20a4250ba5fce154ae2394a2ea9cfef4.ppt

- Количество слайдов: 45

First International Bank of Israel Ltd. - FIBI 1

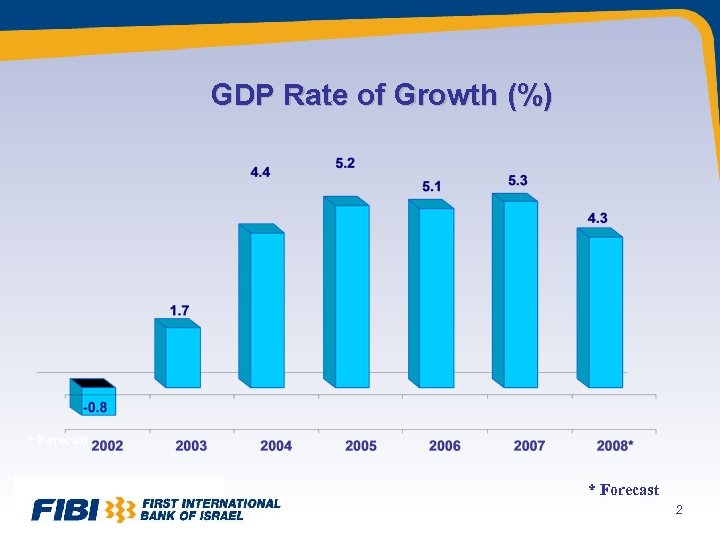

GDP Rate of Growth (%) * Forecast 2

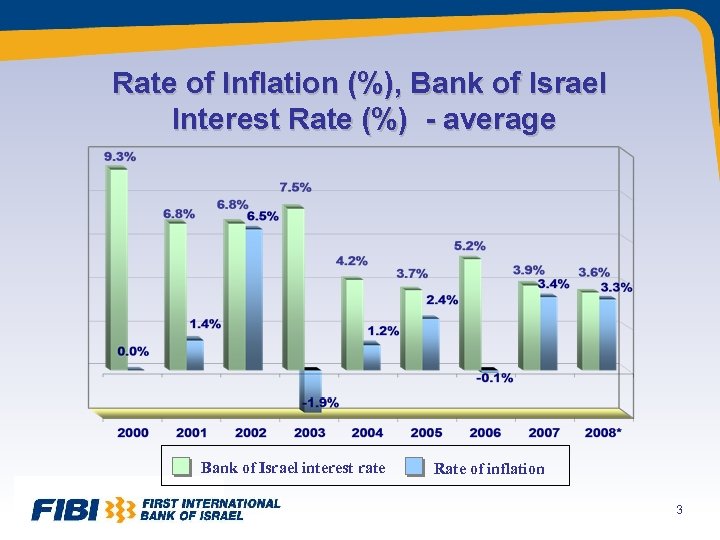

Rate of Inflation (%), Bank of Israel Interest Rate (%) - average Bank of Israel interest rate Rate of inflation 3 * Forecast

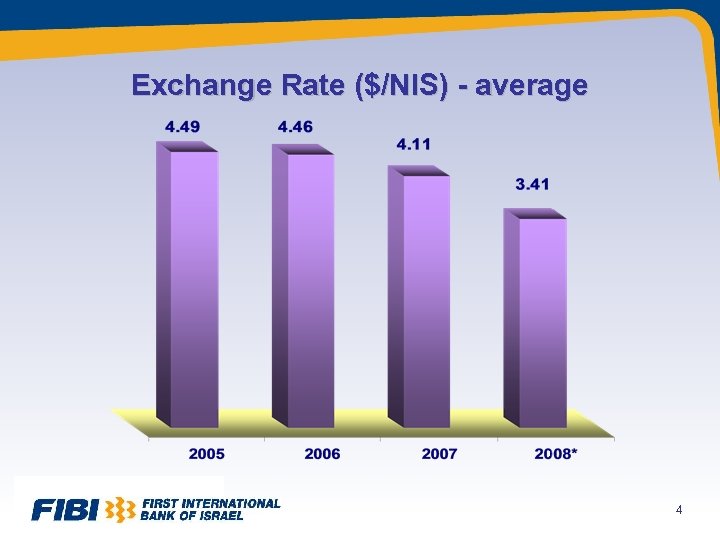

Exchange Rate ($/NIS) - average 4

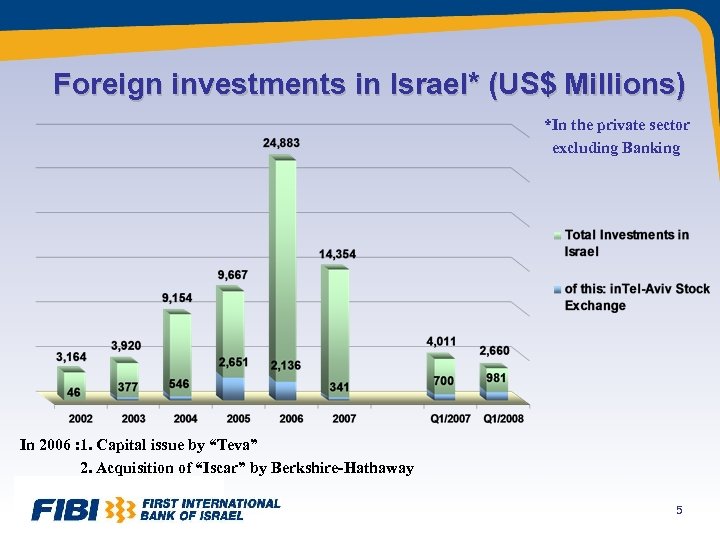

Foreign investments in Israel* (US$ Millions) *In the private sector excluding Banking In 2006 : 1. Capital issue by “Teva” 2. Acquisition of “Iscar” by Berkshire-Hathaway 5

Israeli investments Abroad* (US$ Millions) *In the private sector excluding Banking In 2006 : Acquisition by “Teva” 6

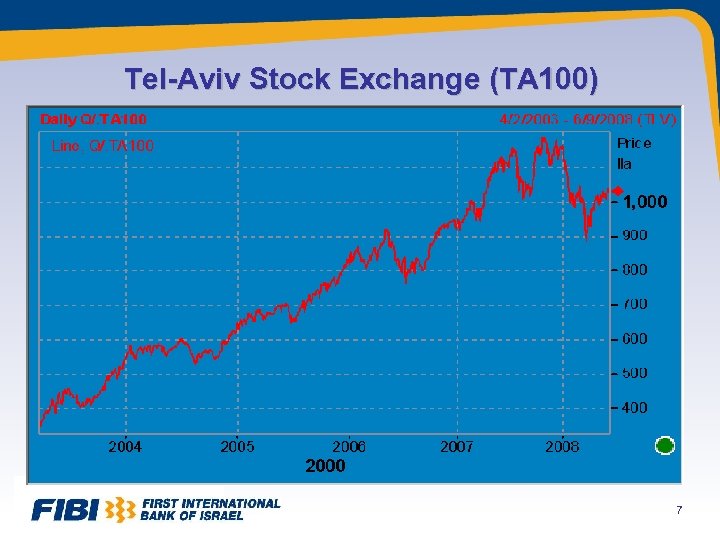

Tel-Aviv Stock Exchange (TA 100) 7

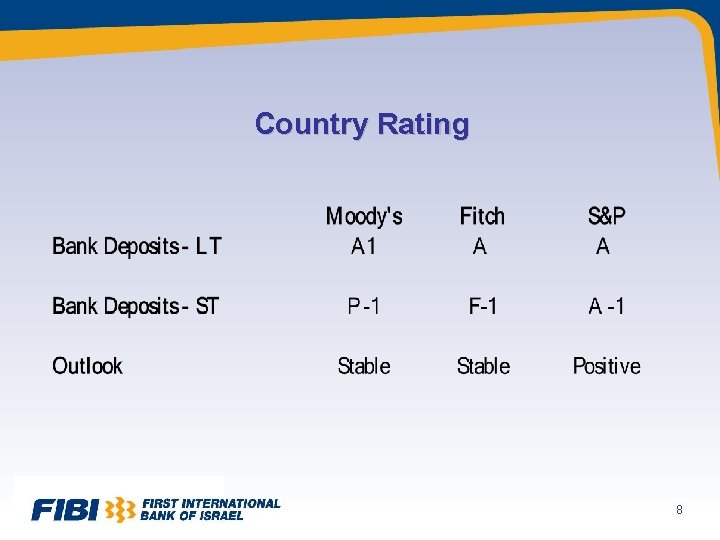

Country Rating 8

First International Bank of Israel Ltd. - FIBI Overview March 31, 2008 9

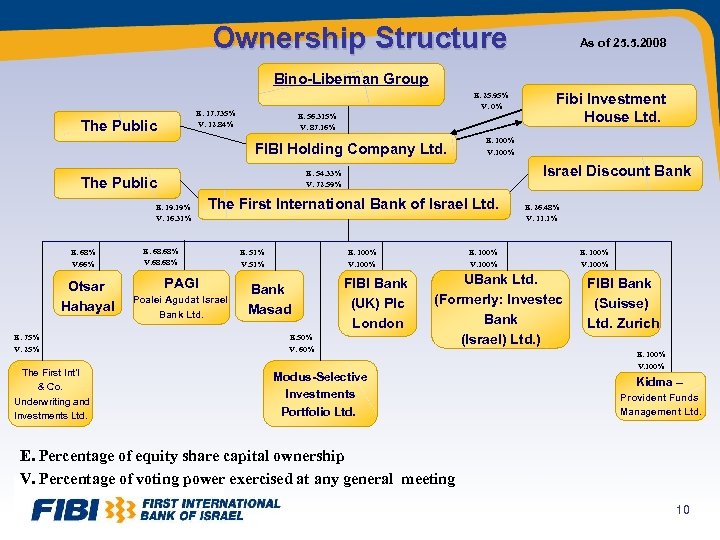

Ownership Structure As of 25. 5. 2008 Bino-Liberman Group E. 25. 95% V. 0% E. 17. 735% V. 12. 84% The Public E. 56. 315% V. 87. 16% FIBI Holding Company Ltd. E. 19% V. 16. 31% E. 68% V. 66% Otsar Hahayal E. 75% V. 25% The First Int’l & Co. Underwriting and Investments Ltd. E. 100% V. 100% Israel Discount Bank E. 54. 33% V. 72. 59% The Public The First International Bank of Israel Ltd. E. 68% V. 68% PAGI Poalei Agudat Israel Bank Ltd. E. 51% V. 51% E. 100% V. 100% Bank Masad Fibi Investment House Ltd. FIBI Bank (UK) Plc London E. 50% V. 60% E. 26. 48% V. 11. 1% E. 100% V. 100% UBank Ltd. (Formerly: Investec Bank (Israel) Ltd. ) Modus-Selective Investments Portfolio Ltd. E. 100% V. 100% FIBI Bank (Suisse) Ltd. Zurich E. 100% V. 100% Kidma – Provident Funds Management Ltd. E. Percentage of equity share capital ownership V. Percentage of voting power exercised at any general meeting 10

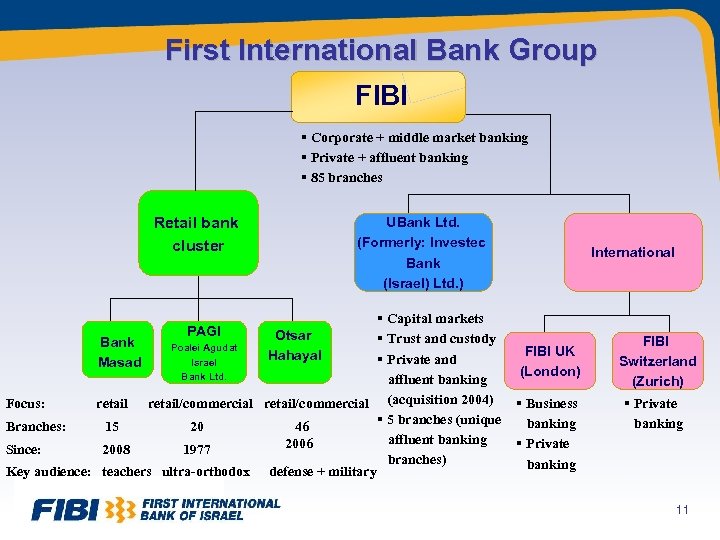

First International Bank Group FIBI § Corporate + middle market banking § Private + affluent banking § 85 branches Retail bank cluster UBank Ltd. (Formerly: Investec Bank (Israel) Ltd. ) § Capital markets Otsar § Trust and custody Bank Poalei Agudat Hahayal § Private and Israel Masad Bank Ltd. affluent banking Focus: retail/commercial (acquisition 2004) § 5 branches (unique Branches: 15 20 46 affluent banking 2006 Since: 2008 1977 branches) Key audience: teachers ultra-orthodox defense + military International PAGI FIBI UK (London) § Business banking § Private banking FIBI Switzerland (Zurich) § Private banking 11

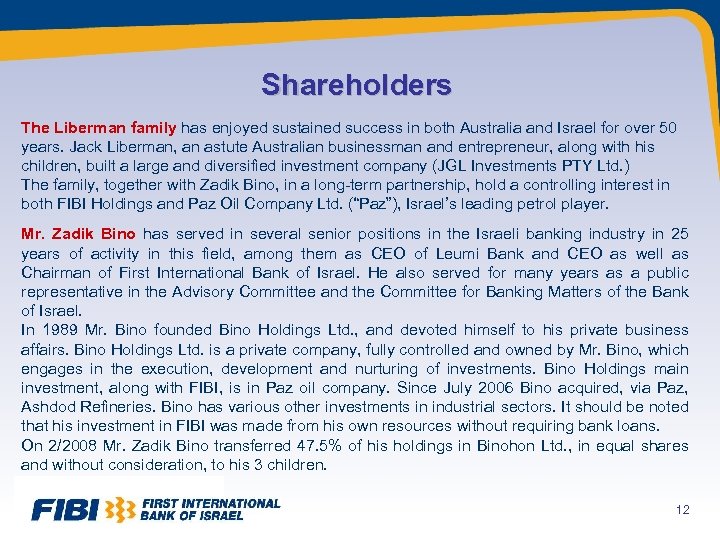

Shareholders The Liberman family has enjoyed sustained success in both Australia and Israel for over 50 years. Jack Liberman, an astute Australian businessman and entrepreneur, along with his children, built a large and diversified investment company (JGL Investments PTY Ltd. ) The family, together with Zadik Bino, in a long-term partnership, hold a controlling interest in both FIBI Holdings and Paz Oil Company Ltd. (“Paz”), Israel’s leading petrol player. Mr. Zadik Bino has served in several senior positions in the Israeli banking industry in 25 years of activity in this field, among them as CEO of Leumi Bank and CEO as well as Chairman of First International Bank of Israel. He also served for many years as a public representative in the Advisory Committee and the Committee for Banking Matters of the Bank of Israel. In 1989 Mr. Bino founded Bino Holdings Ltd. , and devoted himself to his private business affairs. Bino Holdings Ltd. is a private company, fully controlled and owned by Mr. Bino, which engages in the execution, development and nurturing of investments. Bino Holdings main investment, along with FIBI, is in Paz oil company. Since July 2006 Bino acquired, via Paz, Ashdod Refineries. Bino has various other investments in industrial sectors. It should be noted that his investment in FIBI was made from his own resources without requiring bank loans. On 2/2008 Mr. Zadik Bino transferred 47. 5% of his holdings in Binohon Ltd. , in equal shares and without consideration, to his 3 children. 12

First International Bank of Israel - FIBI • Universal bank with strong niche position in capital markets, foreign exchange and foreign trade • Domestic subsidiaries target focused audiences: affluent banking (U-bank), defense sector - retail banking (Otsar Hahayal), ultra-orthodox Jews (PAGI), and teachers (Masad) • Foreign subsidiaries in London (commercial banking) and Zurich (private banking) • Branches: 171 (including subsidiaries) • Employees: 4, 690 • Equity: NIS 5. 5 Billion (US$ 1. 6 B) • 5 th largest bank in Israel 13

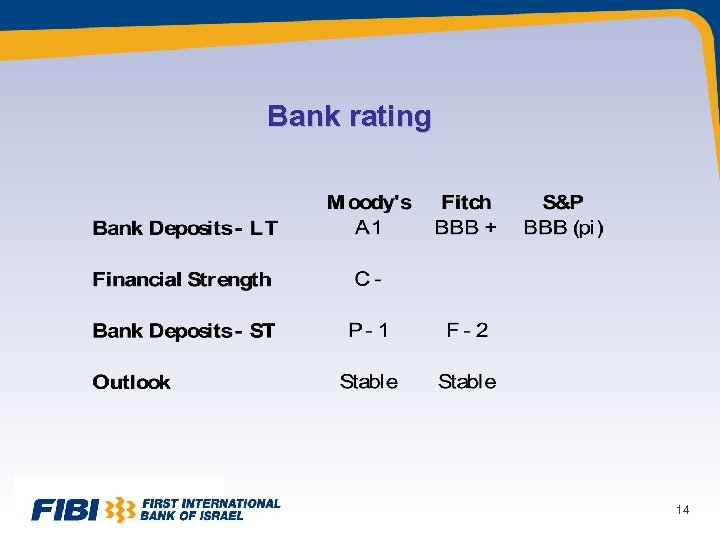

Bank rating 14

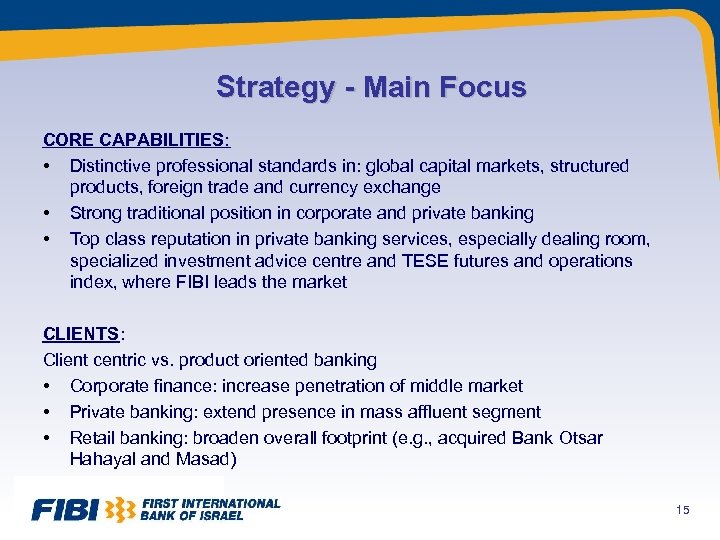

Strategy - Main Focus CORE CAPABILITIES: • Distinctive professional standards in: global capital markets, structured products, foreign trade and currency exchange • Strong traditional position in corporate and private banking • Top class reputation in private banking services, especially dealing room, specialized investment advice centre and TESE futures and operations index, where FIBI leads the market CLIENTS: Client centric vs. product oriented banking • Corporate finance: increase penetration of middle market • Private banking: extend presence in mass affluent segment • Retail banking: broaden overall footprint (e. g. , acquired Bank Otsar Hahayal and Masad) 15

Strategy - Main Focus CREDIT: • Improved mix of credit portfolio through diversification including middle market • Upgraded Scoring model and processes in anticipation of Basel II, including development of advanced credit scoring models for risk based pricing OTHER: • Leveraging competitive strengths, realize synergies from acquisitions • Outsourcing: first Israeli bank to outsource its computer infrastructure • Development of pension planning advice offering 16

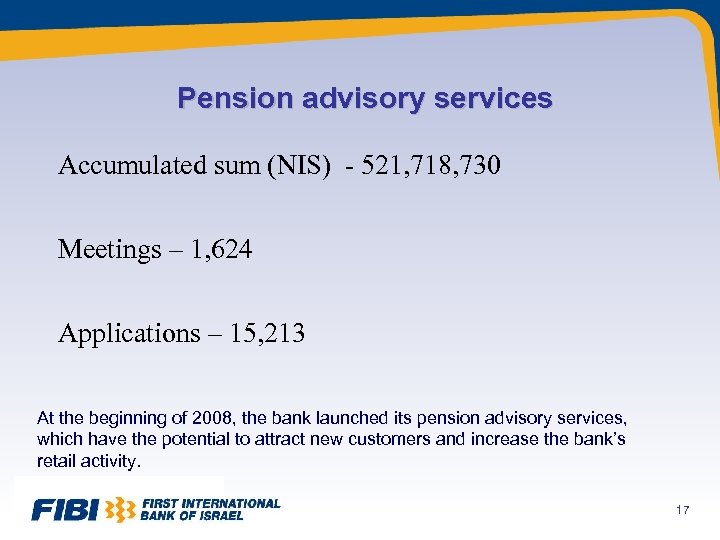

Pension advisory services Accumulated sum (NIS) - 521, 718, 730 Meetings – 1, 624 Applications – 15, 213 At the beginning of 2008, the bank launched its pension advisory services, which have the potential to attract new customers and increase the bank’s retail activity. 17

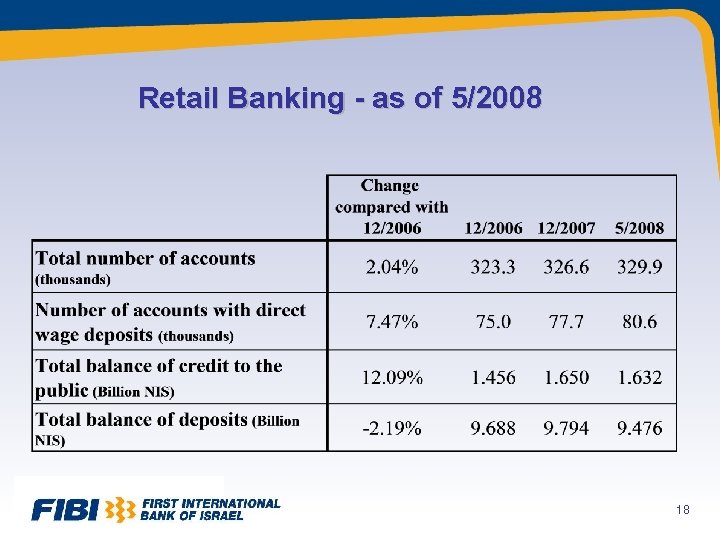

Retail Banking - as of 5/2008 18

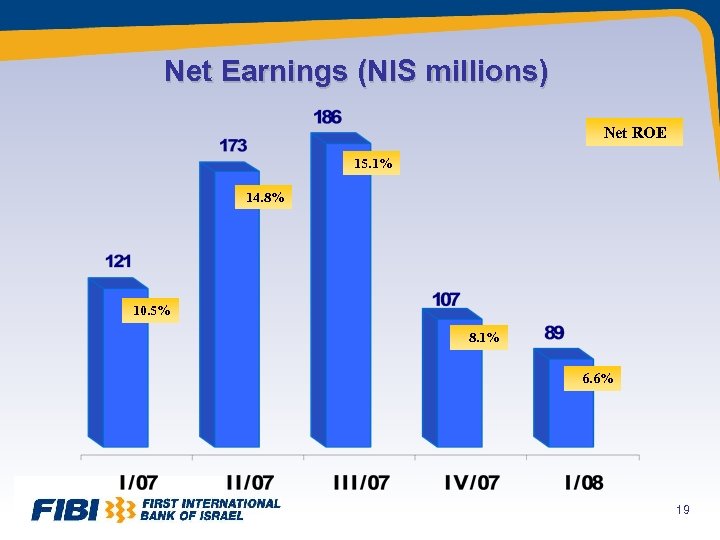

Net Earnings (NIS millions) Net ROE 15. 1% 14. 8% 10. 5% 8. 1% 6. 6% 19

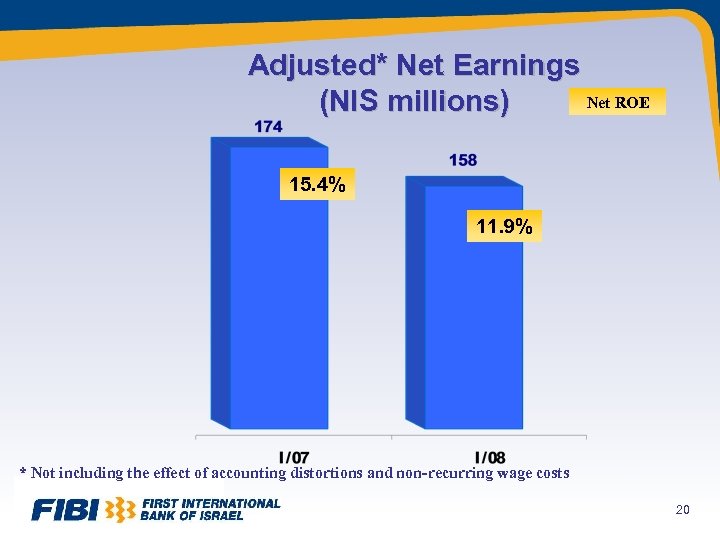

Adjusted* Net Earnings Net ROE (NIS millions) 15. 4% 11. 9% * Not including the effect of accounting distortions and non-recurring wage costs 20

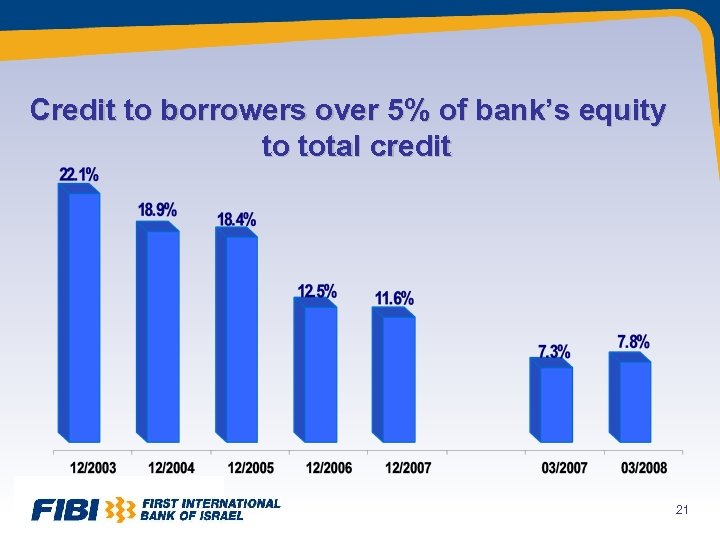

Credit to borrowers over 5% of bank’s equity to total credit 21

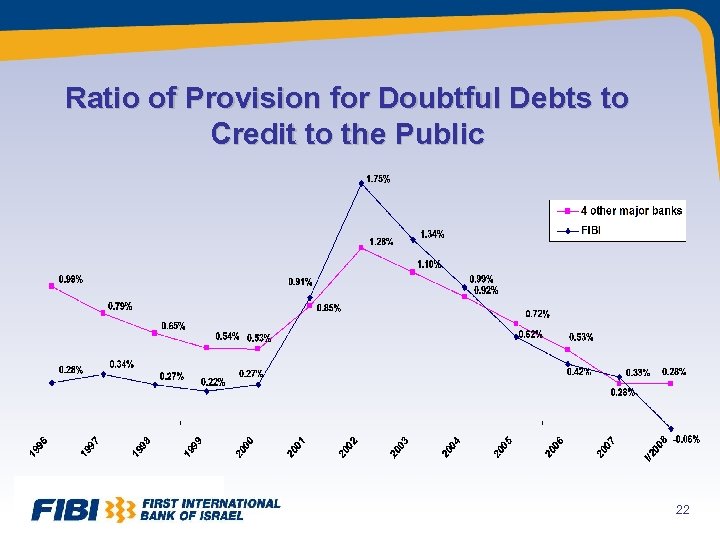

Ratio of Provision for Doubtful Debts to Credit to the Public 22

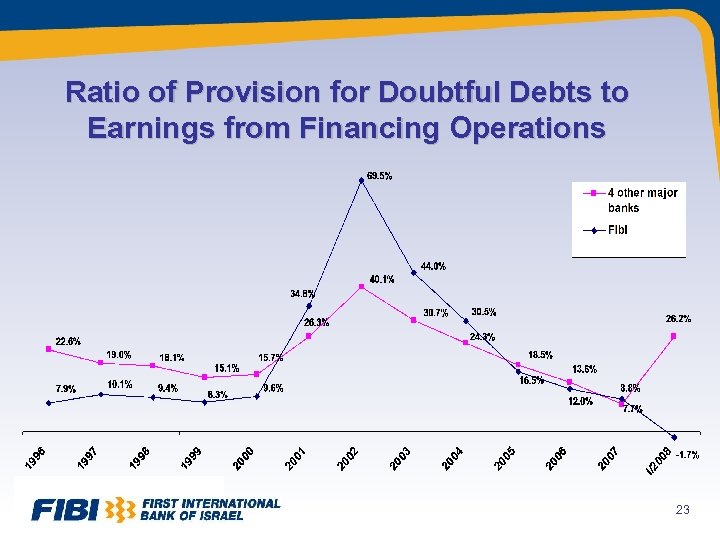

Ratio of Provision for Doubtful Debts to Earnings from Financing Operations 23

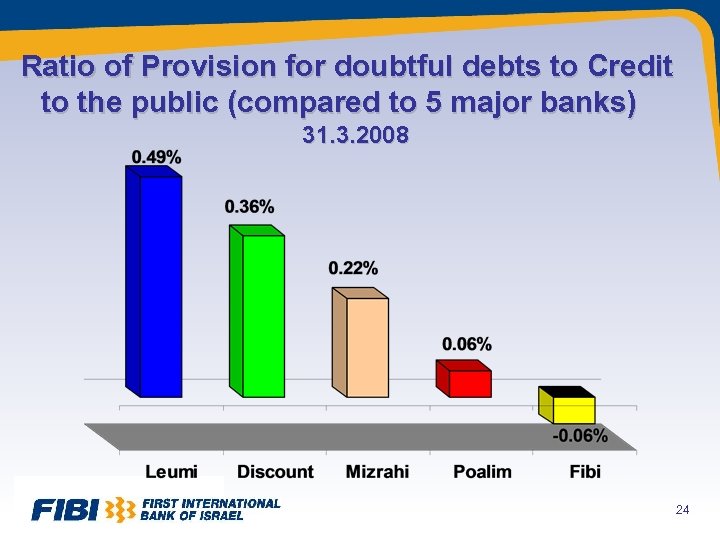

Ratio of Provision for doubtful debts to Credit to the public (compared to 5 major banks) 31. 3. 2008 24

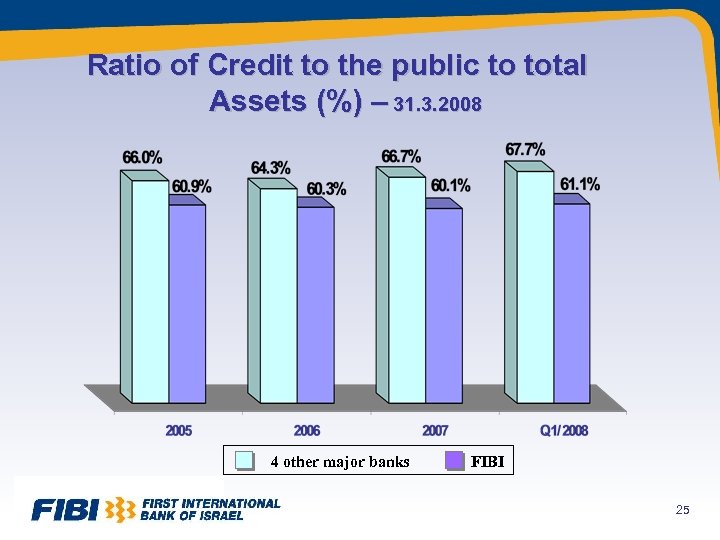

Ratio of Credit to the public to total Assets (%) – 31. 3. 2008 4 other major banks FIBI 25

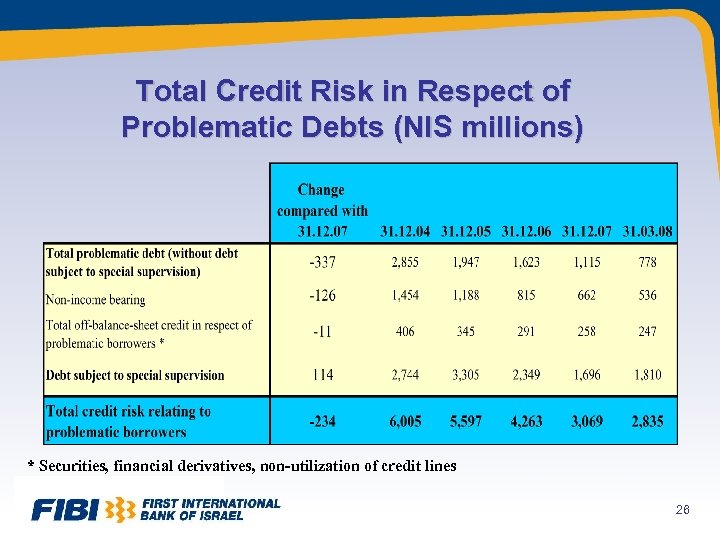

Total Credit Risk in Respect of Problematic Debts (NIS millions) * Securities, financial derivatives, non-utilization of credit lines 26

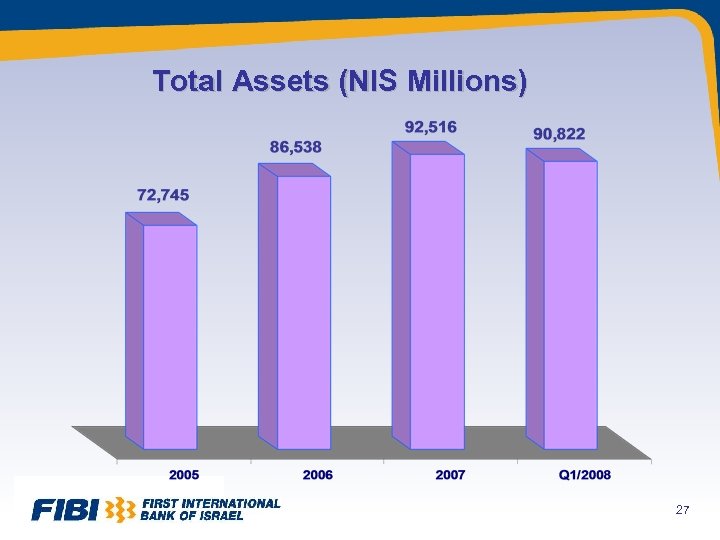

Total Assets (NIS Millions) 27

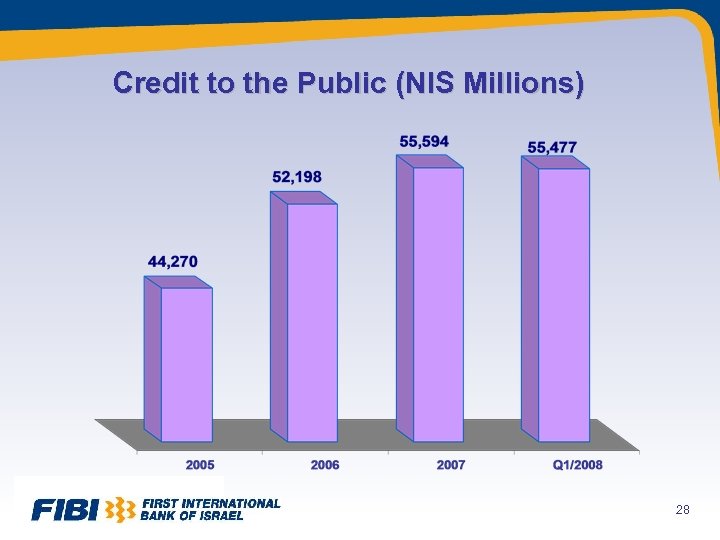

Credit to the Public (NIS Millions) 28

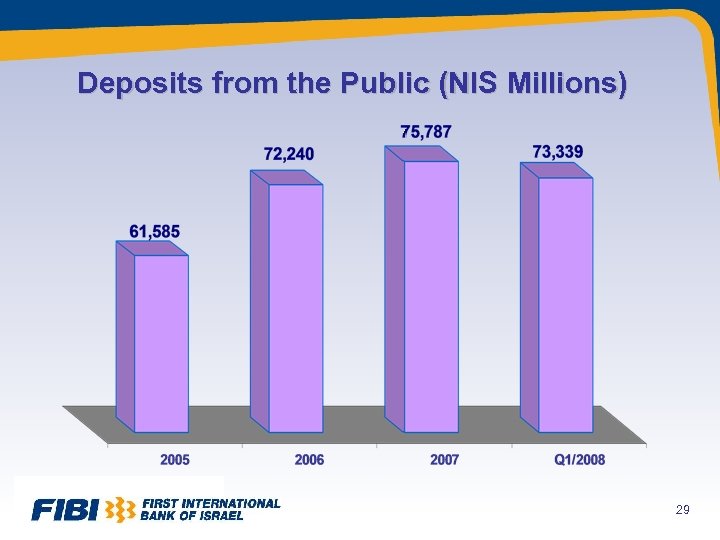

Deposits from the Public (NIS Millions) 29

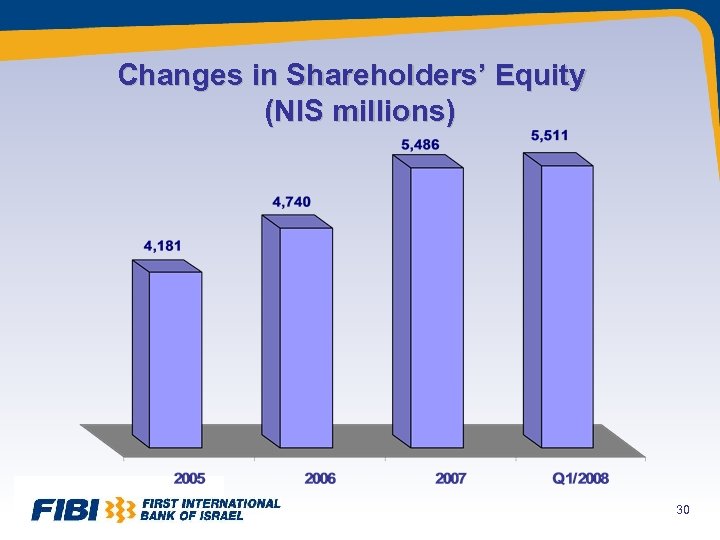

Changes in Shareholders’ Equity (NIS millions) 30

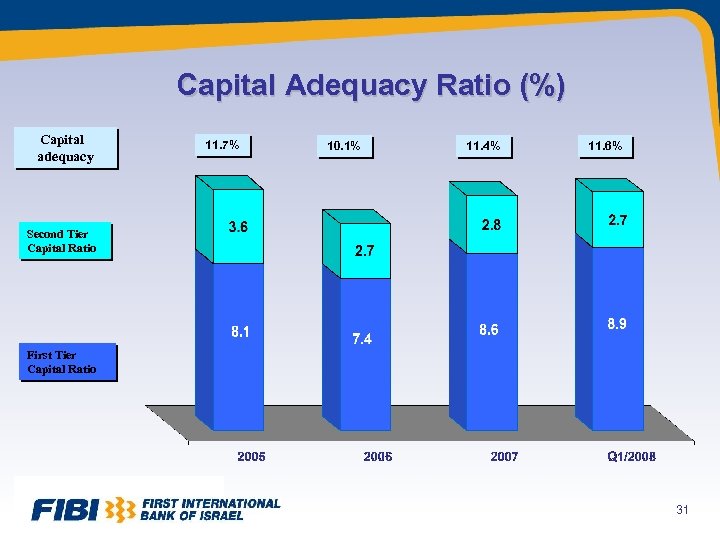

Capital Adequacy Ratio (%) Capital adequacy 11. 7% 10. 1% 11. 4% 11. 6% Second Tier Capital Ratio First Tier Capital Ratio 31

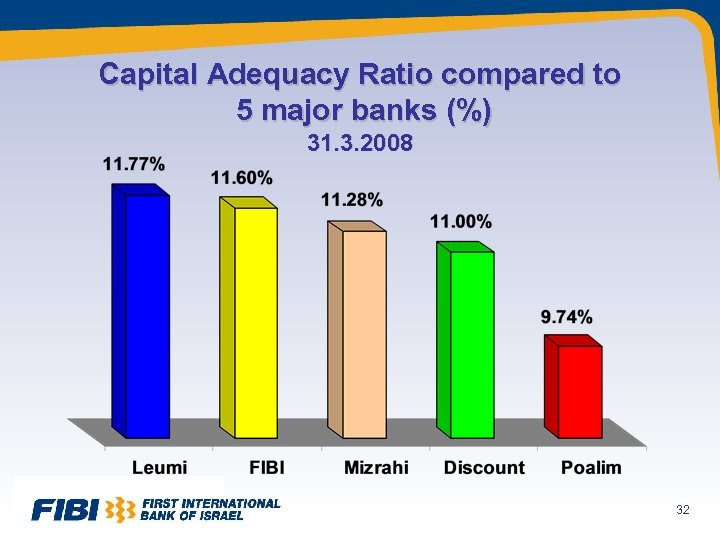

Capital Adequacy Ratio compared to 5 major banks (%) 31. 3. 2008 32

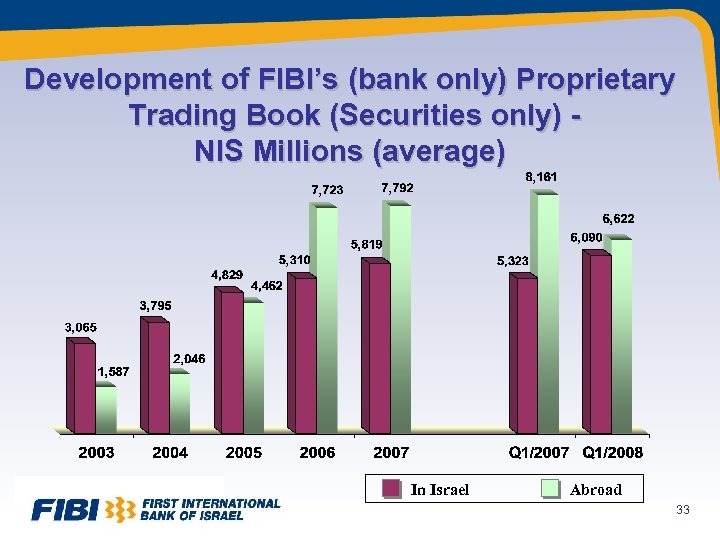

Development of FIBI’s (bank only) Proprietary Trading Book (Securities only) NIS Millions (average) In Israel Abroad 33

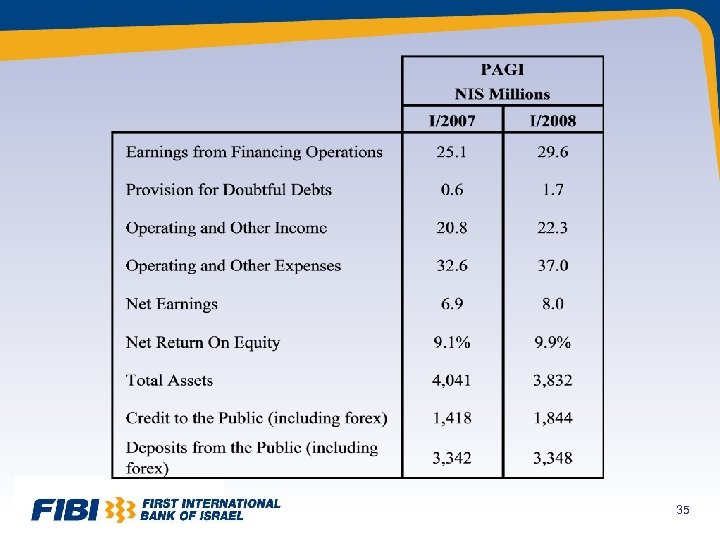

PAGI, in which FIBI has a 68% equity holding is a commercial bank with 20 branches, and the majority of its clients belong to the ultra-orthodox and orthodox sectors. PAGI maintains a unique positioning as Israel’s only orthodox oriented bank and its share in its target segment has grown significantly. PAGI’s strategy is to aggressively grow its client base, while focusing on target segments with intensive financial activity in personal, business, and institutional banking. PAGI invested heavily in modernizing its branch network, while maintaining the conservative demeanor that attracts devout Jews. 34

35

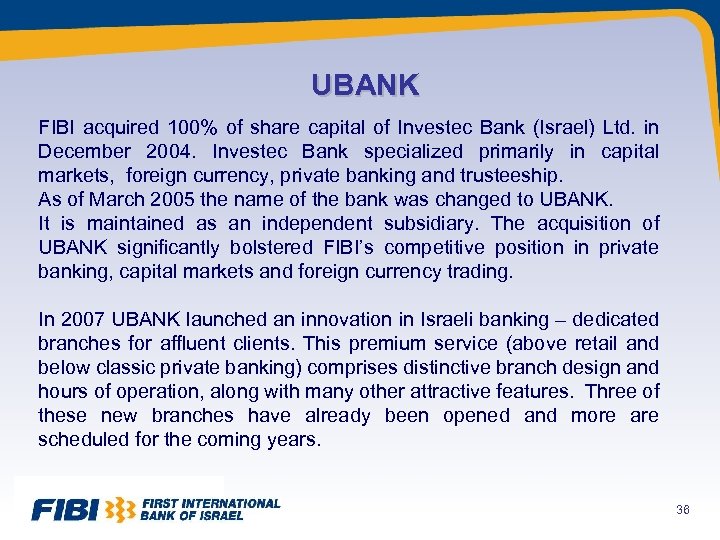

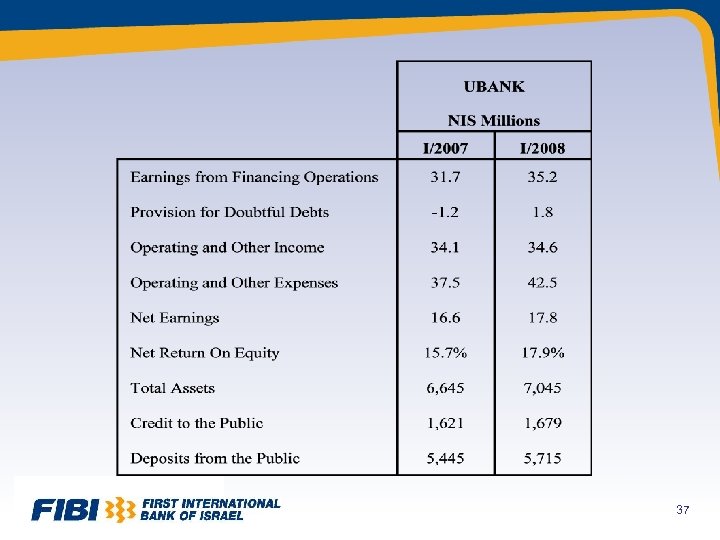

UBANK FIBI acquired 100% of share capital of Investec Bank (Israel) Ltd. in December 2004. Investec Bank specialized primarily in capital markets, foreign currency, private banking and trusteeship. As of March 2005 the name of the bank was changed to UBANK. It is maintained as an independent subsidiary. The acquisition of UBANK significantly bolstered FIBI’s competitive position in private banking, capital markets and foreign currency trading. In 2007 UBANK launched an innovation in Israeli banking – dedicated branches for affluent clients. This premium service (above retail and below classic private banking) comprises distinctive branch design and hours of operation, along with many other attractive features. Three of these new branches have already been opened and more are scheduled for the coming years. 36

37

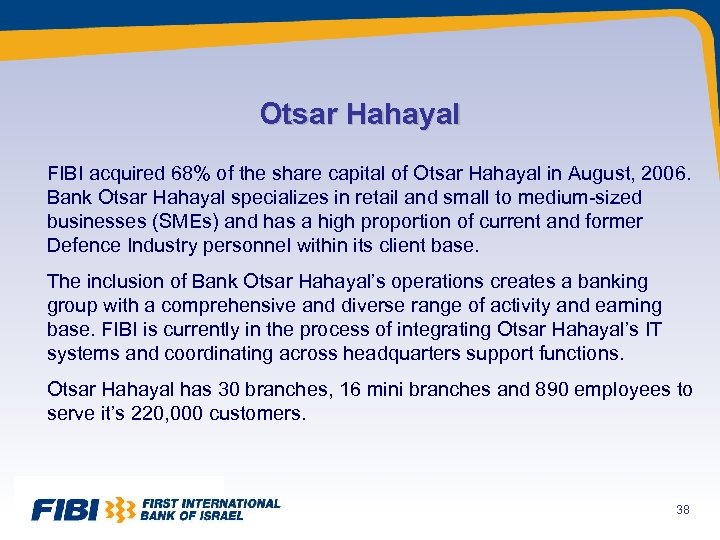

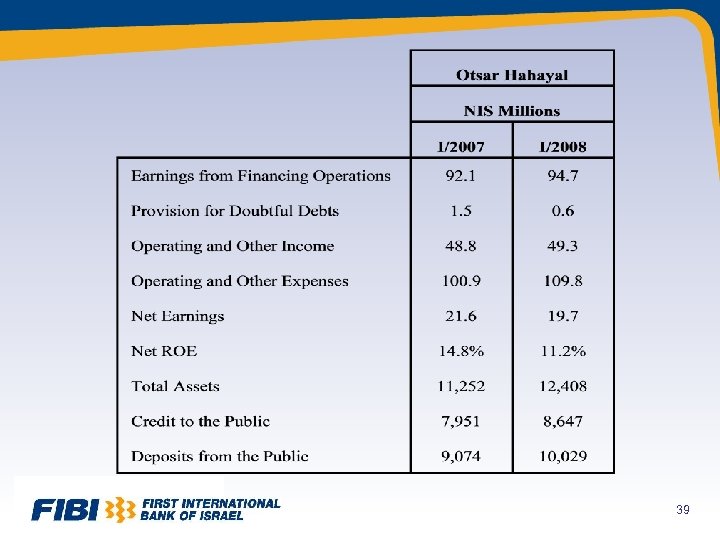

Otsar Hahayal FIBI acquired 68% of the share capital of Otsar Hahayal in August, 2006. Bank Otsar Hahayal specializes in retail and small to medium-sized businesses (SMEs) and has a high proportion of current and former Defence Industry personnel within its client base. The inclusion of Bank Otsar Hahayal’s operations creates a banking group with a comprehensive and diverse range of activity and earning base. FIBI is currently in the process of integrating Otsar Hahayal’s IT systems and coordinating across headquarters support functions. Otsar Hahayal has 30 branches, 16 mini branches and 890 employees to serve it’s 220, 000 customers. 38

39

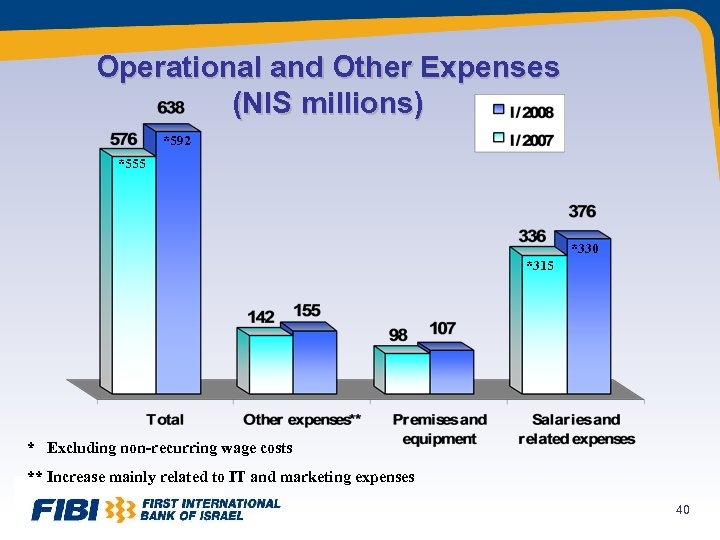

Operational and Other Expenses (NIS millions) *592 *555 *330 *315 * Excluding non-recurring wage costs ** Increase mainly related to IT and marketing expenses 40

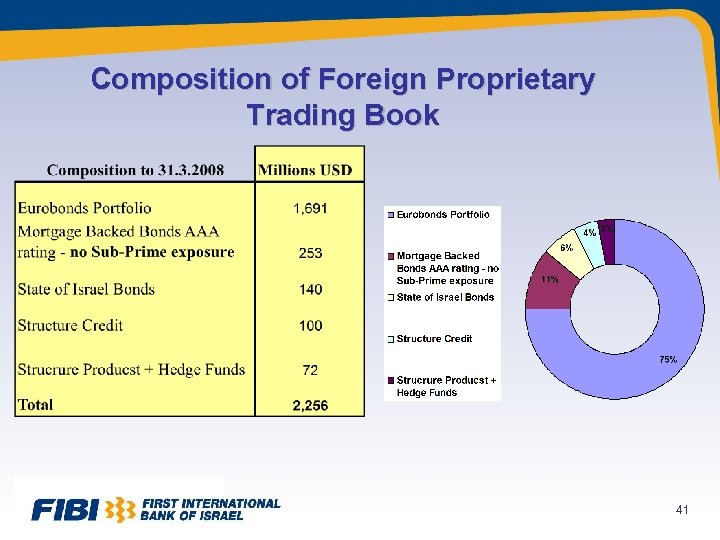

Composition of Foreign Proprietary Trading Book 41

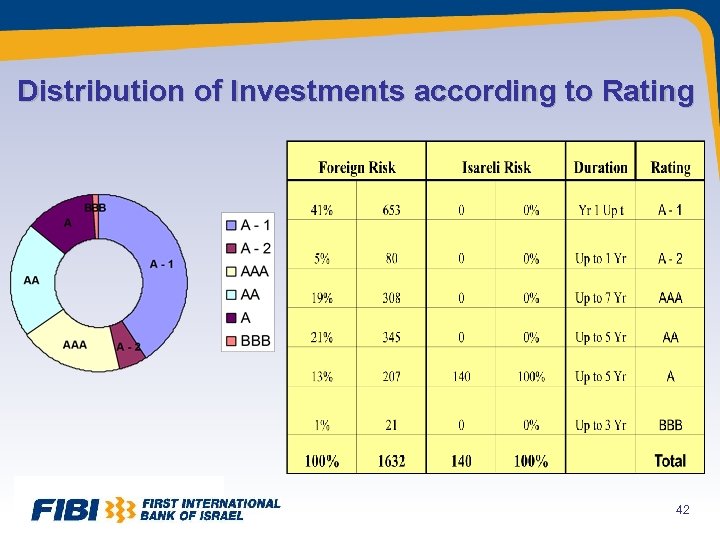

Distribution of Investments according to Rating 42

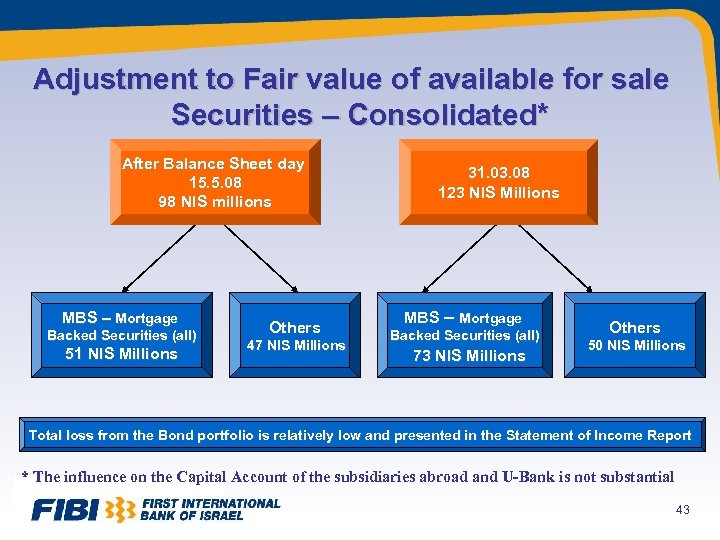

Adjustment to Fair value of available for sale Securities – Consolidated* After Balance Sheet day 15. 5. 08 98 NIS millions MBS – Mortgage Backed Securities (all) 51 NIS Millions Others 47 NIS Millions 31. 03. 08 123 NIS Millions MBS – Mortgage Backed Securities (all) 73 NIS Millions Others 50 NIS Millions Total loss from the Bond portfolio is relatively low and presented in the Statement of Income Report * The influence on the Capital Account of the subsidiaries abroad and U-Bank is not substantial 43

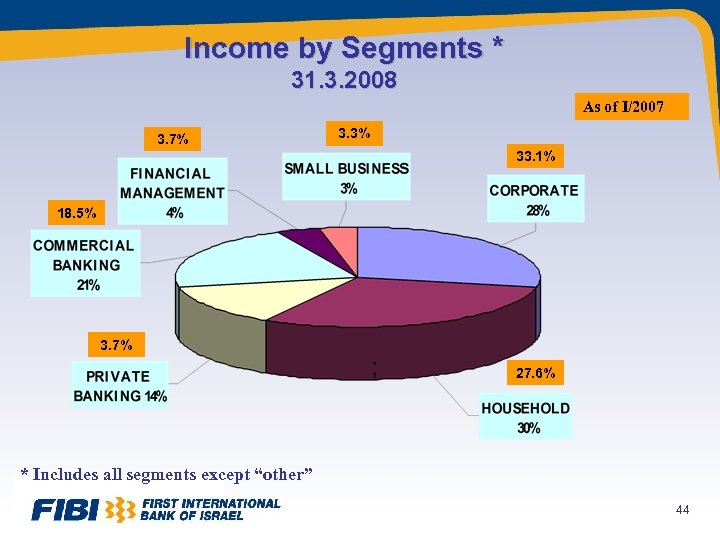

Income by Segments * 31. 3. 2008 As of I/2007 3. 7% 3. 3% 33. 1% 18. 5% 3. 7% 27. 6% * Includes all segments except “other” 44

Planned Actions • Expansion of distinctive private banking offerings - Further development of specialized private banking centers - Opening of new International Private Banking Centre - Expansion of unique affluent banking branches in U-bank • Full realization of group-wide synergies - Group management of shared services - Cross selling of mortgages, structured products and securities trading • Expansion of direct banking channels - Web sites (e. g. , new site for Russian speakers) - Call centre (expanded facilities and increased support for branches) • Non-financial investments • Increase in the Bank’s share of credit card activity • Development of pension planning advice offering 45

20a4250ba5fce154ae2394a2ea9cfef4.ppt