92a5a2db7ef6e5882966e6298ea03caa.ppt

- Количество слайдов: 17

First International Bank of Israel Ltd. - FIBI 1

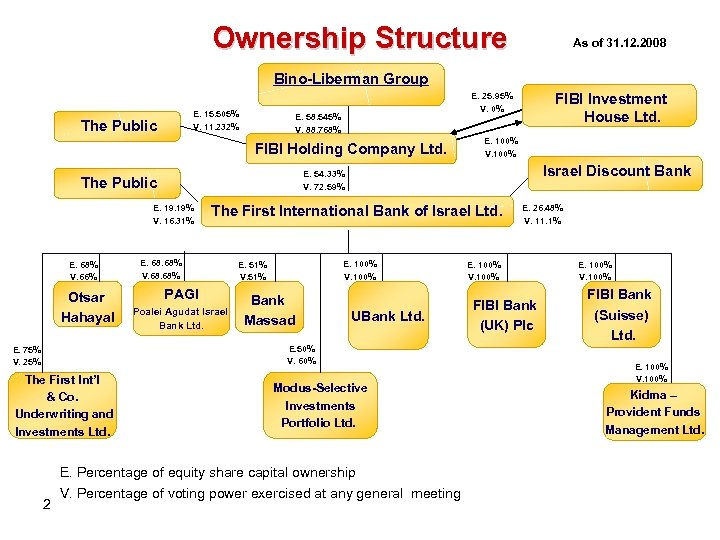

Ownership Structure As of 31. 12. 2008 Bino-Liberman Group E. 15. 505% V. 11. 232% The Public E. 58. 545% V. 88. 768% FIBI Holding Company Ltd. E. 19% V. 16. 31% Otsar Hahayal Israel Discount Bank The First International Bank of Israel Ltd. E. 68% V. 68% PAGI Poalei Agudat Israel Bank Ltd. E. 100% V. 100% E. 51% V. 51% Bank Massad UBank Ltd. E. 50% V. 60% E. 75% V. 25% The First Int’l & Co. Underwriting and Investments Ltd. 2 E. 100% V. 100% E. 54. 33% V. 72. 59% The Public E. 68% V. 66% FIBI Investment House Ltd. E. 25. 95% V. 0% Modus-Selective Investments Portfolio Ltd. E. Percentage of equity share capital ownership V. Percentage of voting power exercised at any general meeting E. 26. 48% V. 11. 1% E. 100% V. 100% FIBI Bank (UK) Plc E. 100% V. 100% FIBI Bank (Suisse) Ltd. E. 100% V. 100% Kidma – Provident Funds Management Ltd.

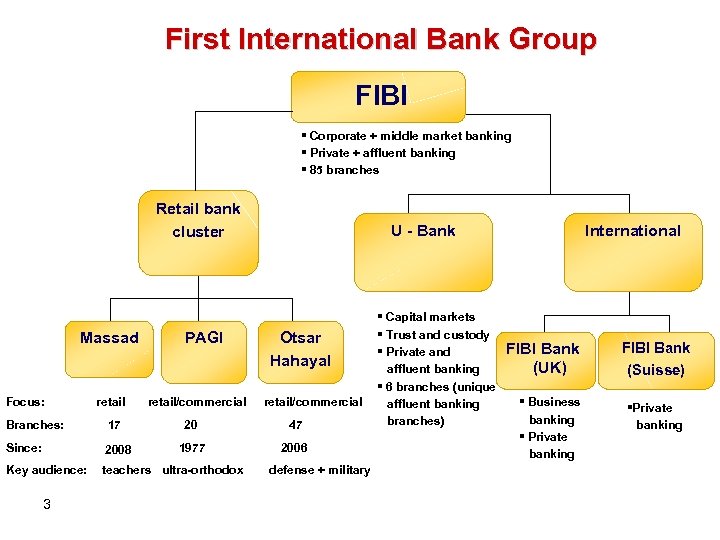

First International Bank Group FIBI § Corporate + middle market banking § Private + affluent banking § 85 branches Retail bank cluster Massad Focus: retail PAGI retail/commercial Branches: 17 Since: 2008 Key audience: teachers ultra-orthodox 3 U - Bank Otsar Hahayal retail/commercial 20 47 1977 2006 defense + military § Capital markets § Trust and custody § Private and affluent banking § 6 branches (unique affluent banking branches) International FIBI Bank (UK) § Business banking § Private banking FIBI Bank (Suisse) §Private banking

First International Bank of Israel - FIBI • Universal bank with strong niche position in capital markets, foreign exchange and foreign trade • Domestic subsidiaries target focused audiences: affluent banking (UBank), defense sector - retail banking (Otsar Hahayal), ultra-orthodox Jews (PAGI), and teachers (Massad) • Foreign subsidiaries in London (commercial banking) and Zurich (private banking) • Branches: 175 in Israel (including subsidiaries) • Employees: 4, 829 • Equity: NIS 5, 491 Million (US$ 1. 419 Million *) • 5 th largest banking group in Israel * $/NIS = 3. 8702 First International Bank of Israel Ltd. | 31. 12. 2008 | 4 4

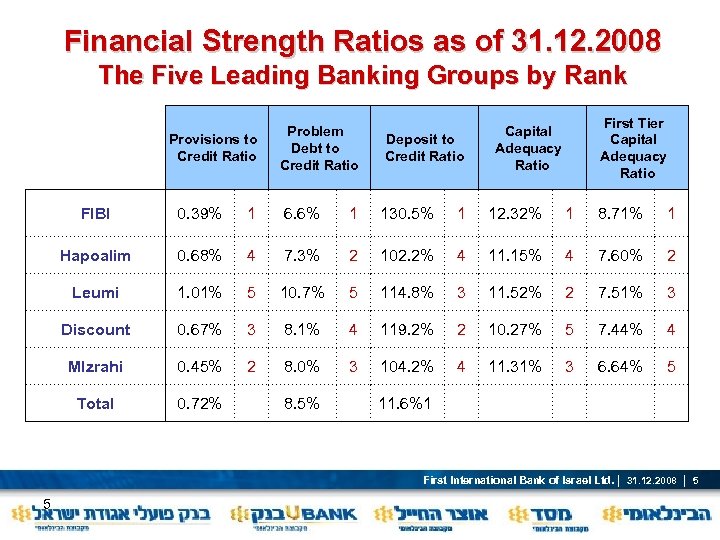

Financial Strength Ratios as of 31. 12. 2008 The Five Leading Banking Groups by Rank Provisions to Credit Ratio Problem Debt to Credit Ratio Deposit to Credit Ratio First Tier Capital Adequacy Ratio FIBI 0. 39% 1 6. 6% 1 130. 5% 1 12. 32% 1 8. 71% 1 Hapoalim 0. 68% 4 7. 3% 2 102. 2% 4 11. 15% 4 7. 60% 2 Leumi 1. 01% 5 10. 7% 5 114. 8% 3 11. 52% 2 7. 51% 3 Discount 0. 67% 3 8. 1% 4 119. 2% 2 10. 27% 5 7. 44% 4 MIzrahi 0. 45% 2 8. 0% 3 104. 2% 4 11. 31% 3 6. 64% 5 Total 0. 72% 8. 5% 11. 6%1 First International Bank of Israel Ltd. | 31. 12. 2008 | 5 5

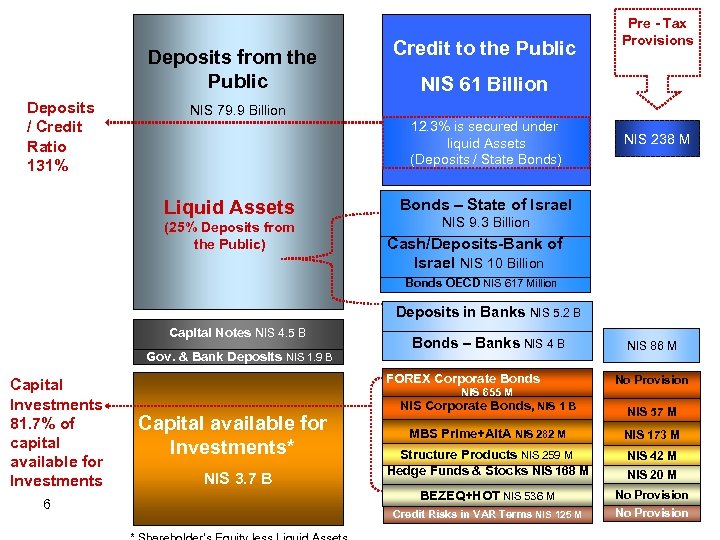

Deposits from the Public Deposits / Credit Ratio 131% Credit to the Public Pre - Tax Provisions NIS 61 Billion NIS 79. 9 Billion 12. 3% is secured under liquid Assets (Deposits / State Bonds) Liquid Assets (25% Deposits from the Public) NIS 238 M Bonds – State of Israel NIS 9. 3 Billion Cash/Deposits-Bank of Israel NIS 10 Billion Bonds OECD NIS 617 Million Deposits in Banks NIS 5. 2 B Capital Notes NIS 4. 5 B Gov. & Bank Deposits NIS 1. 9 B Capital Investments 81. 7% of capital available for Investments 6 Bonds – Banks NIS 4 B FOREX Corporate Bonds NIS 655 M Capital available for Investments* NIS 3. 7 B NIS 86 M No Provision NIS Corporate Bonds , NIS 1 B NIS 57 M MBS Prime+Alt. A NIS 282 M NIS 173 M Structure Products NIS 259 M Hedge Funds & Stocks NIS 168 M NIS 42 M Credit Risks in VAR Terms NIS 125 M No Provision NIS 20 M First International Bank of Israel Ltd. | 31. 12. 2008 | 6 No Provision BEZEQ+HOT NIS 536 M

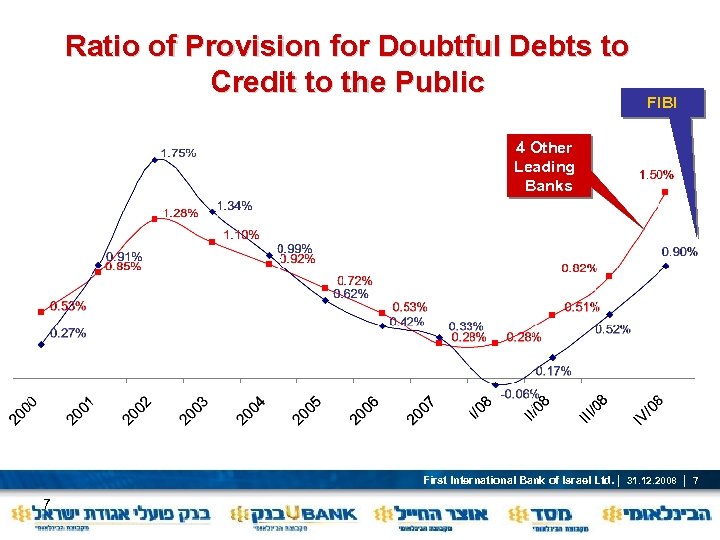

Ratio of Provision for Doubtful Debts to Credit to the Public FIBI 4 Other Leading Banks First International Bank of Israel Ltd. | 31. 12. 2008 | 7 7

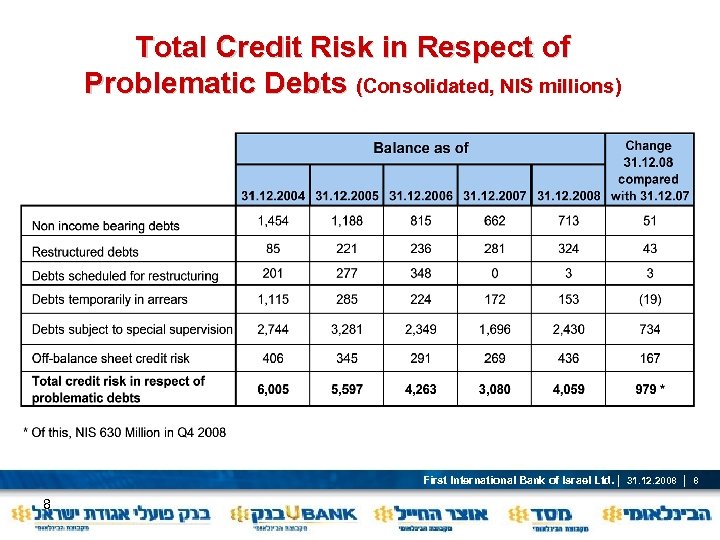

Total Credit Risk in Respect of Problematic Debts (Consolidated, NIS millions) First International Bank of Israel Ltd. | 31. 12. 2008 | 8 8

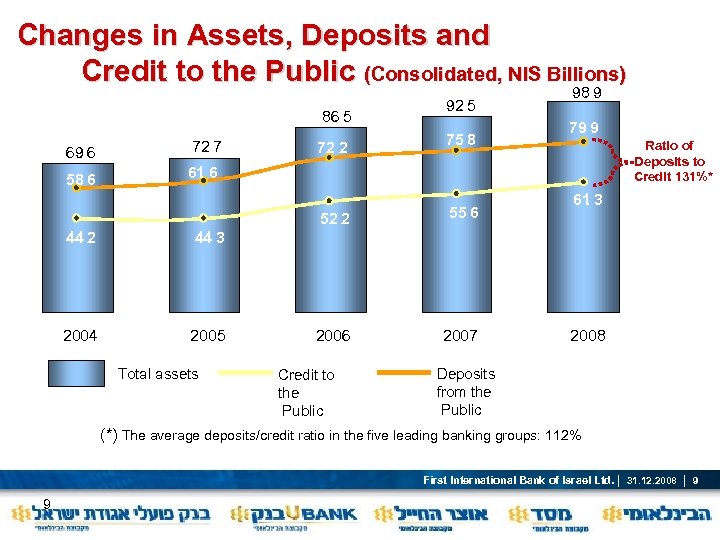

Changes in Assets, Deposits and Credit to the Public (Consolidated, NIS Billions) 86 5. 69 6. 72 7. 58 6. 92 5. 75 8. 98 9. 79 9. 61 6. 72 2. 52 2. 44 2. 2005 2006 2007 61 3. 44 3. 2004 55 6. Ratio of Deposits to Credit 131%* Total assets Credit to the Public 2008 Deposits from the Public (*) The average deposits/credit ratio in the five leading banking groups: 112% First International Bank of Israel Ltd. | 31. 12. 2008 | 9 9

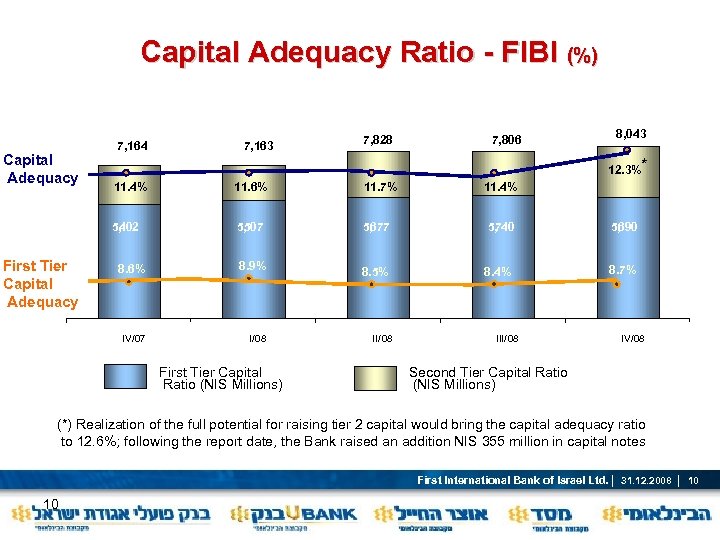

Capital Adequacy Ratio - FIBI (%) Capital Adequacy 7, 164 7, 163 7, 828 7, 806 8, 043 12. 3%* 11. 6% 11. 7% 5, 02 4 5, 07 5 5, 77 6 5, 40 7 5, 90 6 8. 6% 8. 9% 8. 5% 8. 4% 8. 7% IV/07 First Tier Capital Adequacy 11. 4% I/08 First Tier Capital Ratio (NIS Millions) II/08 11. 4% III/08 IV/08 Second Tier Capital Ratio (NIS Millions) (*) Realization of the full potential for raising tier 2 capital would bring the capital adequacy ratio to 12. 6%; following the report date, the Bank raised an addition NIS 355 million in capital notes First International Bank of Israel Ltd. | 31. 12. 2008 | 10 10

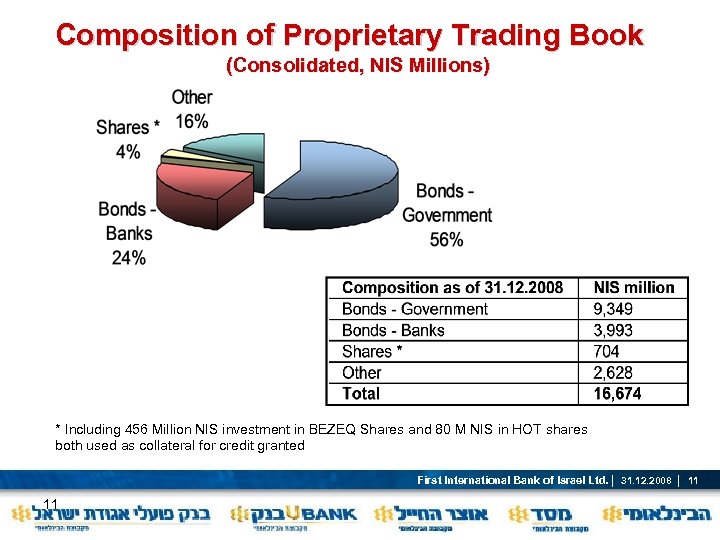

Composition of Proprietary Trading Book (Consolidated, NIS Millions) * Including 456 Million NIS investment in BEZEQ Shares and 80 M NIS in HOT shares both used as collateral for credit granted First International Bank of Israel Ltd. | 31. 12. 2008 | 11 11

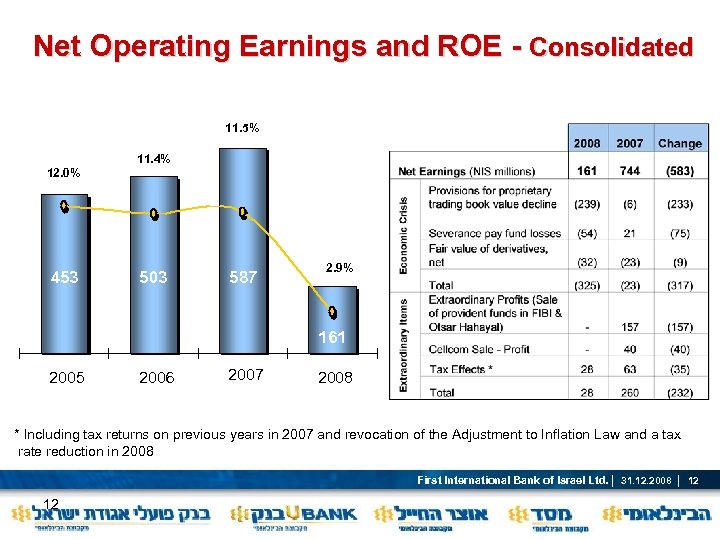

Net Operating Earnings and ROE - Consolidated 11. 5% 11. 4% 12. 0% 453 503 587 2. 9% 161 2005 2006 2007 2008 * Including tax returns on previous years in 2007 and revocation of the Adjustment to Inflation Law and a tax rate reduction in 2008 First International Bank of Israel Ltd. | 31. 12. 2008 | 12 12

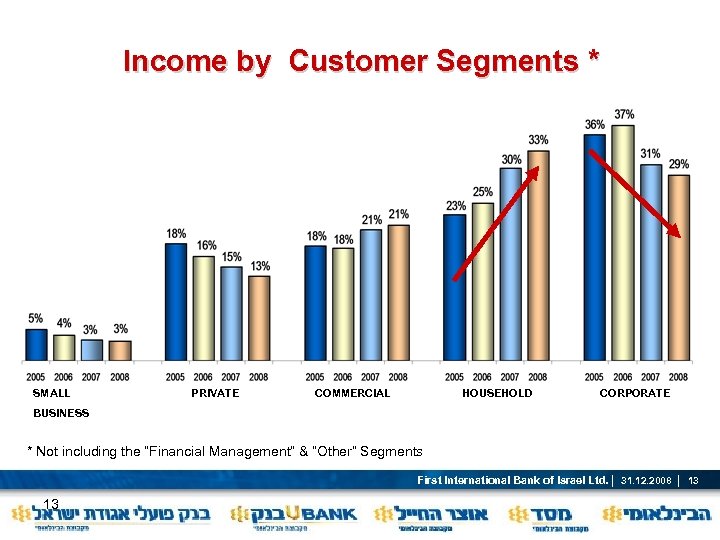

Income by Customer Segments * SMALL PRIVATE COMMERCIAL HOUSEHOLD CORPORATE BUSINESS * Not including the “Financial Management” & “Other” Segments First International Bank of Israel Ltd. | 31. 12. 2008 | 13 13

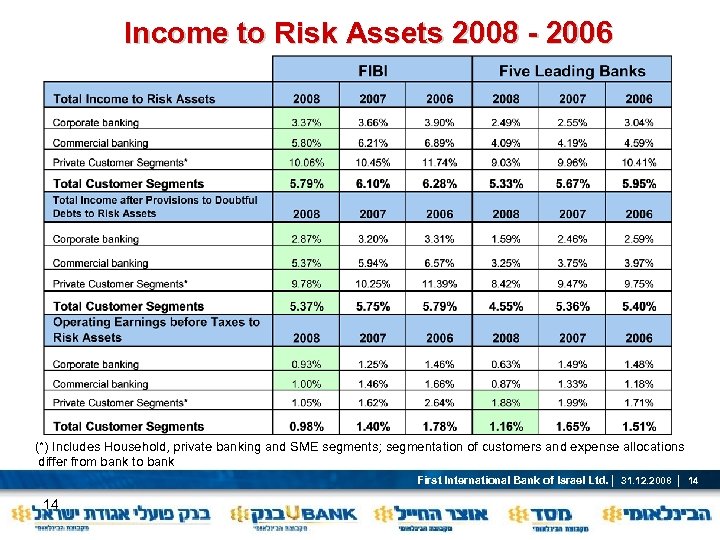

Income to Risk Assets 2008 - 2006 (*) Includes Household, private banking and SME segments; segmentation of customers and expense allocations differ from bank to bank First International Bank of Israel Ltd. | 31. 12. 2008 | 14 14

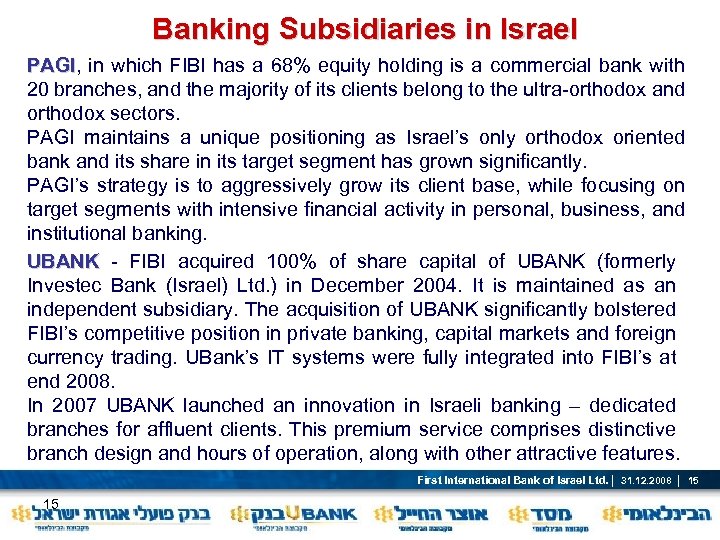

Banking Subsidiaries in Israel PAGI, in which FIBI has a 68% equity holding is a commercial bank with PAGI 20 branches, and the majority of its clients belong to the ultra-orthodox and orthodox sectors. PAGI maintains a unique positioning as Israel’s only orthodox oriented bank and its share in its target segment has grown significantly. PAGI’s strategy is to aggressively grow its client base, while focusing on target segments with intensive financial activity in personal, business, and institutional banking. UBANK - FIBI acquired 100% of share capital of UBANK (formerly UBANK Investec Bank (Israel) Ltd. ) in December 2004. It is maintained as an independent subsidiary. The acquisition of UBANK significantly bolstered FIBI’s competitive position in private banking, capital markets and foreign currency trading. UBank’s IT systems were fully integrated into FIBI’s at end 2008. In 2007 UBANK launched an innovation in Israeli banking – dedicated branches for affluent clients. This premium service comprises distinctive branch design and hours of operation, along with other attractive features. First International Bank of Israel Ltd. | 31. 12. 2008 | 15 15

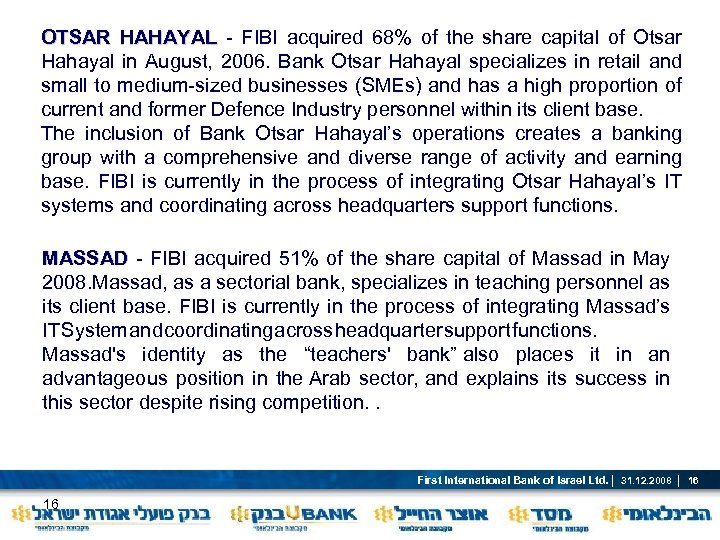

OTSAR HAHAYAL - FIBI acquired 68% of the share capital of Otsar HAHAYAL Hahayal in August, 2006. Bank Otsar Hahayal specializes in retail and small to medium-sized businesses (SMEs) and has a high proportion of current and former Defence Industry personnel within its client base. The inclusion of Bank Otsar Hahayal’s operations creates a banking group with a comprehensive and diverse range of activity and earning base. FIBI is currently in the process of integrating Otsar Hahayal’s IT systems and coordinating across headquarters support functions. MASSAD - FIBI acquired 51% of the share capital of Massad in May MASSAD 2008. Massad, as a sectorial bank, specializes in teaching personnel as its client base. FIBI is currently in the process of integrating Massad’s IT ystem nd oordinating cross eadquarter upport unctions. S a c a h s f Massad's identity as the “teachers' bank” also places it in an advantageous position in the Arab sector, and explains its success in this sector despite rising competition. . First International Bank of Israel Ltd. | 31. 12. 2008 | 16 16

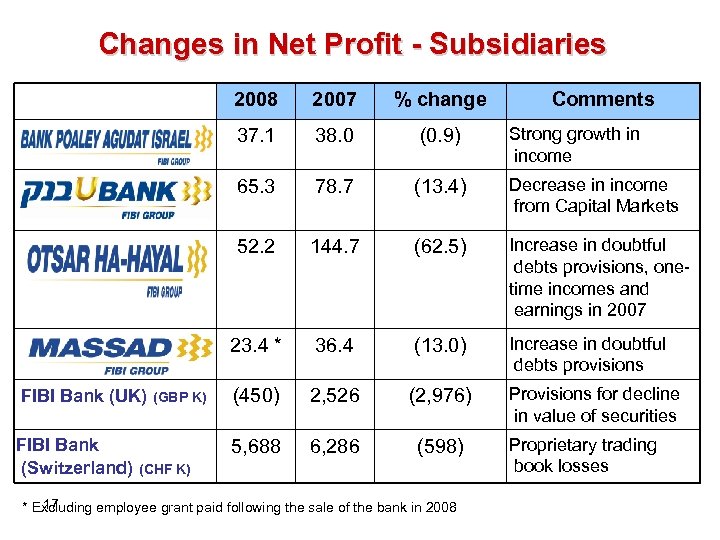

Changes in Net Profit - Subsidiaries 2008 (0. 9) 78. 7 (13. 4) Decrease in income from Capital Markets 52. 2 144. 7 (62. 5) Increase in doubtful debts provisions, onetime incomes and earnings in 2007 23. 4 * FIBI Bank (Switzerland) 38. 0 65. 3 36. 4 (13. 0) Increase in doubtful debts provisions (450) 2, 526 (2, 976) 5, 688 (GBP K) % change 37. 1 FIBI Bank (UK) 2007 6, 286 (598) (CHF K) 17 * Excluding employee grant paid following the sale of the bank in 2008 Comments Strong growth in income Provisions for decline in value of securities Proprietary trading book losses

92a5a2db7ef6e5882966e6298ea03caa.ppt