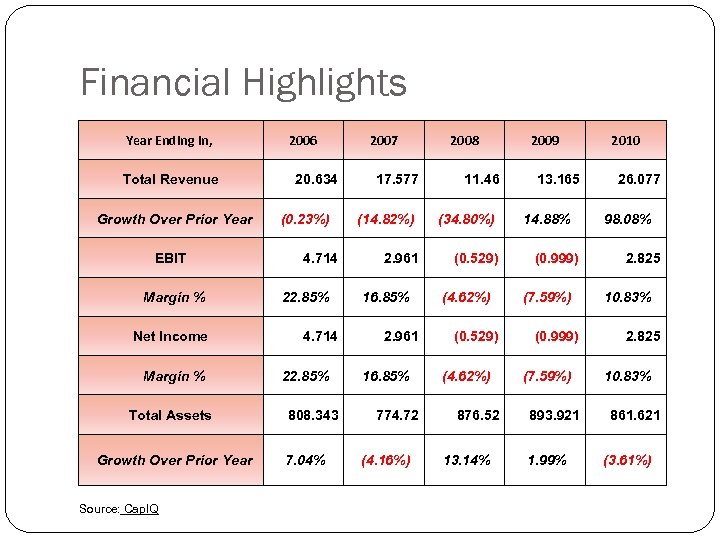

Financial Highlights Year Ending in, Total Revenue Growth Over Prior Year EBIT Margin % Net Income Margin % Total Assets Growth Over Prior Year Source: Cap. IQ 2006 20. 634 (0. 23%) 4. 714 22. 85% 808. 343 7. 04% 2007 17. 577 (14. 82%) 2. 961 16. 85% 774. 72 (4. 16%) 2008 11. 46 (34. 80%) (0. 529) (4. 62%) 876. 52 13. 14% 2009 13. 165 14. 88% (0. 999) (7. 59%) 893. 921 1. 99% 2010 26. 077 98. 08% 2. 825 10. 83% 861. 621 (3. 61%)

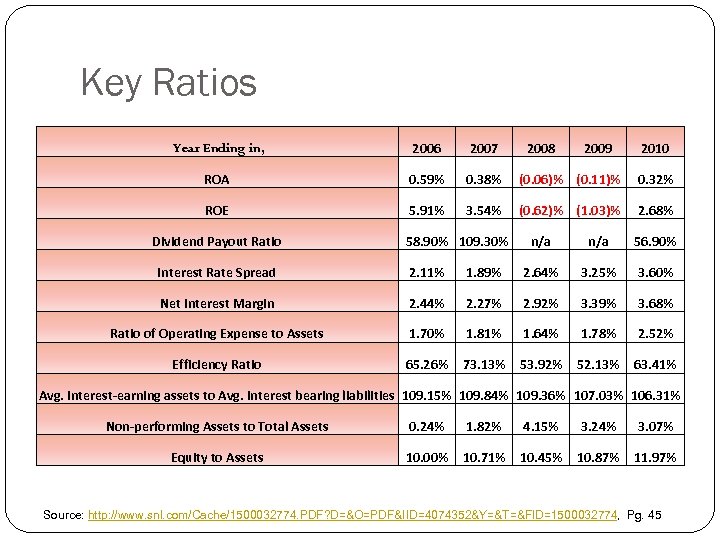

Key Ratios Year Ending in, 2006 2007 ROA 0. 59% 0. 38% (0. 06)% (0. 11)% 0. 32% ROE 5. 91% 3. 54% (0. 62)% (1. 03)% 2. 68% Dividend Payout Ratio 58. 90% 109. 30% 2008 2009 2010 n/a 56. 90% Interest Rate Spread 2. 11% 1. 89% 2. 64% 3. 25% 3. 60% Net Interest Margin 2. 44% 2. 27% 2. 92% 3. 39% 3. 68% Ratio of Operating Expense to Assets 1. 70% 1. 81% 1. 64% 1. 78% 2. 52% Efficiency Ratio 65. 26% 73. 13% 53. 92% 52. 13% 63. 41% Avg. interest-earning assets to Avg. interest bearing liabilities 109. 15% 109. 84% 109. 36% 107. 03% 106. 31% Non-performing Assets to Total Assets 0. 24% 1. 82% 4. 15% 3. 24% 3. 07% Equity to Assets 10. 00% 10. 71% 10. 45% 10. 87% 11. 97% Source: http: //www. snl. com/Cache/1500032774. PDF? D=&O=PDF&IID=4074352&Y=&T=&FID=1500032774, Pg. 45

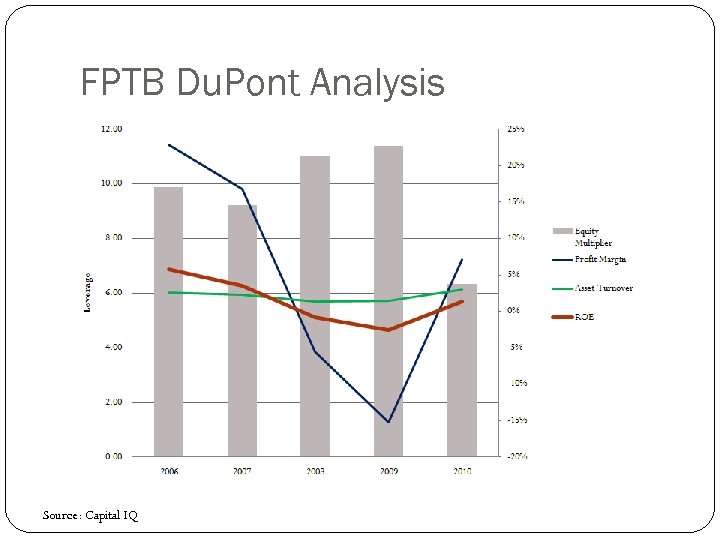

FPTB Du. Pont Analysis Source: Capital IQ

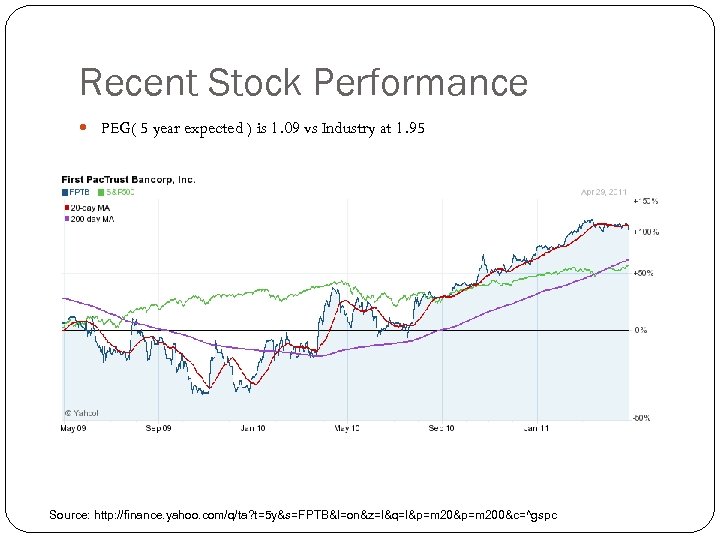

Recent Stock Performance PEG( 5 year expected ) is 1. 09 vs Industry at 1. 95 Source: http: //finance. yahoo. com/q/ta? t=5 y&s=FPTB&l=on&z=l&q=l&p=m 200&c=^gspc

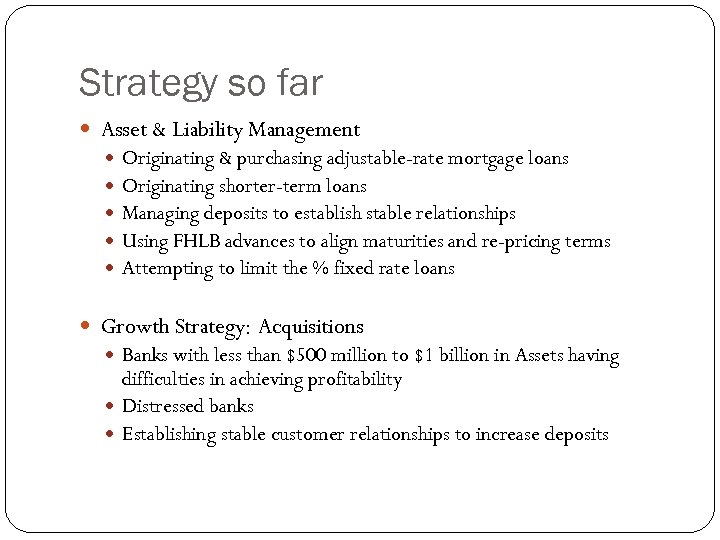

Strategy so far Asset & Liability Management Originating & purchasing adjustable-rate mortgage loans Originating shorter-term loans Managing deposits to establish stable relationships Using FHLB advances to align maturities and re-pricing terms Attempting to limit the % fixed rate loans Growth Strategy: Acquisitions Banks with less than $500 million to $1 billion in Assets having difficulties in achieving profitability Distressed banks Establishing stable customer relationships to increase deposits

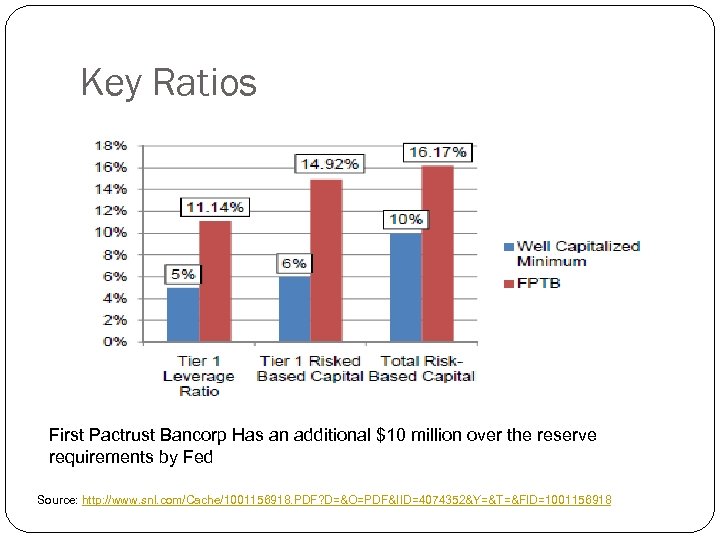

Key Ratios First Pactrust Bancorp Has an additional $10 million over the reserve requirements by Fed Source: http: //www. snl. com/Cache/1001156918. PDF? D=&O=PDF&IID=4074352&Y=&T=&FID=1001156918

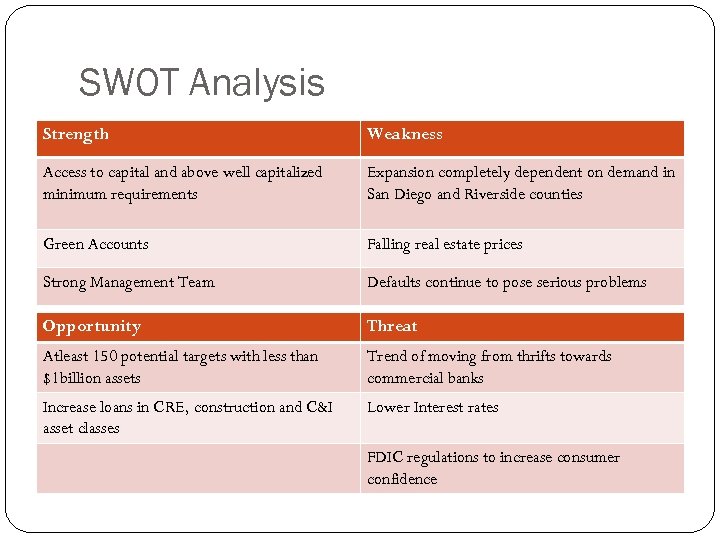

SWOT Analysis Strength Weakness Access to capital and above well capitalized minimum requirements Expansion completely dependent on demand in San Diego and Riverside counties Green Accounts Falling real estate prices Strong Management Team Defaults continue to pose serious problems Opportunity Threat Atleast 150 potential targets with less than $1 billion assets Trend of moving from thrifts towards commercial banks Increase loans in CRE, construction and C&I asset classes Lower Interest rates FDIC regulations to increase consumer confidence

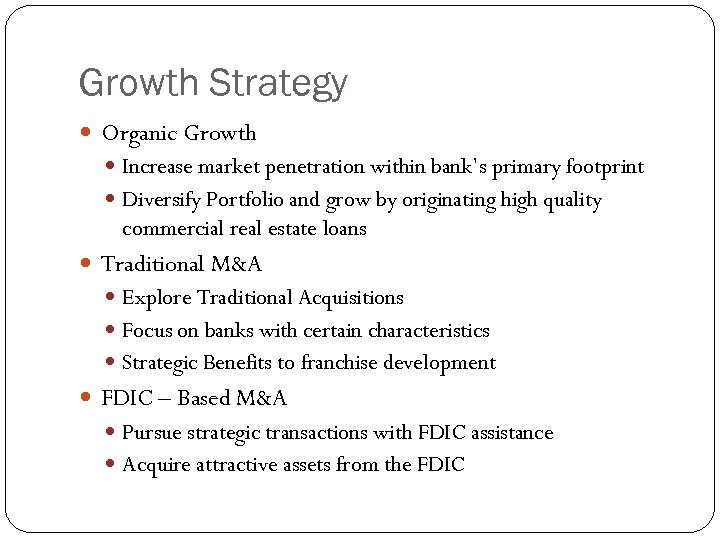

Growth Strategy Organic Growth Increase market penetration within bank’s primary footprint Diversify Portfolio and grow by originating high quality commercial real estate loans Traditional M&A Explore Traditional Acquisitions Focus on banks with certain characteristics Strategic Benefits to franchise development FDIC – Based M&A Pursue strategic transactions with FDIC assistance Acquire attractive assets from the FDIC

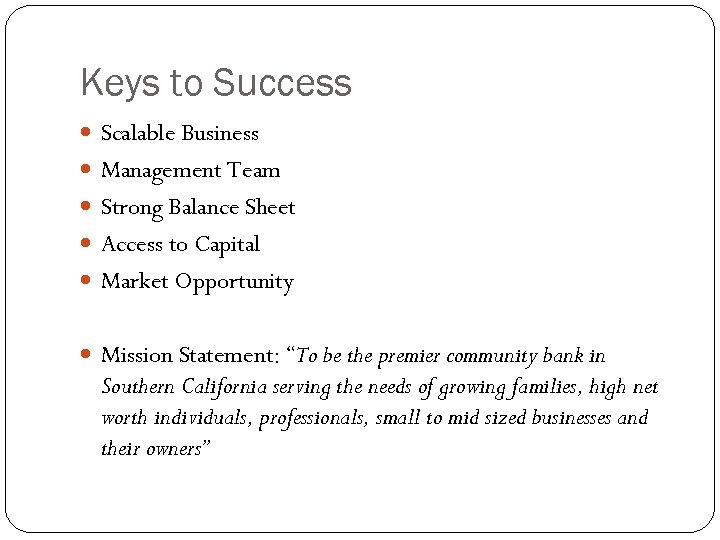

Keys to Success Scalable Business Management Team Strong Balance Sheet Access to Capital Market Opportunity Mission Statement: “To be the premier community bank in Southern California serving the needs of growing families, high net worth individuals, professionals, small to mid sized businesses and their owners”

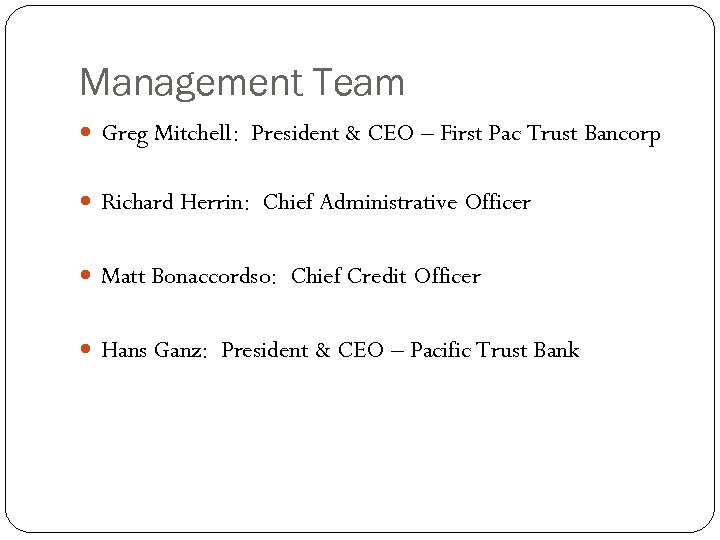

Management Team Greg Mitchell: President & CEO – First Pac Trust Bancorp Richard Herrin: Chief Administrative Officer Matt Bonaccordso: Chief Credit Officer Hans Ganz: President & CEO – Pacific Trust Bank

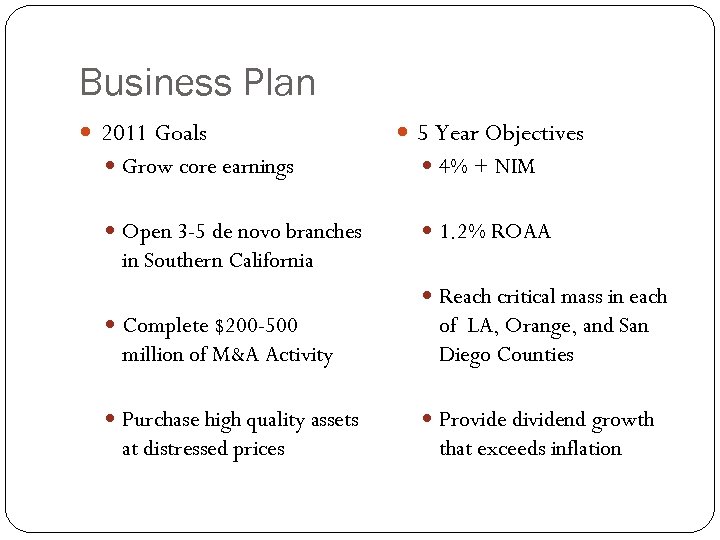

Business Plan 2011 Goals 5 Year Objectives Grow core earnings 4% + NIM Open 3 -5 de novo branches 1. 2% ROAA in Southern California Reach critical mass in each Complete $200 -500 million of M&A Activity of LA, Orange, and San Diego Counties Purchase high quality assets Provide dividend growth at distressed prices that exceeds inflation

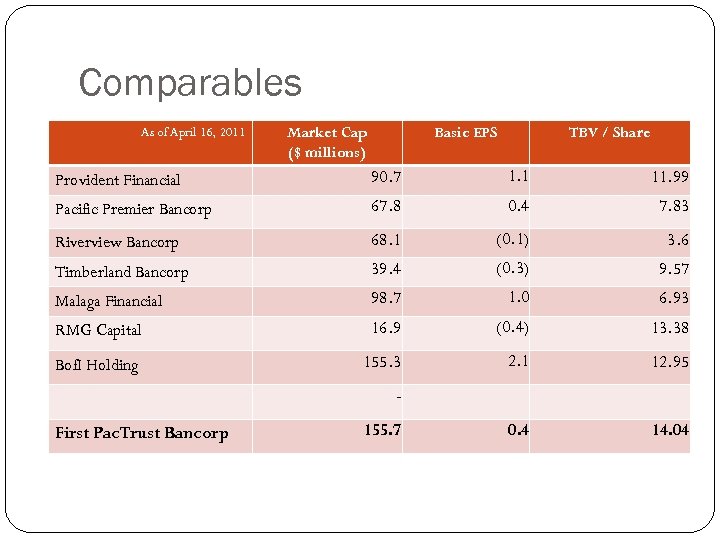

Comparables As of April 16, 2011 Market Cap ($ millions) Basic EPS TBV / Share Provident Financial 90. 7 1. 1 11. 99 Pacific Premier Bancorp 67. 8 0. 4 7. 83 Riverview Bancorp 68. 1 (0. 1) 3. 6 Timberland Bancorp 39. 4 (0. 3) 9. 57 Malaga Financial 98. 7 1. 0 6. 93 RMG Capital 16. 9 (0. 4) 13. 38 Bof. I Holding 155. 3 2. 1 12. 95 0. 4 14. 04 First Pac. Trust Bancorp 155. 7

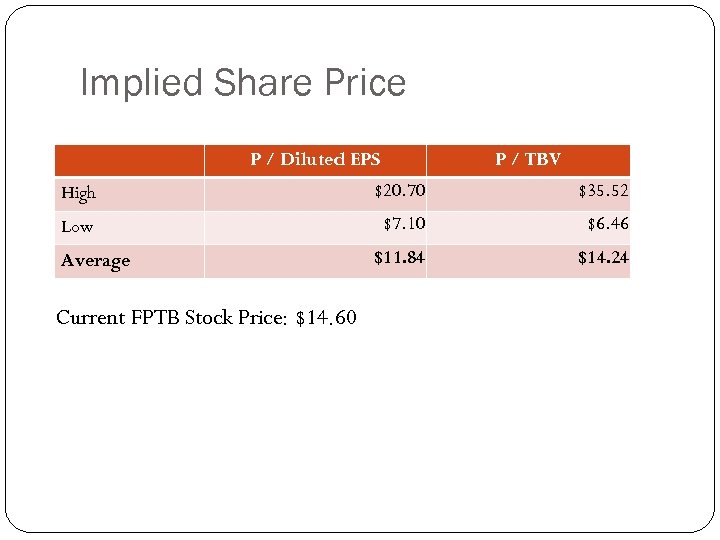

Implied Share Price P / Diluted EPS P / TBV High $20. 70 $35. 52 Low $7. 10 $6. 46 $11. 84 $14. 24 Average Current FPTB Stock Price: $14. 60

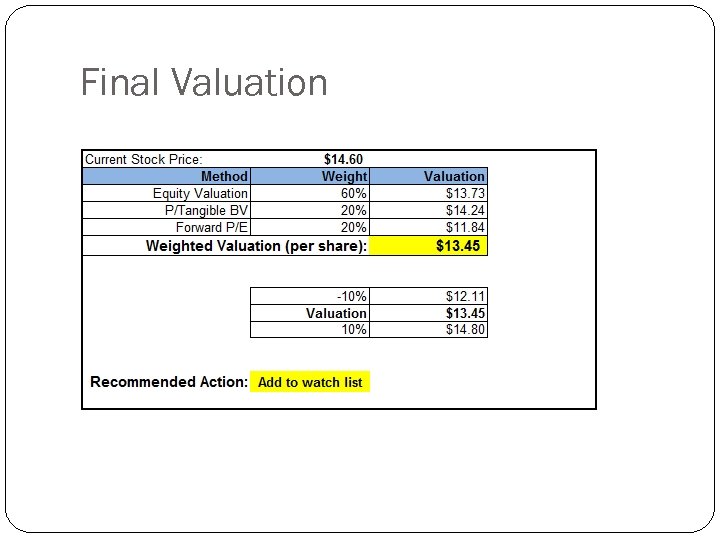

Final Valuation

853f1567c1ffd249b91c95a82c5fc83f.ppt