1db934cda828d1a776211bb3188d4ec0.ppt

- Количество слайдов: 29

First International Bank of Israel - FIBI Overview 30/09/2009 1

2

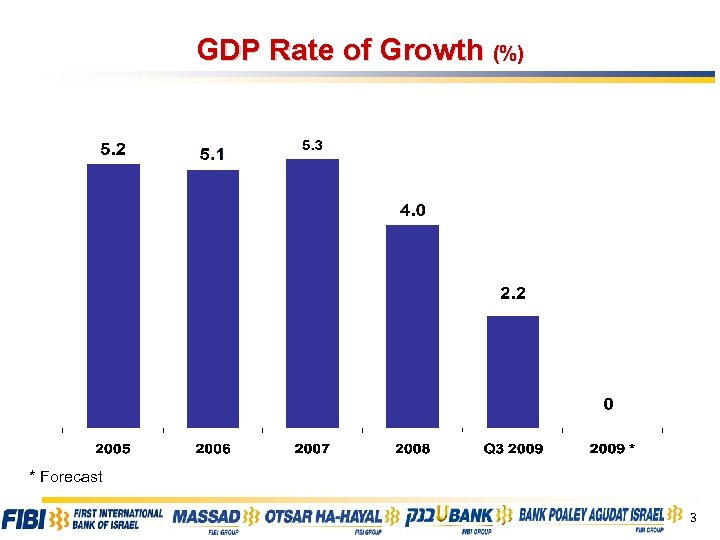

GDP Rate of Growth (%) * Forecast 3

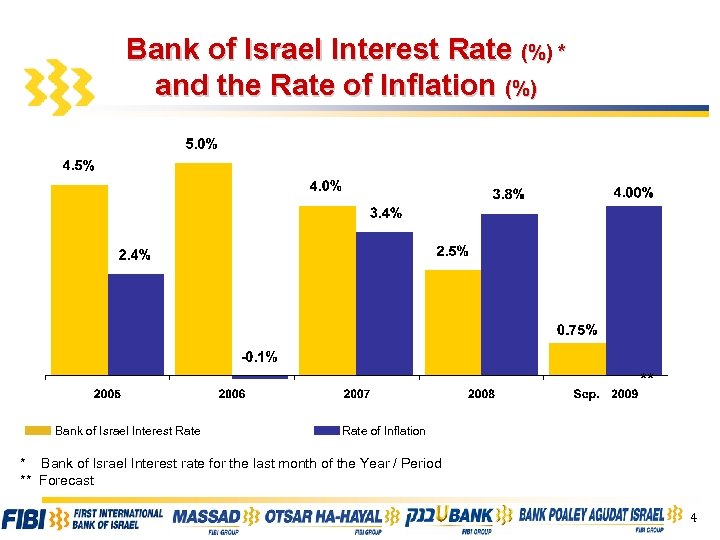

Bank of Israel Interest Rate (%) * and the Rate of Inflation (%) ** Bank of Israel Interest Rate of Inflation * Bank of Israel Interest rate for the last month of the Year / Period ** Forecast 4

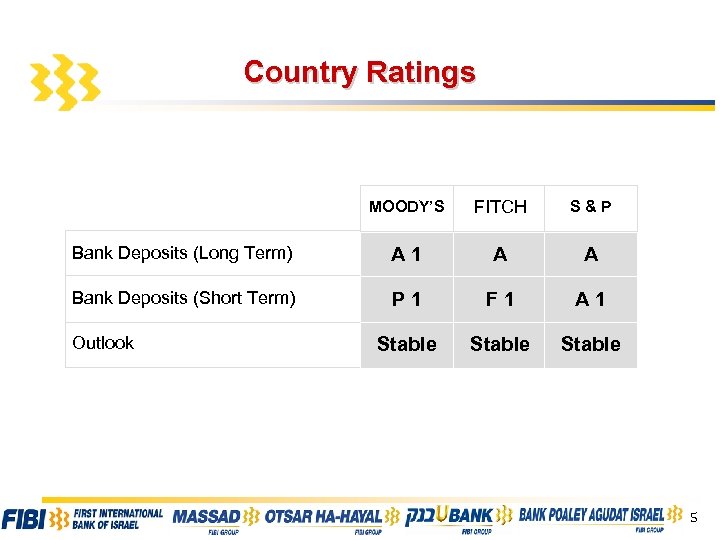

Country Ratings MOODY’S FITCH S&P Bank Deposits (Long Term) A 1 A A Bank Deposits (Short Term) P 1 F 1 A 1 Stable Outlook 5

Foreign Investments in Israel - Israeli Investments Abroad Private (Non Banking) Sector Only (US$ Millions) In 2006: Acquisition of “Iscar” by Berkshire - Hathaway Private (Non Banking) Sector Only (US$ Millions) In 2006: Acquisition by “Teva” 6

7

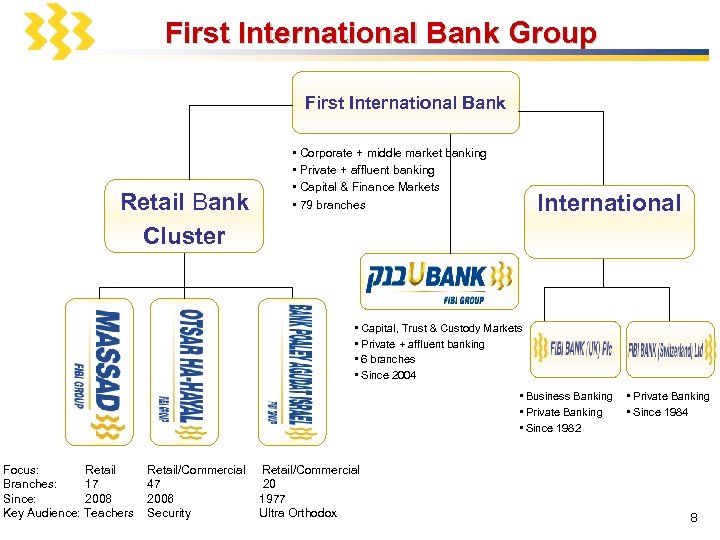

First International Bank Group First International Bank Retail Bank Cluster • Corporate + middle market banking • Private + affluent banking • Capital & Finance Markets • 79 branches International • Capital, Trust & Custody Markets • Private + affluent banking • 6 branches • Since 2004 • Business Banking • Private Banking • Since 1982 Focus: Retail Branches: 17 Since: 2008 Key Audience: Teachers Retail/Commercial 47 20 2006 1977 Security Ultra Orthodox • Private Banking • Since 1984 8

Shareholders The Liberman family has enjoyed sustained success in both Australia and Israel for over 50 years. Jack Liberman, an astute Australian businessman and entrepreneur, along with his children, built a large and diversified investment company (JGL Investments PTY Ltd. ) The family, together with the Bino Group, in a long-term partnership, hold a controlling interest in both FIBI Holdings and Paz Oil Company Ltd. (“Paz”), Israel’s leading petrol player. Mr. Zadik Bino is a highly reputable businessman with broad business interests in Israel. In a banking career spanning over 25 years, Mr. Zadik Bino filled senior positions in the local banking sector, which included CEO of Bank Leumi of Israel and Chairman of the Board of Directors and General Manager of The First International Bank of Israel. Mr. Zadik Bino was also a member of the Advisers Committee and the Committee for Banking Matters of the Bank of Israel. 9

Shareholders (continued) Since 1989, Mr. Bino has devoted himself to his family's private business interests in Israel and abroad. Through the years, the Bino Group has engaged in the execution, development and nurturing of various investments. Besides banking, the main investments of the Bino family is in Energy (through a 42. 6% holding in Paz oil Company Ltd. – a listed company which is Israel’s largest supplier of refined petroleum products, and which owns the Ashdod Refinery). Since acquiring the controlling interest in FIBI and the Bank in 2003, both Mr. Zadik Bino and his son, Mr. Gil Bino, serve as members of the Board of Directors of FIBI, as well as of the Bank's. The controlling interest in FIBI and in the Bank is held by the Bino Family (Mr. Zadik Bino and his three Children). 10

First International Bank of Israel - FIBI • Universal bank with strong niche position in capital markets, foreign exchange and foreign trade • Domestic subsidiaries target focused audiences: affluent banking (UBank), Security sector - retail banking (Otsar Hahayal), ultra-orthodox Jews (PAGI), and teachers (Massad) • Foreign subsidiaries in London (commercial banking) and Zurich (private banking) • Branches: 169 in Israel (including subsidiaries) • Equity: NIS 6, 070 Million (US$ 1, 615 Million *) • 5 th largest banking group in Israel * $/NIS = 3. 758 as of Sep. 30, 2009 11

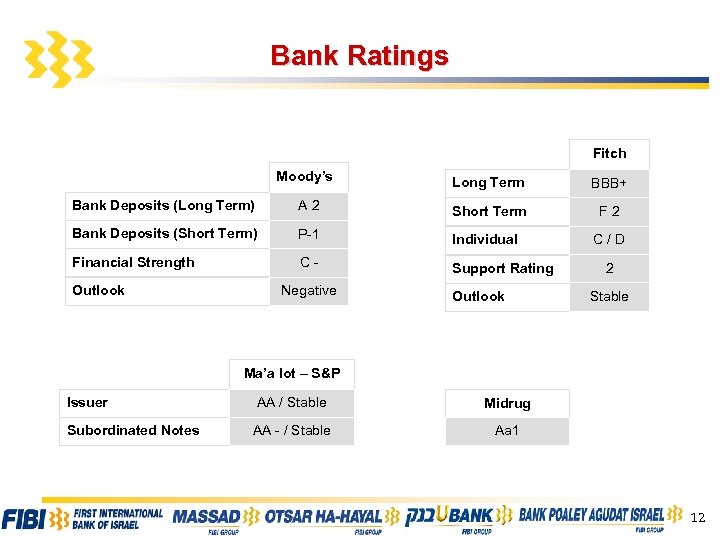

Bank Ratings Fitch Moody’s Long Term BBB+ Bank Deposits (Long Term) A 2 Short Term F 2 Bank Deposits (Short Term) P-1 Individual Financial Strength C - Support Rating Outlook Negative Outlook C / D 2 Stable Ma’a lot – S&P Issuer Subordinated Notes AA / Stable Midrug AA - / Stable Aa 1 12

Strategy - Main Focus Risk Profile • Conservative capitalization levels: capital adequacy ratio of 14. 3%; 1 st tier adequacy ratio of 9. 8%; deposit/credit ratio of 135. 0% • Improved credit mix: steps taken to diversify portfolio through increased penetration of middle market and more consumer credit • Conservatively managed foreign proprietary trading book • Upgraded scoring model and processes in anticipation of Basel II, including development of advanced credit-scoring models for risk-based pricing Core Capabilities • Top class reputation in private banking services, especially dealing room, specialized investment advice center and TASE futures and operations index, where FIBI is a market leader • Distinctive professional standards in: global capital markets, currency exchange, structured products and foreign trade • Strong traditional position in corporate banking 13

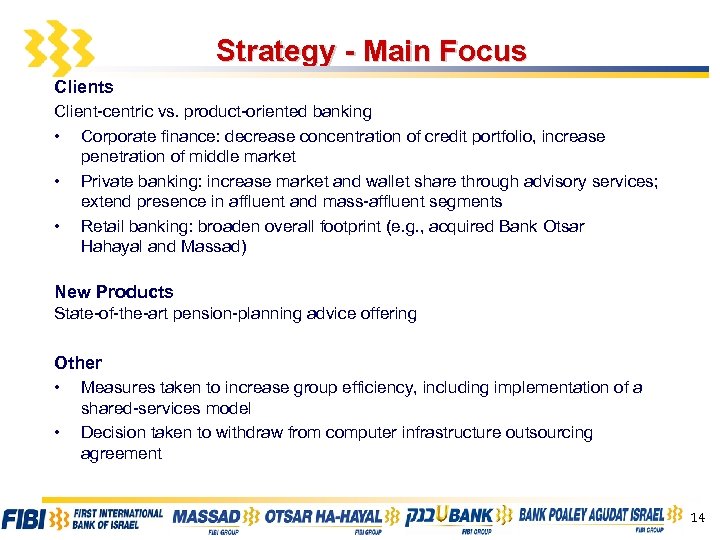

Strategy - Main Focus Client-centric vs. product-oriented banking • Corporate finance: decrease concentration of credit portfolio, increase penetration of middle market • Private banking: increase market and wallet share through advisory services; extend presence in affluent and mass-affluent segments • Retail banking: broaden overall footprint (e. g. , acquired Bank Otsar Hahayal and Massad) New Products State-of-the-art pension-planning advice offering Other • Measures taken to increase group efficiency, including implementation of a • shared-services model Decision taken to withdraw from computer infrastructure outsourcing agreement 14

Group Consolidation Objective: to realize synergies from three bank acquisitions • Implement shared-services model, including IT systems (UBank IT systems converted in 2008, Massad and Otsar Hahayal planned for 2009 -2010; HQ units unified: logistics, severance pay fund operations, regulatory units and parts of training and human resources operations, process to be accelerated in 2009 -2010) • Cross-sell products (mortgages, structured products, advisory services, pension planning, trust, factoring) • Create streamlined and effective branch network to meet growing competition in retail and private banking markets • Oversee management: FIBI executive board members chair the new subsidiaries and serve on their boards 15

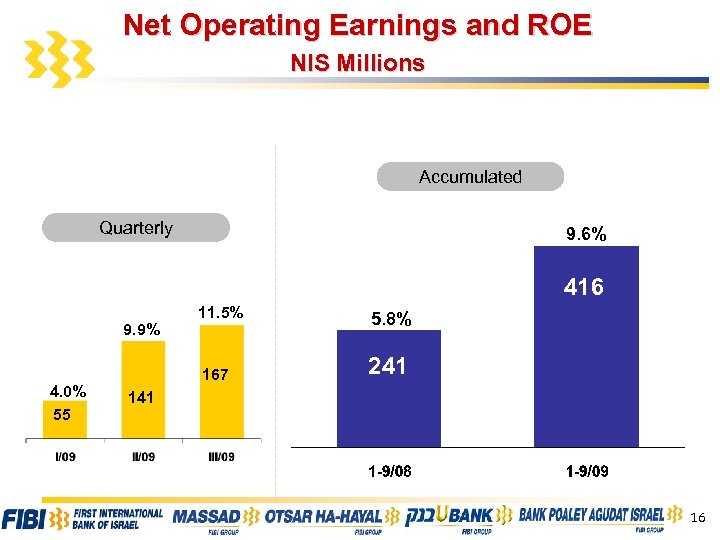

Net Operating Earnings and ROE NIS Millions Accumulated Quarterly 9. 6% 416 4. 0% 55 5. 8% 167 9. 9% 11. 5% 241 16

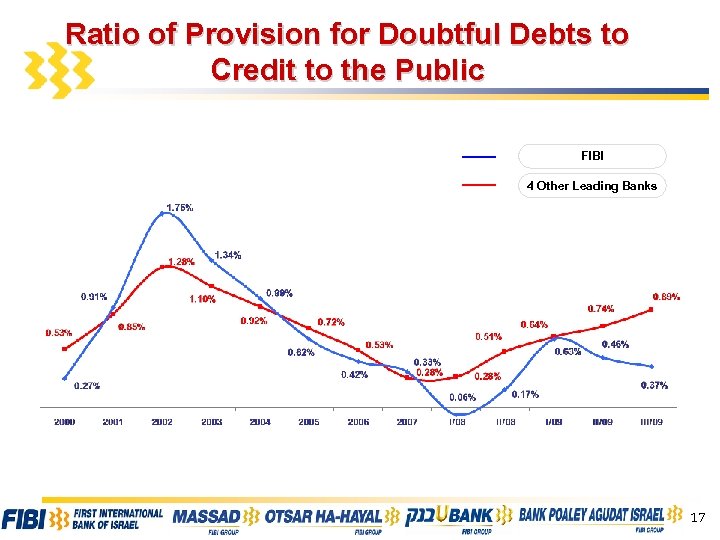

Ratio of Provision for Doubtful Debts to Credit to the Public FIBI 4 Other Leading Banks 17

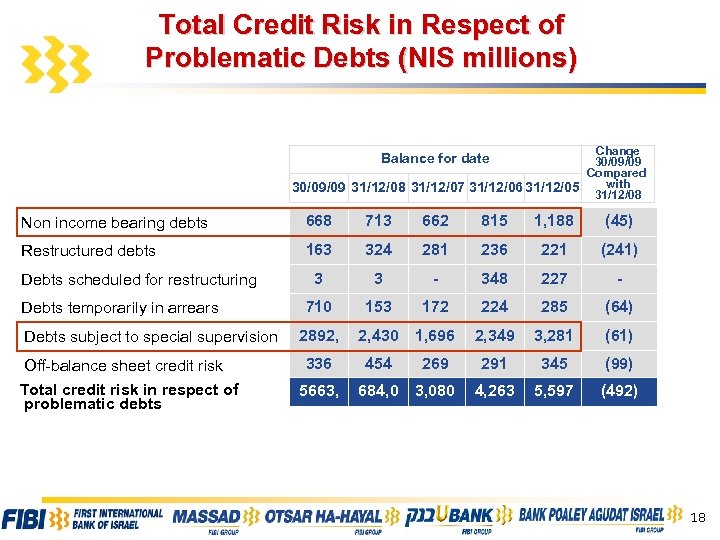

Total Credit Risk in Respect of Problematic Debts (NIS millions) Change 30/09/09 Compared with 30/09/09 31/12/08 31/12/07 31/12/06 31/12/05 31/12/08 Balance for date Non income bearing debts 668 713 662 815 1, 188 (45) Restructured debts 163 324 281 236 221 (241) 3 3 - 348 227 - 710 153 172 224 285 (6 4 ) 2892, 2, 430 1, 696 2, 349 3, 281 (61) 336 454 269 291 345 (99) 5663, 684, 0 3, 080 4, 263 5, 597 (492) Debts scheduled for restructuring Debts temporarily in arrears Debts subject to special supervision Off-balance sheet credit risk Total credit risk in respect of problematic debts 18

Composition of Total Proprietary Trading Book Foreign Currency Proprietary Trading Book Amount NIS M Composition Government & Secured by Government bonds 9, 261 59% Commercial Banks bonds 383, 4 Shares Other 576 2, 357 22% 4% 15% Total 15, 632 100% 19

Operating Commissions - Group (NIS Millions) 1 -9/09 1 -9/08 Total Operating Commissions 1, 056 967 Without Massad 989 922 273 325 308 271 130 74 Massad 1 -9/09 151 77 1 -9/08 20

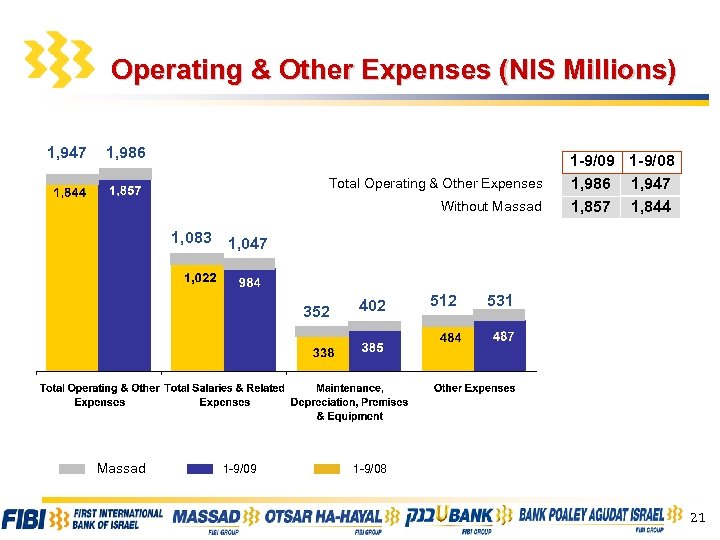

Operating & Other Expenses (NIS Millions) 1, 947 1, 986 Total Operating & Other Expenses Without Massad 1, 083 1, 047 352 Massad 1 -9/09 1 -9/08 1, 986 1, 947 1, 857 1, 844 1 -9/09 402 512 531 1 -9/08 21

Operating Income and Expenses Operating Income & Expenses 50. 2% Operating Income 62. 8% Operating Expenses Adjusted * Operating Income & Expenses 51. 0% % Adjusted Cost / Income Ratio 53. 7% % Cost / Income Ratio * Income excluding dividends, provisions for decline in value of proprietary trading book and severance pay fund gains; expenses excluding severance pay fund effects 22

23

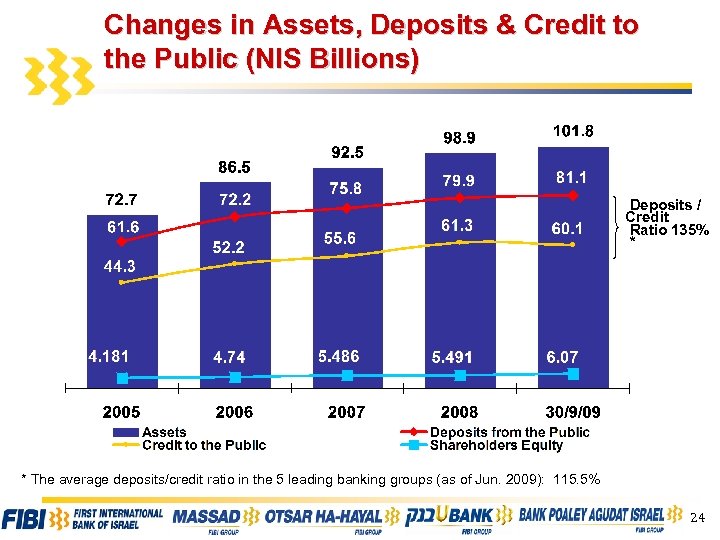

Changes in Assets, Deposits & Credit to the Public (NIS Billions) Deposits / Credit Ratio 135% * * The average deposits/credit ratio in the 5 leading banking groups (as of Jun. 2009): 115. 5% 24

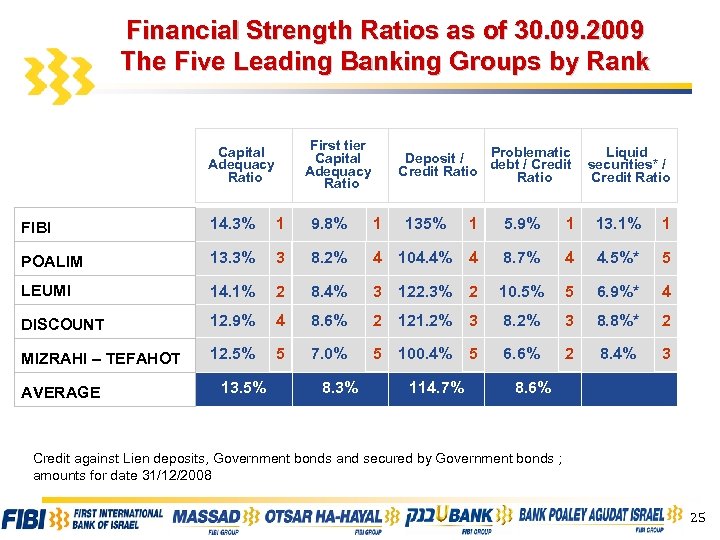

Financial Strength Ratios as of 30. 09. 2009 The Five Leading Banking Groups by Rank First tier Capital Adequacy Ratio Problematic Deposit / debt / Credit Ratio Liquid securities* / Credit Ratio FIBI 14. 3% 1 9. 8% 1 135% 1 5. 9% 1 13. 1% 1 POALIM 13. 3% 3 8. 2% 4 104. 4% 4 8. 7% 4 4. 5%* 5 LEUMI 14. 1% 2 8. 4% 3 122. 3% 2 10. 5% 5 6. 9%* 4 DISCOUNT 12. 9% 4 8. 6% 2 121. 2% 3 8. 8%* 2 MIZRAHI – TEFAHOT 12. 5% 5 7. 0% 5 100. 4% 5 6. 6% 2 8. 4% 3 AVERAGE 13. 5% 8. 3% 114. 7% 8. 6% Credit against Lien deposits, Government bonds and secured by Government bonds ; amounts for date 31/12/2008 25

Changes in Net Profit – Subsidiaries (NIS Millions) 1 -9/09 27. 1 (5. 1) 55. 8 45. 6 10. 2 55. 0 48. 7 6. 3 24. 3 CHF K Change 22. 0 GBP K 1 -9/08 10. 3 14. 0 869 1, 134 (265) 3, 087 2, 488 599 26

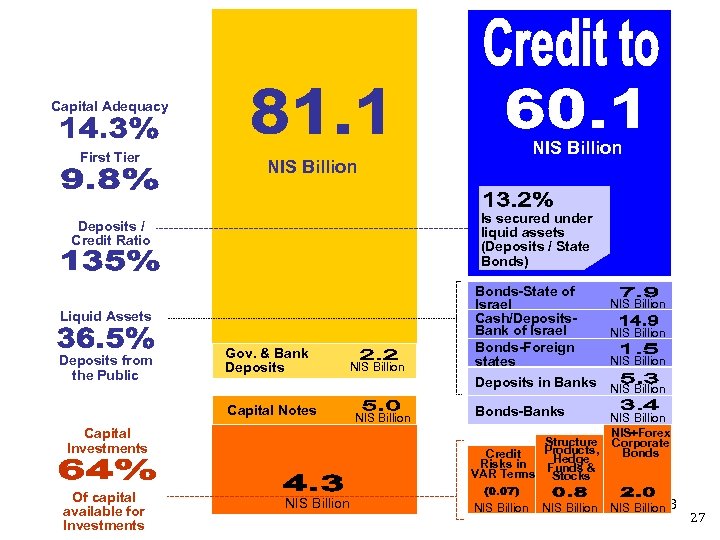

Capital Adequacy First Tier NIS Billion Is secured under liquid assets (Deposits / State Bonds) Deposits / Credit Ratio Liquid Assets Deposits from the Public Gov. & Bank Deposits NIS Billion Bonds-State of Israel Cash/Deposits. Bank of Israel Bonds-Foreign states NIS Billion Deposits in Banks NIS Billion Capital Notes NIS Billion Capital Investments First International Bank of Israel Ltd. Of capital available for Investments 30. 09. 2009 NIS Billion 27 Bonds-Banks NIS Billion NIS+Forex Structure Corporate Products, Bonds Credit Hedge Risks in Funds & VAR Terms Stocks NIS Billion 3/16/2018 NIS Billion 27

Banking Subsidiaries in Israel PAGI, in which FIBI has a 68% equity holding is a commercial bank with 20 branches, PAGI and the majority of its clients belong to the ultra-orthodox and orthodox sectors. PAGI maintains a unique positioning as Israel’s only orthodox oriented bank and its share in its target segment has grown significantly. PAGI’s strategy is to aggressively grow its client base, while focusing on target segments with intensive financial activity in personal, business, and institutional banking. UBANK - FIBI acquired 100% of share capital of UBANK (formerly Investec Bank UBANK (Israel) Ltd. ) in December 2004. It is maintained as an independent subsidiary. The acquisition of UBANK significantly bolstered FIBI’s competitive position in private banking, capital markets and foreign currency trading. In 2007 UBANK launched an innovation in Israeli banking – dedicated branches for affluent clients. This premium service (above retail and bellow classic private banking) comprises distinctive branch design and hours of operation, along with many other attractive features. 28

OTSAR HAHAYAL - FIBI acquired 68% of the share capital of Otsar Hahayal in HAHAYAL August, 2006. Bank Otsar Hahayal specializes in retail and small to medium-sized businesses (SMEs) and has a high proportion of current and former Defence Industry personnel within its client base. The inclusion of Bank Otsar Hahayal’s operations creates a banking group with a comprehensive and diverse range of activity and earning base. FIBI is currently in the process of integrating Otsar Hahayal’s IT systems and coordinating across headquarters support functions. MASSAD - FIBI acquired 51% of the share capital of Massad in May 2008. Massad, MASSAD as a sectorial bank, specializes in teaching personnel as its client base. FIBI is currently in the process of integrating Massad’s IT System and coordinating across headquarter support functions. Massad's identity as the “teachers' bank” also places it in an advantageous position in the Arab sector, and explains its success in this sector despite rising competition. 29

1db934cda828d1a776211bb3188d4ec0.ppt